North America FPGA Market Size, Share, Trends & Growth Forecast Report By Configuration (Low-End FPGA, Mid-Range FPGA, High-End FPGA), Technology, Node Size, Vertical, And Country (US, Canada, And Rest Of North America), Industry Analysis From 2025 To 2033

North America FPGA Market Size

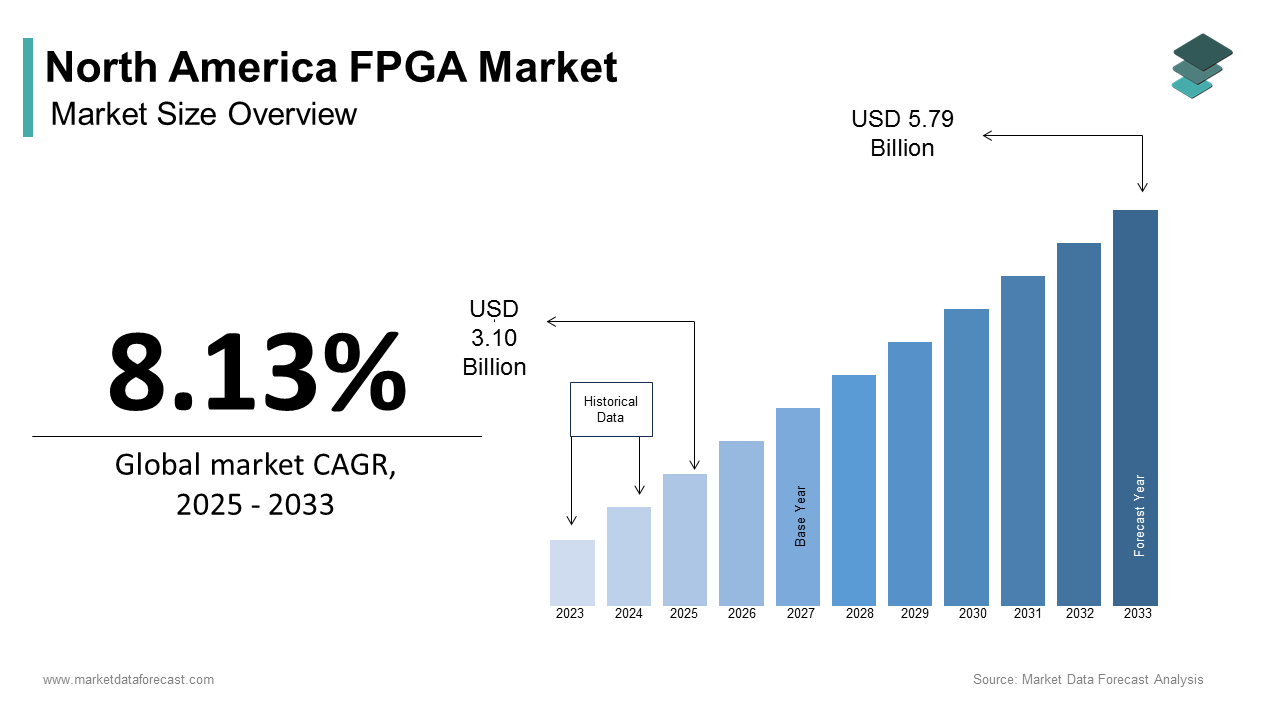

The North America FPGA Market size was calculated to be USD 2.87 billion in 2024 and is anticipated to be worth USD 5.79 billion by 2033, from USD 3.10 billion in 2025, growing at a CAGR of 8.13% during the forecast period.

The North American field-programmable Gate Array (FPGA) market includes the design, development, manufacturing, and application of programmable logic devices that enable customizable digital circuitry for a wide range of industries including aerospace, defense, telecommunications, automotive, healthcare, and industrial automation. Unlike Application-Specific Integrated Circuits (ASICs), FPGAs offer flexibility through reprogrammability, allowing engineers to modify hardware functions post-deployment without requiring physical redesign. As per Innovation, Science and Economic Development Canada, Canada has also been expanding its presence in embedded systems and AI-driven computing, fostering increased adoption of FPGAs in academic research and specialized industry applications. Additionally, the rise of edge computing, artificial intelligence, and advanced driver-assistance systems (ADAS) has spurred demand for high-performance, low-latency processing solutions—areas where FPGAs offer distinct advantages over traditional processors. With the growing reliance on adaptive hardware across both public and private sectors, the North American FPGA market is evolving beyond niche applications into mainstream technology ecosystems. This shift is supported by advancements in chip architecture, improved tooling environments, and increasing integration with machine learning frameworks, positioning FPGAs as a critical enabler of next-generation computing and real-time data processing capabilities.

MARKET DRIVERS

Increasing Adoption in Aerospace and Defense Applications

One of the primary drivers of the North American FPGA market is the growing deployment of field-programmable gate arrays in aerospace and defense systems, particularly in radar, signal processing, and secure communications. These sectors require high-speed, adaptable hardware capable of handling complex computational tasks in dynamic environments—making FPGAs an ideal solution due to their reconfigurable logic and parallel processing capabilities. Programs such as the Airborne Warning and Control System (AWACS) and Joint Tactical Radio System (JTRS) have integrated FPGA-based modules to enhance adaptability and mission readiness. As per the Canadian Institute for Strategic Studies, these upgrades are part of broader modernization efforts aimed at improving situational awareness and operational resilience.

Expansion of Edge Computing and Industrial Automation

A significant driver fueling the growth of the North American FPGA market is the rapid expansion of edge computing and industrial automation, where real-time data processing and low-latency responsiveness are essential. As industries increasingly adopt smart manufacturing, predictive maintenance, and autonomous control systems, the need for flexible and efficient hardware accelerators like FPGAs has surged. These deployments allow for greater customization, faster decision-making, and reduced dependency on cloud-based computation. In Canada, an increase in pilot projects involving FPGA-accelerated industrial IoT systems in 2023, particularly in precision agriculture and energy monitoring applications. Also, this trend is being supported by federal investments in smart grid infrastructure and intelligent transportation systems.

MARKET RESTRAINTS

High Design Complexity and Cost of Implementation

A key restraint affecting the North American FPGA market is the high complexity involved in FPGA design and programming, which requires specialized expertise and extended development cycles. Unlike general-purpose processors or microcontrollers, FPGAs operate at the hardware level, necessitating deep knowledge of hardware description languages (HDLs), synthesis tools, and timing constraints, limiting their accessibility to smaller firms and startups.

Intensifying Competition from ASICs and GPUs

An additional challenge confronting the North American FPGA market is the intensifying competition from alternative technologies such as Application-Specific Integrated Circuits (ASICs) and Graphics Processing Units (GPUs), which are gaining traction in performance-critical applications like AI inference, blockchain processing, and network acceleration. According to the International Technology Roadmap for Semiconductors (ITRS), ASICs offer superior performance and lower power consumption in fixed-function applications, making them more attractive for large-scale deployments where reconfiguration is not required. Companies like Google and Tesla have invested heavily in custom ASIC designs for AI and autonomous vehicle systems, reducing reliance on FPGAs in certain domains. While FPGAs retain advantages in latency-sensitive and reconfigurable applications, the competitive pressure from optimized ASICs and highly programmable GPUs presents a persistent challenge, particularly in consumer electronics and cloud-centric markets.

MARKET OPPORTUNITIES

Integration of FPGAs in 5G Infrastructure and Telecommunications

An emerging opportunity for the North American FPGA market lies in the ongoing rollout of 5G networks and the increasing demand for agile, high-performance radio access infrastructure. As telecom operators deploy Open Radio Access Network (O-RAN) architectures, FPGAs are becoming integral components in baseband processing units, beamforming engines, and network function virtualization. In addition, the U.S. Federal Communications Commission (FCC) has mandated greater flexibility in spectrum usage, prompting equipment providers to adopt FPGA-based radios that can be reconfigured remotely to meet evolving regulatory requirements. As per the Canadian Radio-television and Telecommunications Commission (CRTC), similar policy shifts in Canada are encouraging telecom firms to invest in programmable hardware for future-proofing their infrastructure.

Growth of FPGA Utilization in Automotive and Autonomous Driving Systems

A significant opportunity shaping the future of the North American FPGA market is the expanding role of FPGAs in automotive and autonomous driving technologies, particularly in real-time sensor fusion, image processing, and onboard AI inferencing. As vehicles become more reliant on advanced driver-assistance systems (ADAS) and autonomous navigation, the demand for flexible, low-latency hardware accelerators has surged. According to the Center for Automotive Research (CAR), over 40 automakers and Tier-1 suppliers in the U.S. are actively exploring FPGA-based solutions for LiDAR, radar, and camera data aggregation. Xilinx (AMD) and Intel have both announced partnerships with major automotive OEMs to integrate FPGA co-processors into next-generation electric and self-driving vehicles.

MARKET CHALLENGES

Rapid Technological Obsolescence and Long Development Cycles

A major challenge facing the North American FPGA market is the rapid pace of technological advancement combined with lengthy development cycles, which make it difficult for companies to maintain product relevance and return on investment. FPGA architectures evolve quickly, with device density, power efficiency, and toolchain capabilities undergoing significant changes every 18–24 months. This timeline contrasts sharply with the typical 6–8 month cycle for ASIC or GPU-based implementations, limiting agility in fast-moving commercial sectors. As per the National Research Council of Canada (NRC), this delay often results in deployed systems becoming outdated before they reach end users.

Supply Chain Constraints and Global Component Shortages

Another challenge confronting the North American FPGA market is the ongoing volatility in global supply chains and shortages of critical components used in FPGA manufacturing. The semiconductor industry continues to face bottlenecks in wafer fabrication capacity, packaging materials, and logistics disruptions stemming from geopolitical tensions and trade restrictions. Like, lead times for programmable logic components remained above 30 weeks in early 2024, significantly delaying product shipments and project timelines for companies relying on FPGAs. Also, this led to increased outsourcing of FPGA-based design work to offshore partners with better component access.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

8.13% |

|

Segments Covered |

By Configuration, Technology, Node Size, Vertical, And Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

Us, Canada, And the Rest of North America |

|

Market Leaders Profiled |

Intel Corporation, AMD (Xilinx), Lattice Semiconductor Corporation, Microchip Technology Inc. (Microsemi), Achronix Semiconductor Corporation, QuickLogic Corporation, Flex Logix Technologies Inc., Efinix Inc., Cobham Advanced Electronic Solutions, Broadcom Inc., Taiwan Semiconductor Manufacturing Company Limited, United Microelectronics Corporation. |

SEGMENTAL ANALYSIS

By Configuration Insights

The mid-range FPGA segment had the largest share in the North America FPGA market by capturing a 48.8% of total consumption in 2024. This dominance is credited to the balance these devices offer between performance, flexibility, and cost-effectiveness, making them suitable for a wide range of applications including industrial automation, automotive systems, and edge computing. Also, mid-range FPGAs are increasingly adopted in embedded vision, robotics, and smart manufacturing due to their ability to handle moderate computational loads without requiring the high costs associated with high-end models.

The high-end FPGA segment is projected to grow at the fastest rate within the North American FPGA market, expanding at a compound annual growth rate (CAGR) of 9.4% from 2024 to 2030. This rapid expansion is driven by increasing demand from defense, aerospace, and data center markets that require extreme levels of parallel processing, low-latency execution, and hardware-level customization. According to the U.S. Department of Defense (DoD), next-generation radar systems and secure communication platforms have integrated high-end FPGAs to enable real-time encryption, signal processing, and electronic warfare capabilities. In particular, programs such as the Airborne Warning and Control System (AWACS) and Joint Tactical Radio System (JTRS) rely on these advanced chips for mission-critical adaptability. So, these upgrades align with broader modernization efforts aimed at improving situational awareness and operational resilience. Moreover, major cloud providers such as Microsoft Azure and Amazon Web Services (AWS) are adopting high-end FPGAs for AI inference acceleration and network function virtualization, reinforcing their role in the region's digital infrastructure evolution.

By Technology Insights

SRAM-based FPGAs symbolized the biggest technology segment in the North American FPGA market by accounting for an estimated 65% of total consumption in 2024. This leading position is propelled by their widespread adoption in telecommunications, data centers, and industrial automation where re-programmability and dynamic reconfiguration are essential. SRAM-based FPGAs remain the preferred choice for networking and cloud acceleration due to their high performance and compatibility with software-defined architectures. This trend is reinforced by government-backed initiatives promoting FPGA usage in autonomous vehicle research and real-time analytics.

The flash-based FPGA segment is coming up as the booming category in the North American market, expanding at a CAGR of 8.9% between 2025 and 2033. This accelerated growth is fueled by increasing demand for non-volatile, instant-on programmable logic in automotive, aerospace, and industrial control applications where reliability and lower power consumption are critical. Moreover, flash-based FPGAs are gaining traction in automotive safety systems due to their immunity to radiation-induced errors and ability to retain configuration without external memory. Major automakers including Ford and General Motors have begun incorporating these devices into ADAS and sensor fusion units for improved functional safety. Besides, flash FPGAs are being explored for use in satellite payloads and remote sensing applications due to their inherent security advantages and reduced system complexity.

By Node Size Insights

FPGAs built on 20–90 nm node sizes secured the core share of the North American FPGA market i.e. 52.8% of total volume in 2024. This lead position is attributed to their widespread availability, cost efficiency, and suitability for applications that do not require ultra-low power consumption but still benefit from reasonable performance-per-watt ratios. Also, the majority of current FPGA deployments in industrial automation, medical imaging, and legacy defense systems still operate on 28 nm and 40 nm processes, which provide sufficient density and speed for many existing use cases. These nodes also benefit from mature fabrication ecosystems and stable yield rates, reducing time-to-market for new designs. These node sizes remain ideal for academic experimentation and early-stage product development.

The ≤16 nm FPGA segment is projected to grow at the quickest rate within the North American FPGA market, expanding at a CAGR of 10.2%. This rapid expansion is driven by increasing demand for ultra-high-performance, energy-efficient programmable logic in artificial intelligence, 5G infrastructure, and autonomous mobility applications. Similarly, sub-16 nm FPGAs offer up to 40% improvement in power efficiency and 2.5x higher gate density compared to previous generations, making them attractive for high-speed data processing and machine learning acceleration. These smaller geometries allow for more compact, power-aware modules in mobile military systems.

By Vertical Insights

The telecommunications sector is portrayed as the major vertical for FPGA adoption in North America, capturing an estimated 42.5% of the total market share in 2024. This dominance is primarily driven by the rollout of 5G networks, Open RAN (O-RAN) infrastructure, and the need for flexible, high-speed signal processing in base stations and edge compute nodes. According to GSMA Intelligence, North America accounted for nearly 35% of global 5G investments in 2024, with companies like Verizon, AT&T, and Bell Canada relying heavily on FPGA-based hardware for beamforming, channel coding, and real-time protocol adaptation. These components enable telecom operators to dynamically adjust network behavior without costly ASIC redesigns. As per the University of British Columbia’s Electrical and Computer Engineering Department, FPGAs are instrumental in enabling carrier-grade latency and throughput in next-generation telecom equipment.

The automotive sector is rising as the swiftest advancing application area for FPGAs in North America, expanding at a CAGR of 9.8%. This growth is primarily driven by the increasing reliance on Field-Programmable Gate Arrays for sensor fusion, autonomous driving functions, and advanced driver-assistance systems (ADAS). Xilinx (AMD) and Intel have both announced partnerships with major automotive OEMs to deploy FPGA co-processors in next-generation electric and self-driving vehicles.

REGIONAL ANALYSIS

The United States had the dominant position in the North American FPGA market by capturing an estimated 69.9% of total regional consumption in 2024. This is underpinned by a robust semiconductor ecosystem, significant defense spending, and a thriving technology sector that leverages FPGAs for cutting-edge applications in artificial intelligence, aerospace, and telecommunications. Additionally, the U.S. Department of Defense (DoD) continues to fund FPGA-based electronic warfare and radar modernization programs, ensuring sustained demand for national security applications. In the commercial domain, the U.S. leads in 5G infrastructure deployment, with major carriers adopting FPGA-driven baseband processing units for flexible and scalable network architecture. Also, spectrum-sharing policies have encouraged programmable hardware solutions that can be reconfigured remotely, further boosting FPGA adoption.

Canada's positioning reflects the country’s growing presence in embedded systems, artificial intelligence, and advanced manufacturing, all of which rely on FPGA-based acceleration and reconfigurable logic. The Canadian Institute for Advanced Research (CIFAR) emphasized that FPGA utilization in AI model inference and edge computing has increased among university labs and startup incubators.

The remaining North American countries are smaller in scale, these markets are gradually gaining traction due to cross-border trade agreements, improving digital infrastructure, and rising foreign direct investment in technology parks and semiconductor assembly. Also, semiconductor imports—including FPGAs—grew in 2023, driven by the expansion of automotive manufacturing zones in Guanajuato and Nuevo León. Local tier-one suppliers are increasingly using FPGAs in ADAS and vehicle-to-everything (V2X) communication systems, aligning with North American standards. In addition, the Organization of American States (OAS) reported that FPGA imports into the Caribbean increased by 5% in 2023, supported by international aid programs and private sector investments in resilient communication infrastructure following hurricane seasons.

LEADING PLAYERS IN THE NORTH AMERICAN FPGA MARKET

AMD-Xilinx

AMD’s acquisition of Xilinx has positioned it as a dominant force in the North American FPGA market, offering a comprehensive portfolio of adaptive computing solutions. The company's FPGAs are widely used in telecommunications, aerospace, and data centers where high-performance reconfigurable logic is essential. Xilinx’s prior leadership in programmable hardware, combined with AMD’s global reach, has strengthened its role in AI acceleration, networking, and edge computing applications. In North America, AMD-Xilinx plays a central role in shaping industry standards through collaborations with defense agencies, cloud providers, and automotive innovators, reinforcing its influence on both regional and international FPGA adoption.

Intel Corporation

Intel remains a key player in the North American FPGA market through its Agilex and Stratix product lines, which cater to high-end industrial, defense, and cloud infrastructure applications. The company leverages its strong presence in data centers and embedded systems to integrate FPGAs into real-time processing, network function virtualization, and AI inferencing workloads. Intel collaborates extensively with U.S. government agencies, including the Department of Defense, to develop customized FPGA-based accelerators for secure communications and electronic warfare. With a focus on heterogeneous computing and software-defined hardware, Intel continues to drive innovation in FPGA deployment models across North America, maintaining its strategic relevance in critical technology sectors.

Lattice Semiconductor

Lattice Semiconductor holds a significant position in the North American FPGA market by focusing on low-power, compact, and secure programmable logic devices tailored for industrial automation, cybersecurity, and consumer electronics. Unlike larger competitors, Lattice differentiates itself through optimized architectures for edge computing and IoT applications that prioritize energy efficiency and fast time-to-market. The company actively engages with U.S. federal agencies on supply chain security initiatives, ensuring its FPGAs meet stringent requirements for trusted computing environments. As demand grows for intelligent sensors, vision-guided robotics, and secure embedded platforms, Lattice continues to expand its footprint within specialized niches, contributing to broader FPGA accessibility and application diversity in North America.

TOP STRATEGIES USED BY KEY MARKET PARTICIPANTS

One major strategy employed by leading players in the North America FPGA market is deep integration with AI and machine learning frameworks , allowing developers to deploy custom hardware accelerators for neural network inference and real-time analytics. Companies are investing in software stacks and toolchains that simplify FPGA programming for AI engineers, reducing barriers to entry and enhancing usability.

Another key approach is expanding partnerships with defense and aerospace organizations to secure long-term contracts for mission-critical applications. By aligning with national security priorities and offering radiation-hardened or secure-boot FPGAs, vendors ensure sustained demand from government-backed modernization programs.

Lastly, strengthening vertical-specific solutions and ecosystem support has become a priority for FPGA providers. Vendors are developing reference designs, collaborating with system integrators, and supporting open-source development tools to enhance adoption across telecommunications, automotive, and industrial automation markets, ensuring FPGA relevance in evolving technological landscapes.

KEY MARKET PLAYERS AND COMPETITION OVERVIEW

Major Players of the North America FPGA market include Intel Corporation, AMD (Xilinx), Lattice Semiconductor Corporation, Microchip Technology Inc. (Microsemi), Achronix Semiconductor Corporation, QuickLogic Corporation, Flex Logix Technologies Inc., Efinix Inc., Cobham Advanced Electronic Solutions, Broadcom Inc., Taiwan Semiconductor Manufacturing Company Limited, United Microelectronics Corporation.

The competition in the NorAmerFPGAGAPGA market is characterized by a mix of established semiconductor giants, emerging startups, and niche players vying for dominance in an increasingly fragmented and application-driven landscape. Leading firms such as AMD-Xilinx, Intel, and Lattice Semiconductor maintain their positions through extensive R&D investments, mature design ecosystems, and strong ties to defense, telecom, and enterprise clients. These companies benefit from proprietary silicon architectures, robust IP portfolios, and well-established distribution networks that reinforce their market leadership.

At the same time, smaller firms and new entrants are gaining traction by offering cost-effective, domain-optimized FPGA alternatives tailored for specific use cases such as edge AI, sensor fusion, and cybersecurity. Their agility allows them to respond quickly to evolving technical demands and offer differentiated value propositions in verticals like autonomous vehicles and industrial IoT.

Emerging trends around software-defined hardware, open-source tooling, and cloud-FPGA integration are further reshaping the competitive dynamics, compelling traditional vendors to adapt or risk losing ground to more flexible, cloud-first offerings. To remain relevant, companies must continuously innovate, build developer communities, and engage in policy discussions regarding supply chain resilience and export controls.

With increasing convergence between programmable logic and AI acceleration, the FPGA space is becoming more dynamic than ever, driven by strategic acquisitions, cross-industry collaborations, and shifting geopolitical considerations that influence vendor positioning and customer sourcing decisions.

RECENT HAPPENINGS IN THE MARKET

- In January 2024, AMD-Xilinx launched a new suite of AI acceleration tools specifically designed for its Versal Adaptive Compute Acceleration Platform (ACAP), aiming to streamline deployment in hyperscale data centers and edge inference applications across North America.

- In May 2024, Intel announced a strategic collaboration with a leading U.S. defense contractor to co-develop next-generation FPGA-based radar processors tailored for airborne surveillance systems, reinforcing its presence in mission-critical military electronics and homeland security applications.

- In September 2024, Lattice Semiconductor introduced a dedicated line of secure, low-power FPGAs aimed at federal agencies and private-sector cybersecurity firms, addressing growing concerns over hardware trustworthiness and supply chain integrity in sensitive infrastructure deployments.

- In November 2024, a Canadian FPGA startup secured a multi-year research grant from the Vector Institute to develop AI-assisted compilation techniques that reduce development complexity and improve performance predictability for deep learning workloads running on programmable logic.

- In March 2025, a U.S.-based cloud provider partnered with an FPGA accelerator firm to pilot reconfigurable hardware modules for network offloading and encryption acceleration, signaling increased interest in programmable logic for scalable cloud infrastructure optimization.

MARKET SEGMENTATION

This research report on the NortAmericanca FPGA Market has been segmented and sub-segmented based on configuration, technology, node size, vertical, and region.

By Configuration

- Low-End FPGA

- Mid-Range FPGA

- High-End FPGA

By Technology

- SRAM-Based FPGA

- Flash-Based FPGA

By Node Size

- 20–90 nm Node Size

- ≤16 nm Node Size

By Vertical

- Telecommunications

- Automotive

By Region

- Us

- Canada

- Rest of North America

Frequently Asked Questions

1. What is driving the growth of the North America FPGA market?

Growth is driven by the rising demand for high-performance computing, AI and ML workloads, 5G deployment, automotive electronics, and industrial automation.

2. Who are the major players in the North America FPGA market?

Key players include Intel Corporation, AMD (Xilinx), Lattice Semiconductor, Microchip Technology (Microsemi), Achronix, and QuickLogic.

3. How do FPGAs differ from other programmable devices like microcontrollers?

Unlike microcontrollers which execute sequential instructions, FPGAs perform operations in parallel, offering higher performance and lower latency for specific tasks.

4. Which industries benefit most from FPGAs?

Industries such as telecommunications, defense, automotive (especially ADAS), financial services, and medical imaging benefit significantly from FPGA technology.

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com