North America Non-Residential Polished Concrete Market Size, Share, Trends & Growth Forecast, Segmented By Finishing, Application, End-Use And By Country (The USA, Canada, Mexico and Rest of North America), Industry Analysis From 2025 to 2033

North America Non-Residential Polished Concrete Market Size

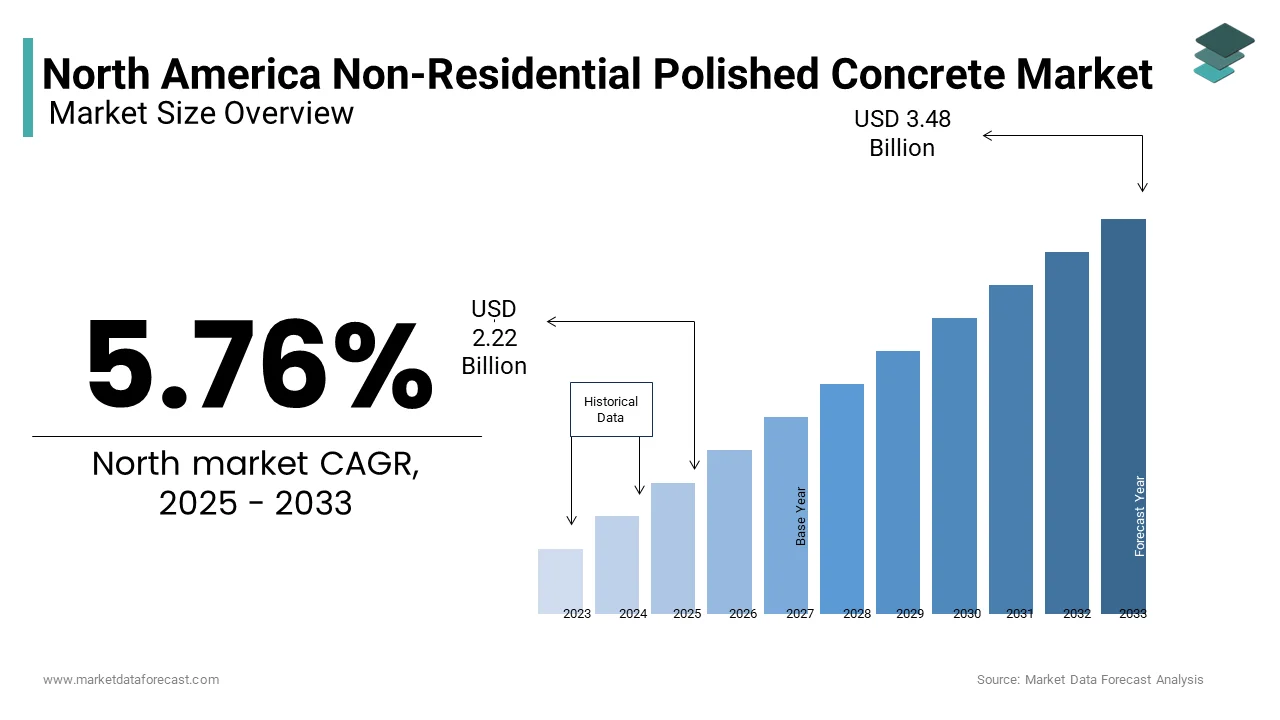

The North American non-residential polished concrete market was valued at USD 2.1 billion in 2024 and is anticipated to reach USD 2.22 billion in 2025 from USD 3.48 billion by 2033, growing at a CAGR of 5.76% during the forecast period from 2025 to 2033.

MARKET DRIVERS

Sustainability Trends in Construction

Sustainability trends in the construction industry are a primary driver for the non-residential polished concrete market in North America. With growing environmental awareness, builders and architects are increasingly prioritizing eco-friendly materials. Like, buildings account for a considerable share of energy consumption in the U.S., prompting a shift toward sustainable practices. Polished concrete, which requires minimal additional materials and reduces waste during installation, aligns perfectly with these goals. Furthermore, the material’s longevity and low lifecycle costs make it an attractive choice for large-scale projects. Also, green building projects in North America grew in recent years, with polished concrete being a key component in achieving sustainability certifications like LEED and WELL.

Cost Efficiency and Durability

Another significant driver is the cost efficiency and durability offered by polished concrete. Unlike traditional flooring options such as carpet or tile, polished concrete requires minimal upkeep and can withstand heavy foot traffic, making it ideal for high-use environments like warehouses, retail spaces, and educational institutions. Similarly, polished concrete floors have a lifespan exceeding 30 years, significantly reducing replacement costs. Additionally, the material’s reflective properties enhance natural lighting, leading to energy savings. The Department of Energy estimates that improved lighting efficiency can greatly reduce energy consumption.

MARKET RESTRAINTS

High Initial Installation Costs

One of the primary restraints impeding the growth of the non-residential polished concrete market is the high initial installation costs associated with the process. While polished concrete offers long-term savings, the upfront expenses can deter budget-conscious clients. This price point is often higher than traditional flooring options like vinyl or carpet, which may appeal to smaller projects or businesses with limited budgets. Additionally, the specialized equipment and skilled labor required for installation add to the overall expense. Also, labor shortages in the construction sector have increased costs in the last few years, further exacerbating this challenge.

Limited Awareness Among End Users

Another significant restraint is the limited awareness among end users about the benefits and applications of polished concrete. Many decision-makers in non-residential construction, particularly in smaller markets, lack comprehensive knowledge about the material’s versatility and advantages. Moreover, only a small portion of facility managers in North America are familiar with the full range of applications for polished concrete. This knowledge gap often leads to hesitation in adopting the material, despite its proven durability and sustainability. Furthermore, misconceptions about polished concrete being prone to cracking or staining persist, deterring potential customers.

MARKET OPPORTUNITIES

Expansion in Retrofit Projects

The growing emphasis on retrofitting existing buildings presents a significant opportunity for the non-residential polished concrete market in North America. Aging infrastructure, particularly in urban areas, has created a surge in demand for cost-effective and durable flooring solutions. Like, a large percentage of public buildings in the U.S. are over 50 years old, necessitating upgrades to meet modern standards. Polished concrete is an ideal choice for retrofit projects due to its ability to transform existing slabs into high-performance floors without the need for extensive demolition. In addition, retrofit projects accounted for a major share of all non-residential construction spending. Additionally, the material’s compatibility with underfloor heating systems enhances its appeal in retrofit applications, driving further adoption.

Adoption in Institutional Facilities

Another promising avenue is the increasing adoption of polished concrete in institutional facilities such as schools, hospitals, and government buildings. These sectors prioritize durability, safety, and ease of maintenance, all of which polished concrete delivers. Polished concrete’s slip-resistant properties and resistance to microbial growth make it particularly suitable for healthcare facilities, as highlighted by the Centers for Disease Control and Prevention. Furthermore, government mandates promoting sustainable construction, such as Executive Order 14057, encourage the use of eco-friendly materials like polished concrete.

MARKET CHALLENGES

Intense Competition from Alternative Flooring Solutions

One of the foremost challenges facing the non-residential polished concrete market is the intense competition from alternative flooring solutions. Materials such as epoxy coatings, terrazzo, and luxury vinyl tiles offer similar aesthetic appeal and performance characteristics, creating a crowded marketplace. For instance, Epoxy coatings are often perceived as more customizable and visually appealing, particularly in retail and hospitality settings. Additionally, the influx of low-cost imports from Asia-Pacific nations, particularly China and India, exacerbates pricing pressures. Also, imports of industrial flooring materials increased in recent years, intensifying competition domestically.

Technical Limitations in Complex Applications

Another significant challenge is the technical limitations associated with polished concrete in complex applications. While the material excels in large, open spaces, it faces challenges in areas requiring intricate designs or specific surface textures. Also, achieving consistent finishes in small or irregularly shaped spaces can be difficult, often requiring additional time and resources. Furthermore, polished concrete’s inability to mask underlying imperfections in older slabs limits its suitability for certain retrofit projects. These technical constraints hinder the material’s adoption in niche applications, where precision and customization are critical.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

5.76% |

|

Segments Covered |

By Finishing, Application, End-Use, and Country |

|

Various Analyses Covered |

Global, Regional, and country-level analysis; Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Country's Covered |

The United States, Canada, and the Rest of North America |

|

Market Leaders Profiled |

Advanced Industrial Coatings, Carolina Concrete Floor Polishing, CG Flooring Systems, Concria, CPC Floor Coatings, Creative Maintenance Solutions, Duracryl, H.J. Martin and Son, Indus Floors, Polished Concrete Company, Preferred, Sika, Sinto, West Pacific Coatings, Zeraus Products. |

SEGMENTAL ANALYSIS

By Finishing Type

The cream polish segment dominated the North American non-residential polished concrete market by capturing 40.7% of the total share in 2024. Also, the popularity of this segment is due to its ability to provide a sleek, modern appearance while maintaining the natural texture of the concrete. According to the Concrete Polishing Association of America, cream polish is favored in commercial spaces such as retail stores and office buildings due to its cost-effectiveness and ease of maintenance. The segment’s growth is further driven by advancements in polishing technologies, enabling faster and more consistent finishes.

Obtained concrete is the fastest-growing segment, with a projected CAGR of 9.2% through 2033. This growth is fueled by the increasing demand for aesthetically pleasing yet durable flooring solutions. According to the American Institute of Architects, stained concrete is gaining traction in institutional facilities such as schools and hospitals, where vibrant colors and patterns enhance visual appeal. Additionally, advancements in stain formulations have expanded design possibilities, making the material more versatile.

By Application Insights

New floors represent the largest application segment, accounting for approximately 65% of the market share in 2022, according to Grand View Research. This dominance is attributed to the rising number of new construction projects across North America. Also, non-residential construction spending significantly increased, driving demand for polished concrete in new builds. Additionally, the material’s compatibility with modern construction techniques, such as tilt-up and precast concrete, enhances its appeal. In addition, polished concrete floors reduce construction timelines, making them a preferred choice for developers.

The retrofit floors segment is moving ahead quickly, with a CAGR of 8.5%. This growth is propelled by the increasing focus on upgrading aging infrastructure. Like, a large portion of public buildings in the U.S. require renovations, creating opportunities for polished concrete installations. The segment’s flexibility in transforming existing slabs into high-performance floors without extensive demolition drives its adoption. Further, retrofit projects utilizing polished concrete have grown in the past few years, showcasing its rapid expansion.

By End Use Insights

The commercial sector spearheaded the North American non-residential polished concrete market with 50.6% of the total share in 2024. This leading position is caused by the material’s aesthetic appeal and durability, making it ideal for retail spaces, offices, and hospitality venues. Similarly, retail construction spending in the U.S. reached a notable market in recent times, fueling demand for polished concrete. Additionally, the material’s ability to enhance natural lighting reduces energy costs, appealing to environmentally conscious businesses.

The industrial sector is the fastest-growing end-use segment, with a projected CAGR of 9.5%. This growth is fueled by the increasing adoption of polished concrete in warehouses, manufacturing facilities, and distribution centers. Also, e-commerce expansion has led to a major increase in warehouse construction, driving demand for durable flooring solutions. Polished concrete’s resistance to heavy machinery and forklift traffic makes it indispensable in industrial settings.

COUNTRY LEVEL ANALYSIS

The United States remained the key player in the North American non-residential polished concrete market with 75.1% of the regional share in 2024. This is underpinned by the country’s robust construction industry, which has witnessed significant investments in both new builds and retrofit projects. Additionally, a significant portion of new non-residential projects are LEED-certified, further propelling the adoption of polished concrete as a sustainable material. Government initiatives promoting infrastructure development, such as the $1.2 trillion Infrastructure Investment and Jobs Act signed into law in 2021, have also created opportunities for polished concrete in institutional and industrial facilities.

Canada is seeing an upward growth trajectory, which is driven by its growing emphasis on green building practices and infrastructure modernization. The Canadian Green Building Council estimates that over 60% of new construction projects in Canada now incorporate sustainable materials, with polished concrete being a popular choice due to its eco-friendly attributes and low lifecycle costs. Institutional facilities, such as schools and hospitals, represent a significant portion of demand. Like, the education sector accounted for a major share of all institutional construction spending in recent years, with many projects opting for polished concrete floors to meet safety and durability requirements. Furthermore, Canada’s commitment to reducing carbon emissions has led to increased investments in energy-efficient buildings. Polished concrete’s ability to enhance natural lighting and reduce heating costs aligns perfectly with these goals. Additionally, the country’s industrial sector, particularly in manufacturing and warehousing, is witnessing steady growth, creating further opportunities for polished concrete installations.

The Rest of North America is witnessing the decent growth in this market. Mexico, in particular, plays a crucial role due to its rapidly expanding industrial sector, which is driven by the growth of automotive manufacturing and e-commerce logistics. Polished concrete’s resistance to heavy machinery and forklift traffic makes it an ideal choice for these applications. Additionally, the rise of e-commerce has spurred warehouse construction, with Prologis reporting a 25% increase in industrial real estate development Beyond Mexico. Smaller economies in Central America are also showing interest in polished concrete for institutional and commercial applications, driven by urbanization and infrastructure development initiatives.

KEY MARKET PLAYERS

Advanced Industrial Coatings, Carolina Concrete Floor Polishing, CG Flooring Systems, Concria, CPC Floor Coatings, Creative Maintenance Solutions, Duracryl, H.J. Martin and Son, Indus Floors, Polished Concrete Company, Preferred, Sika, Sinto, West Pacific Coatings, Zeraus Products, are the market players that are dominating the North American non-residential polished concrete market.

Top Players In The Market

HTC Group

HTC Group is a global leader in the non-residential polished concrete market. The company’s dominance stems from its cutting-edge polishing equipment and innovative solutions tailored to diverse applications. The company’s strong presence in the U.S. and Canada is bolstered by strategic partnerships with major contractors and developers, enabling it to secure large-scale projects in sectors like retail, healthcare, and education. HTC Group’s focus on customer education has also played a pivotal role in driving adoption, as evidenced by its training programs for architects, builders, and facility managers.

Husqvarna Group

Husqvarna Group is another prominent player, renowned for its advanced diamond tools and polishing systems. Husqvarna’s success lies in its ability to deliver high-performance products that cater to both small-scale and large-scale projects. Also, Husqvarna’s commitment to sustainability is evident through its participation in green building initiatives, including collaborations with organizations like the U.S. Green Building Council. Additionally, the company’s acquisition of a regional distributor in Canada in late 2022 has expanded its geographic reach, allowing it to tap into emerging markets across North America.

SASE Company

SASE Company rounds out the list of top players. The company specializes in providing cost-effective solutions tailored to small and medium-sized projects, making it a preferred choice for budget-conscious clients. This innovation has opened up new opportunities in retrofit projects and niche applications such as boutique retail stores and small-scale educational facilities. By focusing on affordability, versatility, and accessibility, SASE Company has carved out a distinct niche in the polished concrete market, catering to segments often overlooked by larger competitors.

Top Strategies Used by Key Market Participants

Key players in the North American non-residential polished concrete market employ a variety of strategies to maintain their competitive edge and drive growth. One prevalent strategy is product innovation, with companies investing heavily in research and development to introduce advanced solutions that meet evolving customer needs. Another widely adopted strategy is forming strategic partnerships with construction firms, architects, and government agencies to promote the adoption of polished concrete. Geographic expansion is also a critical focus, with companies acquiring regional distributors to enhance their presence in emerging markets such as Canada and Mexico. Lastly, companies emphasize customer education and outreach, offering training programs and resources to increase awareness about the benefits and applications of polished concrete.

COMPETITION OVERVIEW

The North American non-residential polished concrete market is characterized by intense competition, with key players vying for dominance through innovation, quality, and strategic initiatives. Companies like HTC Group, Husqvarna Group, and SASE Company dominate the landscape, each leveraging unique strengths to capture market share. HTC Group leads the pack with its advanced polishing equipment and eco-friendly solutions, allowing it to cater to large-scale projects in sectors like retail and healthcare. Husqvarna Group differentiates itself through its focus on industrial applications, offering high-performance diamond tools and resin-bonded systems tailored to warehouses and manufacturing facilities. SASE Company excels in providing cost-effective solutions for small and medium-sized projects, appealing to budget-conscious clients in niche markets. Despite their strengths, all players face challenges such as rising raw material costs, regulatory compliance, and increasing competition from alternative flooring solutions.

RECENT HAPPENINGS IN THE MARKET

- In April 2024, HTC Group launched a new line of eco-friendly polishing equipment designed to minimize dust emissions and reduce environmental impact, aligning with sustainability trends in construction.

- In June 2023, Husqvarna Group partnered with a major construction firm to supply diamond tools for a large-scale retrofit project in New York, underscoring its focus on industrial applications.

- In March 2023, SASE Company introduced a compact polishing system specifically designed for use in tight or irregularly shaped spaces, addressing a key limitation of traditional installations.

- In January 2023, HTC Group invested $50 million in R&D to develop advanced polishing technologies capable of delivering consistent finishes in complex applications.

- In October 2022, Husqvarna Group acquired a regional distributor in Canada to expand its geographic reach and tap into emerging markets across North America.

MARKET SEGMENTATION

This research report on the North American non-residential polished concrete market is segmented and sub-segmented into the following categories.

By Finishing Type

- Cream polish

- Salt and pepper

- Aggregate exposure

- Stained concrete

- Others (decorative patterns, etc.)

By Applications

- New floors

- Retrofit floors

By End Use

- Commercial

- Industrial

- Institutional

By Country

- United States

- Canada

- Mexico

- Rest of North America

Frequently Asked Questions

What is driving the demand for polished concrete in non-residential spaces?

The demand is fueled by polished concrete’s durability, low maintenance cost, modern aesthetic appeal, and its increasing use in high-traffic areas like retail, commercial offices, warehouses, and educational facilities.

Which types of non-residential buildings are most adopting polished concrete flooring?

Commercial spaces like shopping malls, corporate offices, showrooms, and warehouses lead adoption, followed by institutional sectors such as schools, hospitals, and government buildings due to its cost-efficiency and longevity.

What technological advancements are influencing the polished concrete market?

New grinding machines, dust-control systems, and eco-friendly sealers are improving finish quality, while automated polishing techniques and diamond tooling have enhanced speed and consistency in large-scale projects.

What are the key challenges in the North American polished concrete market?

Challenges include limited skilled labor for high-end finishing, surface cracking in older buildings, and hesitancy from some developers unfamiliar with polished concrete’s long-term cost benefits over traditional flooring.

What is the future outlook for this market?

With the rising trend toward industrial-style design, green building certifications, and sustainable construction materials, polished concrete is poised to become a staple flooring choice in modern non-residential developments across North America.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com