North America Indoor Humidifier Market Size, Share, Trends & Growth Forecast Report By Product (Ultrasonic Systems, Steam-to-Steam Humidifiers, Vaporizers, Warm Mist Humidifiers, Evaporative Humidifiers), Industry Vertical, Application, and Country (The United States, Canada and Rest of North America), Industry Analysis From 2025 to 2033

North America Indoor Humidifier Market Size

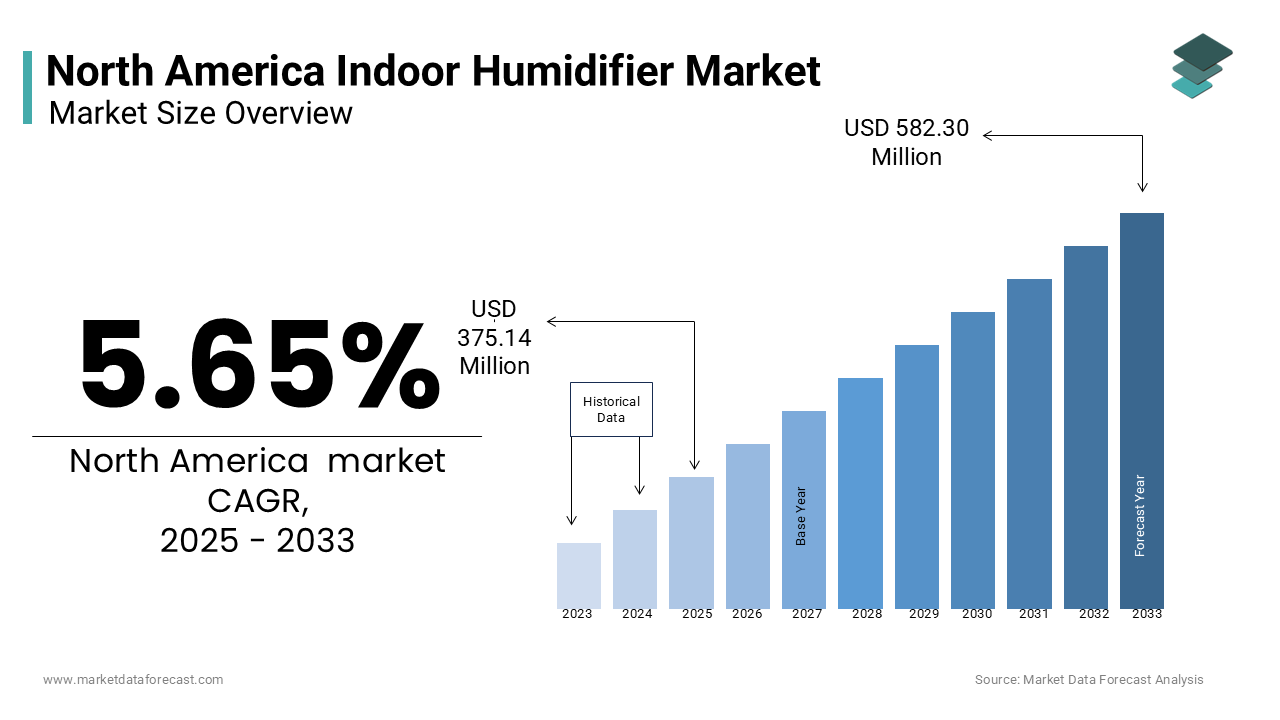

The North America Indoor Humidifier Market was worth USD 355.08 million in 2024. The North America market is expected to reach USD 582.30 million by 2033 from USD 375.14 million in 2025, rising at a CAGR of 5.65% from 2025 to 2033.

MARKET DRIVERS

Rising Awareness About Respiratory Health

A significant factor propelling the North America indoor humidifier market is the heightened awareness surrounding respiratory health issues exacerbated by dry indoor air. Dry air can irritate nasal passages, worsen asthma symptoms, and increase susceptibility to infections. According to data from the Centers for Disease Control and Prevention (CDC), chronic respiratory diseases affect nearly 15 million adults annually in the U.S., creating a substantial demand for solutions like humidifiers. Furthermore, maintaining optimal humidity levels between 40% and 60% reduces airborne virus survival rates, including influenza strains. This scientific backing has spurred consumer interest, particularly among families with young children and elderly members who are more vulnerable to respiratory complications. In recent years alone, sales figures showed a year-over-year increase in humidifier purchases linked directly to health-conscious buying behavior. Manufacturers have responded by introducing advanced models equipped with antibacterial features and automatic humidity control, further stimulating market growth through innovation tailored to address these concerns effectively.

Smart Home Integration Trends

Another pivotal driver is the burgeoning trend of integrating smart technologies into household appliances, including humidifiers. The proliferation of Internet of Things (IoT)-enabled devices has transformed how consumers interact with their living spaces, fostering convenience and energy efficiency. Smart humidifiers, capable of remote operation via mobile apps and voice assistants like Alexa and Google Assistant, have gained immense popularity. For instance, industry leader Honeywell reported a 25% rise in smart humidifier sales in 2022 compared to the previous year. These devices allow users to monitor humidity levels in real-time, schedule operations, and receive maintenance alerts, enhancing user experience significantly. Moreover, partnerships between tech giants and appliance manufacturers have accelerated product development cycles, ensuring cutting-edge functionalities remain accessible to a broad audience.

MARKET RESTRAINTS

High Initial Costs of Advanced Models

One of the primary restraints hindering the widespread adoption of indoor humidifiers in North America is the relatively high initial cost of advanced models, which often feature smart capabilities or specialized filtration systems. While basic humidifiers are affordable, premium options designed for enhanced performance. Consequently, affordability remains a critical challenge impeding broader market penetration across socio-economic demographics.

Misconceptions About Mold and Bacterial Growth

Another restraint stems from lingering misconceptions about mold and bacteria proliferation caused by improper humidifier use. Many consumers fear that inadequately maintained units may inadvertently exacerbate indoor air quality issues instead of alleviating them. Like, a significant portion of respondents cited hygiene concerns as a reason for avoiding humidifier purchases altogether. Although modern designs incorporate antimicrobial materials and self-cleaning mechanisms, misinformation persists regarding older models' susceptibility to contamination. Despite assurances from manufacturers and public health organizations emphasizing proper cleaning protocols, apprehension lingers among first-time buyers. This psychological barrier not only limits new customer acquisition but also hampers repeat purchases from dissatisfied users who fail to adhere to recommended care routines.

MARKET OPPORTUNITIES

Expanding Commercial Applications

A promising opportunity for the North American indoor humidifier market lies in its expanding applications across commercial sectors, particularly in healthcare facilities and office spaces. Similarly, maintaining optimal humidity levels in hospitals and clinics significantly reduces cross-contamination risks and enhances patient recovery rates. For example, surgical wards and intensive care units increasingly rely on industrial-grade humidifiers to create sterile environments conducive to healing. Like, corporate offices are adopting humidification systems to combat dry indoor air caused by HVAC systems, thereby improving employee comfort and productivity. A study published by Harvard Business Review highlighted that workplaces with balanced humidity experienced a reduction in absenteeism related to respiratory illnesses. With the commercial sector poised for growth, manufacturers have an opportunity to develop customized solutions catering to diverse professional settings. Strategic collaborations with facility management companies could further accelerate adoption rates, positioning the market for exponential gains.

Growing Demand for Eco-Friendly Solutions

Another lucrative avenue is the escalating demand for eco-friendly and energy-efficient humidifiers aligned with sustainability goals. Consumers are increasingly prioritizing environmentally responsible products, prompting manufacturers to innovate greener alternatives. According to the U.S. Energy Information Administration (EIA), energy consumption in residential appliances contributes significantly to carbon emissions, urging stakeholders to adopt cleaner technologies. Solar-powered humidifiers and those utilizing recycled materials represent emerging trends gaining traction among environmentally conscious buyers. Besides, government incentives encouraging energy-efficient appliance usage provide a competitive edge to brands offering low-power consumption models. For instance, ENERGY STAR-certified humidifiers consume less electricity than standard counterparts, appealing to both residential and institutional buyers. Leveraging these shifts towards sustainability not only aligns with regulatory frameworks but also differentiates brands in an increasingly crowded marketplace.

MARKET CHALLENGES

Intense Market Competition

The North America indoor humidifier market faces significant challenges stemming from intense competition among key players vying for dominance. This saturation complicates efforts to differentiate products based solely on functionality, pushing companies to invest heavily in marketing and R&D initiatives. However, aggressive pricing strategies adopted by competitors frequently erode profit margins, particularly for mid-tier manufacturers struggling to match promotional budgets. Furthermore, counterfeit products flooding online retail platforms pose additional threats, undermining brand credibility and consumer trust. Such illicit activities distort market dynamics, forcing legitimate businesses to allocate resources toward anti-counterfeiting measures. Navigating this fiercely contested landscape requires innovative approaches, yet achieving sustainable profitability remains a daunting task amid mounting operational pressures.

Regulatory Compliance Hurdles

Regulatory compliance presents another formidable challenge for the North America indoor humidifier market, given the stringent standards governing electrical appliances. Agencies such as the Federal Trade Commission (FTC) and Occupational Safety and Health Administration (OSHA) mandate rigorous testing protocols to ensure product safety and performance consistency. Non-compliance can result in hefty fines, recalls, and reputational damage, severely impacting bottom lines. According to a report by Deloitte, nearly 40% of manufacturers encounter delays in launching new products due to unforeseen regulatory hurdles. Moreover, varying state-level requirements amplify complexity, necessitating tailored adaptations for specific markets. For instance, California’s Proposition 65 mandates explicit labeling of hazardous substances, adding layers of administrative oversight. Smaller firms lacking dedicated legal teams often struggle to navigate these intricacies, limiting their ability to compete effectively.

SEGMENTAL ANALYSIS

By Product Type Insights

The Ultrasonic systems segment dominated the North America indoor humidifier market by commanding a 40.5% share in 2024. Also, the popularity of this segment is credited to superior performance attributes, including whisper-quiet operation and precise humidity control, which cater to both residential and commercial users. These systems employ ultrasonic vibrations to disperse fine water mist without generating heat, ensuring safe usage even in households with children. According to a study by the Consumer Technology Association, ultrasonic humidifiers exhibit a significantly lower malfunction rate than traditional warm mist variants. Additionally, innovations such as built-in hygrometers and adjustable output settings enhance user convenience, driving preference among tech-savvy consumers. Another contributing factor is their versatility; portable designs enable seamless integration into various room sizes, while larger units serve expansive spaces like gyms and conference halls. Like, ultrasonic systems accounted for a major share of all e-commerce transactions within the category, showing their mass appeal.

On the other hand, the steam-to-steam humidifier segment emerges as the fastest-growing segment, boasting a CAGR of 8.5% from 2025 to 2033. This rapid expansion is fueled by their exceptional efficiency in industrial applications, where large-scale humidification is essential. Unlike conventional models, steam-to-steam units utilize pure distilled water vapor, eliminating mineral deposits and reducing maintenance frequency. Furthermore, advancements enabling direct integration with building management systems (BMS) have broadened their applicability in smart infrastructure projects. As industries prioritize operational excellence and sustainability, this segment’s growth trajectory appears poised for sustained acceleration, cementing its status as a transformative force within the market.

By Industry Vertical Insights

The healthcare vertical reigned supreme in the North America indoor humidifier market with a 35.2% of the total share in 2024. Hospitals, clinics, and assisted living facilities extensively deploy humidifiers to maintain optimal humidity levels, which are critical for infection prevention and patient well-being. Research published in the Journal of Clinical Nursing indicates that relative humidity above 40% suppresses airborne pathogens, reducing hospital-acquired infections. Consequently, medical institutions increasingly adopt advanced humidification systems such as evaporative and steam-based models to meet stringent regulatory benchmarks. Another driving factor is the aging population; projections suggest that individuals aged 65+ will constitute a key portion of the populace by 2030, escalating demand for eldercare facilities equipped with reliable climate control solutions. Apart from these, partnerships between medical equipment suppliers and humidifier manufacturers streamline procurement processes, ensuring the timely deployment of cutting-edge technologies. This symbiotic relationship amplifies the healthcare segment’s dominance, solidifying its role as a cornerstone of the indoor humidifier market.

The food and beverages industry segment is seeing the highest expansion, exhibiting a CAGR of 9.2% during the forecast period. Precision humidity control plays a pivotal role in preserving product quality throughout the manufacturing and storage phases. For example, bakeries require consistent moisture levels to prevent dough dehydration, while beverage producers rely on controlled environments to avoid flavor degradation. A report by the Food Processing Suppliers Association highlights that improper humidity management results in an estimated noticeable loss in raw material value annually, compelling businesses to invest in state-of-the-art humidification systems. Moreover, stringent FDA guidelines mandating hygienic processing conditions drive the adoption of antimicrobial-equipped humidifiers are mitigate contamination risks. Innovations such as IoT-enabled monitoring further bolster efficiency is allowing real-time adjustments tailored to specific production needs.

By Application Insights

The residential applications segment led the North America indoor humidifier market by holding a 55.7% share in 2024. This prominence arises from heightened awareness of indoor air quality’s impact on health and comfort. During winter months, heating systems often deplete indoor humidity, prompting homeowners to seek remedies for dry skin, irritated sinuses, and static electricity. Like, maintaining indoor humidity between 30% and 50% minimizes allergen proliferation, benefiting allergy sufferers. Furthermore, the proliferation of smart home ecosystems has catalyzed residential humidifier adoption, with connected models offering remote operation and automated scheduling. Also, a significant portion of smart home owners prioritize air quality devices, showcasing their integral role in modern living spaces. Manufacturers capitalize on this trend by launching compact, aesthetically pleasing designs compatible with contemporary interiors.

On the other hand, the industrial applications segment represents the fastest-growing, registering a CAGR of 10.3% in the future. This surge is caused by the indispensable role of humidification in safeguarding machinery performance and enhancing workplace safety. For instance, textile mills require precise humidity control to prevent yarn breakage and ensure uniform dye absorption, while automotive plants utilize humidifiers to eliminate static charges that damage electronic components. Additionally, stringent occupational health regulations mandate comfortable working conditions, driving factories to upgrade outdated systems with energy-efficient alternatives. Technological breakthroughs, such as desiccant-based humidifiers capable of operating under extreme temperatures, broaden applicability across diverse industrial landscapes.

REGIONAL ANALYSIS

The United States commanded the largest share of the North America indoor humidifier market i.e. 75.4% of regional revenue in 2024. This is linked to pervasive urbanization trends and escalating health consciousness among its populace. Furthermore, the nation’s robust e-commerce infrastructure facilitates easy access to affordable models, fostering widespread accessibility. Notably, Amazon reports an increase in humidifier sales attributed primarily to bundled discounts and seasonal promotions. Government initiatives promoting green technologies also incentivize manufacturers to develop energy-efficient variants, aligning with federal sustainability objectives.

Canada emerges as the second-largest contributor to the North American indoor humidifier market. Harsh winters spanning several provinces necessitate effective humidification solutions to combat dry indoor air, driving consistent demand nationwide. Ontario and Quebec, home to dense urban populations, collectively account for a major share of domestic sales. Public health advisories issued by provincial authorities emphasize the importance of maintaining adequate humidity levels to mitigate respiratory ailments, further boosting consumer confidence in these products. Additionally, stringent environmental policies incentivize eco-friendly designs, prompting local manufacturers to innovate sustainable offerings. Cross-border trade agreements facilitate seamless import-export activities, enabling Canadian firms to leverage U.S.-based R&D expertise.

Mexico constitutes the smaller yet important player of the North America indoor humidifier market. Despite its smaller footprint, the country demonstrates considerable growth potential fueled by rapid urbanization and rising disposable incomes. Affordable pricing strategies adopted by domestic manufacturers make humidifiers accessible to broader demographics, offsetting economic disparities prevalent in rural regions. Collaborations with international brands introduce advanced technologies previously unavailable locally, accelerating market evolution. Moreover, government-led housing programs incorporating climate control provisions enhance long-term prospects, embedding humidifiers into mainstream construction practices.

The Rest of North America encompasses smaller economies such as Puerto Rico and the Caribbean islands, collectively representing a nascent yet promising segment. Also, this region benefits from unique climatic conditions requiring tailored humidification solutions. Similarly, agricultural hubs adopt industrial-grade systems to preserve crop quality, as erratic rainfall patterns disrupt traditional farming methods. Limited local manufacturing capabilities necessitate reliance on imports, fostering symbiotic relationships with U.S.-based suppliers. Educational campaigns spearheaded by NGOs raise awareness about respiratory health, cultivating grassroots demand.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Honeywell International Inc., Philips Electronics, Vicks, Dyson Ltd., Aprilaire, Westinghouse Electric Corporation, Levoit, Crane USA, Sunbeam Products, and Bionaire are some of the key market players in the North America indoor humidifier market.

The North America indoor humidifier market is characterized by intense competition, marked by a delicate balance between established giants and emerging challengers. Market leaders like Honeywell and Dyson dominate through relentless innovation, consistently unveiling technologically advanced products that set industry benchmarks. Meanwhile, smaller firms like Crane USA capitalize on affordability and niche appeal, carving out loyal customer bases. The competitive landscape is further complicated by the influx of counterfeit products, which distort pricing structures and erode brand equity. To counteract this, incumbents engage in aggressive promotional tactics, including influencer partnerships and seasonal discounts, to maintain visibility. Simultaneously, regulatory compliance serves as both a barrier and an opportunity, with companies investing in safer, greener designs to align with evolving standards.

Top Players in the North America Indoor Humidifier Market

Honeywell stands out as a leading player in the North America indoor humidifier market, leveraging its reputation for innovation and reliability. Renowned for producing advanced models like the HCM350W Germ-Free Cool Mist Humidifier, Honeywell addresses key consumer pain points such as bacterial contamination through patented UV technology. Strategic partnerships with major retailers ensure widespread distribution, while investments in R&D yield cutting-edge features like auto-shutoff and customizable mist settings. Its commitment to sustainability is evident in ENERGY STAR-certified offerings, appealing to eco-conscious buyers.

Dyson occupies a prominent position, credited with revolutionizing the market through sleek, high-performance humidifiers integrated with air purification capabilities. The Dyson Humidify+Cool model exemplifies this synergy, combining evaporative humidification with HEPA filtration to deliver unparalleled air quality. Its emphasis on aesthetics and functionality resonates with design-oriented consumers, bolstered by aggressive digital marketing campaigns. Furthermore, Dyson’s global supply chain network enables efficient scaling, reinforcing its competitive edge.

Crane USA rounds out the top three, specializing in affordable yet stylish humidifiers catering to budget-conscious households. Known for its animal-shaped humidifiers popular among families. Its focus on durability and ease of use fosters brand loyalty, particularly in suburban communities. Collaborations with online platforms like Amazon enhance visibility, while periodic discounts drive impulse purchases. Crane’s adaptability to shifting consumer preferences ensures sustained relevance amidst fierce competition.

Top Strategies Used by Key Market Participants

Key players in the North America indoor humidifier market employ diverse strategies to consolidate their positions and stimulate growth. Product differentiation emerges as a cornerstone tactic, with companies like Honeywell and Dyson investing heavily in R&D to introduce multifunctional devices combining humidification with air purification or smart connectivity features. Strategic alliances with e-commerce giants facilitate extensive reach, enabling brands to tap into burgeoning online sales channels. Pricing strategies also play a pivotal role; premium manufacturers like Dyson adopt skimming models targeting affluent demographics, whereas Crane USA focuses on penetration pricing to attract budget-conscious buyers. Additionally, sustainability initiatives, including ENERGY STAR certifications and recyclable materials, resonate with environmentally aware consumers. Marketing campaigns emphasizing health benefits further amplify demand, particularly during peak seasons like winter.

RECENT MARKET DEVELOPMENTS

- In April 2023, Honeywell launched the HUL520WD Whole House Console Humidifier, featuring advanced UV germ-killing technology. This move strengthened its portfolio of health-focused products.

- In June 2023, Dyson unveiled the Humidify+Cool Formaldehyde, introducing formaldehyde destruction capabilities alongside humidification. This reinforced its reputation for multifunctional innovation.

- In August 2023, Crane USA partnered with AmazonBasics to offer exclusive bundles, enhancing affordability and accessibility for budget-conscious consumers.

- In October 2023, Levoit introduced the LV600HH Hybrid Ultrasonic Humidifier, combining warm and cool mist functions. This addressed diverse consumer preferences effectively.

- In December 2023, Boneco collaborated with Apple HomeKit to enable seamless integration of its humidifiers with smart home ecosystems, appealing to tech-savvy users.s

MARKET SEGMENTATION

This research report on the North America indoor humidifier market is segmented and sub-segmented into the following categories.

By Product

- Ultrasonic Systems

- Steam-to-Steam Humidifiers

- Vaporizers

- Warm Mist Humidifiers

- Evaporative Humidifiers

By Industry Vertical

- Healthcare

- Food & Beverages

- Retail

- Paper & Pulps

- Automotive

- Textiles

By Application

- Residential

- Industrial

- Commercial

By Country

- The United States

- Canada

- Rest of North America

Frequently Asked Questions

What are the challenges faced by the North America indoor humidifier market?

The market faces challenges such as high product costs for advanced models, maintenance issues like cleaning to prevent mold buildup, and competition from alternative air quality devices like air purifiers.

What are the future trends in the North America indoor humidifier market?

Future trends in the market include the integration of IoT and smart home devices, increased focus on energy-efficient and eco-friendly models, enhanced design for aesthetic appeal in residential settings, and the expansion of online retail channels for greater consumer reach.

What is the future growth potential of the North America indoor humidifier market?

The market is expected to experience steady growth due to increasing consumer awareness about air quality, health benefits, and the rise in smart home technology integration.

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com