North America Seed Treatment Market Size, Share, Growth, Trends, And Forecasts Report, Segmented By Crop Type, Function, Application, And By Region (The USA, Canada, Mexico & Rest of North America), Industry Analysis From 2025 to 2033

North America Seed Treatment Market Size

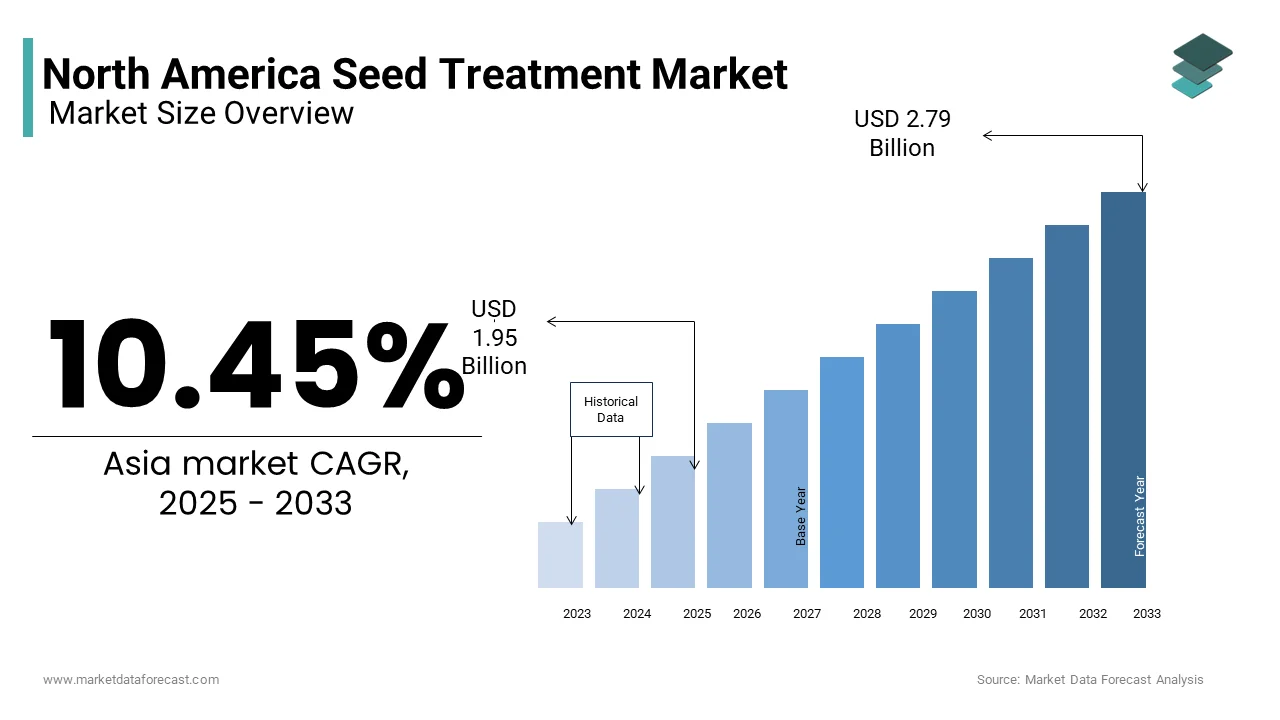

The North America seed treatment market was valued at USD 1.87 billion in 2024 and is anticipated to reach USD 1.95 billion in 2025, from USD 2.79 billion by 2033, growing at a CAGR of 10.45%, during the forecast period from 2025 to 2033.

The seed treatment process has become integral to modern agricultural practices across the United States, Canada, and Mexico, where precision farming and sustainable agriculture are increasingly prioritized. According to data from the USDA’s Economic Research Service, U.S. farmers planted over 90 million acres of corn in 2023, with more than 80% of these seeds treated with insecticides or fungicides before sowing. Furthermore, regulatory frameworks such as the Environmental Protection Agency (EPA) guidelines in the U.S. ensure the safe application of seed treatment products, fostering confidence among growers. The integration of bio-based seed treatments is also gaining momentum, with companies like BASF and Syngenta expanding their biological portfolios in response to consumer demand for eco-friendly inputs.

MARKET DRIVERS

Increasing Adoption of High-Yield Hybrid Seeds

The widespread adoption of high-yield hybrid seeds, which require enhanced protection due to their genetic uniformity and vulnerability to early-stage pests and diseases, is likely to promote the growth of the North American seed treatment market. Hybrid seeds, while offering superior yield potential, lack the natural resilience found in traditional open-pollinated varieties, which is making them more dependent on external interventions such as seed coatings with fungicides, insecticides, and biostimulants. Farmers are increasingly opting for pre-treated hybrid seeds to ensure consistent emergence and early vigor, especially in large-scale commercial farms. Moreover, the growing trend of contract farming and integrated supply chains has enabled agrochemical companies to collaborate directly with seed producers, ensuring seamless delivery of treated seeds to end users. This synergy is further supported by agronomic advisory services provided by firms such as Bayer CropScience and Corteva Agriscience, which promote the benefits of combining hybrid genetics with tailored seed protection protocols.

Rising Demand for Organic and Bio-Based Seed Treatments

A significant driver shaping the North America seed treatment market is the rising preference for organic and bio-based seed treatments, driven by environmental concerns and regulatory support for sustainable agricultural practices. According to the Organic Trade Association, certified organic cropland in the United States increased by approximately 12% between 2020 and 2023, which is creating a robust foundation for the expansion of biological seed treatment solutions. These treatments include microbial inoculants, plant extracts, and natural polymers that enhance seed performance without leaving harmful residues in soil or water systems.

Canada’s Pest Management Regulatory Agency (PMRA) has actively encouraged the registration of biopesticides, leading to a surge in product approvals. In 2023 alone, PMRA approved over 25 new bio-based seed treatment products, reflecting a regulatory environment conducive to innovation in this segment. Companies such as Marrone Bio Innovations and Koppert Biological Systems have capitalized on this trend by introducing biofungicides and biostimulants that improve root development and stress tolerance in crops like soybeans and wheat. Additionally, a survey conducted by the Canadian Fertilizer Institute revealed that 40% of surveyed farmers were willing to pay a premium for seeds treated with biologicals, citing improved soil health and reduced dependency on synthetic chemicals as key motivators.

MARKET RESTRAINTS

Stringent Regulatory Frameworks and Approval Delays

One of the primary restraints affecting the North American seed treatment market is the presence of stringent regulatory frameworks that govern the approval and usage of agrochemicals, particularly in the United States and Canada. The Environmental Protection Agency (EPA) in the U.S. mandates rigorous testing and evaluation of active ingredients used in seed treatments, including neonicotinoids and other systemic insecticides. This extended approval timeline poses a significant challenge for manufacturers aiming to introduce innovative products promptly. For instance, in 2022, Syngenta faced delays in launching its next-generation fungicidal seed treatment due to additional data requirements imposed by the EPA under the Federal Insecticide, Fungicide, and Rodenticide Act (FIFRA). Similarly, in Canada, Health Canada's Pest Management Regulatory Agency (PMRA) has implemented stricter residue limits for certain pesticides used in seed coatings, forcing companies to reformulate existing products or withdraw them entirely.

Public Concern Over Neonicotinoid Use and Pollinator Decline

Another critical restraint influencing the North American seed treatment market is the growing public concern and scientific evidence linking neonicotinoid-based seed treatments to pollinator decline, particularly affecting bee populations. Neonicotinoids, widely used as insecticidal coatings on corn, soybean, and canola seeds, have been implicated in sublethal effects on bees, including impaired navigation and reproduction.

In response, several states in the U.S., including Maryland and Connecticut, have enacted legislation limiting the use of neonicotinoids in non-agricultural settings, while advocacy groups continue to push for broader restrictions. Although enforcement has since relaxed, the stigma associated with neonicotinoid use persists, influencing grower behavior and input supplier strategies. Major agrochemical companies such as Bayer and BASF have had to invest heavily in developing alternative seed treatment chemistries, including sulfoxamine-based compounds, to replace neonicotinoids.

MARKET OPPORTUNITIES

Expansion of Precision Agriculture Technologies

A prominent opportunity driving the North America seed treatment market is the rapid expansion of precision agriculture technologies, which enable targeted and efficient application of seed treatments based on real-time field data. Precision agriculture integrates tools such as GPS-guided equipment, remote sensing drones, and variable rate technology (VRT), allowing farmers to optimize input usage and tailor seed treatments to specific field conditions. This technological shift supports the customization of seed treatment solutions, enabling agronomists and seed companies to apply precise dosages of biological and chemical treatments depending on soil type, pest pressure, and climatic conditions. For example, John Deere’s introduction of SmartSeed Technology in 2022 allows for on-the-go seed coating adjustments during planting, reducing waste and enhancing performance. In Canada, the Prairie Agricultural Machinery Institute reported a 20% increase in the use of sensor-based seeding equipment among Western Canadian farmers, reinforcing the trend toward data-driven seed management. Additionally, companies like IBM and AGvisorPRO are deploying AI-powered platforms that recommend optimal seed treatment regimens based on historical yield data and weather forecasts. As precision agriculture becomes more entrenched in mainstream farming operations, the seed treatment market stands to benefit from increased efficiency, better resource allocation, and stronger grower adoption across North America.

Growing Demand for Climate-Resilient Crops

An emerging opportunity in the North American seed treatment market is the increasing demand for climate-resilient crops capable of withstanding extreme weather events, droughts, and temperature fluctuations. With climate change intensifying, farmers are seeking seed treatments that enhance abiotic stress tolerance, improve germination under unfavorable conditions, and boost early plant vigor. Seed treatment technologies incorporating biostimulants and plant growth regulators are gaining traction as tools to mitigate climate-induced risks. For instance, seaweed extracts, humic acids, and microbial inoculants are being used to prime seeds for improved root development and moisture retention. Similarly, in the U.S., the University of Nebraska-Lincoln reported that soybean seeds coated with amino acid-based biostimulants showed enhanced cold tolerance, enabling earlier planting in northern regions affected by late frosts. Leading agrochemical firms such as UPL Limited and Nufarm are investing in R&D to develop climate-adaptive seed treatments, aligning with global sustainability goals and regional adaptation needs.

MARKET CHALLENGES

Fluctuating Raw Material Prices and Supply Chain Disruptions

A major challenge facing the North American seed treatment market is the volatility in raw material prices and ongoing disruptions in global supply chains, which impact production costs and product availability. The seed treatment industry relies heavily on active pharmaceutical ingredients (APIs), polymers, solvents, and specialty chemicals, many of which are sourced from international suppliers. For instance, China, a key supplier of intermediates used in pesticide synthesis, imposed export restrictions on certain chemicals in 2022 amid domestic supply shortages, causing delays and price hikes for seed treatment manufacturers in North America. In addition, the war in Ukraine disrupted the supply of titanium dioxide and other industrial pigments used in seed coatings, according to a report by IHS Markit. These supply-side constraints have forced companies to seek alternative sourcing options or absorb higher procurement costs, which in turn affects pricing strategies and profit margins. Small and mid-sized players, in particular, face difficulties in maintaining stable production schedules, limiting their ability to compete with larger multinational corporations that have diversified supply networks.

Lack of Awareness and Technical Expertise Among Small-Scale Farmers

Another pressing challenge in the North American seed treatment market is the limited awareness and technical expertise among small-scale and family-owned farms regarding the benefits and proper application of advanced seed treatments. While large commercial farms in the U.S. and Canada have embraced precision seed treatment technologies, many smaller operations still rely on conventional practices due to a lack of information, training, and access to extension services. In rural areas of the Midwest and Great Plains, farm advisory programs often struggle to reach independent growers with updated knowledge on seed treatment advancements. Additionally, the complexity of label instructions and regulatory compliance associated with treated seeds presents another barrier to adoption. Misapplication can lead to poor performance, environmental contamination, or legal repercussions, discouraging hesitant growers from investing in these technologies.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

10.45% |

|

Segments Covered |

By Crop Type, Application, Function, Region |

|

Various Analyses Covered |

Global, Regional and Country Level Analysis; Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

The U.S., Canada, Rest of North America |

|

Market Leaders Profiled |

Syngenta, Bayer CropScience, BASF, Monsanto, BioWorks Inc, Valent USA Corp, Adama Agricultural Solutions Ltd, Advanced Biological Marketing Inc, Brettyoung Limited, Chemtura Agrosolutions, Dupont, and Germains Seed Technology. |

SEGMENTAL ANALYSIS

By Crop Insights

The corn segment accounted in holding 35.4% of the North America seed treatment market in 2024. One key driver behind this dominance is the heavy reliance on genetically modified (GM) hybrid corn varieties that require protective coatings to maximize yield potential. The National Corn Growers Association reported that nearly 95% of all corn grown in the U.S. was GM-based in 2023, making it highly susceptible to early infestations without adequate seed protection. Additionally, regulatory support from the Environmental Protection Agency (EPA) has ensured the continued registration and availability of effective seed treatment chemistries, including neonicotinoids and newer alternatives like sulfoxamines. Another contributing factor is the increasing adoption of integrated pest management (IPM) strategies, where seed treatments serve as a foundational component.

The canola segment is expected to grow with a CAGR of 7.4% in the coming years. The Prairie Agricultural Machinery Institute noted that untreated canola fields experienced an average yield loss of 12–15% in Western Canada during the 2022–2023 growing season. Moreover, the increasing integration of biological seed treatments, particularly microbial inoculants, has further boosted adoption rates. A 2023 study by the Canola Council of Canada found that bio-treated canola seeds showed a 10% improvement in root development and early vigor compared to conventional treatments.

By Application Insights

The chemical agents segment accounted in holding 40.3% of the share in 2024. This dominance stems from the critical role insecticidal seed coatings play in protecting crops against early-season pests such as wireworms, seedcorn maggots, and soybean aphids. A primary driver of this segment is the high-value nature of major row crops like corn and soybeans, where yield losses from pest damage can be economically devastating. The USDA Economic Research Service reported that untreated corn fields experienced an average yield reduction of 15–20 bushels per acre due to early pest infestations. Additionally, the transition from foliar sprays to systemic seed treatments has been encouraged by farm-level efficiency gains and reduced environmental exposure.

The biological agents segment is projected to witness a CAGR of 9.2% in the coming years. One of the key drivers is the growing incorporation of microbial inoculants and biostimulants into mainstream farming practices. A 2023 survey conducted by the Canadian Fertilizer Institute revealed that 40% of surveyed farmers preferred biological seed treatments due to their positive impact on soil health and plant resilience. Additionally, advancements in microbial technology have led to improved formulations capable of enhancing nutrient uptake and disease resistance. Regulatory bodies such as the Pest Management Regulatory Agency (PMRA) have streamlined approval processes for biopesticides, with over 25 new biological seed treatment products approved in Canada in 2023 alone.

By Function Insights

The crop protection chemicals segment was the largest and held 65.4% of the North America seed treatment market share in 2024. This segment includes insecticides, fungicides, and nematicides applied to seeds to safeguard against early-season pests and diseases. The extensive use of these treatments is driven by the need to ensure consistent crop emergence and minimize yield losses, particularly in high-value crops like corn, soybeans, and canola. Similarly, in Canada, Agriculture and Agri-Food Canada reported that more than 75% of canola acreage involved the use of fungicidal seed treatments to combat diseases like damping-off and root rot. Additionally, the Environmental Protection Agency (EPA) continues to approve new active ingredients, including next-generation compounds like sulfoximines, which offer safer and more targeted pest control options.

The seed enhancement segment is expected to grow with a CAGR of 8.7% in the coming years. One of the primary growth drivers is the rising emphasis on climate-resilient agriculture amid increasing weather variability. According to the National Oceanic and Atmospheric Administration (NOAA), the U.S. recorded 20 billion-dollar weather disasters in 2023, prompting growers to seek adaptive solutions. Additionally, advancements in microbial formulations have expanded the utility of seed enhancement beyond yield improvement to include nitrogen fixation and phosphorus solubilization. Companies such as UPL Limited and Nufarm are investing heavily in developing customized seed priming solutions tailored to specific soil and climatic conditions, which is further propelling the growth of this segment.

COUNTRY ANALYSIS

The United States was the largest share of the North American seed treatment market by accounting for 62.3% of the market in 2024. A key driver of market growth is the widespread use of genetically modified (GM) hybrid seeds, which require protective treatments to maximize yield potential. The National Corn Growers Association reported that nearly 95% of all corn grown in the U.S. was GM-based in 2023, making it highly dependent on seed-applied insecticides and fungicides. Additionally, the Environmental Protection Agency (EPA) continues to regulate and approve new seed treatment chemistries, ensuring product availability and efficacy. The increasing integration of precision agriculture tools, such as variable rate seed treatment applicators, further enhances efficiency and adoption rates.

Canada ranked second by capturing 28.6% of the North American seed treatment market share in 2024. The country's strong agricultural sector, particularly in Western provinces such as Saskatchewan, Alberta, and Manitoba, drives demand for high-quality seed treatments. A major growth driver is the increasing focus on sustainable farming practices and the adoption of biological seed treatments. Furthermore, the Prairie Agricultural Machinery Institute observed a 20% increase in the use of sensor-based seeding equipment among Western Canadian farmers, facilitating precise and efficient application of seed treatments. In addition, government-backed initiatives such as the Canadian Agricultural Partnership (CAP) encourage innovation in seed technology, supporting the development of novel treatment solutions.

KEY MARKET PLAYERS

Syngenta, Bayer CropScience, BASF, Monsanto, BioWorks Inc, Valent USA Corp, Adama Agricultural Solutions Ltd, Advanced Biological Marketing Inc, Brettyoung Limited, Chemtura Agrosolutions, Dupon, and Germains Seed Technology. These are the market players that are dominating the North American seed treatment market.

Top Players in the Market

Bayer CropScience (Bayer AG)

Bayer CropScience is a leading global player in the seed treatment market, offering a comprehensive portfolio of chemical and biological solutions tailored for major crops such as corn, soybeans, and canola. The company’s integration of advanced seed protection technologies with digital farming tools has strengthened its position in North America. Its commitment to sustainability and innovation is evident through the development of bio-based treatments that reduce environmental impact while enhancing crop performance. Bayer’s extensive research capabilities and strong distribution network have made it a trusted partner for farmers seeking reliable and high-performing seed treatment options.

Syngenta AG

Syngenta is a dominant force in the North America seed treatment sector, known for its robust product lineup and continuous investment in R&D. The company provides a wide array of seed-applied fungicides, insecticides, and biostimulants designed to improve germination, protect against pests, and boost early plant growth. Syngenta emphasizes integrated pest management strategies, aligning with global trends toward sustainable agriculture. Through strategic collaborations and farmer education programs, Syngenta enhances grower adoption of advanced seed treatment technologies across key agricultural regions in the U.S. and Canada.

Corteva Agriscience

Corteva plays a pivotal role in shaping the North American seed treatment landscape by combining seed genetics with cutting-edge protection technologies. The company focuses on delivering customized seed treatment solutions that enhance seed viability and field performance. Corteva's expertise in both chemical and biological treatments enables it to cater to diverse farming needs, particularly among large-scale commercial growers.

Top Strategies Used by Key Market Participants

One major strategy employed by key players in the North America seed treatment market is product innovation and diversification, where companies continuously develop new formulations, including bio-based treatments, to meet evolving regulatory standards and consumer demand for sustainable solutions. This helps maintain n competitive advantage and broadens their customer base.

Another key approach is strategic partnerships and collaborations, wherein companies work closely with seed producers, academic institutions, and government agencies to co-develop advanced treatment technologies and expand their reach within the agricultural value chain. These alliances facilitate faster adoption and knowledge exchange.

The market expansion and localization a widely adopted tactics, with firms tailoring their seed treatment offerings to regional farming conditions and regulatory environments. This includes localized R&D initiatives and targeted marketing efforts to strengthen presence in high-potential areas across North America.

COMPETITION OVERVIEW

The competition in the North American seed treatment market is highly intense, characterized by the presence of established multinational agrochemical companies striving to consolidate their market positions. Several key players dominate the industry, leveraging extensive R&D capabilities, strong distribution networks, and brand recognition to maintain an edge over smaller competitors. Innovation remains a central battleground, with companies racing to develop next-generation biological treatments that align with sustainability goals and regulatory expectations. Additionally, strategic acquisitions and partnerships are frequently used to expand product portfolios and geographic footprints. The growing emphasis on climate-resilient agriculture and precision farming further intensifies rivalry, as firms seek to offer more customized and efficient seed treatment solutions.

RECENT HAPPENINGS IN THE MARKET

- In January 2023, Syngenta launched a new line of biological seed treatments aimed at improving root health and stress tolerance in soybean crops, which is expanding its sustainable product portfolio in response to rising farmer demand for eco-friendly alternatives.

- In August 2023, Corteva Agriscience introduced a digital seed treatment platform that allows growers to customize seed coatings based on soil data and planting conditions by enhancing efficiency and performance for large-scale operations.

- In March 2024, Bayer CropScience partnered with a leading microbial technology firm to co-develop next-generation bio-stimulant seed treatments designed to enhance nutrient uptake and early plant vigor across major row crops.

- In November 2024, BASF expanded its seed treatment manufacturing facility in the United States to increase production capacity and ensure a steady supply of both chemical and biological seed treatment products to North American markets.

- In May 2025, UPL Limited acquired a niche biologics startup specializing in seed priming technologies, aiming to accelerate its footprint in the biologicals segment and provide farmers with innovative, low-input seed protection solutions.

MARKET SEGMENTATION

This research report on the North America Seed Treatment Market is segmented and sub-segmented into the following categories

By Crop Type

- Corn/Maize

- Soybeans

- Wheat

- Rice

- Canola

- Cotton

- Other products

By Application

- Chemical Agents- Insecticides

- Fungicides

- other chemicals and Biological Agents

By Function

- Crop Protection Chemicals

- Seed Enhancemen

By Country

- The U.S

- Canada

Frequently Asked Questions

What is the projected CAGR of the North America Seed Treatment Market from 2025 to 2033?

The North America seed treatment market is expected to grow at a CAGR of 10.45% from 2025 to 2033, driven by increasing demand for pest-resistant crops, improved germination rates, and sustainable farming practices.

Which country leads in seed treatment adoption within North America?

The U.S. accounts for over 85% of total seed treatment usage , particularly in corn, soybean, and wheat production, with major activity concentrated in the Midwest’s Corn Belt region.

How many acres of farmland in North America are planted with treated seeds annually?

Over 180 million acres of cropland in the U.S. and Canada are planted using fungicide-, insecticide-, or bio-based treated seeds each year, according to USDA's National Agricultural Statistics Service (NASS).

Which type of seed treatment is experiencing the fastest growth in North America?

Biological seed treatments are growing at the fastest rate, with a CAGR of 9.1% , due to rising interest in reducing chemical dependence and enhancing soil microbiome health.

What percentage of U.S. corn and soybean acreage uses neonicotinoid-treated seeds?

Approximately 58% of corn and 32% of soybean acreage in the U.S. used neonicotinoid-coated seeds in 2023, down from peak levels due to environmental concerns and regulatory scrutiny.

How has the EPA’s updated pollinator risk assessment impacted seed treatment formulations?

Following the EPA’s revised guidelines in early 2024 , several companies have reformulated their seed coatings to reduce dust-off and drift, while exploring alternatives like RNAi-based and microbial treatments.

Which states in the U.S. have the highest demand for seed treatments?

Iowa, Illinois, Nebraska, and Minnesota lead in seed treatment consumption due to high-density planting of row crops and strong presence of integrated seed and agrochemical companies

How much do seed treatments contribute to yield increase in major crops?

Seed treatments have been shown to improve yields by 5–12% in corn and soybeans, primarily by protecting young plants from early-season pests and diseases, according to field trials by land-grant universities.

What role do digital tools play in seed treatment decision-making for farmers?

Over 40% of large-scale growers now use agronomic software platforms that recommend specific seed treatments based on soil health, pest pressure, and climate forecasts, improving input efficiency.

How is e-commerce influencing the procurement of seed treatment products in North America?

Online B2B sales of seed treatment products saw a 30% increase in 2023 , especially among independent retailers and smaller farms seeking competitive pricing, technical support, and product traceability.

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com