North America Fruit Juice Market Size, Share, Trends & Growth Forecast Report By Type (Carbonated Juices, Naturally Sweetened beverages, Health Juices, Fruit Juices, Pre-biotic and Pro-biotic drinks, and other), Packaging, Concentration Type, and Country (The United States, Canada and Rest of North America), Industry Analysis From 2025 to 2033

North America Fruit Juice Market Size

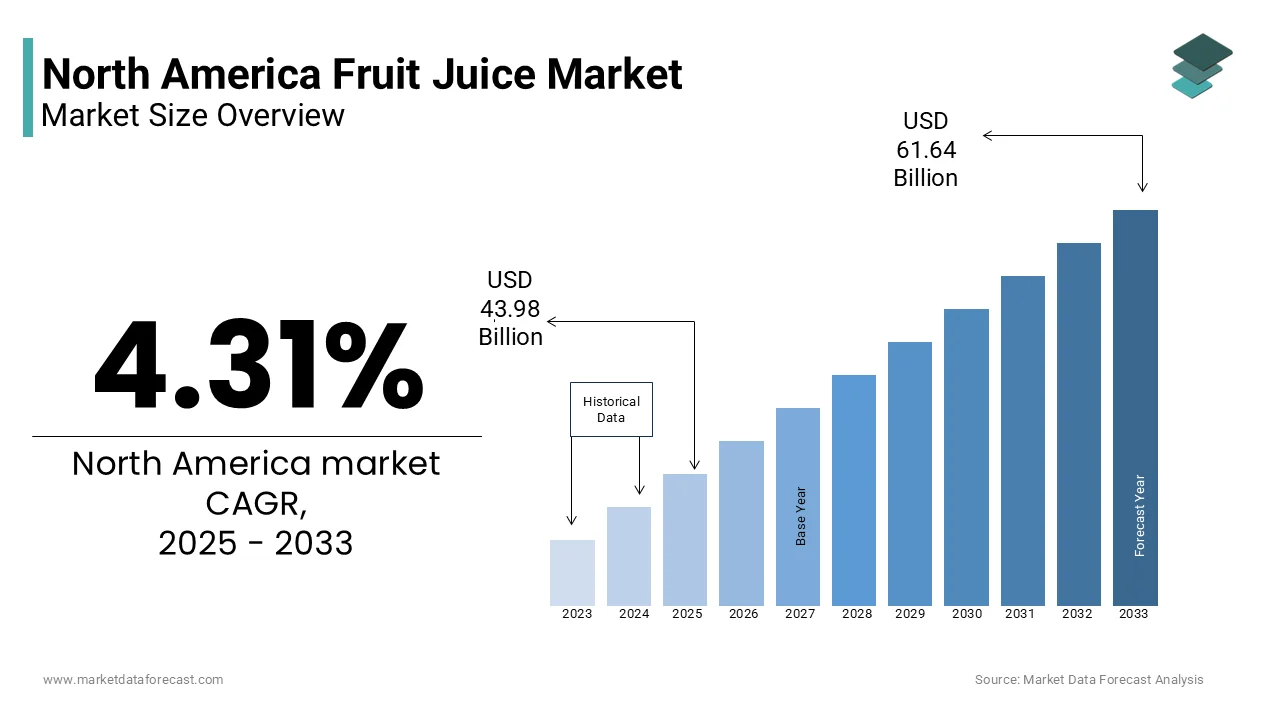

The Fruit juice market size in North America was valued at USD 42.16 billion in 2024 and is predicted to be worth USD 61.64 billion by 2033 from USD 43.98 billion in 2025 and grow at a CAGR of 4.31% from 2025 to 2033.

The North America fruit juice market covers a wide range of products derived from natural fruits, including pure juices, juice blends, and juice drinks with added sweeteners or preservatives. These beverages are consumed for their perceived health benefits, particularly their high vitamin, mineral, and antioxidant content. The market includes both chilled and shelf-stable varieties, available through supermarkets, convenience stores, online platforms, and foodservice channels.

According to the U.S. Department of Agriculture (USDA), fruit juice consumption in American households has remained relatively stable, with orange juice continuing to dominate as the most consumed variety.

Moreover, the rise in health consciousness among consumers has led to a shift toward low-sugar, organic, and cold-pressed juices. Also, the functional beverage trend—where juices are fortified with probiotics, vitamins, or adaptogens—is gaining traction across the region.

MARKET DRIVERS

Increasing Health Awareness Among Consumers

One of the primary drivers of the North America fruit juice market is the growing emphasis on health and wellness, which has significantly influenced consumer beverage choices. According to the International Food Information Council (IFIC), nearly 65% of American consumers consider nutritional content when purchasing beverages, with fruit juices being perceived as a source of essential vitamins and antioxidants.

This shift in consumer behavior has spurred demand for natural, minimally processed, and organic fruit juices. Cold-pressed and NFC (not-from-concentrate) juices are increasingly favored due to their clean-label appeal and retention of nutrients. As public health messaging continues to promote hydration and nutrient-rich diets, fruit juice remains a preferred choice for those seeking healthier alternatives to sugary soft drinks, thereby fueling sustained market growth.

Innovation and Product Diversification

Another key driver of the North America fruit juice market is the continuous innovation and diversification of juice products to cater to evolving consumer preferences. Beverage manufacturers are introducing novel flavor combinations, functional enhancements, and packaging formats designed to align with modern lifestyles.

Companies are leveraging ingredients like turmeric, ginger, beetroot, and adaptogenic herbs to position juices as wellness-oriented functional beverages.

Also, private label brands from major retailers such as Whole Foods, Walmart, and Costco are offering competitively priced, clean-label juice options, making healthy beverages more accessible to a broader audience.

Moreover, the rise of e-commerce and direct-to-consumer juice delivery services has allowed niche brands to reach health-conscious urban consumers more efficiently.

MARKET RESTRAINTS

Concerns Over Sugar Content and Obesity

A significant restraint affecting the North America fruit juice market is the growing concern regarding sugar content and its association with obesity and metabolic diseases. While fruit juice contains naturally occurring sugars, health authorities such as the American Heart Association (AHA) emphasize that excessive consumption can contribute to calorie surplus without providing the same satiety as whole fruits.

According to the Centers for Disease Control and Prevention (CDC), over 40% of adults in the United States are classified as obese , prompting increased scrutiny of all caloric beverages, including fruit juices. Although they are often marketed as natural and healthy, some commercially available juices contain added sugars, blurring the distinction between fruit juice and sugary soft drinks in the eyes of consumers.

School districts across Ontario and British Columbia have restricted the sale of certain fruit drinks in cafeterias unless they meet specific sugar content thresholds.

Furthermore, regulatory bodies such as Health Canada and the U.S. Food and Drug Administration (FDA) have introduced updated nutrition labels that include “added sugars” information, influencing purchasing decisions.

Competition from Alternative Beverages

Competition from Alternative Beverages

The North America fruit juice market faces intense competition from alternative beverage categories such as plant-based drinks, functional waters, ready-to-drink teas, and dairy-based beverages. Consumers are increasingly shifting towards these options due to perceived health benefits, sustainability factors, and changing lifestyle preferences.

Similarly, plant-based milk alternatives like almond, oat, and coconut beverages have gained popularity as substitutes for traditional juices, especially among consumers following vegan or low-calorie diets.

Moreover, the surge in popularity of kombucha, kefir, and probiotic drinks has introduced additional competition, positioning fermented beverages as superior in gut health benefits compared to fruit juices.

MARKET OPPORTUNITIES

Rising Demand for Organic and Clean Label Juices

An emerging opportunity in the North America fruit juice market is the growing consumer preference for organic and clean label juices that are free from artificial additives, preservatives, and excessive sugars. This shift is driven by heightened awareness of ingredient transparency and a desire for products aligned with holistic health principles.

Consumers are increasingly scrutinizing product labels and opting for certified organic, non-GMO, and sustainably sourced juices, particularly among millennials and Gen Z demographics.

Additionally, the rise of direct-to-consumer juice bars and subscription-based cold-pressed juice services has created a premium niche market catering to health-conscious urban consumers. Brands like Suja and Pressed Juicery have capitalized on this trend by emphasizing raw, unpasteurized formulations with minimal processing.

Expansion of Functional and Fortified Juice Products

Another significant opportunity in the North America fruit juice market lies in the development and commercialization of functional and fortified juice products designed to offer targeted health benefits beyond basic hydration and nutrition. Manufacturers are increasingly enhancing juices with ingredients such as probiotics, prebiotics, adaptogens, vitamins, and plant-based proteins to cater to consumers seeking value-added health advantages.

Juices infused with probiotics and digestive enzymes are particularly popular among health-conscious consumers looking to improve gut health and immunity.

Brands are leveraging these fortifications to position fruit juices as part of a proactive wellness strategy rather than just a refreshing drink.

Moreover, collaborations between juice companies and wellness influencers, nutritionists, and fitness experts are helping drive awareness and credibility around functional juice innovations. As demand for personalized nutrition grows, the functional juice segment is well-positioned for sustained expansion within the broader North American beverage market.

MARKET CHALLENGES

Supply Chain Disruptions and Raw Material Cost Volatility

A major challenge facing the North America fruit juice market is the volatility in raw material costs and supply chain disruptions caused by climate change, trade restrictions, and labor shortages. Fruit cultivation is highly sensitive to weather conditions, and recent years have seen significant yield fluctuations due to extreme temperatures, droughts, and unseasonal frosts.

In Canada, where apple and berry juice production is prominent, the Canadian Agricultural Partnership highlights that labor shortages in harvesting sectors have led to delayed fruit collection and reduced processing volumes, impacting supply stability for juice manufacturers.

Also, global supply chain bottlenecks, exacerbated by geopolitical tensions and transportation delays, have increased lead times and input costs for imported fruits and packaging materials. As a result, juice producers face margin pressures and are compelled to either absorb rising expenses or pass them on to consumers, potentially affecting demand elasticity.

Regulatory Scrutiny and Nutritional Perception Shifts

The North America fruit juice market is increasingly challenged by evolving regulatory frameworks and shifting consumer perceptions regarding the nutritional value of fruit juices. While traditionally viewed as a healthy beverage, recent scientific discussions have highlighted concerns over sugar content, glycemic impact, and the lack of fiber compared to whole fruits.

According to the American Academy of Pediatrics (AAP), fruit juice should not be considered a substitute for whole fruit, especially in children’s diets, influencing policy recommendations and school beverage guidelines. Several states in the U.S., including California and New York, have implemented restrictions on juice availability in school meal programs unless it is 100% unsweetened and portion-controlled.

Simultaneously, mandatory front-of-pack warning labels for high-sugar beverages—being rolled out in Canada—may further influence consumer behavior. As regulatory scrutiny intensifies, juice brands must navigate complex compliance landscapes while maintaining consumer trust and market competitiveness.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

4.31% |

|

Segments Covered |

By Type, Packaging, Concentration Type, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

The United States, Canada, Mexico, and Rest of North America |

|

Market Leaders Profiled |

The Coca-Cola Company, PepsiCo, Inc., Keurig Dr Pepper, Inc., The Kraft Heinz Company, Campbell Soup Company, Ocean Spray Cranberries, Inc., and Tropicana Brands Group., and others |

SEGMENTAL ANALYSIS

By Type Insights

The fruit juice segment dominated the North America fruit juice market, accounting for a 58.6% of total market value in 2024. This is primarily attributed to its widespread consumer acceptance, availability across diverse retail channels, and historical positioning as a staple beverage in households.

Also, these traditional flavors are favored for their versatility, affordability, and perceived health benefits such as vitamin C content.

Moreover, major retailers like Walmart, Costco, and Loblaw continue to expand their private-label juice offerings, making them more accessible to a broad demographic. With strong brand recognition and extensive distribution networks, fruit juice remains the cornerstone of the North American juice market.

The probiotic and prebiotic juices segment is projected to grow at the fastest CAGR of 10.7%. This rapid expansion is driven by rising consumer interest in gut health, immunity boosting, and functional beverages that offer additional wellness benefits beyond hydration and nutrition.

Brands such as Suja, KeVita, and Evolution Fresh have introduced fermented and live-culture-enhanced juices targeting health-conscious millennials and Gen Z consumers.

Additionally, the rise of cold-pressed juice bars and direct-to-consumer subscription services has accelerated the adoption of probiotic-enriched products. As scientific research continues to link gut microbiota to overall well-being, this segment is poised for sustained high-growth performance within the North America fruit juice market.

By Packaging Insights

The PET or plastic bottle packaging segment had the largest share of the North America fruit juice market, estimated at 47.6% in 2024. This dominance is largely due to its lightweight nature, durability, cost-effectiveness, and convenience for on-the-go consumption.

Major players such as Tropicana, Minute Maid, and Ocean Spray rely heavily on PET packaging for their mainstream product lines.

In Canada, the Canadian Beverage Association reports that plastic packaging remains the preferred choice for juice beverages in supermarkets and convenience stores, particularly among younger consumers who prioritize portability and ease of use. Retailers like Sobeys and Metro have expanded shelf space for PET-packaged juices, especially in single-serve formats.

Furthermore, advancements in recyclable PET (rPET) materials have improved sustainability credentials, addressing environmental concerns while maintaining commercial viability.

The Tetrapak carton packaging segment is expected to grow at the highest CAGR of 9.4%. This accelerated growth is fueled by increasing consumer preference for eco-friendly, lightweight, and shelf-stable packaging solutions that align with sustainability goals.

According to Tetra Pak’s Global Consumer Survey, a significant share of North American consumers prefer carton-based packaging due to its recyclability and lower carbon footprint compared to plastic and glass alternatives. These cartons are made from renewable materials—primarily paperboard—and are increasingly used for premium chilled and ambient-stable juice products.

Additionally, leading brands such as R.W. Knudsen and Lakewood Organics have adopted Tetrapak for their organic juice lines, citing reduced spoilage risks and enhanced shelf life

By Concentration Type Insights

The concentrated juice segment held the biggest share of the North America fruit juice market, calculated at 52.7% in 2024. This is due to its cost-efficiency in production, transportation, and storage, making it a preferred choice for both manufacturers and consumers seeking affordable beverage options.

According to the U.S. Department of Agriculture (USDA), the majority of orange juice produced in Florida and imported from Brazil is processed into concentrate form before reconstitution for retail sale. Concentrated juices allow for easier handling and longer shelf life, reducing logistics costs and minimizing waste during distribution.

Moreover, concentrated juices remain popular in institutional settings such as schools, hospitals, and cafeterias where bulk purchasing and reconstitution capabilities are common.

The non-concentrated or not-from-concentrate (NFC) juice segment is projected to grow at the fastest CAGR of 11.2%. This rapid expansion is driven by increasing consumer demand for minimally processed, fresh-tasting, and premium-quality juices perceived as healthier and more natural than conventional alternatives. Also, brands have capitalized on this trend by marketing NFC products as pure, unadulterated, and retaining more nutrients and flavor complexity.

In addition, the rise of cold-pressed and refrigerated juice delivery services has further boosted NFC juice adoption, particularly among fitness enthusiasts and wellness-focused demographics. As awareness of processing methods increases, NFC juices are emerging as a high-growth segment within the North America fruit juice landscape.

REGIONAL ANALYSIS

The United States maintained a dominant position in the North America fruit juice market, holding an estimated market share of 76.5% in 2024. This lead position is anchored in the country’s large population, established beverage manufacturing sector, and deep-rooted consumer preference for fruit-based drinks.

Florida and California serve as key production hubs, supplying both domestic and international markets with concentrated and NFC juice variants.

Also, companies like PepsiCo’s Naked Juice, Coca-Cola’s Minute Maid, and private-label brands from Walmart and Costco continue to drive volume and innovation.

With rising health consciousness, sustainability initiatives, and new product introductions, the U.S. remains the central hub for fruit juice development and consumption across North America.

Canada is emerging as a key player in the North America fruit juice market due to increasing demand for organic, locally sourced, and functional juices. The country’s growing emphasis on health and wellness has significantly influenced beverage choices, particularly among urban and younger demographics.

Retailers like Loblaws and Sobeys have expanded their private-label organic juice offerings, contributing to increased accessibility and affordability. With supportive regulatory policies and a strong focus on sustainable agriculture, Canada is strengthening its position in the regional fruit juice landscape, fostering innovation and market expansion.

The Rest of North America, encompassing Mexico and select Caribbean nations, currently accounts for smaller share of the regional fruit juice market in 2024. While still in early stages compared to the U.S. and Canada, this region is witnessing gradual adoption driven by demographic shifts, urbanization, and increasing disposable incomes. Brands like Jumex and Del Valle have capitalized on this trend, offering a wide range of tropical and citrus-based juices tailored to local tastes.

In the Caribbean, countries such as Jamaica and Trinidad and Tobago are exploring partnerships with global juice producers to enhance local bottling and packaging capabilities.

Despite challenges such as economic volatility and fragmented supply chains, the Rest of North America presents promising opportunities for juice vendors, particularly as regional demand for natural and nutritious beverages continues to grow.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

The Coca-Cola Company, PepsiCo, Inc., Keurig Dr Pepper, Inc., The Kraft Heinz Company, Campbell Soup Company, Ocean Spray Cranberries, Inc., and Tropicana Brands Group are playing dominating role in the North America fruit juice market.

The competition in the North America fruit juice market is marked by a blend of dominant multinational corporations and agile regional or specialty brands vying for consumer attention through differentiation in formulation, packaging, and positioning. Established players benefit from extensive distribution networks, strong brand equity, and economies of scale, allowing them to maintain a stronghold on mainstream juice consumption. However, the rise of health-conscious consumers seeking minimally processed, organic, and functional beverages has created opportunities for boutique brands to challenge industry leaders.

Market participants are increasingly focused on product innovation, emphasizing transparency in sourcing, and leveraging digital marketing to appeal to younger, eco-aware demographics. Additionally, the shift toward sustainable packaging and ethical sourcing has intensified competitive pressure, pushing companies to adopt greener supply chain practices. At the same time, private label brands offered by major retailers are gaining traction, offering cost-effective alternatives that further fragment the market.

While large beverage conglomerates continue to dominate in volume and visibility, the growing influence of independent juice bars, cold-pressed juice delivery services, and wellness-oriented startups is reshaping the competitive landscape. As consumer preferences evolve, agility, authenticity, and responsiveness to health and environmental concerns will be key differentiators in securing long-term market relevance.

TOP PLAYERS IN THE MARKET

PepsiCo (Naked Juice)

PepsiCo, through its subsidiary Naked Juice, is a major player in the North America fruit juice market, offering a wide range of premium, cold-pressed, and organic juices. The brand has been instrumental in shaping consumer preferences for natural and nutrient-rich beverages. PepsiCo’s global supply chain, marketing strength, and distribution network have enabled Naked Juice to maintain a strong presence across retail and foodservice channels in the U.S. and Canada.

The Coca-Cola Company

The Coca-Cola Company commands a significant share of the North American fruit juice market with well-established brands like Minute Maid and Simply Orange. These brands are synonymous with quality and consistency, catering to diverse consumer tastes with both traditional and NFC (not-from-concentrate) juice options. The company’s investment in sustainability and product innovation has reinforced its leadership position in the region.

Keurig Dr Pepper

Keurig Dr Pepper plays a vital role in the North American juice landscape through its Snapple and Evolution Fresh brands. While Snapple appeals to mass-market consumers with affordable juice drinks, Evolution Fresh targets health-conscious buyers with high-quality, cold-pressed formulations. The company’s strategic positioning bridges mainstream and premium juice segments, contributing to its sustained influence in the market.

TOP STRATEGIES USED BY KEY PLAYERS

One of the primary strategies employed by key players in the North America fruit juice market is product innovation and diversification , particularly in clean-label, organic, and functional juice formats. Companies are continuously launching new blends, fortifying juices with probiotics and vitamins, and introducing plant-based alternatives to meet evolving consumer expectations.

Another crucial approach is sustainability-driven branding and packaging reformulation , where manufacturers are shifting toward recyclable materials such as Tetrapak cartons and rPET bottles. This aligns with growing consumer demand for environmentally responsible products and supports corporate commitments to reduce carbon footprints and plastic waste.

Lastly, strategic partnerships, acquisitions, and direct-to-consumer expansion have become essential for sustaining growth. Leading companies are acquiring niche juice brands, collaborating with wellness influencers, and investing in e-commerce platforms to strengthen brand loyalty and reach health-focused urban consumers more effectively.

RECENT HAPPENINGS IN THE MARKET

- In February 2024, PepsiCo launched a new line of organic, NFC (not-from-concentrate) juices under the Naked Juice brand, targeting health-conscious consumers and expanding its premium juice portfolio to compete with rising cold-pressed juice brands.

- In May 2024, The Coca-Cola Company announced a partnership with a leading U.S. cold-chain logistics provider to enhance refrigerated juice distribution, ensuring fresher product availability in convenience stores and specialty retailers nationwide.

- In July 2024, Keurig Dr Pepper introduced an expanded line of low-sugar, probiotic-infused juice drinks under the Snapple brand, aiming to capture a larger share of the functional beverage segment while appealing to wellness-focused consumers.

- In September 2024, Dole Food Company acquired a minority stake in a fast-growing direct-to-consumer cold-pressed juice startup, signaling its intent to expand beyond traditional retail and tap into the booming home delivery juice market.

- In November 2024, Suja Life, a premium organic juice brand, entered into a national retail agreement with Whole Foods Market to increase shelf space and promotional support, reinforcing its position as a leader in the premium refrigerated juice category.

MARKET SEGMENTATION

This research report on the North America fruit juice market has been segmented and sub-segmented based on the following categories.

By Type

- Carbonated Juices

- Naturally Sweetened

- Health Juice

- Fruit Juice

- Prebiotic and Probiotic

- Others

By Packaging

- PET/Plastic

- Metal can

- Tetrapaks

- Glass

- Other

By Concentration Type

- Concentrated

- Non-concentrated

By Country

- The United States

- Canada

- Rest of North America

Frequently Asked Questions

1. What is the size of the North America fruit juice market?

The market was valued at USD 42.16 billion in 2024 and is expected to reach USD 61.64 billion by 2033.

2. What key trends are shaping the North America fruit juice market?

Trends include demand for natural, organic, and low-sugar fruit juice products.

3. What is driving the growth of the fruit juice market in North America?

Rising health awareness and preference for functional beverages are major growth drivers.

4. Which type of fruit juice is gaining popularity in North America?

Orange, apple, and blended fruit juices are experiencing increased demand.

5. How is consumer behavior impacting the fruit juice market?

Consumers are shifting toward clean-label and nutrient-rich juice options.

6. What role does innovation play in the fruit juice industry?

Innovation in flavors, packaging, and health-focused formulations is boosting market appeal.

7. Is the demand for organic fruit juices increasing in North America?

Yes, organic and non-GMO juices are witnessing significant growth in consumer preference.

8. How are sugar concerns affecting the fruit juice market?

Rising concerns over sugar content are pushing brands to offer low or no-sugar alternatives.

9. Which distribution channels are prominent in this market?

Supermarkets, online platforms, and convenience stores are key distribution channels.

10. Are functional and fortified juices influencing market growth?

Yes, functional juices with added vitamins, probiotics, or prebiotics are fueling demand.

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com