North America Laminating Adhesives Market Size, Share, Trends & Growth Forecast Report By Resin (Polyurethane, Acrylic, Others),Technology, End-Use and Country (The United States, Canada and Rest of North America), Industry Analysis From 2025 to 2033

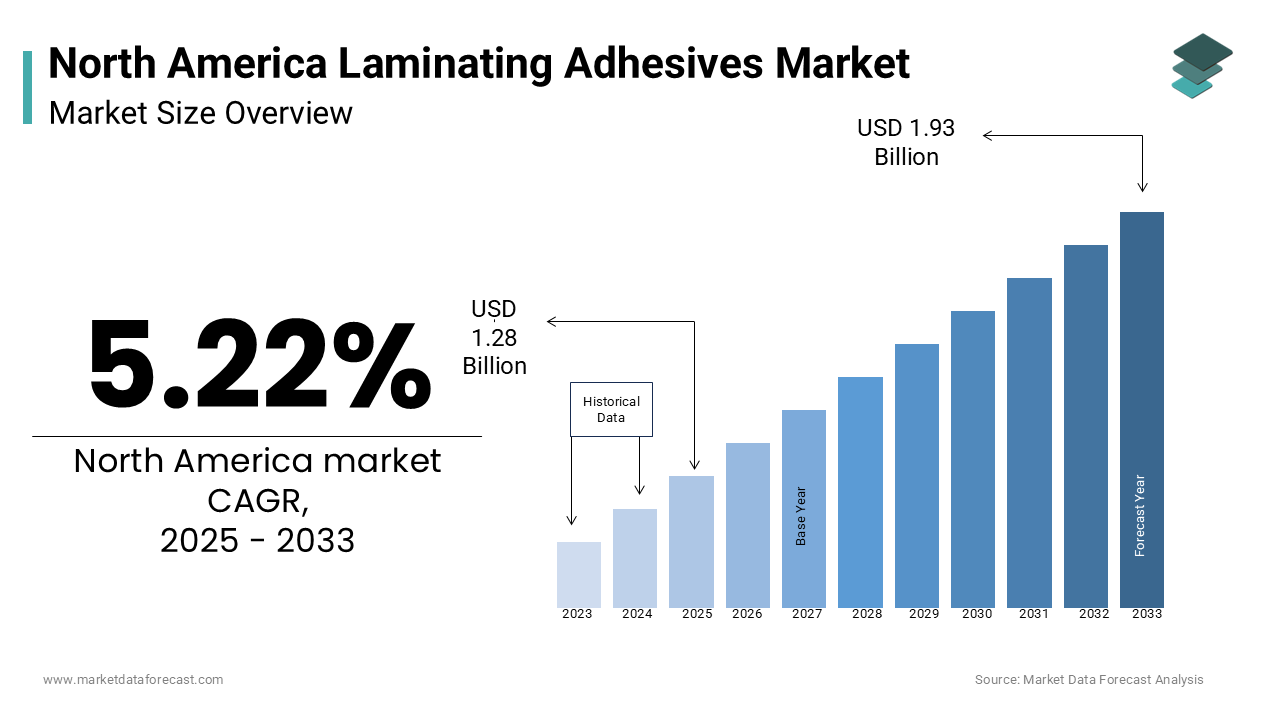

North America Laminating Adhesives Market Size

The North America laminating adhesives market was worth USD 1.22 billion in 2024. The North America market is expected to reach USD 1.93 billion by 2033 from USD 1.28 billion in 2025, rising at a CAGR of 5.22% from 2025 to 2033.

Technological advancements have played a pivotal role in shaping market conditions. For instance, innovations in solvent-less and water-based adhesives have addressed environmental concerns, aligning with stringent regulations such as those imposed by the Environmental Protection Agency (EPA). Furthermore, the growing trend of lightweight packaging, coupled with consumer preference for sustainable materials, has bolstered demand for laminating adhesives.

MARKET DRIVERS

Rising Demand for Flexible Packaging

Flexible packaging represents one of the most significant drivers of the North America laminating adhesives market by accounting for over 60% of total applications. This surge is attributed to the growing popularity of convenient, lightweight, and cost-effective packaging solutions, particularly in the food and beverage sector. Laminating adhesives play a critical role in bonding multiple layers of materials, such as polyethylene and aluminum foil, to create durable and moisture-resistant packaging. The rise of e-commerce further amplifies this trend, as online retailers require tamper-proof and visually appealing packaging to enhance brand loyalty. Additionally, advancements in adhesive technologies, such as solvent-less formulations to enable manufacturers to meet stringent regulatory standards while reducing production costs.

Stringent Environmental Regulations

Stringent environmental regulations are another key driver propelling the adoption of eco-friendly laminating adhesives. The Environmental Protection Agency mandates a reduction in VOC emissions, compelling manufacturers to transition from solvent-based to water-based and solvent-less adhesives. Water-based adhesives offer a viable solution by minimizing environmental impact without compromising performance. This shift drives demand for green adhesives in the pharmaceutical and consumer goods sectors.

MARKET RESTRAINTS

High Cost of Advanced Formulations

One of the primary restraints facing the North America laminating adhesives market is the high cost associated with advanced formulations, such as solvent-less and UV-curable adhesives. While these products offer superior performance and environmental benefits, their production involves complex manufacturing processes and expensive raw materials. This cost barrier limits widespread adoption, particularly in price-sensitive industries like consumer goods packaging. Additionally, fluctuations in raw material prices, such as isocyanates used in polyurethane-based adhesives, exacerbate cost pressures.

Technical Limitations in Application

Another significant restraint is the technical limitations associated with certain laminating adhesives, particularly in high-performance applications. Solvent-based adhesives, while widely used, pose challenges such as prolonged drying times and potential health hazards due to VOC emissions. As per the Occupational Safety and Health Administration (OSHA), workplace exposure to VOCs in adhesive formulations led to a 10% increase in respiratory-related incidents in 2021. Water-based adhesives, though environmentally friendly, often lack the same level of adhesion strength and resistance to extreme temperatures, thereby limiting their usability in industrial settings. Furthermore, inconsistencies in bonding quality across different substrates, such as plastic films and metallic foils, create operational inefficiencies. These technical drawbacks force manufacturers to invest heavily in R&D to develop solutions that balance performance, safety, and cost-effectiveness, that adds to operational complexities and slows market growth.

MARKET OPPORTUNITIES

Expansion into Emerging End-Use Industries

Emerging end-use industries present a lucrative opportunity for the North America laminating adhesives market, driven by rapid industrialization and technological advancements. Sectors such as electric vehicles (EVs) and renewable energy are increasingly adopting laminated materials for battery components and solar panels. These adhesives are essential for bonding multi-layer structures in lithium-ion batteries, ensuring thermal stability and electrical insulation. Manufacturers focusing on customizing adhesive formulations for these niche applications can tap into high-growth markets.

Growing Adoption of Smart Packaging Solutions

The growing adoption of smart packaging solutions represents another promising opportunity for laminating adhesives. Smart packaging, which incorporates features like QR codes, NFC chips, and temperature sensors, requires specialized adhesives to bond multiple functional layers seamlessly. Laminating adhesives play a critical role in integrating electronic components into packaging designs by ensuring durability and functionality. Moreover, the rise of IoT-enabled devices and contactless shopping trends has amplified demand for interactive packaging, particularly in the pharmaceutical and consumer goods sectors.

MARKET CHALLENGES

Supply Chain Disruptions

Supply chain disruptions pose a significant challenge to the North America laminating adhesives market, exacerbated by geopolitical tensions and logistical bottlenecks. The COVID-19 pandemic increased the vulnerabilities in global supply chains, with key raw materials like resins and solvents experiencing shortages. These delays disrupt production schedules and inflate costs, forcing manufacturers to seek alternative suppliers or pass additional expenses onto customers. Furthermore, trade restrictions, such as tariffs on Chinese imports, have impacted the availability of affordable raw materials, further complicating procurement processes. These disruptions not only strain profitability but also hinder the ability to meet rising demand by creating operational uncertainties for market players.

Intense Competition from Substitute Products

Intense competition from substitute products, such as mechanical fasteners and tapes, presents another challenge for the laminating adhesives market. Mechanical fasteners, though less versatile, offer superior load-bearing capabilities and ease of disassembly by making them a preferred choice in certain industrial applications. Additionally, pressure-sensitive tapes are gaining traction due to their ease of application and compatibility with automated systems. These substitutes not only compete on performance but also benefit from lower installation costs are posing a threat to adhesive manufacturers.

SEGMENTAL ANALYSIS

By Resin Type Insights

The polyurethane-based segment was the largest and held 45.3% of the North America market share in 2024 owing to the exceptional bonding strength and versatility across diverse substrates, including plastics, metals, and foils. Their resistance to extreme temperatures and moisture makes them ideal for high-performance packaging solutions, such as retort pouches and vacuum-sealed bags. Additionally, advancements in solvent-less polyurethane formulations have addressed environmental concerns, driving adoption in eco-conscious markets.

The acrylic-based laminating adhesives segment is likely to experience a projected CAGR of 6.2% throughout he forecast period. This growth is fueled by their excellent UV resistance and optical clarity, making them ideal for applications requiring transparency and durability. The acrylic adhesives are increasingly adopted in the pharmaceutical and consumer goods sectors, where visual appeal and product visibility are critical. Innovations in water-based acrylic formulations have further expanded their usability by offering eco-friendly alternatives to solvent-based products. Additionally, the rise of smart packaging solutions, which incorporate interactive elements like NFC tags, benefits from acrylic adhesives’ ability to bond delicate components seamlessly.

By Technology Insights

The solvent-based laminating adhesives segment accounted in holding 50.4% of the North America laminating adhesives market share in 2024 with the superior bonding strength and compatibility with a wide range of substrates. The solvent-based adhesives are extensively used in the food and beverage sector, where they ensure moisture resistance and durability for flexible packaging. Despite environmental concerns, their cost-effectiveness and established manufacturing processes make them a preferred choice for large-scale applications. However, regulatory pressures are prompting manufacturers to explore alternatives by creating opportunities for eco-friendly technologies to gain traction.

The solvent-less laminating adhesives segment is expected to witness the fastest CAGR of 7.1% in the next coming years. This growth is driven by their alignment with stringent environmental regulations and reduced VOC emissions. As per data from the Environmental Protection Agency, industries adopting solvent-less adhesives witnessed a 40% reduction in compliance-related penalties between 2020 and 2022. Additionally, advancements in formulation technologies have enhanced their performance by enabling use in high-demand applications like pharmaceutical packaging. The growing emphasis on sustainability and cost savings further accelerates adoption by positioning solvent-less adhesives as a transformative force in the market.

By End-Use Industry Insights

The packaging segment dominated the North America laminating adhesives market with a significant share in 2024 owing to the growing demand for flexible packaging solutions that ensure product freshness and extend shelf life. Laminating adhesives are critical in creating multi-layered structures that combine materials like polyethylene and aluminum foil by offering moisture resistance and barrier properties. The rise of e-commerce has further amplified demand, as online retailers require tamper-proof and visually appealing packaging to enhance brand loyalty. Additionally, innovations in solvent-less and water-based adhesives align with regulatory standards, making them ideal for food-safe applications.

The pharmaceuticals segment is projected to grow with a CAGR of 7.5% from 2025 to 2033. The growth of the segment is fueled by the increasing demand for advanced packaging solutions that ensure product safety and compliance with stringent regulatory standards. Laminating adhesives play a pivotal role in creating child-resistant and tamper-evident packaging, addressing critical safety concerns. Additionally, the rise of smart packaging solutions, which incorporate features like NFC chips and temperature sensors, benefits from specialized adhesives that bond multiple functional layers seamlessly.

REGIONAL ANALYSIS

The United States laminating adhesives market accounted in holding 80.1% of the share in 2024. According to the U.S. Environmental Protection Agency (EPA), industries adopting low-VOC adhesives witnessed a 30% reduction in compliance-related penalties between 2019 and 2022. The growing demand for flexible packaging solutions in sectors like food and beverages, pharmaceuticals, and e-commerce will further propel the growth of the market. The rise of online shopping platforms has further intensified demand for lightweight yet durable packaging materials by driving the adoption of advanced laminating adhesives.

Additionally, the U.S. government’s emphasis on sustainability through programs like ENERGY STAR and LEED certification aligns with the development of eco-friendly adhesive technologies. Water-based and solvent-less adhesives, which reduce emissions and environmental impact, are gaining traction among manufacturers seeking to meet regulatory standards.

Canada was accounted in holding 15.4% of the North America laminated adhesives market share in 2024. The country’s strong emphasis on sustainability and adherence to stringent environmental regulations supports the widespread adoption of eco-friendly adhesive solutions. According to Natural Resources Canada, over 60% of new packaging projects incorporate green materials is benefiting manufacturers of water-based and solvent-less adhesives. The pharmaceutical and renewable energy sectors are key growth drivers in Canada. For instance, the rising demand for child-resistant and tamper-evident packaging in the pharmaceutical industry amplifies the need for specialized laminating adhesives.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

The key market players in the North America Laminating Adhesives Market include Henkel AG & Co. KGaA, The Dow Chemical Company, H.B. Fuller Company, 3M Company, and Arkema Group.

The North America laminating adhesives market is characterized by intense competition, driven by the presence of established giants and emerging players vying for market share. Companies differentiate themselves through a combination of technological advancements, design innovation, and sustainability initiatives. Henkel AG & Co. KGaA, H.B. Fuller, and 3M dominate the market, leveraging their extensive product portfolios, strong distribution networks, and focus on eco-friendly solutions to maintain their dominant positions.

Smaller players, however, are gaining traction by targeting niche segments and offering specialized products tailored to specific applications. For instance, some manufacturers focus on luxury adhesives designed for high-end applications like aerospace and medical devices, appealing to affluent buyers. Others emphasize affordability and functionality, catering to budget-conscious consumers. The rise of e-commerce platforms has further intensified competition, as online retailers offer competitive pricing and convenience, which is challenging traditional brick-and-mortar stores. Aggressive marketing campaigns and continuous improvements in product quality further amplify rivalry, ensuring dynamic market evolution.

Top Players in the Market

Henkel AG & Co. KGaA is a dominant force in the North America laminating adhesives market. The company’s success stems from its extensive product portfolio, which includes innovative solutions like solvent-less, UV-curable, and water-based adhesives. Henkel’s Loctite brand is synonymous with superior bonding strength and versatility across diverse substrates by making it a preferred choice for industries ranging from food packaging to automotive manufacturing.

Henkel’s commitment to sustainability is evident in its development of eco-friendly formulations that comply with stringent environmental regulations. For instance, the company’s solvent-less adhesives have reduced VOC emissions by 40% compared to traditional formulations, as per data from the Adhesive and Sealant Council. Strategic investments in R&D enable Henkel to stay ahead of market trends, while its global expansion initiatives ensure widespread accessibility.

H.B. Fuller Company

H.B. Fuller leverages its strong brand reputation and extensive distribution network to capture significant market share. H.B. Fuller’s focus on innovation is reflected in its development of advanced adhesive technologies, such as reactive hot melts and water-based formulations, which cater to diverse end-use industries. The acquisition of Royal Adhesives & Sealants in 2021 significantly enhanced H.B. Fuller’s capabilities in high-performance applications, including flexible packaging, pharmaceuticals, and electronics. This strategic move expanded the company’s product portfolio and strengthened its position in niche markets. H.B. Fuller’s ability to adapt to market trends and regulatory requirements ensures sustained competitiveness.

3M Company

3M Company distinguishes itself through its emphasis on innovation and quality by offering specialized adhesive solutions tailored to specific end-use industries. 3M’s Scotch-Weld line of adhesives is renowned for its durability and performance in demanding applications, such as aerospace, automotive, and electronics. The company’s commitment to sustainability is reflected in its development of low-VOC formulations that align with global environmental standards. For instance, 3M’s solvent-less adhesives have gained traction in the pharmaceutical and packaging sectors due to their eco-friendly properties and compliance with regulatory standards. Strategic partnerships with major retailers and OEMs further amplify 3M’s reach by ensuring widespread availability of its products. Its focus on customer-centric solutions and cutting-edge technologies strengthens its position as a key market player by enabling it to compete effectively in a highly dynamic industry.

Top Strategies Used by Key Market Participants

Key players in the North America laminating adhesives market employ a variety of strategies to maintain and enhance their competitive positions. One prominent strategy is mergers and acquisitions, which enable companies to expand their product portfolios and geographic reach. For instance, Henkel AG & Co. KGaA’s acquisition of Advanced Materials Technologies in 2021 significantly bolstered its capabilities in UV-curable adhesives, addressing growing demand in the electronics sector.

Product innovation is another critical strategy, with companies investing heavily in R&D to develop cutting-edge solutions that address consumer pain points. 3M’s introduction of low-VOC adhesives exemplifies this approach, catering to the growing demand for sustainable products. Additionally, manufacturers are leveraging digital tools and virtual experiences to enhance customer engagement, allowing buyers to visualize adhesive performance in real-world applications. Geographic expansion is also a key focus area, with companies targeting emerging markets to tap into untapped growth opportunities.

RECENT MARKET DEVELOPMENTS

- In April 2024, Henkel AG launched Loctite UV-Cure Pro , a new line of UV-curable adhesives designed for high-speed packaging applications. This move addresses the growing demand for fast-curing solutions in the food and beverage sector.

- In June 2023, H.B. Fuller partnered with Amazon to expand its e-commerce presence, resulting in a 25% increase in online sales. The collaboration leverages Amazon’s vast customer base and digital infrastructure.

- In March 2023, 3M introduced Scotch-Weld GreenBond, a low-VOC adhesive formulated to meet stringent environmental standards. This initiative aligns with growing consumer demand for sustainable products.

- In January 2023, Bostik acquired a Midwest distributor, enhancing its supply chain efficiency and ensuring the timely delivery of products to customers across North America.

- In November 2022, Dow Chemical invested $60 million in a new R&D facility to develop advanced adhesive technologies, focusing on solvent-less and water-based formulations to reduce environmental impact.

MARKET SEGMENTATION

This research report on the North America laminating adhesives market is segmented and sub-segmented into the following categories.

By Resin

- Polyurethane

- Acrylic

- Others

By Technology

- Solvent-Based

- Water-Based

- Solvent-less

- Others

By End-use

- Packaging

- Food & Beverages

- Pharmaceuticals

- Consumer Products

- Industrial

- Insulation

- Window Films

- Electronics

- Other Applications

- Automotive & Transportation

By Country

- The United States

- Canada

- Rest of North America

Frequently Asked Questions

What factors are driving the growth of the laminating adhesives market in North America?

Increasing demand for flexible packaging, technological advancements, and the rise in e-commerce are key growth drivers.

How is technology impacting the laminating adhesives market in North America?

Innovations in adhesive formulations and application technologies are enhancing bond strength, curing times, and compatibility with diverse substrates.

What is the future growth outlook for the laminating adhesives market in North America?

The market is expected to witness steady growth due to rising demand in flexible packaging, sustainable adhesive solutions, and advancements in manufacturing technologies.

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com