North America Heat Transfer Fluids Market Research Report – Segmented By Type ( Mineral Oils , Glycol-Based Fluids ) Application and Country (The U.S., Canada and Rest of North America) - Industry Analysis, Size, Share, Growth, Trends, & Forecasts 2025 to 2033.

North America Heat Transfer Fluids Market Size

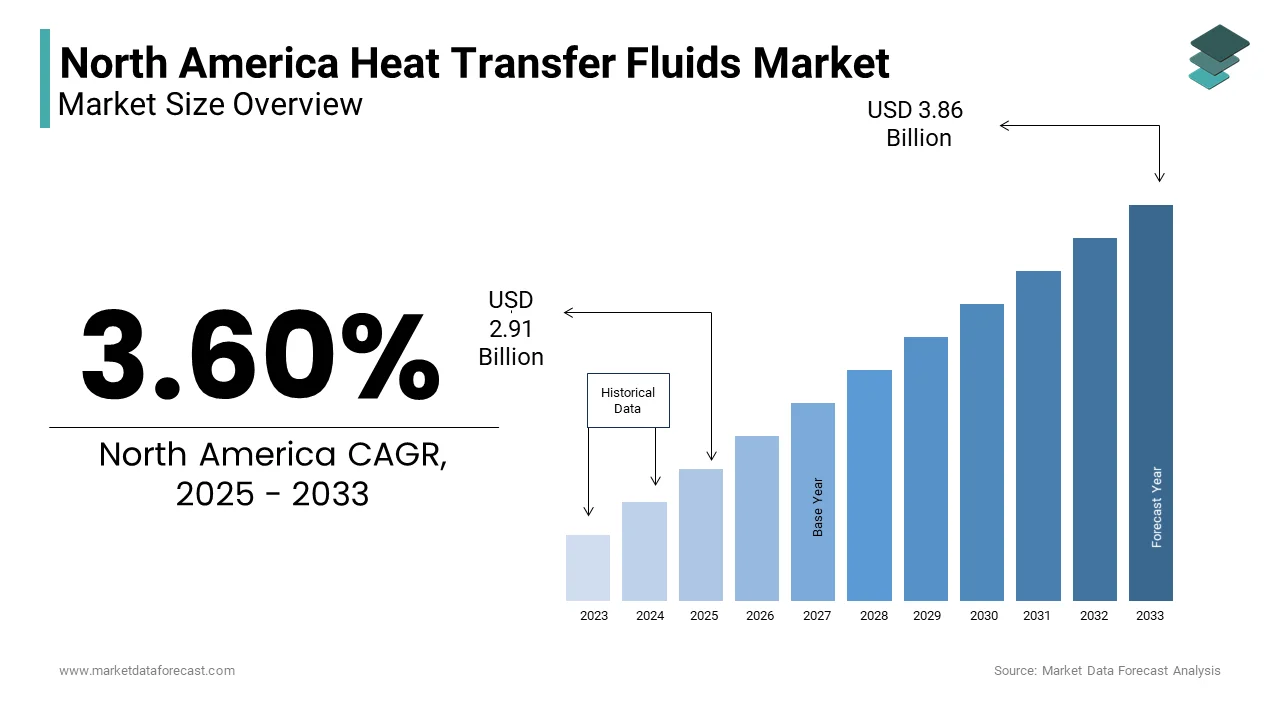

The North America Heat Transfer Fluids Market Size was valued at USD 2.81 billion in 2024. The North America Heat Transfer Fluids Market size is expected to have 3.60 % CAGR from 2025 to 2033 and be worth USD 3.86 billion by 2033 from USD 2.91 billion in 2025.

MARKET DRIVERS

Industrial Expansion and Technological Advancements

Industrial expansion remains a cornerstone driving the North America heat transfer fluids market. The region's manufacturing sector relies heavily on efficient thermal management solutions. Industries such as petrochemicals and pharmaceuticals require precise temperature control, which is achieved using high-performance heat transfer fluids. For instance, aromatic fluids are extensively used in chemical processing due to their thermal stability and ability to operate at extreme temperatures. Furthermore, technological advancements in fluid formulations have extended their application scope, enhancing their adoption.

Growing Renewable Energy Investments

The surge in renewable energy initiatives, particularly concentrated solar power (CSP), is another significant driver. Also, CSP installations in North America witnessed a major year-over-year increase in recent times, driven by federal incentives like the Inflation Reduction Act. These systems rely on heat transfer fluids to store and transfer thermal energy efficiently. Glycol-based fluids, known for their non-toxicity and anti-freeze properties, dominate this segment. Moreover, state-level policies, such as California’s mandate for 100% clean energy by 2045, further amplify the need for reliable thermal management solutions. This dual push from industrial growth and renewable energy adoption positions heat transfer fluids as a critical enabler of sustainable progress.

MARKET RESTRAINTS

Environmental and Health Concerns

Environmental and health concerns pose a significant restraint to the North America heat transfer fluids market. Many traditional fluids such as mineral oils and certain aromatic compounds contain hazardous substances that pose risks to both human health and ecosystems. According to the Environmental Protection Agency (EPA), improper disposal of these fluids can lead to soil and water contamination, resulting in long-term ecological damage. For instance, polychlorinated biphenyls (PCBs), once widely used in heat transfer applications, were banned due to their carcinogenic properties. While newer formulations aim to address these issues, regulatory frameworks continue to tighten. The Occupational Safety and Health Administration (OSHA) mandates stringent workplace safety standards, increasing compliance costs for manufacturers. Simileraly, exposure to certain heat transfer fluids can cause respiratory issues, further limiting their acceptance.

High Initial Costs and Maintenance Requirements

The high initial costs associated with heat transfer fluid systems act as another major restraint. Installing advanced thermal management systems requires substantial capital investment, often deterring small and medium enterprises (SMEs) from adopting them. In addition, SMEs constitute a substantial portion of U.S. manufacturing firms but face budget constraints that limit their ability to invest in premium solutions. Additionally, maintenance costs add to the financial burden, as these systems require regular monitoring and fluid replacements to ensure optimal performance. Data from the American Society of Mechanical Engineers indicates that downtime caused by fluid degradation can lead to losses exceeding USD 1 million annually for large-scale operations. Furthermore, the lack of skilled personnel to manage these systems exacerbates the issue, particularly in rural areas where technical expertise is scarce.

MARKET OPPORTUNITIES

Bio-Based and Eco-Friendly Fluids

The rising demand for sustainable and eco-friendly solutions presents a lucrative opportunity for the North America heat transfer fluids market. In North America, companies are increasingly exploring plant-derived fluids, such as ester-based formulations, which offer superior biodegradability and reduced toxicity compared to conventional options. Like, bio-based fluids can reduce carbon emissions considerably, aligning with corporate sustainability goals. Regulatory support further amplifies this trend; for instance, the USDA BioPreferred Program incentivizes the use of renewable materials in industrial applications. With industries like pharmaceuticals and food & beverages prioritizing eco-conscious practices, the adoption of bio-based heat transfer fluids is expected to surge.

Expansion into Emerging Applications

Emerging applications, particularly in electric vehicle (EV) manufacturing and data centers, offer significant growth avenues. It is driven by government incentives and consumer demand for cleaner transportation. Heat transfer fluids play a critical role in battery thermal management systems, ensuring optimal performance and longevity. Similarly, the exponential growth of data centers necessitates advanced cooling solutions to prevent overheating. Silicone fluids, known for their excellent dielectric properties, are gaining traction in these applications. Similarly, energy-efficient cooling technologies could reduce data center energy consumption greatly and is creating a strong impetus for innovation.

MARKET CHALLENGES

Stringent Regulatory Compliance

Stringent regulatory compliance represents a significant challenge for the North America heat transfer fluids market. Governments across the region have implemented rigorous environmental and safety standards, which manufacturers must adhere to in order to operate legally. For instance, the Toxic Substances Control Act (TSCA), enforced by the EPA, mandates comprehensive testing and reporting for chemicals used in industrial applications, including heat transfer fluids. Also, non-compliance can result in hefty penalties per violation, creating financial strain for smaller players. Additionally, frequent updates to these regulations require continuous R&D investments to reformulate products and maintain market relevance. This regulatory complexity not only hampers innovation but also elongates product development timelines, making it difficult for companies to respond swiftly to market demands.

Intense Market Competition

Intense market competition poses another formidable challenge, with numerous players vying for market share in a saturated landscape. Established players leverage economies of scale to offer competitive pricing, making it challenging for smaller firms to penetrate the market. Furthermore, rapid technological advancements necessitate continuous innovation, placing additional pressure on companies to differentiate their offerings. Also, marketing and branding efforts account for notable share of operational expenses for mid-sized firms, further straining resources. Price wars and aggressive promotional strategies exacerbate the situation, eroding profit margins. This hyper-competitive environment forces companies to adopt strategic partnerships or mergers to sustain their position, complicating the market dynamics and increasing barriers to entry.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

3.60 % |

|

Segments Covered |

By Type, Application and Country. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Country Covered |

The U.S., Canada and Rest of North America |

|

Market Leader Profiled |

Kosmos Energy Ltd, BP PLC ADR, Huntsman Corp, Shell PLC, Eastman Chemical Co |

SEGMENTAL ANALYSIS

By Type Insights

The mineral oils segment dominated the North America heat transfer fluids market by holding a market share of 40.1% in 2024. This dominance is attributed to their cost-effectiveness and widespread availability, making them a preferred choice for low-temperature applications. Industries such as HVAC and food & beverages rely heavily on mineral oils due to their non-toxic nature and ease of maintenance. Additionally, their compatibility with existing systems reduces the need for costly upgrades, further solidifying their position. However, the segment faces challenges from emerging bio-based alternatives, which threaten to disrupt its stronghold. Despite this, mineral oils remain indispensable, particularly in price-sensitive industries, ensuring their continued leadership in the foreseeable future.

On the contrary, the Glycol-based fluids segment is the fastest-growing, with a projected CAGR of 8.2%. This is fueled by their versatility and suitability for applications requiring freeze protection, such as concentrated solar power and automotive cooling systems. The study shows that glycol-based fluids can operate efficiently in temperatures ranging from -50°C to 150°C, making them ideal for diverse industrial needs. Furthermore, their non-corrosive properties extend equipment lifespan, reducing maintenance costs. The rise of electric vehicles further accelerates demand for glycol-based solutions in battery thermal management. Additionally, advancements in formulation techniques have enhanced their thermal stability, addressing previous limitations.

By Application Insights

The oil & gas sector held the largest share of 28.7% of the North America heat transfer fluids market. This is credited to the sector's reliance on efficient thermal management solutions to optimize extraction, refining, and transportation processes. Also, the U.S. oil production reached 11.8 million barrels per day in 2022, creating a substantial demand for heat transfer fluids. Enhanced oil recovery techniques, such as steam-assisted gravity drainage, further amplify this need. Additionally, the sector's emphasis on reducing carbon footprints has spurred the adoption of eco-friendly fluids, aligning with sustainability goals. However, fluctuating oil prices pose a risk, impacting investment in advanced thermal technologies. Despite this, the oil & gas industry remains a cornerstone of the market, driving consistent demand for high-performance heat transfer solutions.

The concentrated solar power (CSP) segment is accelerating quickly in this market, with a projected CAGR of 9.5%. This growth is driven by increasing investments in renewable energy projects, supported by federal incentives like tax credits and grants. Glycol-based and molten salt fluids are widely used in CSP systems due to their ability to store and transfer thermal energy efficiently. Furthermore, advancements in fluid technology have improved their thermal stability, enabling operation at higher temperatures. State-level policies, such as California’s mandate for 100% clean energy by 2045, further accelerate adoption. These factors position CSP as a key driver of innovation and growth in the heat transfer fluids market.

COUNTRY LEVEL ANALYSIS

The United States was the largest contributor to the North America heat transfer fluids market by commanding a market share of 70.5% in 2024. This dominance is fueled by the country's robust industrial infrastructure, technological advancements, and significant investments in renewable energy projects. Like, energy consumption in the country will grow through 2030, driving demand for efficient thermal management solutions. Key industries such as oil & gas, chemical processing, HVAC, and concentrated solar power (CSP) are the primary consumers of heat transfer fluids. For instance, the HVAC sector alone contributes majorly to the economy, with glycol-based fluids widely used in residential and commercial cooling systems. Federal initiatives like the Inflation Reduction Act further bolster the market by providing incentives for clean energy projects, particularly CSP installations. Additionally, the presence of major manufacturers and suppliers ensures a highly competitive yet innovative environment, fostering continuous advancements in fluid formulations.

Canada accounting for a key share of the regional revenue in 2024. The country’s vast oil sands operations, particularly in Alberta, create a substantial demand for thermal management solutions. Similarly, oil sands production reached higher barrels per day in 2022, showing the sector’s critical role in driving fluid demand. Furthermore, Canada’s commitment to reducing greenhouse gas emissions, outlined in its Net-Zero Emissions by 2050 plan, has spurred the adoption of eco-friendly and bio-based heat transfer fluids. The growing prevalence of HVAC systems in urban areas also amplifies demand, with the residential sector accounting for notable share of the country’s total energy consumption.

Mexico represents the third-largest market in North America. The country’s expanding manufacturing and automotive sectors are the primary drivers of heat transfer fluid demand. The automotive industry, in particular, is a major consumer, with Mexico producing over 3.5 million vehicles annually. Rising urbanization and infrastructure development have also led to increased demand for HVAC systems, which rely on heat transfer fluids for efficient operation. Mexico’s participation in the United States-Mexico-Canada Agreement (USMCA) has strengthened trade ties, facilitating access to advanced thermal management technologies.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Companies playing a prominent role in the North America Heat Transfer Fluids Market are Kosmos Energy Ltd, BP PLC ADR, Huntsman Corp, Shell PLC, Eastman Chemical Co, ConocoPhillips, Chevron Corp, Basf SE, Exxon Mobil Corp, Dow Inc, Lanxess AG, Sasol Ltd.

The North America heat transfer fluids market is characterized by intense competition, with established players and emerging entrants vying for dominance. The market’s competitive landscape is shaped by factors such as technological advancements, regulatory compliance, and sustainability trends. Key players like Dow Inc., ExxonMobil Corporation, and BASF SE leverage their extensive R&D capabilities to introduce innovative products, setting high standards for performance and environmental safety. However, niche players focusing on bio-based and specialized fluids are gaining traction, challenging traditional leaders. Price wars and aggressive marketing further intensify competition, particularly in price-sensitive industries like HVAC and food & beverages.

Top Players in the Market

Dow Inc.

Dow Inc., headquartered in Michigan, is a global leader in the heat transfer fluids market. The company specializes in innovative silicone-based and bio-based fluid formulations, catering to diverse industries such as concentrated solar power (CSP), HVAC, and pharmaceuticals. Dow’s R&D capabilities enable it to introduce eco-friendly solutions that align with sustainability trends. Dow’s extensive distribution network and strategic collaborations further enhance its market position, making it a dominant force in both North America and global markets.

ExxonMobil Corporation

ExxonMobil Corporation, based in Texas, is another key player. The company specializes in high-performance aromatic and mineral-based fluids, primarily serving industries like oil & gas, chemical processing, and HVAC. ExxonMobil’s focus on product innovation and efficiency has enabled it to maintain a competitive edge. ExxonMobil’s strong brand reputation and extensive supply chain further solidify its leadership in the market.

BASF SE

BASF SE, with significant operations in North America, focuses on bio-based and specialty heat transfer fluids, aligning with global sustainability goals. BASF’s commitment to innovation is evident in its introduction of next-generation ester-based fluids, which offer superior biodegradability and thermal stability. The company’s geographic expansion strategy, including the establishment of new manufacturing facilities in Mexico, has further strengthened its market presence. BASF’s ability to adapt to evolving market needs positions it as a key contributor to the global heat transfer fluids market.

Top Strategies Used by Key Players

Key players in the North America heat transfer fluids market employ a variety of strategies to strengthen their competitive position and capitalize on emerging opportunities. Product innovation remains a cornerstone, with companies investing heavily in R&D to develop eco-friendly and high-performance fluids. Strategic partnerships are another critical strategy. Geographic expansion is also prominent, with BASF SE establishing new manufacturing facilities in Mexico to cater to growing demand in Latin America. Additionally, mergers and acquisitions are utilized to consolidate market share. These strategies collectively enable companies to adapt to evolving market dynamics and maintain a competitive edge.

RECENT HAPPENINGS IN THE MARKET

- In April 2023 , Dow Inc. launched a new bio-based silicone fluid designed for concentrated solar power applications, enhancing its sustainability portfolio.

- In June 2023 , ExxonMobil partnered with a leading CSP developer to optimize heat transfer fluid efficiency, targeting a 20% performance improvement.

- In August 2023 , BASF SE opened a manufacturing facility in Monterrey, Mexico, to meet rising demand in Latin America and expand its regional footprint.

- In October 2023 , Chevron Phillips Chemical acquired a specialty fluids manufacturer, broadening its product range and strengthening its market position.

- In December 2023 , Shell Global introduced a next-generation glycol-based fluid with enhanced thermal stability, aiming to capture a larger share of the EV market.

MARKET SEGMENTATION

This research report on the north america heat transfer fluids market has been segmented and sub-segmented into the following.

By Type

- Mineral Oils

- Glycol-Based Fluids

By Application

- Oil & Gas

- Concentrated Solar Power

By Country

- The U.S.

- Canada

- Rest of North America.

Frequently Asked Questions

What is the current market size of the North America heat transfer fluids market?

As of the most recent data, the North America heat transfer fluids market is valued at several hundred million USD, with steady growth projected due to increasing industrial and renewable energy applications.

How is the shift toward renewable energy impacting the HTF market in North America?

The rise of solar thermal power plants and wind energy systems increases the demand for efficient, stable HTFs capable of withstanding high temperatures and operating in environmentally friendly ways.

Which countries in North America are leading in the consumption of heat transfer fluids?

United States (dominates the regional market) Canada (significant in renewable energy and industrial applications) Mexico (growing demand in manufacturing and automotive sectors)

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com