North America Non-Invasive Aesthetic Treatment Market Size, Share, Trends & Growth Forecast Report By Procedure (Injectable Treatments, Skin Rejuvenation Procedures), End Use and Country (The United States, Canada and Rest of North America), Industry Analysis From 2025 to 2033

North America Non-Invasive Aesthetic Treatment Market Size

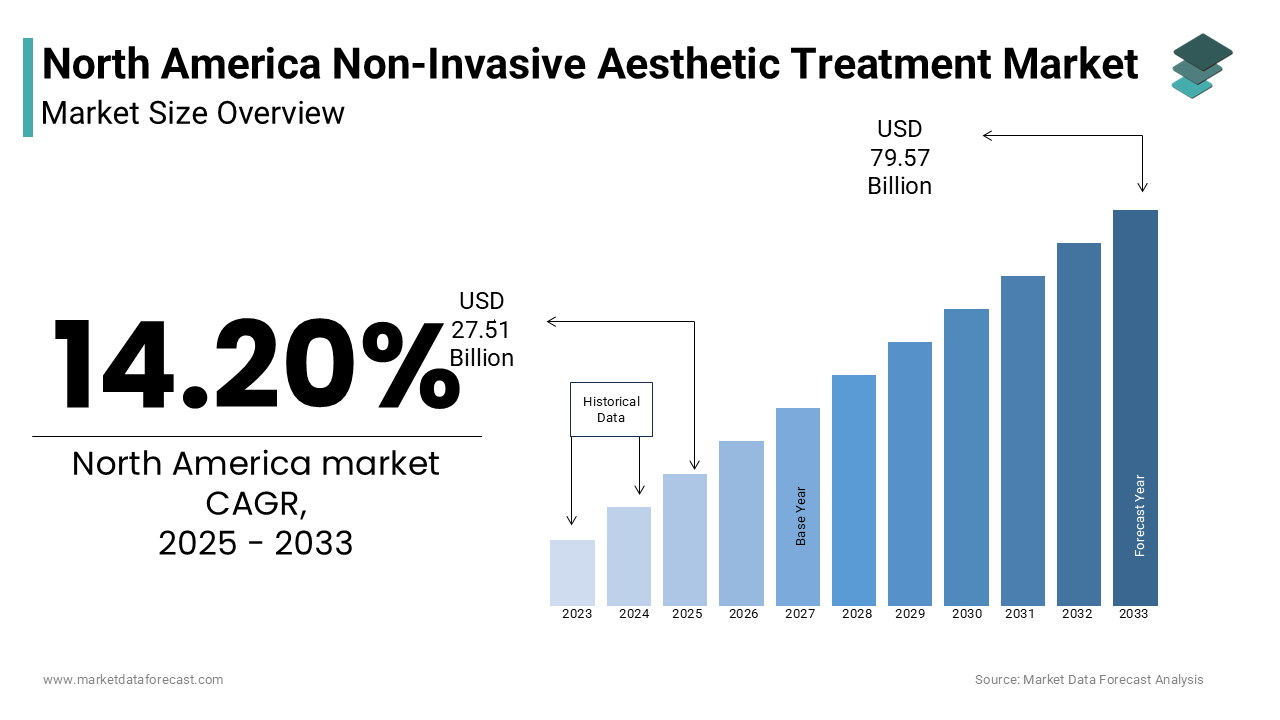

The North America Non-Invasive Aesthetic Treatment Market was worth USD 24.09 billion in 2024. The North America market is expected to reach USD 79.57 billion by 2033 from USD 27.51 billion in 2025, rising at a CAGR of 14.20% from 2025 to 2033.

Non-invasive aesthetic treatments include laser therapies, injectables (such as Botox and dermal fillers), body contouring techniques, skin tightening, and chemical peels. The growing emphasis on personal appearance, combined with advancements in medical aesthetics, has fueled the popularity of these minimally invasive alternatives that offer quicker recovery times and reduced risks compared to traditional cosmetic surgery.

According to the American Society of Plastic Surgeons, over 20 million minimally invasive cosmetic procedures were performed in the United States in 2023, marking a steady increase from previous years. This trend reflects shifting consumer attitudes toward proactive self-care and image enhancement across both genders and multiple age groups.

In addition, rising disposable incomes, increased accessibility through medispas and dermatology clinics, and aggressive marketing by aesthetic device manufacturers have contributed to widespread adoption.

Moreover, technological innovations such as AI-driven facial analysis tools and radiofrequency-based devices are enhancing treatment precision and patient satisfaction.

MARKET DRIVERS

Rising Consumer Awareness and Acceptance of Aesthetic Treatments

A primary driver behind the growth of the North America non-invasive aesthetic treatment market is the increasing awareness and social acceptance of cosmetic procedures among diverse demographic groups.

According to the Pew Research Center, over 75% of U.S. adults reported using social media platforms daily in 2023, where exposure to beauty ideals and before-and-after transformation content has influenced perceptions of appearance and self-image. This digital influence has encouraged more individuals to explore aesthetic enhancements, particularly those that are low-risk and require minimal downtime.

Moreover, public figures, influencers, and celebrities openly discussing their experiences with non-invasive treatments have played a significant role in destigmatizing cosmetic interventions. Medical spas, dermatology clinics, and even primary care physicians have expanded their service offerings to accommodate this demand, making treatments more accessible across urban and suburban regions.

Furthermore, educational initiatives by professional associations such as the American Academy of Dermatology have improved public understanding of treatment safety and efficacy.

Technological Advancements Enhancing Treatment Outcomes

Another key driver fueling the North America non-invasive aesthetic treatment market is the continuous advancement of technologies that improve procedural efficiency, safety, and results. Innovations such as fractional lasers, high-intensity focused ultrasound (HIFU), and AI-assisted diagnostics have significantly enhanced the effectiveness of treatments while reducing discomfort and recovery time.

According to the U.S. Food and Drug Administration, over 40 new aesthetic devices received clearance for commercial use in 2023, reflecting a strong pipeline of next-generation solutions entering the market. These technological breakthroughs have enabled practitioners to offer highly customized treatments tailored to individual skin types and concerns.

For example, companies like Cutera, Cynosure, and Lutronic have introduced multi-application platforms that allow providers to perform a variety of procedures—including skin resurfacing, fat reduction, and muscle stimulation—using a single system.

Moreover, integration with telemedicine platforms has allowed patients to receive virtual consultations and follow-up assessments, further streamlining access to care.

SEGMENTAL ANALYSIS

By Procedure Insights

The injectable treatments segment holds the largest share of the North America non-invasive aesthetic treatment market, accounting for 57.3% of total revenue in 2024. This dominance is primarily attributed to the widespread popularity of botulinum toxin injections (e.g., Botox) and dermal fillers, which are among the most commonly performed cosmetic procedures in the region.

.webp)

One of the key drivers behind this segment’s leadership is the growing consumer preference for quick, minimally invasive procedures that offer immediate visible results with little to no downtime. According to the American Society of Plastic Surgeons, over 4.4 million Botox procedures were performed in the U.S. in 2023, making it the most sought-after non-surgical cosmetic treatment. Dermal fillers such as hyaluronic acid-based products also saw a significant rise.

Also, injectables have gained traction across diverse demographics, including younger consumers seeking preventative care and men increasingly opting for aesthetic enhancements. With continuous product innovation and expanded indications for use, injectables remain the cornerstone of the non-invasive aesthetic treatment landscape.

The skin rejuvenation procedures segment is projected to grow at the fastest CAGR of nearly 11.3%. This rapid expansion is largely driven by increasing demand for laser treatments, chemical peels, microdermabrasion, and intense pulsed light (IPL) therapies aimed at improving skin texture, tone, and overall appearance.

A major factor contributing to this segment’s acceleration is the rising prevalence of skin concerns such as acne scars, pigmentation, fine lines, and sun damage, particularly among millennials and Gen Z consumers.

Another key driver is the integration of advanced technologies like AI-assisted diagnostics and customized skincare regimens into medispa services. Companies such as Cutera and Lutronic have introduced next-generation platforms that allow practitioners to tailor treatments based on individual patient profiles.

In addition, rising awareness of preventive skincare and the normalization of aesthetic treatments in mainstream culture have further fueled growth.

By End Use Insights

The MedSpa segment accounted for the largest share of the North America non-invasive aesthetic treatment market, representing 62% of total service delivery in 2024. This is mainly due to the increasing accessibility, affordability, and convenience offered by MedSpas compared to hospital or surgical center settings.

One of the key factors driving this segment’s leadership is the shift in consumer preference toward outpatient, spa-like environments where aesthetic treatments can be administered with minimal discomfort and recovery time.

Additionally, MedSpas benefit from aggressive marketing strategies and bundled package deals that make aesthetic procedures more financially accessible. With continued investment in staff training and equipment upgrades, MedSpas continue to dominate the end-use landscape in the non-invasive aesthetics sector.

The hospitals and surgical centers segment is anticipated to expand at the highest CAGR of around 9.8%. This accelerated growth is being propelled by the increasing medicalization of aesthetic treatments and the need for higher safety standards, particularly for complex procedures requiring physician oversight.

One significant factor driving this segment’s momentum is the rising number of patients seeking advanced non-invasive body contouring and facial rejuvenation procedures that require FDA-approved devices and licensed practitioners. According to the American Society of Plastic Surgeons, over 1.2 million non-invasive body contouring treatments were performed in clinical settings in 2023, with high-intensity focused ultrasound (HIFU) and cryolipolysis leading adoption.

Another key contributor is the integration of aesthetic services within dermatology and plastic surgery departments of major hospitals. Institutions such as the Mayo Clinic and Cleveland Clinic have expanded their offerings to include laser resurfacing, photofacials, and injectables under medical supervision.

REGIONAL ANALYSIS

The United States maintained the top position in the North America non-invasive aesthetic treatment market, holding more than 84% of regional market share in 2024. As one of the global epicenters for cosmetic medicine, the U.S. benefits from a mature healthcare infrastructure, strong regulatory framework, and a culture that embraces proactive self-care and appearance enhancement.

One of the key drivers behind this dominance is the widespread availability of certified MedSpas, dermatology clinics, and aesthetic treatment centers across urban and suburban areas. The presence of leading device manufacturers such as Allergan, Cutera, and Solta Medical has further strengthened the ecosystem by ensuring a steady flow of innovative technologies into the market.

Additionally, shifting demographic trends, including an aging population and increased interest among younger consumers, have contributed to sustained demand.

Canada’s market is distinguished by its strong emphasis on patient safety, professional certification, and ethical practice standards, which have fostered consumer trust and consistent growth.

A major growth catalyst is the increasing number of board-certified dermatologists and plastic surgeons offering non-invasive procedures through private clinics and MedSpas. The country’s regulatory environment ensures that only licensed professionals administer aesthetic treatments, enhancing perceived credibility among consumers.

Another key contributor is the rising participation of men in aesthetic treatments, mirroring trends seen in the U.S. Additionally, the expansion of tele-aesthetic consultations and virtual follow-ups has improved access, especially in remote regions.

Mexico is positioned as a growing market, Mexico has witnessed rising demand for aesthetic procedures, particularly in major metropolitan areas such as Mexico City, Guadalajara, and Monterrey, where disposable incomes and exposure to international beauty standards have increased.

One of the key growth drivers is the country’s well-established medical tourism industry, which attracts international patients seeking cost-effective yet high-quality aesthetic treatments. The presence of bilingual, internationally trained practitioners and state-of-the-art clinics enhances the appeal for foreign visitors.

Also, domestic demand is expanding due to increasing awareness and social media influence. With continued investment in clinic infrastructure and digital outreach, Mexico is playing an increasingly influential role in shaping the broader North American non-invasive aesthetic treatment market.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

llergan Aesthetics (AbbVie Inc.), Cutera, Inc., Cynosure, LLC (a division of Lutronic Corporation), Revance Therapeutics, Inc., Lumenis Ltd., Fotona, Syneron Medical Ltd. (now part of Candela Corporation), Venus Concept Inc., Bausch Health Companies Inc., and Hologic, Inc. are some of the key market players.

The competition in the North America non-invasive aesthetic treatment market is highly dynamic, driven by rapid technological advancements, shifting consumer preferences, and an increasing number of market entrants. Established players maintain dominance through strong brand recognition, extensive distribution networks, and continuous innovation in both device-based and injectable treatments. However, new entrants—particularly those specializing in at-home aesthetic devices or niche injectablesare gaining traction by offering cost-effective alternatives and differentiated service models.

A key battleground for competitive differentiation lies in the integration of artificial intelligence and personalized treatment planning, which enhances patient experience and procedural accuracy. Additionally, regulatory compliance and physician endorsement play crucial roles in determining market success. Companies are increasingly focusing on partnerships with MedSpas, dermatology clinics, and telehealth platforms to expand reach and streamline customer engagement. As aesthetic procedures become more mainstream, the market is witnessing heightened investment in branding, patient education, and outcome transparency, reinforcing the need for companies to continuously innovate and adapt to sustain leadership positions.

Top Players in the North America Non-Invasive Aesthetic Treatment Market

Allergan Aesthetics (An AbbVie Company)

Allergan Aesthetics is a global leader in the non-invasive aesthetic treatment market, best known for its flagship products Botox Cosmetic and Juvederm dermal fillers. The company has played a pivotal role in shaping consumer and professional perceptions of aesthetic medicine through extensive research, clinical trials, and physician education programs. Its robust product portfolio and strategic marketing campaigns have made it a dominant force in both injectables and skincare solutions.

Lumenis Ltd.

Lumenis is a leading innovator in medical aesthetic technologies, offering a broad range of laser and light-based systems used in skin rejuvenation, body contouring, and facial treatments. The company’s commitment to technological advancement has positioned it as a preferred choice among dermatologists and cosmetic surgeons. Lumenis continues to influence the global market by introducing next-generation devices that enhance procedural efficiency, safety, and patient satisfaction across MedSpas and clinical settings.

Cutera, Inc.

Cutera specializes in developing safe, effective, and easy-to-use aesthetic systems designed for a variety of non-invasive treatments including laser skin resurfacing, photorejuvenation, and body sculpting. The company's focus on flexibility and user-friendly platforms has enabled widespread adoption across diverse practice types, from private clinics to large aesthetic centers. Cutera contributes to industry growth by continuously expanding its device portfolio to meet evolving clinical needs and consumer expectations.

Top Strategies Used by Key Market Participants

Expansion of Product Portfolios Through Innovation and Acquisitions

Leading companies are continuously enhancing their offerings by investing in R&D to develop advanced devices and injectable formulations. Additionally, strategic acquisitions of smaller biotech and aesthetics firms help consolidate market presence and introduce novel treatment options that cater to emerging consumer preferences.

Enhanced Training and Physician Engagement Programs

To ensure consistent adoption and proper application of aesthetic treatments, key players offer comprehensive training initiatives for dermatologists, plastic surgeons, and MedSpa practitioners. These educational efforts not only improve procedural outcomes but also strengthen brand loyalty among healthcare providers who rely on trusted technologies and formulations.

Digital Integration and Direct-to-Consumer Marketing Campaigns

Major market participants are leveraging digital platforms to engage directly with consumers, using targeted advertising, virtual consultations, and social media outreach. By creating awareness and fostering trust in their brands, companies drive demand while simultaneously supporting practitioners with marketing tools and patient acquisition strategies.

RECENT MARKET DEVELOPMENTS

- In January 2024, Allergan Aesthetics launched a new line of hyaluronic acid-based dermal fillers tailored specifically for ethnic skin tones, addressing a growing demand for inclusive aesthetic solutions across diverse patient populations.

- In April 2024, Lumenis announced a strategic partnership with a major U.S.-based telemedicine platform to integrate virtual consultation capabilities into its aesthetic treatment workflow, enabling patients to receive pre-procedure assessments remotely.

- In July 2024, Cutera introduced a compact, AI-enabled laser system designed for small practices and mobile aesthetic providers, lowering the entry barrier for independent practitioners seeking access to premium technology.

- In October 2024, Merz Aesthetics acquired a Canadian-based skincare formulation startup specializing in post-treatment recovery products, strengthening its position in the holistic aesthetic care segment.

- In February 2025, Alma Lasers expanded its North American footprint by opening a new regional headquarters in Dallas, Texas, aimed at accelerating product distribution and enhancing customer support services for medical professionals.

MARKET SEGMENTATION

This research report on the North America Non-Invasive Aesthetic Treatment Market is segmented and sub-segmented into the following categories.

By Procedure

- Injectable Treatments

- Skin Rejuvenation Procedures

By End Use

- MedSpas

- Hospitals and Surgical Centers

By Country

- The United States

- Canada

- Rest of North America

Frequently Asked Questions

What is driving the growth of this market in North America?

The market is driven by increasing demand for minimally invasive cosmetic procedures, rising awareness of aesthetic treatments, technological advancements in devices, and growing influence of social media and beauty standards.

What are the emerging trends in this market?

Emerging trends include the integration of AI in aesthetic technologies, rise in at-home aesthetic devices, demand for personalized treatments, and increased interest in combination therapies.

How is the regulatory environment shaping the market?

The market is regulated by agencies like the FDA in the U.S., which ensures the safety and efficacy of aesthetic devices and injectables, promoting consumer trust and market growth.

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com