North America Polyacrylamide Market Size, Share, Trends & Growth Forecast Report By Product (Cationic, Anionic), Application, and Country (The United States, Canada and Rest of North America), Industry Analysis From 2025 to 2033

North America Polyacrylamide Market Size

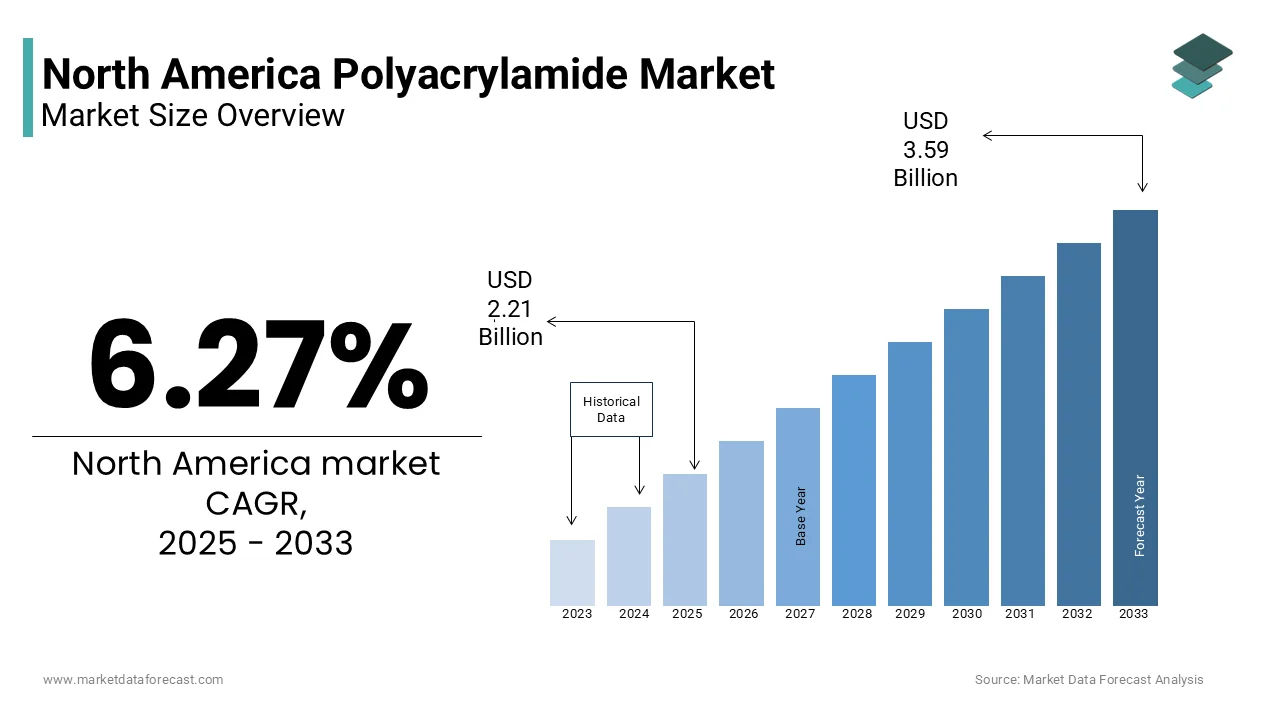

The Polyacrylamide market size in North America was valued at USD 2.08 billion in 2024 and is predicted to be worth USD 3.59 billion by 2033 from USD 2.21 billion in 2025 and grow at a CAGR of 6.27% from 2025 to 2033.

The North American polyacrylamide market is a significant contributor to the global industry, driven by robust industrialization and extensive usage in sectors such as water treatment, oil and gas, and paper manufacturing. As per a report from Grand View Research, the region accounted for approximately 28% of the global polyacrylamide demand in 2022, reflecting its dominant position. The United States serves as the primary consumer, with Canada also emerging as a key player due to increasing investments in wastewater management infrastructure.

A critical factor shaping the market scenario is the growing emphasis on sustainable water treatment solutions. According to the Environmental Protection Agency (EPA), nearly 30 billion gallons of wastewater are treated daily in the U.S., creating a substantial demand for flocculants like polyacrylamide. Furthermore, the shale gas boom has amplified the compound's adoption in enhanced oil recovery processes. Data from the U.S. Energy Information Administration indicates that shale gas production reached 84 billion cubic feet per day in 2022, underscoring the material's importance in this sector.

Despite these favorable conditions, regulatory scrutiny over the environmental impact of polyacrylamide residues remains a concern. Stringent guidelines issued by agencies such as the Occupational Safety and Health Administration (OSHA) have necessitated the development of eco-friendly variants. These dynamics create a complex yet promising landscape for the North American polyacrylamide market.

MARKET DRIVERS

Rising Demand in Water Treatment Applications

Polyacrylamide plays a pivotal role in water treatment processes, particularly as a flocculant to remove suspended particles and impurities. The North American region faces escalating challenges related to water scarcity and contamination, prompting increased investment in advanced purification technologies. According to the World Health Organization (WHO), around 2.2 billion people globally lack access to safe drinking water, with North America witnessing significant stress on freshwater resources due to urbanization and industrial activities. In response, municipalities and industries are adopting polyacrylamide-based solutions at an accelerated pace. For instance, the American Water Works Association estimates that water utilities in the U.S. spend over $100 billion annually on infrastructure upgrades, including treatment facilities.

Expansion of Enhanced Oil Recovery (EOR) Techniques

The oil and gas sector represent another major driver for polyacrylamide demand in North America. Enhanced oil recovery methods, which utilize polymers like polyacrylamide to improve extraction efficiency, have gained traction amid fluctuating crude oil prices and depleting reserves. The Society of Petroleum Engineers states that EOR techniques contribute to approximately 3-5% of total U.S. oil production, with polymer flooding being one of the most effective approaches. Statistical data from the U.S. Department of Energy reveals that EOR projects could potentially unlock an additional 60 billion barrels of oil across the country. This underscores the immense potential for polyacrylamide utilization. Moreover, the resurgence of domestic energy production following the shale revolution further amplifies demand, positioning the material as a cornerstone of technological advancements in the hydrocarbon sector.

MARKET RESTRAINTS

Stringent Environmental Regulations

One of the primary restraints affecting the North American polyacrylamide market stems from stringent environmental regulations targeting residual monomers and their ecological impact. Acrylamide, a key raw material in polyacrylamide synthesis, is classified as a probable human carcinogen by the International Agency for Research on Cancer (IARC). Regulatory bodies such as the Environmental Protection Agency (EPA) enforce strict limits on acrylamide concentrations in treated water and soil, compelling manufacturers to adopt costly purification technologies. A study published by the National Institutes of Health highlights that even trace amounts of unreacted acrylamide can pose long-term health risks, leading to heightened scrutiny during product approvals. These compliance requirements not only increase operational costs but also slow down innovation cycles, thereby constraining market growth.

Volatility in Raw Material Prices

Another significant restraint is the volatility in prices of key raw materials such as acrylonitrile and acrylic acid, which are essential precursors for polyacrylamide production. Fluctuations in crude oil prices directly influence the availability and cost of these feedstocks, given their petrochemical origins. According to data from the U.S. Energy Information Administration, crude oil price variations averaged 30% annually over the past decade, creating uncertainty for manufacturers reliant on stable input costs. This instability forces companies to either absorb higher expenses or pass them onto consumers, negatively impacting profitability margins. Additionally, supply chain disruptions caused by geopolitical tensions exacerbate this issue, making it challenging for stakeholders to forecast production schedules effectively. Such economic pressures act as a deterrent to sustained market expansion.

MARKET OPPORTUNITIES

Advancements in Biodegradable Polyacrylamide Variants

The development of biodegradable and environmentally friendly polyacrylamide formulations presents a transformative opportunity for the North American market. Growing awareness about sustainability has led industries to seek alternatives that minimize ecological footprints while maintaining performance standards. Research conducted by the American Chemical Society indicates that biodegradable polymers can degrade within six months under natural conditions, significantly reducing environmental hazards compared to conventional counterparts. This shift aligns with regulatory frameworks promoting green chemistry, offering manufacturers a competitive edge. For example, initiatives by the EPA’s Safer Choice program encourage the adoption of safer chemical substitutes, opening lucrative avenues in sectors such as agriculture and wastewater management. Industry forecasts suggest that the global market for bio-based polymers could reach $10 billion by 2027, with North America poised to capture a substantial share due to its proactive stance on sustainability.

Increasing Adoption in Mining Operations

Another promising opportunity lies in expanding applications within the mining industry, where polyacrylamide serves as a vital agent for solid-liquid separation and tailings management. The Mining Association of Canada reports that mineral extraction generates over 100 million tons of waste annually, necessitating efficient processing solutions. Polyacrylamide aids in clarifying process water and thickening slurry, enhancing operational efficiency and reducing environmental liabilities. As per data from the U.S. Geological Survey, mineral production in North America is projected to grow by 4% annually through 2030, driven by rising demand for metals like copper and lithium. This surge creates a fertile ground for polyacrylamide suppliers to penetrate new client bases and diversify revenue streams. Collaborations with mining firms focused on sustainable practices further amplify growth prospects, positioning the material as indispensable in modern metallurgical operations.

MARKET CHALLENGES

Intense Competition Among Regional Players

The North American polyacrylamide market is characterized by intense competition among regional players striving to gain dominance, posing a significant challenge for smaller enterprises. Established giants such as BASF SE and SNF Group dominate the landscape, leveraging economies of scale and extensive distribution networks. According to a report by Business Wire, these companies collectively hold over 60% of the market share, leaving limited room for emerging competitors. Smaller firms often struggle to match the pricing strategies and technological prowess of their larger counterparts, resulting in fragmented market dynamics. Furthermore, mergers and acquisitions are increasingly common, This consolidation trend intensifies barriers to entry, making it difficult for new entrants to establish themselves without substantial capital investment or innovative offerings.

Dependence on Imports for Key Raw Materials

Another pressing challenge involves the heavy reliance on imported raw materials, particularly acrylonitrile and acrylic acid, which are sourced predominantly from Asia-Pacific nations. The U.S. International Trade Commission states that imports account for nearly 40% of the country’s acrylonitrile supply, exposing manufacturers to geopolitical risks and logistical uncertainties. Disruptions caused by events such as trade wars or pandemics can severely impact supply chains, driving up costs and delaying production timelines. For instance, during the height of the COVID-19 pandemic, shipping delays resulted in a 15% spike in raw material prices, according to data from the American Chemistry Council. This dependence not only undermines operational stability but also weakens the bargaining power of North American producers vis-à-vis international suppliers. Addressing this vulnerability requires strategic investments in local manufacturing capabilities, though such endeavors face high upfront costs and technical complexities.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

6.27% |

|

Segments Covered |

By Product, Application, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

The United States, Canada, Mexico, and Rest of North America |

|

Market Leaders Profiled |

Anhui Jucheng Fine Chemicals Co., LTD, Ashland Inc., BASF SE, Kemira Oyj, SNF Group, Black Rose Industries Ltd., Shandong Baomo Biochemical Co., Ltd., Xitao Polymer Co., Ltd., The Dow Chemical Company (Dow Corning Ltd.), and Solvay SA, and others |

SEGMENTAL ANALYSIS

By Product Insights

Anionic polyacrylamide dominates the North American market. This significant share is driven by its widespread use in water treatment and mineral processing applications, where its high molecular weight and negative charge make it ideal for flocculation processes. A key factor propelling its dominance is the escalating demand for clean water across the region. The U.S. Environmental Protection Agency estimates that over 40 billion gallons of wastewater are treated daily in the United States alone, with anionic polyacrylamide playing a critical role in removing suspended solids and impurities.

Another driving force is its application in mining operations. According to the Mining Association of Canada, mineral extraction generates nearly 100 million tons of waste annually, necessitating efficient solid-liquid separation solutions. Anionic polyacrylamide facilitates this process by improving sedimentation rates and reducing water content in tailings. Its cost-effectiveness compared to other alternatives further cements its position as the preferred choice. Additionally, advancements in polymerization technologies have enhanced the performance characteristics of anionic variants, making them more versatile and reliable. These factors collectively ensure the segment’s sustained leadership in the market.

This rapid expansion is fueled by its increasing adoption in sludge dewatering and paper manufacturing processes. In wastewater treatment plants, cationic polyacrylamide is indispensable for conditioning and dewatering sludge, enabling efficient disposal or reuse. Data from the American Water Works Association reveals that sludge management accounts for up to 50% of operational costs in municipal facilities, underscoring the importance of effective solutions provided by cationic variants.

Another factor driving its accelerated growth is the growing emphasis on sustainable practices in the pulp and paper industry. The U.S. Forest Service reports that the paper sector consumes around 40% of global industrial wood production, creating immense pressure to optimize resource utilization. Cationic polyacrylamide aids in improving retention and drainage during papermaking, reducing energy consumption and raw material wastage. Furthermore, innovations in biodegradable formulations are addressing environmental concerns, broadening its appeal. These dynamics position cationic polyacrylamide as the most dynamic segment within the product category.

By Application Insights

The water treatment application holds the largest share of the North American polyacrylamide market, accounting for approximately 58% as per MarketsandMarkets. This dominance is attributed to the region's mounting challenges related to water scarcity and contamination. According to the World Health Organization, over 2.2 billion people globally lack access to safe drinking water, with North America experiencing heightened stress due to urbanization and industrial activities. Polyacrylamide serves as a critical flocculant in treating both potable and wastewater, ensuring compliance with stringent regulatory standards.

A pivotal driver is the substantial investment in water infrastructure upgrades. The American Society of Civil Engineers estimates that the U.S. requires $1 trillion in funding over the next two decades to modernize aging water systems. Polyacrylamide-based solutions are integral to these initiatives, enhancing filtration efficiency and reducing operational costs. Moreover, the rise of shale gas exploration has amplified wastewater volumes, necessitating advanced treatment methods. Data from the U.S. Energy Information Administration indicates that hydraulic fracturing generates billions of gallons of flowback water annually, further boosting demand for polyacrylamide in this segment.

This growth is driven by the expanding use of polyacrylamide in enhanced oil recovery (EOR) techniques, which aim to maximize hydrocarbon extraction from mature fields. The Society of Petroleum Engineers highlights that EOR projects contribute to 3-5% of total U.S. oil production, with polymer flooding being one of the most effective methods.

Another contributing factor is the resurgence of domestic energy production following the shale revolution. Statistical data from the U.S. Department of Energy reveals that shale gas production reached 84 billion cubic feet per day in 2022, underscoring the material's importance in maintaining output levels. Polyacrylamide enhances viscosity in injection fluids, improving sweep efficiency and recovery rates. Additionally, ongoing research into eco-friendly formulations is mitigating environmental concerns, fostering broader acceptance. These trends position the oil and gas segment as the most rapidly evolving application area.

REGIONAL ANALYSIS

This leadership stems from the country's robust industrial base and stringent regulatory frameworks governing water quality and environmental protection. The Clean Water Act mandates rigorous treatment protocols, driving demand for polyacrylamide-based solutions. According to the U.S. Geological Survey, over 85% of freshwater withdrawals in the U.S. are used for thermoelectric power generation and irrigation, highlighting the need for efficient water management systems.

Furthermore, the nation's dominance in shale gas production bolsters polyacrylamide consumption in the oil and gas sector. The U.S. Energy Information Administration states that shale gas accounts for nearly 70% of natural gas output, generating vast quantities of wastewater requiring treatment. Investments in infrastructure and technological advancements also play a crucial role. For instance, the Bipartisan Infrastructure Law allocates $55 billion for water system improvements, creating opportunities for polyacrylamide suppliers. These factors solidify the U.S.'s position as the primary contributor to regional market growth.

The country's abundant natural resources and focus on sustainable development drive polyacrylamide adoption across various sectors. The Canadian Mining Association reports that the mining industry contributes over CAD 100 billion annually to the economy, with polyacrylamide playing a vital role in tailings management and mineral processing.

Additionally, Canada's commitment to environmental stewardship fuels demand in water treatment applications. Environment and Climate Change Canada estimates that municipalities spend CAD 8 billion yearly on wastewater infrastructure, emphasizing the importance of effective purification technologies. Polyacrylamide's ability to enhance sedimentation and reduce sludge volume aligns perfectly with these objectives. Moreover, the country's participation in global trade agreements fosters access to advanced materials and technologies, supporting market expansion. These dynamics underscore Canada's significance within the regional landscape.

The nation's burgeoning industrial sector, coupled with increasing urbanization, drives demand for water treatment solutions. The Mexican Institute of Water Technology notes that only 40% of wastewater receives adequate treatment, creating a substantial opportunity for polyacrylamide-based interventions.

Another key factor is the growth of the oil and gas industry, particularly in regions like Veracruz and Tabasco. Mexico's National Hydrocarbons Commission reports that crude oil production averages 1.7 million barrels per day, with enhanced recovery techniques gaining traction. Polyacrylamide supports these efforts by improving fluid mobility and reservoir performance. Additionally, government initiatives aimed at modernizing infrastructure and promoting sustainability further bolster market prospects. These elements position Mexico as a promising contributor to regional growth.

The "Rest of North America" category includes smaller economies such as those in Central America and the Caribbean, collectively representing less than 5% of the market, according to Business Wire. Despite their modest contribution, these countries exhibit potential due to rising industrial activities and environmental awareness. The Inter-American Development Bank highlights that Central America invests heavily in renewable energy projects, which often require water treatment solutions involving polyacrylamide.

Moreover, tourism-driven economies in the Caribbean face unique challenges related to wastewater management. The Caribbean Public Health Agency estimates that untreated sewage contributes significantly to marine pollution, prompting investments in advanced purification technologies. Polyacrylamide's versatility makes it suitable for addressing these issues effectively. While current demand remains limited, ongoing development efforts and international partnerships could unlock new opportunities, gradually elevating the region's market status.

Emerging markets within North America, including Puerto Rico and other U.S. territories, are increasingly adopting polyacrylamide solutions to address localized needs. As per the Federal Emergency Management Agency, Puerto Rico faces recurring challenges related to water scarcity and stormwater management, exacerbated by climate change. Polyacrylamide aids in mitigating these issues by improving filtration efficiency and reducing contamination risks.

Similarly, Alaska's remote locations rely on innovative water treatment methods to meet community needs. The Alaska Department of Environmental Conservation emphasizes the importance of sustainable practices, given the fragile ecosystem. Polyacrylamide's adaptability to diverse conditions ensures its relevance in such settings. Although these markets currently represent a small fraction of overall demand, their strategic importance cannot be overlooked, offering untapped potential for future growth.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Anhui Jucheng Fine Chemicals Co., LTD, Ashland Inc., BASF SE, Kemira Oyj, SNF Group, Black Rose Industries Ltd., Shandong Baomo Biochemical Co., Ltd., Xitao Polymer Co., Ltd., The Dow Chemical Company (Dow Corning Ltd.), and Solvay SA are playing dominating role in the North America polyacrylamide market.

The North America polyacrylamide market is characterized by intense competition, with global giants like BASF SE, SNF Group, and Kemira Oyj dominating the landscape. These companies leverage their extensive distribution networks, cutting-edge technologies, and strong brand recognition to secure leadership positions. Innovation remains a cornerstone of competitive strategy, with firms investing heavily in developing sustainable and high-performance products. Regulatory pressures have also spurred the adoption of biodegradable variants, creating new battlegrounds for differentiation. Smaller players face significant barriers due to economies of scale enjoyed by larger entities, though niche markets offer some opportunities. Collaborations and joint ventures are common tactics to access untapped segments or enhance technological capabilities. For instance, partnerships with municipal authorities and industrial clients facilitate customized solutions tailored to specific needs. Furthermore, pricing strategies play a crucial role, as cost efficiency often determines supplier selection. Despite consolidation trends, the market remains dynamic, driven by evolving demand patterns and technological breakthroughs that continually reshape competitive dynamics.

TOP PLAYERS IN THE MARKET

BASF SE

BASF SE is a leading innovator in the polyacrylamide market, renowned for its advanced polymer technologies tailored to water treatment and oil recovery applications. The company’s commitment to sustainability has driven investments in eco-friendly formulations, aligning with stringent environmental regulations in North America. Recently, BASF launched a new line of biodegradable polyacrylamides designed to minimize ecological impact while maintaining performance standards. These efforts have strengthened its reputation as a pioneer in green chemistry solutions. By collaborating with municipalities and industrial clients, BASF continues to expand its footprint across key sectors.

SNF Group

SNF Group is a dominant player known for its high-performance polyacrylamide products used in diverse applications such as mining, paper manufacturing, and wastewater management. The company has consistently invested in research and development to enhance product efficiency and adaptability. In recent years, SNF introduced next-generation cationic polyacrylamides optimized for sludge dewatering processes, addressing critical needs in municipal wastewater treatment plants. Additionally, SNF’s strategic partnerships with regional distributors have enabled it to penetrate underserved markets effectively, solidifying its leadership position.

Kemira Oyj

Kemira Oyj specializes in delivering innovative chemical solutions for water-intensive industries, leveraging its expertise in polyacrylamide production. The company focuses on improving resource efficiency and reducing operational costs for clients. A notable recent initiative includes the development of smart polymers integrated with digital monitoring tools to optimize water treatment processes. This innovation underscores Kemira’s dedication to technological advancement. Furthermore, its active engagement in sustainability programs has reinforced its appeal among environmentally conscious stakeholders in North America.

TOP STRATEGIES USED BY KEY PLAYERS

Key players in the North America polyacrylamide market employ strategies such as product innovation, strategic collaborations, and geographic expansion to maintain competitiveness. Companies focus on developing eco-friendly formulations to meet regulatory demands and consumer preferences. Partnerships with local distributors enhance market penetration, particularly in emerging regions like Mexico. Investment in R&D drives advancements in application-specific solutions, ensuring superior performance. Additionally, mergers and acquisitions enable firms to consolidate resources and broaden their service offerings. These strategies collectively strengthen market positions while addressing evolving industry challenges and opportunities.

RECENT HAPPENINGS IN THE MARKET

- In April 2023, BASF SE launched a series of biodegradable polyacrylamides aimed at reducing environmental impact, enhancing its appeal in regulated markets.

- In June 2023, SNF Group partnered with a Canadian wastewater treatment provider to expand its presence in municipal applications across North America.

- In August 2023, Kemira Oyj introduced smart polymer solutions integrated with IoT-enabled monitoring systems, optimizing water management processes for industrial clients.

- In October 2023, Ashland Inc. acquired a regional distributor in Mexico, bolstering its supply chain capabilities and market reach in Central America.

- In February 2024, Solenis LLC collaborated with a U.S.-based shale gas operator to develop specialized polyacrylamide formulations for enhanced oil recovery projects.

MARKET SEGMENTATION

This research report on the North America polyacrylamide market has been segmented and sub-segmented based on the following categories.

By Product

- Anionic

- Cationic

- Non-ionic

By Application

- Water Treatment

- Oil & Gas

- Paper Making

- Others

By Country

- The United States

- Canada

- Rest of North America

Frequently Asked Questions

1. What are the growth opportunities in the North America Polyacrylamide Market?

The growing demand for enhanced oil recovery, water treatment applications, and shale gas exploration offers significant opportunities for polyacrylamide adoption across industrial and municipal sectors.

2. What challenges are impacting the North America Polyacrylamide Market?

Key challenges include fluctuating raw material prices, environmental concerns related to acrylamide toxicity, and regulatory scrutiny impacting production and application methods.

3. Who are the major players in the North America Polyacrylamide Market?

Leading companies include SNF Group, Kemira, BASF SE, Solenis, and Ashland, known for their advanced formulations and strong regional distribution networks.

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com