North America Flexographic Printing Inks Market Research Report – Segmented By Product Type( water-based inks, UV-cured inks ) Application ( packaging, Other ) and Country (The U.S., Canada and Rest of North America) - Industry Analysis, Size, Share, Growth, Trends, & Forecasts 2025 to 2033.

North America Flexographic Printing Inks Market Size

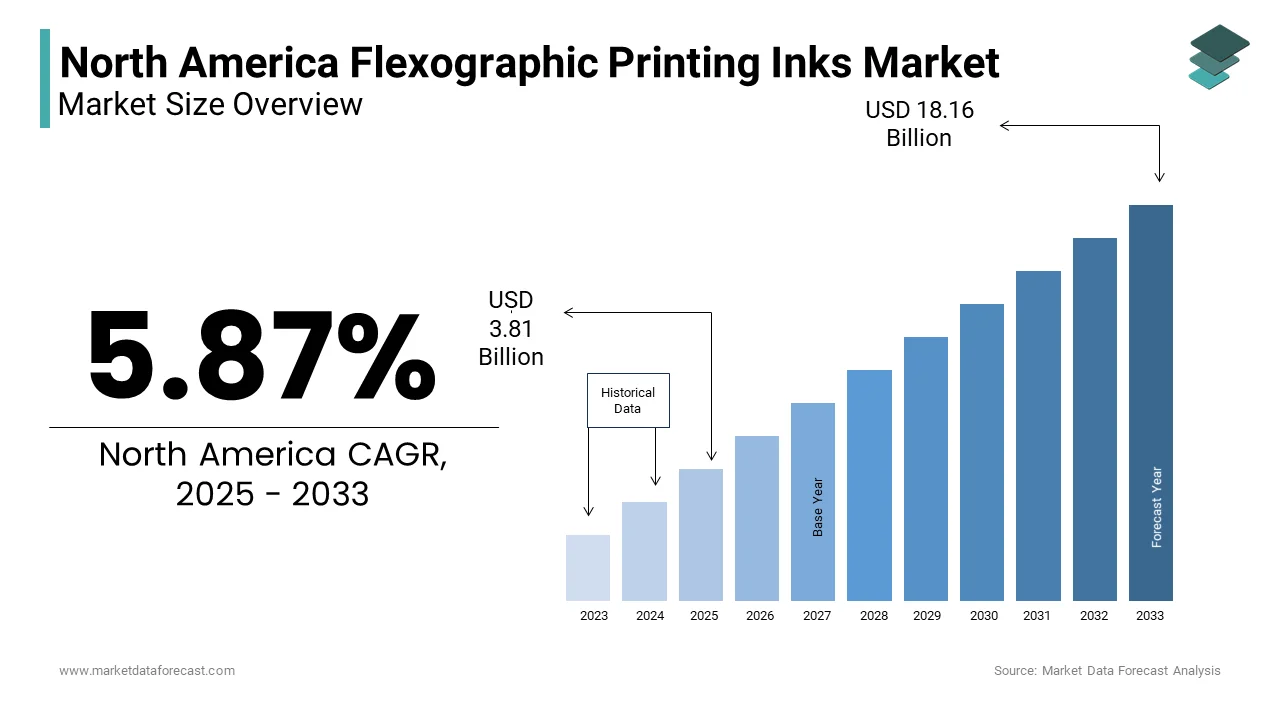

The North America Flexographic Printing Inks Market Size was valued at USD 3.60 billion in 2024. The North America Flexographic Printing Inks Market size is expected to have 5.87 % CAGR from 2025 to 2033 and be worth USD 18.16 billion by 2033 from USD 3.81 billion in 2025.

MARKET DRIVERS

Growing Demand for Flexible Packaging

Flexible packaging is a primary driver of the North America flexographic printing inks market, fueled by its versatility and cost-effectiveness across industries like food and beverage, pharmaceuticals, and e-commerce. This surge is attributed to the increasing consumer preference for convenient, resealable, and lightweight packaging solutions. Flexographic inks play a critical role in this segment, enabling high-quality printing on diverse substrates such as plastic films, paper, and aluminum foils. For instance, water-based flexographic inks are widely used in food packaging due to their non-toxic and odorless properties, ensuring compliance with FDA regulations. Another factor driving demand is the rise of e-commerce, which requires durable and visually appealing packaging to protect products during transit.

Shift Toward Sustainable Solutions

The shift toward sustainable printing solutions is another significant driver, propelled by stringent environmental regulations and consumer awareness. According to the Environmental Protection Agency, the U.S. generates over 80 million tons of packaging waste annually, which is prompting brands to adopt recyclable and biodegradable materials. UV-curable and water-based flexographic inks have gained traction as eco-friendly alternatives to solvent-based inks by reducing VOC emissions by up to 90%. Additionally, companies are investing in bio-based inks derived from renewable resources like vegetable oils by aligning with corporate sustainability goals.

MARKET RESTRAINTS

Volatile Raw Material Prices

One of the most pressing restraints in the North America flexographic printing inks market is the volatility of raw material prices for resins, pigments, and solvents. These materials are subject to price fluctuations driven by geopolitical tensions, supply chain disruptions, and energy costs. For instance, the price of titanium dioxide, a key pigment used in white inks, surged by over 30% in 2022 due to export restrictions in China. Such instability creates uncertainty for manufacturers, who must either absorb additional costs or pass them on to customers. This pricing volatility disproportionately affects small and medium-sized enterprises, which operate on tighter margins and lack the financial resilience to weather sudden cost spikes. Moreover, frequent price adjustments disrupt long-term planning and investment decisions by hindering market growth.

Stringent Regulatory Standards

Another significant restraint is the stringent regulatory framework governing VOC emissions and chemical usage in printing inks. Compliance with these regulations often involves costly R&D investments and process modifications. Additionally, state-level regulations, such as California’s Proposition 65, impose further restrictions, complicating cross-border operations. These challenges create barriers for smaller players and slow down the adoption of innovative solutions, thereby impacting overall market dynamics.

MARKET OPPORTUNITIES

Adoption of Digital Printing Technologies

The integration of digital printing technologies presents a transformative opportunity for the North America flexographic printing inks market. Flexographic inks are increasingly being optimized for compatibility with digital presses by enabling high-speed, customizable printing for short-run jobs. This trend is particularly relevant in the label and packaging sectors, where brands demand personalized designs and variable data printing. For instance, the food and beverage industry uses digital flexographic inks to print batch-specific information, such as expiration dates and QR codes, enhancing traceability and consumer engagement. Moreover, the ability to switch between traditional and digital workflows allows manufacturers to meet diverse customer needs while maintaining operational efficiency.

Expansion into Biodegradable and Compostable Inks

Another promising opportunity lies in the development of biodegradable and compostable flexographic inks, which cater to the growing demand for sustainable packaging. Bio-based inks, derived from renewable resources like soybean oil and cornstarch, offer a viable alternative to petroleum-based formulations, reducing environmental impact. The U.S. Department of Agriculture’s BioPreferred Program promotes the use of such materials by providing certification and marketing support to manufacturers. Additionally, compostable inks align with zero-waste initiatives, particularly in industries like food delivery and retail. For example, coffee chains are adopting compostable cups printed with bio-based inks to enhance their sustainability credentials.

MARKET CHALLENGES

Intense Competition and Price Wars

Intense competition within the North America flexographic printing inks market poses a significant challenge, exacerbated by the presence of numerous global and regional players vying for market share. This competitive environment often leads to price wars, eroding profit margins and making it difficult for companies to sustain long-term growth. Smaller players frequently undercut prices to attract customers, while larger companies struggle to differentiate their offerings in a saturated market. Additionally, the influx of low-cost imports from countries like China and India further intensifies pricing pressures. This combination of internal rivalry and external competition creates a challenging environment for businesses seeking profitability and market stability.

Limited Awareness of Advanced Ink Technologies

Another pressing challenge is the limited awareness and adoption of advanced ink technologies among end-users, particularly small and medium-sized enterprises. Despite the availability of innovative solutions like UV-curable and LED-curable inks, many businesses remain hesitant to invest due to perceived risks and upfront costs. According to a survey by Printing Industries of America, over 60% of small printing firms cite lack of knowledge and technical expertise as barriers to adopting new technologies. Moreover, the absence of standardized training programs and industry-wide education initiatives exacerbates the issue.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

5.87 % |

|

Segments Covered |

By Product Type, Application and Country. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Country Covered |

The U.S., Canada and Rest of North America |

|

Market Leader Profiled |

DIC CORPORATION, INX International Ink Co., Sun Chemical Corp. Inc. |

SEGMENTAL ANALYSIS

By Product Type Insights

The water-based inks segment led the North America flexographic printing inks market by capturing 45.3% of the share in 2024 with their widespread use in food and beverage packaging, where safety and compliance with stringent regulations are paramount. According to the Food and Drug Administration (FDA), water-based inks are preferred for direct and indirect food contact applications due to their non-toxic and odorless properties. According to the Environmental Protection Agency, water-based inks emit up to 90% fewer VOCs compared to solvent-based alternatives by aligning with environmental goals. Another driving factor is the increasing adoption of lightweight flexible packaging. The Flexible Packaging Association reports that flexible packaging accounted for nearly 19% of the U.S. packaging market in 2022, driven by its recyclability and cost-effectiveness. Water-based inks excel in this segment due to their ability to adhere to diverse substrates like plastic films and paper without compromising print quality.

The UV-cured inks segment is projected to register a CAGR of 7.8% from 2025 to 2033. The growth of the segment is fueled by their superior performance characteristics, including instant curing, high durability, and vibrant color reproduction. A major factor driving this growth is the shift toward digital printing technologies. Keypoint Intelligence notes that hybrid printing systems combining flexography and inkjet technology are increasingly adopting UV-cured inks for their compatibility and efficiency. Another factor is the rising demand for premium packaging in industries like cosmetics and pharmaceuticals. UV-cured inks enable intricate designs and glossy finishes by meeting these aesthetic requirements while ensuring compliance with regulatory standards.

By Application Insights

The packaging was the largest segment in the North America flexographic printing inks market with dominant share in 2024. The growth of the segment is attributed to the extensive use of flexographic inks in flexible packaging, labels, and corrugated boxes, which are critical to industries like food and beverage, e-commerce, and pharmaceuticals. A key factor driving this dominance is the rise of e-commerce. Another contributing factor is the growing emphasis on sustainability. The Environmental Protection Agency estimates that over 80 million tons of packaging waste are generated annually in the U.S. by prompting brands to adopt recyclable materials. Water-based and UV-cured flexographic inks play a pivotal role in this transition by enabling eco-friendly printing without compromising quality.

The "Other" segment is likely to experience a CAGR of 6.5% in the foreseen years. The growth of the segment can be driven the versatility of flexographic inks in meeting diverse industrial needs. For instance, flexographic inks are widely used in textile printing for producing vibrant designs on fabrics in the fashion and home decor industries. Another factor is the increasing adoption of flexographic inks in the automotive sector for printing on interior components and decals. According to the Center for Automotive Research, vehicle production in North America exceeded 16 million units in 2022 by driving demand for high-quality inks. Additionally, advancements in ink formulations have expanded their applicability to unconventional substrates, such as metals and ceramics, further propelling growth.

COUNTRY LEVEL ANALYSIS

The United States led the North America flexographic printing inks market with 80.4% of the share in 2024 owing to a robust packaging industry and strong regulatory focus on sustainability. A key driver is the widespread use of water-based inks in food and beverage packaging by ensuring compliance with FDA regulations. Additionally, the rise of e-commerce has amplified demand for corrugated boxes and shipping labels will accelerate the growth of the segment.

Canada was second by capturing 17.2% of the North America flexographic printing inks market share in 2024 with the growing emphasis on sustainable packaging and the country’s strong presence in the food and beverage sector. According to Agriculture and Agri-Food Canada, the food processing industry contributes over CAD 140 billion annually to the economy by creating steady demand for safe and compliant printing inks. Water-based inks are widely adopted in this segment due to their non-toxic properties and alignment with environmental goals. Another factor is the increasing adoption of UV-cured inks in premium packaging applications. According to the Canadian Packaging Association, the demand for visually appealing packaging has surged in the cosmetics and pharmaceutical industries.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Companies playing a prominent role in the North America flexographic printing inks market are DIC CORPORATION, INX International Ink Co., Sun Chemical Corp. Inc., Antonine Printing Inks Ltd, Kao Chimigraf.

The North America flexographic printing inks market is characterized by intense competition with the presence of global leaders and regional players striving to innovate and capture market share. Companies are investing heavily in R&D to develop cutting-edge products, such as biodegradable inks and UV-curable solutions, to cater to diverse industrial needs. The market is also witnessing a surge in collaborations, mergers, and acquisitions by enabling firms to consolidate their positions and expand their portfolios. Regulatory pressures to adopt safer and greener alternatives have further intensified competition, pushing companies to align with sustainability goals. Additionally, price wars and aggressive marketing tactics are common among smaller players seeking to challenge established brands.

Top Players in the Market

Sun Chemical

Sun Chemical is a leading innovator in the North America flexographic printing inks market, renowned for its sustainable and high-performance ink solutions. The company has made significant contributions by developing eco-friendly products, such as bio-based and water-based inks, which align with regulatory standards and consumer preferences. In 2023, Sun Chemical launched a new line of bio-based inks designed to reduce carbon footprints while maintaining superior print quality. Additionally, the company has invested in expanding its R&D capabilities to enhance product recyclability and compatibility with digital printing technologies by reinforcing its commitment to sustainability and innovation.

Flint Group

Flint Group is a key player known for its advanced UV-cured and solvent-based flexographic inks, widely used in packaging and industrial applications. The company has strengthened its market position by expanding its production facilities in North America, particularly in Illinois, to meet rising demand for UV-cured inks. Flint Group has also introduced customized ink solutions tailored to specific customer needs, ensuring high performance across diverse substrates. Recent initiatives include collaborations with end-users to optimize ink formulations for sustainability and efficiency by reflecting its focus on delivering value-added solutions to the market.

INX International Ink Co.

INX International Ink Co. specializes in innovative flexographic inks, including water-based and UV-curable formulations by catering to industries like food packaging and e-commerce. The company has recently partnered with recycling firms to develop closed-loop systems for reusing spent inks, promoting circular economy practices. INX has also launched a digital platform to streamline customer orders and provide real-time technical support by enhancing operational efficiency.

Top Strategies Used by Key Players

Key players in the North America flexographic printing inks market employ strategies such as product innovation, strategic partnerships, and sustainability initiatives to maintain their competitive edge. Product innovation involves developing advanced inks, such as bio-based and UV-curable formulations, to meet evolving industry standards and consumer demands. Strategic partnerships with recycling firms and technology providers enable companies to enhance supply chain efficiency and adopt circular economy practices. Sustainability initiatives focus on reducing environmental impact through recyclable materials and energy-efficient manufacturing processes. Additionally, investments in R&D and facility expansions allow firms to enhance production capacities and deliver high-quality products.

RECENT HAPPENINGS IN THE MARKET

- In March 2023, Sun Chemical launched a new line of bio-based flexographic inks, which was designed to reduce carbon footprints while maintaining high performance.

- In June 2023, Flint Group expanded its production facility in Illinois, USA, to meet rising demand for UV-cured inks in the packaging sector.

- In August 2023, INX International partnered with a recycling firm to develop a closed-loop system for reusing spent inks, which is promoting circular economy practices.

- In November 2023, Siegwerk introduced a digital platform to streamline customer orders and provide real-time technical support for ink solutions.

- In February 2024, Toyo Ink acquired a startup specializing in water-based ink technology, which is enhancing its portfolio for food packaging applications.

MARKET SEGMENTATION

This research report on the north america flexographic printing inks market has been segmented and sub-segmented into the following.

By Product Type

- water-based inks

- UV-cured inks

By Application

- packaging

- Other

By Country

- The U.S.

- Canada

- Rest of North America

Frequently Asked Questions

What are the main factors driving the growth of the flexographic printing inks market in North America?

Key drivers include increasing demand for flexible packaging, eco-friendly ink solutions, and growth in the food & beverage and personal care sectors.

Which types of inks are most commonly used in flexographic printing in North America?

Water-based and UV-curable inks are dominant, owing to their environmental benefits and fast-drying properties.

What are the major end-use industries for flexographic printing inks in this region?

Primary end-use industries include packaging (flexible & rigid), labels, food & beverage, cosmetics, and pharmaceuticals.

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com