North America Set-Top Box Market Size, Share, Trends & Growth Forecast Report By Product (IPTV, Satellite, Cable, DTT, OTT),Content Quality, Distribution Channel, Application, Operating System and Country (The United States, Canada and Rest of North America), Industry Analysis From 2025 to 2033

North America Set-Top Box Market Size

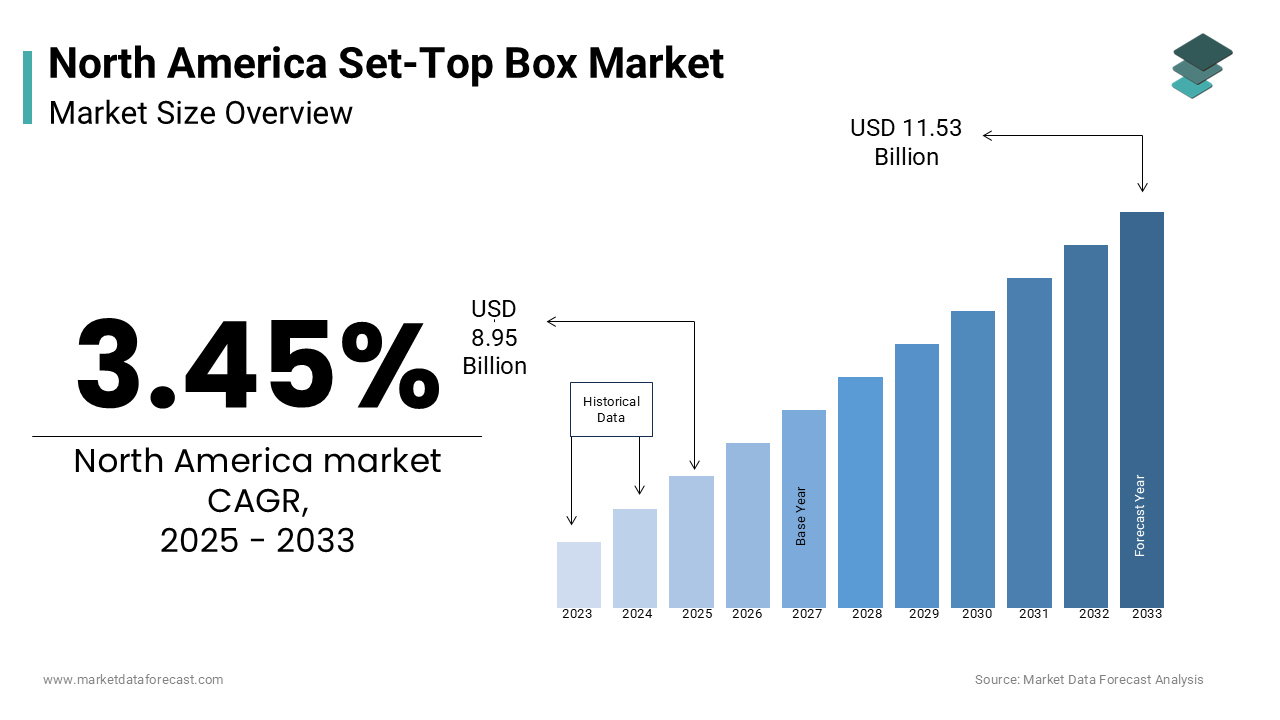

The North America set-top box market was worth USD 8.67 billion in 2025. The North American market is estimated to grow at a CAGR of 3.45% from 2025 to 2033 and be valued at USD 11.53 billion by the end of 2033 from USD 8.95 billion in 2025.

The North American set-top box (STB) market has established itself as a pivotal segment within the region’s broader consumer electronics and entertainment ecosystem. Also, the United States dominates the regional landscape, accounting for a major portion of the total market share. A key factor influencing this growth is the widespread adoption of digital television services, which has been further accelerated by government mandates phasing out analog broadcasting.

Additionally, the growing preference for IPTV and satellite-based services has bolstered demand. Despite these positive trends, the market faces challenges such as declining cable TV subscriptions. However, the integration of advanced features like voice control and AI-driven recommendations continues to sustain consumer interest, ensuring steady market growth.

MARKET DRIVERS

Proliferation of High-Speed Internet and OTT Platforms

The rapid expansion of high-speed internet infrastructure across North America has emerged as a significant driver for the set-top box market. Also, internet penetration in the region has increased greatly in recent years, creating an ideal environment for OTT platforms like Netflix, Hulu, and Disney+ to thrive. These platforms have spurred the demand for advanced STBs capable of delivering seamless streaming experiences. This surge in OTT adoption has compelled manufacturers to innovate, integrating features such as 4K resolution support and voice-activated controls into their devices. Furthermore, the affordability of internet plans, coupled with government initiatives to bridge the digital divide, has expanded broadband access, further fueling the demand for connected STBs.

Rising Demand for Smart Home Integration

The growing trend of smart home ecosystems is another critical driver propelling the North American STB market forward. Consumers are increasingly seeking STBs that can seamlessly integrate with other smart devices, enabling centralized control through platforms like Amazon Alexa or Google Assistant. This convergence of entertainment and home automation has led to the development of hybrid STBs that offer functionalities beyond traditional broadcasting, including home security monitoring and energy management. Such innovations not only enhance user convenience but also justify premium pricing, thereby driving revenue growth in the STB market.

MARKET RESTRAINTS

Declining Cable TV Subscriptions

A notable restraint impacting the North American STB market is the steady decline in cable TV subscriptions, which has historically been a primary revenue stream for manufacturers. Consumers are increasingly shifting towards cost-effective alternatives such as streaming services, which often do not require dedicated STBs. For instance, 60% of U.S. households identify a streaming platform as their "most used" TV setup, a significant increase in 2020. This shift has resulted in reduced demand for conventional cable STBs, forcing manufacturers to pivot their strategies. While some companies have adapted by developing hybrid devices compatible with both cable and OTT services, the overall market remains constrained by the diminishing reliance on cable infrastructure.

High Initial Costs and Technological Obsolescence

Another significant restraint is the high initial cost of advanced STBs, coupled with the rapid pace of technological obsolescence. Additionally, the fast-evolving nature of technology means that devices become outdated quickly, discouraging long-term investments. For example, a significant portion of consumers hesitate to purchase new STBs due to concerns about future compatibility with emerging standards. This challenge is further exacerbated by the fragmented regulatory landscape, where different regions adopt varying broadcasting standards, complicating product design and increasing costs for manufacturers.

MARKET OPPORTUNITIES

Expansion of 5G Networks

The rollout of 5G networks across North America presents a transformative opportunity for the set-top box market. According to Ericsson's Mobility Report, 5G is believed to account for 71% of all mobile subscriptions in North America by the end of 2024, enabling ultra-fast connectivity and low latency. This advancement is particularly beneficial for STBs, as it facilitates the delivery of high-quality 4K and 8K streaming content without buffering. Moreover, 5G's enhanced capabilities support the integration of augmented reality (AR) and virtual reality (VR) features into STBs, offering immersive entertainment experiences. Manufacturers that capitalize on this trend by developing 5 G-compatible STBs can tap into a lucrative segment, attracting tech-savvy consumers who prioritize cutting-edge functionality.

Growing Demand for Personalized Content

The increasing consumer appetite for personalized content represents another significant opportunity for the North American STB market. As per Accenture's research, 91% of consumers are more likely to engage with brands that provide tailored recommendations and experiences. This trend has prompted STB manufacturers to incorporate AI-driven algorithms that analyze viewing habits and suggest relevant content. For instance, TiVo's Voice Remote, powered by machine learning, has gained popularity for its ability to deliver customized suggestions. Besides, the integration of analytics tools allows operators to gather insights into user preferences, enabling targeted advertising and subscription models.

MARKET CHALLENGES

Intense Competition from Streaming Devices

The foremost challenge confronting the North American STB market is the intense competition posed by standalone streaming devices such as Roku, Amazon Fire TV Stick, and Apple TV. According to a report, streaming devices captured a considerable portion of the total video consumption market in recent years, surpassing traditional STBs for the first time. These devices offer similar functionalities at a lower price point, often eliminating the need for dedicated STBs. This competitive pressure has forced STB manufacturers to invest heavily in R&D to differentiate their offerings, straining profit margins. Moreover, the dominance of major tech giants in the streaming device space creates additional barriers for smaller STB players trying to gain market share.

Regulatory and Privacy Concerns

Regulatory and privacy concerns pose another critical challenge to the North American STB market. As per a study by the Electronic Frontier Foundation (EFF), there is growing apprehension among consumers regarding data collection practices by STBs, particularly those integrated with smart home systems. These devices often collect sensitive information, such as viewing habits and location data, raising privacy issues. In response, governments have introduced stringent regulations, such as the California Consumer Privacy Act (CCPA), which mandates transparency in data usage. Compliance with these regulations increases operational costs for manufacturers, who must invest in robust data protection measures. Additionally, consumer skepticism about data privacy has led to hesitancy in adopting advanced STBs, as highlighted by a Pew Research Center survey indicating that 64% of respondents are concerned about how their data is used.

SEGMENTAL ANALYSIS

By Product Type Insights

The satellite segment dominated the North American set-top box market by holding 40.2% of the total market share in 2024. This dominance is largely credited to the extensive reach of satellite services, particularly in rural and remote areas where terrestrial infrastructure is limited. DirecTV and Dish Network, the leading satellite service providers, collectively serve close to 20 million households. The reliability of satellite broadcasting, coupled with its ability to deliver high-definition content to underserved regions, has solidified its position as the largest segment. Furthermore, advancements in satellite technology, like the deployment of high-throughput satellites (HTS), have enhanced bandwidth capacity, enabling superior content quality.

The OTT segment is the fastest-growing category within the North American STB market, with a projected CAGR of 22.5% from 2025 to 2033. This growth is fueled by the rising demand for on-demand content and the increasing availability of affordable OTT-compatible STBs. The proliferation of platforms like Netflix and Disney+, which reported a combined subscriber base of 150 million in North America in 2022, has driven this trend. Additionally, the integration of AI-driven personalization features in OTT STBs has enhanced user engagement, further accelerating adoption. For example, personalized recommendations account for a significant portion of viewing time on OTT platforms, showcasing the segment's appeal.

By Content Quality Insights

The HD and Full HD content segment commanded the North American set-top box market with a 65.7% share in 2024. This prominence is linked to the widespread availability of HD-enabled televisions, with a considerable share of U.S. households owning at least one HD TV. Moreover, the affordability of HD STBs, coupled with the ubiquity of HD content across cable, satellite, and OTT platforms, has cemented their popularity. For instance, major broadcasters like NBCUniversal and CBS have transitioned entirely to HD broadcasting, ensuring consistent demand for compatible STBs. Furthermore, advancements in compression technologies, such as H.265, have improved the efficiency of HD content delivery, reducing bandwidth requirements while maintaining quality. This technological synergy has reinforced HD and Full HD as the cornerstone of the STB market.

The 4K and above segment is experiencing exponential growth, with a CAGR of 30% projected from 2025 to 2033. This surge is driven by the increasing adoption of 4K televisions. The availability of native 4K content on platforms like Netflix and YouTube has further fueled demand for 4 K-compatible STBs. Besides, the integration of HDR (High Dynamic Range) technology has enhanced visual quality, making 4K content more appealing to consumers. The convergence of affordable 4K TVs, expanding content libraries, and technological advancements ensures that this segment will continue to outpace others in terms of growth.

By Distribution Channel Insights

The offline distribution channel held the largest share of the North American set-top box market, i.e,. 60.4% of total sales in 2024. This is primarily due to the established retail network, which includes big-box stores like Best Buy and Walmart, as well as specialized electronics retailers. For instance, Comcast's Xfinity X1 platform is predominantly distributed through retail partners, contributing to the channel's prominence. The offline model also supports after-sales services, such as repairs and upgrades, enhancing customer satisfaction and loyalty.

The online distribution channel segment is witnessing swift progress, with a CAGR of 25% anticipated from 2025 to 2033. This surge is credited to the increasing popularity of e-commerce platforms like Amazon and eBay, which offer competitive pricing and convenience. The COVID-19 pandemic further accelerated this trend, as lockdowns prompted consumers to shift to online shopping. Also, the availability of detailed product reviews and comparisons online aids purchasing decisions, making the channel more attractive. For example, Amazon reported a significant increase in STB sales during the holiday season, showcasing the segment's potential. The integration of AI-driven recommendation engines on e-commerce platforms further enhances the online shopping experience, ensuring sustained growth.

By Application Insights

The residential segment constituted the biggest application area for set-top boxes in North America by capturing a substantial portion in 2024. The leading position of the segment is driven by the widespread adoption of STBs in households for accessing digital television and streaming services. Moreover, the proliferation of smart TVs and OTT platforms has further entrenched STBs in residential settings, as they enable seamless integration of traditional and digital content. Additionally, the affordability and versatility of residential STBs make them a preferred choice for families seeking comprehensive entertainment solutions.

The commercial segment is accelerating in the application category, with a projected CAGR of 18.8% in the future. This rise is fueled by the increasing adoption of STBs in hospitality, healthcare, and corporate environments. For example, hotels are integrating STBs to offer personalized entertainment options to guests, while hospitals use them to provide patient education and relaxation content. A report by Hospitality Net reveals that 60% of luxury hotels in North America have adopted smart room technologies, including STBs, to enhance guest experiences. Similarly, corporate offices are leveraging STBs for digital signage and video conferencing, driven by the rise of hybrid work models. The versatility of modern STBs, capable of supporting multiple applications which makes them indispensable in commercial settings.

By Operating System Insights

The Android operating system led the North American set-top box market with a 55.7% market share in 2024. The growth of the segment is attributed to Android's open-source architecture, which allows manufacturers to customize STBs for diverse applications, from residential entertainment to commercial use. According to research, over 2.5 billion active Android devices globally create a vast ecosystem, facilitating seamless integration with other smart devices. Besides, Android's compatibility with a wide range of apps, including popular streaming platforms like Netflix and YouTube, enhances its appeal. For instance, Nvidia's Shield TV, powered by Android, has gained traction for its gaming and streaming capabilities, contributing to the segment's growth. So, the availability of frequent software updates and robust developer support further solidifies Android's position as the preferred OS for STBs.

The Linux operating system is rapidly expanding, with a CAGR of 20.1% projected from 2025 to 2033. This growth is credited to Linux's lightweight architecture and high level of customization, making it ideal for OTT and hybrid STBs. According to Red Hat, Linux powers over 90% of the world's public cloud infrastructure, underscoring its reliability and scalability. The rise of open-source initiatives has also encouraged manufacturers to adopt Linux, as it reduces licensing costs while offering superior performance. For example, Roku's proprietary OS, based on Linux, has enabled the company to deliver cost-effective yet feature-rich STBs, capturing a significant market share. Apart from these, Linux's robust security features appeal to commercial users, further accelerating its adoption.

REGIONAL ANALYSIS

The United States stood as the leader in the North American set-top box (STB) market by commanding a 75.5% of the regional share in 2024. This position of the segment is due to the country's robust digital infrastructure and high consumer spending on entertainment technologies. Also, the proliferation of OTT platforms like Netflix and Hulu has further bolstered demand. With Additionally, government initiatives promoting broadband expansion have extended internet access to rural areas, enabling wider use of advanced STBs. The integration of AI-driven features, such as voice control and personalized recommendations, has also driven growth.

Canada remains a key market for set-top boxes in North America. The country’s strong telecommunications sector, led by companies like Rogers Communications and Shaw Communications, has significantly contributed to this position. Over 80% of Canadian households subscribe to digital television services, driving steady demand for STBs. Furthermore, the growing popularity of IPTV services, which notably grew annually, has propelled the market forward. Canada’s tech-savvy population, coupled with government incentives for smart home adoption, has encouraged the integration of advanced features like 4K resolution and smart home compatibility in STBs.

Mexico is positioning itself as the third-largest contributor to the market. The country’s growth is mainly propelled by increasing urbanization and rising disposable incomes, which have expanded access to digital television services. According to INEGI, Mexico’s National Institute of Statistics, a significant portion of households now own a television connected to satellite or cable services, compared to 2018. Also, satellite-based STBs dominate the landscape due to their affordability and ability to reach remote areas. Dish Mexico, a leading provider, reported an increase in STB sales, showcasing the segment’s resilience. Additionally, government programs aimed at improving internet connectivity have facilitated the adoption of OTT-compatible STBs.

The Rest of North America holds a smaller share of the market. Despite its smaller size, this region is experiencing steady growth due to expanding tourism and hospitality industries, which rely on STBs for guest entertainment.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Cisco Systems, Inc., Comcast Corporation, EchoStar Corporation, ARRIS International (now part of CommScope), Technicolor SA (now Vantiva), Samsung Electronics Co., Ltd., LG Electronics, Apple Inc., Roku, Inc., and Amazon (Amazon Fire TV) are some of the key market players in the North American set-top box market.

The North American set-top box market is characterized by intense competition, driven by rapid technological advancements and shifting consumer preferences. Leading players like Comcast, Roku, and Samsung dominate the landscape, leveraging their expertise in AI, cloud computing, and 4K streaming to differentiate their offerings. Smaller firms, however, face challenges due to high R&D costs and the dominance of established brands. The market is also witnessing increased competition from standalone streaming devices, such as Amazon Fire TV Stick, which offer similar functionalities at lower price points. Regulatory pressures and privacy concerns further complicate the competitive environment, requiring manufacturers to balance innovation with compliance. Despite these challenges, the market remains dynamic, with opportunities for growth in emerging segments like 5 G-enabled STBs and personalized content delivery.

Top Players in the North America Set-Top Box Market

Comcast Corporation

Comcast Corporation leads the North American STB market. Its Xfinity X1 platform, which integrates cable, satellite, and OTT services, has revolutionized content delivery, attracting a substantial number of subscribers. The company’s partnerships with major content providers have further strengthened its position, making it a benchmark for innovation worldwide.

Roku Inc.

Roku Inc. is a key contributor to the global STB market. Known for its affordable yet feature-rich streaming devices, Roku has captured significant market share in North America and beyond. The company’s proprietary OS, based on Linux. Roku’s emphasis on user-friendly interfaces and seamless app integration has made it a preferred choice for both residential and commercial applications, driving international adoption.

Samsung Electronics

Samsung Electronics is another important player in the market. Its Smart STB solutions, compatible with Android and Tizen OS, cater to diverse consumer needs. Samsung’s leadership in 4K and 8K display technologies has positioned it as a key player in delivering ultra-high-definition content. With a global presence spanning over 100 countries, Samsung continues to influence the STB market through cutting-edge innovations.

Top Strategies Used by Key Market Participants

Key players in the North American set-top box market employ diverse strategies to maintain their competitive edge. Product innovation remains a cornerstone, with companies integrating AI, voice control, and 4K/8K support into their devices. Strategic partnerships with content providers, such as Netflix and Disney+, enable seamless content delivery. Mergers and acquisitions are another critical tactic; for instance, AT&T’s acquisition of DirecTV expanded its reach in the satellite STB segment. Additionally, firms invest heavily in R&D to develop hybrid STBs that combine traditional broadcasting with OTT capabilities. Finally, aggressive marketing campaigns targeting smart home integration highlight the versatility of modern STBs, appealing to tech-savvy consumers.

RECENT MARKET DEVELOPMENTS

- In April 2023, Comcast Corporation launched its Xfinity Flex Pro STB, featuring AI-driven recommendations and 8K resolution support. This move strengthened its position in the premium STB segment.

- In June 2023, Roku Inc. partnered with Walmart to offer exclusive discounts on its streaming devices, boosting accessibility and expanding its customer base.

- In August 2023, Samsung Electronics unveiled its SmartThings-integrated STB, enabling seamless smart home control, enhancing its appeal in the residential market.

- In October 2023, AT&T acquired Hughes Network Systems, expanding its satellite STB portfolio and reinforcing its foothold in rural markets.

- In December 2023, TiVo introduced its Voice Remote 2.0, powered by machine learning, to enhance user experience and drive adoption of its hybrid STB solutions.

MARKET SEGMENTATION

This research report on the North America Set-Top Box Market is segmented and sub-segmented based on categories.

By Product

- IPTV

- Satellite

- Cable

- DTT

- OTT

By Content Quality

- HD & Full HD

- 4K and Above

By Distribution Channel

- Offline

- Online

By Application

- Residential

- Commercial

By Operating System

- Android

- Linux

- Others

By Country

- The United States

- Canada

- Rest of North America

Frequently Asked Questions

What is driving the growth of the set-top box market in North America?

Key growth drivers include rising demand for high-definition and 4K content, increasing adoption of OTT services, and technological advancements such as AI integration and cloud-based STBs.

What are the latest trends in the North American set-top box market?

Trends include the integration of voice control, AI features, 4K and 8K support, cloud DVR services, and partnerships between STB makers and content providers.

What is the future outlook for the North America STB market?

The market is expected to shift more towards smart, connected, and cloud-based devices with a focus on user experience and content accessibility.

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com