North America Jojoba Oil Market Research Report – Segmented By Type ( cold-pressed jojoba oil, refined jojoba oil ) Application, Sales Channel and Country (The U.S., Canada and Rest of North America) - Industry Analysis, Size, Share, Growth, Trends, & Forecasts 2025 to 2033.

North America Jojoba Oil Market Size

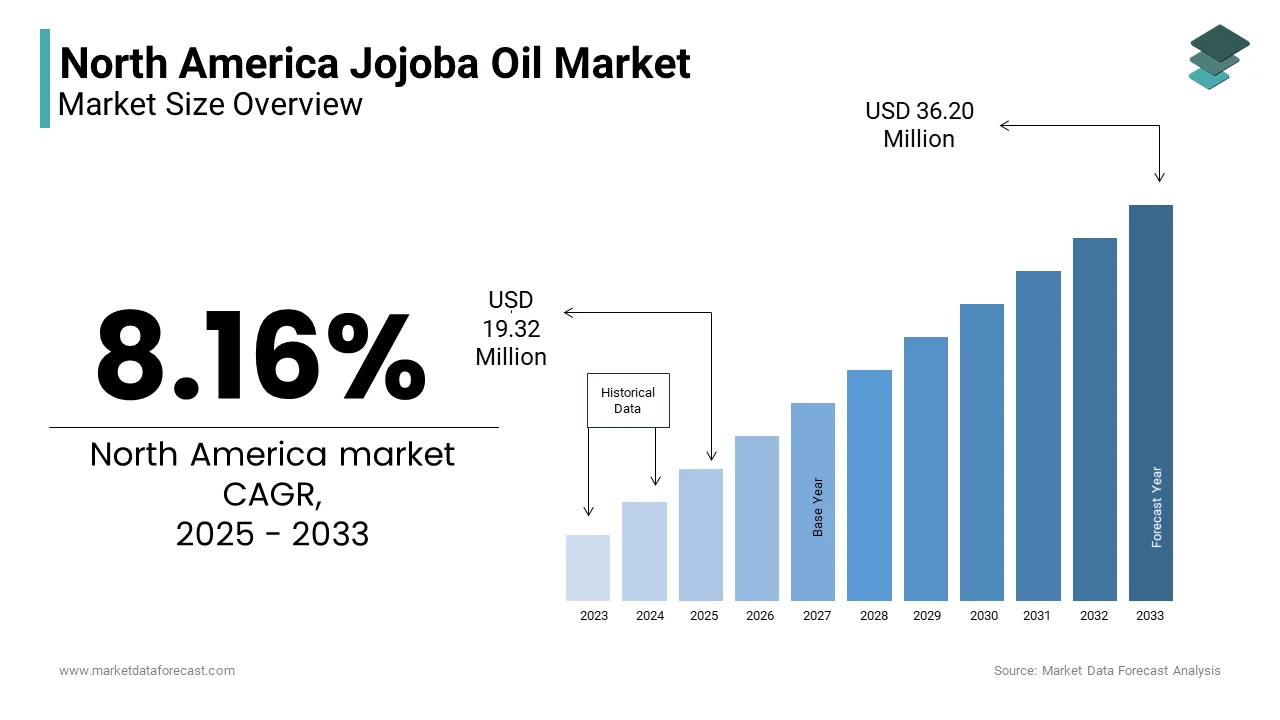

The North America Jojoba Oil Market Size was valued at USD 17.87 million in 2024. The North America Jojoba Oil Market size is expected to have 8.16 % CAGR from 2025 to 2033 and be worth USD 36.20 million by 2033 from USD 19.32 million in 2025.

The North America Jojoba Oil Market is driven by its versatile applications across industries. The rising consumer preference for plant-based and sustainable products is driving the growth of the market. Additionally, stringent regulations promoting bio-based alternatives, such as those enforced by the Environmental Protection Agency (EPA), have further propelled the adoption of jojoba oil. These dynamics reflect a mature yet evolving market landscape, characterized by innovation and steady growth.

MARKET DRIVERS

Growing Demand in Cosmetics and Personal Care

The cosmetics and personal care industry is a major driver of the jojoba oil market, fueled by increasing consumer awareness about natural skincare solutions. Jojoba oil is known for its non-comedogenic properties and ability to mimic human sebum, has become a staple ingredient in moisturizers, serums, and cleansers. Furthermore, the rise of e-commerce platforms like Amazon and Sephora has expanded access to jojoba oil-based products, driving demand.

Rising Adoption in Pharmaceutical Applications

The pharmaceutical sector represents another significant driver of the jojoba oil market in topical medications and wound care. Jojoba oil’s antimicrobial and anti-inflammatory properties make it an ideal base for ointments and creams used to treat conditions like eczema and psoriasis. A study by the American Academy of Dermatology reveals that 31.6 million Americans suffer from eczema, creating sustained demand for effective treatments. Additionally, the growing emphasis on plant-based medicines, as per the Natural Products Association, has encouraged pharmaceutical companies to incorporate jojoba oil into their formulations. For instance, Pfizer’s recent launch of a jojoba oil-infused topical cream has gained traction among healthcare providers is boosting market penetration.

MARKET RESTRAINTS

High Production Costs and Limited Supply

One of the primary challenges facing the jojoba oil market is the high cost of production with the limited availability of jojoba plants. According to the U.S. Department of Agriculture, jojoba cultivation requires arid climates and extensive irrigation systems, which restrict its geographic scope. Approximately 90% of global jojoba production occurs in arid regions like Israel and Mexico is leading to supply chain dependencies. These costs are often passed on to consumers is limiting adoption among price-sensitive industries. Additionally, fluctuating weather patterns, such as droughts that further exacerbate supply volatility. These financial and logistical constraints hinder market penetration in competitive sectors like retail and industrial applications.

Competition from Synthetic Substitutes

Competition from synthetic substitutes poses another significant restraint to the jojoba oil market. According to a report by the American Chemistry Council, synthetic emollients and silicones dominate the cosmetics and pharmaceutical industries due to their lower costs and consistent performance. its higher price point makes it less attractive to manufacturers focused on cost optimization while jojoba oil offers superior skin compatibility. Furthermore, advancements in chemical engineering have enhanced the functionality of synthetic ingredients by narrowing the performance gap.

MARKET OPPORTUNITIES

Adoption in Industrial Applications

The integration of jojoba oil into industrial applications represents a transformative opportunity for the North American market. Jojoba oil’s exceptional lubricity and thermal stability make it an ideal substitute for petroleum-based lubricants by aligning with sustainability goals. For example, Shell’s adoption of bio-based lubricants, including jojoba oil, has reduced carbon emissions by 20%, as per a case study by Accenture. Similarly, General Motors’ use of jojoba oil in metalworking fluids has improved efficiency and reduced wear by enhancing operational performance. These applications not only address environmental concerns but also comply with regulatory requirements for eco-friendly solutions. Jojoba oil manufacturers can position themselves at the forefront of this industrial revolution by unlocking new revenue streams and competitive advantages.

MARKET CHALLENGES

Supply Chain Disruptions

Supply chain disruptions have emerged as a significant challenge for the jojoba oil market, exacerbated by geopolitical tensions and climate-related issues. According to the U.S. Chamber of Commerce, supply chain bottlenecks caused a 20% increase in raw material costs for jojoba oil producers in 2022. The Russia-Ukraine conflict, for instance, disrupted the supply of fertilizers essential for jojoba cultivation, leading to shortages and delays. Additionally, extreme weather events, such as droughts in Arizona and California, have impacted crop yields and transportation networks. According to a report by the National Oceanic and Atmospheric Administration (NOAA), climate-related disruptions cost the U.S. economy USD 145 billion in 2021, affecting industries reliant on timely delivery of goods. These challenges force companies to adopt contingency measures, such as diversifying suppliers and increasing inventory levels, which strain profitability and operational efficiency.

Balancing Sustainability and Performance

Achieving a balance between sustainability and performance remains a persistent challenge for the jojoba oil market. While there is growing pressure to adopt eco-friendly practices, these initiatives often fail to match the scalability of synthetic alternatives. Moreover, the lack of standardized certifications for sustainable sourcing creates confusion among manufacturers and consumers. A survey by NielsenIQ reveals that 73% of North American consumers prioritize environmentally friendly products, only 30% are willing to compromise on product quality. This disconnect forces companies to invest in extensive R&D to develop formulations that meet both environmental and functional requirements by adding complexity to the innovation process.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

8.16 % |

|

Segments Covered |

By Type, Application, Sales Channel and Country. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Country Covered |

The U.S., Canada and Rest of North America |

|

Market Leader Profiled |

Ecolab Inc, Nutrix International, Opawica Explorations Inc, Jojoba Desert, Lubricantes Inca, US Organic Group. |

SEGMENTAL ANALYSIS

By Type Insights

The cold-pressed jojoba oil segment was the largest by accounting for 55.5% of the North American market share in 2024 with its superior quality and retention of natural nutrients during extraction. Industries such as cosmetics and pharmaceuticals rely heavily on cold-pressed solutions for their purity and efficacy. Additionally, the growing preference for organic and minimally processed ingredients has further promoted the growth of the segment. Investments in advanced pressing technologies have also lowered production costs are making cold-pressed jojoba oil more accessible to diverse industries.

The refined jojoba oil segment is likely to exhibit a CAGR of 8.5% from 2025 to 2033. The growth of the segment is with the rising demand for odorless and colorless solutions in industrial applications. A study by the American Chemical Society reveals that refined jojoba oil reduces friction by 35% compared to unrefined alternatives by making it ideal for lubricants and metalworking fluids. Innovations such as multi-stage filtration and deodorization processes have enhanced its performance, addressing earlier limitations. Furthermore, the shift toward minimalistic packaging designs aligns with consumer preferences for convenience and sustainability.

By Application Insights

The cosmetics and personal care segment dominated the North America Jojoba Oil Market by capturing a 55.4% of share in 2024 owing to the widespread adoption is driven by jojoba oil’s moisturizing and hypoallergenic properties by making it ideal for skincare and haircare formulations. The introduction of clean beauty trends, such as those promoted by Sephora, has further heightened demand for natural oils. According to a study by the American Academy of Dermatology, jojoba oil reduces acne by 40% by reinforcing its appeal as a sustainable option. Additionally, advancements in blending technologies have enabled customization by allowing brands to enhance their product offerings.

The pharmaceutical applications segment is esteemed to witness a fastest CAGR of 9.2% during the forecast period. This growth is fueled by the increasing demand for plant-based ingredients in topical medications and wound care. Jojoba oil’s antimicrobial and anti-inflammatory properties make it an ideal base for ointments and creams used to treat conditions like eczema and psoriasis. A report by IQVIA reveals that 31.6 million Americans suffer from eczema by creating sustained opportunities for manufacturers. Furthermore, the rise of telemedicine platforms has boosted online sales of jojoba

By Sales Channel Insights

The B2B sales segment dominated the North American jojoba oil market with significant share in 2024. The widespread adoption of jojoba oil in bulk quantities by industries like cosmetics, pharmaceuticals, and lubricants is ascribed to boost the growth of the segment. The food and beverage sector, in particular, relies on B2B solutions for their ability to integrate jojoba oil into formulations. As per a study by the American Food Industry Association, 90% of manufacturers prefer direct procurement from suppliers, reducing costs and ensuring consistency. Additionally, investments in automation and AI-driven logistics have enhanced supply chain efficiency by making B2B sales more reliable and scalable.

The B2C sales segment is likely to witness a CAGR of 10.5% during the forecast period. This growth is fueled by the rising popularity of e-commerce platforms and direct-to-consumer marketing strategies. The online sales of natural skincare products grew by 45% during the pandemic, with jojoba oil gaining traction among health-conscious consumers. Brands like The Ordinary and Herbivore Botanicals have capitalized on this trend is offering jojoba oil-based products through platforms like Amazon and Shopify. Many consumers associate brand transparency with trust that will drive investments in digital marketing and customer engagement. Furthermore, the shift toward minimalist packaging aligns with consumer preferences for convenience and sustainability.

COUNTRY LEVEL ANALYSIS

The United States jojoba oil market was the largest contributor for the North America Jojoba Oil Market with 85.6% of the share in 2024 with a robust cosmetics and pharmaceutical industry that heavily relies on jojoba oil for its versatility and natural properties. Jojoba oil’s unique ability to mimic human sebum makes it indispensable in moisturizers, serums, and cleansers, with brands like The Ordinary and Herbivore Botanicals leading the charge. Additionally, e-commerce platforms such as Amazon and Sephora have democratized access to jojoba oil-based products are enabling small and medium-sized enterprises to compete alongside established giants. Investments in R&D in Arizona and California regions conducive to jojoba cultivation have further bolstered supply chain resilience. The government’s focus on bio-based alternatives, supported by regulations from the Environmental Protection Agency (EPA), has also incentivized manufacturers to adopt jojoba oil over synthetic emollients.

Canada was accounted in holding 15.1% of the share in the North America Jojoba Oil Market in 2024 due to its thriving pharmaceutical and agricultural sectors. Jojoba oil’s antimicrobial and anti-inflammatory properties make it a preferred ingredient in topical medications and wound care solutions. As per a report by Environment and Climate Change Canada, the country’s emphasis on eco-friendly practices has accelerated the adoption of bio-based alternatives, including jojoba oil, across various industries. Indigenous communities, particularly in British Columbia and Alberta, have emerged as key stakeholders in sustainable jojoba cultivation by fostering partnerships with local manufacturers. For instance, collaborations between First Nations groups and private companies have led to the development of organic jojoba oil lines is gaining traction among health-conscious consumers. Furthermore, Canada’s participation in international trade agreements, such as the USMCA, has facilitated cross-border exports is creating opportunities for growth.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Companies playing a prominent role in the North America Jojoba Oil Market are Ecolab Inc, Nutrix International, Opawica Explorations Inc, Jojoba Desert, Lubricantes Inca, US Organic Group.

The North America Jojoba Oil Market is characterized by intense competition, with a mix of multinational corporations and regional players vying for market share. These companies leverage their technological expertise, strong distribution networks, and strategic partnerships to maintain their dominance. For example, Desert Whale’s focus on sustainable sourcing and Purcell’s adoption of AI-driven farming technologies have set them apart from competitors. However, the market is also witnessing the emergence of niche players targeting specific segments, such as industrial lubricants or organic skincare formulations. This fragmentation creates a dynamic environment where innovation and adaptability are critical for success. Intense competition has spurred investments in R&D, with firms prioritizing the development of bio-based alternatives and eco-friendly solutions. Smaller players, while limited in scale, often differentiate themselves through unique value propositions, such as locally sourced ingredients or artisanal production methods.

Top Players in the Market

Desert Whale Jojoba Company

Desert Whale Jojoba Company is a trailblazer in the jojoba oil market. Headquartered in Arizona, the company specializes in sustainably sourced and cold-pressed jojoba oil by catering to diverse industries such as cosmetics, pharmaceuticals, and industrial lubricants. The company’s organic jojoba oil line has gained immense popularity in the clean beauty sector, with partnerships spanning global brands like L’Oréal and Estée Lauder.

Purcell Jojoba Company

Purcell Jojoba Company is another dominant player, renowned for its premium-quality cold-pressed jojoba oil. Purcell’s operations are centered in California, where it employs state-of-the-art irrigation systems to optimize water usage and enhance crop yields. The company’s focus on sustainability extends beyond cultivation, with initiatives aimed at reducing carbon emissions during processing and transportation.

Jojoba Desert (JD) Ltd.

Jojoba Desert (JD) Ltd. is a key innovator in the refined jojoba oil segment. The company’s refined jojoba oil offerings cater primarily to industrial applications, such as lubricants and metalworking fluids, where performance consistency is paramount. According to a case study by Accenture, JD Ltd.’s partnerships with industrial giants like Shell and General Motors have propelled its growth, positioning it as a leader in bio-based lubricants. Additionally, the company’s commitment to recyclable packaging aligns with consumer preferences for environmentally responsible products, further enhancing its brand equity.

Top Strategies Used by Key Players

Key players in the North America Jojoba Oil Market employ a variety of strategies to maintain their competitive edge and drive growth. One prominent approach is mergers and acquisitions, which enable companies to expand their cultivation capabilities and diversify product portfolios. For instance, Desert Whale Jojoba Company acquired a sustainable farming startup in 2021 by allowing it to integrate innovative irrigation techniques and enhance crop yields. Another strategy involves partnerships with academic institutions to leverage AI and machine learning in farming practices. Purcell Jojoba Company’s collaboration with Arizona State University exemplifies this trend, as it uses predictive analytics to optimize water usage and improve soil health. Sustainability remains a core focus, with companies launching initiatives to promote eco-friendly packaging and reduce carbon footprints. Jojoba Desert (JD) Ltd.’s recyclable packaging campaign, introduced in 2023, has resonated strongly with environmentally conscious consumers. Additionally, investments in R&D and digital marketing have enabled players to innovate and engage with customers more effectively by ensuring long-term success in a highly competitive market.

RECENT HAPPENINGS IN THE MARKET

- In April 2024, Desert Whale Jojoba Company acquired a sustainable farming startup to enhance its cultivation capabilities and expand its portfolio of organic jojoba oil products.

- In June 2023, Purcell Jojoba partnered with Arizona State University to integrate AI-driven farming technologies by optimizing water usage and improving crop yields by 20%.

- In February 2023, Jojoba Desert launched a recyclable packaging initiative targeting eco-conscious consumers by aligning with growing demand for sustainable solutions in the cosmetics sector.

- In September 2022, JD Ltd. introduced a refined jojoba oil line for industrial lubricants, reducing friction by 35% and forging partnerships with industrial giants like Shell and General Motors.

- In January 2022, Desert Whale unveiled a biodegradable cold-pressed jojoba oil solution for cosmetics applications by addressing consumer concerns about environmental impact and regulatory compliance.

MARKET SEGMENTATION

This research report on the north america jojoba oil market has been segmented and sub-segmented into the following.

By Type

- cold-pressed jojoba oil

- refined jojoba oil

By Application

- cosmetics and personal care

- pharmaceutical applications

By Sales Channel

- B2B sales

- B2C sales

By Country

- The U.S.

- Canada

- Rest of North America.

Frequently Asked Questions

What are the major applications of jojoba oil in North America?

Jojoba oil is primarily used in cosmetics and personal care (skin care, hair care), pharmaceuticals, and as a lubricant in industrial applications.

Which countries in North America are the key contributors to the jojoba oil market?

The United States is the largest market, followed by Canada and Mexico, due to higher demand for organic and natural cosmetic products.

What are the key factors driving the growth of the jojoba oil market in North America?

Growth drivers include rising consumer preference for natural and organic products, increasing demand in personal care and cosmetics, and expanded applications in pharmaceuticals and lubricants.

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com