North America Pharmaceutical Packaging Market Size, Share, Trends, Forecast, Research Report - Segmented By Product Type (Medical Pouches, Blister Packs, Vials, Ampoules, Cartridges, and Syringes), Material, Packaging Type, Drug Delivery Mode, and Country (The United States, Canada and Rest of North America), Industry Analysis From 2024 to 2033

North America Pharmaceutical Packaging Market Size

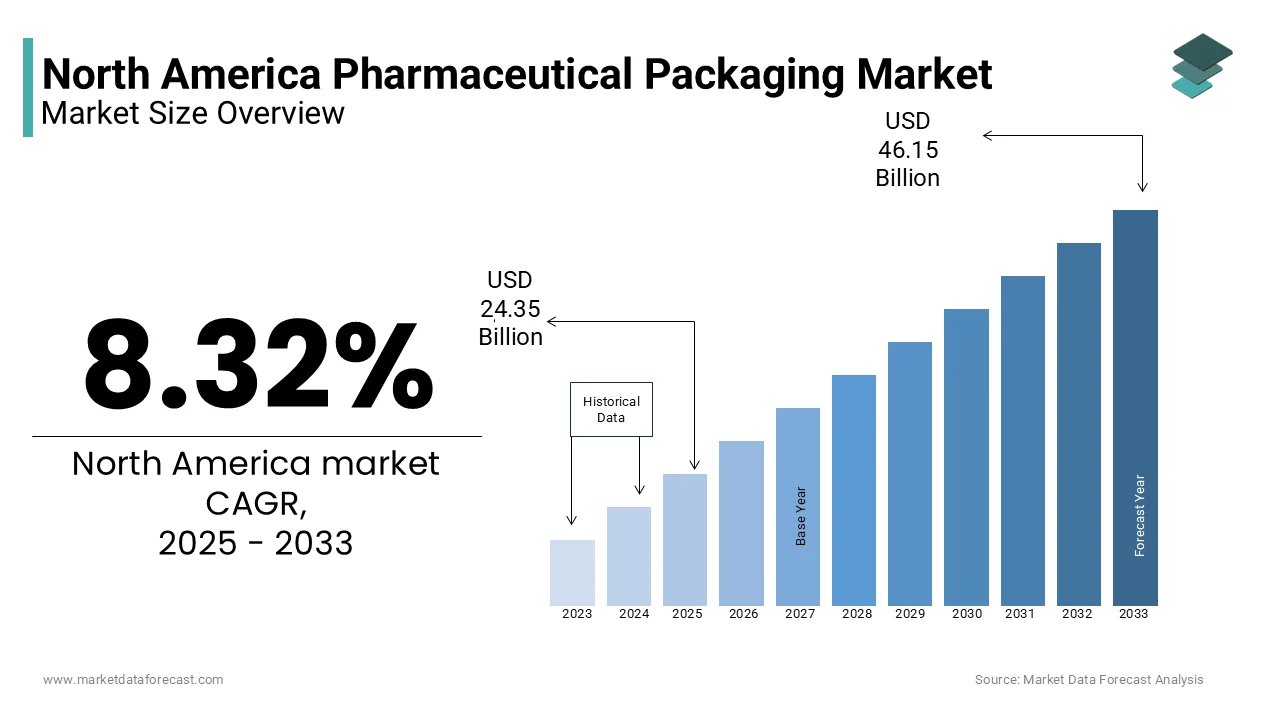

The North American Pharmaceutical Packaging Market size was valued at USD 22.48 billion in 2024. The global market size is expected to reach USD 24.35 billion in 2025 and USD 46.15 billion by 2033, with a CAGR of 8.32% during the forecast period.

The North America pharmaceutical packaging market incorporates a broad range of materials, technologies, and solutions designed to protect, preserve, and deliver pharmaceutical products in compliance with regulatory standards. This includes primary packaging such as blister packs, bottles, vials, syringes, and ampoules, as well as secondary packaging like cartons, labels, and tamper-evident seals. The industry is driven by the need for product safety, patient compliance, and supply chain integrity across prescription drugs, over-the-counter medications, biologics, and specialty pharmaceuticals. North America holds a dominant position in the global pharmaceutical packaging landscape due to its robust healthcare infrastructure, strong presence of leading pharmaceutical companies, and stringent regulatory frameworks enforced by agencies such as the U.S. Food and Drug Administration (FDA). According to the Healthcare Distribution Alliance, the U.S. pharmaceutical supply chain distributed over 6 billion prescription units annually in recent years, necessitating advanced packaging solutions that ensure traceability, sterility, and counterfeiting resistance. Apart from these, the rise in chronic disease prevalence and increasing geriatric population have led to higher medication consumption, further fueling demand for secure and user-friendly packaging formats.

MARKET DRIVERS

Rising Demand for Anti-Counterfeiting and Track-and-Trace Solutions

A main aspect of the North America pharmaceutical packaging market is the escaNorthg demand for anti-counterfeiting and track-and-trace technologies. With the proliferation of counterfeit medicines posing serious risks to public health and brand integrity, pharmaceutical companies are increasingly adopting smart packaging features such as holograms, QR codes, RFID tags, and serialized barcodes. According to the World Health Organization (WHO), counterfeit medicines account for up to 10% of the global pharmaceutical trade, prompting regulators and manufacturers to invest heavily in secure packaging solutions. In response, the FDA has mandated compliance with the Drug Supply Chain Security Act (DSCSA), requiring full serialization and traceability of prescription drugs by 2024. As per the Healthcare Distribution Alliance, this regulatory push has significantly increased the adoption of digital tracking systems within pharmaceutical packaging. Companies like WestRock and Amcor have introduced integrated smart packaging platforms that enable real-time monitoring of drug authenticity and distribution pathways. Moreover, consumer awareness regarding medication safety has grown, particularly in the wake of high-profile drug recalls and online pharmacy fraud cases.

Increasing Focus on Patient-Centric and Compliance-Oriented Packaging

Another driver shaping the North America pharmaceutical packaging market is the growing emphasis on patient-centric and compliance-oriented packaging solutions. With an aging population and rising prevalence of chronic diseases, there is an urgent need for packaging that enhances medication adherence and simplifies administration. According to the Centers for Disease Control and Prevention (CDC), nearly 90% of older adults in the U.S. suffer from at least one chronic condition, many of which require long-term or complex medication regimens. To solve this challenge, pharmaceutical packaging providers are introducing innovative designs such as easy-open blister packs, dose reminder labels, color-coded compartments, and auto-injector pens. Companies like Aptar and Becton Dickinson have launched integrated adherence packaging systems tailored for elderly and visually impaired patients. Besides, advancements in connected packaging—such as sensor-equipped blister packs and mobile app-linked dispensers—are gaining traction, offering real-time feedback on medication intake. Furthermore, regulatory bodies and healthcare providers are advocating for improved packaging ergonomics to reduce medication errors and enhance usability.

MARKET RESTRAINTS

Regulatory Complexity and Compliance Burdens

One of the major restraints affecting the North America pharmaceutical packaging market is the complexity and stringency of regulatory requirements imposed by agencies such as the U.S. Food and Drug Administration (FDA) and Health Canada. These regulations govern everything from material safety and labeling accuracy to serialization mandates and environmental compliance, creating a demanding operational landscape for packaging manufacturers. Under the Drug Supply Chain Security Act (DSCSA), pharmaceutical packaging must incorporate unique identifiers for each package to enable traceability throughout the supply chain. As per the Healthcare Distribution Alliance, compliance with these serialization standards has required substantial investments in printing technology, data management systems, and packaging line modifications. Smaller packaging firms, in particular, face challenges in adapting to these evolving norms without compromising production efficiency or cost competitiveness. Also, environmental regulations are tightening, particularly concerning single-use plastics and recyclability. According to the Environmental Protection Agency (EPA), plastic packaging waste constitutes a significant portion of municipal solid waste, prompting stricter guidelines on sustainable alternatives. Many pharmaceutical packaging suppliers are now compelled to reformulate materials or redesign packaging structures to meet eco-label certifications, adding layers of complexity and cost to an already highly regulated industry.

High Raw Material and Production Costs

High Raw Material and Production Costs

Another critical restraint influencing the North America pharmaceutical packaging market is the rising cost of raw materials and manufacturing inputs, which significantly impacts profit margins and pricing strategies. Packaging materials such as aluminum, polyethylene terephthalate (PET), polypropylene, and specialty adhesives are subject to price volatility due to fluctuations in crude oil prices, supply chain disruptions, and geopolitical tensions. According to the American Chemistry Council, resin prices—a key component in plastic pharmaceutical packaging—increased by double digits in 2023 compared to the previous year, driven by energy market instability and transportation bottlenecks. Moreover, the shift toward sustainable packaging materials—such as bio-based polymers and recyclable films—has introduced additional cost burdens. While these alternatives align with corporate sustainability goals and regulatory expectations, they often come at a premium compared to conventional materials.

MARKET OPPORTUNITIES

Growth in Biopharmaceutical and Specialty Drug Packaging

A significant opportunity emerging in the North America pharmaceutical packaging market is the rapid expansion of biopharmaceutical and specialty drug formulations, which require highly specialized packaging solutions. Unlike traditional small-molecule drugs, biologics are sensitive to temperature, light, and contamination, necessitating advanced containment, cold-chain compatibility, and aseptic handling protocols. According to the Biotechnology Innovation Organization (BIO), over 900 biologic therapies were in clinical development in the U.S. in 2023, signaling a major shift toward complex, injectable, and personalized treatments. This trend is driving demand for pre-filled syringes, dual-chamber vials, and temperature-controlled packaging systems capable of preserving drug integrity throughout the supply chain. Companies like Stevanato Group, SCHOTT Pharma, and Gerresheimer have expanded their portfolios to include ready-to-use vials, silicone-free containers, and smart injection devices tailored for biologics and gene therapies. Moreover, the rise of home-based biologic treatments for conditions such as rheumatoid arthritis and multiple sclerosis has intensified the need for patient-friendly, self-administered packaging formats.

Adoption of Sustainable and Eco-Friendly Packaging Solutions

An additional opportunity shaping the North America pharmaceutical packaging market is the accelerating adoption of sustainable and eco-friendly packaging solutions. Driven by regulatory pressure, corporate sustainability commitments, and consumer demand for greener products, pharmaceutical companies are increasingly prioritizing recyclable, biodegradable, and reduced-material packaging options. According to the Environmental Protection Agency (EPA), pharmaceutical packaging contributes significantly to healthcare-related waste, with millions of tons of plastic and paperboard discarded annually. In response, major pharmaceutical and packaging firms are collaborating to develop lightweight containers, plant-based resins, and mono-material packaging structures that facilitate recycling and minimize environmental impact. Leading packaging manufacturers such as Amcor, WestRock, and Constantia Flexibles have introduced certified recyclable blister packs, paper-based desiccants, and water-based inks to replace conventional petroleum-derived components. Also, extended producer responsibility (EPR) laws in states like California and New York are pushing companies to adopt circular economy models, where packaging waste is systematically collected and repurposed.

MARKET CHALLENGES

Ensuring Compatibility Between Packaging Materials and Drug Formulations

A critical challenge facing the North America pharmaceutical packaging market is the need to ensure absolute compatibility between packaging materials and drug formulations. Pharmaceuticals are highly sensitive to external contaminants, moisture, oxygen, and chemical interactions, making it imperative that packaging materials do not compromise drug stability or efficacy. This challenge is particularly pronounced in the case of biologics, peptides, and highly potent drugs, which require barrier protection against permeation, leaching, and sorption effects. According to the United States Pharmacopeia (USP), extractables and leachables from packaging components can alter drug composition and pose safety risks, necessitating extensive testing and validation before commercialization. Regulatory scrutiny around packaging-drug interaction has intensified, especially under FDA guidelines that mandate rigorous analytical assessments. As per the Parenteral Drug Association (PDA), pharmaceutical firms must conduct multi-stage compatibility studies involving accelerated aging, migration analysis, and risk assessment frameworks, all of which extend development timelines and increase costs.

Managing Rapid Technological Changes and Digital Integration

Managing Rapid Technological Changes and Digital Integration

The North America pharmaceutical packaging market is grappling with the challenge of managing rapid technological advancements and integrating digital functionalities into traditional packaging systems. Innovations such as smart labels, embedded sensors, blockchain authentication, and IoT-enabled packaging are transforming how pharmaceutical products are tracked, dispensed, and monitored. However, implementing these technologies requires significant capital investment, skilled workforce training, and alignment with existing manufacturing workflows. Also, pharmaceutical companies must navigate cybersecurity concerns associated with connected packaging, including data privacy and potential breaches in supply chain integrity. As per the Healthcare Information and Management Systems Society (HIMSS), cyber threats targeting healthcare supply chains have surged in recent years, raising concerns about the safety of digitally enabled packaging solutions.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

8.32% |

|

Segments Covered |

By Product Type, Material, Packaging Type, Drug Delivery Mode, and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

The United States, Canada, Mexico, and Rest of North America |

|

Market Leaders Profiled |

Amcor plc (Australia), Gerresheimer AG (Germany), Berry Global Inc. (US), Schott AG (Germany), and AptarGroup Inc. (US), and others. |

SEGMENTAL ANALYSIS

By Product Type Insights

Blister packs symbolised the largest segment in the North America pharmaceutical packaging market, capturing approximately 34% of total market share in 2024. This control over the market is credited to their widespread use in over-the-counter (OTC) medications, prescription drugs, and unit-dose packaging due to advantages such as product visibility, tamper resistance, and patient convenience. An important aspect to this segment’s prowess is the increasing demand for child-resistant and senior-friendly packaging formats. Besdies, blister packaging allows for compact design and lightweight material usage, reducing shipping costs and enhancing sustainability profiles. Moreover, blister packs are ideal for moisture-sensitive formulations, offering superior barrier protection against humidity and contamination. Also, blister packaging reduces dispensing errors and improves medication compliance, particularly among elderly patients managing multiple prescriptions.

Syringes are the most dynamic segment within the North America pharmaceutical packaging market, predicted to rise at a CAGR of 8.1%. This quick development is basically driven by the expanding use of injectable drug therapies, including biologics, vaccines, and self-administered treatments for chronic conditions like diabetes and autoimmune diseases. A main point fueling this expansion is the rise in home healthcare settings, where prefilled syringes offer greater ease of use and reduced risk of dosing errors. According to the American Diabetes Association, a large number of Americans suffer from diabetes, with a significant portion relying on daily insulin injections, reinforcing the need for safe and efficient syringe packaging. Also, the surge in biopharmaceutical development has heightened demand for high-quality glass and polymer-based syringes that maintain drug integrity and prevent contamination.

REGIONAL ANALYSIS

The United States occupied the dominant position in the North America pharmaceutical packaging market, accounting for a 85.3% of the regional market share in 2024. This is caused by its well-established pharmaceutical industry, robust regulatory environment, and high investment in research and development. A major growth driver is the country's leading role in biopharmaceutical innovation. According to the Biotechnology Innovation Organization (BIO), the U.S. accounts for nearly half of global biopharma R&D expenditures, necessitating advanced packaging solutions that ensure stability and safety for complex drug formulations. Additionally, the presence of top-tier pharmaceutical companies and packaging manufacturers—such as Amcor, Becton Dickinson, and WestRock—has facilitated continuous advancements in serialization, smart packaging, and sustainable materials. The implementation of the Drug Supply Chain Security Act (DSCSA) has further strengthened the need for secure, traceable packaging systems, reinforcing the U.S. as a model for regulatory excellence in pharmaceutical packaging.

Canada is experiencing steady growth due to demographic shifts, government initiatives promoting drug affordability, and increasing adoption of patient-centric packaging. A key growth factor is the country’s rapidly aging population. This has led to increased demand for easy-open blister packs, multi-dose organizers, and adherence-enhancing packaging formats tailored for seniors. Furthermore, recent healthcare reforms such as the National Strategy for Pharmaceuticals and the introduction of generic drug price caps have spurred pharmaceutical firms to invest in cost-effective yet compliant packaging solutions. The Canadian Agency for Drugs and Technologies in Health (CADTH) highlights that medication non-adherence costs the healthcare system billions annually, prompting stakeholders to prioritize packaging innovations that improve therapeutic outcomes. With ongoing investments in biopharma manufacturing and sustainable packaging technologies, Canada is strengthening its position as a strategic player in the evolving pharmaceutical packaging landscape.

The Rest of North America exhibits early-stage growth potential due to expanding pharmaceutical production capacity and improving healthcare infrastructure. Mexico, in particular, is emerging as a pharmaceutical manufacturing hub, supported by its proximity to the U.S. and favorable trade agreements under USMCA. Additionally, public health programs aimed at expanding access to essential medicines are driving investments in basic and child-resistant packaging solutions. However, challenges such as inconsistent regulatory enforcement, limited cold-chain logistics, and lower disposable incomes continue to restrict large-scale commercialization. Despite these constraints, Mexico’s growing industrial base and integration into North American supply chains suggest untapped opportunities for pharmaceutical packaging providers seeking diversification beyond traditional markets.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Amcor plc (Australia), Gerresheimer AG (Germany), Berry Global Inc. (US), Schott AG (Germany), and AptarGroup Inc. (US) are the key players in the North America pharmaceutical packaging market.

The North America pharmaceutical packaging market is highly competitive, characterized by the presence of established multinational corporations alongside agile regional players. Major firms such as Amcor, WestRock, Becton Dickinson, Gerresheimer, and Aptar dominate due to their extensive product portfolios, technological expertise, and deep-rooted relationships with pharmaceutical clients. These companies continuously invest in innovation to meet evolving regulatory standards, patient needs, and sustainability mandates.

At the same time, mid-sized and niche players are gaining traction by focusing on specific packaging formats, such as child-resistant blister packs, serialized cartons, or temperature-controlled vials for biologics. Startups and specialty converters are also emerging with digital packaging solutions, antimicrobial coatings, and eco-friendly alternatives that challenge traditional business models.

Regulatory pressures, particularly under the Drug Supply Chain Security Act (DSCSA), have intensified competition around traceability and anti-counterfeiting capabilities. Additionally, the growing demand for personalized medicines and home healthcare treatments has led to increased customization in packaging design, further diversifying the market landscape. As pharmaceutical companies seek partners capable of delivering both compliance and innovation, the competition in North America remains dynamic and rapidly evolving.

TOP PLAYERS IN THE MARKET

Amcor plc

Amcor is a global leader in responsible packaging solutions and holds a strong presence in the North America pharmaceutical packaging market. The company offers a comprehensive portfolio of flexible and rigid packaging products tailored for injectables, oral solid dosage forms, and biologics. Amcor emphasizes sustainability through its commitment to developing recyclable and reduced-material packaging formats. Its strategic acquisitions and continuous R&D investments have reinforced its position as a preferred partner for major pharmaceutical firms seeking innovative and compliant packaging solutions.

WestRock Company

WestRock plays a pivotal role in shaping the North America pharmaceutical packaging landscape with its advanced paper-based and corrugated packaging solutions. The company specializes in secondary and tertiary packaging, including folding cartons, labels, and tamper-evident containers that integrate serialization and anti-counterfeiting features. WestRock’s emphasis on digital printing, smart packaging technologies, and sustainable sourcing has made it a key player in secure and patient-centric pharmaceutical packaging design and production across the region.

Becton Dickinson (BD)

Becton Dickinson is a leading innovator in primary pharmaceutical packaging, particularly in the syringes and injection devices segment. BD develops high-precision, prefillable glass and polymer syringes designed for biologics, vaccines, and self-administered therapies. The company focuses on enhancing drug delivery safety, reducing medication errors, and improving patient adherence through integrated packaging systems. BD's strong relationships with biopharma clients and regulatory expertise have positioned it as a critical enabler of next-generation pharmaceutical packaging solutions in North America.

TOP STRATEGIES USED BY THE KEY MARKET PLAYERS

Investing in Sustainable and Eco-Friendly Packaging Solutions

Major players are prioritizing the development of recyclable, biodegradable, and lightweight packaging materials to align with evolving environmental regulations and corporate sustainability goals. Companies like Amcor and WestRock are introducing mono-material films, plant-based resins, and certified recyclable cartons to reduce their ecological footprint while maintaining product integrity and compliance.

Enhancing Digital Integration and Smart Packaging Capabilities

Pharmaceutical packaging leaders are incorporating digital elements such as QR codes, RFID tags, and blockchain-enabled traceability into their designs. These technologies support anti-counterfeiting measures, supply chain transparency, and patient engagement, offering added value to pharmaceutical manufacturers and healthcare providers alike.

Expanding Through Strategic Collaborations and Acquisitions

To strengthen their market positions, companies are engaging in strategic mergers, acquisitions, and partnerships. These moves enable access to new technologies, broaden geographic reach, and enhance capabilities in specialized segments such as biopharma packaging, injectable containment, and serialization solutions tailored for regulatory compliance in North America.

RECENT HAPPENINGS IN THE MARKET

- In January 2024, Amcor launched a fully recyclable polyethylene (PE) blister pack designed specifically for prescription medications, aiming to reduce plastic waste while maintaining barrier protection and compliance with FDA packaging standards.

- In May 2024, WestRock announced a strategic partnership with a leading pharmaceutical serialization software provider to integrate real-time track-and-trace capabilities directly into its folding carton production lines, enhancing supply chain security and regulatory compliance.

- In September 2023, Becton Dickinson introduced a new line of silicone-free prefilled syringes engineered to minimize protein aggregation in biologic drugs, addressing a critical need in the expanding injectables market and strengthening its position in primary pharmaceutical packaging.

- In March 2024, a consortium of North American pharmaceutical packaging firms collaborated with a circular economy initiative to pilot a nationwide take-back program for used blister packs and medicine cartons, aiming to improve recycling rates and support corporate ESG goals.

- In November 2024, a U.S.-based sustainable packaging startup secured venture capital funding to scale its production of compostable tablet pouches made from plant-based polymers, targeting over-the-counter medication brands looking to transition away from conventional plastics in North America.

MARKET SEGMENTATION

This research report on the North America pharmaceutical packaging market is segmented and sub-segmented into the following categories.

Product Types

- Medical Pouches

- Blister Packs

- Vials

- Ampoules

- Cartridges

- Syringes

By Material

- Based on material

- Plastics

- Glass

- Metal

- Paper & paperboard

By Packaging Type

- Primary

- Secondary

- Tertiary.

By Drug Delivery Mode Analysis

- Oral drug delivery packaging

- Injectable packaging

- Topical drug delivery packaging

- Pulmonary drug delivery packaging

- Transdermal drug delivery packaging

- Ocular drug delivery packaging

- Nasal drug delivery packaging

- Others.

By Country

- The United States

- Canada

- Mexico

- Rest of North America

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com