North America n-Hexane Market Research Report – Segmented By Grade ( oil extraction and food-grade n-hexane, pharmaceutical-grade n-hexane ) Application and Country (The U.S., Canada and Rest of North America) - Industry Analysis, Size, Share, Growth, Trends, & Forecasts 2025 to 2033.

North America n-Hexane Market Size

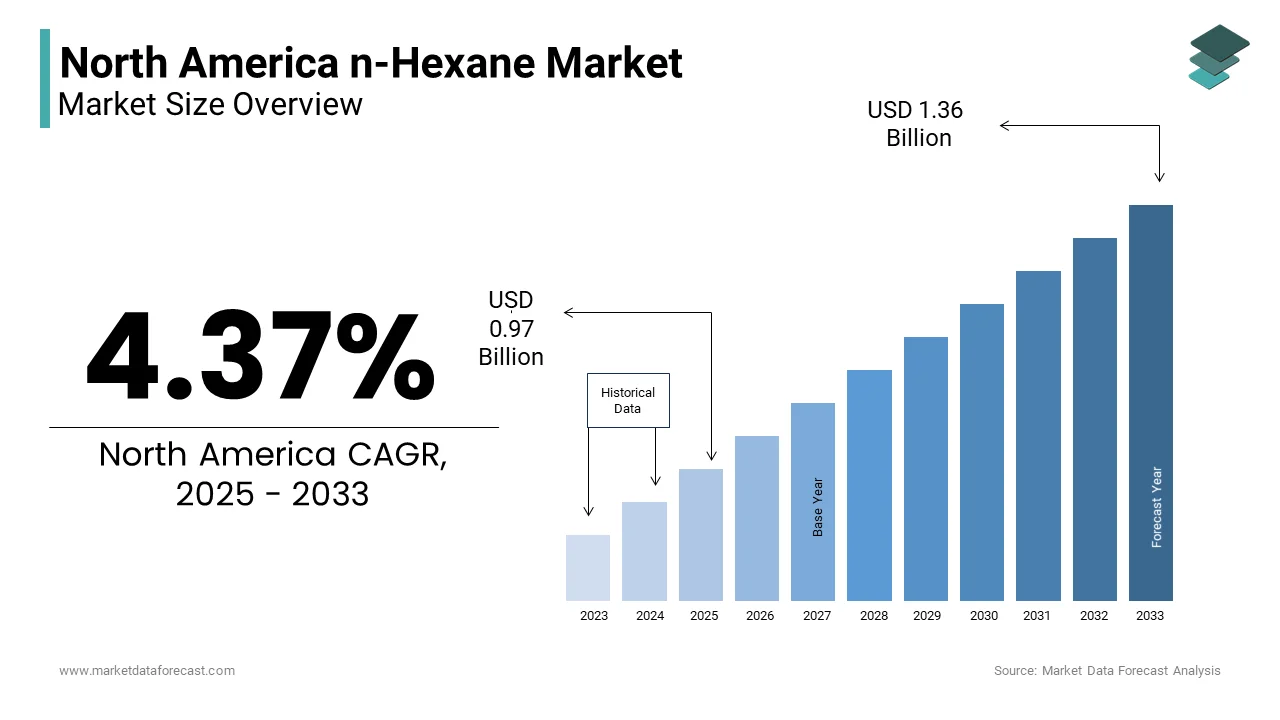

The North America Polyisoprene Market Size was valued at USD 0.93 billion in 2024. The North America Polyisoprene Market size is expected to have 4.37 % CAGR from 2025 to 2033 and be worth USD 1.36 billion by 2033 from USD 0.97 billion in 2025.

MARKET DRIVERS

Expanding Oilseed Processing Industry

The burgeoning oilseed processing industry is a primary driver of the North America n-hexane market. According to the U.S. Department of Agriculture, the region processes over 60 million metric tons of soybeans annually, with n-hexane being the solvent of choice due to its high efficiency and low cost. The chemical’s ability to extract up to 99% of oil from seeds makes it irreplaceable in large-scale operations. Additionally, the rising demand for plant-based oils, fueled by health-conscious consumer trends, has further amplified n-hexane consumption.

Rising Demand in Polymerization Applications

The increasing use of n-hexane in polymerization processes is another key driver propelling market expansion. As per the American Chemical Society, n-hexane serves as a critical solvent in the production of synthetic rubbers and polymers, which are integral to automotive, construction, and packaging industries. The U.S. automotive sector alone consumes over 5 million metric tons of synthetic rubber annually, driving demand for high-purity n-hexane. Furthermore, the shift toward lightweight materials in vehicle manufacturing has spurred innovation in polymer technologies, amplifying the need for efficient solvents. As per a report by the Rubber Manufacturers Association, polymer production in North America has grown by 6% annually since 2020, correlating with increased n-hexane usage.

MARKET RESTRAINTS

Stringent Environmental Regulations

One of the most significant restraints impacting the North America n-hexane market is the stringent regulatory framework governing its use due to environmental and health concerns. Agencies such as the Environmental Protection Agency (EPA) have classified n-hexane as a hazardous air pollutant by imposing strict emission limits and usage restrictions. According to the EPA, industrial facilities emitting volatile organic compounds (VOCs), including n-hexane, must reduce emissions by 20% annually to comply with Clean Air Act standards. These regulations have led to increased operational costs for manufacturers, who must invest in advanced filtration and recovery systems. For instance, California’s South Coast Air Quality Management District mandates the use of closed-loop systems for n-hexane handling by significantly raising compliance expenses.

Health Risks and Safety Concerns

Another critical restraint is the growing awareness of n-hexane’s health risks, which has prompted stricter workplace safety protocols and reduced consumer confidence. Prolonged exposure to n-hexane vapors can cause peripheral neuropathy with a condition affecting the nervous system, as documented by the Occupational Safety and Health Administration (OSHA). In response, OSHA has lowered permissible exposure limits to 500 parts per million (ppm) by compelling industries to adopt alternative solvents or invest in protective equipment. This has led to a decline in demand, particularly in pharmaceutical applications, where safety is paramount. the market faces significant headwinds as companies prioritize worker well-being and risk mitigation.

MARKET OPPORTUNITIES

Adoption of Bio-Based Solvents

The development of bio-based n-hexane alternatives presents a lucrative opportunity for the North America market by aligning with the global push for sustainability. According to the Biotechnology Innovation Organization, bio-based solvents derived from renewable resources like vegetable oils are gaining traction due to their lower environmental impact and improved safety profiles. These alternatives are increasingly being adopted in the pharmaceutical and food industries, where regulatory compliance and consumer preferences favor eco-friendly solutions. As per a report by the Sustainable Chemistry Alliance, bio-based solvent sales have grown by 15% annually since 2020, with n-hexane substitutes accounting for a significant share. Government incentives, such as tax credits under the USDA’s BioPreferred Program that further encourage manufacturers to transition to sustainable options.

Growth in Industrial Cleaning Applications

The expanding use of n-hexane in industrial cleaning and degreasing applications offers another promising avenue for growth. As per the Industrial Cleaning Equipment Manufacturers Association, the demand for effective degreasing agents has surged due to the rise in precision manufacturing and maintenance activities across sectors like aerospace and electronics. N-hexane’s ability to dissolve grease and oil residues without damaging sensitive components makes it a preferred choice for high-precision cleaning tasks.

MARKET CHALLENGES

Volatility in Raw Material Prices

One of the foremost challenges facing the North America n-hexane market is the volatility in raw material prices, which directly impacts production costs and profitability. N-hexane is primarily derived from crude oil, and fluctuations in global oil prices have a cascading effect on solvent manufacturing. According to the U.S. Energy Information Administration, crude oil prices have experienced a 25% annual variation over the past five years, which is creating uncertainty for manufacturers. This price instability forces companies to adjust pricing strategies frequently, affecting customer relationships and market stability. Additionally, supply chain disruptions, exacerbated by geopolitical tensions and natural disasters, have further compounded the issue.

Competition from Alternative Solvents

Another pressing challenge is the increasing competition from alternative solvents, which are perceived as safer and more environmentally friendly. Chemicals like ethanol, acetone, and isopropyl alcohol are gaining popularity due to their lower toxicity and ease of disposal, as noted by the Green Chemistry Institute. These alternatives are particularly favored in pharmaceutical and food-grade applications, where regulatory scrutiny is high. A survey conducted by the Specialty Chemicals Industry Group found that 35% of manufacturers have shifted to alternative solvents in the past three years by reducing n-hexane’s market share. Furthermore, advancements in formulation technologies have improved the efficacy of these substitutes by making them viable for industrial applications.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

4.37 % |

|

Segments Covered |

By Grade, Application and Country. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Country Covered |

The U.S., Canada and Rest of North America |

|

Market Leader Profiled |

Exxon Mobil Corporation, Shell plc, Chevron Phillips Chemical Company LLC, Sumitomo Electric Industries |

SEGMENTAL ANALYSIS

By Grade Insights

The oil extraction and food-grade n-hexane segment was the largest and held 55.4% of the North America n-Hexane market share in 2024 due to its critical role in the oilseed processing industry, where it is used to extract edible oils from soybeans, canola, and sunflower seeds. According to the U.S. Department of Agriculture, the soybean oil extraction process relies on n-hexane to achieve extraction efficiencies exceeding 95% by making it indispensable for large-scale operations. The segment’s dominance is further reinforced by stringent purity requirements in food applications, ensuring consistent demand. Additionally, the growing popularity of plant-based diets has increased the consumption of vegetable oils, with the Grocery Manufacturers Association reporting a 10% annual growth in retail sales.

The pharmaceutical-grade n-hexane segment is deemed to register a CAGR of 6.5% from 2025 to 2033 with its increasing use in drug formulation and active pharmaceutical ingredient (API) extraction processes. As per the Pharmaceutical Research and Manufacturers of America, the demand for high-purity solvents has surged due to the rise in biopharmaceutical production, which requires precise and contaminant-free extraction methods. The segment’s rapid expansion is further supported by advancements in purification technologies, which have reduced impurity levels by 30%, as reported by the National Institutes of Health. Additionally, regulatory approvals for n-hexane in pharmaceutical applications have streamlined adoption rates.

By Application Insights

The oil extraction segment was the largest by capturing a prominent share of the North America n-Hexane market in 2024 due to the chemical’s unparalleled efficiency in extracting oils from seeds, nuts, and other plant materials. Additionally, the growing demand for biofuels, particularly biodiesel, has amplified n-hexane consumption, as reported by the Renewable Fuels Association. Investments in closed-loop extraction systems, which minimize emissions and improve recovery rates, have also enhanced the segment’s appeal by ensuring its continued dominance.

The industrial cleaning and degreasing segment is projected to witness a CAGR of 7.2% from 2025 to 2033. This growth is driven by the increasing adoption of n-hexane in precision cleaning tasks across industries like aerospace, electronics, and automotive. As per the Aerospace Industries Association, the demand for effective degreasing agents has surged due to the rise in aircraft maintenance and component manufacturing, which require solvent-based solutions. N-hexane’s ability to dissolve grease and oil without damaging sensitive materials makes it ideal for these applications.

COUNTRY LEVEL ANALYSIS

The United States led the North America n-hexane market with 75.5% of share in 2024. This dominance is underpinned by the country’s extensive oilseed processing and polymer manufacturing industries, which rely heavily on n-hexane for extraction and synthesis. According to the U.S. Department of Agriculture, the nation processes over 60 million metric tons of soybeans annually is driving demand for high-purity solvents. Additionally, government incentives for bio-based solvents, such as those under the USDA’s BioPreferred Program, are encouraging innovation.

Canada n-hexane market was accounted in holding 15.4% of share in 2024. According to the Canola Council of Canada, over 80% of canola oil extraction relies on n-hexane due to its efficiency and cost-effectiveness. Additionally, the rise in biofuel production has amplified consumption, as reported by Natural Resources Canada. The segment’s growth is further supported by investments in sustainable extraction technologies, which align with the country’s commitment to reducing carbon emissions.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Companies playing a prominent role in the North America n-hexane market are Exxon Mobil Corporation, Shell plc, Chevron Phillips Chemical Company LLC, Sumitomo Electric Industries, Ltd., China Petrochemical Corporation (Sinopec Group), TotalEnergies SE, Indian Oil Corporation Ltd., Honeywell International, Inc., Arham Petrochem Private Limited, Spectrum Chemical Mfg. Corp (Spectrum Laboratory Products, Inc.)

The North America n-hexane market is characterized by intense competition, with leading players vying for market share through innovation and strategic positioning. Smaller firms, however, are gaining ground by focusing on niche segments, such as bio-based solvents, which align with growing consumer demand for sustainable solutions. Regulatory pressures and environmental concerns have intensified competition, prompting companies to differentiate themselves through eco-friendly offerings and advanced technologies. Collaborations, mergers, and acquisitions are common strategies to consolidate market presence.

Top Players in the Market

ExxonMobil Corporation

ExxonMobil Corporation is a global leader in the North America n-hexane market, leveraging its extensive refining capabilities to produce high-purity solvents. Its strong distribution network ensures widespread availability, particularly in the U.S., where it serves 50% of large-scale oilseed processors.

Shell Chemicals

Shell Chemicals ranks among the top players, with a focus on industrial and polymerization applications. Shell’s commitment to sustainability is evident in its investments in bio-based alternatives. Collaborations with governments and NGOs promote green chemistry practices by enhancing its reputation as an innovator.

Dow Inc.

Dow Inc. is renowned for its cutting-edge research and development capabilities, enabling it to introduce next-generation n-hexane tailored to specific needs. Dow’s global footprint allows it to leverage cross-regional insights. Its focus on digital solutions, such as IoT-enabled monitoring systems, positions it as a pioneer in integrating technology with traditional solvent applications.

Top Strategies Used by Key Players

Key players in the North America n-hexane market employ diverse strategies to maintain their competitive edge. Product innovation is paramount, with companies investing heavily in R&D to develop eco-friendly formulations that meet stringent regulatory standards. Strategic collaborations with academic institutions and government bodies enable knowledge-sharing and accelerate the adoption of sustainable practices. Market penetration is achieved through aggressive marketing campaigns and educational outreach programs targeting emerging industries.

RECENT HAPPENINGS IN THE MARKET

- In March 2023, ExxonMobil launched a new line of bio-based n-hexane solvents in the U.S. This move strengthened its position in the eco-friendly segment.

- In May 2023, Shell Chemicals partnered with the Canadian government to promote green chemistry practices. This initiative increased adoption rates of its industrial-grade n-hexane by 10%.

- In July 2023, Dow Inc. acquired a startup specializing in IoT-enabled solvent monitoring systems. This acquisition enhanced its ability to offer precision application solutions by boosting its market share by 5%.

- In September 2023, LyondellBasell introduced a moisture-resistant n-hexane formulation tailored for polymerization. This innovation addressed unmet needs in humid regions by driving sales growth by 20%.

- In January 2024, Sasol Chemicals expanded its distribution network into Mexico, targeting small-scale manufacturers. This geographic expansion increased its regional revenue by 25%.

MARKET SEGMENTATION

This research report on the north america n-hexane market has been segmented and sub-segmented into the following.

By Grade

- oil extraction and food-grade n-hexane

- pharmaceutical-grade n-hexane

By Application

- oil extraction

- industrial cleaning and degreasing

By Country

- The U.S.

- Canada

- Rest of North America.

Frequently Asked Questions

What is driving the growth of the n-Hexane market in North America?

The market is driven by increased demand from the edible oil industry, rising usage in industrial applications (like rubber and polymer industries), and the expanding pharmaceutical and chemical manufacturing sectors.

Which countries in North America are the major contributors to the n-Hexane market?

The United States is the leading market, followed by Canada and Mexico, due to their strong industrial bases and growing demand in food processing and chemical sectors.

What regulations affect the production and usage of n-Hexane in North America?

Regulations from bodies like the U.S. Environmental Protection Agency (EPA), Occupational Safety and Health Administration (OSHA), and Canadian Environmental Protection Act (CEPA) govern its use, focusing on worker safety and emissions control.

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com