North America Hay Market Size, Share, Trends, & Growth Forecast Report, Segmented By Product (Hay Bales, Hay Pellets And Hay Cubes), Type (Dairy Cow Feed, Beef Cattle & Sheep Feed, Pig Feed And Poultry Feed), And By Region (The USA, Canada and Rest of North America), Industry Analysis From 2025 to 2033

North America Hay Market Size

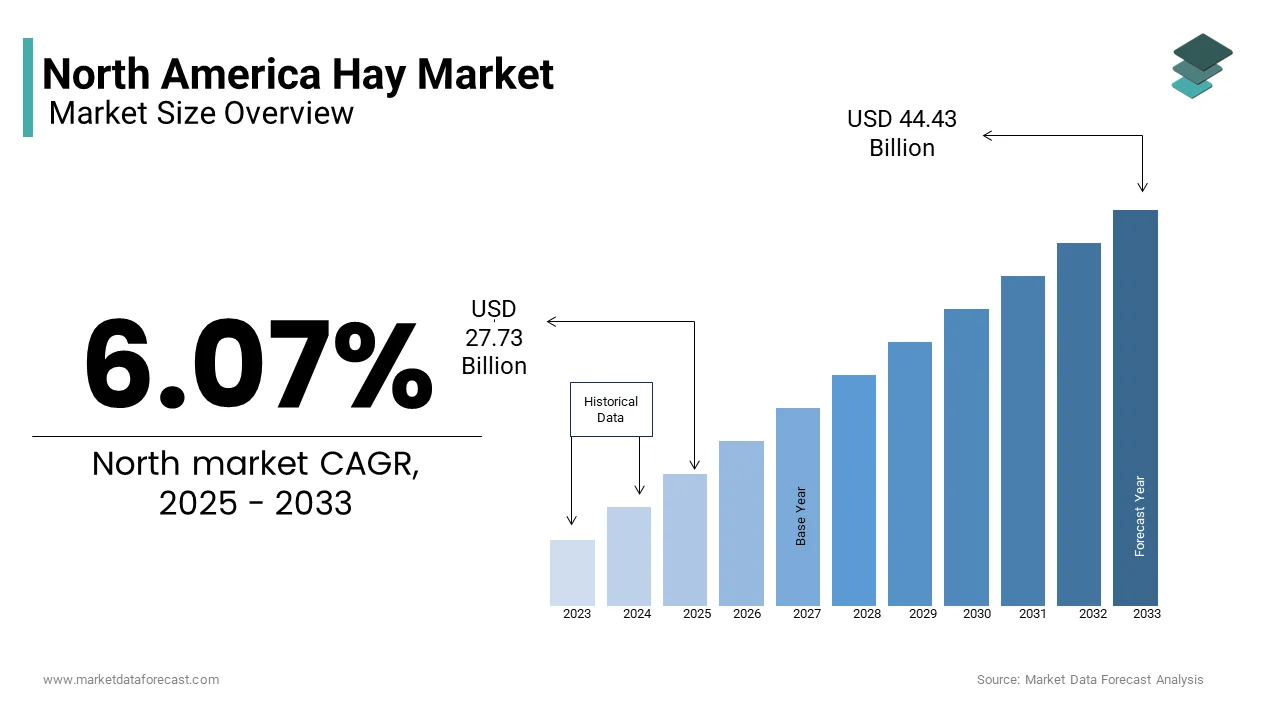

The North American hay market was valued at USD 26.14 billion in 2024 and is anticipated to reach USD 27.73 billion in 2025 from USD 44.43 billion by 2033, growing at a CAGR of 6.07% during the forecast period from 2025 to 2033.

The North American hay market is a critical component of the agricultural economy, serving as a primary feed source for livestock such as cattle, horses, sheep, and dairy animals. Hay, a dried grass or legume forage, plays an indispensable role in ensuring year-round nutrition for livestock, particularly during winter months when fresh pasture is unavailable. According to the United States Department of Agriculture (USDA), over 55 million acres of land are dedicated to hay production in the U.S. alone, underscoring its significance in regional agriculture. The market’s dynamics are influenced by factors such as livestock population, export demand, and climatic conditions.

Hay production is deeply intertwined with sustainability practices, as it supports soil health and carbon sequestration. As per the Food and Agriculture Organization (FAO), alfalfa, one of the most common hay varieties, can fix up to 200 pounds of nitrogen per acre annually, reducing the need for synthetic fertilizers. Additionally, the increasing global demand for high-quality protein sources has amplified the importance of hay in livestock nutrition. For instance, Canada’s hay exports to Asia have grown significantly due to the rising demand for premium beef and dairy products. This convergence of agricultural necessity, environmental benefits, and international trade makes the North American hay market a cornerstone of both regional and global food systems.

MARKET DRIVERS

Rising Livestock Population and Protein Demand

The growing livestock population and increasing global demand for animal-based protein are significant drivers propelling the North American hay market forward. According to the USDA, the U.S. alone houses approximately 94 million cattle, with dairy and beef industries relying heavily on high-quality hay for optimal animal nutrition. Alfalfa and timothy hay, known for their rich nutrient profiles, are essential for maintaining livestock health and productivity, particularly in intensive farming systems.

A key factor is the rising global consumption of meat and dairy products. As per the FAO, global meat consumption is projected to increase by 14% by 2030, driven by population growth and dietary shifts in developing countries. This surge in demand has intensified the need for premium hay to support livestock growth and milk production. For example, studies conducted by Texas A&M University reveal that incorporating high-quality hay into cattle diets can improve weight gain by up to 20%, making it a preferred choice for ranchers. This alignment between livestock farming and hay production ensures sustained demand for hay across North America.

International Export Opportunities

International export opportunities represent another major driver for the North American hay market, particularly in regions like Asia and the Middle East. As per the U.S. Census Bureau, hay exports from the U.S. reached over 4 million metric tons in recent years, with Japan, South Korea, and China being key destinations. These countries rely on imported hay to meet the nutritional needs of their livestock, particularly dairy cows producing high-quality milk.

A significant factor is the stringent quality standards demanded by international buyers. For instance, Japan requires hay with minimal moisture content and high digestibility, creating a niche market for premium-grade alfalfa. Additionally, geopolitical factors, such as trade agreements and tariffs, play a crucial role. According to the USDA Foreign Agricultural Service, favorable trade policies have bolstered U.S. hay exports to China, which seeks alternatives to domestically produced forage due to water scarcity and land constraints. These export-driven dynamics position North America as a dominant player in the global hay trade.

MARKET RESTRAINTS

Climatic Variability and Extreme Weather Events

Climatic variability and extreme weather events pose significant challenges to the North American hay market, impacting both production and quality. Droughts, floods, and unseasonal frosts can severely disrupt hay yields and compromise the nutritional value of harvested crops. According to the National Oceanic and Atmospheric Administration (NOAA), the western United States experienced prolonged drought conditions between 2020 and 2022, reducing hay production in key states like California and Nevada.

For example, insufficient rainfall during the growing season can lead to stunted plant growth, resulting in lower yields and reduced fiber content. As per a study by the University of Nebraska-Lincoln, drought-affected hay often contains higher levels of indigestible lignin, making it less suitable for livestock consumption. Such conditions force farmers to either purchase additional feed or reduce herd sizes, increasing operational costs. The unpredictability of weather patterns, exacerbated by climate change, creates persistent challenges for hay producers, limiting supply stability and market growth.

High Transportation and Storage Costs

High transportation and storage costs act as another significant restraint for the North American hay market, particularly for small-scale producers and exporters. Hay is a bulky and lightweight commodity, making it expensive to transport over long distances. According to the American Farm Bureau Federation, transportation costs account for up to 30% of the total price of exported hay, eating into profit margins for farmers.

Additionally, proper storage is critical to maintaining hay quality, yet it requires significant investment in infrastructure. As per research by the University of Wisconsin-Madison, improper storage can lead to losses of up to 20% due to spoilage, mold, and pest infestations. Small-scale producers, who lack access to advanced storage facilities, often struggle to preserve hay quality, particularly during humid seasons. These financial and logistical barriers limit the competitiveness of smaller players, hindering broader market participation.

MARKET OPPORTUNITIES

Expansion into Organic and Specialty Hay Production

The growing demand for organic and specialty hay presents a transformative opportunity for the North American hay market. As per the Organic Trade Association, sales of organic products in the U.S. reached $61.9 billion in 2022, reflecting a cultural shift towards sustainable and chemical-free farming practices. Organic hay, which is grown without synthetic fertilizers or pesticides, appeals to environmentally conscious consumers and livestock producers seeking premium feed options.

For instance, organic alfalfa hay is increasingly used in the production of organic milk and grass-fed beef, aligning with consumer preferences for healthier and more sustainable food choices. Additionally, government incentives, such as subsidies for organic farming under programs like EQIP, encourage farmers to transition to organic hay production. According to the USDA, over 2 million acres of farmland in the U.S. are certified organic, providing a strong foundation for expanding this segment. By capitalizing on this trend, the hay market can tap into lucrative niche markets while promoting ecological sustainability.

Integration with Carbon Sequestration Initiatives

The integration of hay production with carbon sequestration initiatives offers another significant opportunity for the North American hay market. As per the Environmental Protection Agency (EPA), perennial crops like alfalfa can sequester up to 2.5 tons of carbon dioxide per acre annually, making them valuable tools in combating climate change. This aligns with broader sustainability goals and creates new revenue streams through carbon credit programs.

For example, programs like California’s Healthy Soils Initiative provide financial incentives to farmers adopting practices that enhance soil health and carbon storage. Hay producers can leverage these initiatives to offset operational costs while contributing to environmental conservation. Additionally, advancements in regenerative agriculture emphasize the role of hay in improving soil structure and reducing erosion, further amplifying its appeal. By aligning with carbon sequestration efforts, the hay market can position itself as a key player in North America’s transition to a low-carbon economy.

MARKET CHALLENGES

Dependence on Manual Labor and Harvesting Efficiency

A significant challenge facing the North American hay market is its dependence on manual labor and the inefficiencies associated with traditional harvesting practices. According to the American Society of Agricultural and Biological Engineers, labor shortages in rural areas have led to delays in hay harvesting, compromising both yield and quality. Timely cutting and baling are critical to preserving the nutritional value of hay, yet labor constraints often hinder these processes.

For example, delayed harvesting can result in over-mature plants with reduced digestibility, negatively impacting livestock performance. Additionally, as per a study by Iowa State University, manual labor accounts for up to 40% of production costs, making it a significant financial burden for small-scale producers. While mechanization offers a potential solution, the high cost of equipment limits accessibility for many farmers. Addressing this challenge requires investments in affordable automation technologies and workforce training programs, posing a persistent obstacle to market efficiency.

Competition from Alternative Feed Sources

Competition from alternative feed sources represents another major challenge for the North American hay market. Corn silage, soybean meal, and other concentrated feeds dominate the market due to their higher energy density and lower costs compared to hay. As per the USDA, corn silage production occupies over 6 million acres in the U.S., making it a formidable competitor for hay producers.

Additionally, misconceptions about the nutritional equivalence of hay and concentrated feeds deter adoption. According to a survey by the National Cattlemen’s Beef Association, nearly 30% of livestock producers perceive hay as less effective for weight gain compared to grain-based feeds, despite its superior fiber content. This perception gap, combined with fluctuating corn prices, creates a challenging environment for hay producers. Bridging this gap requires targeted education campaigns and demonstrations of hay’s cumulative benefits, which remain an uphill battle in the current competitive landscape.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

6.07% |

|

Segments Covered |

By Product, Type, and Country. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

The U.S, Mexico, Brazil, Rest of North America |

|

Market Leaders Profiled |

Anderson Hay & Grain, Border Valley, Knight Ag Sourcing, Hay USA, Bailey Farms, Hayday Farm, Barr-Ag, Standlee, Legal Alfalfa Products Ltd, M&C Hay. |

SEGMENTAL ANALYSIS

By Product Insights

Hay bales dominate the North American hay market, accounting for approximately 70% of the total market share, as per the United States Department of Agriculture (USDA). This leadership is driven by their widespread use in livestock feeding and ease of handling compared to other forms of hay. For instance, according to the American Society of Agricultural and Biological Engineers, hay bales are cost-effective to produce and transport, making them the preferred choice for large-scale operations such as cattle ranching and dairy farming.

A key driving factor is the versatility of hay bales in meeting diverse livestock nutritional needs. As per a study by Texas A&M University, hay bales provide balanced fiber and energy content essential for maintaining animal health during winter months when fresh pasture is unavailable. Additionally, advancements in baling technology have improved efficiency and reduced labor costs, enabling farmers to produce high-quality bales consistently. Programs like the USDA’s Conservation Stewardship Program further incentivize sustainable hay production practices, bolstering the dominance of hay bales in the market.

Hay pellets are the fastest-growing segment in the North American hay market, with a projected CAGR of 8.5% through 203, according to the Organic Trade Association. This growth is fueled by their increasing adoption in specialty feed markets, particularly for horses, rabbits, and exotic animals, where pelletized forms offer enhanced digestibility and convenience.

A significant driver is the rising demand for organic and premium feed products. According to the Organic Trade Association, sales of organic livestock feed reached $1.4 billion in 2022, reflecting a growing preference for chemical-free and nutrient-dense options. Hay pellets, which are easier to store and distribute than traditional bales, align perfectly with this trend. Additionally, government initiatives promoting regenerative agriculture have encouraged farmers to adopt pelletized feed systems that reduce waste and improve nutrient retention. The convergence of consumer preferences and policy support positions hay pellets as a critical growth driver in the market.

By Type Insights

Dairy cow feed dominates the North American hay market, capturing approximately 45% of the total market share, as stated by the USDA. This prominence stems from the critical role hay plays in ensuring consistent milk production and maintaining herd health. For example, according to the National Milk Producers Federation, over 9 million dairy cows in the U.S. rely on high-quality alfalfa hay to meet their daily nutritional requirements.

A primary driving factor is the increasing global demand for dairy products. As per the Food and Agriculture Organization (FAO), global milk consumption is projected to grow by 20% by 2030, driven by population growth and urbanization. High-quality hay, rich in protein and fiber, is essential for optimizing milk yields and improving cow health. Additionally, programs like EQIP provide subsidies for dairy farmers adopting sustainable feed practices, further accelerating the demand for hay as a core component of dairy cow diets.

Beef cattle and sheep feed is the fastest-growing segment in the North American hay market, with a CAGR of 7.2%, as per the USDA Foreign Agricultural Service. This growth is propelled by the rising global demand for beef and lamb, particularly in export markets like Japan, South Korea, and China.

A key driver is the emphasis on high-quality meat production. According to the National Cattlemen’s Beef Association, beef exports from the U.S. reached over 3.3 billion pounds in 2022, underscoring the importance of premium feed sources. High-quality hay, such as timothy and orchard grass, supports optimal weight gain and muscle development in beef cattle and sheep, making it indispensable for ranchers targeting international markets. Additionally, trade agreements and favorable tariffs have expanded export opportunities, further fueling the demand for hay tailored to beef and sheep nutrition.

COUNTRY ANALYSIS

Top Leading Countries In The North American Hay Market

The U.S. leads the North American hay market, holding a 65% market share as per the USDA. Its dominance is driven by its vast agricultural infrastructure and robust export capabilities. For instance, California and Idaho are among the top hay-producing states, contributing significantly to both domestic consumption and international trade. According to the USDA Foreign Agricultural Service, the U.S. exported over 4 million metric tons of hay in recent years, primarily to Asia and the Middle East.

Canada ranks second, with a 20% market share, according to Agriculture and Agri-Food Canada. The country’s leadership is fueled by its focus on premium hay production, particularly for export markets. Programs like the Canadian Agricultural Partnership provide funding for sustainable hay farming, enhancing the quality and competitiveness of Canadian hay in global markets.

Mexico holds a 10% market share, as per the Mexican Ministry of Agriculture. The country’s growth is driven by its expanding livestock sector, particularly in regions like Jalisco and Chihuahua. Government initiatives promoting sustainable agriculture have spurred investments in hay production, supporting both local consumption and regional trade.

Brazil accounts for 3% of the market, according to the Brazilian Agricultural Research Corporation. The nation’s tropical climate and extensive pasturelands make it a key player in hay production for livestock feed. Initiatives like the ABC Plan, which promotes low-carbon agriculture, further bolster the adoption of hay-based feeding systems.

The remaining countries hold a 2% market share, as per regional trade associations. These nations leverage hay production to address localized challenges, such as drought-induced feed shortages. For instance, Caribbean islands are increasingly adopting hay imports to sustain livestock during dry seasons, supported by international partnerships and funding.

KEY MARKET PLAYERS

Anderson Hay & Grain, Border Valley, Knight Ag Sourcing, Hay USA, Bailey Farms, Hayday Farm, Barr-Ag, Standlee, Legal Alfalfa Products Ltd, M&C Hay. These are the market players that are dominating the North American hay market.

Top Players In the North American Hay Market

Anderson Hay & Grain, Inc.

Anderson Hay & Grain, Inc. is a leading player in the North American hay market, renowned for its high-quality alfalfa and timothy hay products. The company’s contribution to the global market lies in its ability to meet stringent international quality standards, making it a preferred supplier for markets like Japan, South Korea, and China. Anderson Hay focuses on sustainable farming practices and efficient logistics, ensuring consistent supply to both domestic and export markets. Its strategic partnerships with livestock producers and feed manufacturers reinforce its reputation as a reliable provider of premium hay, supporting the nutritional needs of dairy cows, horses, and other livestock worldwide.

Al Dahra Agriculture

Al Dahra Agriculture, headquartered in the UAE but with significant operations in North America, plays a pivotal role in the hay market through its focus on large-scale production and export capabilities. The company specializes in producing high-grade alfalfa hay tailored to international buyers, particularly in the Middle East. By leveraging advanced irrigation technologies and sustainable farming practices, Al Dahra ensures year-round production, even in arid regions. Its commitment to innovation and quality has positioned it as a key contributor to the global hay trade, addressing the growing demand for animal feed in emerging markets.

Green Plains Alliance

Green Plains Alliance is a prominent name in the North American hay market, offering a diverse range of hay products, including bales, pellets, and cubes. The company’s focus on organic and specialty hay has enabled it to cater to niche markets such as equine feed and organic livestock farming. Green Plains actively collaborates with farmers to promote regenerative agriculture practices, enhancing soil health and reducing environmental impact. Its innovative approach and emphasis on sustainability have strengthened its position as a leader in the evolving agricultural landscape, contributing to both regional and global markets.

Top Strategies Used by Key Market Participants

Strengthening Export Networks

Key players in the North American hay market are increasingly focusing on expanding their export networks to tap into lucrative international markets. By establishing long-term contracts with importers in Asia and the Middle East, companies ensure stable revenue streams while meeting the growing demand for high-quality hay. Strategic collaborations with foreign governments and trade associations also help firms navigate regulatory requirements and quality standards, enhancing their global presence and competitiveness.

Adoption of Sustainable Farming Practices

Sustainability has become a cornerstone strategy for market leaders aiming to differentiate themselves in an increasingly eco-conscious world. Companies are investing in precision irrigation, carbon sequestration initiatives, and organic farming to reduce environmental impact and improve soil health. These efforts not only align with global sustainability goals but also appeal to environmentally conscious consumers, reinforcing brand loyalty and market leadership.

Diversification into Specialty Products

To capture niche markets, key players are diversifying their product portfolios by introducing specialty hay products such as pellets, cubes, and organic hay. By targeting specific segments like equine feed, exotic animals, and organic livestock farming, companies can command premium pricing and reduce reliance on traditional markets. This strategy not only broadens their customer base but also positions them as innovators in the evolving agricultural landscape.

COMPETITION OVERVIEW

The North American hay market is characterized by intense competition, driven by the presence of established producers and emerging players striving to capture market share. Leading companies leverage their expertise in farming, logistics, and international trade to offer high-quality products that comply with stringent global standards. The competitive landscape is further shaped by the increasing demand for sustainable and organic feed solutions, prompting firms to adopt strategies such as mergers, acquisitions, and partnerships. Smaller players, on the other hand, focus on niche markets, targeting specific applications like equine feed or specialty livestock diets. This dynamic interplay between innovation, sustainability, and strategic initiatives underscores the complexity of the market, ensuring robust growth and continuous evolution.

RECENT HAPPENINGS IN THE MARKET

- In April 2024, Anderson Hay & Grain signed a five-year supply agreement with a Japanese importer to provide premium alfalfa hay. This collaboration aims to meet Japan’s growing demand for high-quality dairy feed while securing long-term revenue for the company.

- In June 2023, Al Dahra Agriculture launched an initiative to expand its organic hay production in North America. This move aligns with the rising global demand for chemical-free feed products, strengthening the company’s position in niche markets.

- In February 2024, Green Plains Alliance acquired advanced pelletizing equipment to enhance its specialty feed product line. This investment allows the company to cater to emerging trends like organic livestock farming and equine nutrition.

- In September 2023, a U.S.-based cooperative introduced a carbon sequestration program for hay farmers. This initiative enables participants to earn carbon credits, positioning the cooperative as a leader in sustainable hay production.

- In November 2023, a Canadian hay exporter partnered with the government to promote regenerative agriculture practices. This collaboration aims to improve soil health and increase production efficiency, boosting the company’s domestic and international market presence.

MARKET SEGMENTATION

This research report on the North American Hay Market is segmented and sub-segmented into the following categories.

By Product

- Hay Bales

- Hay Pellets

- Hay Cubes

By Type

- Dairy Cow Feed

- Beef Cattle & Sheep Feed

- Pig Feed and Poultry Feed

By Country

- USA

- Canada

- Mexico

- Rest of North America

Frequently Asked Questions

What is driving demand in the North America hay market?

Increased demand from the livestock and dairy industries, especially for high-quality alfalfa hay, is the main driver.

Which types of hay are most popular in North America?

Alfalfa and timothy hay are the most commonly used due to their high nutritional value and digestibility.

How does weather impact hay production?

Weather has a major impact—droughts, floods, or untimely rains can reduce yield and quality, affecting prices and supply.

Who are the key buyers of hay in North America?

Dairy farms, beef cattle operations, horse owners, and export markets (like China and Japan) are the primary buyers.

Is hay exported from North America?

Yes, especially from the U.S. West Coast. Alfalfa hay is a major export, primarily to Asian countries.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]