North America Hydrogen Peroxide Market Report Research – Segmented Product ( Function Bleaching , Oxidant ) End-User Industry and Country (The U.S., Canada and Rest of North America) - Industry Analysis( 2025 to 2033).

North America Hydrogen Peroxide Market Size

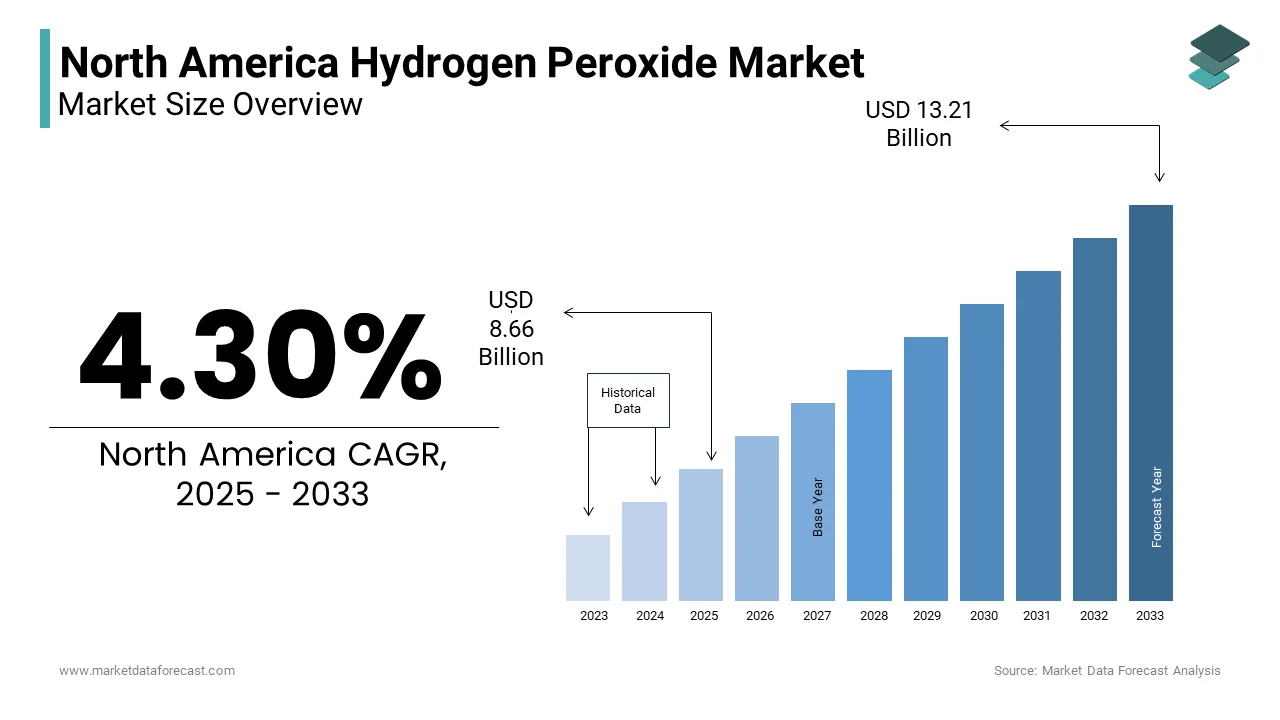

The North America Hydrogen Peroxide Market Size was valued at USD 8.21 billion in 2024. The North America Hydrogen Peroxide Market size is expected to have 4.30 % CAGR from 2025 to 2033 and be worth USD 13.29 billion by 2033 from USD 8.66 billion in 2025.

The North America Hydrogen Peroxide Market is part of the chemical industry, involving the production and distribution of hydrogen peroxide (H₂O₂) for industrial, commercial, and consumer applications. Widely recognized for its strong oxidizing properties, hydrogen peroxide is used across diverse sectors including pulp and paper, textiles, chemicals, electronics manufacturing, water treatment, pharmaceuticals, and personal care.

In industrial contexts, it plays a critical role in bleaching processes within the pulp and paper industry, as well as in the synthesis of various organic and inorganic compounds. As per data from the U.S. Environmental Protection Agency (EPA), hydrogen peroxide is increasingly favored over chlorine-based alternatives due to its lower environmental impact and decomposition into water and oxygen, making it a preferred choice for eco-conscious manufacturing.

In the U.S., the Department of Energy (DOE) highlights that hydrogen peroxide is gaining traction in green chemistry initiatives and advanced oxidation processes aimed at reducing toxic emissions and chemical waste.

Moreover, the healthcare sector continues to expand its reliance on hydrogen peroxide for sterilization, wound care, and antimicrobial formulations. The rise in demand for disinfectants post-pandemic has further reinforced its importance in public health infrastructure.

MARKET DRIVERS

Expansion of the Pulp and Paper Industry

One of the primary drivers of the North America Hydrogen Peroxide Market is the continued expansion and modernization of the pulp and paper industry, which relies heavily on hydrogen peroxide as an environmentally friendly bleaching agent. Unlike traditional chlorine-based methods, hydrogen peroxide offers a non-toxic, biodegradable alternative that aligns with sustainability goals and regulatory mandates. Like, the U.S. pulp and paper sector generated over $300 billion in annual shipments in 2023, with a significant share of mills transitioning to elemental chlorine-free (ECF) or totally chlorine-free (TCF) bleaching technologies. Hydrogen peroxide is a key component of TCF processes, eliminating the formation of harmful dioxins and persistent organic pollutants. Furthermore, Canadian pulp mills have significantly increased their adoption of hydrogen peroxide-based bleaching systems to meet stringent environmental regulations under the Canadian Environmental Protection Act (CEPA). Over 75% of Canadian kraft pulp producers now utilize hydrogen peroxide in their bleaching sequences to reduce effluent toxicity and improve process efficiency. Moreover, the growing demand for recycled paper products has spurred the need for gentler yet effective bleaching agents, where hydrogen peroxide provides superior performance without compromising fiber integrity.

Rising Demand in Water Treatment and Disinfection Applications

Another significant driver of the North America Hydrogen Peroxide Market is the rising demand for water treatment and disinfection solutions, especially in municipal and industrial settings. Hydrogen peroxide is widely used for its ability to effectively neutralize contaminants such as bacteria, viruses, and organic pollutants without generating harmful by-products. Its use in combination with UV light or ozone—known as AOP (Advanced Oxidation Process)—has proven highly effective in breaking down emerging contaminants like pharmaceutical residues and microplastics. In addition, the Centers for Disease Control and Prevention (CDC) notes that hydrogen peroxide-based disinfectants are extensively used in healthcare facilities for surface sterilization, equipment cleaning, and infection control protocols. This pattern was further accelerated during the pandemic, leading to sustained demand even beyond the crisis period. Moreover, industrial sectors such as food and beverage, electronics manufacturing, and oil and gas are adopting hydrogen peroxide for its high-efficiency oxidation capabilities in cleaning and purification. As per the National Institute of Standards and Technology (NIST), hydrogen peroxide is increasingly employed in semiconductor manufacturing for ultra-clean surface treatments, reinforcing its value in precision industries.

MARKET RESTRAINTS

Volatility in Raw Material Prices and Supply Chain Constraints

A major restraint affecting the North America Hydrogen Peroxide Market is the volatility in raw material prices and supply chain constraints, which can disrupt production schedules and increase operational costs. Hydrogen peroxide is primarily manufactured using the anthraquinone auto-oxidation process, which depends on inputs such as hydrogen, oxygen, and organic solvents—all subject to fluctuating global commodity prices. According to the U.S. Energy Information Administration (EIA), natural gas prices—a key input for hydrogen production—experienced sharp fluctuations in 2023, impacting the cost structure for hydrogen peroxide manufacturers. Also, the Bureau of Labor Statistics (BLS) s that chemical feedstock prices rose in 2023 compared to the previous year, adding financial pressure on producers. Supply chain disruptions, particularly in logistics and transportation, have also contributed to delays in raw material procurement and finished product delivery. Furthermore, geopolitical tensions and trade restrictions have introduced uncertainties in sourcing essential components. As noted by the U.S. International Trade Commission (USITC), import tariffs on certain chemical intermediates have increased procurement costs for smaller-scale manufacturers, limiting their ability to compete with larger players.

Stringent Regulatory Frameworks and Handling Requirements

Stringent regulatory frameworks and handling requirements pose another major challenge for the North America Hydrogen Peroxide Market . Given its strong oxidizing properties, hydrogen peroxide must be stored, transported, and handled with extreme caution to prevent degradation, contamination, and potential hazards. Regulatory bodies such as the U.S. Occupational Safety and Health Administration (OSHA) and Environment and Climate Change Canada (ECCC) enforce strict guidelines on concentration levels, storage conditions, and workplace exposure limits. Compliance with these safety standards increases operational complexity and capital expenditures for manufacturers and end-users alike. Moreover, the Environmental Protection Agency (EPA) monitors industrial emissions and discharges containing hydrogen peroxide, ensuring they do not exceed permissible thresholds that could affect aquatic life and ecosystems. As outlined by the EPA’s Integrated Science Assessments, improper disposal or excessive release of hydrogen peroxide into water bodies may interfere with microbial treatment processes in wastewater facilities. Furthermore, state-level environmental agencies impose additional ing obligations, particularly in California and New York, creating a fragmented compliance landscape.

MARKET OPPORTUNITIES

Growth in Green Chemistry and Sustainable Industrial Processes

A compelling opportunity for the North America Hydrogen Peroxide Market lies in the growing adoption of green chemistry and sustainable industrial processes. As industries seek to reduce their environmental footprint, hydrogen peroxide is increasingly being utilized as a clean oxidizing agent in chemical synthesis, textile bleaching, and pollution control applications. According to the American Chemical Society (ACS), hydrogen peroxide-based oxidation reactions generate fewer hazardous byproducts compared to conventional methods, making them ideal for sustainable manufacturing. Moreover, the U.S. Department of Energy (DOE) notes that hydrogen peroxide is playing a strategic role in the development of green hydrogen production technologies. Companies involved in electrochemical water plitting and catalytic oxidation are exploring hydrogen peroxide as a viable intermediate in decentralized hydrogen generation, supporting the broader energy transition. In the textile industry, the Textile Exchange s that sustainable fabric bleaching using hydrogen peroxide has gained momentum, particularly among brands committed to the Zero Discharge of Hazardous Chemicals (ZDHC) initiative.

Expanding Use in Electronics Manufacturing and Semiconductor Fabrication

The expanding use of hydrogen peroxide in electronics manufacturing and semiconductor fabrication presents a significant growth opportunity for the North America Hydrogen Peroxide Market . As electronic devices become more sophisticated, the demand for ultra-pure cleaning and etching agents has surged, with hydrogen peroxide serving as a critical component in photolithography, wafer cleaning, and oxide layer removal. According to the Semiconductor Industry Association (SIA), North America accounts for nearly 20% of global semiconductor production, with billions of dollars invested in domestic chip manufacturing following the passage of the CHIPS and Science Act in 2022. As per the National Institute of Standards and Technology (NIST), hydrogen peroxide is a fundamental reagent in the Standard Clean 1 (SC1) solution used for removing organic and metallic contaminants from silicon wafers. Moreover, the rise in demand for electric vehicles, 5G infrastructure, and advanced computing has intensified the need for high-purity hydrogen peroxide solutions. As ed by SEMI, North America saw over $60 billion in planned semiconductor investments in 2023, directly influencing hydrogen peroxide procurement strategies.

MARKET CHALLENGES

Storage and Transportation Limitations Due to Instability

One of the principal challenges facing the North America Hydrogen Peroxide Market is the inherent instability of concentrated hydrogen peroxide, which necessitates stringent storage and transportation protocols. Unlike many industrial chemicals, hydrogen peroxide is prone to decomposition when exposed to heat, light, or incompatible materials, posing logistical and safety concerns. According to the U.S. Chemical Safety and Hazard Investigation Board (CSB), several industrial incidents have been attributed to improper handling or contamination of hydrogen peroxide, resulting in fires, explosions, and equipment damage. These risks mandate the use of specialized containers, stabilizers, and temperature-controlled transport, increasing operational costs and limiting flexibility in supply chain logistics. This classification often leads to higher freight costs and longer approval times for cross-border shipments. Apart from these, the requirement for cold-chain logistics in high-concentration applications restricts the ability to serve remote or underserved markets efficiently.

Competition from Alternative Oxidizing Agents

The North America Hydrogen Peroxide Market faces stiff competition from alternative oxidizing agents such as sodium hypochlorite, potassium permanganate, and ozone, which are often selected based on cost, availability, and application-specific efficacy. While hydrogen peroxide is preferred for its environmental benefits, competing chemicals remain dominant in certain niche applications due to lower initial costs and established supply chains. According to the American Water Works Association (AWWA), sodium hypochlorite continues to be the most commonly used disinfectant in municipal water treatment due to its low cost and ease of handling. Although less environmentally benign, it is widely accepted in regions where hydrogen peroxide's higher price point is a deterrent. Similarly, in the textile industry, chlorine-based bleaching agents still hold a significant share in cost-sensitive operations, despite growing regulatory scrutiny. The Textile Rental Services Association (TRSA) notes that some large-scale laundry services continue to rely on chlorine derivatives due to their rapid action and lower formulation costs. Moreover, ozone-based oxidation systems are gaining traction in high-end water purification and food processing applications. As per the International Ozone Association (IOA), ozone generators offer on-site production advantages that eliminate storage and transportation concerns, positioning them as a viable alternative in select industrial segments.

Regulatory Hurdles in Consumer Product Formulations

Hydrogen peroxide is widely used in consumer products such as antiseptics, contact lens solutions, and hair dyes; however, regulatory scrutiny around consumer safety and formulation concentration is becoming increasingly stringent. While diluted hydrogen peroxide (3–6%) is deemed safe for household use, higher concentrations pose health risks if misused, prompting regulatory bodies to tighten oversight. According to the U.S. Food and Drug Administration (FDA), consumer-grade hydrogen peroxide products must adhere to strict labeling, dilution, and packaging requirements to prevent accidental ingestion or skin irritation. The FDA has issued multiple advisory notices regarding the misuse of high-strength hydrogen peroxide in alternative health regimens, leading to calls for enhanced consumer education and product restrictions. In addition, Health Canada has implemented labeling mandates under the Consumer Chemicals and Containers Regulations (CCCR) that limit available concentrations for retail sale and require child-resistant packaging. These regulatory interventions, while necessary for public safety, create barriers for companies seeking to expand into consumer-focused markets. Moreover, consumer advocacy groups and environmental organizations have raised concerns about hydrogen peroxide’s potential interactions with other ingredients in personal care and household cleaners. These evolving regulatory dynamics necessitate continuous reformulation efforts, compliance investments, and clear communication strategies to maintain consumer trust and ensure market viability.

Impact of Economic Downturns on Industrial Demand

Economic downturns and cyclical fluctuations in industrial activity pose a significant challenge to the North America Hydrogen Peroxide Market . Since hydrogen peroxide is deeply embedded in sectors such as pulp and paper, textiles, and chemical manufacturing—industries sensitive to macroeconomic conditions—its demand can experience sharp declines during periods of reduced production and investment. As noted by the Federal Reserve Economic Data (FRED), manufacturing activity contracted for three consecutive quarters, leading to lower chemical consumption across key end-use sectors. The pulp and paper industry, one of the largest consumers of hydrogen peroxide, was particularly impacted. As ed by the American Forest & Paper Association (AF&PA), paper shipments dropped by nearly 8% in 2023 compared to the previous year, reflecting reduced demand from printing and publishing sectors. Similarly, the textile industry experienced a slowdown, with the National Council of Textile Organizations (NCTO) noting a 6% decline in U.S. textile exports due to weakening global demand. These economic headwinds have led to cautious procurement behaviors and deferred capacity expansions among hydrogen peroxide users.

REPORT COVERAGE

|

METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

4.30 % |

|

Segments Covered |

By Product Function, End-User Industry and Country. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Country Covered |

The U.S., Canada and Rest of North America |

|

Market Leader Profiled |

Evonik Industries AG, Taekwang, Arkema SA, Grupa Azoty |

SEGMENTAL ANALYSIS

By Product Function Insights

The bleaching segment held the largest share of the North America Hydrogen Peroxide Market by accounting for 36.4% in 2024. This dominance is primarily attributed to its widespread use in the pulp and paper industry as an environmentally friendly alternative to chlorine-based bleaching agents. The Canadian Pulp and Paper Association (CPPA) s that more than 80% of Canadian kraft pulp producers now utilize hydrogen peroxide in their bleaching sequences to comply with environmental regulations under the Canadian Environmental Protection Act (CEPA). Also, the textile industry continues to rely on hydrogen peroxide for fabric whitening and dye removal. Moreover, rising demand for recycled paper products has further reinforced the need for gentler yet effective bleaching solutions. As per data from Natural Resources Canada, hydrogen peroxide usage in de-inking and fiber recovery applications has increased annually, driven by sustainability mandates and consumer preference for eco-friendly packaging materials.

The oxidant segment is coming up as the booming category in the North America Hydrogen Peroxide Market , predicted to rise at a CAGR of 6.4% through 2033. This progress is fueled by increasing demand from chemical synthesis, electronics manufacturing, and pollution control applications where hydrogen peroxide serves as a critical oxidation agent. According to the American Chemical Society (ACS), hydrogen peroxide is gaining traction in green chemistry initiatives due to its ability to replace toxic oxidants like permanganate and chromate in organic synthesis. A large share of new chemical process innovations in North America now incorporate hydrogen peroxide to reduce hazardous waste generation and improve reaction efficiency. Furthermore, the Semiconductor Industry Association (SIA) highlights that hydrogen peroxide is essential in ultra-pure cleaning formulations used during wafer processing. In addition, advanced oxidation processes (AOPs) utilizing hydrogen peroxide are being deployed in industrial wastewater treatment plants to degrade persistent pollutants such as pharmaceutical residues and microplastics.

By End-User Industry Insights

The pulp and paper industry represented the largest end-user segment in the North America Hydrogen Peroxide Market by holding 32.3% of total market share in 2024. This is due to the sector's reliance on hydrogen peroxide as a key bleaching agent in both virgin and recycled fiber production. Hydrogen peroxide plays a pivotal role in totally chlorine-free (TCF) processes, eliminating the formation of toxic byproducts while maintaining high-quality fiber output. Also, the growing demand for recycled paper products has spurred the need for gentler yet effective bleaching agents. Also, hydrogen peroxide provides superior performance in removing ink and contaminants without compromising fiber integrity. With increasing pressure to adopt sustainable practices and regulatory support for non-chlorinated bleaching agents, the pulp and paper industry remains the dominant driver of hydrogen peroxide consumption across North America.

The cosmetics and healthcare segment is the swiftest advancing in the North America Hydrogen Peroxide Market , anticipated to grow at a CAGR of 7.2%. This rapid expansion is driven by its extensive use in antiseptics, disinfectants, dental care products, and medical device sterilization protocols. According to the Centers for Disease Control and Prevention (CDC), hydrogen peroxide-based disinfectants are extensively used in hospitals and clinics for surface sterilization and infection control. The pandemic accelerated adoption rates, and post-crisis hygiene awareness has sustained demand across healthcare facilities. Moreover, hydrogen peroxide remains a common ingredient in mouthwashes, contact lens solutions, and wound care products due to its antimicrobial properties and biodegradable nature. Also, the rise in home healthcare services and self-administered medical devices has expanded the use of hydrogen peroxide for cleaning and sterilization.

COUNTRY LEVEL ANALYSIS

The United States accounted for a 78.3% of the North America Hydrogen Peroxide Market , maintaining its position as the dominant regional player due to strong industrial demand, regulatory support for clean chemistry, and extensive use in water treatment and healthcare applications. Additionally, the semiconductor industry’s resurgence—spurred by the CHIPS and Science Act—has boosted hydrogen peroxide demand for precision cleaning in fabrication facilities. In the healthcare sector, hydrogen peroxide-based disinfectants are extensively used in hospitals for sterilization and infection control, reinforcing its importance in public health infrastructure. With ongoing investments in green chemistry and industrial modernization, the U.S. continues to drive the North America Hydrogen Peroxide Market .

Canada is experiencing steady growth supported by strict environmental policies and expanding applications in water purification and industrial processing. The country has seen a marked increase in hydrogen peroxide usage in municipal water treatment and pulp bleaching due to its decomposition into water and oxygen, making it a preferred alternative to chlorine-based compounds. Moreover, the healthcare and cosmetics sectors are expanding hydrogen peroxide applications. With government-backed sustainability initiatives and increasing industrial adoption, Canada remains a key contributor to the regional hydrogen peroxide market’s expansion.

The Rest of North America, comprising Mexico and select Central American territories, constituted descent share of the regional hydrogen peroxide market but exhibits considerable potential for future expansion. While currently smaller in scale, this sub-region is witnessing growing interest in hydrogen peroxide for industrial and water treatment applications due to rising environmental awareness and industrial modernization efforts. Also, the country has implemented stricter water discharge regulations, prompting industries such as textiles, food processing, and mining to adopt hydrogen peroxide for cleaner oxidation and disinfection processes. In Central America, countries like Costa Rica and Panama are developing niche markets for hydrogen peroxide in pharmaceuticals and bottled water purification. The Pan American Health Organization (PAHO) highlights that access to safe drinking water remains a priority, leading to increased deployment of hydrogen peroxide-based disinfection in rural and urban settings.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Companies playing a prominent role in the North America Hydrogen Peroxide Market are Evonik Industries AG, Taekwang, Arkema SA, Grupa Azoty, Solvay SA, Akzo Nobel NV, gujarat alkalies and chemical ltd, National Peroxide Ltd., OCI Chemical, Airedale Chemical.

The North America Hydrogen Peroxide Market is characterized by a competitive landscape featuring a mix of global chemical giants and regional suppliers vying for market share through innovation, operational efficiency, and strategic positioning. Established players such as Solvay, Evonik, and Arkema maintain strong footholds due to their technical expertise, broad product portfolios, and long-standing relationships with industrial customers.

At the same time, regional and specialty chemical providers are leveraging localized production and customized service offerings to capture niche segments in water treatment, healthcare, and consumer goods. The market is further shaped by evolving environmental regulations that favor non-chlorinated bleaching agents, driving demand for hydrogen peroxide across pulp and paper, textiles, and municipal water purification sectors.

Competition is intensified by the convergence of hydrogen peroxide with green chemistry and advanced oxidation technologies, creating opportunities for tech-driven entrants to influence market dynamics. As the industry evolves, differentiation through formulation stability, cost optimization, and sustainability will be essential for maintaining a strong market presence and delivering value across industrial and consumer segments.

Top Players in the Market

Solvay S.A.

Solvay is a major global supplier of hydrogen peroxide with a significant presence in the North American market. The company offers a wide range of hydrogen peroxide grades tailored for industrial, chemical synthesis, and environmental applications. Solvay's commitment to innovation and sustainability has positioned it as a leader in green chemistry solutions.

Through its Peroxygens business line, Solvay supports the pulp and paper industry by providing high-efficiency bleaching agents that align with environmental regulations. Its hydrogen peroxide formulations are also integral to advanced oxidation processes (AOPs) in water treatment facilities, contributing to improved contaminant removal without harmful byproducts.

Additionally, Solvay collaborates with academic institutions and technology firms to develop next-generation hydrogen peroxide delivery systems that enhance process efficiency and reduce transportation risks. These strategic initiatives reinforce Solvay’s influence in shaping the North America Hydrogen Peroxide Market .

Evonik Industries AG

Evonik is a key player in the North America Hydrogen Peroxide Market , offering specialized formulations for chemical synthesis, electronics manufacturing, and disinfection applications. The company leverages its expertise in specialty chemicals to provide high-purity hydrogen peroxide variants designed for demanding industrial environments.

Evonik’s hydrogen peroxide is widely used in the semiconductor industry for wafer cleaning and photolithography processes. As per the National Institute of Standards and Technology (NIST), hydrogen peroxide-based SC1 solutions remain a standard in ultra-clean surface preparation, ensuring Evonik’s relevance in the high-tech manufacturing space.

Beyond industrial applications, Evonik supplies hydrogen peroxide to the pharmaceutical and healthcare sectors, supporting disinfection, sterilization, and formulation development. The company has also invested in modular hydrogen peroxide production units that enable on-site generation, reducing logistics complexity and enhancing supply chain resilience.

By focusing on technological differentiation, customer-specific solutions, and sustainable manufacturing, Evonik continues to strengthen its footprint in the North America Hydrogen Peroxide Market .

Arkema S.A.

Arkema is a prominent player in the North America Hydrogen Peroxide Market , offering a comprehensive portfolio of hydrogen peroxide-based solutions for industrial, environmental, and consumer applications. The company's Peroxide business unit focuses on delivering high-concentration and stabilized hydrogen peroxide products tailored for challenging operating conditions.

Arkema plays a crucial role in the pulp and paper industry by supplying hydrogen peroxide for chlorine-free bleaching processes. As ed by the Canadian Pulp and Paper Association (CPPA), Arkema’s hydrogen peroxide formulations are instrumental in achieving high brightness levels in recycled fibers while complying with CEPA guidelines.

Additionally, Arkema is actively involved in advancing hydrogen peroxide applications in advanced oxidation processes (AOPs) for water purification. Collaborations with environmental agencies and research institutions have led to the development of efficient pollutant degradation techniques using hydrogen peroxide in combination with UV and ozone.

The company also extends its hydrogen peroxide expertise into the pharmaceutical and cosmetics sectors, supporting disinfection and formulation needs. By combining technical excellence with sustainability-driven innovation, Arkema maintains a strong position in the evolving North America hydrogen peroxide landscape.

Top Strategies Used by Key Players

One of the primary strategies employed by key players in the North America Hydrogen Peroxide Market is expanding application-specific product lines , allowing companies to cater to diverse industrial needs including water treatment, semiconductor manufacturing, and healthcare disinfection.

Another key approach is leveraging partnerships and joint ventures with chemical distributors, equipment manufacturers, and environmental engineering firms to enhance product integration and ensure seamless adoption across end-use sectors.

Lastly, companies are increasingly focusing on developing localized production and on-site generation capabilities , which help mitigate transportation risks, reduce supply chain disruptions, and support industries requiring high-purity hydrogen peroxide in real-time applications such as electronics and pharmaceutical manufacturing.

RECENT HAPPENINGS IN THE MARKET

In January 2024, Solvay announced the launch of a new hydrogen peroxide formulation specifically designed for use in advanced oxidation processes (AOPs) for industrial wastewater treatment, aiming to enhance contaminant removal efficiency and support regulatory compliance.

In March 2024, Evonik expanded its hydrogen peroxide distribution network by partnering with a leading U.S. chemical logistics provider, ensuring faster and safer delivery of high-concentration hydrogen peroxide to semiconductor and electronics manufacturing hubs across North America.

In May 2024, Arkema entered into a strategic collaboration with a major U.S. pulp and paper manufacturer to co-develop next-generation bleaching solutions that reduce energy consumption and chemical waste, reinforcing its position in the sustainable forestry industry.

In August 2024, a mid-sized hydrogen peroxide supplier established a new production facility in Texas to serve growing demand from oil and gas operators seeking eco-friendly oxidants for fracking fluid remediation and well stimulation.

In November 2024, a leading chemical distributor acquired a hydrogen peroxide storage and blending facility near Montreal, Canada, aimed at improving supply chain efficiency and enabling direct delivery to textile, pharmaceutical, and water treatment clients across Eastern Canada and the Northeastern U.S.

MARKET SEGMENTATION

This research on the north america hydrogen peroxide market has been segmented and sub-segmented into the following.

By Product Function

- Bleaching

- Oxidant

By End-User Industry

- Pulp and Paper

- Cosmetics and Healthcare

By Country

- The U.S.

- Canada

- Rest of North America

Frequently Asked Questions

What is driving the growth of the North America hydrogen peroxide market?

Key growth drivers include rising demand for wastewater treatment, increasing use in the healthcare and cosmetics industries, and expanding paper & pulp production.

Which countries in North America are the major consumers of hydrogen peroxide?

The United States is the largest consumer, followed by Canada and Mexico, due to strong industrial bases and healthcare infrastructure.

Is the hydrogen peroxide market in North America regulated?

Yes, it is regulated by environmental and health safety standards from agencies like the EPA (Environmental Protection Agency) and FDA (Food and Drug Administration).

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com