North America Molded Pulp Packaging Market Size, Share, Trends & Growth Forecast Report By Molded Type (Thickwall, Transfer Molded, Thermoformed Fiber and Processed Pulp), Product Type, End-Use, and Country (The United States, Canada and Rest of North America), Industry Analysis From 2025 to 2033

North America Molded Pulp Packaging Market Size

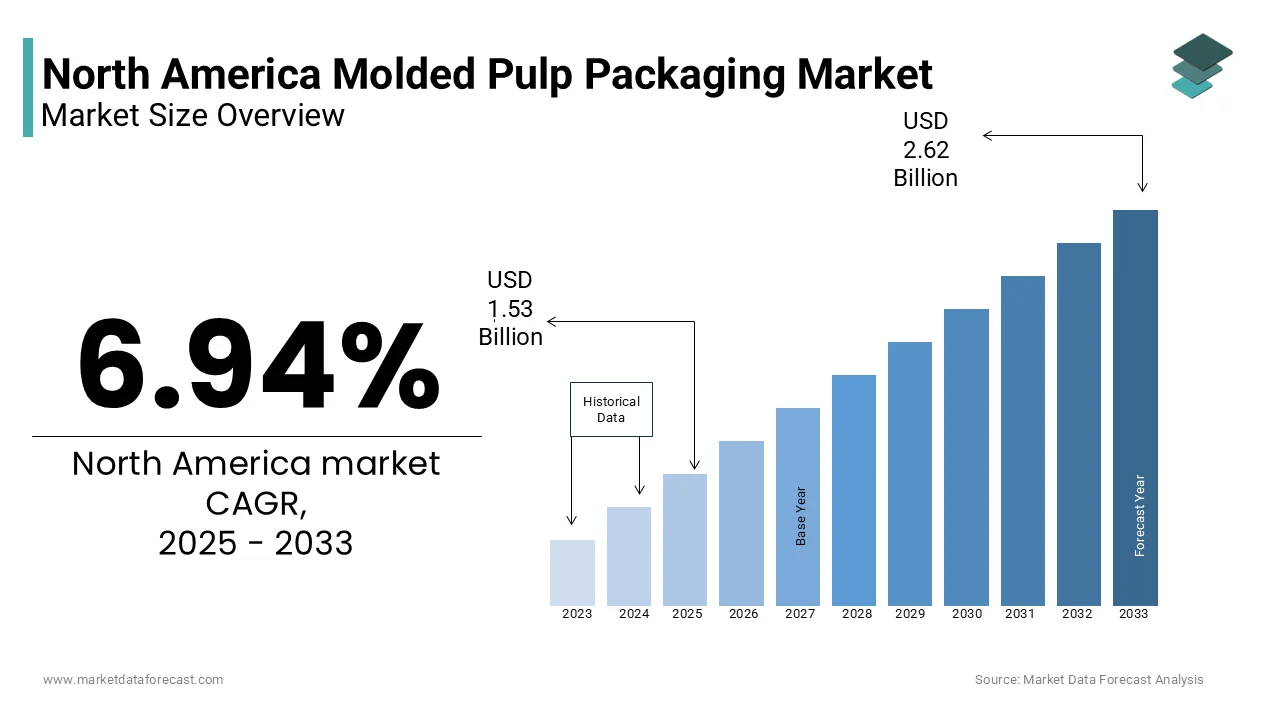

The Molded pulp packaging market size in North America was valued at USD 1.43 billion in 2024 and is predicted to be worth USD 2.62 billion by 2033 from USD 1.53 billion in 2025 and grow at a CAGR of 6.94% from 2025 to 2033.

The North America molded pulp packaging market refers to a sustainable wrapping part that utilizes recycled fibers from wood, agricultural residues, and post-consumer waste to create biodegradable and compostable containers. This form of packaging is widely used in food service, consumer goods, electronics, and healthcare industries due to its environmental benefits and functional properties such as shock absorption and thermal insulation. Unlike plastic or foam-based alternatives, molded pulp packaging offers an eco-friendly solution that aligns with growing sustainability mandates and corporate green initiatives. Also, major retailers and fast-food chains have made public commitments to phase out non-recyclable packaging. For instance, McDonald's North America announced in 2023 its intention to transition all fiber-based packaging to 100% certified sustainable sources by 2025.

MARKET DRIVERS

Increasing Regulatory Pressure Against Single-Use Plastics

A main element of the North America molded pulp packaging market is the intensifying regulatory scrutiny against single-use plastics at both federal and state levels. Governments across the U.S. and Canada are implementing bans and restrictions on non-recyclable packaging materials to curb pollution and promote sustainable alternatives. Like, as per Environment and Climate Change Canada, over 3 million tons of plastic waste entered Canadian landfills in 2022, prompting stricter regulations on single-use plastics and encouraging businesses to adopt biodegradable packaging options like molded pulp. In response, the Canadian government classified certain plastic products as toxic under the Canadian Environmental Protection Act in 2023, accelerating the shift toward biodegradable packaging solutions like molded pulp. Similarly, in the United States, states such as California, New York, and Washington have enacted comprehensive laws banning polystyrene and expanded polystyrene (EPS) packaging. These regulatory shifts have prompted foodservice providers and retailers to seek viable alternatives, with molded pulp emerging as a preferred option due to its durability, cost-effectiveness, and minimal environmental impact.

Rising Consumer Demand for Sustainable and Biodegradable Packaging

Further driver shaping the North America molded pulp packaging market is the growing consumer preference for sustainable and biodegradable packaging materials. With increasing awareness about climate change and plastic pollution, consumers are prioritizing eco-conscious brands that demonstrate environmental responsibility. This shift in consumer behavior has led major food and beverage companies to re-evaluate their packaging strategies. Many companies have increasingly adopted molded pulp trays and clamshells for fresh food packaging, leveraging its natural appearance and compostability to appeal to environmentally conscious shoppers. Furthermore, social media and digital advocacy have amplified consumer expectations regarding corporate sustainability efforts. And, brands that fail to adopt greener packaging risk reputational damage and declining customer loyalty.

MARKET RESTRAINTS

Limited Performance Capabilities Compared to Plastic and Foam Alternatives

A major restraint affecting the growth of the North America molded pulp packaging market is its limited performance capabilities when compared to conventional plastic and foam-based packaging materials. While molded pulp is praised for its sustainability, it often lacks the moisture resistance, structural integrity, and insulating properties required for certain applications, particularly in the foodservice and cold-chain logistics sectors. Moreover, these products tend to be heavier and bulkier than their plastic counterparts, leading to increased transportation costs and logistical challenges. Also, molded pulp containers can weigh more than equivalent plastic packaging, impacting fuel efficiency and emissions during distribution. In addition, the material’s susceptibility to compression and deformation under load presents concerns for e-commerce and product protection applications. Some manufacturers have attempted to address these limitations by applying biodegradable liners or wax coatings, but these add complexity and cost.

High Initial Investment and Manufacturing Complexity

Next notable constraint impeding the widespread adoption of molded pulp packaging in North America is the relatively high initial investment required for production infrastructure and the complexity involved in manufacturing processes. Unlike traditional plastic molding, which benefits from well-established supply chains and economies of scale, molded pulp requires specialized equipment, longer drying times, and precise mold design to ensure consistent quality. Additionally, the energy-intensive drying process involved in molded pulp production contributes to higher operational expenses. This makes it less economically viable for small and mid-sized producers who may struggle to compete with lower-cost plastic alternatives. Furthermore, fluctuations in the availability and pricing of recycled fiber feedstock—driven by global paper recycling trends—add another layer of unpredictability to production costs.

MARKET OPPORTUNITIES

Expansion into E-Commerce and Protective Packaging Applications

A most promising opportunities for the North America molded pulp packaging market lies in its expanding application within the e-commerce and protective packaging sector. As online retail continues to grow, so does the need for durable, sustainable cushioning materials that can replace expanded polystyrene (EPS) and plastic air pillows. Molded pulp offers an eco-friendly alternative that not only provides structural support but also aligns with the sustainability commitments of major retailers. Leading logistics companies and direct-to-consumer brands are increasingly exploring molded pulp inserts and custom-molded cushions to reduce reliance on plastic-based void fill. As per McKinsey & Company, over 30% of DTC brands surveyed in 2023 indicated plans to incorporate molded pulp into their shipping packaging within the next two years. Amazon and Walmart have also initiated pilot programs to test molded pulp-based protective packaging for select product categories. Also, innovations such as starch-based coatings and hybrid designs are enhancing the moisture resistance and shock-absorbing properties of molded pulp, making it more competitive with conventional materials.

Integration with Circular Economy Initiatives and Waste Diversion Programs

An emerging prospect for the North America molded pulp packaging market is its alignment with circular economy initiatives and municipal waste diversion programs aimed at reducing landfill dependency. Cities and corporations across the region are increasingly adopting closed-loop systems where materials are reused, repurposed, or composted rather than discarded. According to the U.S. Environmental Protection Agency, only limited share of plastics were recycled, whereas molded pulp packaging, being largely compostable and recyclable, fits seamlessly into zero-waste strategies. Municipalities such as San Francisco, Seattle, and Toronto have implemented aggressive organic waste collection programs, allowing molded pulp packaging to be processed alongside food scraps in industrial composting facilities. Additionally, large corporations like Unilever and Nestlé have pledged to make all their packaging reusable, recyclable, or compostable by 2025, further boosting demand for molded pulp alternatives. Beyond municipal initiatives, foodservice operators and universities are integrating molded pulp into campus-wide sustainability efforts. Institutions like Harvard University and Stanford have phased out plastic disposables in favor of molded pulp trays and bowls, contributing to measurable reductions in solid waste generation.

MARKET CHALLENGES

Competition from Alternative Eco-Friendly Packaging Materials

A foremost challenges facing the North America molded pulp packaging market is the growing competition from other eco-friendly packaging materials that offer comparable or superior performance characteristics. While molded pulp is favored for its biodegradability and compostability, alternatives such as PLA (polylactic acid), bagasse, bamboo fiber, and mushroom-based packaging are gaining traction due to their enhanced moisture resistance, lightweight structure, and versatility in design. PLA, derived from corn starch, is particularly popular in foodservice applications due to its clarity, rigidity, and ability to withstand low temperatures, making it suitable for cold food packaging. Similarly, bagasse-based packaging, made from sugarcane waste, is gaining favor among food delivery platforms due to its heat resistance and grease barrier properties.

Supply Chain Constraints and Raw Material Availability

A serious problem confronting the North America molded pulp packaging market is the volatility in raw material supply and the constraints associated with sourcing high-quality fiber inputs. This pulp relies heavily on recycled paper, cardboard, and agricultural byproducts such as wheat straw and rice husks, which are subject to seasonal availability and fluctuating market prices. According to the Recycled Paperboard Technical Association, disruptions in the recycling supply chain in led to an increase in fiber costs, directly impacting the profitability of molded pulp manufacturers. Moreover, the reliance on post-consumer waste creates variability in fiber consistency, which can affect the strength and finish of molded pulp products. As per a 2023 report by Resource Recycling Systems, contamination rates in recovered paper streams rose due to improper sorting and declining municipal recycling participation, complicating the production process. In addition, transportation bottlenecks and labor shortages have delayed raw material deliveries, causing production delays for smaller molded pulp producers. Unlike plastic resin, which is readily available through stable petrochemical supply chains, molded pulp feedstocks are more susceptible to regional and seasonal disruptions.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

6.94% |

|

Segments Covered |

By Molded Type, Product Type, End-Use Source, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

The United States, Canada, Mexico, and Rest of North America |

|

Market Leaders Profiled |

Brødrene Hartmann A/S; Huhtamäki Oyj; UFP Technologies; Thermoform Engineered Quality (Subsidiary of Sonoco Product Company); Genpak, LLC; Eco-Products, Inc; Pro-Pac Packaging Limited; Fabri-Kal; Henry Molded Products, Inc.; Sabert Corporation; Pacific Pulp Molding, and others |

SEGMENTAL ANALYSIS

By Molded Type Insights

The thickwall molded pulp packaging became the largest segment in the North America market by accounting for a 42.4% of total revenue share in 2024. This control is basically credited to its widespread use in protective and industrial packaging applications, particularly for electronics, automotive parts, and medical devices where durability and shock absorption are critical. Also, a major aspect behind this segment’s lead position is the rapid expansion of e-commerce and logistics networks across North America. Major logistics companies like FedEx and UPS have started incorporating thickwall molded pulp inserts in shipping boxes to reduce plastic usage and enhance brand sustainability profiles. Apart from these, advancements in mold design and drying technologies have improved production efficiency, making thickwall solutions more cost-competitive.

Thermoformed fiber is emerging as the fastest-growing segment in the North America molded pulp packaging market, projected to expand at a CAGR of 14.6%. This growth is mainly driven by its rising adoption in foodservice packaging, where manufacturers seek lightweight, moisture-resistant alternatives to plastic clamshells and foam containers. A notable point fueling this segment’s growth is the increasing preference for ready-to-eat meals and food delivery services, which require packaging that balances sustainability with functionality. Moreover, innovations such as starch-based coatings and hybrid material blends are enhancing the performance of thermoformed fiber products, making them more attractive to both foodservice providers and retailers.

By Product Type Insights

Trays depicted the strongest product type in the North America molded pulp packaging market by capturing a 38.3% of total market share in 2024. This influence is because of their extensive use in foodservice, retail, and agricultural packaging, where they serve as efficient carriers for fresh produce, bakery items, and prepared meals. A primary driver of this segment’s leadership is the growing shift among foodservice operators toward compostable and recyclable packaging. As per the National Restaurant Association, high percentage of U.S. restaurants reported increased customer demand for eco-friendly packaging in 2023. Chains such as McDonald's, Dunkin’, and Panera Bread have replaced polystyrene trays with molded pulp alternatives, contributing to significant volume growth. Also, tray designs offer versatility in size and structure, making them suitable for both dine-in and takeout formats. The rise of meal kit services and grocery store delis has further boosted tray demand, as these sectors prioritize packaging that enhances presentation while maintaining environmental integrity.

Bowls are the quickest rising product type in the North America molded pulp packaging market, predicted to grow at a CAGR of 15.2%. This surge is largely attributed to the booming popularity of on-the-go dining and plant-based food consumption, which necessitate packaging that is both functional and environmentally responsible. Another key factor driving bowl adoption is the expansion of food delivery platforms and ghost kitchen models, which rely heavily on disposable yet sustainable packaging. Also, innovations such as multi-layered pulp compositions and water-resistant coatings have enhanced the performance of molded pulp bowls, making them more competitive with plastic counterparts. Also, universities and corporate cafeterias have increasingly adopted molded pulp bowls as part of campus-wide sustainability initiatives.

By End-Use Source Insights

The segment of wood pulp remained the dominant raw material source in the North America molded pulp packaging market by holding 68.1% of total supply share in 2024. This leading position is mainly because of the well-established forestry infrastructure in the region, particularly in the U.S. South and Canadian provinces such as Ontario and British Columbia, which provide a steady and scalable supply of virgin and recycled wood fibers. Like, a large number of timber were harvested in North America in 2023, with a significant portion processed into paper and pulp for packaging applications.

A major driver supporting the continued dominance of wood pulp is its compatibility with existing molded pulp manufacturing processes, offering consistency in texture, strength, and molding precision. Additionally, large-scale manufacturers such as Georgia-Pacific and WestRock have invested heavily in upgrading pulp processing facilities to enhance efficiency and minimize environmental impact. With strong regulatory support for sustainable forestry practices and ongoing improvements in recycling technology, wood pulp continues to serve as the backbone of the molded pulp packaging industry in North America.

Non-wood pulp is emerging as the fastest-growing source in the North America molded pulp packaging market, expanding at a CAGR of 13.8%. This growth is fueled by increasing interest in agricultural residue-based feedstocks such as wheat straw, rice husks, sugarcane bagasse, and bamboo, which offer renewable and low-cost alternatives to traditional wood-derived fibers. One key factor driving this segment’s expansion is the rising concern over forest conservation and the environmental impact of logging. As per the Food and Agriculture Organization (FAO), global deforestation rates remain a pressing issue, prompting companies to explore non-timber fiber sources that utilize agricultural byproducts. In response, startups and packaging firms such as Evoware and Eco-Products have introduced molded pulp products made from bagasse and straw, appealing to eco-conscious brands looking to reduce their ecological footprint. Additionally, government incentives in states like California and provinces such as Alberta encourage the use of non-wood biomass in industrial applications, further boosting market penetration.

REGIONAL ANALYSIS

The United States accounted for the largest share of the North America molded pulp packaging market by representing a 78.3% of total regional revenue in 2024. This top position is underpinned by a combination of progressive environmental policies, robust consumer demand for sustainable products, and a highly developed packaging industry. Major cities such as New York, San Francisco, and Seattle have implemented bans on polystyrene and expanded polystyrene (EPS) food containers, directly influencing foodservice providers to switch to molded pulp alternatives. Moreover, multinational corporations including Starbucks, McDonald's, and Whole Foods have committed to phasing out plastic packaging in favor of molded pulp trays, bowls, and clamshells. The presence of major molded pulp producers such as DS Smith, Genpak, and Dart Container further strengthens the country’s production capabilities. Hence, the U.S. remains the most dynamic market for molded pulp packaging in North America.

Canada held a notable share of the North America molded pulp packaging market in 2024. While smaller in scale compared to the U.S., Canada exhibits strong growth momentum, supported by national sustainability targets, municipal waste diversion programs, and increasing corporate commitments to green packaging. Major retailers like Tim Hortons, Loblaws, and Sobeys have begun replacing plastic containers with molded pulp trays and bowls to comply with evolving regulations and consumer expectations. Additionally, municipalities such as Vancouver, Toronto, and Montreal have launched composting initiatives that accommodate molded pulp packaging, facilitating end-of-life disposal. With proactive government action and growing brand participation, Canada is positioned as a rapidly maturing market with substantial long-term potential in the molded pulp sector.

The Rest of North America, comprising Mexico and select Caribbean economies, contributed a major share of total regional revenue in the molded pulp packaging market in 2024. Though currently a minor player, this segment presents considerable growth potential due to rising environmental awareness, increasing foreign investment in sustainable packaging, and evolving regulatory landscapes.

Mexico has been actively promoting green packaging through initiatives such as the National Pact for the Prevention and Comprehensive Management of Waste, which encourages businesses to adopt biodegradable materials. Companies such as Grupo Bimbo and FEMSA have begun piloting molded pulp trays and cups in their foodservice operations. In the Caribbean, nations like Jamaica and the Bahamas are exploring molded pulp for tourism-driven hospitality packaging as part of broader sustainability strategies.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Brødrene Hartmann A/S; Huhtamäki Oyj; UFP Technologies; Thermoform Engineered Quality (Subsidiary of Sonoco Product Company); Genpak, LLC; Eco-Products, Inc; Pro-Pac Packaging Limited; Fabri-Kal; Henry Molded Products, Inc.; Sabert Corporation; Pacific Pulp Molding are playing dominating role in the North America molded pulp packaging market.

The competition in the North America molded pulp packaging market is intensifying as more players enter the space, driven by rising demand for sustainable packaging alternatives. Established manufacturers are leveraging their production expertise and distribution networks to maintain dominance, while emerging firms are introducing innovative product designs and alternative fiber sources to capture market share. The landscape is characterized by a mix of large multinational corporations and regional producers, all striving to align with evolving regulatory mandates and consumer expectations around environmental responsibility. Companies are increasingly focused on differentiation through enhanced product performance, customization, and end-of-life recyclability or compostability. As brand owners continue to prioritize sustainability in their packaging choices, competition is shifting from cost-based models to value-driven strategies centered on innovation and green credentials. Additionally, advancements in molding technology and drying processes are enabling greater efficiency, further fueling competitive dynamics. The convergence of regulatory pressure, corporate ESG commitments, and shifting consumer behavior is expected to sustain this highly active and evolving market environment.

TOP PLAYERS IN THE MARKET

DS Smith plc

DS Smith is a leading player in the North America molded pulp packaging market, known for its strong commitment to sustainable packaging solutions. The company has significantly expanded its molded pulp capabilities through strategic acquisitions and investments in advanced production technologies. DS Smith’s emphasis on circular economy principles has positioned it as a preferred partner for brands seeking eco-friendly packaging alternatives that align with global sustainability goals.

Genpak, LLC

Genpak is a major contributor to the growth of molded pulp packaging in North America, particularly within the foodservice industry. With a broad product portfolio that includes trays, bowls, and clamshells, Genpak serves national restaurant chains and retail food providers looking to replace plastic-based containers. The company focuses on innovation and customer-centric design to deliver high-performance, compostable packaging at scale.

Dart Container Corporation

Dart Container has been instrumental in driving the adoption of molded pulp packaging across North America by offering durable, biodegradable alternatives to foam and plastic products. The company continues to invest in research and development to enhance the functionality and aesthetics of molded pulp items. Dart’s extensive distribution network and brand reputation make it a key influencer in shaping the region’s sustainable packaging landscape.

TOP STRATEGIES USED BY KEY PLAYERS

Product Innovation and Customization

Leading companies are focusing on developing customized molded pulp solutions tailored to specific industries such as foodservice, e-commerce, and consumer goods. By enhancing design flexibility and performance attributes, they aim to meet diverse client needs while differentiating their offerings in a competitive market.

Expansion of Production Capacity and Facilities

To meet growing demand, manufacturers are investing in new production lines and expanding existing facilities across North America. This allows them to improve supply chain efficiency, reduce lead times, and support large-scale clients requiring consistent packaging volumes.

Strategic Partnerships and Sustainability Collaborations

Key players are forming alliances with environmental organizations, retailers, and logistics providers to promote molded pulp as a core component of sustainable packaging strategies. These collaborations help reinforce brand credibility and accelerate market penetration through joint initiatives and awareness campaigns.

RECENT HAPPENINGS IN THE MARKET

- In January 2024, DS Smith launched a new line of lightweight molded pulp trays designed specifically for fresh produce and ready-to-eat meals, aiming to provide an eco-friendly alternative to plastic packaging while enhancing shelf appeal and durability.

- In March 2024, Genpak announced a partnership with a major U.S. fast-food chain to supply fully compostable molded pulp bowls, reinforcing its position as a go-to provider for sustainable foodservice packaging solutions.

- In June 2024, Dart Container introduced a redesigned manufacturing process that significantly improves the moisture resistance of its molded pulp products without the use of plastic coatings, addressing a key performance limitation in the sector.

- In August 2024, a prominent Canadian molded pulp manufacturer formed a joint venture with an agricultural waste management firm to secure a steady supply of non-wood fiber inputs, diversifying raw material sourcing and reducing dependency on traditional pulp suppliers.

- In October 2024, a U.S.-based startup specializing in molded pulp inserts for e-commerce packaging secured a multi-year contract with a leading online retailer, signaling growing interest in sustainable protective packaging solutions across the logistics sector.

MARKET SEGMENTATION

This research report on the North America molded pulp packaging market has been segmented and sub-segmented based on the following categories.

By Molded Type

- Thick Wall

- Transfer Molded

- Thermoformed Fiber

- Processed Pulp

By Product

- Food

- Trays

- Clamshells

- Cups

- Plates

- Bowls

- Others

By End-Use

- Food Service Disposables

- Food Packaging

- Healthcare

- Electronics

- Others

By Country

- The United States

- Canada

- Rest of North America

Frequently Asked Questions

1. What is the size of the North America molded pulp packaging market?

The market was valued at USD 1.43 billion in 2024 and is projected to reach USD 2.62 billion by 2033.

2. What is the expected CAGR of the molded pulp packaging market in North America?

The market is expected to grow at a CAGR of 6.94% from 2025 to 2033.

3. What is driving the growth of molded pulp packaging in North America?

Increasing demand for sustainable and eco-friendly packaging solutions is fueling market growth.

4. Which industries are the major users of molded pulp packaging?

Food & beverage, electronics, healthcare, and consumer goods industries are key users.

5. How does molded pulp packaging benefit the environment?

It is biodegradable, recyclable, and made from renewable materials, reducing environmental impact.

6. Is the demand for molded pulp packaging increasing in e-commerce?

Yes, the rise of e-commerce is boosting demand for protective and sustainable packaging like molded pulp.

7. What are the key types of molded pulp packaging used in the market?

Trays, clamshells, end caps, and plates are commonly used molded pulp packaging types.

8. Which countries in North America dominate the molded pulp packaging market?

The United States and Canada are the major contributors to market revenue.

9. What challenges does the molded pulp packaging market face?

High initial production costs and limited water resistance are key challenges.

10. Are companies investing in innovation for molded pulp packaging?

Yes, companies are innovating to improve strength, shape versatility, and moisture resistance.

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com