North America Medical Oxygen Concentrators Market Size, Share, Trends & Growth Forecast Report By Modality (Stationary Oxygen Concentrators, Portable Oxygen Concentrators), Technology, End User, And Country (Us, Canada, And Rest Of North America), Industry Analysis From 2025 To 2033

North America Medical Oxygen Concentrators Market Size

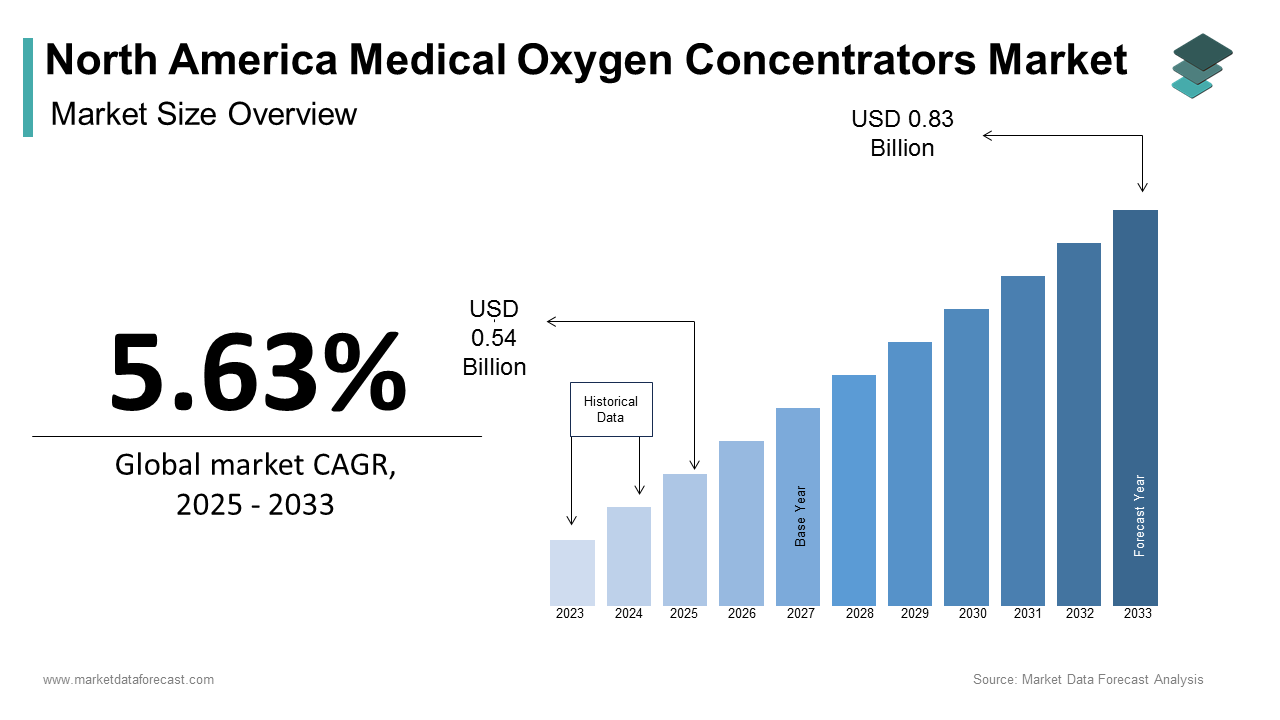

The North America Medical Oxygen Concentrators Market size was calculated to be USD 0.51 billion in 2024 and is anticipated to be worth USD 0.83 billion by 2033 from USD 0.54 billion in 2025, growing at a CAGR of 5.63% during the forecast period.

The North America medical oxygen concentrators market is an important component of the region's healthcare infrastructure with its role in managing chronic respiratory conditions and ensuring patient safety. The Centers for Disease Control and Prevention (CDC) estimates that over 25 million Americans suffer from asthma, while chronic obstructive pulmonary disease (COPD) affects nearly 16 million individuals with the demand for oxygen therapy devices. Canada, with its publicly funded healthcare model, has seen steady adoption, supported by government initiatives to enhance respiratory care infrastructure. As per Deloitte, advancements in portable and stationary oxygen concentrators have expanded their usability is catering to both hospital and home care settings. Furthermore, as per McKinsey, the integration of IoT-enabled features in concentrators has improved remote monitoring capabilities is positioning the region as a leader in innovative respiratory care solutions.

MARKET DRIVERS

Rising Prevalence of Chronic Respiratory Diseases

The escalating incidence of chronic respiratory diseases is a primary driver propelling the North America medical oxygen concentrators market forward. According to the American Lung Association, respiratory conditions such as COPD and asthma account for over 10 million hospitalizations annually in the U.S. alone. These conditions necessitate long-term oxygen therapy is driving demand for both portable and stationary concentrators. Furthermore, as per a study by the National Institutes of Health (NIH), the prevalence of respiratory illnesses is projected to increase by 15% over the next decade due to environmental factors like air pollution and smoking. This trend is compounded by the aging population, with the U.S. Census Bureau projecting that individuals aged 65 and above will constitute 22% of the population by 2030. Older adults are disproportionately affected by respiratory conditions, amplifying the need for reliable oxygen delivery systems.

Technological Advancements in Device Design

Technological advancements in oxygen concentrator design represent another significant driver that is propelling the North America market. Innovations such as IoT-enabled monitoring systems and lightweight portable models have revolutionized patient care, enhancing both convenience and safety. According to a report by Frost & Sullivan, IoT-integrated concentrators enable real-time tracking of oxygen levels thereby reducing emergency interventions by 20%. Additionally, as per a study by PwC, advancements in battery technology have extended the operational life of portable concentrators by making them ideal for home care settings. The growing emphasis on patient-centric care has further accelerated adoption, with over 60% of providers exploring smart concentrators. These technological breakthroughs not only improve clinical outcomes but also expand the addressable market is driving widespread adoption across healthcare facilities.

MARKET RESTRAINTS

High Costs of Advanced Devices

The substantial costs associated with advanced medical oxygen concentrators pose a significant barrier to market growth, particularly for smaller healthcare providers. According to a study by KPMG, the average cost of a portable oxygen concentrator ranges from 2,000to5,000 is depending on its features and capabilities. This financial burden often deters rural hospitals and clinics from upgrading their equipment is limiting access to cutting-edge technologies. Furthermore, as per a report by the Healthcare Financial Management Association (HFMA), ongoing maintenance and calibration expenses can add an additional 15-20% to the total cost of ownership. These expenditures are particularly challenging for facilities operating on tight budgets, where allocating resources for capital investments is a constant struggle. While larger institutions can absorb these costs, smaller entities face difficulties justifying the return on investment in regions with limited patient volumes.

Stringent Regulatory Requirements

Stringent regulatory requirements governing the approval and usage of medical oxygen concentrators present another major restraint impacting the market. The U.S. Food and Drug Administration (FDA) mandates rigorous testing and compliance with safety standards, which can delay product launches and increase development costs. According to a study by Ernst & Young, the average time required to bring a new concentrator model to market is approximately 3-5 years, significantly longer than other medical devices. Additionally, as per a report by Deloitte, manufacturers must adhere to evolving guidelines, such as those outlined in ISO 13485, to ensure quality management systems are in place. These regulatory hurdles often deter smaller companies from entering the market, consolidating dominance among established players. Furthermore, the complexity of navigating international standards, such as those set by Health Canada, adds another layer of difficulty for manufacturers seeking to expand their reach.

MARKET OPPORTUNITIES

Expansion of Home Healthcare Services

The growing emphasis on home healthcare services presents a transformative opportunity for the North America medical oxygen concentrators market. Portable oxygen concentrators are gaining traction in this segment due to their compact design and ease of usel. Furthermore, advancements in telehealth technologies have enabled remote monitoring of oxygen-dependent patients, enhancing safety and compliance. According to a study by McKinsey, integrating AI-driven analytics into home concentrators can reduce emergency interventions by 25% by lowering overall healthcare costs.

Integration with Smart Healthcare Systems

The integration of medical oxygen concentrators with smart healthcare systems offers a lucrative opportunity for the North America market. Connected concentrators, equipped with IoT sensors and real-time data analytics will enable seamless communication between devices and healthcare providers. According to a report by Gartner, over 60% of hospitals plan to adopt smart healthcare solutions by 2025, creating a strong demand for interoperable concentrator systems. These technologies facilitate predictive maintenance by reducing downtime and ensuring optimal performance. Additionally, as per a study by PwC, AI-driven concentrators can analyze patient data to optimize oxygen delivery parameters, improving clinical outcomes. The shift towards value-based care models further amplifies the need for integrated systems that align financial incentives with patient outcomes.

MARKET CHALLENGES

Limited Skilled Workforce

A limited skilled workforce capable of operating advanced medical oxygen concentrators poses a significant challenge to the North America market. According to a study by the American Association of Critical-Care Nurses (AACN), there is a projected shortage of over 100,000 registered nurses specializing in respiratory care by 2025. This shortage is exacerbated by the complexity of modern concentrators, which require specialized training to operate effectively. Furthermore, as per a report by the Joint Commission, inadequate training leads to a 30% increase in device-related complications, undermining patient safety and operational efficiency. Rural areas, in particular, face difficulties in recruiting qualified personnel, further widening the gap in access to advanced respiratory care. Addressing this challenge requires targeted educational initiatives and partnerships between healthcare institutions and manufacturers to develop comprehensive training programs.

Supply Chain Disruptions

Supply chain disruptions have emerged as a critical challenge for the North America medical oxygen concentrators market during periods of heightened demand. According to a report by McKinsey, over 70% of concentrator components are sourced internationally that is making the supply chain vulnerable to geopolitical tensions and logistical bottlenecks. According to the COVID-19 pandemic, vulnerabilities, with manufacturers experiencing delays of up to six months in securing essential parts. Furthermore, as per a study by Deloitte, fluctuations in raw material prices have increased production costs by 25% that is impacting profitability. These disruptions not only hinder timely delivery of concentrators but also limit the ability to scale production during crises. Strengthening domestic manufacturing capabilities and diversifying supplier networks are essential to mitigate these risks.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

5.63% |

|

Segments Covered |

By Modality, Technology, End User, And Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

US, Canada, Mexico, and Rest of North America |

|

Market Leaders Profiled |

Inogen, Invacare Corporation, Philips Respironics, Chart Industries, Drive DeVilbiss Healthcare, O2 Concepts, Precision Medical, Nidek Medical, GCE Group, Teijin Limited |

SEGMENTAL ANALYSIS

By Modality Insights

The stationary oxygen concentrators dominated the North America medical oxygen concentrators market by capturing 60.2% of share in 2024. According to the Centers for Disease Control and Prevention, over 4.5 million patients require supplemental oxygen annually in the U.S. is driving demand for reliable stationary systems. The advancements in concentrator design, such as noise reduction and energy efficiency, have enhanced their appeal. Hospitals are increasingly investing in these systems to ensure compliance with stringent regulatory standards and improve patient outcomes.

The portable oxygen concentrators segment is likely to witness a fastest CAGR of 10.5% from 2025 to 2033. This rapid growth is fueled by the increasing demand for mobility and flexibility in patient care. A study by Frost & Sullivan reveals that portable concentrators reduce hospital readmissions by 20%, making them particularly appealing for home healthcare settings. Additionally, as per a report by PwC, advancements in battery technology and wireless connectivity have expanded their usability, enabling remote monitoring and real-time data transmission. The growing emphasis on patient-centric care has further accelerated adoption, with over 50% of providers exploring portable solutions.

By Technology Insights

The continuous flow oxygen concentrators segment was the largest and held the significant share of the North America medical oxygen concentrators market in 2024. The growth of the segment is due to their role in managing severe respiratory conditions that require uninterrupted oxygen delivery. According to the National Institute of Health, continuous flow systems are utilized in over 70% of cases involving acute respiratory failure. The precision and reliability offered by continuous flow concentrators make them indispensable in high-stakes scenarios during pandemics. Furthermore, as per a study by Deloitte, advancements in concentrator design, such as adaptive modes and real-time monitoring, have enhanced their efficacy. Hospitals are increasingly investing in these systems to ensure compliance with regulatory standards and improve patient outcomes by reinforcing their prominence as the largest segment.

The pulse flow oxygen concentrators segment is anticipated to experience a CAGR of 11.2% from 2025 to 2033. This growth is driven by their ability to conserve oxygen and minimize waste by making them ideal for mild to moderate respiratory conditions. According to a study by PwC, pulse flow systems reduce oxygen consumption by 30% is attracting widespread adoption. Additionally, as per a report by Frost & Sullivan, advancements in sensor technology have improved accuracy and responsiveness, enhancing patient comfort and compliance. The growing emphasis on preventive care has further accelerated adoption, with over 60% of providers exploring pulse flow solutions.

By End User Insights

The home care segment dominated the North America medical oxygen concentrators market by capturing 55.4% of share in 2024. This dominance is attributed to the growing preference for personalized and cost-effective care among patients requiring long-term oxygen therapy. According to a study by Accenture, over 40% of patients prefer home-based solutions is citing improved quality of life and reduced hospital stays. Furthermore, as per a report by McKinsey, advancements in telehealth technologies have enabled remote monitoring of oxygen-dependent patients by enhancing safety and compliance. The growing emphasis on patient-centric care has further accelerated adoption, with over 50% of providers exploring home care solutions is reinforcing their prominence as the largest segment.

The ambulatory surgical centers segment is likely to gain huge traction with an estimated CAGR of 9.8% during the forecast period. The growth of the segment is attributed to be driven by the increasing number of outpatient surgeries, which require reliable oxygen delivery systems. According to a study by Frost & Sullivan, ambulatory centers reduce hospital readmissions by 25% by making them particularly appealing for post-operative care. Additionally, as per a report by PwC, advancements in portable concentrators have expanded their usability, enabling seamless integration into surgical workflows. The growing emphasis on cost-effective care has further accelerated adoption, with over 60% of centers exploring advanced oxygen solutions.

REGIONAL ANALYSIS

The U.S. led the North America medical oxygen concentrators market with 85.6% of the share in 2024 owing to the advanced healthcare system and high prevalence of chronic respiratory conditions. As per a study by the Centers for Disease Control and Prevention, respiratory diseases account for over 10 million hospitalizations annually, driving demand for concentrators. The aging population is projected to reach 22% by 2030. Investments in smart healthcare systems and IoT-driven concentrators are gaining traction, with over 60% of hospitals adopting these technologies.

Canada is likely to register a dominant CAGR of 13.2% during the forecast period. The country’s publicly funded healthcare system presents unique challenges by including limited budgets and slower adoption rates of advanced technologies. However, as per Statistics Canada, healthcare spending increased by 5% in 2022 by signaling growing interest in concentrators. Government initiatives to enhance respiratory care infrastructure have spurred adoption, with over 50% of hospitals upgrading their equipment. According to a study by Frost & Sullivan, portable concentrators are gaining popularity owing to their cost-effectiveness and scalability.

LEADING PLAYERS IN THE MARKET

Philips Healthcare

Philips Healthcare is a prominent player in the North America medical oxygen concentrators market with renowned for its innovative and reliable products tailored to diverse patient needs. The company’s strengths lie in its ability to deliver cutting-edge technologies, such as IoT-integrated concentrators, which enhance patient safety and operational efficiency. Philips’ commitment to innovation is evident in its strategic partnerships with research institutions to develop next-generation concentrator systems.

ResMed Inc.

ResMed Inc. is a key contributor to the North America medical oxygen concentrators market by offering a comprehensive range of products tailored to the needs of hospitals and home care settings. The company’s strengths include its scalable solutions and robust customer support services. ResMed’s focus on interoperability ensures seamless integration with existing healthcare IT systems by enhancing operational efficiency. Its strategic investments in smart healthcare technologies have enabled the development of connected concentrators is positioning it as a trusted partner for healthcare organizations.

Invacare Corporation

Invacare Corporation is a leading player in the North America medical oxygen concentrators market, known for its user-friendly platforms and advanced service offerings. The company’s strengths lie in its ability to deliver customizable solutions that cater to the unique needs of healthcare providers. Invacare’s emphasis on patient-centric care has resulted in the development of concentrators that prioritize comfort and compliance. Its strategic collaborations with telehealth providers have expanded its reach by enabling it to address the growing demand for remote respiratory care solutions.

TOP STRATEGIES USED BY KEY MARKET PARTICIPANTS

Key players in the North America medical oxygen concentrators market employ several strategies to maintain their competitive edge. Strategic acquisitions are a common approach, allowing companies to expand their product portfolios and enter new markets. Partnerships with technology firms, particularly those specializing in AI and IoT, are also prevalent, enabling the development of advanced concentrator systems. Additionally, investments in research and development drive innovation, ensuring compliance with evolving regulatory standards. Companies also focus on enhancing customer engagement through training programs and support services. These strategies collectively strengthen their market position and drive growth.

KEY MARKET PLAYERS AND COMPETITION OVERVIEW

Major Players of the North America medical oxygen concentrators market include Inogen, Invacare Corporation, Philips Respironics, Chart Industries, Drive DeVilbiss Healthcare, O2 Concepts, Precision Medical, Nidek Medical, GCE Group, Teijin Limited

The North America medical oxygen concentrators market is characterized by intense competition, with numerous players vying for market share. Established companies leverage their extensive networks and technological expertise to maintain dominance, while emerging players focus on niche markets to differentiate themselves. The market is witnessing a wave of consolidation, with mergers and acquisitions becoming increasingly common. Additionally, the growing emphasis on digital transformation has intensified competition, as companies strive to offer innovative solutions that meet the evolving needs of healthcare providers.

RECENT HAPPENINGS IN THE MARKET

- In April 2024, Philips Healthcare launched a new IoT-enabled oxygen concentrator by enhancing predictive monitoring capabilities and improving patient outcomes.

- In June 2023, ResMed Inc. partnered with a telehealth provider to integrate remote monitoring features into its concentrator systems by expanding its service offerings.

- In January 2024, Invacare Corporation introduced a portable concentrator designed for home healthcare settings by addressing the growing demand for mobility and flexibility.

- In September 2023, Medline Industries acquired a startup specializing in IoT-enabled concentrators by strengthening its position in the smart healthcare segment.

- In November 2023, Cardinal Health collaborated with a research institution to develop next-generation concentrator technologies by focusing on energy efficiency and sustainability.

DETAILED SEGMENTATION OF NORTH AMERICA MEDICAL OXYGEN CONCENTRATORS MARKET INCLUDED IN THIS REPORT

This research report on the North America medical oxygen concentrators market has been segmented and sub-segmented based on modality, technology, end user & region.

By Modality

- Stationary Oxygen Concentrators

- Portable Oxygen Concentrators

By Technology

- Continuous Flow Oxygen Concentrators

- Pulse Flow Oxygen Concentrators

By End User

- Home Care

- Ambulatory Surgical Centres

By Region

- United States

- Canada

- Mexico

- Rest of North America

Frequently Asked Questions

1. What is driving the growth of this market in North America?

Key drivers include a rise in chronic respiratory diseases (like COPD and asthma), the aging population, growing demand for home healthcare devices, and advancements in portable oxygen technology.

2. Who are the major end-users of oxygen concentrators?

Home care settings, Hospitals & clinics, Ambulatory surgical centers, and Emergency responders and long-term care centers

3. Which technology is more efficient continuous flow or pulse flow?

It depends on the patient’s condition. Continuous flow delivers a constant stream of oxygen, while pulse flow is more energy-efficient and delivers oxygen only when the patient inhales.

4. How do medical oxygen concentrators work?

They extract nitrogen from ambient air using filters and sieves, concentrating the oxygen and delivering it to the patient through a nasal cannula or mask.

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com