North America Forging Market Size, Share, Trends & Growth Forecast Report By End-user (Automotive, Defense and Aerospace, Shipbuilding, Others), Raw Material (Carbon Steel, Alloy Steel, Aluminum, Magnesium, Others), Application (Closed Die Forging, Open Die Forging, Seamless Rings), and Country (United States, Canada, Mexico, Rest of North America) – Industry Analysis From 2025 to 2033.

North America Forging Market Size

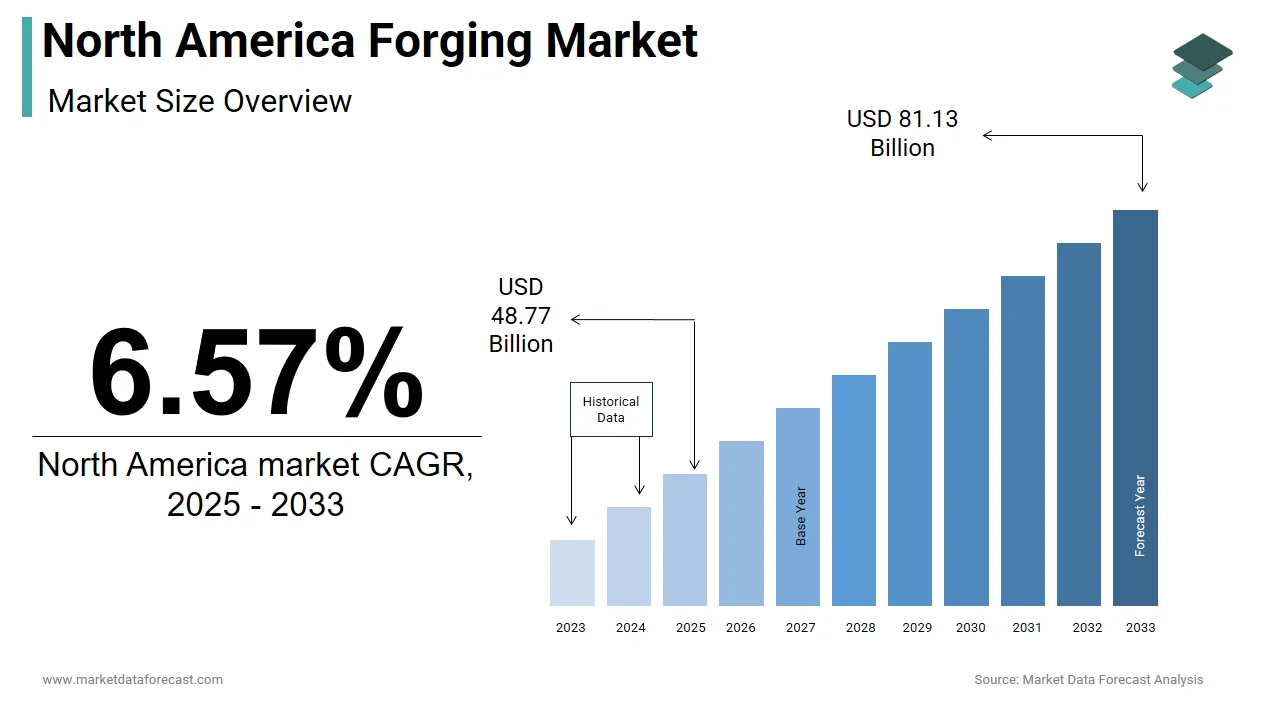

The size of the North America forging market was worth USD 45.76 billion in 2024. The North America market is anticipated to grow at a CAGR of 6.57% from 2025 to 2033 and be worth USD 81.13 billion by 2033 from USD 48.77 billion in 2025.

MARKET DRIVERS

Rising Demand from the Automotive Sector

The automotive industry stands as a primary driver of the North America forging market. The surge in vehicle production, coupled with stringent safety and emission standards, has fueled the need for high-strength forged components such as crankshafts, connecting rods, and steering knuckles. As per the International Organization of Motor Vehicle Manufacturers (OICA), North America produced over 13 million vehicles in 2022, reflecting a consistent upward trajectory.

Lightweight materials like aluminum and magnesium are gaining traction, propelled by the transition to electric vehicles (EVs). Like, EV manufacturers prioritize forged parts for their superior strength-to-weight ratio, which enhances battery efficiency and range. Additionally, the rise of autonomous vehicles has spurred demand for precision-engineered components, ensuring reliability under extreme conditions.

Expansion of Defense and Aerospace Applications

The defense and aerospace sectors represent another significant driver. The escalating geopolitical tensions and increased defense spending have amplified demand for forged components used in aircraft engines, landing gear, and missile systems. In addition, defense expenditures surged significantly, driving investments in advanced manufacturing technologies.

Aerospace applications are equally pivotal, with Boeing and Airbus projecting a combined demand for over 40,000 new aircraft by 2030. These aircraft require forged titanium and alloy steel components, which offer exceptional durability and resistance to extreme temperatures. Innovations such as additive manufacturing and precision forging have further enhanced capabilities, enabling manufacturers to meet stringent quality standards.

MARKET RESTRAINTS

High Energy Costs and Environmental Regulations

Among the primary restraints facing the North America forging market is the escalating energy costs associated with forging processes. Similarly, industrial electricity prices rose in recent years, impacting manufacturers reliant on energy-intensive operations. Forging requires high temperatures to shape metals, making it particularly vulnerable to fluctuations in energy prices.

Environmental regulations further compound this challenge. California’s stringent emissions standards, enforced under Proposition 65, mandate reductions in greenhouse gas emissions, increasing compliance costs for forging facilities. A notable number of manufacturers have faced operational disruptions due to regulatory pressures. While some companies are transitioning to energy-efficient furnaces, the high upfront investment limits adoption.

Supply Chain Disruptions and Raw Material Shortages

Supply chain disruptions and raw material shortages pose another significant restraint for the forging market. The COVID-19 pandemic revealed weaknesses in global logistics networks, causing delays and higher costs. Like, transportation expenses surged by considerably in 2022, impacting manufacturers reliant on imported materials. Alloy steel, a key raw material, faced supply constraints due to geopolitical tensions, driving up prices.

These disruptions compelled companies to rethink their procurement strategies, often affecting profitability. Smaller players, in particular, struggle to absorb rising costs, leading to reduced production capacities and inventory shortages.

MARKET OPPORTUNITIES

Adoption of Lightweight Materials for EVs

The transition to electric vehicles (EVs) presents a lucrative opportunity for the North America forging market. Aluminum and magnesium alloys, prized for their strength-to-weight ratio, are increasingly replacing traditional steel in EV manufacturing.

Manufacturers are capitalizing on this trend by innovating with advanced forging techniques, such as closed-die forging, to produce precision-engineered components. For instance, companies like Alcoa and Novelis have introduced forged aluminum parts that reduce vehicle weight, enhancing battery efficiency and range. These innovations not only align with regulatory standards but also appeal to environmentally conscious consumers.

Growth in Additive Manufacturing and Smart Technologies

The integration of additive manufacturing and smart technologies represents another promising avenue for growth. Forging companies are leveraging these innovations to enhance operational efficiency and product quality. For example, Arconic has partnered with aerospace giants like Boeing to develop 3D-printed titanium components, reducing waste and production time. Similarly, IoT-enabled sensors are being deployed to monitor forging processes in real-time is ensuring consistency and reducing defects. These advancements not only improve competitiveness but also open new revenue streams, positioning the forging market at the forefront of industrial innovation.

MARKET CHALLENGES

Intense Price Competition and Market Fragmentation

Intense price competition and market fragmentation pose major challenges for the North America forging market, with numerous players, from established brands to regional manufacturers, engaging in frequent pricing wars. This fragmentation results in a race to the bottom, eroding profit margins and stifling innovation.

Additionally, the commoditization of basic forged components has further exacerbated the issue. Generic products, which dominate a key portion of industrial applications, offer little differentiation, forcing manufacturers to compete solely on price. This unsustainable approach undermines brand equity and limits investment in R&D, hindering the development of next-generation solutions.

Skilled Labor Shortages and Workforce Gaps

Skilled labor shortages represent another major challenge, jeopardizing the sustainability of the forging market. According to the National Association of Manufacturers (NAM), over 2.1 million manufacturing jobs could remain unfilled by 2030 due to a lack of qualified workers. Forging, being a specialized process, requires expertise in metallurgy, machining, and quality control, making it particularly vulnerable to workforce gaps.

The aging workforce further compounds this issue, with a considerable percentage of skilled workers expected to retire by 2025. Younger generations are less inclined toward manufacturing careers, preferring tech-driven industries. This disconnect has led to increased training costs and prolonged onboarding times, impacting productivity.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Type, Route of Administration, Drug Class, and Region. |

|

Various Analyses Covered |

Global, Regional and Country-Level Analysis, Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Countries Covered |

United States, Canada, Mexico, and the Rest of North America. |

|

Market Leaders Profiled |

Aichi Steel Corp., Ajax Tocco Magnethermic Corp., Alicon Castalloy Ltd., All Metals and Forge Group, Allegheny Technologies Inc., Aluminum Precision Products, American Axle and Manufacturing Inc., Asahi Forge Corp., Bharat Forge Ltd., Bruck GmbH, Consolidated Industries Inc., Farinia SA, Fountaintown Forge Inc., Larsen and Toubro Ltd., Mitsubishi Steel Mfg. Co. Ltd., Pacific Forge Inc., Patriot Forge Co., Scot Forge Co., Sumitomo Heavy Industries Ltd., thyssenkrupp AG, and others. |

SEGMENTAL ANALYSIS

By End-User Insights

The automotive sector dominated the North America forging market by commanding a 40.5% share in 2024. This rise is credited to the critical role forged components play in vehicle performance and safety. Components like crankshafts, connecting rods, and steering knuckles are indispensable for internal combustion engines (ICEs) and electric vehicles (EVs).

Consumer preferences for lightweight and fuel-efficient vehicles have further reinforced this dominance. A large number of automakers prioritize forged aluminum parts to reduce vehicle weight and enhance battery efficiency. Retailers and OEMs like Ford and General Motors have capitalized on this trend by integrating forged components into their designs, driving accessibility and visibility.

The defense and aerospace segment represented the fastest-growing, with a CAGR of 8.5% projected from 2025 to 2033. This growth is fueled by escalating defense budgets and the rising demand for commercial aircraft. Forged titanium and alloy steel components are essential for aircraft engines and missile systems, ensuring durability under extreme conditions. Government contracts and partnerships with aerospace giants like Boeing and Airbus have accelerated adoption.

By Raw Material Insights

Carbon steel gained the maximum prominence in the North America forging market with a 50.5% share in 2024. The widespread adoption of this segment is credited to its affordability, durability, and versatility. Also, carbon steel is ideal for producing high-strength components, such as gears and shafts, which are critical for industrial machinery and automotive applications.

Consumer trust in carbon steel is further bolstered by its compatibility with various forging techniques. Retailers like McMaster-Carr and Grainger have amplified their reach by offering bulk purchase options, catering to industrial clients. These attributes reinforce carbon steel’s leadership position in the market.

Aluminum is advancing at a rapid pace in the market, with a CAGR of 9.2% predicted in the future. This rapid expansion is driven by its lightweight properties and corrosion resistance, appealing to modern industries. Aluminum’s adoption in EV manufacturing has surged, with companies prioritizing forged parts to enhance battery efficiency and range.

Advancements in forging technologies have enabled the production of complex geometries, addressing diverse consumer needs. A key portion of the manufacturers prefer aluminum for its sustainability credentials. Brands like Alcoa and Novelis have successfully tapped into this demand, launching premium variants infused with advanced alloys.

By Application Insights

The closed die forging segment commanded the North America forging market by accounting for 60.3% of total revenue in 2022, as per IBISWorld. Its prominence is attributed to its ability to produce high-precision components with minimal waste, making it ideal for automotive and aerospace applications. The process ensures superior mechanical properties, meeting stringent quality standards.

Consumer behavior reinforces its dominance. Big retail players like Amazon Business have expanded their product ranges to include closed-die forged parts, driving accessibility and visibility. These factors underscore its leadership position in the market.

The seamless rings segment is viewed as the swiftest moving category, which is expected to have a CAGR of 10.3% in the future. Their progress is fueled by their application in high-performance industries, such as aerospace and power generation. Seamless rings offer exceptional strength and fatigue resistance, ensuring reliability under extreme conditions.

Innovations in forging technologies have enhanced their utility, attracting repeat customers. Also, a notable portion of aerospace manufacturers prioritize seamless rings for their structural integrity. These attributes position seamless rings as a transformative force in the market’s evolution.

COUNTRY LEVEL ANALYSIS

The United States remains on top of the North America forging market by commanding an 80.4% share of regional revenue in 2024. This dominance is driven by the country’s robust manufacturing base, which includes a large number of forging facilities spread across key industrial hubs such as Detroit, Houston, and Los Angeles. The automotive sector, a cornerstone of the U.S. economy, serves as the largest consumer of forged components, accounting for a significant percentage of total demand. According to the International Organization of Motor Vehicle Manufacturers (OICA), the U.S. produced approximately 10 million vehicles in 2022, creating a steady demand for high-strength forged parts like crankshafts, connecting rods, and steering knuckles.

Consumer preferences in the U.S. are evolving rapidly, with a growing emphasis on lightweight materials such as aluminum and magnesium alloys. Walmart and Target are examples of big retail companies that have expanded their industrial product offerings, while e-commerce platforms like Amazon Business cater to the rising demand for forged components among small and medium enterprises (SMEs). Additionally, government initiatives promoting domestic manufacturing under the "Made in America" campaign have further bolstered the forging industry’s growth.

Canada is contributing notably to regional revenue in 2024. The country’s strong automotive and aerospace sectors, coupled with its abundant natural resources, provide a solid foundation for the forging industry. Cities like Toronto, Montreal, and Vancouver serve as major manufacturing hubs, with a particular focus on producing forged components for heavy machinery, mining equipment, and commercial aircraft.

Environmental consciousness is a defining characteristic of Canadian consumers and manufacturers alike. A significant portion of Canadian companies prioritize sustainable practices, including the adoption of energy-efficient forging technologies and recyclable materials. Retail chains e.g. Canadian Tire and industrial suppliers such as Acklands-Grainger, play a pivotal role in distributing forged products to local markets. Moreover, the Canadian government’s commitment to reducing carbon emissions has incentivized manufacturers to adopt green technologies, further aligning with global sustainability trends.

Mexico represents a key market in North America. The country’s strategic location, proximity to the U.S., and participation in trade agreements like the USMCA have positioned it as a key player in the forging supply chain. Also, Mexico City, Monterrey, and Guadalajara are major manufacturing centers, with a focus on producing forged components for the automotive and appliance industries. Similarly, Mexico’s automotive fleet surpassed 50 million vehicles in 2022, creating a vast consumer base for forged parts.

Affordability remains a key driver in Mexico. Private-label brands dominate the market, offering budget-friendly alternatives to premium products. OXXO and Chedraui are of the big retailers that ensure widespread accessibility, while e-commerce platforms like MercadoLibre are gaining traction among younger demographics. Besides, partnerships with global automakers such as Nissan and Volkswagen have spurred investments in forging facilities, enhancing production capabilities.

MARKET KEY PLAYERS

Companies playing a dominant role in the North America forging market profiled in this report are Aichi Steel Corp., Ajax Tocco Magnethermic Corp., Alicon Castalloy Ltd., All Metals and Forge Group, Allegheny Technologies Inc., Aluminum Precision Products, American Axle and Manufacturing Inc., Asahi Forge Corp., Bharat Forge Ltd., Bruck GmbH, Consolidated Industries Inc., Farinia SA, Fountaintown Forge Inc., Larsen and Toubro Ltd., Mitsubishi Steel Mfg. Co., Ltd., Pacific Forge Inc., Patriot Forge Co., Scot Forge Co., Sumitomo Heavy Industries Ltd., thyssenkrupp AG, and others.

TOP LEADING PLAYERS IN THE MARKET

Arconic Corporation

Arconic Corporation commands by leveraging its expertise in lightweight materials such as aluminum and titanium. The company’s success is rooted in its ability to cater to diverse industries, including automotive, aerospace, and defense. Arconic’s focus on sustainability is evident in its development of eco-friendly forging processes and recyclable materials, aligning with growing environmental consciousness. Strategic partnerships with automakers like Ford and aerospace giants like Boeing have further amplified its reach, solidifying its position as a market leader.

Precision Castparts Corp.

Precision Castparts Corp., a subsidiary of Berkshire Hathaway. The company stands out by specializing in high-performance forged components for aerospace, defense, and power generation. Its state-of-the-art facilities and advanced forging technologies enable the production of precision-engineered parts that meet stringent quality standards.

Allegheny Technologies Incorporated (ATI)

The company’s emphasis on high-performance alloys and specialty metals has resonated with manufacturers seeking durable and reliable components for harsh environments. ATI’s seamless rings and open die forgings are widely used in the oil and gas, chemical processing, and marine industries. Strategic investments in additive manufacturing and smart technologies have enabled ATI to enhance operational efficiency and product quality.

TOP STRATEGIES USED BY KEY MARKET PARTICIPANTS

Key players in the North America forging market employ a variety of strategies to maintain their competitive edge and capitalize on emerging opportunities. These strategies encompass product innovation, sustainability initiatives, strategic partnerships, and aggressive marketing campaigns, all of which contribute to sustained growth and market leadership.

Product Innovation

Innovation remains a cornerstone of success in the forging market, with companies investing heavily in R&D to develop next-generation products.

Sustainability Initiatives

Sustainability has emerged as a critical focus area, with manufacturers prioritizing eco-conscious practices to address regulatory pressures and consumer expectations.

COMPETITION OVERVIEW

The North America forging market is characterized by intense competition, driven by the presence of established brands and emerging players vying for market share. Fragmentation enables smaller entities to prosper, while larger companies capitalize on economies of scale to retain dominance. Sustainability and technological advancements have become key differentiators, shaping the competitive landscape and influencing consumer preferences.

The market’s fragmentation is evident in the distribution of market share, with the top five players accounting for a notable portion of total revenue. This leaves the remainder divided among smaller entities, creating a highly dynamic environment. Price wars are prevalent, with manufacturers using aggressive discounting strategies to appeal to budget-conscious consumers. However, this often undermines profitability, leading companies to seek alternative ways to differentiate themselves.

Sustainability has turned into a competitive battleground, with brands racing to launch eco-friendly products that resonate with consumer values. Companies like Arconic and ATI have gained a competitive edge by prioritizing recyclable materials and energy-efficient processes. Similarly, technological advancements have opened new frontiers, with smart forging technologies redefining operational efficiency and product quality.

RECENT MARKET DEVELOPMENTS

- April 2023: Arconic Launches EV-Specific Components: In April 2023, Arconic launched a line of forged aluminum components specifically designed for electric vehicles (EVs). These lightweight parts aim to enhance battery efficiency and range, aligning with the growing demand for sustainable mobility solutions.

- June 2023: Precision Castparts Partners with Boeing: In June 2023, Precision Castparts partnered with Boeing to develop titanium forged parts for next-generation aircraft engines. This collaboration underscores the company’s commitment to advancing aerospace technology and meeting stringent quality standards.

- August 2023: ATI Unveils IoT-Enabled Forging Process: In August 2023, Allegheny Technologies Incorporated (ATI) unveiled a smart forging process integrating IoT sensors for real-time monitoring. This innovation enhances operational efficiency and ensures consistency in product quality.

- October 2023: Alcoa Expands Magnesium-Based Solutions: In October 2023, Alcoa expanded its product line with magnesium-based forged solutions, targeting lightweight applications in the automotive and aerospace sectors. This move highlights the company’s adaptability to shifting market trends.

- December 2023: Novelis Acquires Additive Manufacturing Startup: In December 2023, Novelis acquired a startup specializing in additive manufacturing for forged components. This acquisition enhances the company’s capabilities and strengthens its position in the advanced manufacturing segment.

MARKET SEGMENTATION

This research report on the North America forging market is segmented and sub-segmented into the following categories.

By End-user

- Automotive

- Defense and aerospace

- Shipbuilding

- Others

By Raw Material

- Carbon steel

- Alloy steel

- Aluminum

- Magnesium

- Others

By Application

- Closed die forging

- Open die forging

- Seamless rings

By Country

- United States

- Canada

- Mexico

- Rest of North America

Frequently Asked Questions

1. What are the main factors driving growth in the North America forging market?

Growth is driven by rising automotive production, demand for lightweight and high-strength components in electric vehicles, and increased defense and aerospace investments.

2. What challenges does the forging industry face in North America?

The industry faces challenges from high energy costs, strict environmental regulations, supply chain disruptions, and skilled labor shortages.

3. What trends and opportunities are shaping the future of the market?

Key trends include the adoption of advanced forging technologies, increased use of aluminum and magnesium alloys, and the integration of smart manufacturing and additive processes to enhance efficiency and sustainability

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com