North America Flexible Foam Market Size, Share, Trends & Growth Forecast Report By Type (Polyurethane (PU), Polyethylene (PE), Polpropylene (PP)), Application, And Country (US, Canada, And Rest Of North America), Industry Analysis From 2025 To 2033

North America Flexible Foam Market Size

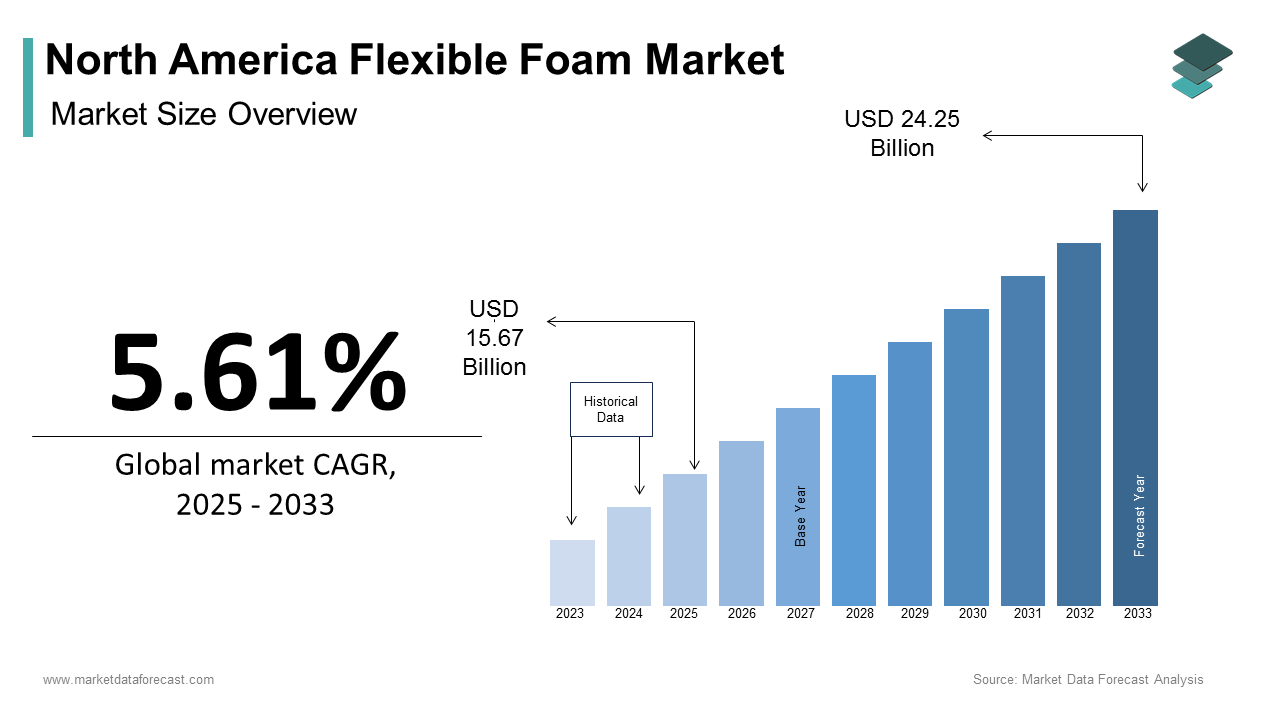

The North America flexible foam market size was calculated to be USD 14.84 billion in 2024 and is anticipated to be worth USD 24.25 billion by 2033, from USD 15.67 billion in 2025, growing at a CAGR of 5.61% during the forecast period.

MARKET DRIVERS

Rising Demand in Furniture & Bedding

The furniture and bedding industry stands as a primary driver of the North American flexible foam market. Consumer preferences for ergonomic designs and comfort-enhancing materials have amplified the use of flexible foams in mattresses, sofas, and cushions. Additionally, innovations such as viscoelastic memory foam have revolutionized sleep quality will propel the growth of the market. For example, Tempur Sealy International reported a 15% increase in revenue during Q3 2023, which is attributed to premium foam-based products. Moreover, the rise of e-commerce platforms has expanded accessibility by enabling direct-to-consumer sales of foam-based furniture.

Expansion in Automotive Applications

Automotive applications represent another key driver for the North America flexible foam market. Flexible foams are indispensable in manufacturing vehicle components such as seating, headrests, and interior panels due to their lightweight and shock-absorbing properties. The Society of Automotive Engineers reports that foam usage in vehicles reduces weight by up to 20% by enhancing fuel efficiency and reducing emissions. Tesla’s Model S Plaid, for instance, incorporates advanced PU foams to achieve superior comfort and durability.

MARKET RESTRAINTS

Volatility in Raw Material Prices

Price fluctuations of raw materials pose a significant challenge to the flexible foam market. Petrochemicals like polyols and isocyanates are essential for manufacturing polyurethane (PU) foams due to geopolitical tensions. Such volatility directly impacts production costs, eroding profit margins for manufacturers. Limited availability of alternatives exacerbates the issue for smaller firms unable to absorb cost escalations. This instability undermines long-term planning and investment decisions is hindering market development.

Stringent Environmental Regulations

Stringent environmental regulations present another major restraint, influencing both production and disposal practices. The Environmental Protection Agency (EPA) enforces strict guidelines on emissions and waste management is compelling manufacturers to adopt costly mitigation measures. Non-compliance penalties can reach USD 50,000 per violation is deterring smaller players. Additionally, public opposition to chemical manufacturing plants intensifies scrutiny around hazardous substance handling that is complicating project approvals. California’s ban on certain industrial chemicals in 2023 exemplifies how localized restrictions disrupt supply chains. These regulatory hurdles limit innovation flexibility and escalate compliance costs are acting as barriers to seamless market expansion.

MARKET OPPORTUNITIES

Adoption of Bio-Based Foams

The advent of bio-based foams presents a transformative opportunity for the market. Derived from renewable sources such as soybean oil and corn starch, these materials offer superior thermal and acoustic insulation properties while minimizing environmental impact. For instance, Dow Chemical’s RENUVA technology utilizes plant-based polyols to produce eco-friendly foams for automotive seating. Government incentives under the Inflation Reduction Act of 2022 further promote adoption, offering tax credits for sustainable materials. Consumer awareness campaigns amplify demand for green-certified products by positioning bio-based foams as a competitive advantage.

Growth in Packaging Applications

The burgeoning trend of e-commerce has significantly amplified demand for flexible foam in packaging applications. Lightweight and durable foams, such as polyethylene (PE), are widely used to safeguard fragile items during transit. Amazon’s partnership with Sealed Air Corporation in 2023 exemplifies this trend by utilizing customized foam inserts to enhance product safety. Additionally, the rise of sustainable packaging mandates drives innovation in recyclable and biodegradable foam materials. Strategic collaborations between manufacturers and logistics providers ensure seamless execution by enabling scalable solutions.

MARKET CHALLENGES

Supply Chain Disruptions

Supply chain vulnerabilities continue to hinder seamless operations in the flexible foam market. Geopolitical tensions, exemplified by Russia-Ukraine conflicts, disrupt raw material imports such as petrochemicals, which are critical components of foam production. Consulting firm McKinsey notes that logistics delays caused by port congestions added an average of 10-15 days to delivery timelines in 2023. Manufacturers reliant on just-in-time inventory models struggle to meet sudden spikes in demand, which are eroding customer trust. Additionally, labor shortages stemming from the pandemic persist by hampering production capacities.

Limited Availability of Skilled Labor

The shortage of skilled labor poses a persistent challenge in installation and retrofitting projects. According to the Associated General Contractors of America (AGC), nearly 80% of construction firms reported difficulty hiring qualified workers in 2023 by impacting project timelines and quality. Insufficient training programs and aging workforce demographics exacerbate the issues are limiting the pool of technicians proficient in advanced foam fabrication techniques. For instance, spray foam applications require specialized equipment and expertise by deterring smaller contractors from adopting the technology. High training costs associated with developing skilled labor deter hesitant investors, widening the gap between demand and supply.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

5.61% |

|

Segments Covered |

By Type, Application, And Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

Us, Canada, And Rest Of North America |

|

Market Leaders Profiled |

BASF SE, Covestro AG, Huntsman Corporation, Dow Inc., Recticel NV, UFP Technologies Inc., Carpenter Co., Rogers Corporation, Future Foam Inc., Foamcraft Inc. |

SEGMENTAL ANALYSIS

By Type Insights

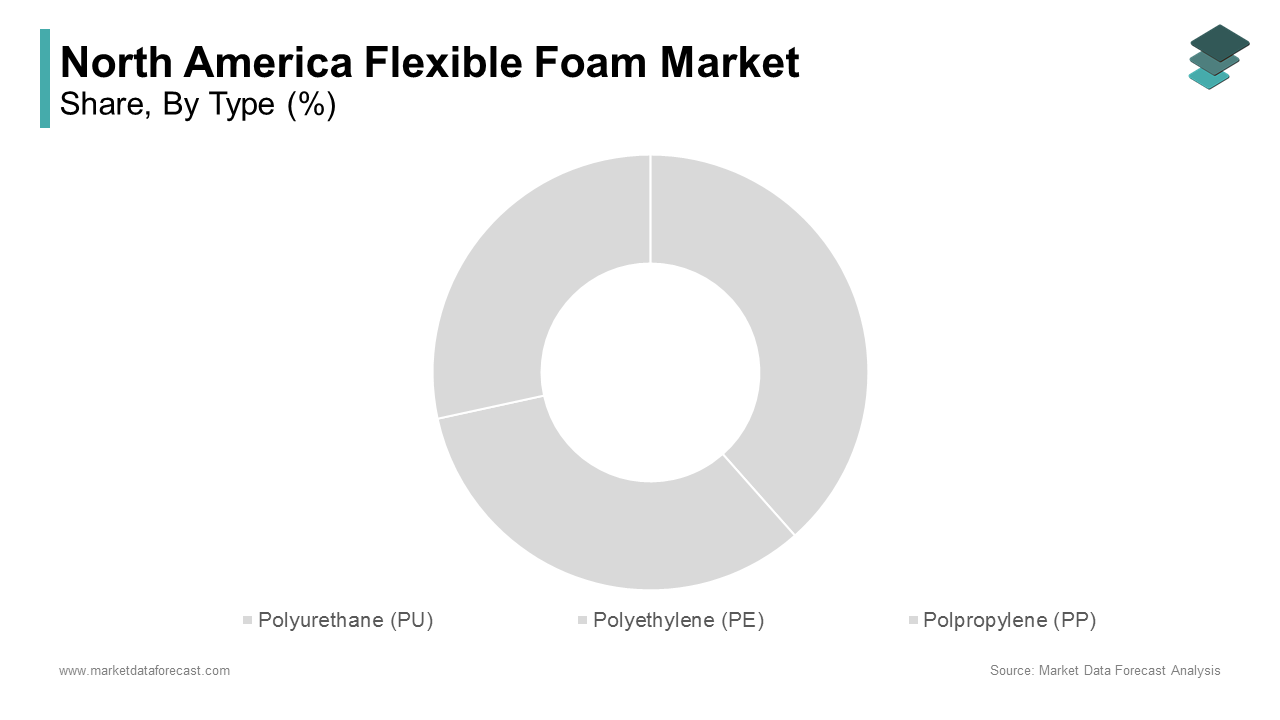

The Polyurethane (PU) segment dominated the North America flexible foam market by holding 55.4% of share in 2024. Its superior elasticity, durability, and versatility make it ideal for applications requiring high performance, such as automotive seating and furniture cushioning. Compatibility with diverse climatic conditions ensures widespread adoption in regions with extreme temperatures. Moreover, ongoing efforts to develop enhanced formulations address limitations such as moisture resistance and thermal degradation. Industry leaders like BASF emphasize continuous improvements, introducing proprietary PU lines that rival traditional alternatives.

The polyethylene (PE) is swiftly emerging with a projected CAGR of 8.2% during the forecast period. Superior lightweight properties and ease of customization drive its popularity in applications such as protective packaging and medical devices. DuPont’s recent adoption of PE for cushioning inserts promotes its suitability for high-performance protection. Growing emphasis on sustainability amplifies demand, as it complies with stringent recycling mandates without compromising performance. Additionally, rising investments in e-commerce necessitate robust packaging solutions are favoring PE formulations.

By Application Insights

The furniture & bedding segment was the largest and held 40.1% of the North America flexible foam market share in 2024 with the abundant use cases requiring flexible foams to enhance comfort and durability in residential and commercial settings. Accessibility and well-established infrastructure facilitate rapid deployment of foam-based activities, ensuring consistent utilization. Moreover, advancements in ergonomic designs enhance productivity are driving sustained demand for compatible materials. As per the National Association of Home Builders, furniture & bedding contributes nearly 70% of total U.S. household comfort upgrades by reinforcing its pivotal position in shaping market dynamics.

The transportation segment is likely to register a CAGR of 9.5% in the next coming years. Increasing focus on lightweight materials propels this growth of the market. Innovations in automotive design enable access to previously inaccessible thermal barriers is fueling demand for high-performance foams. For instance, Ford utilizes customized PU formulations tailored for electric vehicle interiors. Government backing through favorable funding terms accelerates project approvals is attracting multinational corporations. Additionally, strategic collaborations between service providers and operators streamline execution, reducing turnaround times.

REGIONAL ANALYSIS

The U.S. led the North American flexible foam market with 75.5% of the share in 2024. Federal incentives under the Inflation Reduction Act of 2022 have bolstered domestic production, which is spurring demand for high-performance foams. According to the Aluminum Association, Texas and California collectively house over 600 active facilities. Strategic investments in R&D ensure cutting-edge offerings by maintaining the country’s competitive edge amidst evolving industry standards.

Canada held 19.8% of the North America flexible foam market share in 2024. Alberta serves as the epicenter by hosting major projects like Syncrude and Suncor Energy. Cold climate operations necessitate durable powders are driving innovation in low-temperature formulations. Government policies supporting indigenous partnerships foster inclusive growth.

LEADING PLAYERS IN THE MARKET

BASF SE

BASF SE dominated the North American flexible foam market. Renowned for pioneering technologies, the company invests heavily in R&D to launch flagship products like Elastollan. Collaborations with major operators ensure widespread adoption is strengthening its dominant position.

Dow Inc.

Dow Inc. is excelling in integrated services. Its Foam line caters to diverse applications, enhancing customer satisfaction. Strategic acquisitions expand its portfolio by enabling comprehensive solutions tailored to specific client needs.

Covestro AG

Covestro is emphasizing sustainability. Eco-friendly innovations like Cardyon differentiate it from competitors. Strong partnerships with oil majors reinforce its reputation as a trusted provider, which is ensuring steady revenue streams.

TOP STRATEGIES USED BY KEY PARTICIPANTS

Major strategies include mergers and acquisitions to consolidate market presence, aggressive R&D investments for technological differentiation, and strategic alliances to penetrate emerging markets. Digital transformation initiatives enhance operational efficiencies, while sustainability-focused campaigns align with evolving consumer preferences.

KEY MARKET PLAYERS AND COMPETITION OVERVIEW

Major Players of the North America Flexible foam market include BASF SE, Covestro AG, Huntsman Corporation, Dow Inc., Recticel NV, UFP Technologies Inc., Carpenter Co., Rogers Corporation, Future Foam Inc., Foamcraft Inc.

The North American flexible foam market exhibits intense competition, characterized by a mix of established giants and niche players. BASF, Dow, and Covestro are leveraging the specialized segments by fostering innovation. Price wars and regulatory pressures intensify rivalry are prompting continuous adaptation to maintain competitiveness.

RECENT HAPPENINGS IN THE MARKET

- In April 2024, BASF acquired Thermobreak, enhancing its synthetic fluid capabilities.

This acquisition allows BASF to expand its portfolio of high-performance foams by targeting advanced applications like automotive seating and packaging. - In June 2024, Dow partnered with Equinor for HPHT fluid optimization, improving recovery rates.

The collaboration focuses on developing advanced formulations capable of enduring extreme conditions with Dow’s position in specialized applications. - In August 2024, Covestro launched Cardyon+, targeting eco-conscious clients with sustainable innovations.

The product addresses growing demand for green-certified foams by aligning with regulatory mandates and consumer preferences. - In October 2024, Sealed Air expanded its bio-fluid range , catering to offshore demands and environmental compliance. This expansion enhances Sealed Air’s ability to serve niche markets by reinforcing its reputation as a leader in sustainable solutions.

- In December 2024, NOV introduced AI-driven fluid management systems by revolutionizing real-time analytics and operational efficiency. The system enables predictive maintenance and process optimization by setting new standards for technological innovation in the industry.

MARKET SEGMENTATION

This research report on the North America flexible foam market has been segmented and sub-segmented based on type, application and region.

By Type

- Polyurethane (PU)

- Polyethylene (PE)

- Polpropylene (PP)

By Application

- Furniture & Bedding

- Transportation

- Packaging

By Region

- United States

- Canada

- Mexico

- Rest of North America

Frequently Asked Questions

1. Which industries are the major end-users of flexible foam in North America?

Major end-users include the furniture & bedding industry, automotive sector, construction, and packaging industries.

2. What is driving the growth of the North America flexible foam market?

Growth is driven by rising demand for comfort and cushioning in furniture and bedding, increasing automotive production, and expanding e-commerce that fuels protective packaging needs.

3. Who are the key market players in this region?

Major companies include BASF SE, Covestro AG, Huntsman Corporation, Dow Inc., Recticel NV, UFP Technologies, Carpenter Co., Rogers Corporation, Future Foam, and Foamcraft.

4. How is the market responding to sustainability concerns?

Manufacturers are focusing on producing eco-friendly foams, using renewable raw materials, and improving recycling capabilities to address environmental impacts.

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com