North America Powder Coatings Market Size, Share, Trends & Growth Forecast Report By Resin Type (Acrylic, Epoxy, Polyester, Polyurethane, Epoxy-Polyester, Other), End-User Industry, and Country (The United States, Canada and Rest of North America), Industry Analysis From 2025 to 2033

North America Powder Coatings Market Size

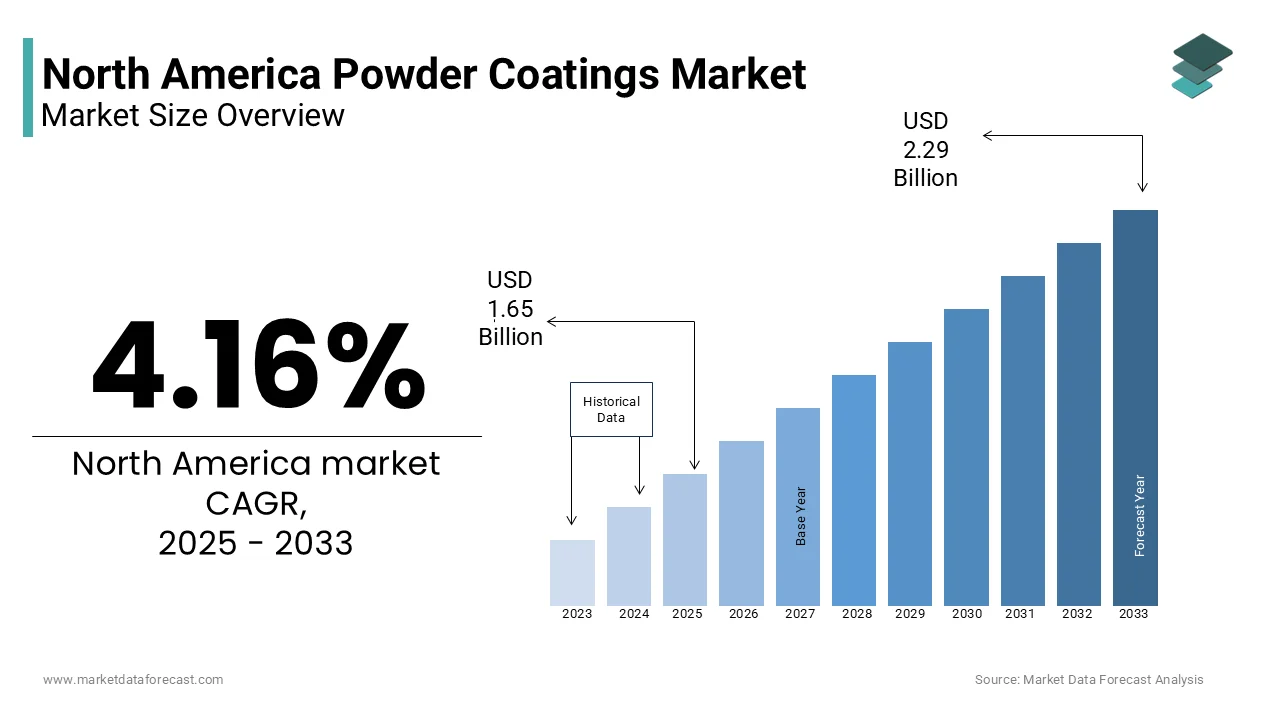

The Powder coatings market size in North America was valued at USD 1.58 billion in 2024 and is predicted to be worth USD 2.29 billion by 2033 from USD 1.65 billion in 2025 and grow at a CAGR of 4.16% from 2025 to 2033.

The North America powder coatings market includes the production, distribution, and application of solvent-free, dry coating materials that are electrostatically applied and thermally cured to provide durable, high-quality finishes on metal surfaces. These coatings emit negligible volatile organic compounds (VOCs), making them a preferred choice in industries seeking environmentally compliant surface finishing solutions. Also, their ability to meet stringent environmental regulations has further reinforced adoption, particularly in regions like California and New York where air quality standards are highly restrictive.

Moreover, the shift toward sustainable manufacturing practices and energy-efficient curing technologies has enabled broader use of powder coatings in small-to-medium enterprises.

With regulatory pressures mounting on conventional coating technologies and technological advancements improving application versatility, the powder coatings market is positioned for sustained growth across North America.

MARKET DRIVERS

Regulatory Support for Low-VOC Coating Technologies

An essential catalyst for the North America powder coatings market is the strong regulatory support for low-volatile organic compound (VOC) coating technologies. As concerns about air pollution and environmental sustainability intensify, governments at both federal and state levels have implemented increasingly stringent emissions standards governing industrial coating operations.

According to the U.S. Environmental Protection Agency, the National Emission Standards for Hazardous Air Pollutants (NESHAP) and various state-level VOC regulations have significantly curtailed the use of solvent-based coatings in key industries such as automotive, aerospace, and metal fabrication. In response, manufacturers have increasingly turned to powder coatings, which contain no solvents and release minimal hazardous emissions during application and curing.

California’s Air Resources Board (CARB) has been particularly proactive in enforcing low-VOC mandates, influencing nationwide trends in coating selection.

Moreover, Environment and Climate Change Canada has encouraged the adoption of powder coatings through its Clean Air Regulatory Agenda, offering tax incentives and compliance credits to businesses transitioning away from traditional paint systems. These policy-driven shifts have made powder coatings not only an environmentally responsible option but also a cost-effective alternative under tightening regulatory frameworks.

Expanding Applications in the Automotive and Transportation Sector

Expanding Applications in the Automotive and Transportation Sector

A significant driver fueling the growth of the North America powder coatings market is the expanding application of these coatings in the automotive and transportation industry. Powder coatings offer superior durability, impact resistance, and aesthetic appeal, making them ideal for coating wheels, chassis components, engine parts, and structural elements in vehicles ranging from passenger cars to commercial trucks and rail systems. This trend was particularly evident in electric vehicle (EV) production, where lightweight coated components contribute to overall efficiency gains without compromising performance or corrosion resistance.

The Aluminum Association highlighted that the use of powder-coated aluminum extrusions in vehicle frames and battery enclosures increased in 2023, driven by the rise of EV platforms requiring thermal management and weight reduction.

With ongoing investments in next-generation mobility solutions and infrastructure modernization, the automotive and transportation segment continues to serve as a robust growth catalyst for the North America powder coatings market.

MARKET RESTRAINTS

High Initial Equipment Investment and Application Limitations

A pressing restraint affecting the North America powder coatings market is the relatively high initial capital investment required for application equipment and facility modifications. Unlike conventional liquid paint systems, powder coating application demands specialized electrostatic spray guns, curing ovens, and booth systems, which can be prohibitively expensive for small- and medium-sized enterprises (SMEs). This financial barrier discourages smaller manufacturers from adopting powder coatings despite their long-term cost and environmental benefits.

Moreover, the technical complexity of powder coating processes requires trained personnel and dedicated space, limiting flexibility compared to more easily adaptable liquid coating techniques. Also, certain niche applications—such as complex three-dimensional parts or heat-sensitive substrates—remain unsuitable for standard powder coating procedures due to temperature constraints during the curing phase.

Fluctuations in Raw Material Prices and Supply Chain Disruptions

Another significant restraint impacting the North America powder coatings market is the volatility in raw material prices and persistent supply chain disruptions. Powder coatings rely heavily on resin polymers, pigments, curing agents, and fillers, all of which have experienced price fluctuations due to global trade dynamics, inflationary pressures, and logistical bottlenecks.

Supply chain constraints have further exacerbated cost instability. The American Chemistry Council reported that delays in resin and pigment imports from Asia and Europe led to inventory shortages at several North American coating manufacturers in 2023. These disruptions forced some companies to seek alternative suppliers at premium prices, squeezing profit margins.

Labor shortages in logistics and warehousing sectors have also contributed to extended lead times. With geopolitical uncertainties and energy market volatility expected to persist, the powder coatings industry must navigate these challenges while maintaining competitive pricing and reliable supply availability to sustain growth momentum.

MARKET OPPORTUNITIES

Adoption of Powder Coatings in Architectural and Construction Applications

An emerging opportunity for the North America powder coatings market lies in the increasing adoption of these coatings in architectural and construction applications, particularly for aluminum window frames, door systems, fencing, and structural steel components. The growing emphasis on sustainable building practices, coupled with the need for long-lasting, low-maintenance finishes, has positioned powder coatings as a preferred alternative to traditional paints and anodizing.

According to the U.S. Green Building Council, a significant portion of new non-residential buildings constructed in recent years pursued LEED certification, many of which specified powder-coated aluminum profiles to meet indoor air quality and environmental performance criteria. Powder coatings’ zero or near-zero VOC emissions align well with green building standards, making them a favored choice in schools, hospitals, and office complexes.

Besides, the Metal Building Manufacturers Association reported that demand for pre-finished metal panels and curtain wall systems surged in 2023, largely due to urban redevelopment projects and high-rise construction activity in cities like Chicago, Dallas, and Toronto. These components often utilize powder coatings for their color retention, UV resistance, and ease of cleaning.

With continued expansion in smart city initiatives and eco-conscious construction trends, the architectural segment presents a substantial growth avenue for the North America powder coatings industry.

Development of Low-Temperature and UV-Curable Powder Coatings

Another promising opportunity for the North America powder coatings market is the development and commercialization of low-temperature and ultraviolet (UV)-curable powder coating technologies. These innovations address longstanding limitations associated with conventional powder coatings, particularly the requirement for high-temperature curing, which restricts their use on heat-sensitive substrates such as plastics, wood composites, and thin-gauge metals.

Furthermore, UV-curable powder coatings—still in early adoption stages—are gaining attention for their rapid curing capabilities and compatibility with plastic and composite materials.

Additionally, the U.S. Department of Energy has recognized these advancements as part of its Sustainable Materials Management initiative, encouraging manufacturers to adopt energy-efficient coating technologies that reduce thermal load and improve throughput.

MARKET CHALLENGES

Competition from Liquid Coating Alternatives

A significant challenge confronting the North America powder coatings market is the persistent competition from liquid coating alternatives, particularly in niche and small-scale applications where process flexibility and lower upfront costs remain critical decision factors. Despite the environmental and performance advantages of powder coatings, many manufacturers—especially in the custom fabrication and repair sectors—continue to favor solvent-based and waterborne coatings due to their established application methods and wider substrate compatibility.

Unlike powder coatings, which require specialized curing equipment, liquid coatings can be applied using conventional spray systems, brushes, or immersion methods, making them more accessible to small job shops and field refinishers.

Moreover, the ability to apply thin-film coatings and achieve ultra-smooth finishes remains a key advantage of liquid systems, particularly in high-end decorative and electronics applications.

In addition, some end-users perceive liquid coatings as offering better gloss control and color consistency, especially in multi-layer applications. As per the Paint Quality Institute, recent advancements in waterborne and two-component (2K) urethane coatings have narrowed the performance gap with powder coatings, particularly in corrosion resistance and chemical durability.

Technical Complexity and Limited Workforce Expertise

A critical challenge facing the North America powder coatings market is the technical complexity involved in application processes and the shortage of skilled labor capable of managing advanced coating systems. Unlike traditional liquid painting, powder coating requires precise electrostatic charging, uniform powder deposition, and controlled thermal curing—factors that demand both technical knowledge and hands-on expertise.

Many vocational training programs have yet to fully integrate powder coating instruction, leading to a skills gap that hampers adoption among small and mid-sized enterprises.

These problems often stem from improper gun settings, incorrect oven temperatures, or inadequate pretreatment procedures—all of which require experienced technicians to troubleshoot effectively.

Moreover, the transition from liquid to powder coatings involves reconfiguring production lines, modifying part handling systems, and investing in dust collection and reclaim systems, which can be daunting for firms unfamiliar with the technology. Addressing this challenge will require greater collaboration between industry associations, educational institutions, and coating equipment providers to enhance workforce readiness and facilitate smoother adoption of powder coating technologies across North America.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

4.16% |

|

Segments Covered |

By Resin Type, End-User Industry, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

The United States, Canada, Mexico, and Rest of North America |

|

Market Leaders Profiled |

Akzo Nobel N.V., Jotun, PPG Industries, Inc., RPM International Inc., and The Sherwin-Williams Company, and others |

SEGMENTAL ANALYSIS

By Resin Type Insights

Epoxy-polyester hybrid resins represented the largest segment in the North America powder coatings market, capturing 35% of total resin consumption in 2024. This dominance is primarily attributed to the balanced performance characteristics offered by these resins, combining the excellent chemical resistance of epoxy with the superior weatherability and flexibility of polyester.

One key driver behind their widespread use is their compatibility with standard curing conditions and ease of application, making them a versatile option for mid-range performance requirements.

Moreover, cost-effectiveness plays a crucial role in sustaining demand. With growing infrastructure investments and steady adoption across general industrial applications, epoxy-polyester hybrid resins continue to maintain their leadership position in the North America powder coatings market.

Polyurethane resins are emerging as the fastest-growing segment in the North America powder coatings market, projected to expand at a CAGR of 6.8% between 2025 and 2033. This growth is primarily driven by increasing demand for high-performance coatings that offer exceptional mechanical strength, scratch resistance, and aesthetic finish—qualities highly valued in premium automotive and durable goods sectors.

A major factor contributing to this upward trend is the resin’s superior surface appearance and low-temperature curing capabilities. Additionally, the automotive industry has been a key adopter of polyurethane powders for coated bumpers, wheels, and interior trim components. Furthermore, advancements in formulation chemistry have enabled the development of low-VOC, fast-curing polyurethane powders that align with environmental regulations and production efficiency goals. As per Environment and Climate Change Canada, polyurethane powder coatings were among the top three most recommended technologies under recent green manufacturing incentives, reinforcing their market momentum.

By End-User Industry Insights

The industrial applications segment held the largest share of the North America powder coatings market, accounting for approximately 42% of total demand in 2024. This dominance is primarily driven by the extensive use of powder coatings in machinery, equipment, and fabricated metal components that require long-lasting protection against corrosion, abrasion, and harsh operating environments.

These applications benefit from powder coatings’ ability to deliver thick, uniform films without sagging or running a critical requirement for heavy-duty industrial equipment.

In addition, the rise of smart manufacturing and automation has increased demand for durable, low-maintenance finishes on robotics, conveyors, and assembly line components. The Society of Manufacturing Engineers noted that powder-coated surfaces on industrial robots showed a longer service life compared to conventional paints, enhancing overall operational efficiency.

Canada has also contributed significantly to industrial powder coating usage. Natural Resources Canada reported that metal fabricators in Ontario and Quebec increased their powder coating adoption in 2023, citing improved worker safety and reduced emissions as key motivators.

Moreover, the HVAC and plumbing equipment sector has seen rising integration of powder coatings for ductwork, radiators, and pipe fittings.

The automotive applications segment anticipated to grow most rapidly in the North America powder coatings market, anticipated to rise at a CAGR of 7.1% through 2033. This expansion is primarily fueled by increasing adoption of powder coatings for both functional and decorative purposes in passenger cars, commercial vehicles, and electric mobility platforms.

Powder coatings offer superior impact resistance, thermal stability, and corrosion protection—attributes essential for automotive components exposed to road debris, moisture, and temperature fluctuations.

One key growth driver is the shift toward lightweight materials in electric vehicles (EVs), which often rely on coated aluminum and magnesium parts to reduce weight and improve energy efficiency. Additionally, the U.S. Environmental Protection Agency encouraged the transition from liquid paint systems to powder coatings in auto manufacturing due to their near-zero VOC emissions. As reported by the American Coatings Association, several Tier 1 suppliers received tax credits for converting painting lines to powder coating systems, accelerating industry-wide adoption. Beyond OEM applications, the aftermarket segment has also gained momentum.

REGIONAL ANALYSIS

The United States continued to lead the North America powder coatings market, accounting for a 80.4% of total regional production and consumption in 2024. As the largest economy in the region, the U.S. maintains a robust manufacturing base that drives consistent demand for high-performance, environmentally compliant surface finishing solutions.

The country benefits from a mature supply chain network, advanced coating technology infrastructure, and a large customer base spanning multiple industries.

The automotive sector remains a major contributor. This includes wheel assemblies, underbody shields, and electric vehicle battery casings, where durability and sustainability are paramount.

Industrial manufacturing also sustains demand, particularly in fabricated metal products, HVAC equipment, and farm machinery. Additionally, the push for green building certifications such as LEED has reinforced the use of powder-coated aluminum in window frames and curtain walls. With a well-established industrial ecosystem and favorable regulatory environment, the U.S. continues to serve as the central hub of the North America powder coatings market.

Canada held a significant share of the North America powder coatings market in 2024, maintaining a stable but smaller presence compared to the United States. Despite its modest scale, Canada sustains a growing powder coatings industry, particularly in the architectural and industrial finishing segments.

Provinces like Ontario and Quebec remain key centers of activity, benefiting from proximity to U.S. markets and access to skilled labor.

Architectural applications have been a major growth driver. Like, powder-coated aluminum profiles are increasingly used in high-rise residential and commercial developments , particularly in Toronto, Montreal, and Vancouver, where urban renewal projects emphasize sustainable construction practices.

In addition, Canada’s commitment to reducing industrial emissions has accelerated the shift from liquid to powder coatings. Furthermore, the automotive industry has expanded its use of powder coatings for components such as wheels, suspension arms, and undercarriage parts.

The Rest of North America is gradually expanding due to growing industrial activity, foreign direct investment, and cross-border trade dynamics.

Mexico serves as the primary contributor within this sub-region, benefiting from its integration into the U.S. supply chain under the U.S.-Mexico-Canada Agreement (USMCA).

Construction activity has also played a role in driving demand. Additionally, the Mexican government has intensified efforts to promote cleaner production methods, offering incentives for companies transitioning away from solvent-based coatings. While still developing, the powder coatings market in the Rest of North America presents emerging opportunities for expansion, particularly as regional economies continue to integrate with North American supply chains and adopt more stringent environmental standards.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Akzo Nobel N.V., Jotun, PPG Industries, Inc., RPM International Inc., and The Sherwin-Williams Company are the key players in the North America powder coatings market.

The competition within the North America powder coatings market is characterized by a blend of multinational corporations, regional manufacturers, and niche specialty players striving to capture market share amid shifting industry dynamics. While global leaders dominate through scale, innovation, and brand recognition, regional players continue to thrive by offering customized solutions, localized service support, and competitive pricing. This creates a fragmented yet dynamic landscape where differentiation is achieved through technical expertise, sustainability initiatives, and customer-centric offerings.

Market participants face challenges related to raw material volatility, capital-intensive application equipment, and increasing pressure to align with environmental regulations. Some companies differentiate themselves through formulation innovations, while others focus on expanding into emerging application areas such as electric vehicles, smart infrastructure, and architectural aluminum systems.

Additionally, trade relationships between the U.S., Canada, and Mexico influence supply chain resilience and market positioning. With rising interest in green building certifications and clean manufacturing practices, the powder coatings industry must continuously adapt to remain resilient. As a result, the competitive environment remains fluid, shaped by technological progress, regulatory evolution, and shifting end-user preferences across key industrial sectors.

TOP PLAYERS IN THE MARKET

AkzoNobel

AkzoNobel is a global leader in paints and coatings, with a strong presence in the North America powder coatings market. The company offers a comprehensive portfolio of high-performance powder solutions tailored for automotive, architectural, and industrial applications. AkzoNobel is known for its innovation in sustainable coating technologies, including low-temperature curing powders and bio-based formulations. Its commitment to environmental responsibility and product excellence has made it a preferred supplier across key industries, reinforcing its leadership position in both regional and international markets.

PPG Industries

PPG Industries is a major participant in the North America powder coatings sector, recognized for its advanced formulation capabilities and extensive distribution network. The company serves a wide range of end-use markets, from automotive and aerospace to consumer electronics and construction. PPG focuses on delivering durable, high-quality finishes that meet evolving customer needs and regulatory standards. Its investment in R&D and strategic partnerships has enabled continuous product development and market expansion, contributing significantly to global advancements in coating technology and application efficiency.

BASF Coatings

BASF Coatings is a leading player in the North America powder coatings industry, offering innovative solutions that combine performance, aesthetics, and sustainability. The company leverages its chemical expertise to develop next-generation powder formulations with enhanced properties such as ultra-low bake cycles and improved flow characteristics. BASF’s emphasis on circular economy principles and digitalization in coating processes has positioned it at the forefront of industry transformation. Its influence extends beyond North America, shaping global trends in eco-friendly surface finishing technologies and industrial applications.

TOP STRATEGIES USED BY KEY PLAYERS

One of the primary strategies employed by leading companies in the North America powder coatings market is product innovation and formulation advancement . Manufacturers are investing heavily in research and development to create high-performance, sustainable, and cost-effective powder coatings that cater to evolving industry demands and regulatory requirements.

Another crucial strategy is expansion of production capacity and modernization of manufacturing facilities . Companies are upgrading existing plants with energy-efficient curing systems, automated application lines, and dust recovery technologies to enhance operational efficiency and reduce environmental impact while meeting growing demand.

Lastly, strategic acquisitions and partnerships have become a favored approach to consolidate market presence and expand technological capabilities. Leading players are acquiring specialty coating firms, forming joint ventures, and collaborating with equipment suppliers to strengthen their foothold and offer integrated solutions to customers across diverse sectors.

RECENT HAPPENINGS IN THE MARKET

- In January 2024, AkzoNobel launched a new line of ultra-low-temperature powder coatings designed for heat-sensitive substrates, expanding its application scope in furniture and MDF panel manufacturing while reinforcing its sustainability credentials.

- In March 2024, PPG Industries announced a strategic partnership with a European resin supplier to co-develop next-generation polyester and hybrid powder formulations aimed at enhancing durability and color retention in exterior architectural applications.

- In June 2024, BASF Coatings completed the expansion of its Cincinnati, Ohio facility, adding dedicated R&D and pilot-scale production units focused on developing advanced powder coating technologies tailored for North American industrial clients.

- In August 2024, Axalta Coating Systems introduced a digital color matching platform for powder coatings, enabling real-time customization and reducing lead times for automotive and custom fabrication clients across the United States.

- In November 2024, Sherwin-Williams finalized the acquisition of a mid-sized Canadian powder coatings manufacturer, strengthening its regional footprint and enhancing its ability to serve architectural and transportation equipment clients in eastern North America.

MARKET SEGMENTATION

This research report on the North America powder coatings market has been segmented and sub-segmented based on the following categories.

By Resin Type

- Acrylic

- Epoxy

- Polyester

- Polyurethane

- Epoxy-Polyester

- Other Resin Types (Polyvinyl Chloride, Polyolefins,etc.)

By End-User Industry

- Architecture and Decorative

- Automotive

- Industrial

- Other End-user Industries (Furniture, Appliances, etc.)

By Country

- The United States

- Canada

- Rest of North America

Frequently Asked Questions

1. What is the market size and CAGR of the North America powder coatings market?

The market is projected to reach USD 2.29 billion by 2033 from USD 1.65 billion in 2025, with a CAGR of 4.16%.

2. What factors are driving growth in the powder coatings market?

Eco-friendly formulations, durable finishes, and expanding automotive and appliances sectors are key drivers.

3. Which industries use powder coatings the most in North America?

Automotive, appliances, furniture, and construction industries are the largest users of powder coatings.

4. Why are powder coatings considered eco-friendly?

They contain no solvents and emit minimal VOCs, aligning with stricter environmental regulations.

5. What challenges does the powder coatings market face?

Limited application on heat-sensitive substrates and high initial setup costs pose key challenges.

6. What trends are emerging in the North America powder coatings market?

UV-curable and low-temperature curing powders are gaining popularity for energy savings and versatility.

7. How is technology shaping the powder coatings industry?

Advances in coating uniformity, automated systems, and enhanced adhesion are improving efficiency and quality.

8. What are the opportunities for new entrants in this market?

Demand for customized colors, texture finishes, and sustainable coatings offers room for innovation.

9. How are consumer preferences influencing product development?

There’s a growing shift toward low-gloss, matte finishes and textured coatings for aesthetic appeal.

10. Which distribution channels are key in this market?

Direct sales, distributors, and online channels serve industrial clients and small-scale buyers effectively.

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com