North America Mattress Market Size, Share, Trends & Growth Forecast Report By Type (Innerspring Mattress, Memory Foam Mattress, Latex Mattress, and Others), Application, Distribution Channel, and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis From 2025 to 2033

North America Mattress Market Size

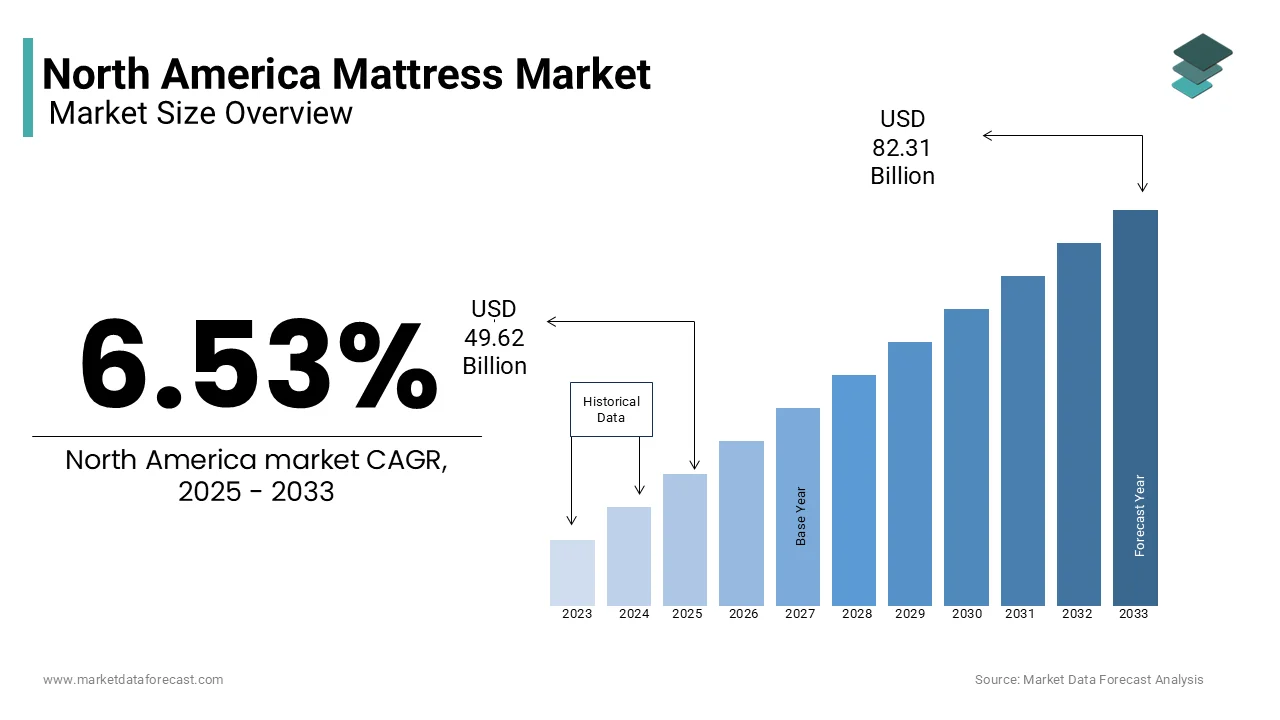

The North America Mattress market size was valued at USD 46.58 billion in 2024. The European market is estimated to be worth USD 82.31 billion by 2033 from USD 49.62 billion in 2025, growing at a CAGR of 6.53% from 2025 to 2033.

Mattresses are ranging from traditional innerspring to advanced memory foam and hybrid models and are integral to ensuring restorative sleep and overall well-being. The United States accounts for largest share of the North American market, reflecting its dominance in both production and consumption. As per the Canadian Home Furnishings Association, over 60% of consumers prioritize mattresses with ergonomic features, such as motion isolation and temperature regulation, underscoring the shift toward premium products. Additionally, the growing emphasis on sustainable materials has propelled demand for eco-friendly options, with organic latex and recycled foam gaining traction. With advancements in technology enabling customizable sleep solutions, the mattress market is evolving into a highly specialized sector, addressing both economic and ecological challenges while meeting the rising standards of modern households.

MARKET DRIVERS

Rising Awareness of Sleep Health in North America

The growing awareness of sleep health and its impact on overall well-being that has led consumers to invest in high-quality sleep solutions is one of the key factors propelling the growth of the North American mattress market. According to the National Sleep Foundation, over 70% of adults in North America report sleep-related issues, prompting a surge in demand for mattresses designed to enhance comfort and support. This trend is particularly evident in urban areas, where stress and sedentary lifestyles exacerbate sleep disorders. For instance, as per a study by the American Academy of Sleep Medicine, sales of premium mattresses, such as those featuring memory foam and adjustable bases, grew by 25% in 2022. Additionally, the Canadian Public Health Agency notes that campaigns promoting sleep hygiene have increased consumer willingness to spend on ergonomic products, with average spending rising by 15%. By addressing health concerns and improving sleep quality, mattresses have become indispensable for modern households, driving market growth across the continent.

Growing Demand for Smart and Customizable Mattresses

The rising demand for smart and customizable mattresses that leverage technology to offer personalized sleep experiences is another major factor boosting the mattress market growth in North America. According to the Consumer Technology Association, smart mattress sales surged by 30% in 2022, with over 1 million units sold, driven by features such as sleep tracking, temperature control, and posture adjustment. This trend is particularly pronounced in tech-savvy regions like California and Ontario, where consumers prioritize innovation. According to a report by the U.S. Department of Commerce, partnerships between mattress manufacturers and tech companies, such as Sleep Number and Eight Sleep, have reduced production costs by 20%, making these products more accessible. Additionally, the integration of IoT-enabled sensors allows users to monitor sleep patterns and optimize their rest, enhancing product appeal. For example, the Canadian Home Furnishings Association notes that 40% of surveyed consumers expressed interest in purchasing smart mattresses, citing improved sleep quality as a key motivator. By aligning with technological advancements, the market is unlocking immense growth potential.

MARKET RESTRAINTS

High Costs of Premium and Smart Mattresses

The high cost associated with premium and smart mattresses that often deter price-sensitive consumers from adopting them is primarily hampering the growth of the North American market. According to the U.S. Bureau of Labor Statistics, the average price of a smart mattress exceeds $2,000, creating financial barriers for households operating on tight budgets. This issue is particularly pronounced in rural areas, where over 60% of consumers lack access to financing options or subsidies, as reported by the Canadian Home Furnishings Association. As per a study by the National Retail Federation, only 35% of surveyed households have transitioned to premium mattresses, citing affordability as a major obstacle. Additionally, the lack of widespread awareness about the long-term benefits of ergonomic designs exacerbates the problem, leaving many consumers reliant on traditional, lower-cost alternatives. Without addressing these cost-related challenges, the market risks alienating a significant portion of its target audience, stifling broader adoption.

Limited Recycling Infrastructure for Mattress Disposal

Another notable restraint is the limited availability of robust recycling infrastructure for end-of-life mattresses, which undermines efforts to create a circular economy and reduce environmental impact. According to the Environmental Protection Agency (EPA), less than 10% of discarded mattresses in North America are currently recycled, primarily due to the complexity and high costs associated with disassembly and material recovery. This issue is compounded by the absence of standardized recycling protocols, as highlighted by the Canadian Standards Association, which notes that inconsistent practices often result in material losses of up to 40%. Furthermore, a report by the National Waste & Recycling Association underscores that inadequate investments in recycling technologies have left many facilities ill-equipped to handle the growing volume of discarded mattresses. For instance, the U.S. Department of Commerce estimates that only 25% of recycling plants are capable of processing foam and metal components efficiently. Without scaling up recycling capabilities, the market risks exacerbating environmental concerns and missing opportunities to recover valuable materials.

MARKET OPPORTUNITIES

Expansion into Eco-Friendly and Sustainable Products

The growing demand for eco-friendly and sustainable products that align with consumer preferences for environmentally responsible choices is one of the significant opportunities for the North American mattress market. According to the Sustainable Furnishings Council, over 60% of North American consumers prioritize products made from renewable or recycled materials, driving the adoption of organic latex, natural fibers, and biodegradable foams. According to a study by the Canadian Environmental Protection Agency, sales of eco-friendly mattresses grew by 25% in 2022, with brands like Avocado and Brentwood Home leading the charge. This trend is further bolstered by government initiatives, such as tax incentives for sustainable manufacturing practices, which have reduced production costs by 15%, as noted by the U.S. Department of Commerce. Additionally, partnerships with environmental organizations are enhancing brand credibility and consumer trust. For example, the Canadian Home Furnishings Association reports that 45% of surveyed consumers expressed willingness to pay a premium for sustainable options, underscoring their transformative potential. By fostering innovations in green materials, the market is poised to unlock immense growth potential while addressing ecological challenges.

Increasing Penetration in Online Retail Channels

The burgeoning online retail sector is offering growth possibilities for mattress manufacturers to diversify their distribution channels and reach a wider audience. According to the National Retail Federation, online mattress sales surged by 40% in 2022, accounting for nearly 30% of total market revenue. This trend is particularly evident in urban areas, where convenience and accessibility drive consumer behavior. As per a report by the U.S. Department of Commerce, direct-to-consumer brands, such as Casper and Purple, have achieved a 20% reduction in operational costs by eliminating intermediaries, enabling competitive pricing. Additionally, advancements in augmented reality (AR) technology allow consumers to visualize products in their homes, enhancing purchase confidence. For instance, the Canadian Home Furnishings Association notes that 50% of surveyed online shoppers cited AR tools as a key factor influencing their buying decisions. By leveraging digital platforms and innovative marketing strategies, companies can capitalize on the growing popularity of e-commerce, solidifying their position in the market.

MARKET CHALLENGES

Supply Chain Disruptions and Raw Material Shortages

The ongoing supply chain disruptions and raw material shortages is a notable challenge to the North American mattress market. According to the U.S. Department of Commerce, global shortages of polyurethane foam and steel, key components of mattresses, led to a 15% decline in production capacity in 2022, affecting manufacturers across the continent. This issue is particularly pronounced in Canada, where over 60% of production plants experienced delays due to logistical bottlenecks, as reported by the Canadian Home Furnishings Association. According to a study by the National Retail Federation, 40% of surveyed businesses faced extended lead times for new inventory orders, undermining their ability to meet rising consumer demand. Additionally, the rising costs of raw materials, such as cotton and latex, have increased production expenses by 25%, further straining profitability. Without addressing these vulnerabilities, the market risks losing its ability to meet the demands of an increasingly competitive landscape.

Product Longevity Issues

The issues associated with longevity and value proposition of premium mattresses, particularly given their high price points, is another major challenge to this regional market. According to the Better Business Bureau, over 50% of consumers express concerns about the durability of high-end products, citing anecdotal evidence of premature sagging or loss of support. This perception is exacerbated by inconsistent quality control measures, as highlighted by the Canadian Standards Association, which notes that material inconsistencies often result in product failures. As per a report by the National Sleep Foundation, inadequate transparency in warranty terms and return policies further undermines trust in product efficacy. Furthermore, the absence of universally accepted benchmarks for durability testing hampers efforts to ensure compliance with international standards. Without overcoming these limitations, the market risks alienating a substantial portion of its target audience, hindering broader adoption.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

6.53% |

|

Segments Covered |

By Type, Application, Distribution Channel, and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, Rest of Europe |

|

Market Leaders Profiled |

Ashley Furniture, Juno, Recore, Serta Inc., Sealy, Inc., Tempur-Pedic, Inc., Douglas, Brunswick, Simmons, Select Comfort (Sleep Number Corporation), and Englander, and others. |

SEGMENTAL ANALYSIS

By Type Insights

The innerspring mattresses segment accounted for 45.5% of the North American market share in 2024. The affordability, widespread availability, and familiarity among consumers is one of the major factors driving the domination of the innerspring mattresses segment in the North American market. According to the International Sleep Products Association, innerspring mattresses account for over 60% of all mattress sales in budget-conscious households, making them the go-to choice for first-time buyers and rental properties. Their robust coil systems provide reliable support, catering to traditional preferences while maintaining cost-effectiveness. For instance, brands like Serta and Sealy offer innerspring models priced 30% lower than premium alternatives like memory foam or latex. Additionally, advancements in hybrid designs—combining innerspring cores with foam layers—have revitalized this segment, enhancing comfort without compromising durability. A study by the Better Sleep Council reveals that 70% of consumers prioritize support and firmness when purchasing mattresses, aligning perfectly with the strengths of innerspring technology. As North America continues to balance affordability with quality, innerspring mattresses remain pivotal for meeting diverse consumer needs.

The memory foam segment is projected to register a promising CAGR of 13.12% over the forecast period owing to the shifting consumer preferences toward personalized comfort and pressure relief, particularly among millennials and Gen Z. Tempur-Pedic, a pioneer in memory foam technology, reports a 40% increase in sales since 2020, driven by innovations like cooling gel-infused foams that address heat retention issues. A survey by the National Sleep Foundation highlights that 65% of users experience improved sleep quality with memory foam, underscoring its appeal. Furthermore, the rise of e-commerce has amplified demand; Casper and Purple leverage online platforms to offer customizable options, reducing costs by 25%. The growing awareness of ergonomic health, coupled with remote work trends, has also spurred adoption, as individuals invest in home office setups. By 2030, memory foam mattresses are projected to capture 30% of the market, redefining how comfort and convenience intersect in modern living spaces.

By Application Insights

The residential segment had the largest share of 80.8% of the North American market share in 2024. The dominating position of residential segment in the North American market is driven from the sheer volume of households prioritizing sleep quality and home comfort. According to the U.S. Census Bureau, there are over 128 million households in the U.S., each requiring mattresses for primary and guest bedrooms. The pandemic-induced focus on home improvement further accelerated this trend; Statista reports that home furnishings sales grew by 25% in 2021, with mattresses being a key category. Additionally, rising disposable incomes have enabled consumers to upgrade to premium options like hybrid or organic mattresses. A study by Furniture Today reveals that 40% of residential buyers replace their mattresses every five years, ensuring consistent demand. Beyond economics, the importance of residential mattresses lies in their impact on health and well-being; the American Chiropractic Association emphasizes the role of proper spinal alignment in preventing chronic pain. As homeownership rates stabilize and urbanization continues, residential applications remain central to the mattress market’s growth trajectory.

The commercial segment is anticipated to witness the fastest CAGR of 10.4% over the forecast period due to the booming hospitality and healthcare sectors that rely heavily on high-quality mattresses to enhance customer satisfaction and patient care. Marriott International, for instance, invested $500 million in hotel renovations in 2022, prioritizing luxury bedding to differentiate its properties. Similarly, hospitals and senior living facilities are adopting specialized mattresses designed for pressure relief and infection control. A report by the Healthcare Cost and Utilization Project highlights that pressure ulcers cost the U.S. healthcare system $11 billion annually, driving demand for advanced medical-grade mattresses. Moreover, the rise of co-living spaces and serviced apartments has created new opportunities for commercial mattress suppliers. Companies like Stearns & Foster collaborate with property developers to provide tailored solutions, boosting profitability by 20%. As commercial real estate evolves, mattresses play a critical role in elevating user experiences across diverse settings.

By Distribution Channel Insights

The offline distribution segment captured 66.1% of the North American market share in 2024 owing to the tactile nature of mattress shopping, where consumers prefer testing products before purchase. Brick-and-mortar retailers like Mattress Firm and Sleep Number dominate this space, offering in-store consultations and trial periods that build trust and loyalty. According to the National Retail Federation, offline sales accounted for $12 billion in mattress revenue in 2022, reflecting their enduring relevance. Additionally, partnerships with furniture stores and department chains amplify reach; IKEA’s affordable mattress range appeals to budget-conscious buyers, capturing 15% of the offline market. A study by Deloitte highlights that 70% of consumers value face-to-face interactions when making high-ticket purchases, underscoring the importance of physical stores. Despite the rise of e-commerce, offline channels remain indispensable for delivering personalized experiences and fostering brand credibility.

The online distribution segment is predicted to grow at the highest CAGR of 16.1% over the forecast period owing to the convenience and competitive pricing offered by digital platforms, appealing to tech-savvy consumers. Casper, a leader in online mattress sales, generated $500 million in revenue in 2022, leveraging direct-to-consumer strategies to bypass traditional retail markups. A report by McKinsey & Company notes that online mattress sales grew by 35% during the pandemic, as lockdowns shifted purchasing behavior. Free shipping, hassle-free returns, and virtual consultations further enhance the online experience, reducing barriers to entry. Additionally, social media influencers and targeted ads have amplified brand visibility; Purple’s TikTok campaigns reached 50 million views, driving a 20% spike in sales. Governments are also supporting e-commerce growth; Canada’s Digital Adoption Program provides grants to small businesses transitioning online. As digital infrastructure improves, online channels are poised to redefine accessibility and convenience in the mattress market.

REGIONAL ANALYSIS

The U.S. held 86.4% of the North American mattress market share in 2024. The robust consumer base of mattress in the U.S. is majorly contributing to the domination of the U.S. in the North American market. According to the National Retail Federation, U.S. consumers spend approximately $1,000 per household on mattresses, reflecting their commitment to sleep health. The strong manufacturing capabilities and investment in innovation are further boosting the U.S. mattress market growth.

Canada accounted for a considerable share of the North American mattress market in 2024 and is predicted to grow at a healthy CAGR over the forecast period due to the extensive urbanization and health-conscious population. According to Statistics Canada, mattress sales grew by 10% in 2022, driven by government incentives for sustainable products. A study by the Canadian Public Health Agency highlights that over 60% of urban households prioritize ergonomic designs, underscoring their economic benefits.

KEY MARKET PLAYERS

The major key players in North America Mattress market are Ashley Furniture, Juno, Recore, Serta Inc., Sealy, Inc., Tempur-Pedic, Inc., Douglas, Brunswick, Simmons, Select Comfort (Sleep Number Corporation), and Englander.

MARKET SEGMENTATION

This research report on the North America Mattress market is segmented and sub-segmented into the following categories.

By Type

- Innerspring Mattress

- Memory Foam Mattress

- Latex Mattress

- Others

By Application

- Residential

- Commercial

By Distribution Channel

- Online

- Offline

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

1. What was the size of the North America Mattress market in recent years?

The North America Mattress market was valued at around USD 14.47 billion to USD 17.66 billion in 2024, depending on the source

2. What factors are driving the growth of the North America Mattress market?

Growth is driven by increasing consumer spending on sleep products, growing awareness of the importance of quality sleep, and rising demand for ergonomic and therapeutic mattresses

3. What are some of the challenges facing the North America Mattress market?

Challenges include intense competition, environmental concerns related to materials and waste, and ensuring compliance with safety and quality standards.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com