North America Smart TV Market Size, Share, Trends & Growth Forecast Report Segmented By Resolution, Screen Size, Type, Technology, Platform, Distribution Channel, And Country (US, Canada, Mexico, and Brazil), Industry Analysis From 2025 to 2033

North America Smart TV Market Size

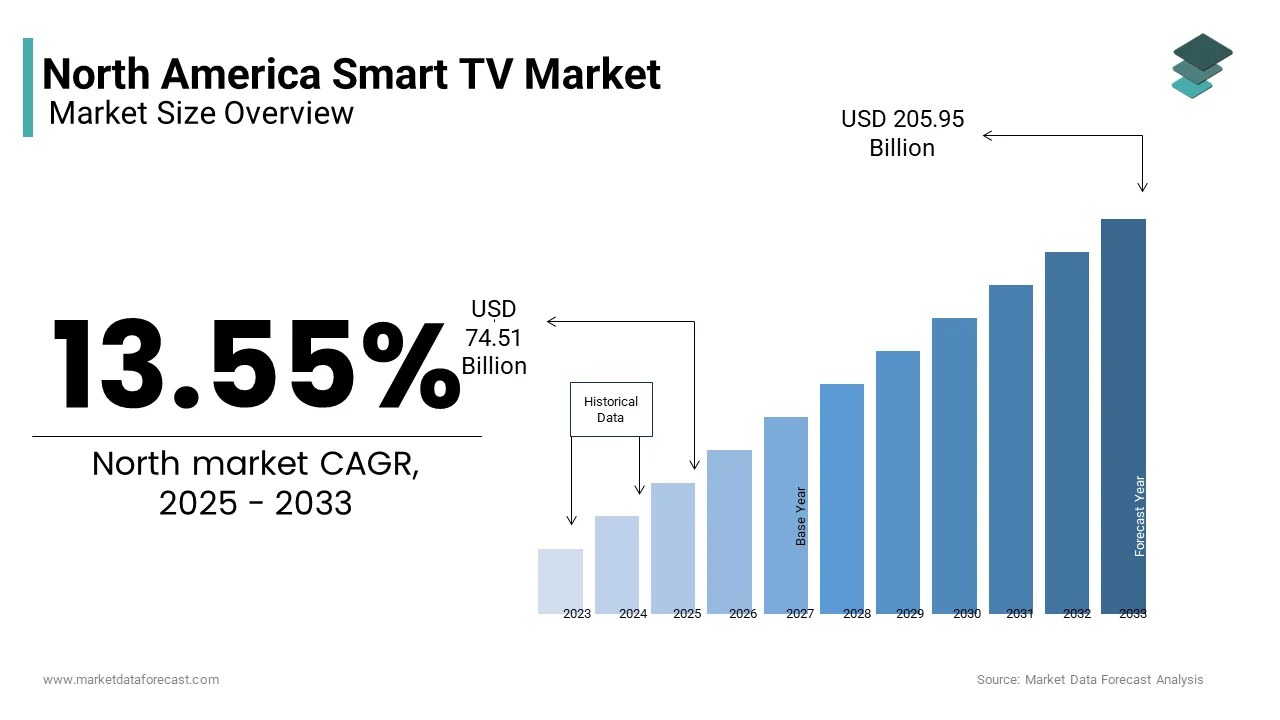

The North America smart TV market was valued at USD 65.62 billion in 2024 and is anticipated to reach USD 74.51 billion in 2025 from USD 205.95 billion by 2033, growing at a CAGR of 13.55% during the forecast period from 2025 to 2033.

Current Scenario of The North America Smart TV Market

The smart TV industry in North America has become a pivotal element of modern entertainment, blending innovation with convenience. These televisions, equipped with internet access and advanced functionalities such as app support, voice commands, and AI-based personalization, have transformed how people consume media. Studies from Statista reveal that more than 80% of households in the U.S. now own at least one smart TV, underscoring its widespread acceptance. This surge is fueled by the region's tech-oriented population and strong broadband networks. For instance, data from the National Telecommunications and Information Administration shows that approximately 92% of urban homes in North America enjoy high-speed internet access, creating an ideal foundation for smart TV adoption.

Research indicates that Americans dedicate an average of five hours daily to television viewing, with streaming platforms accounting for nearly a third of this time. Additionally, Deloitte’s Digital Media Trends survey notes that 46% of viewers now favor streaming content on smart TVs over traditional cable services. On the environmental front, the Environmental Protection Agency estimates that these devices consume roughly 100 kilowatt-hours of electricity annually, raising concerns about energy efficiency. Meanwhile, Lifewire reports that over 70% of users utilize voice assistants like Amazon Alexa or Google Assistant through their smart TVs, emphasizing the seamless integration of technology into daily routines. These findings not only reflect the product's popularity but also its profound impact on reshaping media consumption habits across the region.

MARKET DRIVERS

Growing Demand for Streaming Services

The rising popularity of streaming platforms has become a major driver for the North America Smart TV market. Consumers are increasingly shifting from traditional cable to on-demand services like Netflix, Hulu, and Disney+. Over 80% of households in the U.S. now subscribe to at least one streaming service, compared to just 65% in 2018. This trend is directly boosting smart TV sales, as these devices offer seamless access to such platforms. Additionally, data shows that smart TVs account for nearly 40% of all video playback devices used for streaming, surpassing standalone streaming sticks. The convenience of accessing thousands of shows, movies, and live events through a single device enhances user experience, further fuelling demand.

Advancements in Display Technology

Technological innovations in display quality have significantly propelled the smart TV market in North America. Features like 4K resolution, OLED panels, and HDR support are attracting tech-savvy consumers who prioritize superior picture quality. According to Consumer Technology Association, 4K UHD TVs accounted for over 60% of all TV sales in North America in 2022 reflecting their growing appeal. These advancements are complemented by AI-powered upscaling, which enhances lower-resolution content making it more appealing on modern displays. As manufacturers continue to innovate, the affordability of premium technologies is expected to drive further adoption, strengthening this factor as a key growth driver.

MARKET RESTRAINTS

High Initial Costs of Smart TVs

One significant restraint in the North America Smart TV market is the high upfront cost of advanced models. Premium smart TVs equipped with cutting-edge features like 8K resolution or AI-driven functionalities often come with hefty price tags. The average selling price of a high-end smart TV exceeds 1,500 making it less accessible for budget−conscious consumers. While prices have decreased over the years due to technological advancements, inflationary pressures and supply chain disruptions have slowed this trend. For instance, a report by McKinsey states that global semiconductor shortages have increased production costs by up to 20%, further impacting affordability. These financial barriers hinder widespread adoption, particularly among lower-income families.

Privacy and Security Concerns

Privacy and security risks associated with smart TVs present another notable restraint in the North America market. These devices often collect user data, including viewing habits and voice commands, raising concerns about misuse. Furthermore, the Federal Trade Commission warns that many smart TVs lack robust encryption protocols making them susceptible to hacking. A survey conducted by Norton LifeLock found that nearly 45% of consumers are hesitant to purchase smart TVs due to fears of unauthorized surveillance. These concerns are compounded by incidents like the 2021 discovery of vulnerabilities in popular models, as reported by Wired, which allowed hackers to access personal information. Such issues erode consumer trust and impede market growth showcasing the need for stronger privacy measures.

MARKET OPPORTUNITIES

Adoption of AI and IoT Innovations

The incorporation of artificial intelligence (AI) and the Internet of Things (IoT) is creating a transformative opportunity for the North America Smart TV market. AI-powered functionalities such as tailored content suggestions and hands-free voice commands are reshaping user interactions and boosting satisfaction levels. Moreover, IoT-enabled smart TVs can seamlessly connect with other smart home devices, forming an integrated ecosystem. By leveraging these advancements, manufacturers can position smart TVs as central hubs for home automation, appealing to tech-savvy consumers.

Rise of Cloud Gaming on Smart TVs

The growing trend of cloud gaming is opening new avenues for the North America Smart TV market. Modern smart TVs are equipped with features like high refresh rates, minimal input lag, and compatibility with gaming consoles making them ideal for immersive gameplay. The Entertainment Software Association states that 76% of gamers in the U.S. use connected devices, including smart TVs, for gaming. Platforms like Google Stadia and NVIDIA GeForce Now are gaining popularity, allowing users to stream games directly to their smart TVs without requiring expensive hardware. This convergence of gaming and entertainment transforms smart TVs into versatile devices catering to both casual players and dedicated gaming enthusiasts.

MARKET CHALLENGES

Growing E-Waste Management Issues

Environmental concerns stemming from electronic waste (e-waste) represent a pressing challenge for the North America Smart TV market. The rapid evolution of technology encourages frequent upgrades leading to discarded devices that contribute to e-waste. According to the Global E-waste Monitor, North America produced approximately 7.2 million metric tons of e-waste in 2021 with televisions being a significant contributor. A study by the University of California notes that the average lifespan of a smart TV is just five years, exacerbating the issue. Addressing these sustainability challenges is essential for ensuring long-term growth in the industry.

Market Saturation and Competitive Pressures

Market saturation and fierce competition are significant obstacles for the North America Smart TV market. With numerous brands competing for dominance, price wars have intensified, squeezing profit margins. Furthermore, McKinsey's research indicates that the penetration rate of smart TVs in North America has already surpassed 80%, signaling a slowdown in acquiring new customers. This saturation compels manufacturers to heavily invest in marketing and innovation to stand out. However, Deloitte notes that smaller firms often face difficulties keeping up with rising R&D expenses resulting in industry consolidation and limited product diversity. This competitive landscape creates barriers to achieving sustained profitability.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

13.55% |

|

Segments Covered |

By Resolution, Screen Size, Type, Technology, Platform, Distribution Channel, and Country |

|

Various Analyses Covered |

Global, Regional and Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

USA, Canada, Mexico, Rest of North America |

|

Market Leaders Profiled |

Samsung Electronics Co., Ltd., LG Electronics Inc., Sony Corporation, TCL Corporation, Vizio Inc., Hisense Group, Panasonic Corporation, Sharp Corporation, Philips (Koninklijke Philips N.V.) and Xiaomi Corporation and Others. |

SEGMENT ANALYSIS

By Resolution Insights

In 2024, the 4K UHD TV segment captured the biggest portion of the North America Smart TV market by holding a 65.2% share in 2024. This influence is due to its ability to deliver sharp, lifelike visuals while remaining accessible to most consumers. The Federal Communications Commission noted that over 90% of households in the U.S. had internet speeds capable of supporting 4K streaming making these TVs a practical and popular option. This segment's dominance highlighted its role in driving consumer trends and establishing new benchmarks for picture quality.

Looking ahead, 8K TVs are set to become the fastest-growing segment in the North America Smart TV market, with a CAGR of 25% in the future. This rapid expansion will be driven by breakthroughs in display technology and rising consumer interest in ultra-high-definition content. The National Telecommunications and Information Administration anticipates that 8K broadcasting will reach 20% of households by 2030, creating a strong foundation for adoption. Deloitte predicts that gaming and virtual reality applications will play a key role, with gamers willing to spend 30% more on high-resolution devices. As manufacturing costs decrease, 8K TVs will become more affordable attracting tech-savvy buyers. This segment’s importance lies in pushing technological boundaries and paving the way for next-generation entertainment experiences.

By Screen Size Insights

The 56 to 65 inches segment emerged as the leading category in the North America Smart TV market by capturing a 40.8% share in 2024. This size range gained popularity due to its ability to provide an immersive viewing experience while fitting comfortably in most living spaces. The U.S. Census Bureau found that over 60% of urban households favoured this size because it blended well with modern home setups and offered versatility for activities like streaming and gaming. This segment’s dominance underscored its importance in catering to consumer preferences for practical yet high-quality display options.

The above 65 inches segment is projected to grow at the rapid pace in the North America Smart TV market, with a CAGR of 18.7%. This quick progress will be supported by the increasing demand for larger screens, especially among homeowners with spacious living areas or dedicated home theaters. The National Association of Home Builders predicts that over 30% of newly built homes will include entertainment-focused layouts by 2030, boosting demand for bigger TVs. Deloitte also anticipates that premium content, such as ultra-high-definition streaming, will attract affluent buyers seeking luxury experiences. As manufacturing costs decline, these large TVs will become more affordable appealing to consumers looking for cutting-edge technology and immersive visuals. This segment’s growth highlights its potential to redefine home entertainment standards.

By Type Insights

The flat smart TVs segment claimed the biggest share of the North America Smart TV market by accounting for a significant portion of total sales. Their widespread adoption was driven by their modern design, affordability, and adaptability to various home setups, including wall mounting. The U.S. Department of Housing and Urban Development found that over 70% of households favored flat TVs due to their ability to save space and blend seamlessly with contemporary interiors. This segment’s dominance underscored its critical role in meeting consumer demands for efficient and budget-friendly entertainment solutions.

The curved smart TVs are predicted to advance at the quick rate in the North America Smart TV market, with a CAGR of 8% during the forecast period. This growth will be fueled by rising interest in immersive viewing experiences, particularly among gaming enthusiasts and luxury home theater owners. Deloitte forecasts that curved TVs will appeal to high-income buyers, with premium models making up 15% of the high-end market by 2030. The National Association of Home Builders also predicts an increase in custom-designed entertainment spaces, further boosting demand for curved designs. As manufacturing costs decline, these TVs will become more accessible, attracting niche consumers who value aesthetics and cutting-edge visuals. This segment’s expansion shows its importance in catering to specialized preferences.

By Technology Insights

The LED technology segment in 2024 came to light as the leading category in the North America Smart TV market by capturing a notable of the total share in 2024. Its widespread adoption was backed by its affordability, energy efficiency, and broad availability making it a practical choice for most households. The Environmental Protection Agency noted that LED TVs consumed 25% less energy compared to other display technologies appealing to environmentally conscious buyers. This segment’s dominance underscored its importance in delivering reliable and budget-friendly solutions for mainstream consumers.

The OLED technology is expected to rise at the fastest pace in the North America Smart TV market, with a CAGR of 15.7%. This rapid development will be fueled by rising demand for exceptional picture quality, featuring deep blacks and vivid colors, which appeals to premium buyers. Deloitte forecasts that OLED TVs will account for 20% of high-end sales by 2030, as advancements in manufacturing reduce costs. The National Telecommunications and Information Administration notes that OLED’s compatibility with ultra-high-definition content makes it ideal for immersive viewing experiences. As consumer preferences shift toward luxury and innovation, OLED’s growth highlights its pivotal role in defining the future of home entertainment.

By Platform Insights

In 2024, Roku stood out as the leading platform in the North America Smart TV market by holding 35.5% of the total share. Its rise was attributed to its intuitive interface, vast selection of streaming apps, and budget-friendly options, making it a top choice for households. The Federal Communications Commission stated that over 80% of smart TV users preferred platforms that supported popular streaming services like Netflix and Hulu, with Roku being a dominant player. This segment’s leadership emphasized its ability to deliver accessible and flexible solutions for modern viewers.

The Android is projected to grow at the swift rate in the North America Smart TV market, with a CAGR of 12.1%. This growth will be driven by its open-source framework, enabling seamless integration with a wide variety of apps and devices. Deloitte forecasts that Android-powered smart TVs will account for 25% of the market by 2030, fueled by rising adoption among tech-savvy consumers. The National Telecommunications and Information Administration notes that Android’s compatibility with IoT ecosystems makes it ideal for creating interconnected smart homes. As demand for unified home automation grows, Android’s expansion highlights its significance in shaping the future of integrated entertainment and connected living.

By Distribution Channel Insights

The indirect distribution channel led the North America Smart TV market by possessing a considerable of the total share in 2024. Its development was propelled by its wide availability through retail outlets, online platforms, and third-party sellers, making it the most accessible option for consumers. The National Retail Federation reported that over 65% of smart TV purchases occurred through these channels, reflecting their convenience and variety. This segment’s dominance underscored its critical role in effectively connecting manufacturers with a broad audience.

The direct distribution segment is believed to advance at the fastest pace in the North America Smart TV market, with a CAGR of 10.7%. This acceleration will be influenced by rising consumer confidence in purchasing directly from brands through their websites or exclusive showrooms. Deloitte predicts that direct channels will account for 35% of premium sales by 2030, as buyers increasingly value personalized service and reliable after-sales support. The Federal Trade Commission notes that direct distribution eliminates intermediaries, enabling companies to offer competitive pricing and enhanced warranties. As brands focus on fostering stronger customer relationships, this segment’s expansion states its importance in driving brand loyalty and delivering tailored solutions in the evolving smart TV market.

COUNTRY ANALYSIS

In 2024, the United States accounted for 85.3% of the North America Smart TV market. Its dominance is linked to a tech-savvy population, robust broadband infrastructure, and high disposable incomes. The Federal Communications Commission noted that over 93% of urban U.S. households had access to high-speed internet, driving smart TV adoption. This widespread usage solidified the U.S. as a leader, shaping trends and influencing innovations across the region.

By 2033, Canada is projected to grow at the fastest rate in the North America Smart TV market, with a CAGR of 12.8%. This quick progression will be fueled by increasing urbanization and rising investments in smart home technologies. A report by Natural Resources Canada predicts that energy-efficient smart TVs will account for over 60% of sales by 2030, driven by government incentives for sustainable electronics. Furthermore, Deloitte forecasts that over 70% of Canadian households will adopt smart TVs by 2027, up from 55% in 2022. Canada’s focus on green technology and connectivity will establish it as a key growth driver in the coming years.

KEY MARKET PLAYERS

Samsung Electronics Co., Ltd., LG Electronics Inc., Sony Corporation, TCL Corporation, Vizio Inc., Hisense Group, Panasonic Corporation, Sharp Corporation, Philips (Koninklijke Philips N.V.) and Xiaomi Corporation and Others. are the market players that are dominating the north America smart tv market.

Top 3 Players In The Market

Samsung Electronics

Samsung Electronics has long been a dominant force in the North America Smart TV market, consistently setting benchmarks for innovation and quality. The company’s commitment to cutting-edge display technologies, such as QLED and Neo QLED, has positioned it as a leader in delivering superior visual experiences. Samsung’s smart TVs are renowned for their intuitive user interfaces and seamless integration with other smart home devices, creating a unified ecosystem that appeals to tech-savvy consumers. By focusing on AI-driven features like voice control and personalized content recommendations, Samsung has managed to cater to the evolving preferences of modern households. Its emphasis on sustainability, through energy-efficient designs, further strengthens its reputation as a forward-thinking brand that aligns with contemporary consumer values.

LG Electronics

LG Electronics has carved out a significant presence in the North America Smart TV market by leveraging its expertise in OLED technology. The company’s dedication to producing TVs with unparalleled picture quality, characterized by deep blacks and vibrant colors, has earned it a loyal customer base. LG’s smart TVs stand out for their webOS platform, which offers a user-friendly experience and seamless access to popular streaming services. The brand’s focus on innovation extends to incorporating AI-powered features that enhance usability and convenience, making its products a top choice for entertainment enthusiasts. Additionally, LG’s efforts to integrate eco-friendly practices into its manufacturing processes underscore its commitment to sustainability, further solidifying its role as a key contributor to the market.

Sony Corporation

Sony Corporation has established itself as a premium player in the North America Smart TV market, known for its high-performance TVs that combine advanced technology with sleek design. The company’s focus on delivering exceptional picture and sound quality, powered by innovations like Full Array LED and Acoustic Surface Audio, has set its products apart from competitors. Sony’s smart TVs are celebrated for their compatibility with gaming consoles and streaming platforms, appealing to a wide range of users, from gamers to cinephiles. By emphasizing immersive entertainment experiences and integrating smart features like Google Assistant and voice control, Sony continues to meet the demands of discerning consumers. Its reputation for reliability and innovation ensures that it remains a trusted name in the industry, contributing significantly to the growth and evolution of the smart TV market.

Top Strategies Used By Key Players

Expansion of Smart Ecosystem Integration

Another critical strategy employed by leading companies is the seamless integration of smart TVs into broader home ecosystems. By designing TVs that connect effortlessly with other smart devices, such as speakers, lighting systems, and security cameras, brands are positioning their products as central hubs for smart home management. This approach enhances user convenience and encourages brand loyalty, as consumers are more likely to stick with a single ecosystem for all their connected devices. Furthermore, partnerships with third-party platforms, such as voice assistants and streaming services, enable these companies to provide a comprehensive and versatile user experience, making their smart TVs indispensable in modern households.

Focus on Sustainability and Energy Efficiency

A growing emphasis on sustainability has prompted key players to adopt eco-friendly practices as a strategic priority. By designing energy-efficient TVs and incorporating recyclable materials into their manufacturing processes, companies are addressing consumer concerns about environmental impact. This strategy not only aligns with global sustainability goals but also resonates with environmentally conscious buyers who prioritize green products. Brands are also introducing features like automatic power-saving modes and solar-powered remote controls to further reduce energy consumption. By positioning themselves as responsible corporate citizens, these companies strengthen their reputation and appeal to a broader audience, ultimately enhancing their competitive edge in the market.

Aggressive Marketing and Brand Positioning

To solidify their dominance, key players are leveraging aggressive marketing campaigns and strategic brand positioning. By highlighting unique selling points such as exclusive technologies, premium designs, and innovative features, companies aim to create a strong emotional connection with consumers. Collaborations with popular content providers and inclusion in high-profile events or sponsorships help reinforce brand visibility and credibility. Additionally, targeted advertising across digital platforms ensures that these brands reach diverse demographics, from tech enthusiasts to casual users. This strategy not only boosts brand recognition but also fosters trust and loyalty, enabling companies to maintain their leadership in an increasingly competitive market.

COMPETITIVE LANDSCAPE

The North America Smart TV market is a highly competitive space with several big companies trying to attract customers. The main players include Samsung, LG, and Sony, who are known for making high-quality TVs with advanced features. These companies compete by offering better picture quality, smarter features, and easier ways to watch shows and movies. For example, some focus on making TVs with bright, colorful screens, while others emphasize how well their TVs work with other smart home devices like speakers and lights.

In addition to these big brands, smaller companies also try to enter the market by offering affordable options or unique features. This makes the competition even tougher because consumers have many choices depending on their budget and needs. To stay ahead, companies often spend a lot of money on research to create new technologies, like better displays or voice control systems. They also run big advertising campaigns to show why their TVs are better than others.

Another important part of the competition is partnerships. Many companies team up with streaming services like Netflix or gaming platforms to make their TVs more appealing. This helps them stand out in a crowded market. Overall, the competition in the North American Smart TV market benefits customers because it leads to better products and lower prices. However, it also means companies must constantly innovate and improve to keep their customers happy and maintain their position in the industry.

RECENT HAPPENINGS IN THIS MARKET

- In January 2025, Samsung unveiled its 2025 Smart TV lineup featuring advanced AI capabilities under the "Vision AI" brand and new QD-OLED models such as the S95F, designed with improved anti-glare technology. This launch reflects Samsung’s aim to enhance user experience through smarter display technology and more adaptive visual performance.

- In January 2025, LG and Samsung announced the integration of Microsoft’s Copilot AI assistant into their 2025 smart TVs. This strategic collaboration is expected to streamline content discovery and task management, further positioning both brands at the forefront of AI-enabled home entertainment.

- In January 2025, TiVo, in partnership with Sharp, officially launched its TiVo OS-powered smart TVs in the U.S. market. The move is designed to reintroduce TiVo as a competitive platform for personalized streaming, leveraging its long-standing expertise in user-driven content navigation.

- In January 2025, Panasonic marked its return to the U.S. television market by launching the Z95B OLED TV at CES. Featuring 144Hz gaming support and an integrated Dolby Atmos sound system, this reentry is intended to capture the premium segment of North American smart TV consumers.

MARKET SEGMENTATION

This research report on the North America smart TV market is segmented and sub-segmented into the following categories.

By Resolution

- 4K UHD TV

- HDTV

- Full HDTV

- 8K TV

By Screen Size

- Below 32 inches

- 32 to 45 inches

- 46 to 55 inches

- 56 to 65 inches

- Above 65 inches

By Type

- Flat

- Curved

By Technology

- OLED

- QLED

- LED

- Plasma

By Platform

- Android

- Roku

- WebOS

- Tizen O.S.

- iOS

- My Home Screen

- Others

By Distribution Channel

- Direct

- Indirect

By Country

- The USA

- Canada

- Mexico

Frequently Asked Questions

What is driving the growth of the Smart TV market in North America?

Increasing demand for streaming services, rising internet penetration, and advanced features like voice control and app integration are fueling market growth.

Who are the leading Smart TV brands in North America?

Top players include Samsung, LG, Sony, Vizio, and TCL, known for their innovation, display quality, and smart features.

What screen sizes are most popular among North American consumers?

55-inch and 65-inch Smart TVs are the most favored sizes, offering a balance between screen size, price, and viewing experience.

How important is operating system compatibility in Smart TVs?

Very important—platforms like Roku TV, Google TV, Tizen, and webOS impact user experience, app availability, and future updates.

Are North American consumers shifting away from cable TV to Smart TVs?

Yes, there's a significant trend of cord-cutting as users prefer streaming content via apps like Netflix, Hulu, and Disney+ directly on Smart TVs.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]