North America Hormone Replacement Therapy Market Research Report - Segmented By Hormone Type, Route Of Administration & Country (U.S, Canada & Rest of North America) - Industry Analysis, Size, Share, Growth, Trends, & Forecasts (2025 to 2033)

North America Hormone Replacement Therapy Market Size

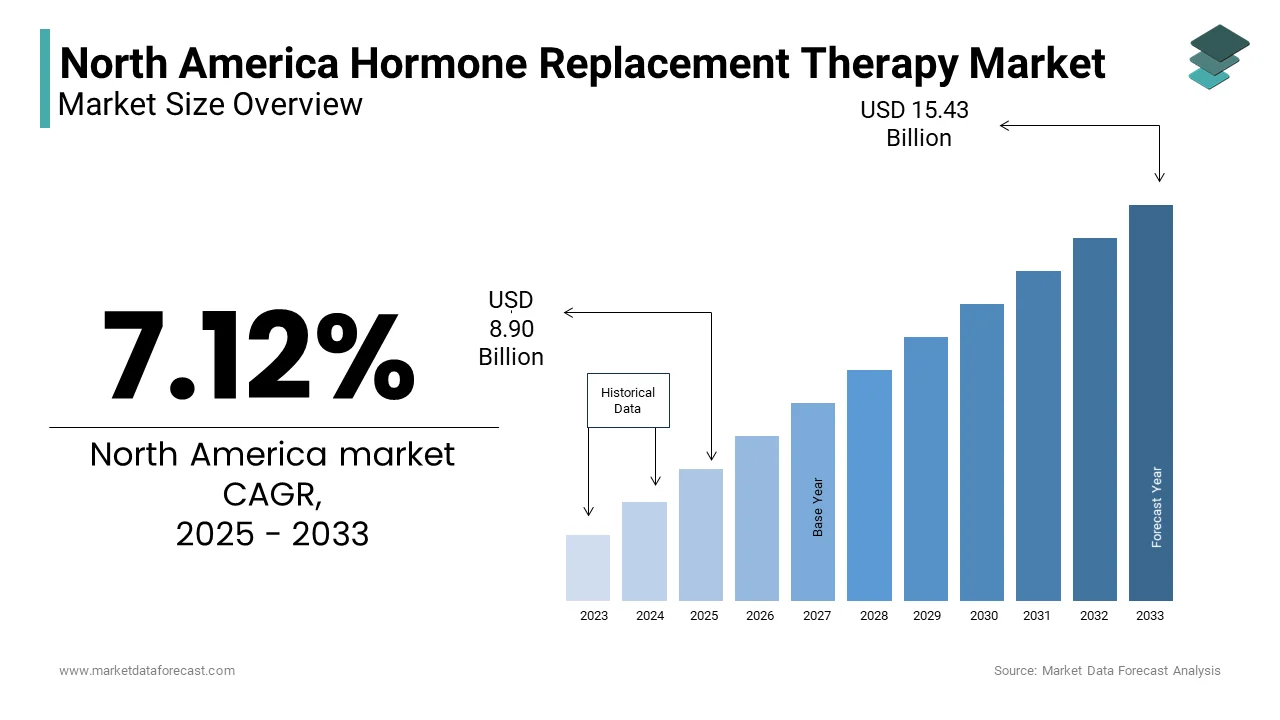

The North American hormone replacement therapy market was valued at USD 8.31 billion in 2024. The North American hormone replacement therapy market is expected to have a 7.12 % CAGR from 2024 to 2033 and be worth USD 15.43 billion by 2033 from USD 8.90 billion in 2025.

Hormone Replacement Therapy (HRT) is a medical treatment designed to replenish declining hormone levels in individuals experiencing hormonal imbalances, commonly due to aging, menopause, or certain medical conditions. This therapy is widely used to manage symptoms of menopause, hypogonadism, thyroid disorders, and growth hormone deficiencies. In North America, the demand for HRT has risen due to increasing awareness of its benefits, an aging population, and advancements in personalized medicine.

The region has witnessed a surge in HRT adoption, particularly for menopause management, as nearly 1.3 million women in the United States reach menopause each year, according to the North American Menopause Society. Additionally, the American Thyroid Association estimates that over 20 million Americans suffer from thyroid disorders, many of whom require hormone therapy for regulation. Beyond menopause and thyroid-related conditions, HRT is also an integral part of gender-affirming care for transgender individuals. A report from the Williams Institute at UCLA states that approximately 1.6 million people in the U.S. identify as transgender, with many opting for hormone therapy as part of their transition.

Although HRT provides substantial benefits, it also carries certain risks. The Women’s Health Initiative, a long-term national study, has noted concerns over prolonged hormone therapy use and its potential links to cardiovascular issues and certain cancers. As a result, ongoing research and evolving guidelines shape the therapeutic landscape, balancing efficacy with safety to optimize patient outcomes.

MARKET DRIVERS

Aging Population and Rising Menopause Cases

The growing aging population in North America is a significant factor driving the demand for hormone replacement therapy (HRT). According to the U.S. Census Bureau, by 2030, all baby boomers will be aged 65 or older, increasing the need for treatments addressing age-related hormonal deficiencies. The North American Menopause Society reports that approximately 6,000 women in the United States reach menopause daily, translating to over two million annually. Many of these women seek HRT to alleviate symptoms such as osteoporosis, hot flashes, and mood swings. The rising prevalence of age-related conditions, such as osteoporosis, which affects an estimated 10 million Americans according to the National Osteoporosis Foundation, further fuels the adoption of HRT.

Increasing Awareness and Advancements in Personalized Medicine

Growing awareness about the benefits of hormone replacement therapy and advancements in personalized medicine are key factors accelerating market growth. The American College of Obstetricians and Gynecologists states that modern HRT formulations, including bioidentical hormones, offer tailored solutions with improved safety profiles. Additionally, ongoing research has led to the development of non-oral delivery methods, such as transdermal patches and gels, reducing the risk of side effects associated with oral estrogen. The Centers for Disease Control and Prevention highlights that nearly 42% of American adults use some form of complementary or alternative medicine, reflecting a broader trend toward personalized healthcare. This shift is driving demand for customized HRT regimens that cater to individual hormonal needs.

MARKET RESTRAINTS

Potential Health Risks and Safety Concerns

Despite its benefits, hormone replacement therapy has been associated with potential health risks, leading to hesitancy among patients and healthcare providers. The Women’s Health Initiative study found that long-term HRT use may increase the risk of breast cancer, stroke, and cardiovascular diseases, especially in older women. The American Cancer Society reports that women undergoing combination HRT (estrogen plus progestin) have a 75% higher risk of developing breast cancer compared to non-users. Also, the American Heart Association warns that oral estrogen therapy may contribute to an elevated risk of blood clots. These safety concerns have led to stringent regulations and cautious prescribing practices, limiting HRT adoption despite its therapeutic advantages.

High Treatment Costs and Limited Insurance Coverage

The high cost of hormone replacement therapy remains a major barrier, particularly for uninsured and underinsured individuals. Moreover, Medicare and private insurance plans often impose restrictions on HRT coverage, requiring extensive documentation or prior authorization. The National Center for Health Statistics shows that nearly 8% of Americans delay or skip medication due to cost concerns. These financial barriers limit access to HRT, especially among middle- and lower-income populations, constraining market expansion.

MARKET OPPORTUNITIES

Advancements in Non-Hormonal Alternatives and Adjunct Therapies

The development of innovative non-hormonal alternatives and adjunct therapies is opening new growth opportunities in the HRT market. While traditional HRT remains a primary treatment, pharmaceutical advancements have introduced selective estrogen receptor modulators (SERMs) and neurokinin B inhibitors as effective alternatives for managing menopausal symptoms. The FDA recently approved fezolinetant, a non-hormonal treatment for hot flashes, showcasing the potential for complementary therapies. According to the National Institutes of Health, nearly 45% of menopausal women seek non-hormonal treatments due to concerns over HRT risks. By integrating these alternatives with traditional hormone therapy, companies can expand their market reach and cater to a broader patient base including those hesitant to use conventional HRT.

Growing Male Hormone Replacement Therapy Market

While HRT is widely associated with menopause treatment, increasing awareness of male hormonal imbalances is creating a new market segment. Testosterone replacement therapy (TRT) is gaining traction among men with hypogonadism, a condition affecting testosterone production. The American Urological Association estimates that nearly 2% of men over 40 have clinically diagnosed low testosterone, with many more experiencing subclinical symptoms. Furthermore, a study published in The Journal of Clinical Endocrinology & Metabolism reports that testosterone prescriptions in the U.S. have increased nearly fourfold over the past two decades. As male aging-related hormone deficiencies become more widely recognized, the demand for TRT and related therapies is expected to rise significantly.

MARKET CHALLENGES

Limited Long-Term Data on Newer Therapies

Although modern HRT formulations and bioidentical hormones are gaining acceptance, the lack of extensive long-term clinical data remains a challenge. Many newer formulations, including bioidentical hormones and plant-derived estrogens, have not undergone the same level of rigorous, decades-long studies as traditional HRT. The Endocrine Society notes that while short-term studies suggest improved safety profiles, long-term effects on cardiovascular health, cancer risks, and metabolic functions remain uncertain. This uncertainty makes regulatory approvals more complex and influences healthcare providers’ willingness to prescribe newer HRT formulations. Without robust long-term research, patients and physicians may remain hesitant to adopt emerging HRT solutions despite their potential benefits.

Disparities in Access to HRT Across Demographics

Access to hormone replacement therapy is not uniform across North America, with significant disparities based on socioeconomic status, race, and geographic location. The Centers for Disease Control and Prevention highlights that rural populations often have limited access to specialized healthcare providers, reducing their ability to receive timely HRT consultations. Additionally, a report from the American Medical Association indicates that Black and Hispanic women are less likely to be prescribed HRT compared to white women, despite experiencing more severe menopausal symptoms on average. Financial constraints also play a role, as many insurance plans do not fully cover HRT, making affordability a significant barrier. These disparities create unequal healthcare outcomes and limit market penetration in underserved communities.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

7.12 % |

|

Segments Covered |

By Hormone Type , Route of Administration and Country. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Country Covered |

The U.S., Canada and Rest of North America |

|

Market Leader Profiled |

Beneo GmbH, FrieslandCampina, and DuPont de Nemours, Inc. |

SEGMENTAL ANALYSIS

By Hormone Type Insights

In 2024, estrogen replacement therapy accounted for the biggest portion of the North American hormone replacement market, capturing 45% of the total share. This is linked to its critical role in treating menopause-related issues, which impact thousands of women daily. According to the Centers for Disease Control and Prevention, over 6,000 women in the U.S. enter menopause every day. With nearly 20 million women aged 45-64 in the country, demand soared. The National Institutes of Health emphasized its importance, noting its ability to ease symptoms like hot flashes and reduce osteoporosis risks, significantly improving quality of life.

Looking ahead, growth hormone replacement therapy is set to expand at the highest CAGR of 8.5% between 2025 and 2033. This growth will be fueled by greater awareness of growth disorders and breakthroughs in biotechnology. Data from the National Center for Biotechnology Information shows that about 1 in 4,000 children in the U.S. are diagnosed with growth hormone deficiency each year. Additionally, the aging population, expected to hit 78 million by 2030 as per U.S. Census Bureau estimates, will drive demand further. By addressing height deficiencies and muscle loss, this therapy is becoming a cornerstone of modern healthcare solutions.

By Route of Administration Insights

The oral administration dominated the North American hormone replacement therapy market by holding a 55% share in 2024. This position is due to its convenience and widespread acceptance among patients. According to the U.S. Food and Drug Administration, oral medications are preferred by over 60% of patients due to their ease of use and non-invasive nature. Additionally, the Centers for Disease Control and Prevention reported that nearly 70% of women aged 50-64 rely on oral therapies for managing menopausal symptoms. Its importance lies in providing consistent hormone levels, improving compliance, and reducing discomfort associated with injections or patches.

The transdermal administration segment is projected to grow at the fastest CAGR of 9.2% from 2025 to 2033. This growth will be driven by rising demand for non-invasive delivery methods and advancements in patch technology. The National Institutes of Health highlights that transdermal patches offer steady hormone absorption, benefiting over 4 million users annually. Furthermore, the U.S. Census Bureau predicts a surge in the elderly population, expected to reach 78 million by 2030, boosting demand for safer alternatives. With fewer side effects compared to oral treatments, transdermal options are gaining traction, making them vital for long-term hormone management and patient comfort.

Country Level Analysis

In 2024, the United States held the largest share of the North America hormone replacement therapy market by contributing 85.2% of the regional revenue. A key factor behind this dominance was the rising number of women experiencing menopause-related symptoms. According to the U.S. Census Bureau, more than 50 million women were 51 or older, the typical age range for menopause onset. The country’s advanced healthcare system and the presence of top pharmaceutical companies made HRT widely accessible. Additionally, the Centers for Disease Control and Prevention (CDC) noted that over 12 million hormone therapy prescriptions were dispensed in 2024, reflecting strong demand for these treatments.

Canada is expected to be the fastest-expanding market for hormone replacement therapy in North America, with a projected CAGR of 7.2% from 2025 to 2033. One of the main drivers is the country’s aging population. Statistics Canada estimates that nearly 24% of Canadians will be 65 or older by 2030, increasing the demand for hormone therapy. Greater awareness of menopause and advancements in telemedicine are also fueling market growth. Moreover, the Canadian Institute for Health Information reported that pharmaceutical spending exceeded CAD 40 billion in 2024, with a rising portion allocated to hormonal treatments exhibiting the growing focus on HRT accessibility and innovation.

Top 3 Players in the market

Pfizer Inc.

Pfizer is a key player in the North American dietary supplements market, known for its strong portfolio of health and wellness products. The company focuses on research-driven formulations, offering a wide range of multivitamins, minerals, and specialty supplements designed to support immune health, bone strength, and overall well-being. Pfizer leverages its extensive distribution network and brand trust to maintain a strong presence in both retail and online channels. With continued investment in innovation and strategic partnerships, the company has expanded its reach, catering to diverse consumer needs, from general nutrition to targeted health solutions.

Abbott Laboratories

Abbott Laboratories is a leading name in the dietary supplements sector, offering high-quality nutritional products tailored for different age groups and health conditions. The company emphasizes science-backed formulations, ensuring that its supplements meet industry standards for safety and efficacy. Abbott has built a reputation for developing specialized nutrition solutions, particularly in areas like digestive health, heart wellness, and muscle maintenance. Through continuous product innovation and consumer education initiatives, the company has strengthened its influence in the North American market, adapting to evolving health trends and growing demand for personalized nutrition.

Amway Corporation

Amway Corporation plays a significant role in the North American dietary supplements industry through its strong direct-selling model and diverse range of health supplements. The company focuses on plant-based and organic ingredients, aligning with consumer preferences for natural and sustainable products. Amway's extensive global supply chain and commitment to quality control enable it to maintain a loyal customer base. By integrating scientific research with holistic wellness trends, the company continues to expand its portfolio, offering personalized nutrition solutions that appeal to health-conscious consumers. Its emphasis on sustainability and innovation has further positioned it as a trusted name in the dietary supplements market.

Top strategies used by the key market participants

Personalization and Customization

A growing strategy among leading companies in the dietary supplements market is offering personalized or customizable supplement plans tailored to individual health needs. Companies are increasingly leveraging digital tools such as quizzes, apps, or online consultations to create personalized nutrition solutions for consumers. This personalized approach not only enhances customer satisfaction by addressing specific health goals—such as weight management, energy boosting, or skin health—but also improves customer retention. By offering targeted products based on individual health profiles, companies can build stronger relationships with consumers and cater to the growing trend of personalized wellness.

Sustainability and Ethical Sourcing

Sustainability has become a key differentiator for companies in the dietary supplements market, with many players shifting to eco-friendly practices. Brands are focusing on ethical sourcing of ingredients, such as using organic farming methods or ensuring that their supply chains are free of harmful chemicals and pesticides. Additionally, sustainable packaging and environmentally responsible manufacturing processes are becoming a priority. This strategy not only appeals to environmentally conscious consumers but also helps companies align with increasing regulations and standards regarding environmental impact. By emphasizing sustainability, companies position themselves as responsible brands in a market increasingly focused on ethical consumerism.

Influencer and Digital Marketing Campaigns

Digital marketing and influencer partnerships are a growing strategy for market players to engage with younger, health-conscious audiences. Companies are collaborating with fitness influencers, nutrition experts, and health coaches to promote their products on social media platforms. This direct connection with consumers via trusted voices enhances brand credibility and widens reach. Additionally, creating engaging online content such as educational videos, wellness blogs, and health challenges allows companies to build a loyal community. By tapping into digital trends and influencer culture, companies can create buzz around their products, increasing visibility and customer loyalty in a highly competitive market.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Companies playing a prominent role in the North America Hormone Replacement Therapy Market are Novartis, Abbott Laboratories, Pfizer, Mylan Laboratories, F. Hoffmann-La Roche, Merck & Co, Amgen, Eli Lily, Bayer, Novo Nordisk, Wyeth, Hisamitsu Pharmaceutical Co. Inc.

The North America Hormone Replacement Therapy (HRT) market is highly competitive, with many companies offering a variety of products to meet the needs of women going through menopause. These products include pills, patches, gels, and creams, each designed to manage symptoms like hot flashes, night sweats, and mood swings. The competition is driven by the growing demand for safe and effective treatments for menopause-related health issues.

Several major pharmaceutical companies dominate the market, and they compete by offering different types of HRT, improving the quality of their products, and expanding their distribution networks. These companies focus on research and development to create new, improved formulations, especially those that minimize side effects.

Additionally, the rise of alternative therapies and natural options adds another layer of competition. Some women prefer bioidentical hormone therapy or plant-based supplements over traditional HRT, pushing companies to innovate further.

Marketing plays a big role in this market as companies use advertisements, online campaigns, and partnerships with healthcare professionals to build consumer trust. As more people become aware of the benefits of HRT, the competition among these companies is expected to grow, with each trying to offer the best solutions for women’s health.

RECENT HAPPENINGS IN THE MARKET

In February 2025, The Guardian reported on the "So Hot Right Now" conference in Sydney, which sparked discussions on the evolving approaches to menopausal hormone therapy (MHT). The event highlighted differing medical opinions on hormone dosages and testosterone therapy, reflecting the ongoing debate between traditional and emerging treatment methods.

In February 2025, The Times covered new guidelines that now allow menopausal hormone therapy for cancer survivors. Previously avoided due to concerns about recurrence risks, HRT is now considered for certain patients under personalized treatment plans, balancing the potential benefits with risks.

In February 2025, Verywell Health highlighted a study suggesting that hormone therapy may slow biological aging in women. The research found that women using HRT appeared biologically younger, though the study was observational and did not establish direct causality.

MARKET SEGMENTATION

This research report on the North America Hormone Replacement Therapy Market has been segmented and sub-segmented into the following categories.

By Hormone Type

- Estrogen Replacement Therapy

- Growth Hormone Replacement Therapy

- Thyroid replacement therapy

- Others

By Route of Administration

- Oral

- Transdermal

- Parenteral

- other routes

By Country

- The United States

- Canada

- Rest of North America

Frequently Asked Questions

What are the leading companies operating in the North America hormone replacement therapy market?

Leading companies operating in the North America hormone replacement therapy market include Pfizer, Novartis AG, Amgen Inc., and Merck & Co.

What are the emerging trends in the hormone replacement therapy market in North America?

Emerging trends in the hormone replacement therapy market in North America include increasing use of customized hormone replacement therapy, rising demand for non-oral HRT products, and growing popularity of bio-identical hormones.

Which types of hormone replacement therapies are most commonly used?

The most common types of HRT include estrogen replacement therapy, testosterone replacement therapy, thyroid hormone therapy, and growth hormone therapy.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com