North America Household Vacuum Cleaners Market Size, Share, Trends & Growth Forecast Report By Product (Upright Vacuum Cleaners, Robotic Vacuum Cleaners), Distribution Channel, Power Source, And Country (Us, Canada, And Rest Of North America), Industry Analysis From 2025 To 2033

North America Household Vacuum Cleaners Market Size

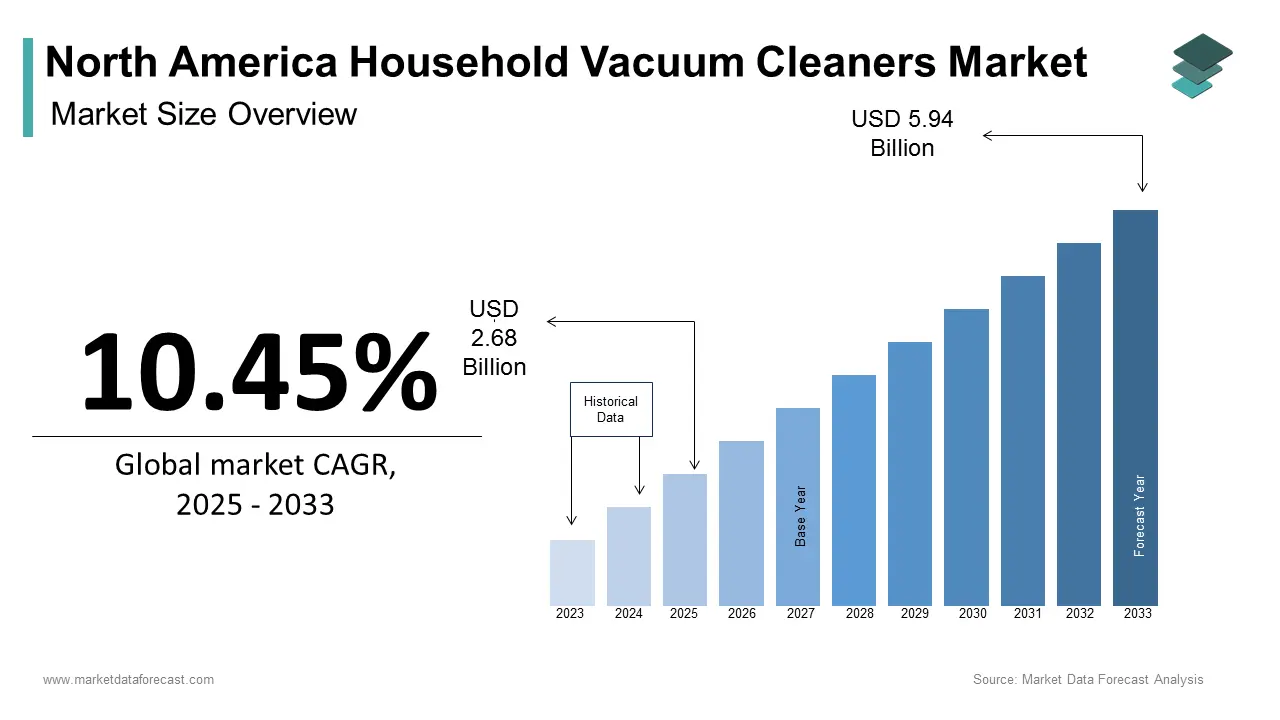

The North America household vacuum cleaners market size was calculated to be USD 2.43 billion in 2024 and is anticipated to be worth USD 5.94 billion by 2033 from USD 2.68 billion in 2025, growing at a CAGR of 10.45% during the forecast period.

The North American household vacuum cleaners market has established itself as a dynamic segment within the broader home appliances industry, driven by evolving consumer preferences and technological advancements. Also, the United States dominates the regional landscape, accounting for a major portion of the total revenue. A key factor influencing this growth is the increasing demand for smart and cordless vacuum cleaners, which offer convenience and enhanced cleaning efficiency. Additionally, the rise of pet ownership, with 70% of U.S. households owning pets, has driven demand for high-performance vacuums capable of handling pet hair and allergens. Despite these positive trends, fluctuating raw material costs and supply chain disruptions remain challenges, as per Deloitte's industry analysis.

MARKET DRIVERS

Rising Demand for Smart and IoT-Enabled Vacuums

The integration of smart technologies into household vacuum cleaners represents a significant driver for the North American market. These devices, equipped with AI-driven navigation and app-based controls, appeal to tech-savvy consumers seeking convenience and automation. For example, iRobot’s Roomba series, which features voice control and scheduling capabilities, reported a 25% increase in sales during 2022. Additionally, the proliferation of IoT-enabled homes has expanded the adoption of smart vacuums, as they seamlessly integrate with other connected devices. The increasing number of smart homes in North America are equipped with IoT-compatible appliances, further fueling demand.

Increasing Focus on Indoor Air Quality and Allergen Management

The growing emphasis on indoor air quality and allergen management is another major driver propelling the market forward. According to the Asthma and Allergy Foundation of America, over 50 million Americans suffer from allergies annually and is creating a strong demand for vacuums with advanced filtration systems. For instance, Miele’s HEPA-filter-equipped vacuums gained significant traction in 2022, with a rise in sales attributed to their ability to trap 99.97% of allergens. Additionally, the rise in pet ownership has amplified the need for vacuums capable of handling pet dander and hair, as noted by the American Veterinary Medical Association.

MARKET RESTRAINTS

High Initial Costs of Advanced Models

A restraint impacting the North American vacuum cleaner market is the high initial cost associated with advanced models and particularly smart and robotic vacuums. This financial barrier limits adoption, especially among low-income households and first-time buyers. In addition, the perception of high maintenance costs further discourages potential users. For instance, a significant percentage of respondents hesitated to purchase robotic vacuums due to concerns about battery replacement and repair expenses. While technological advancements have reduced costs over time, the upfront investment remains prohibitive for many, slowing market penetration.

Limited Awareness of Product Features and Benefits

One more critical restraint is the limited awareness of product features and benefits, particularly among older demographics and rural populations. A notable share of North American consumers do not fully understand the functionality of smart vacuums, such as app-based controls and automated scheduling. This lack of awareness creates hesitation among potential buyers, who may perceive advanced models as unnecessary or overly complex. Furthermore, misconceptions about the durability and performance of cordless vacuums deter adoption.

MARKET OPPORTUNITIES

Expansion in Urban and Smart Home Markets

The urbanization trend and the proliferation of smart homes present significant opportunities for the North American vacuum cleaner market. a significant number of smart homes in North America are expected to incorporate IoT-enabled appliances by 2025, creating a fertile ground for smart vacuums. Besides, partnerships with smart home platforms like Amazon Alexa and Google Assistant have expanded the functionality of robotic vacuums, enhancing their appeal.

Adoption in Commercial and Institutional Spaces

Commercial and institutional spaces represent another promising avenue for growth, driven by the need for efficient cleaning solutions in high-traffic environments. Hotels, offices, and educational institutions are increasingly adopting advanced vacuums to maintain hygiene standards and improve operational efficiency. For example, Marriott International has been exploring and implementing robotic vacuums in its hotels. Additionally, government incentives promoting energy-efficient appliances have accelerated adoption in public facilities.

MARKET CHALLENGES

Rapid Technological Obsolescence

Rapid pace of technological obsolescence is a further challenge for the market participants. It is driven by continuous innovation in vacuum design and functionality. This rapid evolution creates challenges for manufacturers, who must constantly innovate to stay competitive. For example, Dyson reported an increase in R&D spending in recent years. However, smaller firms struggle to keep pace, as they lack the resources to invest in cutting-edge technologies. Furthermore, consumer’s growing preference for multifunctional devices which are capable of handling multiple cleaning tasks further accelerates obsolescence and is posing a significant hurdle for traditional players.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

10.45% |

|

Segments Covered |

By Product, Distribution Channel, Power Source, And Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

Us, Canada, And Rest Of North America |

|

Market Leaders Profiled |

BISSELL, Dyson, LG Electronics, Miele, Panasonic, Samsung, SharkNinja, iRobot, Eureka, Hoover |

SEGMENTAL ANALYSIS

By Product Insights

The upright vacuum cleaners segment commanded the North American market by holding 40.8% of the total share in 2024. This growth of the segment is due to their powerful suction capabilities and affordability that is making them ideal for households with carpets and large living spaces. For instance, upright models like those from Hoover and Bissell are widely used in suburban homes, where carpeted floors are prevalent. Additionally, advancements in motor technology have improved efficiency and noise reduction, enhancing user experience.

The robotic vacuum cleaners segment is the fastest-growing category and is projected to have a CAGR of 25.3% from 2025 to 2033. This growth is fueled by their convenience and automation capabilities are appealing to busy urban professionals and tech-savvy consumers. Additionally, the integration of IoT and voice control has expanded applications in smart homes, enabling seamless connectivity with other devices.

By Distribution Channel Insights

The offline retail segment commanded the North American vacuum cleaner market and captured 65.8% of the total share in 2024. This is because of the established presence of brick-and-mortar stores like Best Buy and Walmart, which offer consumers the ability to physically inspect products before purchase. Moreover, offline channels benefit from higher consumer trust, particularly for premium models requiring detailed demonstrations. Further, partnerships between manufacturers and retailers often involve bundled sales through offline outlets, further boosting this segment.

Online retail is the rapidly advancing category having a calculated CAGR of 20.4%. This progress is driven by the increasing popularity of e-commerce platforms like Amazon and eBay, which offer competitive pricing and convenience. Also, online retail sales in North America grew notably in recent years, with electronics being a key contributor. The availability of detailed product reviews and comparisons online aids purchasing decisions, making the channel more attractive. For example, Amazon reported a, increase in vacuum cleaner sales during Black Friday 2022, showcasing the segment’s potential. The integration of AI-driven recommendation engines on e-commerce platforms further enhances the online shopping experience, ensuring sustained growth.

By Power Source Insights

The corded vacuum cleaners segment held the largest market share of 55.3% of the total in 2024. This dominance is primarily due to their consistent power supply and superior suction capabilities, making them ideal for deep cleaning tasks. For instance, corded models are widely used in households with heavy-duty cleaning needs. Besides, advancements in motor efficiency have reduced energy consumption, enhancing their appeal.

The segment of cordless vacuum cleaners are emerging quickly, with a projected CAGR of 22.9% from 2025 to 2033. This growth is fueled by their portability and ease of use, appealing to urban consumers with compact living spaces. For instance, some cordless models reported a surge in sales in 2022 which is driven by their lightweight design and versatility. Like, advancements in battery technology have extended runtime and is addressing previous limitations. Over 60% of cordless vacuum buyers cited convenience as the primary reason for their purchase.

REGIONAL ANALYSIS

The United States led the North American vacuum cleaner market by commanding a 85.1% share in 2024. This rise is caused by its robust consumer electronics sector and strong emphasis on home automation. In addition, a significant portion of U.S. households prioritize cleaning efficiency when purchasing appliances which is creating a fertile ground for advanced vacuums. Additionally, federal incentives promoting energy-efficient technologies have bolstered adoption. For instance, ENERGY STAR-certified models gained popularity in 2022, with a 15% increase in sales attributed to tax rebates. Big companies have capitalized on this trend by offering tailored solutions for diverse applications, from urban apartments to suburban homes.

Canada is a major player in the market. The progress is due to investments in sustainable housing and smart city projects. According to Natural Resources Canada, municipalities like Vancouver and Toronto are prioritizing energy-efficient appliances in public spaces to improve citizen well-being.

Mexico is expected to witness growth in the regional market which is attributed to the expanding middle class and rising disposable incomes, supported by economic reforms. Additionally, the hospitality sector has embraced robotic vacuums to enhance guest experiences, particularly in luxury resorts. Government-led urbanization projects can also lead to expanded vacuum applications in residential and commercial buildings.

The Rest of North America is likely to see progress in this market. This region’s growth is driven by tourism and hospitality industries, which rely on vacuums for guest comfort and hygiene. In addition, hotel revenue grew notably in 2022, spurring investments in advanced cleaning solutions.

LEADING PLAYERS IN THE NORTH AMERICA HOUSEHOLD VACUUM CLEANERS MARKET

iRobot Corporation

iRobot leads the North American vacuum cleaner market. Its Roomba series, designed for smart homes, integrates seamlessly with IoT platforms, making it a preferred choice for tech-savvy consumers. For instance, iRobot’s AI-driven navigation systems are widely used in urban apartments to enhance cleaning efficiency.

Dyson Ltd.

Dyson is a key contributor to the market. Known for its innovative designs, the company serves sectors ranging from residential to commercial. Its emphasis on modularity and scalability has positioned it as a leader in adaptive cleaning technologies, catering to diverse customer needs.

SharkNinja Operating LLC

SharkNinja holds a notable spot by offering affordable yet feature-rich vacuums, Shark serves residential and commercial markets. Its Shark IQ line of robotic vacuums, designed for hands-free cleaning, gained popularity among busy professionals and families. Shark’s partnerships with retailers like Target and Walmart have expanded its footprint, solidifying its reputation for precision and reliability.

TOP STRATEGIES USED BY KEY MARKET PARTICIPANTS

Key players in the North American vacuum cleaner market employ diverse strategies to maintain their competitive edge. Innovation remains central, with companies investing heavily in R&D to develop AI-driven and IoT-enabled solutions. Strategic partnerships with retailers, such as Amazon and Walmart, ensure wide distribution and accessibility. For instance, iRobot collaborates with smart home platforms to enhance connectivity and functionality. Expanding geographic reach through online channels and targeting emerging markets like smart cities further strengthens market presence. Finally, sustainability initiatives, such as eco-friendly materials and energy-efficient designs, align with global trends, appealing to environmentally conscious consumers.

KEY MARKET PLAYERS AND COMPETITION OVERVIEW

Major Players of the North America vacuum cleaner market include BISSELL, Dyson, LG Electronics, Miele, Panasonic, Samsung, SharkNinja, iRobot, Eureka, Hoover

The North American vacuum cleaner market is characterized by fierce competition, driven by rapid technological advancements and diverse applications. Leading players like iRobot, Dyson, and Shark dominate the landscape, leveraging their expertise in AI, IoT, and material science to differentiate offerings. Smaller firms, however, face challenges due to high R&D costs and the dominance of established brands. The market is also witnessing increased competition from low-cost imports, which remain more affordable and accessible. Regulatory pressures and the need for compliance with energy efficiency standards further complicate the competitive environment. Despite these challenges, opportunities abound in emerging sectors like smart homes, healthcare, and education. Companies that balance innovation with affordability while addressing regional needs are likely to thrive.

RECENT HAPPENINGS IN THE MARKET

- In February 2023, iRobot launched its Roomba Combo j7+, featuring dual brushes and AI-driven navigation. This move strengthened its position in the robotic vacuum segment.

- In April 2023, Dyson acquired a robotics startup specializing in AI-driven cleaning technologies. This acquisition enhanced its capabilities in autonomous navigation.

- In July 2023, Shark partnered with Amazon to offer exclusive discounts on its cordless vacuums. This collaboration expanded its customer base and boosted sales.

- In October 2023, iRobot introduced a new line of app-controlled vacuums for smart homes, targeting tech-savvy urban professionals. This launch boosted its brand appeal in the residential market.

- In December 2023, Dyson unveiled a next-generation cordless vacuum with extended battery life, positioning itself as a leader in energy-efficient cleaning solutions.

MARKET SEGMENTATION

This research report on the North American household vacuum cleaners market has been segmented and sub-segmented based on product, distribution channel, power source, and region.

By Product

- Upright Vacuum Cleaners

- Robotic Vacuum Cleaners

By Distribution Channel

- Offline Retail

- Online Retail

By Power Source

- Corded Vacuum Cleaners

- Cordless Vacuum Cleaners

By Region

- United States

- Canada

- Mexico

- Rest of North America

Frequently Asked Questions

1. What factors are driving the growth of the vacuum cleaner market in North America?

The growth is driven by increasing urbanization, rising disposable income, growing awareness of hygiene, and the adoption of smart and robotic vacuum technologies.

2. Which product types are most popular in the North American market?

Popular product types include upright vacuum cleaners, canister vacuum cleaners, robotic vacuum cleaners, handheld vacuums, and stick vacuums.

3. Who are the major players in the North America Household Vacuum Cleaners Market?

Key players include BISSELL, Dyson, LG Electronics, Miele, Panasonic, Samsung, SharkNinja, iRobot, Eureka, and Hoover.

4. How is the North America household vacuum cleaners market expected to grow in the coming years?

The market is expected to witness steady growth driven by increasing consumer preference for smart and efficient cleaning appliances, rising disposable income, and advancements in vacuum cleaner technologies such as robotic and cordless models.

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com