North America Flat Glass Market Size, Share, Growth, Trends, And Forecasts Report, Segmented By Product, End-User And By Country (The USA, Canada, Mexico and Rest of North America), Industry Analysis (2025 to 2033)

North America Flat Glass Market Size

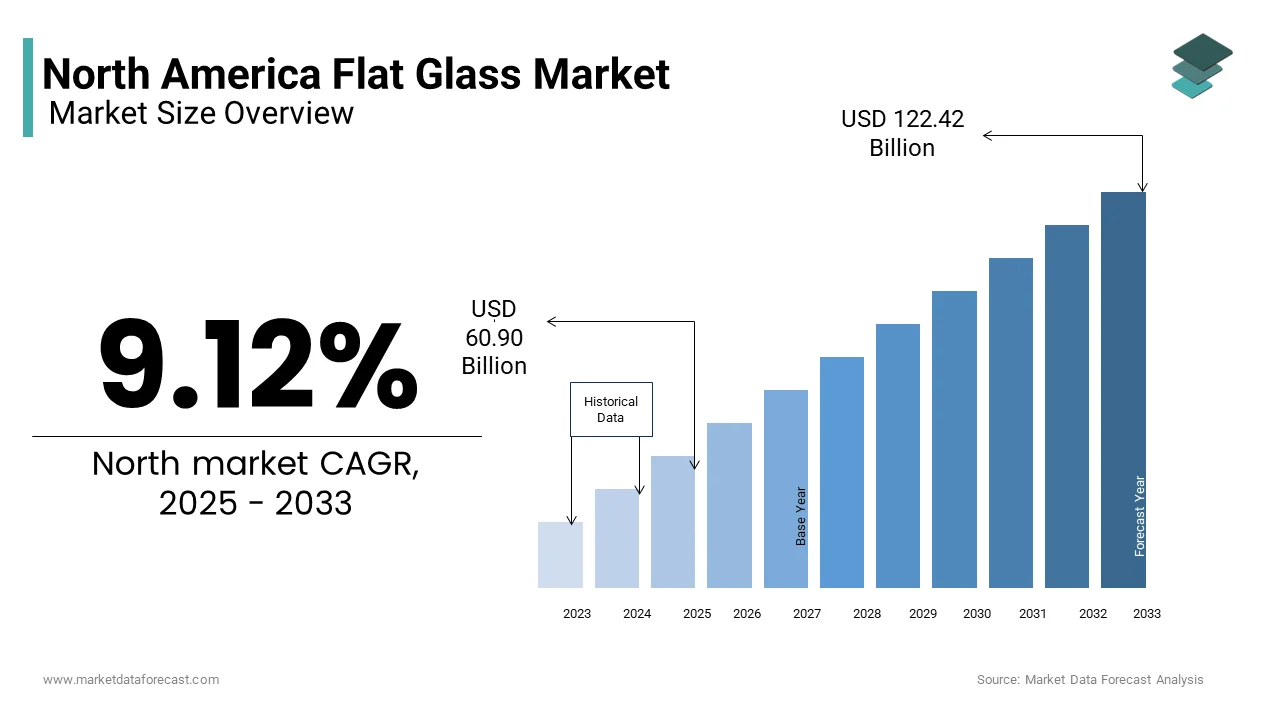

The North America flat glass market was valued at USD 55.81 billion in 2024 and is anticipated to reach USD 60.90 billion in 2025 from USD 122.42 billion in 2033, growing at a CAGR of 9.12% during the forecast period from 2025 to 2033.

The North American flat glass market encompasses the production and consumption of non-curved, transparent, or tinted glass primarily used in construction, automotive, and solar energy applications. Flat glass is manufactured through processes such as float glass production, where molten glass is cooled on a bed of molten metal to achieve a smooth, uniform surface. This type of glass serves critical functions in windows, façades, windshields, and photovoltaic panels.

Additionally, the U.S. Department of Energy (DOE) reports that building energy codes are increasingly mandating the use of high-performance glazing systems, further influencing the adoption of advanced flat glass products. In the automotive sector, the shift toward electric vehicles with large glass panels for aesthetic and aerodynamic benefits has also boosted market growth. Moreover, the expansion of utility-scale and rooftop solar installations across North America has increased reliance on tempered and coated flat glass for photovoltaic modules.

MARKET DRIVERS

Growth in Residential and Commercial Construction Activities

One of the primary drivers of the North American flat glass market is the robust growth in residential and commercial construction activities, particularly in the United States and Canada. These developments directly translate into increased demand for flat glass in windows, curtain walls, and interior partitions. Moreover, urban redevelopment initiatives and green building certifications such as LEED have encouraged the use of energy-efficient glazing solutions, including low-emissivity (Low-E) and insulated glass units. These high-performance products now constitute a growing share of architectural glass installations, reinforcing the long-term trajectory of market expansion driven by construction sector dynamics.

Expansion of Solar Energy Infrastructure

Another major driver fueling the North American flat glass market is the rapid expansion of solar energy infrastructure, which relies heavily on tempered and coated flat glass for photovoltaic panel manufacturing. As per the Solar Energy Industries Association (SEIA), the U.S. installed over 32 gigawatts of solar capacity in 2023, marking a 37% increase from the previous year. This surge in solar deployment is largely attributed to federal incentives such as the Inflation Reduction Act (IRA), which provides substantial tax credits for domestic renewable energy projects. Flat glass plays a crucial role in solar panels by protecting photovoltaic cells while allowing maximum light transmission. As the demand for clean energy solutions rises, so does the need for specialized flat glass that meets durability, thermal resistance, and optical clarity standards. With continued investment in grid modernization and distributed solar systems, the flat glass industry is poised to benefit significantly from this ongoing energy transition.

MARKET RESTRAINTS

High Raw Material and Energy Costs

A significant restraint affecting the North American flat glass market is the volatility and rising costs of raw materials and energy inputs essential to glass production. Flat glass manufacturing requires substantial quantities of silica sand, soda ash, limestone, and dolomite, all of which have experienced price fluctuations due to supply chain disruptions and geopolitical tensions. Additionally, the U.S. Energy Information Administration (EIA) reports that industrial electricity prices rose in 202, directly impacting the energy-intensive melting and forming processes involved in flat glass production. These cost pressures reduce profit margins for manufacturers and may lead to higher end-product pricing, potentially deterring buyers in price-sensitive sectors such as residential construction and automotive replacement parts.

Regulatory and Environmental Compliance Pressures

Another key restraint in the North American flat glass market is the increasing regulatory scrutiny surrounding emissions, energy efficiency, and sustainable manufacturing practices. Governments at both the federal and state levels have implemented stringent environmental policies aimed at reducing carbon footprints and promoting circular economy principles. As per the U.S. Environmental Protection Agency (EPA), glass manufacturing facilities are required to comply with strict air quality standards, including limits on nitrogen oxides (NOx), sulfur dioxide (SO₂), and particulate matter emissions. Meeting these requirements often necessitates costly upgrades to pollution control equipment and process modifications. Moreover, Environment and Climate Change Canada (ECCC) has introduced carbon pricing mechanisms and emission reduction targets that impact energy-intensive industries like flat glass production. The Canadian Glass Association (CGA) reports that compliance costs have risen significantly, affecting operational flexibility and investment planning for manufacturers.

MARKET OPPORTUNITY

Rising Demand for Smart and Energy-Efficient Glass Solutions

A major opportunity emerging in the North American flat glass market is the growing adoption of smart and energy-efficient glass technologies designed to enhance building performance, occupant comfort, and sustainability. Smart glass, electrochromic windows, and vacuum-insulated glazing are gaining traction among architects, developers, and facility managers seeking innovative ways to reduce energy consumption and improve indoor environments. The U.S. Department of Energy (DOE) estimates that advanced window technologies can reduce building energy use, making them a strategic component of net-zero energy initiatives. Furthermore, cities such as New York, San Francisco, and Toronto have enacted local building codes that encourage or mandate the use of energy-efficient glass in new constructions and retrofits. The International Code Council (ICC) has also incorporated more stringent insulation and daylighting requirements into the latest edition of the International Energy Conservation Code (IECC).

Expansion of Electric Vehicle Production and Glazing Requirements

An emerging opportunity in the North American flat glass market is the accelerating growth of the electric vehicle (EV) industry, which demands larger and more sophisticated glass components than conventional automobiles. EVs often feature panoramic sunroofs, expansive windshields, and lightweight laminated glass to enhance aesthetics, aerodynamics, and driver experience. This shift is being supported by government incentives, charging infrastructure investments, and automakers’ commitments to electrification. Automotive glass suppliers such as Saint-Gobain and AGC Inc. have noted a rise in orders for curved, tempered, and acoustic-laminated glass tailored for EV platforms. The Society of Automotive Engineers (SAE) highlights that EV manufacturers are increasingly prioritizing weight reduction and thermal management, leading to innovations in thin, high-strength glass applications.

MARKET CHALLENGES

Complexity in Logistics and Transportation of Large Glass Panels

One of the most pressing challenges facing the North American flat glass market is the complexity and cost associated with transporting large, fragile glass panels from manufacturing sites to end-use locations. Unlike standardized industrial materials, flat glass requires specialized handling, secure packaging, and precision loading to prevent breakage and ensure product integrity. According to the Glass Association of North America (GANA), transportation accounts for a significant portion of total project costs, particularly for oversized and custom-shaped glass used in high-rise buildings, curtain walls, and specialty automotive applications. The association emphasizes that logistics providers must invest in temperature-controlled trailers, cranes, and anti-vibration systems to meet industry safety and quality standards. Additionally, the U.S. Department of Transportation (DOT) enforces strict regulations regarding oversized loads, route restrictions, and delivery timelines, complicating last-mile distribution for time-sensitive construction and infrastructure projects.

Intense Competition from Alternative Materials and Substitutes

Another significant challenge confronting the North American flat glass market is the increasing competition from alternative materials such as polycarbonate, acrylic, and composite glazing systems that offer comparable transparency, reduced weight, and enhanced impact resistance. These substitutes are gaining traction in niche applications within the automotive, aerospace, and security industries, where durability and design flexibility are paramount. According to the American Chemistry Council (ACC), the use of thermoplastic glazing materials in vehicle production has grown steadily, with several automakers adopting polycarbonate windows to reduce overall vehicle weight and improve fuel efficiency. In the construction sector, laminated composites and translucent insulation panels are being explored as alternatives to conventional glass in certain architectural designs. The U.S. Green Building Council (USGBC) highlights that some developers are opting for lightweight, high-performance substitutes that provide similar daylighting benefits without the structural and thermal drawbacks of standard glass.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

9.12% |

|

Segments Covered |

By Product Type, End-Use, and By Country |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

United States, Canada, Mexico, and the country |

|

Market Leaders Profiled |

AGC Inc., CPS, BY CARDINAL GLASS INDUSTRIES, INC, China Glass Holdings Limited, Fuyao Glass Industry Group Co., Ltd, Guardian Industries Holdings, Nippon Sheet Glass Co. Ltd, Saint-Gobain, SCHOTT, Şişecam, Vitro |

SEGMENTAL ANALYSIS

By Product Insights

The annealed glass segment spearheaded the North America flat glass market by accounting for 38.2% of total consumption in 2024. This dominance is attributed to its widespread use across the construction, automotive, and furniture industries due to its affordability, clarity, and adaptability to secondary processing. One key driver behind this segment’s leadership is its extensive application in residential and commercial building windows, where cost-effective glazing solutions are preferred without compromising on transparency or basic functionality.

The coated glass segment is developing as the booming category within the North American flat glass market, projected to expand at a CAGR of 7.3%. This rapid growth is primarily driven by increasing adoption in energy-efficient buildings, smart architecture, and advanced automotive glazing systems. A major factor fueling this expansion is the rising demand for low-emissivity (Low-E) coatings, which significantly enhance thermal insulation while allowing natural light transmission. Moreover, the automotive industry is increasingly integrating coated glass into windshields and sunroofs to improve UV protection, glare reduction, and aerodynamic performance.

By End-user Industry Insights

The construction sector depicted the largest application area in the North American flat glass market. This is credited to the integral role of flat glass in residential, commercial, and institutional building projects, particularly in windows, curtain walls, and internal partitions. One major driver of this segment's leadership is the steady recovery of housing starts and infrastructure development across the region. Furthermore, the adoption of energy-efficient glazing systems has surged due to stricter building codes and sustainability mandates. The American Architectural Manufacturers Association (AAMA) also notes that architects are increasingly specifying high-performance glazing to meet net-zero energy goals, reinforcing the construction sector’s continued dominance in the flat glass market.

The solar energy application segment is the fastest-growing within the North America flat glass market, expanding at a CAGR of 8.1%. This growth is primarily fueled by the rapid deployment of photovoltaic (PV) panels for utility-scale and distributed solar power generation. This surge was largely supported by the Inflation Reduction Act (IRA), which extended investment tax credits (ITC) for domestic solar manufacturing and installation. Flat glass serves as a critical component in PV modulesprotectingst environmental elements while maintaining high optical transmittance. Additionally, state-level renewable portfolio standards (RPS) and corporate sustainability commitments have further accelerated solar adoption, positioning the solar segment as the most dynamic growth driver in the North American flat glass industry.

COUNTRY ANALYSIS

The United States maintained the dominant position in the North American flat glass market by accounting for 85.7% of total regional consumption in 2024. This is underpinned by robust construction activity, a thriving automotive industry, and one of the world’s fastest-growing solar energy markets. Simultaneously, the automotive sector has seen increased integration of large-format and coated glass in electric vehicles (EVs). Additionally, the Solar Energy Industries Association (SEIA) highlights that the U.S. installed over 32 gigawatts of solar capacity in 2023, further reinforcing the country’s position as a leading consumer of flat glass in diverse industrial applications.

Canada’s market is steadily growing due to increasing investments in sustainable architecture, urban redevelopment, and energy-efficient building retrofits. Also, the country saw a key rise in green building certifications in recent months, driven by provincial incentives and national climate action plans. Moreover, the Canadian Solar Industries Association (CanSIA) reports that solar installations grew in 2023, supported by government grants and local utility programs promoting clean energy adoption. These trends are influencing flat glass demand in both architectural and renewable energy applications, positioning Canada as a steady growth contributor in the regional market.

The "Rest of North America", primarily comprising Mexico and select Central American territories, accounts for da descending share of total regional consumption in 2024. Though relatively modest in volume, this segment is showing promising growth potential due to expanding manufacturing activities and increasing foreign direct investment in the construction and automotive sectors. Additionally, infrastructure modernization efforts in Central American countries are boosting demand for flat glass in public buildings, schools, and healthcare facilities. As industrialization progresses and cross-border trade dynamics evolve, the RoNA market is expected to play an increasingly significant role in shaping the future trajectory of flat glass consumption in North America.

KEY MARKET PLAYERS

AGC Inc., CPS, BY CARDINAL GLASS INDUSTRIES, INC, China Glass Holdings Limited, Fuyao Glass Industry Group Co., Ltd, Guardian Industries Holdings, Nippon Sheet Glass Co. Ltd, Saint-Gobain, SCHOTT, Şişecam, Vitro. Are the market players that are dominating the flat glass market?

Top Players In The Market

Guardian Industries (A Saint-Gobain Company)

Guardian Industries, now part of Saint-Gobain, is a leading global manufacturer of flat glass with a strong presence in North America. The company produces a wide range of products, including float glass, coated glass, and insulated glass units for construction, automotive, and solar applications. Known for its innovation in energy-efficient glazing solutions, Guardian has significantly contributed to sustainable building practices and advanced architectural design worldwide.

VitroSAB. de CV (Vitro Glass)

Vitro Glass is one of the largest flat glass producers in North America, offering a comprehensive portfolio of products for residential, commercial, and industrial uses. With manufacturing facilities across the U.S. and Mexico, Vitro plays a crucial role in supplying high-performance glass solutions tailored to regional building codes and climate conditions. Its commitment to research and development has positioned it as a key player in smart and energy-saving glass technologies.

AGC Inc. (Formerly Asahi Glass Co., Ltd.)

AGC Inc. is a major international player in the flat glass industry with a growing influence in the North American market. The company supplies high-quality architectural and automotive glass, emphasizing innovation in lightweight, safety, and thermal control applications. AGC’s expansion into North America has been driven by strategic partnerships and investments in local production capabilities, strengthening its footprint in both the construction and electric vehicle sectors.

Top Strategies Used by Key Market Participants

One major strategy employed by key players in the North American flat glass market is continuous investment in product innovation and advanced glass technologies. Companies are focusing on developing high-performance coatings, smart glass, and ultra-thin tempered glass to meet evolving demands in energy efficiency, aesthetics, and durability across construction and automotive applications.

Another key approach is expanding production capacities and optimizing supply chain networks to ensure timely delivery and cost-effectiveness. Leading manufacturers are upgrading existing facilities and establishing new regional distribution centers to reduce logistics costs and improve responsiveness to customer needs, particularly in fast-growing urban and infrastructure markets.

Lastly, firms are increasingly engaging in strategic acquisitions and partnerships to consolidate their market position and diversify offerings. These moves allow companies to integrate complementary technologies, expand into niche segments such as photovoltaic glass, and strengthen relationships with architects, builders, and automakers seeking customized glazing solutions.

COMPETITIVE OVERVIEW

The competition in the North American flat glass market is highly consolidated, with a few dominant multinational corporations controlling a significant portion of production and distribution. Companies such as Guardian Industries, Vitro Glass, and AGC Inc. have established themselves as market leaders through extensive product portfolios, technological expertise, and well-developed sales channels. Their strong brand reputations and long-standing relationships with key end-users in construction, automotive, and renewable energy sectors give them a competitive edge over smaller regional players.

However, mid-sized and emerging glass manufacturers are actively challenging this dominance by specializing in niche applications such as smart glass, laminated safety glass, and custom architectural glazing. These firms often focus on localized service models, rapid customization, and sustainability-driven innovations to attract environmentally conscious developers and designers. Additionally, rising demand for energy-efficient buildings and electric vehicles is pushing all market participants to enhance their offerings in coated and lightweight glass solutions.

As regulatory standards become more stringent and consumer preferences shift toward high-performance materials, competition is expected to intensify further. Companies that can balance innovation, cost-efficiency, and environmental responsibility will be best positioned to capture growing opportunities in this evolving market landscape.

RECENT HAPPENINGS IN THE MARKET

- In February 2023, Guardian Industries announced the launch of a new line of ultra-low emissivity (Low-E) coated glass designed specifically for cold climate applications. This product rollout was aimed at improving thermal insulation in residential and commercial buildings while complying with stricter energy codes across northern U.S. states and Canada.

- In July 2023, Vitro Glass expanded its production facility in California to increase output capacity for solar panel glass and high-performance architectural glazing. This move was intended to support growing demand from utility-scale solar farms and green building projects in the western United States.

- In January 2024, AGC Inc. partnered with a leading electric vehicle manufacturer to co-develop lightweight, curved laminated glass for panoramic sunroofs. This collaboration was designed to enhance vehicle aesthetics and aerodynamics while maintaining structural integrity and occupant safety.

- In September 2023, Saint-Gobain acquired a specialty glass coating technology firm based in the Midwest, aiming to integrate advanced electrochromic and self-cleaning glass functionalities into its North American product lineup. This acquisition was expected to bolster the company’s leadership in smart building materials.

- In May 2024, Cardinal Glass Industries introduced a state-of-the-art digital ordering and tracking platform for architects and contractors, streamlining the procurement process for custom glass orders. This initiative was intended to improve customer experience and reinforce Cardinal’s reputation for service excellence in the architectural glass sector.

MARKET SEGMENTATION

This research report on the North American flat glass market is segmented and sub-segmented into the following categories.

By Product Type

- Annealed Glass (Including Tinted Glass)

- Coater Glass

- Reflective Glass

- Processed Glass

- Mirrors

By End-user

- Construction

- Automotive

- Solar

- Other End-user Industries

By Country

- US

- Canada

- Mexico

- Rest of North America

Frequently Asked Questions

What is the projected CAGR of the North America Flat Glass Market from 2025 to 2033?

The North America flat glass market is expected to grow at a CAGR of 9.12% from 2024 to 2030, driven by rising construction activity and increased use of energy-efficient glazing in commercial buildings.

Which country dominates flat glass consumption in North America?

The U.S. accounts for over 80% of total flat glass demand , fueled by large-scale residential and non-residential construction projects, especially in states like Texas, California, and Florida.

How much flat glass is used annually in new building construction across North America?

Approximately 75 million square meters of flat glass is installed each year in new commercial and residential buildings, according to the Glass Association of North America (GANA) .

Which application segment leads in flat glass usage?

Architectural glass for windows and façades holds the largest share, accounting for nearly 58% of all flat glass applications, particularly in urban infrastructure and green building developments.

What percentage of new commercial buildings in the U.S. use low-E coated flat glass?

Over 65% of newly constructed commercial buildings in the U.S. now specify low-emissivity (low-E) coated glass, as reported by the U.S. Department of Energy, to meet energy efficiency standards.

How has post-pandemic construction rebound affected flat glass demand?

Following supply chain disruptions, the U.S. saw a 12% increase in flat glass imports in Q1 2024, signaling a strong recovery in both residential and institutional construction sectors.

What role does vehicle electrification play in automotive flat glass demand?

EVs require advanced glazing solutions for improved aerodynamics and battery insulation. This shift has led to a 9% rise in demand for lightweight, acoustic-laminated flat glass in the North American auto industry since 2022.

Which region in the U.S. consumes the most flat glass per capita?

The Mountain West region (Colorado, Utah, Idaho) leads in per capita flat glass consumption due to rapid population growth, new housing developments, and high-altitude architectural design preferences.

How much flat glass is recycled annually in North America?

Around 1.2 million tons of flat glass is collected and processed for recycling each year, with Canada’s Glass Container Recycling Program and U.S.-based Regional Recycling Partnerships playing key roles.

How is AI being used in flat glass manufacturing in North America?

Major manufacturers like Guardian Industries and Vitro Architectural Glass have adopted AI-powered quality control systems , reducing defects by up to 20% and improving production efficiency in float glass lines.

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com