North America Home Improvement Market Size, Share, Trends & Growth Forecast Report By Product Type (Kitchen Fixtures, Bathroom Fixtures, Flooring, Paints and Coatings, Home Décor Source), Application, Distribution Channel, And Country (US, Canada, And Rest Of North America), Industry Analysis From 2025 To 2033

North America Home Improvement Market Size

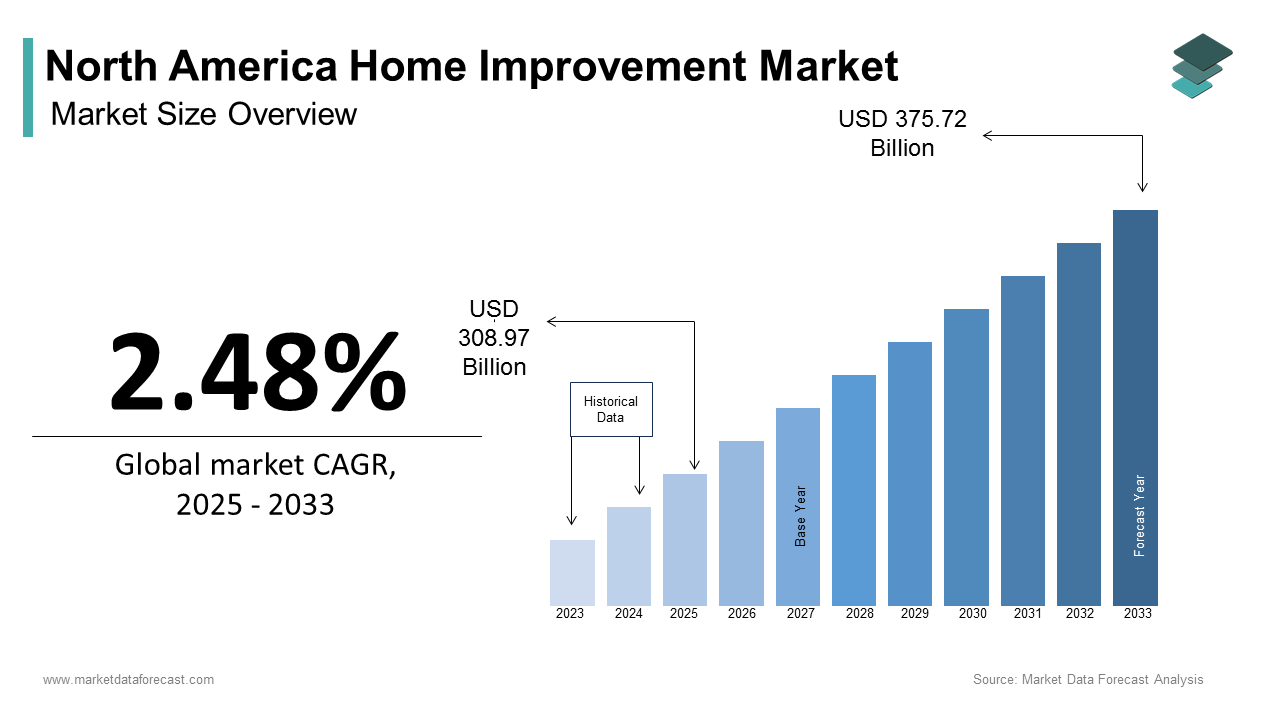

The size of the North America Home Improvement Market was calculated to be USD 301.50 billion in 2024 and is anticipated to be worth USD 375.72 billion by 2033, from USD 308.97 billion in 2025, growing at a CAGR of 2.48% during the forecast period.

The North American home improvement market involves a broad range of products and services aimed at enhancing residential properties, including renovations, repairs, remodeling, and smart home upgrades. This sector serves both homeowners and professional contractors, covering categories such as flooring, roofing, plumbing, electrical systems, kitchen and bathroom fixtures, HVAC, outdoor living spaces, and energy-efficient appliances.

Also, companies have expanded their offerings to include smart home integration, eco-friendly materials, and DIY-friendly solutions tailored to evolving consumer preferences. In addition, rising property values and limited housing inventory have encouraged homeowners to invest in upgrades rather than relocate.

MARKET DRIVERS

Rise in Residential Construction and Remodelling Activities

Among the primary growth enablers is the significant uptick in residential construction and remodeling projects. This growth has directly stimulated demand for various home improvement products, particularly among first-time homebuyers seeking modernized interiors and upgraded amenities.

Renovations often include flooring replacements, kitchen and bathroom overhauls, and exterior enhancements, all of which constitute major portions of the home improvement budget. For instance,

Moreover, low interest rates and favorable mortgage conditions earlier in the decade encouraged property investments, further stimulating both new builds and retrofits. This environment has created a sustained demand for home improvement solutions, with consumers prioritizing long-term value and design flexibility, thereby boosting product innovation and market expansion.

Increasing Demand for Sustainable and Smart Home Solutions

A growing emphasis on sustainability and technological integration is significantly shaping the choices of homeowners across North America.

According to the U.S. Green Building Council, more than 60,000 LEED-certified buildings existed in the United States as of early 2024, many incorporating energy-efficient lighting, water-saving fixtures, and eco-friendly insulation materials. These standards appeal to environmentally conscious buyers and have prompted manufacturers to develop greener alternatives.

This shift in consumer behavior has prompted leading brands like Lowe’s and Home Depot to expand their green product portfolios. For example, Kohler introduced a line of low-flow faucets made from recycled brass, which saw a 22% sales increase in 2023 compared to the prior year.

Government incentives and stricter environmental regulations are further accelerating this trend. Environment and Climate Change Canada reported that federal green building initiatives led to a notable increase in the use of certified sustainable materials in public infrastructure projects during 2023. As awareness grows and certification programs gain prominence, the demand for sustainable home improvement products is expected to continue rising, reinforcing their role as a critical growth driver for the North American market.

MARKET RESTRAINTS

Supply Chain Disruptions and Raw Material Price Volatility

The North American home improvement industry has faced persistent supply chain challenges, exacerbated by global economic uncertainties and geopolitical tensions. These disruptions have led to extended lead times and increased production costs, ultimately affecting profit margins and pricing strategies.

Furthermore, raw material price volatility remains a critical concern. These fluctuations complicate budget planning for manufacturers and retailers alike.

These cost pressures are often passed on to consumers, reducing affordability and dampening demand. In response, some companies have delayed product launches or scaled back expansion plans.

Labor Shortages and Installation Cost Constraints

Labor shortages in the construction and renovation sectors have significantly hindered the growth of the North American home improvement market.

As per the Associated General Contractors of America, 82% of U.S. construction firms struggled to fill hourly craft worker positions, including carpenters, plumbers, electricians, and general remodelers. This shortage has resulted in longer project timelines and increased labor costs, discouraging both homeowners and developers from initiating new improvement projects.

Specialized installations—such as smart home automation, energy-efficient windows, and custom cabinetry—require skilled technicians, whose availability has diminished in recent years. According to the Bureau of Labor Statistics, the median wage for construction trades workers in the U.S. increased, reaching an average of $58,320 annually, making it more expensive for small contractors and DIY enthusiasts to undertake home improvement projects. Thilaborur crunch is further compounded by training gaps and an aging workforce.

MARKET OPPORTUNITIES

Expansion of Smart and Connected Home Technologies

The emergence of smart and connected home technologies presents a compelling opportunity for growth in the North American home improvement market. These advanced systems integrate seamlessly into residential environments, offering enhanced control, convenience, and energy efficiency through mobile apps and voice-activated assistants.

In residential applications, smart thermostats, lighting controls, security cameras, and automated window treatments are gaining traction, particularly among tech-savvy homeowners.

In commercial settings, multifamily housing developments are increasingly incorporating smart locks, remote-controlled HVAC systems, and energy monitoring tools to attract tenants.

Additionally, government incentives and utility rebate programs are encouraging homeowners to adopt energy-saving smart devices. As technology continues to evolve and costs decrease, smart home integration is expected to become more mainstream, offering a robust avenue for market expansion in North America.

Growth in E-commerce and Direct-to-Consumer Sales Channels

The digital transformation of the home improvement industry has unlocked a significant growth opportunity through e-commerce and direct-to-consumer (DTC) sales channels. Online platforms now allow consumers to browse, compare, and purchase home improvement products from the comfort of their homes, supported by augmented reality (AR) tools and virtual room visualization services.

Major retailers such as Lowe’s, The Home Depot, and Amazon have expanded their digital footprints, offering free samples, online consultations, and even virtual installation guides.

This shift reflects changing consumer behavior toward convenience and transparency in purchasing decisions.

Additionally, the integration of logistics and fulfillment networks has improved last-mile delivery and installation coordination, overcoming traditional barriers to online home improvement sales.

MARKET CHALLENGES

Intense Competition and Price Sensitivity Among Consumers

The North American home improvement market faces intense competition among a wide array of domestic and international players, resulting in aggressive pricing strategies and margin pressures. This saturation has intensified rivalry, compelling firms to frequently discount products to retain market share, especially in price-sensitive segments.

Price sensitivity among consumers remains a critical challenge. A survey by J.D. Power found that a significant portion of U.S. homeowners considered price as the top factor when selecting home improvement products, surpassing brand reputation and sustainability credentials. This preference has driven demand for cheaper alternatives like laminate countertops, basic vinyl flooring, and entry-level LED lighting, squeezing profits for premium product manufacturers.

Moreover, imported home improvement products, particularly from China and Vietnam, have flooded the North American market due to lower production costs. The U.S. International Trade Commission reported that imports of power tools, plumbing fixtures, and building materials into the U.S. increased in volume terms in 2023 intensifying competition for domestic producers.

While this offers consumers more choice, it puts pressure on local manufacturers to either reduce costs or differentiate their offerings through innovation, branding, or service enhancements.

Regulatory Compliance and Environmental Standards

Regulatory scrutiny around emissions, indoor air quality, and sustainable sourcing poses a significant challenge for home improvement product manufacturers operating in North America. Both the U.S. and Canada have implemented stringent environmental and health-related regulations that require products to meet specific performance and chemical emission standards.

According to the California Air Resources Board, formaldehyde emissions from composite wood products—including engineered wood flooring and cabinetry—are strictly regulated under the Airborne Toxic Control Measure (ATCM), requiring manufacturers to invest in compliant materials and testing procedures.

As per UL Environment, compliance with these standards has increased the production costs for certain product categories, particularly those using adhesives and synthetic finishes. Meeting these requirements not only increases operational complexity but also limits the use of cost-effective yet non-compliant materials.

Smaller manufacturers face difficulties in adapting to evolving regulations without compromising profitability. As environmental policies continue to tighten, ensuring regulatory alignment while maintaining competitive pricing remains a pressing challenge for the North American home improvement market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

2.48% |

|

Segments Covered |

By Product Type, Application, Distribution Channel, And Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

Us, Canada, and the Rest of North America |

|

Market Leaders Profiled |

The Home Depot, Lowe’s Companies Inc., Menards, Ace Hardware, True Value Company, Ferguson Enterprises, Floor & Decor Holdings Inc., Sherwin-Williams Company, Amazon.com Inc., Wayfair Inc. |

SEGMENTAL ANALYSIS

By Product Type Insights

The kitchen fixtures segment commanded the North American home improvement market, capturing 28.2% of the total market share as of 2024. This dominance is primarily attributed to the growing emphasis on kitchen remodeling, which remains one of the most popular and high-impact home improvement activities.

One key driver behind this segment's growth is the increasing trend of homeowners investing in modern, functional kitchens that enhance both aesthetics and usability. Additionally, kitchen upgrades are widely recognized as a top investment for increasing property value, further reinforcing demand.

Another major factor is the rising popularity of high-end, designer-style fixtures such as touchless faucets, pull-out drawers, and integrated lighting systems. Companies like Kohler and Moen reported double-digit sales growth in their smart faucet lines during the year, capitalizing on consumer interest in convenience and sustainability.

Moreover, real estate trends indicate that buyers are increasingly drawn to move-in-ready homes with updated kitchens, prompting sellers to invest in fixture upgrades before listing properties.

The paints and coatings segment is currently the fastest-growing within the North American home improvement market, expanding at a CAGR of 9.3% in the coming years. This rapid growth is largely driven by the rising adoption of eco-friendly, low-VOC (volatile organic compound) paints and specialty coatings designed for durability, moisture resistance, and aesthetic enhancement.

A major contributing factor is the surge in DIY home improvement projects, particularly among younger homeowners and renters seeking affordable ways to refresh interiors. These consumers prioritize color customization, sustainability, and health-conscious products, pushing manufacturers to innovate with bio-based resins and antimicrobial additives.

In addition, the commercial sector has seen increased demand for durable coatings used in multifamily housing, office renovations, and hospitality settings.

Technological advancements have also played a role in boosting adoption. Sherwin-Williams and Benjamin Moore introduced AI-powered color-matching tools and augmented reality apps in 2023, allowing users to visualize paint choices digitally before purchasing.

By Application Insights

The remodeling segment remained at the forefront in the North America home improvement market, accounting for 42.5% of total revenue in 2024. Remodeling encompasses extensive updates to kitchens, bathrooms, living spaces, and exteriors—activities that significantly enhance property value and livability.

The segment continues to lead, primarily due to the sustained rise in home renovation spending. Kitchens and bathrooms remain the most frequently remodeled areas due to their impact on daily life and resale value. Additionally, limited housing inventory has encouraged homeowners to invest in upgrading rather than relocating. With ongoing construction and remodeling activity, the remodeling segment remains a cornerstone of the North American home improvement market.

The repair segmenis t poised for accelerated adoption within the North American home improvement market, expanding at a CAGR of 8.7% during the forecast period. This growth is largely attributed to the aging housing stock across the United States and Canada, where older homes require frequent maintenance and component replacements.

A major factor propelling this trend is the increasing need for plumbing, electrical, roofing, and HVAC repairs in homes built before 1990.

In addition, extreme weather events linked to climate change have accelerated wear and tear on residential structures. These incidents have led to increased demand for water-resistant materials, reinforced roofing, and mold remediation services.

Moreover, the rise in remote work has prompted homeowners to address long-deferred repairs to improve comfort and productivity. With ongoing infrastructure aging and climate-related challenges, the repair segment is expected to maintain its upward trajectory.

By Distribution Channel Insights

The retail stores segment led the North American home improvement market, capturing 56.2% of total revenue in 2024. This is due to the continued preference of consumers and professionals for in-store shopping experiences, where they can see, test, and immediately purchase products ranging from tools and hardware to large appliances and building materials.

Its dominance is underpinned by the accessibility and immediacy offered by big-box retailers such as Lowe’s and The Home Depot, which together operate a large number of stores across the United States and Canada.

Also, the in-store experience allows for expert guidance through trained associates and demonstration displays, which is especially valuable for complex or high-value items like power tools, smart home devices, and flooring options.

Furthermore, seasonal promotions, exclusive in-store deals, and bundled service offerings continue to attract budget-conscious shoppers.

The online distribution channel is experiencing accelerated growth in the North American home improvement market, rising at a CAGR of 11.2%. This quick expansion is primarily driven by shifting consumer behavior, digital transformation of retail, and enhanced logistics capabilities that make online shopping for bulky and specialized home improvement items more viable.

The market is being significantly influenced by the increasing use of mobile devices and desktop platforms to research and purchase home improvement products. Major players such as Amazon, Houzz, and Wayfair have expanded their offerings to include curated selections of tiles, cabinetry, and smart home devices tailored to both DIY enthusiasts and professional contractors.

Additionally, the integration of augmented reality (AR) visualization tools has enhanced the online buying experience. These tools allow users to preview products in their own space before purchasing, reducing return rates and increasing consumer confidence.

Logistics improvements have also played a crucial role in overcoming traditional barriers to online home improvement sales.

REGIONAL ANALYSIS

United States Home Improvement Market Insights

The United States remained the key contributor in the North American home improvement market, representing 79.3% of regional revenue in 2024. As the global leader in residential construction and renovation activity, the U.S. drives massive demand for products such as flooring, kitchen fixtures, bathroom upgrades, and smart home technologies.

One of the primary drivers of the market in the U.S. is the scale of residential construction activity. Simultaneously, the renovation sector has seen strong growth. Renovations often include flooring replacements, kitchen and bathroom overhauls, and exterior enhancements, all of which constitute major portions of the home improvement budget.

Major retailers such as Lowe’s and The Home Depot have capitalized on this trend by expanding their product portfolios and digital presence.

Canada Home Improvement Market Insights

Canada has established itself as a strong market player in the North America home improvement. The Canadian home improvement industry benefits from stable economic growth, increasing urbanization, and a growing emphasis on sustainable building practices.

Residential construction plays a pivotal role in sustaining demand. In addition to residential demand, commercial construction has seen a resurgence, particularly in institutional and healthcare sectors.

Major manufacturers such as Norandex and Plastpro have expanded their presence through localized production and distribution networks. With increasing disposable incomes and regulatory support for energy-efficient construction, Canada’s home improvement market continues to evolve, positioning itself as a key player in the broader North American landscape.

Mexico represents the third-largest contributor to the North American home improvement market. While smaller in scale compared to the U.S. and Canada, Mexico's home improvement industry is gradually expanding due to industrialization, urban development, and rising disposable incomes.

A key driver of market growth is the expansion of the residential construction sector. This uptick has spurred demand for cost-effective home improvement solutions, particularly in lower-income segments where ceramic tiles, PVC piping, and basic plumbing fixtures dominate.

Additionally, foreign investment in manufacturing and logistics facilities has contributed to commercial home improvement demand. Domestic producers such as Coppel and Ferreterías Corcovado have capitalized on this trend by expanding their product lines to include locally manufactured tools, plumbing supplies, and electrical components.

LEADING PLAYERS IN THE NORTH AMERICA HOME IMPROVEMENT MARKET

The Home Depot, Inc.

The Home Depot is a dominant force in the North American home improvement market and one of the largest retailers globally. The company offers an extensive range of products and services, including tools, building materials, appliances, and installation services. Known for its customer-centric approach, The Home Depot serves both DIY enthusiasts and professional contractors. Its vast store network, strong supply chain, and investment in digital transformation have solidified its leadership position. The company also plays a key role in promoting sustainable home solutions through eco-friendly product lines and energy-efficient partnerships.

Lowe’s Companies, Inc.

Lowe’s is a major competitor to The Home Depot and holds a significant share of the North American home improvement market. The company operates thousands of stores across the U.S. and Canada, offering a broad selection of home improvement products and services. Lowe’s has invested heavily in enhancing its online shopping experience, expanding delivery options, and integrating smart home technologies into its retail strategy. It also supports community-driven initiatives and contractor loyalty programs, reinforcing its presence in both residential and commercial markets.

Sherwin-Williams Company

Sherwin-Williams is a leading manufacturer and retailer of paints, coatings, and related products, playing a crucial role in the home improvement sector. The company is known for its innovation in sustainable paint formulations, color-matching technologies, and durable finishes tailored for both interior and exterior applications. With a strong distribution network and a focus on customer service, Sherwin-Williams caters to homeowners, professionals, and industrial clients. Its acquisition strategy has further strengthened its market position by expanding regional reach and product diversity.

TOP STRATEGIES USED BY KEY MARKET PARTICIPANTS

Expansion of E-Commerce and Digital Integration

To align with evolving consumer behavior, leading players are investing heavily in digital platforms, augmented reality visualization tools, and seamless mobile experiences. These enhancements aim to streamline the purchasing journey, improve customer engagement, and support omnichannel strategies that integrate online and in-store services.

Product Innovation and Sustainability Focus

Companies are prioritizing research and development to introduce high-performance, eco-friendly, and smart-enabled home improvement solutions. This includes low-VOC paints, energy-efficient lighting, water-saving fixtures, and modular designs that cater to modern living trends while meeting regulatory standards.

Strategic Acquisitions and Partnerships

To enhance product portfolios and geographic reach, major players are actively acquiring niche brands, regional distributors, and specialty retailers. These moves allow companies to diversify offerings, strengthen supply chains, and better serve specialized customer segments within the broader home improvement ecosystem.

KEY MARKET PLAYERS AND COMPETITION OVERVIEW

Major Players of the North America Home Improvement market include The Home Depot, Lowe’s Companies Inc., Menards, Ace Hardware, True Value Company, Ferguson Enterprises, Floor & Decor Holdings Inc., Sherwin-Williams Company, Amazon.com Inc., Wayfair Inc.

The competition in the North American home improvement market is highly dynamic and marked by the presence of large multinational retailers, regional suppliers, and emerging e-commerce platforms. Industry leaders such as The Home Depot, Lowe’s, and Sherwin-Williams maintain dominant positions due to their extensive product offerings, well-established distribution networks, and robust brand recognition. These companies continuously innovate to differentiate themselves and capture larger market shares.

Mid-sized and local firms are gaining traction by focusing on niche markets, cost-effective solutions, and localized marketing strategies. The rise of online marketplaces and direct-to-consumer models has further intensified competition, compelling traditional retailers to enhance their digital capabilities and logistics infrastructure.

Sustainability and smart technology integration have become critical battlegrounds, with companies vying to offer eco-friendly and connected home solutions. Additionally, fluctuating raw material prices and labor shortages continue to pressure profit margins, forcing firms to optimize operations and adopt lean manufacturing practices. As consumer expectations evolve, companies must balance affordability, durability, and aesthetic appeal to remain competitive in this fast-paced environment.

RECENT HAPPENINGS IN THE MARKET

- In January 2024, The Home Depot launched a new AI-powered visual search feature on its mobile app, allowing customers to take a photo of a room and instantly find matching products, significantly improving the online shopping experience for home improvement items.

- In March 2024, Lowe’s introduced a nationwide same-day delivery service for core home improvement products, partnering with third-party logistics providers to enhance convenience and reduce delivery times for both DIY and professional customers.

- In May 2024, Sherwin-Williams acquired a specialty coatings startup specializing in zero-emission interior paints, strengthening its portfolio of eco-friendly products and supporting its commitment to sustainability and indoor air quality.

- In July 2024, The Home Depot expanded its Pro Contractor Program with enhanced financing options, dedicated sales representatives, and exclusive bulk pricing, aiming to deepen relationships with professional builders and tradespeople across the U.S. and Canada.

- In September 2024, Lowe’s unveiled a series of smart home demonstration centers within select retail locations, showcasing integrated lighting, security, and climate control systems designed to help consumers visualize and test smart home improvements before purchase.

DETAILED SEGMENTATION OF THE North America Home Improvement Market INCLUDED IN THIS REPORT

This research report on the North America Home Improvement Market has been segmented and sub-segmented based on product type, application, distribution channel, & region.

By Product Type

- Kitchen Fixtures,

- Bathroom Fixtures

- Flooring, Paints and Coatings

- Home Décor Source

By Application

- Remodeling

- Repair

- Maintenance

- New Construction

By Distribution Channel

- Online

- Retail Stores

- Wholesale

- Direct Sales

By Region

- US

- Canada

- Mexico

- Rest of North America

Frequently Asked Questions

1. What is driving the growth of the home improvement market in North America?

Key drivers include rising home ownership, aging housing stock, increased focus on home aesthetics, and growing DIY (do-it-yourself) trends.

2. Who are the key players in the North America home improvement market?

Major players include The Home Depot, Lowe’s Companies Inc., Menards, Ace Hardware, True Value Company, Wayfair Inc., Amazon.com Inc., Ferguson Enterprises, Sherwin-Williams Company, and Floor & Decor Holdings Inc.

3. Which product segments are included in the home improvement market?

The market includes building materials, tools, hardware, lighting, flooring, kitchen and bathroom products, and furniture.

4. How is e-commerce impacting the home improvement market?

E-commerce is growing rapidly, enabling consumers to purchase tools, décor, and renovation materials online with increased convenience.

5. What are the main trends shaping the market?

Trends include smart home integration, energy-efficient upgrades, sustainable materials, and an increase in remote work-driven remodeling projects.

6. What challenges does the market face?

Challenges include supply chain disruptions, labor shortages in skilled trades, and fluctuating raw material costs.

7. What is the role of DIY and DIFM in this market?

Both DIY (Do-It-Yourself) and DIFM (Do-It-For-Me) segments are growing, with DIY appealing to budget-conscious consumers and DIFM preferred for complex projects.

8. Which countries lead the North America home improvement market?

The United States dominates, followed by Canada and Mexico, with strong demand in both urban and suburban areas.

9. How does urbanization affect the growth of this market?

Urbanization leads to more housing development and remodeling activities, which supports continuous market growth, especially in metropolitan areas.

10. Which distribution channels are seeing the most growth?

E-commerce and online platforms are experiencing rapid growth as consumers increasingly prefer digital channels for purchasing home improvement products.

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com