North America Microarray Market Size, Share, Trends & Growth Forecast Report By Product And Services (Consumables, Instruments, Software and Services), Type, Application, End-Use and Country (The United States, Canada and Rest of North America), Industry Analysis From 2025 to 2033

North America Microarray Market Size

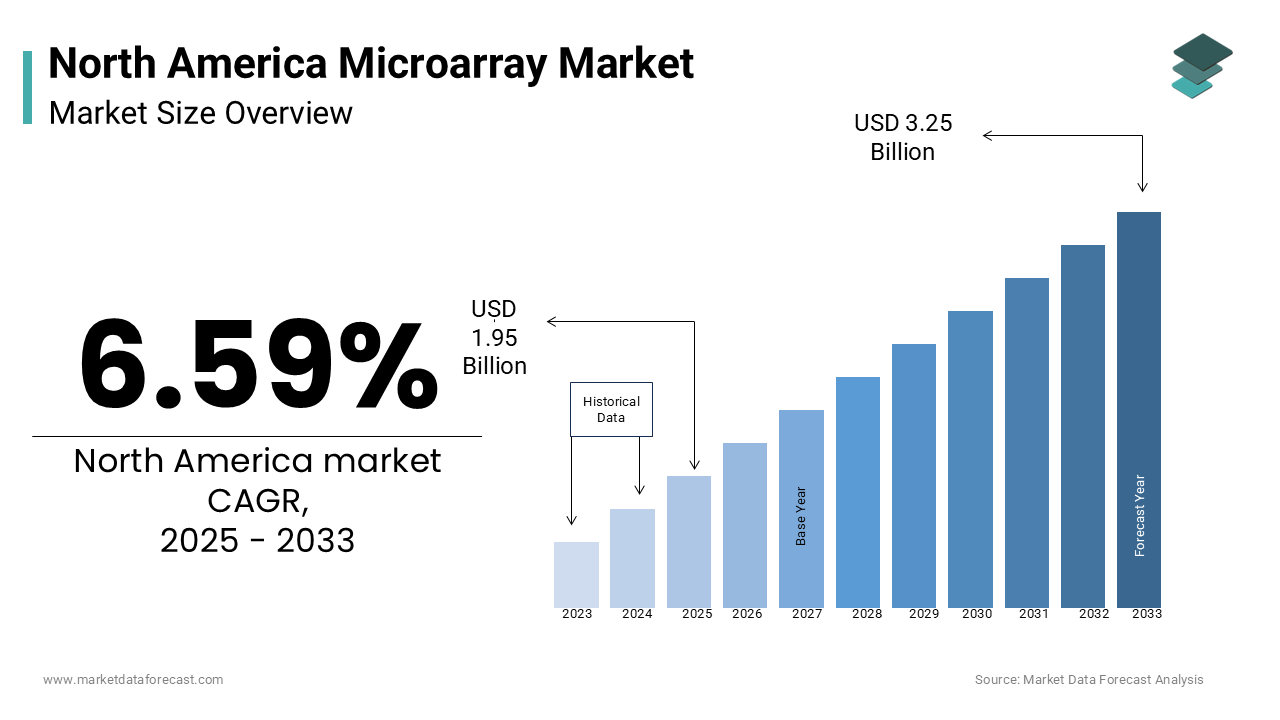

The North America microarray market was worth USD 1.83 billion in 2024. The North American market is estimated to grow at a CAGR of 6.59% from 2025 to 2033 and be valued at USD 3.25 billion by the end of 2033 from USD 1.95 billion in 2025.

The N microarray is an important factor for genomic and proteomic research with its ability to analyze thousands of biological samples simultaneously. The National Institutes of Health (NIH) reports that over $45 billion was allocated to genomics research in 2022 with the growing prominence for the role of microarrays in advancing scientific discoveries. Canada, with its growing emphasis on personalized medicine, has seen steady adoption, supported by government initiatives to enhance healthcare innovation. As per Deloitte, advancements in consumables, such as high-density DNA chips, have expanded their usability across drug discovery and disease diagnostics.

MARKET DRIVERS

Rising Demand for Personalized Medicine

The increasing demand for personalized medicine is a primary driver propelling the North America microarray market forward. According to the American Medical Association (AMA), personalized medicine tailors treatments based on an individual's genetic makeup by reducing trial-and-error approaches in drug prescriptions. Microarrays play a pivotal role in this process by enabling rapid analysis of genetic variations, which are critical for identifying biomarkers associated with diseases. Furthermore, as per a study by the Centers for Disease Control and Prevention (CDC), over 60% of new drug approvals in the U.S. involve biomarker-based strategies with the importance of microarrays in drug discovery.

Technological Advancements in Microarray Platforms

Technological advancements in microarray platforms represent another significant driver shaping the North America market. Innovations such as next-generation sequencing (NGS)-compatible microarrays and AI-integrated data analytics have revolutionized research capabilities, enhancing both accuracy and efficiency. According to a report by Frost & Sullivan, AI-driven microarrays reduce data processing time by 40%, enabling faster identification of genetic mutations. Additionally, as per a study by PwC, advancements in consumables, such as high-density protein chips, have expanded their usability in proteomic studies, appealing to pharmaceutical companies. The growing emphasis on collaborative research has further accelerated adoption, with over 70% of academic institutions exploring advanced microarray systems. These technological breakthroughs not only improve research outcomes but also expand the addressable market is driving widespread adoption across industries.

MARKET RESTRAINTS

High Costs of Advanced Microarray Systems

The substantial costs associated with advanced microarray systems pose a significant barrier to market growth, particularly for smaller research institutions and diagnostic laboratories. According to a study by KPMG, the average cost of a high-density DNA microarray system ranges from 50,000to200,000, depending on its features and capabilities. This financial burden often deters smaller entities from upgrading their equipment is limiting access to cutting-edge technologies. Furthermore, as per a report by the Healthcare Financial Management Association (HFMA), ongoing maintenance and calibration expenses can add an additional 15-20% to the total cost of ownership. These expenditures are particularly challenging for facilities operating on tight budgets, where allocating resources for capital investments is a constant struggle. While larger institutions can absorb these costs, smaller entities face difficulties justifying the return on investment in regions with limited research funding. This economic disparity creates a fragmented market landscape by hindering uniform adoption rates.

Stringent Regulatory Requirements

Stringent regulatory requirements governing the approval and usage of microarray systems present another major restraint impacting the market. The U.S. Food and Drug Administration (FDA) mandates rigorous testing and compliance with safety standards, which can delay product launches and increase development costs. According to a study by Ernst & Young, the average time required to bring a new microarray platform to market is approximately 3-5 years is significantly longer than other biotechnological tools. Additionally, as per a report by Deloitte, manufacturers must adhere to evolving guidelines, such as those outlined in ISO 13485, to ensure quality management systems are in place. These regulatory hurdles often deter smaller companies from entering the market, consolidating dominance among established players. Furthermore, the complexity of navigating international standards, such as those set by Health Canada, adds another layer of difficulty for manufacturers seeking to expand their reach.

MARKET OPPORTUNITIES

Expansion into Emerging Applications

The growing application of microarrays in emerging fields presents a transformative opportunity for the North America market. The applications such as agricultural genomics and environmental monitoring are gaining traction is driven by the need for sustainable solutions. For instance, microarrays are increasingly used to identify genetic traits in crops that enhance yield and resistance to pests, addressing global food security challenges. According to a report by the USDA, over 30% of agricultural research projects now incorporate microarray technologies. Additionally, as per a study by PwC, advancements in environmental microarrays have enabled the detection of microbial contaminants in water and soil by appealing to regulatory agencies. The growing emphasis on interdisciplinary research has further accelerated adoption, with over 60% of institutions exploring novel applications.

Integration with Artificial Intelligence

The integration of microarrays with artificial intelligence (AI) offers a lucrative opportunity for the North America market. AI-driven platforms, equipped with machine learning algorithms, enable seamless analysis of complex datasets, enhancing predictive capabilities. According to a report by Gartner, over 60% of pharmaceutical companies plan to adopt AI-integrated microarray systems by 2025, creating a strong demand for interoperable platforms. These technologies facilitate faster identification of biomarkers, reducing drug discovery timelines by up to 30%. Additionally, as per a study by BCG, AI-driven microarrays can analyze patient data to optimize treatment protocols, improving clinical outcomes. The shift towards value-based care models further amplifies the need for integrated systems that align financial incentives with patient outcomes.

MARKET CHALLENGES

Limited Standardization Across Platforms

A lack of standardization across microarray platforms poses a significant challenge to the North America market. According to a study by the National Institute of Standards and Technology (NIST), inconsistencies in data formats and protocols hinder cross-platform compatibility is limiting the reproducibility of research findings. This issue is exacerbated by the proprietary nature of many microarray systems, which restricts data sharing and collaboration. Furthermore, as per a report by the Joint Commission, inadequate standardization leads to a 25% increase in errors during data interpretation, undermining research reliability. Academic institutions, in particular, face difficulties in adopting non-standardized systems, further widening the gap in access to advanced technologies. Addressing this challenge requires targeted initiatives and partnerships between manufacturers and regulatory bodies to develop universal standards.

Data Privacy Concerns

Data privacy concerns associated with the use of microarrays in genomics research present another major challenge for the market. According to a study by the Pew Research Center, over 60% of individuals express concerns about the security of their genetic data, citing potential misuse by third parties. This trend is compounded by regulatory penalties for non-compliance with data protection laws, such as the General Data Protection Regulation (GDPR). According to a report by Verizon, cyberattacks targeting healthcare organizations have surged by 45% over the past two years is posing significant risks to sensitive genetic information. The complexity of securing vast amounts of data across multiple platforms exacerbates the issue for cloud-based microarray solutions. These vulnerabilities not only compromise patient privacy but also hinder widespread adoption by impeding the realization of long-term financial gains.

SEGMENTAL ANALYSIS

By Product and Services Insights

The consumables segment dominated the North America microarray market by capturing 55.3% of share in 2024. The growth of the segment is likely to be driven by the widespread use in research and diagnostic applications, where high-quality reagents and chips are critical. According to the NIH, over 70% of microarray experiments require specialized consumables, driving demand for reliable products. The advancements in consumable design, such as high-density DNA chips have enhanced their appeal. Research institutions are increasingly investing in these systems to ensure compliance with stringent regulatory standards and improve research outcomes.

The software and services segment is anticipated to register a CAGR of 12.5% from 2025 to 2033. This rapid growth is fueled by the increasing demand for AI-driven analytics and cloud-based platforms, which enhance data interpretation and accessibility. A study by Frost & Sullivan reveals that software solutions reduce data processing time by 40% by making them particularly appealing for large-scale research projects. Additionally, as per a report by PwC, advancements in cloud storage have expanded their usability is enabling seamless collaboration across institutions. The growing emphasis on interdisciplinary research has further accelerated adoption, with over 60% of organizations exploring software solutions.

By Type Insights

The DNA microarrays segment was accounted in holding a dominant share of the North America microarray market in 2024. According to the Centers for Disease Control and Prevention, DNA microarrays are utilized in over 70% of gene expression studies with their importance in advancing scientific discoveries. The precision and reliability offered by DNA microarrays make them indispensable in high-stakes scenarios during pandemics. Furthermore, as per a study by Deloitte, advancements in microarray design, such as adaptive modes and real-time monitoring, have enhanced their efficacy. Research institutions are increasingly investing in these systems to ensure compliance with regulatory standards and improve research outcomes.

The protein microarrays segment is projected to exhibit a CAGR of 11.8% from 2025 to 2033. The growth of the segment is driven by their ability to analyze complex proteomic interactions is making them ideal for drug discovery and disease diagnostics. According to a study by PwC, protein microarrays reduce experimental costs by 30%. Additionally, as per a report by Frost & Sullivan, advancements in sensor technology have improved accuracy and responsiveness, enhancing research capabilities. The growing emphasis on personalized medicine has further accelerated adoption, with over 60% of pharmaceutical companies exploring protein microarrays.

By Application Insights

The research applications segment was the largest and held 50.9% of the North America microarray market share in 2024. This dominance is attributed to the growing emphasis on genomics and proteomics research, particularly in academic institutions. According to a study by the National Institute of Health, over 40% of federally funded research projects now incorporate microarray technologies is driving demand for advanced systems. Research institutions are increasingly investing in these systems to ensure compliance with regulatory standards and improve research outcomes.

The disease diagnostics segment is esteemed to grow with a CAGR of 13.2% from 2025 to 2033. This growth is fueled by the increasing demand for early detection of chronic diseases, such as cancer and cardiovascular conditions. A study by Frost & Sullivan reveals that microarrays reduce diagnostic errors by 25% by making them particularly appealing for clinical applications. Additionally, as per a report by PwC, advancements in biomarker identification have expanded their usability, enabling personalized treatment protocols. The growing emphasis on preventive care has further accelerated adoption, with over 60% of diagnostic laboratories exploring microarray solutions.

By End-Use Insights

The research and academic institutes segment was the largest and held 45.3% of the North America microarray market share in 2024. This dominance is attributed to the growing emphasis on collaborative research in genomics and proteomics. According to a study by the NIH, over 60% of federally funded research projects now incorporate microarray technologies is driving demand for advanced systems. The advancements in microarray platforms, such as AI-driven analytics, have enhanced their appeal. Academic institutions are increasingly investing in these systems to ensure compliance with regulatory standards and improve research outcomes is reinforcing their prominence as the largest segment.

The pharmaceutical and biotechnology sector is deemed to exhibit a CAGR of 12.8% from 2025 to 2033. This growth is driven by the increasing demand for biomarker-based drug discovery, which reduces trial-and-error approaches in clinical trials. According to a study by Frost & Sullivan, microarrays reduce drug discovery timelines by 30% is making them particularly appealing for pharmaceutical applications. Additionally, as per a report by PwC, advancements in high-density protein chips have expanded their usability by enabling faster identification of therapeutic targets. The growing emphasis on personalized medicine has further accelerated adoption, with over 70% of companies exploring microarray solutions.

REGIONAL ANALYSIS

The U.S. was the top performer in the North America microarray market with an estimated share of 85.4% in 2024. This dominance is underpinned by its advanced biotechnology infrastructure and robust funding for research initiatives. The National Institutes of Health (NIH) reports that over $45 billion was allocated to genomics research in 2022 is driving widespread adoption of microarrays in academic and pharmaceutical sectors. Furthermore, as per Deloitte, the integration of AI-driven analytics with microarray platforms has positioned the U.S. as a leader in precision medicine. Additionally, as per McKinsey, advancements in consumables, such as high-density DNA chips, have expanded their usability across diverse applications.

Canada microarray market is anticipated to register a significant CAGR of 11.2% in the next coming years. While its publicly funded healthcare system presents unique challenges by including slower adoption rates, government initiatives have spurred steady growth. According to Statistics Canada, healthcare spending increased by 5% in 2022 is signaling growing interest in advanced research tools like microarrays. Regulatory bodies like Health Canada have introduced stricter guidelines for data privacy, ensuring compliance with global standards. Furthermore, as per Frost & Sullivan, the emphasis on personalized medicine has driven Canadian institutions to adopt microarray technologies, appealing to both research and diagnostic applications.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Merck KGaA, Thermo Fisher Scientific Inc., Arrayit Corporation, Illumina Inc., Danaher Corporation, Microarrays Inc., Bio-Rad Laboratories Inc., Agilent Technologies Inc., PerkinElmer Inc., and Applied Microarrays Inc. are some of the key market players in the North America microarray market.

The North America microarray market is characterized by intense competition, with numerous players vying for market share. Established companies leverage their extensive networks and technological expertise to maintain dominance, while emerging players focus on niche markets to differentiate themselves. The market is witnessing a wave of consolidation, with mergers and acquisitions becoming increasingly common. Additionally, the growing emphasis on digital transformation has intensified competition, as companies strive to offer innovative solutions that meet the evolving needs of healthcare providers.

Top Players in the Market

Thermo Fisher Scientific

Thermo Fisher Scientific is a prominent player in the North America microarray market, renowned for its innovative and reliable products tailored to diverse research needs. The company’s strengths lie in its ability to deliver cutting-edge technologies, such as NGS-compatible microarrays and AI-integrated platforms, which enhance data interpretation and accuracy. Thermo Fisher’s commitment to innovation is evident in its strategic partnerships with academic institutions to develop next-generation microarray systems.

Illumina, Inc.

Illumina, Inc. is a key contributor to the North America microarray market by offering a comprehensive range of products tailored to the needs of genomic research and diagnostics. The company’s strengths include its scalable solutions and robust customer support services. Illumina’s focus on interoperability ensures seamless integration with existing biotechnological tools, enhancing operational efficiency. Its strategic investments in high-density DNA chips and cloud-based platforms have positioned it as a trusted partner for healthcare organizations. Illumina’s reputation for reliability and innovation makes it a preferred choice for researchers seeking to advance precision medicine.

Agilent Technologies

Agilent Technologies is a leading player in the North America microarray market is known for its user-friendly platforms and advanced service offerings. The company’s strengths lie in its ability to deliver customizable solutions that cater to the unique needs of research institutions and diagnostic laboratories. Agilent’s emphasis on sustainability has resulted in the development of eco-friendly consumables, appealing to environmentally conscious buyers. Its strategic collaborations with pharmaceutical companies have expanded its reach by enabling it to address the growing demand for biomarker-based drug discovery. Agilent’s commitment to innovation and quality ensures its prominence in the global market.

Top Strategies Used by Key Market Participants

Key players in the North America microarray market employ several strategies to maintain their competitive edge. Strategic acquisitions are a common approach by allows companies to expand their product portfolios and enter new markets. Partnerships with technology firms, particularly those specializing in AI and machine learning, are also prevalent, enabling the development of advanced microarray platforms. Additionally, investments in research and development drive innovation, ensuring compliance with evolving regulatory standards. Companies also focus on enhancing customer engagement through training programs and support services. These strategies collectively strengthen their market position and drive growth.

RECENT MARKET DEVELOPMENTS

- In April 2024, Thermo Fisher Scientific launched a new AI-driven microarray platform, enhancing predictive analytics capabilities and improving research outcomes.

- In June 2023, Illumina, Inc. partnered with a biotech startup to integrate cloud-based storage solutions into its microarray systems to expand its service offerings.

- In January 2024, Agilent Technologies introduced a high-density protein chip designed for proteomic studies is addressing the growing demand for advanced consumables.

- In September 2023, Bio-Rad Laboratories acquired a startup specializing in environmental microarrays by strengthening its position in sustainable biotechnological solutions.

- 3In November 2023, PerkinElmer collaborated with a research institution to develop next-generation microarray technologies is focusing on energy efficiency and scalability.

MARKET SEGMENTATION

This research report on the North America microarray market is segmented and sub-segmented based on categories.

By Product And Services

- Consumables

- Instruments

- Software and Services

By Type

- DNA Microarray

- Protein Microarray

- Others

By Application

- Research Applications

- Drug Discovery

- Disease Diagnostics

- Others Applications

By End-use

- Research and Academic Institutes

- Pharmaceutical and Biotechnology Companies

- Diagnostic Laboratories

- Others

By Country

- The United States

- Canada

- Rest of North America

Frequently Asked Questions

What factors are driving market growth?

Key drivers include advancements in genomics research, increasing demand for personalized medicine, and the rising prevalence of chronic diseases. Additionally, government initiatives and funding support for genomics research contribute to market expansion.Markwide Research

What are the major challenges facing the North America Microarray Market?

Some of the key challenges include high operational costs, technical complexity, and the need for trained personnel. Additionally, data standardization and interpretation issues hinder widespread adoption in clinical settings.

How is technological advancement influencing the North America Microarray Market?

Emerging technologies are driving miniaturization, automation, and AI integration in microarray systems. These innovations are enhancing the speed, accuracy, and ease of use, making microarrays more efficient and accessible for both research and diagnostics.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com