North America Smartphone Accessories Market Size, Share, Trends & Growth Forecast Report Segmented By Type, Price Range, Distribution Channel, And Country (US, Canada, Mexico, and Brazil), Industry Analysis From 2025 to 2033

North America Smartphone Accessories Market Size

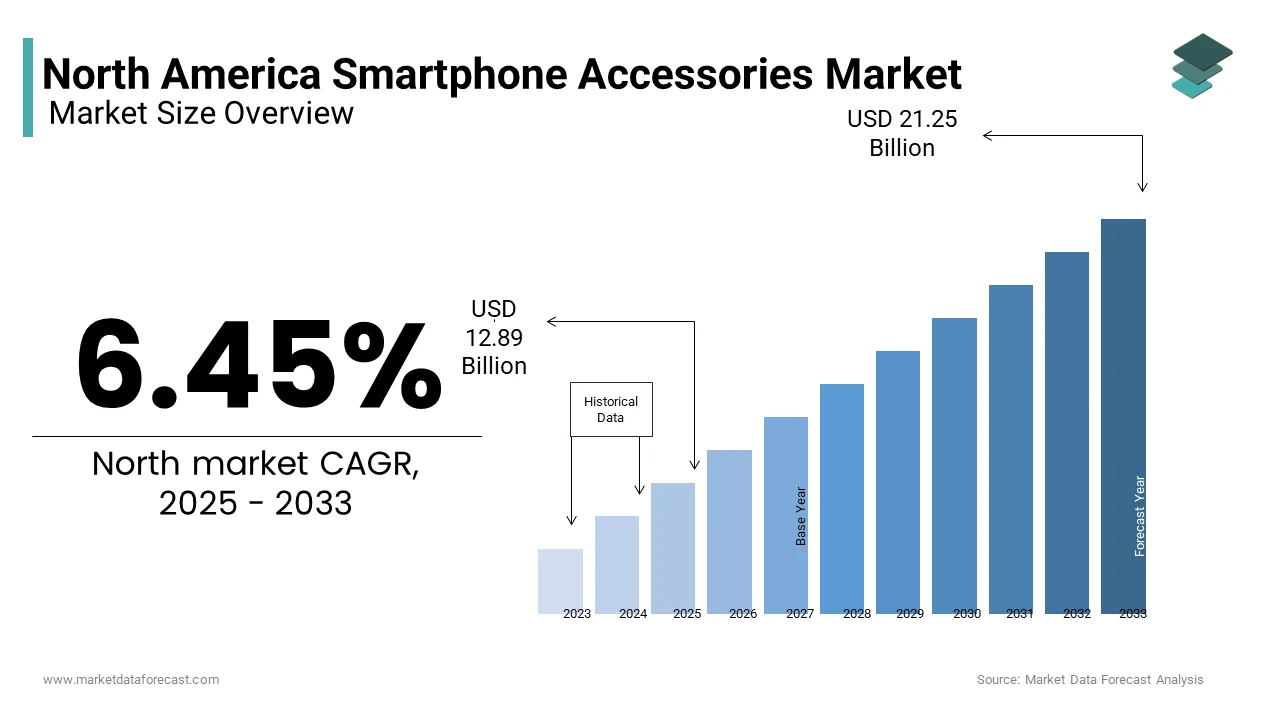

The North America smartphone accessories market was valued at USD 12.11 billion in 2024 and is anticipated to reach USD 12.89 billion in 2025 from USD 21.25 billion by 2033, growing at a CAGR of 6.45% during the forecast period from 2025 to 2033.

The North America smartphone accessories market has emerged as a cornerstone of the consumer electronics industry, driven by the widespread adoption of smartphones and their evolving functionalities. According to the Consumer Technology Association, over 85% of North Americans own a smartphone, fueling robust demand for complementary accessories. The U.S. dominates this regional market, contributing nearly 75% of its total value, while Canada follows closely due to increasing urbanization and tech-savvy demographics.

Moreover, the proliferation of 5G technology has further amplified demand for high-performance accessories such as wireless earbuds, power banks, and screen protectors, as reported by the Federal Communications Commission. Additionally, the rise of e-commerce platforms has enhanced accessibility, with online sales accounting for over 40% of total revenue, according to the U.S. Department of Commerce. With an estimated annual growth rate of 8%, the market is poised for sustained progress, supported by innovations in materials and design.

MARKET DRIVERS

Rising Smartphone Penetration

The exponential rise in smartphone penetration serves as a primary driver of the North America smartphone accessories market. According to the Pew Research Center, over 96% of Americans aged 18–29 own a smartphone, reflecting near-universal adoption among younger demographics. This trend extends to older age groups, with ownership rates exceeding 85% for individuals aged 30–49. The Consumer Electronics Association reports that the average smartphone user replaces their device every 2.5 years, creating recurring demand for accessories such as chargers, protective cases, and screen guards. On top of that, the growing popularity of premium smartphones, including Apple’s iPhone and Samsung’s Galaxy series, has amplified interest in complementary products that enhance both functionality and aesthetics. With manufacturers continuously innovating to meet diverse consumer needs, the rising tide of smartphone ownership ensures sustained growth in the accessories market.

Growing Popularity of Wireless Accessories

The growing popularity of wireless accessories represents another significant driver of the market. Innovations such as noise-canceling technology, voice assistants, and extended battery life have made these products indispensable for tech-savvy consumers. Like, a study by Deloitte shows that 70% of smartphone users prioritize wireless connectivity for convenience and aesthetic appeal. Brands like Apple (AirPods) and Bose have capitalized on this trend, achieving record sales figures. In extension of this, the integration of Bluetooth 5.0 and advanced codecs has improved audio quality, further boosting adoption. With wireless accessories projected to capture 60% of the market by 2025, as cited by industry experts, their dominance reflects a transformative shift in consumer preferences.

MARKET RESTRAINTS

Short Product Lifecycles

One of the primary restraints in the North America smartphone accessories market is the short product lifecycle, which creates challenges for both manufacturers and consumers. As per the Consumer Technology Association, the average lifespan of smartphone accessories such as earphones and chargers is less than two years due to rapid technological advancements. This frequent obsolescence discourages long-term investments, particularly for budget-conscious buyers. Besides, the environmental impact of discarded accessories has drawn criticism, with the Environmental Protection Agency estimating that electronic waste contributes to over 50 million metric tons annually. Manufacturers face pressure to innovate while addressing sustainability concerns, adding complexity to product development. So, these factors not only increase costs but also limit the market's ability to retain customer loyalty, posing a significant barrier to sustained growth.

Intense Price Competition

Intense price competition poses another major restraint for the market. Based on a report by PwC, over 300 companies compete in the North American smartphone accessories space, leading to aggressive pricing strategies that erode profit margins. Also, budget brands and counterfeit products flood online platforms, undercutting premium offerings from established players like Apple and Samsung. According to the Better Business Bureau, counterfeit accessories account for 15% of online sales, compromising quality and safety standards. As well as, the prevalence of discounts and promotional campaigns during events like Black Friday exacerbates pricing pressures. Smaller firms struggle to differentiate themselves, often resorting to niche applications with limited scalability. This competitive landscape creates barriers for innovation and hinders sustainable growth across the industry.

MARKET OPPORTUNITIES

Expansion into Smart Wearables Integration

The integration of smartphone accessories with smart wearables presents a lucrative opportunity for the North America market. Findings by the International Data Corporation indicate that shipments of wearable devices like smartwatches and fitness trackers exceeded 150 million units globally in 2022, with North America accounting for 40% of this volume. Accessories designed to complement these devices, such as wireless charging docks and modular bands, are gaining traction. For instance, Apple’s ecosystem strategy, linking AirPods and Watch chargers with iPhones, has driven accessory sales by 30%, as per internal reports. Additionally, the rise of health-conscious consumers has fueled demand for accessories that enhance functionality, such as heart rate monitoring straps. Partnerships between tech giants and healthcare providers, like Fitbit’s collaboration with insurance firms, have expanded use cases.

Growth in Eco-Friendly Accessories

Eco-friendly accessories represent another promising opportunity, driven by increasing consumer awareness of sustainability. Manufacturers like Pela Case have capitalized on this trend, offering biodegradable phone cases and compostable packaging. Similarly, a study by the Environmental Protection Agency notes that eco-friendly accessories reduce electronic waste by 25% is aligning with regulatory mandates. To add to this, initiatives like Apple’s trade-in program, which encourages recycling have boosted brand loyalty among environmentally conscious buyers. According to Forbes, the global market for sustainable electronics is projected to reach $20 billion by 2025, underscoring the potential for growth. Therefore, by prioritizing green innovations, companies can tap into a burgeoning market while addressing ecological concerns.

MARKET CHALLENGES

Counterfeit Products and Quality Concerns

Counterfeit products pose a significant challenge to the North America smartphone accessories market, undermining trust and profitability. As suggested by the Better Business Bureau, counterfeit accessories account for 15% of online sales, often lacking essential safety certifications. These products, sold at discounted prices, compromise performance and pose risks such as overheating and electrical hazards. A report by the Federal Trade Commission reveals that counterfeit chargers alone caused over 500 incidents of device damage in 2022. This issue not only tarnishes brand reputations but also forces legitimate manufacturers to invest heavily in anti-counterfeiting measures. Apart from these, consumer skepticism about product authenticity deters purchases, particularly in online channels. Without stringent enforcement and consumer education, the proliferation of counterfeit goods threatens to stifle innovation and market growth.

Regulatory Compliance and Safety Standards

Regulatory compliance and safety standards present another major challenge for the market. The Consumer Product Safety Commission mandates rigorous testing for electronic accessories, including chargers and batteries, to ensure safety. According to the National Fire Protection Association, faulty chargers caused over 100 fires annually in residential settings, prompting stricter regulations. Also, Compliance with these standards requires significant investment in R&D and manufacturing processes, which may not be feasible for smaller firms. Furthermore, varying state-level regulations complicate cross-border sales, particularly in the U.S., where standards differ across jurisdictions. A report by the U.S. Chamber of Commerce stresses that regulatory delays cost the industry approximately $10 billion annually. Consequently, these challenges hinder innovation and delay product launches, impeding market expansion and competitiveness.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

6.45% |

|

Segments Covered |

By Type, Price Range, Distribution Channel and Country |

|

Various Analyses Covered |

Global, Regional and Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

USA, Canada, Mexico, Rest of North America |

|

Market Leaders Profiled |

Apple Inc., Bose Corporation, Griffin Technology LLC (Incipio Technologies, Inc.), JVC Kenwood Corporation, Otter Products LLC, Panasonic Corporation, Plantronics Inc., Samsung Electronics Co. Ltd., Sennheiser Consumer Electronics GmbH & Co. KG (Sennheiser electronic GmbH & Co. KG) and Sony Corporation |

SEGMENTAL ANALYSIS

By Type Insights

The protective cases segment became the most popular category of the North America smartphone accessories market by capturing a 30.8% share in 2024. This happened due to their critical role in safeguarding expensive smartphones from damage. The Federal Communications Commission highlighted that over 70% of smartphone users prioritize device protection, driving demand for durable and stylish cases. Additionally, the Consumer Electronics Association noted that protective cases reduce repair costs by 40%, making them a practical choice. Their affordability and widespread availability further solidified their position as the largest segment in the market.

Power banks segment on the other hand is seeing the highest growth rate in the market, with a CAGR of 22.5%. Increasing reliance on mobile devices and the need for portable charging solutions are the reasons behind this progress. Like, The National Renewable Energy Laboratory predicts a 50% rise in demand for energy-efficient accessories by 2030, driven by longer battery life requirements. Innovations in fast-charging technology have reduced charging times by 60%, enhancing user convenience. Partnerships between manufacturers and tech firms will expand accessibility, ensuring power banks play a pivotal role in addressing growing energy needs. These trends highlight their importance in supporting mobile lifestyles.

By Price Range Insights

Mid-range accessories were the leading segment of the North America smartphone accessories market by possessing a 47.6% share in 2024. This dominance is accredited to their balance of affordability and quality, appealing to a broad demographic. Additionally, the rise of budget-conscious millennials and Gen Z consumers has amplified demand, with brands like Belkin and Anker capitalizing on this trend. Also, marketing strategies emphasizing durability and functionality further enhance adoption. So, these factors solidify mid-range accessories as the largest segment in the market.

The premium accessories segment witnessed sudden rise in the market and is expected to attain a CAGR of 15.8% during the forecast period. Such type of development can be linked to the increasing adoption of luxury smartphones like the iPhone Pro series, which drive demand for complementary high-end products. Similarly, according to Forbes, premium accessories such as MagSafe chargers and leather cases have experienced a 30% annual sales increase, reflecting their appeal to affluent consumers. Innovations in materials, such as carbon fiber and recycled aluminum, enhance exclusivity, further boosting adoption. Apart from these, partnerships with luxury brands, such as Louis Vuitton’s collaboration with Apple, have expanded the segment’s reach. With disposable incomes rising, this segment is poised for exponential growth.

By Distribution Channel Insights

The online stores segment prevailed under the North America smartphone accessories market and captured a 40.5% share in 2024. It is driven by the convenience and competitive pricing offered by e-commerce platforms like Amazon and Best Buy. On top of that, the availability of customer reviews and comparison tools enhances purchasing confidence, particularly among tech-savvy millennials. Brands like Anker and Spigen have successfully leveraged this channel, achieving a 50% increase in sales, as reported by Forbes. As a result, these factors reinforce online stores as the largest distribution channel in the market.

The single-brand stores segment is expanding a swift pace in the market and is calculated to have a CAGR of 18.1% during the forecast period. This growth is fueled by the increasing popularity of flagship stores operated by brands like Apple and Samsung, which offer personalized customer experiences and exclusive product launches. According to the Consumer Electronics Association, single-brand stores improve customer satisfaction by 30%, driving repeat purchases and brand loyalty. Additionally, the integration of augmented reality (AR) tools for virtual try-ons enhances engagement, particularly for premium accessories. Strategic collaborations with influencers and tech bloggers further amplify reach. These trends highlight the segment’s potential to reshape the distribution landscape.

COUNTRY ANALYSIS

In 2024, the United States dominated the North America smartphone accessories market and held a 76.1% share. This is because of the high consumer spending on electronics and widespread adoption of advanced technologies. The Federal Communications Commission emphasized that over 90% of U.S. households owned smartphones, driving demand for accessories like chargers, cases, and earphones. Additionally, the rise of e-commerce platforms expanded accessibility, with online sales accounting for over 40% of total revenue. The Consumer Technology Association noted a 30% increase in smart home integrations, further boosting accessory adoption. These factors strengthened the U.S.'s pivotal role in shaping regional market trends.

Canada is expected to grow at the fastest rate, with a CAGR of 12% from 2025 to 2033. This growth will be driven by increasing urbanization, rising disposable incomes, and a focus on tech-savvy lifestyles. The Canadian Ministry of Innovation predicts a 50% rise in smart home adoption by 2030, amplifying demand for compatible accessories. Advancements in wireless charging and IoT-enabled devices have reduced costs, making them more accessible. Partnerships between manufacturers and local tech firms will expand distribution networks, ensuring affordability. Canada’s emphasis on sustainability aligns with eco-friendly accessory trends, positioning it as a transformative force in the market.

Mexico, though smaller in scale, is anticipated to witness steady growth, with projections indicating an 8% annual increase in smartphone accessory adoption by 2030. Rising middle-class populations and increasing awareness of digital technologies are expected to drive this trend. Government-backed campaigns promoting connectivity in rural areas will further accelerate adoption. However, challenges such as limited internet access persist, with only 60% of rural households connected, according to the International Telecommunication Union. Despite these constraints, Mexico’s strategic positioning as a burgeoning market offers significant potential for long-term growth, ensuring its contribution to regional expansion.

KEY MARKET PLAYERS

Apple Inc., Bose Corporation, Griffin Technology LLC (Incipio Technologies, Inc.), JVC Kenwood Corporation, Otter Products LLC, Panasonic Corporation, Plantronics Inc., Samsung Electronics Co. Ltd., Sennheiser Consumer Electronics GmbH & Co. KG (Sennheiser electronic GmbH & Co. KG) and Sony Corporation. are the market players dominating the North America smartphone accessories market.

Top 3 Players in the North America Smartphone Accessories Market

Apple Inc.

Apple Inc. is a dominant player in the smartphone accessories market, leveraging its ecosystem to offer seamless integration with its devices. Products like AirPods, MagSafe chargers, and leather cases exemplify the company’s focus on premium design and functionality. Apple’s strengths lie in its brand loyalty and innovative approach, investing over $10 billion annually in R&D. Its emphasis on sustainability, such as using recycled materials, aligns with modern consumer values. By targeting affluent demographics, Apple continues to set benchmarks in the accessories market.

Samsung Electronics

Samsung Electronics stands out for its diverse range of accessories, catering to both Android and iOS users. The company’s Galaxy Buds and wireless chargers are widely regarded for their affordability and performance. Samsung’s strengths include its strategic partnerships with retailers and focus on inclusivity, offering products for various budgets. Additionally, its commitment to innovation, such as foldable phone cases, enhances usability. By addressing diverse consumer needs, Samsung maintains its competitive edge.

Belkin International

Belkin International is renowned for its mid-range accessories, offering products like screen protectors and cables at competitive prices. The company’s strengths lie in its strong distribution network and customer-centric designs, ensuring accessibility. Collaborations with tech giants like Apple and Google have expanded its reach, while innovations in materials enhance durability. By prioritizing affordability and quality, Belkin appeals to a broad audience.

Top Strategies Used By Key Market Participants

Key players employ strategies such as product innovation, strategic partnerships, and direct-to-consumer sales to strengthen their positions. Companies like Apple focus on ecosystem integration, while Samsung emphasizes affordability and inclusivity. Additionally, brands like Belkin leverage e-commerce platforms to expand accessibility. Offering subscription-based services and personalized health insights drives customer loyalty, ensuring sustained growth.

COMPETITION OVERVIEW

The North America smartphone accessories market is characterized by intense competition, with key players striving to innovate and capture a larger share of the growing industry. Established companies leverage their expertise in advanced technologies to develop products that cater to diverse consumer needs, such as protective cases, chargers, earphones, and power banks. These firms focus on enhancing product functionality, ensuring durability, and addressing concerns about affordability and usability. Their strong brand recognition and extensive distribution networks enable them to maintain a competitive edge.

Emerging players also play a crucial role in shaping the market landscape. By introducing cost-effective and innovative solutions, these companies challenge traditional leaders and expand accessibility to advanced accessories. Partnerships with technology providers, e-commerce platforms, and retailers further amplify their impact, fostering trust and credibility among consumers.

To differentiate themselves, companies emphasize customization, offering personalized designs and features tailored to specific user preferences. Sustainability and ethical considerations are increasingly prioritized, aligning with evolving consumer values. However, challenges such as affordability, regulatory compliance, and technical limitations persist, requiring strategic foresight and adaptability. The competitive environment drives continuous innovation, ensuring that only the most reliable and user-friendly products succeed.

RECENT HAPPENINGS IN THIS MARKET

- In March 2023, Apple launched a new line of MagSafe accessories, enhancing compatibility with its latest iPhone models.

- In May 2023, Samsung partnered with Amazon to offer exclusive discounts on its Galaxy Buds series, boosting online sales.

- In July 2023, Belkin introduced eco-friendly screen protectors, targeting environmentally conscious consumers.

In September 2023, Anker collaborated with YouTube influencers to promote its portable chargers, increasing brand visibility. - In November 2023, Spigen acquired a startup specializing in AR-based product visualization, enhancing its e-commerce platform.

MARKET SEGMENTATION

This research report on the North America smartphone accessories market is segmented and sub-segmented into the following categories.

By Type

- Battery

- Earphones/Headphones

- Portable Speaker

- Charger

- Memory Card

- Power Bank

- Protective Cases

- Battery Cases

- Screen Guard

- Smart Watch

- Others

By Price Range

- Mid

- Premium

- Low

By Distribution Channel

- Multi-Brand Store

- Single-Brand Store

- Online Store

By Country

- The USA

- Canada

- Mexico

- Rest of North America

Frequently Asked Questions

What is driving the growth of the smartphone accessories market in North America?

Increased smartphone adoption, demand for wireless accessories, and a tech-savvy consumer base are key growth drivers.

Which smartphone accessory segment is most popular in North America?

Wireless earbuds and headphones lead the market, followed closely by protective cases and chargers.

How is 5G technology influencing the accessories market?

5G adoption is boosting demand for compatible accessories like faster chargers, advanced headphones, and gaming controllers.

Who are the major players in the North American accessories market?

Top brands include Apple, Samsung, Anker, Belkin, and OtterBox.

What are the current consumer trends in smartphone accessories?

Trends include eco-friendly materials, MagSafe accessories, wireless charging, and smart wearables integration.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]