North America Railway Management System Market Size, Share, Trends & Growth Forecast Report By Solutions (Rail Operations Management, Rail Traffic Management, Asset Management, Intelligent In-train, Safety, Security), Rail Traffic Management, and Country (The United States, Canada and Rest of North America), Industry Analysis From 2025 to 2033

North America Railway Management System Market Size

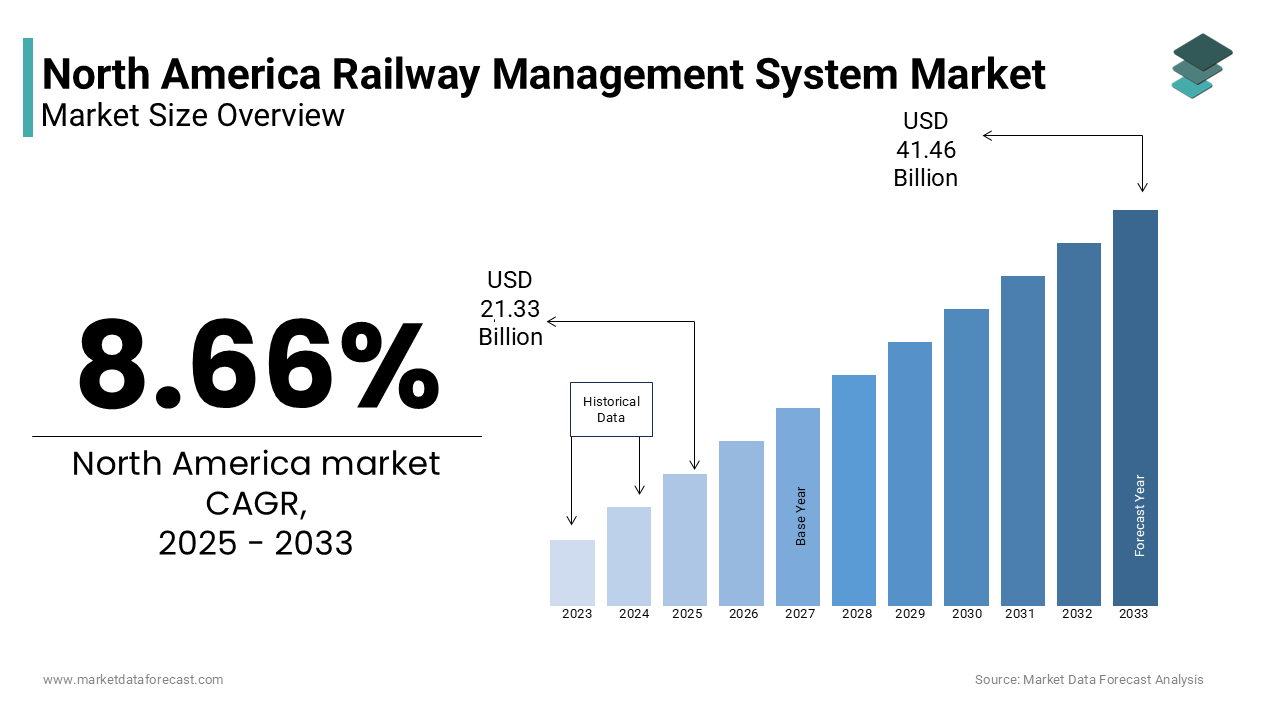

The Railway Management System market size in North America was valued at USD 19.63 billion in 2024 and is predicted to be worth USD 41.46 billion by 2033 from USD 21.33 billion in 2025 and grow at a CAGR of 8.66% from 2025 to 2033.

The North American railway management system market growth is by advancements in technology and increasing demand for efficient transportation solutions. As per the Association of American Railroads, freight railroads in the United States alone move approximately 40% of the nation’s goods. Canada and Mexico also contribute significantly to this ecosystem, with their extensive rail networks facilitating cross-border trade under agreements like the USMCA. The region has witnessed steady investments in digitalization, with predictive maintenance systems gaining traction to reduce operational downtime. Additionally, the growing emphasis on sustainability has pushed rail operators to adopt energy-efficient technologies, as railways emit 75% less greenhouse gases per ton-mile compared to trucks, as stated by the Environmental Protection Agency. Despite these positive indicators, the market faces challenges such as aging infrastructure and regulatory complexities, which hinder seamless growth.

MARKET DRIVERS

Rising Freight Transportation Demand

One of the primary drivers of the North American railway management system market is the escalating demand for freight transportation. The U.S. Department of Transportation estimates that freight volumes will increase by 30% over the next decade by necessitating more efficient rail operations. Railways are a preferred mode of transport for bulk commodities like coal, grain, and chemicals due to their cost-effectiveness and lower carbon footprint. For instance, BNSF Railway reported moving over 12 million carloads annually with the scale of operations. These systems leverage real-time data analytics to enhance decision-making by reducing delays and improving throughput.

Government Investments in Smart Infrastructure

Government initiatives aimed at modernizing rail infrastructure are another significant driver. The Biden administration’s Bipartisan Infrastructure Law allocates $66 billion specifically for rail projects, including upgrades to Amtrak services and freight lines. This funding supports the deployment of cutting-edge railway management systems, such as automated signaling and traffic control platforms. Canada’s Railway Safety Act mandates the adoption of safety-enhancing technologies is accelerating market growth. According to the Railway Association of Canada, these investments have already led to a 15% improvement in safety metrics over the past five years. Moreover, public-private partnerships are emerging as key enablers, with companies like Siemens collaborating with government bodies to deploy integrated solutions.

MARKET RESTRAINTS

Aging Infrastructure and High Upgrade Costs

A significant restraint facing the North American railway management system market is the prevalence of aging infrastructure, which poses both financial and logistical challenges. Many rail networks in the U.S. and Canada were built over a century ago and require substantial investment to modernize. The American Society of Civil Engineers (ASCE) estimates that the backlog of deferred maintenance for rail infrastructure exceeds 100billion. Such expenses strain budgets, especially for regional carriers with limited resources. Furthermore, integrating new technologies with legacy systems often leads to compatibility issues by delaying implementation timelines. This challenge underscores the need for strategic planning and phased investments to balance immediate operational needs with long-term modernization goals.

Regulatory Hurdles and Standardization Issues

Another major restraint is the complex regulatory environment governing railway operations. Regulations vary significantly between states and countries within North America by creating inconsistencies that complicate cross-border logistics. For instance, while the U.S. mandates PTC systems for passenger and hazardous material trains, similar requirements are not uniformly enforced in Canada or Mexico. Additionally, standardization issues arise when deploying railway management systems across diverse jurisdictions. Different communication protocols and data formats hinder seamless interoperability by limiting the effectiveness of centralized management platforms. Industry leaders, such as Union Pacific, have promoted these challenges as barriers to achieving fully integrated networks. Addressing these concerns requires harmonized policies and collaborative efforts among stakeholders to streamline regulations and promote uniform standards.

MARKET OPPORTUNITIES

Integration of Artificial Intelligence and Machine Learning

The integration of artificial intelligence (AI) and machine learning (ML) presents a transformative opportunity for the North American railway management system market. These technologies enable predictive analytics by allowing operators to anticipate equipment failures before they occur. For instance, Canadian National Railway implemented an ML-based system that analyzes sensor data from locomotives by resulting in a 25% reduction in mechanical failures. Beyond maintenance, AI enhances operational efficiency by optimizing train schedules and routing decisions. As railways increasingly adopt smart technologies, AI and ML will play pivotal roles in driving innovation and unlocking new revenue streams.

Expansion of Passenger Rail Services

The expansion of passenger rail services represents another promising opportunity. With urbanization rates rising, cities across North America are investing in commuter rail networks to alleviate traffic congestion. According to the American Public Transportation Association, ridership on light rail and subway systems increased by 12% in 2022 compared to pre-pandemic levels. Projects like California’s High-Speed Rail aim to connect major metropolitan areas, creating demand for advanced management systems to handle increased passenger volumes. Similarly, Amtrak plans to expand its Northeast Corridor services, requiring upgrades to signaling and traffic management platforms.

MARKET CHALLENGES

Cybersecurity Threats

As railway management systems become increasingly digitized, cybersecurity threats emerge as a critical challenge. The interconnected nature of these systems makes them vulnerable to cyberattacks, which can disrupt operations and compromise sensitive data. For example, a cyberattack on CSX Corporation temporarily halted operations across several routes by causing significant economic losses. Protecting these systems requires robust encryption protocols and continuous monitoring, yet many operators struggle to allocate sufficient resources for cybersecurity measures. This gap exposes the industry to potential breaches by undermining trust and operational reliability.

Workforce Skill Gaps

Another pressing challenge is the widening skill gap within the workforce needed to operate and maintain advanced railway management systems. As per the National Academy of Sciences, over 50% of rail industry employees are expected to retire within the next decade by leaving a void in technical expertise. Training programs have struggled to keep pace with rapid technological advancements, which is leading to a shortage of qualified personnel. For instance, Norfolk Southern reported difficulties in recruiting engineers proficient in IoT and cloud-based platforms by delaying the deployment of certain projects. Additionally, the complexity of modern systems requires specialized knowledge, which is making it challenging for existing staff to transition smoothly. A study by the Brookings Institution highlights that only 30% of rail workers receive adequate training in emerging technologies.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

8.66% |

|

Segments Covered |

By Solutions, Rail Traffic Management, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

The United States, Canada, Mexico, and Rest of North America |

|

Market Leaders Profiled |

Huawei Technologies Co., Ltd. (Huawei Investment & Holding Co., Ltd.), Siemens AG, Hitachi, Ltd., Wabtec Corporation, Cisco Systems, Inc., ABB Ltd., IBM Corporation, Honeywell International, Inc., BAE Systems PLC, and Advantech Co., Ltd, and others |

SEGMENTAL ANALYSIS

By Solutions Insights

The rail operations management segment held 35.4% of the North American railway management system market share in 2024 with the critical need for seamless coordination across rail networks in freight-heavy regions like the Midwest and Texas. One of the primary factors fueling this segment's growth is the increasing volume of freight traffic. The U.S. Department of Transportation projects that freight railroads will move over 2 billion tons annually by 2030 with advanced operational tools to manage schedules, track availability, and crew deployment. Another driving factor is the integration of IoT-based solutions, which enhance visibility and control. The regulatory mandates such as the Federal Railroad Administration’s requirement for digital record-keeping have accelerated adoption. These systems not only ensure compliance but also provide actionable insights by making them indispensable for large-scale operators.

The Intelligent In-Train segment is projected to grow with a CAGR of 18.5% from 2025 to 2033. The growth of the market can be attributed to the rapid expansion is fueled by advancements in passenger experience technologies and the rising demand for real-time connectivity on trains. A key driver is the proliferation of IoT devices within train cabins, enabling features like predictive maintenance and real-time passenger information systems. Additionally, government initiatives aimed at modernizing passenger rail services are propelling growth. Moreover, the rise of hybrid and electric locomotives has created opportunities to integrate energy-efficient in-train systems. The convergence of technological innovation and policy support positions Intelligent In-Train systems as the fastest-growing segment in the market.

By Rail Traffic Management Insights

The Centralized Traffic Control (CTC) segment was the largest with dominant share of the North America railway management systems market due to its ability to enhance safety and efficiency by providing real-time oversight of train movements across vast networks. One significant driver is the growing complexity of rail corridors in high-density freight regions like the Gulf Coast. Another contributing factor is the emphasis on reducing accidents. Additionally, regulatory mandates such as the Positive Train Control (PTC) requirements have accelerated adoption, with Class I railroads investing approximately $12 billion in PTC-compliant CTC infrastructure. These systems not only improve safety but also optimize resource allocation by reducing operational costs by up to 15%.

The signaling Systems segment is poised to grow at a CAGR of 16.2% during the forecast period with the advancements in communication-based train control (CBTC) technologies. The rapid adoption of CBTC systems is transforming signaling into a dynamic and adaptive solution for urban transit networks. Government funding plays a pivotal role in this growth. According to the American Society of Civil Engineers, these upgrades have improved punctuality rates by 25% across participating cities. Furthermore, the push toward sustainability has encouraged the integration of energy-efficient signaling technologies, which align with broader decarbonization goals.

REGIONAL ANALYSIS

The United States led the North American railway management system market with 70.3% of share in 2024 due to attributed to the country’s extensive rail network, which spans over 140,000 miles and supports both freight and passenger services. A key driver is the freight industry, which moves approximately 40% of the nation’s goods, according to the U.S. Department of Transportation. Major operators like Union Pacific and CSX Corporation have invested heavily in digital transformation by deploying AI-driven platforms to enhance operational efficiency. Federal policies also play a crucial role. According to the Federal Railroad Administration, these investments have already led to a 15% improvement in safety metrics. Additionally, the push for sustainability has spurred the adoption of energy-efficient technologies, with railways emitting 75% less greenhouse gases per ton-mile compared to trucks, as stated by the Environmental Protection Agency.

Canada railway management system market was accounted in holding 14.9% of the share in 2024. The country’s robust rail network, which extends over 49,000 kilometers, facilitates cross-border trade and resource transportation. Regulatory frameworks also contribute to growth. The Railway Safety Act mandates the adoption of safety-enhancing technologies by resulting in a 15% reduction in accidents over the past five years. Furthermore, public-private partnerships are accelerating modernization efforts, with Siemens collaborating on projects to deploy integrated traffic management systems.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Huawei Technologies Co., Ltd. (Huawei Investment & Holding Co., Ltd.), Siemens AG, Hitachi, Ltd., Wabtec Corporation, Cisco Systems, Inc., ABB Ltd., IBM Corporation, Honeywell International, Inc., BAE Systems PLC, and Advantech Co., Ltd are the key players in the North America railway management system market.

The North America railway management system market is highly competitive, characterized by technological advancements and strategic collaborations. Leading players like Siemens, Thales, and Hitachi dominate through innovation, offering solutions ranging from signaling systems to predictive maintenance platforms. The market thrives on digital transformation, with IoT, AI, and cloud-based systems gaining prominence. Government initiatives, such as the Bipartisan Infrastructure Law, fuel competition by incentivizing modernization projects. Smaller firms focus on niche segments, leveraging specialized expertise to carve out market space. This dynamic landscape fosters innovation but also intensifies rivalry, as companies strive to differentiate themselves through unique value propositions. Cybersecurity and sustainability are emerging as key battlegrounds by shaping the future trajectory of competition.

TOP PLAYERS IN THE MARKET

Siemens Mobility

Siemens Mobility is a global leader in railway technology, contributing significantly to the North American market through its innovative solutions. The company has been instrumental in modernizing rail infrastructure with advanced signaling and traffic management systems. In recent years, Siemens partnered with Amtrak to upgrade the Northeast Corridor’s signaling systems, enhancing safety and efficiency. Additionally, their investment in AI-driven predictive maintenance platforms has streamlined operations for freight carriers like BNSF Railway.

Thales Group

Thales Group has established itself as a key player through its cutting-edge signaling and communication-based train control (CBTC) systems. The company’s CBTC solutions have transformed urban transit networks, including New York City’s subway system, by improving punctuality and capacity. Thales recently collaborated with Transport Canada to enhance cybersecurity measures for rail networks, addressing growing concerns about digital vulnerabilities. Their emphasis on integrating IoT and cloud-based platforms has enabled real-time monitoring by reducing operational disruptions. Thales continues to innovate, ensuring railways remain resilient and future-ready.

Hitachi Rail

Hitachi Rail has made significant strides in the North American market by delivering intelligent in-train and asset management solutions. The company’s partnership with Metra Chicago led to the deployment of advanced passenger information systems, boosting customer satisfaction. Hitachi also launched a hybrid locomotive pilot program, reducing emissions while maintaining performance. By investing in digital twins and AI analytics, Hitachi optimizes asset utilization for freight operators. Their commitment to innovation and sustainability escalates their impact on transforming rail operations across the continent.

TOP STRATEGIES USED BY KEY PLAYERS

Key players in the North America railway management system market employ strategies such as partnerships, acquisitions, and R&D investments to strengthen their positions. Partnerships with government bodies and private operators enable tailored solutions for regional needs. For instance, Siemens collaborated with Amtrak to modernize signaling systems. Acquisitions are another critical strategy, allowing companies to expand their technological capabilities. Hitachi Rail acquired Perpetuum Ltd to enhance predictive maintenance offerings. Additionally, heavy investments in R&D drive innovation, with Thales focusing on cybersecurity to address emerging threats. These strategies ensure sustained growth and competitiveness.

RECENT HAPPENINGS IN THE MARKET

- In April 2023, Siemens partnered with Amtrak to upgrade signaling systems along the Northeast Corridor by enhancing safety and reliability.

- In June 2023, Thales Group launched a cybersecurity initiative with Transport Canada by addressing vulnerabilities in digital rail networks.

- In August 2023, Hitachi Rail acquired Perpetuum Ltd by expanding its predictive maintenance capabilities for rail assets.

- In October 2023, Alstom unveiled a new AI-driven traffic management platform by improving operational efficiency for freight operators.

- In December 2023, Wabtec Corporation introduced hybrid locomotives in collaboration with Union Pacific by reducing emissions and operational costs.

MARKET SEGMENTATION

This research report on the North America railway management system market has been segmented and sub-segmented based on the following categories.

By Solutions

- Rail Operations Management

- Rail Traffic Management

- Asset Management

- Intelligent In-train

- Safety, Security

By Rail Traffic Management

- Signaling

- Centralized Traffic Control

By Country

- The United States

- Canada

- Rest of North America

Frequently Asked Questions

1. What market opportunities are driving the growth of the North America railway management system market?

The growth is fueled by increasing investments in smart rail infrastructure, rising demand for enhanced operational efficiency, adoption of IoT and AI technologies, and government initiatives promoting sustainable and modernized transportation systems.

2. What challenges are hindering the growth of the North America railway management system market?

Major challenges include high initial setup costs, complexities in system integration across old infrastructure, cybersecurity risks, and regulatory hurdles affecting the rapid adoption of digital solutions.

3. Who are the key players in the North America railway management system market?

Key players include Siemens AG, Alstom SA, Hitachi Ltd., Bombardier Inc., and Thales Group, actively focusing on innovation, digital transformation, and expanding their regional footprint.

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com