North America Switchgear Market Size, Share, Trends & Growth Forecast Report By Insulation Type (Gas-Insulated Switchgear (GIS), Air-Insulated Switchgear (AIS)), Installation Type, End User and Country (The United States, Canada and Rest of North America), Industry Analysis From 2025 to 2033

North America Switchgear Market Size

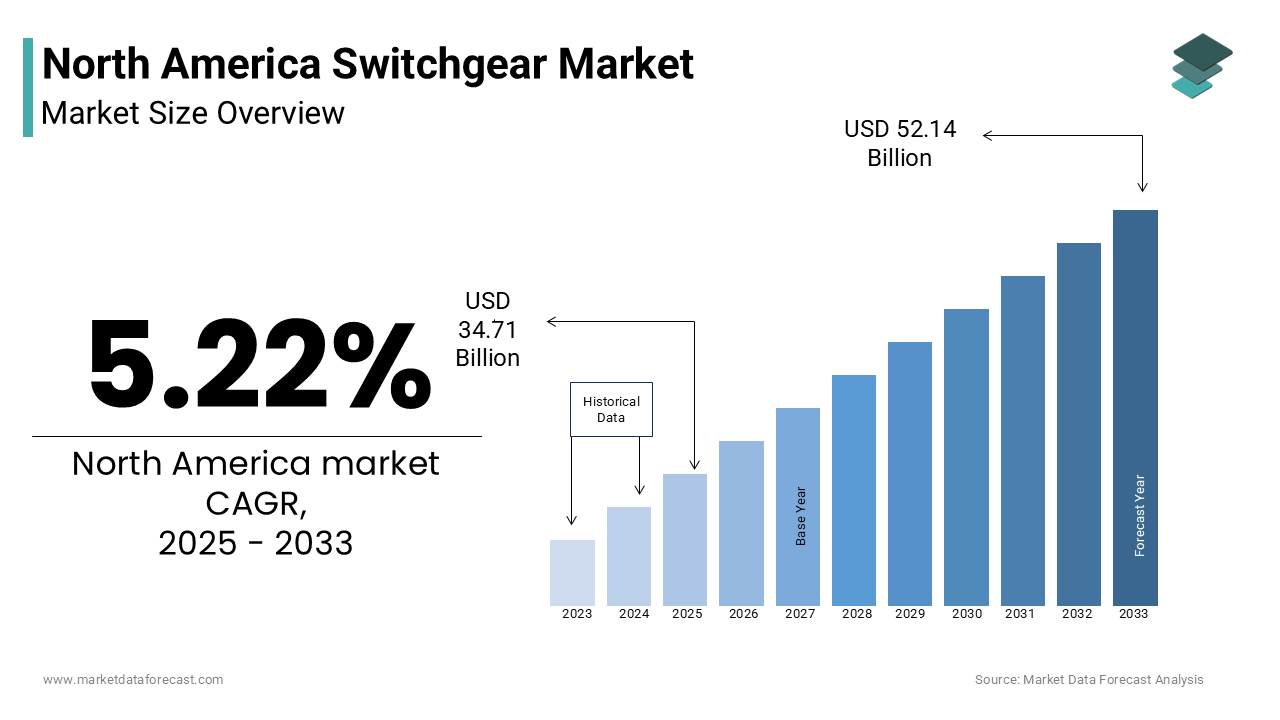

The North America switchgear market was worth USD 32.98 billion in 2024. The North America market is expected to reach USD 52.14 billion by 2033 from USD 34.71 billion in 2025, rising at a CAGR of 5.22% from 2025 to 2033.

The North America switchgear market encompasses a broad range of electrical equipment designed to control, regulate, and protect electrical circuits and equipment across various voltage levels. This includes low, medium, and high-voltage systems that are integral to power generation, transmission, and distribution networks. The market spans components such as circuit breakers, switches, fuses, relays, and protective devices deployed in residential, commercial, industrial, and utility sectors. With increasing emphasis on grid modernization, energy efficiency, and electrification of transportation and industrial processes, the demand for advanced switchgear solutions has seen significant traction in recent years. These figures underscore the scale of power infrastructure requiring robust switchgear systems to ensure safe and uninterrupted operations. Moreover, according to Natural Resources Canada, the country's reliance on hydropower—accounting for nearly 60% of its electricity production—has further reinforced the need for durable and efficient switchgear technologies to manage renewable-based grids. In the U.S., aging infrastructure, with some components dating back to the mid-20th century, is prompting large-scale investments in grid resilience and automation.

MARKET DRIVERS

Grid Modernization and Infrastructure Upgrades

One of the primary drivers of the North America switchgear market is the ongoing modernization of aging electrical infrastructure, particularly in the United States. Much of the existing grid infrastructure was constructed several decades ago and is now facing obsolescence, inefficiency, and vulnerability to outages. According to the American Society of Civil Engineers (ASCE), the U.S. power grid received a grade of "C-" in its 2023 Infrastructure Report Card, highlighting the urgent need for upgrades to enhance reliability and reduce downtime. The Department of Energy estimates that power outages cost the U.S. economy up to $70 billion annually, reinforcing the necessity for smarter, more resilient grid systems. In response, governments and utility companies have committed substantial funding toward grid modernization initiatives. For instance, the Bipartisan Infrastructure Law (BIL) allocated approximately $65 billion for improving the U.S. power grid, including investments in smart grid technologies, digital substations, and intelligent switchgear systems. These funds are being utilized to replace outdated mechanical components with digitally integrated switchgear that supports real-time monitoring, predictive maintenance, and enhanced fault detection. This transformation is not only enhancing system reliability but also fostering the integration of distributed energy resources (DERs), such as solar, wind, and battery storage, which require advanced switchgear to manage bidirectional power flows and maintain grid stability.

Expansion of Renewable Energy Capacity

Another key driver of the North America switchgear market is the rapid expansion of renewable energy installations, particularly in wind and solar power. Governments across the U.S. and Canada have set ambitious clean energy targets, spurring investment in alternative power sources. According to the International Renewable Energy Agency (IRENA), North America added over 35 GW of new renewable capacity in 2023, with the U.S. accounting for the majority of this growth. The U.S. Energy Information Administration (EIA) projects that renewable energy will constitute nearly 44% of total U.S. electricity generation by 2050, up from 23% in 2022. Renewable energy systems necessitate specialized switchgear to manage variable power inputs, integrate with the main grid, and ensure safety during fluctuating conditions. Unlike conventional power plants, renewable installations often operate at remote locations and require decentralized switchgear solutions capable of handling intermittent generation patterns. Moreover, offshore wind development along the U.S. Atlantic coast is gaining momentum, supported by federal incentives under the Inflation Reduction Act (IRA). These large-scale renewable projects mandate high-capacity switchgear systems for substation connectivity and grid synchronization. The growing deployment of microgrids and behind-the-meter solar installations further amplifies the need for compact and modular switchgear units tailored to decentralized energy architectures.

MARKET RESTRAINTS

Supply Chain Disruptions and Component Shortages

A significant restraint affecting the North America switchgear market is the persistent supply chain disruptions and shortages of critical electronic components. The global semiconductor shortage, which began during the pandemic and continued into 2023, has severely impacted the production timelines of switchgear manufacturers. Switchgear systems increasingly rely on digital components for automation, remote monitoring, and smart grid compatibility. However, the concentration of semiconductor manufacturing in East Asia, coupled with geopolitical tensions and logistical bottlenecks, has led to extended lead times and increased costs. Additionally, rising freight costs and customs delays have compounded the problem. These constraints have forced many manufacturers to delay project deliveries, inflate pricing, or seek alternative components, which may compromise performance standards.

Regulatory Compliance and Environmental Standards

Stringent regulatory frameworks and evolving environmental compliance requirements pose another major challenge for the North America switchgear market. Regulatory bodies such as the U.S. Environmental Protection Agency (EPA) and Environment and Climate Change Canada (ECCC) have imposed rigorous standards on greenhouse gas emissions, hazardous materials, and lifecycle sustainability of electrical equipment. A notable example is the EPA’s Significant New Alternatives Policy (SNAP) program, which restricts the use of sulfur hexafluoride (SF6)—a potent greenhouse gas commonly used in high-voltage switchgear due to its excellent dielectric properties. According to the EPA, SF6 has a global warming potential 22,800 times greater than CO2 and can remain in the atmosphere for up to 3,200 years. As a result, regulations are pushing manufacturers to develop alternatives such as vacuum interrupters, dry air insulation, or fluoroketone-based gases. While these substitutes offer lower environmental impact, they often come with higher upfront costs and require extensive R&D investment. As reported by the Electric Power Research Institute (EPRI), retrofitting existing SF6-based systems to comply with new standards could cost utilities up to $2.5 billion by 2030. Moreover, varying state-level regulations in the U.S., particularly in California and New York, add complexity to nationwide deployment strategies. Manufacturers must navigate a patchwork of compliance mandates, leading to increased operational overhead and slower product launches.

MARKET OPPORTUNITIES

Electrification of Transportation and EV Charging Infrastructure

A compelling opportunity for the North America switchgear market lies in the accelerating electrification of transportation and the concurrent build-out of electric vehicle (EV) charging infrastructure. Governments in both the U.S. and Canada have set aggressive targets for phasing out internal combustion engine vehicles and expanding EV adoption. According to the International Energy Agency (IEA), EV sales in North America surpassed 1.2 million units in 2023, representing a year-over-year growth of 47%. This transition demands substantial upgrades to the electrical grid to support high-load EV charging stations, particularly fast-charging hubs that can draw power equivalent to hundreds of homes. Such facilities require robust and intelligent switchgear systems to manage load balancing, prevent overloads, and integrate with renewable energy sources. As per the Edison Electric Institute (EEI), utilities are planning to invest over $100 billion in grid enhancements specifically aimed at supporting EV integration by 2030. Furthermore, the rise of vehicle-to-grid (V2G) technology, where EVs can feed electricity back into the grid during peak demand, introduces complex bidirectional power flows that traditional switchgear cannot efficiently handle. Advanced digital switchgear equipped with real-time analytics and automated switching capabilities is essential to accommodate these dynamics.

Digitalization and Adoption of Smart Grid Technologies

The increasing digitalization of power networks and the widespread adoption of smart grid technologies present a transformative opportunity for the North America switchgear market. Utilities and industrial operators are investing heavily in digitized infrastructure to improve grid reliability, optimize energy consumption, and integrate distributed energy resources (DERs). Smart switchgear plays a crucial role in enabling real-time monitoring, remote diagnostics, and self-healing capabilities within the grid. These features allow for faster fault detection, reduced outage durations, and improved asset management. Moreover, the integration of artificial intelligence (AI) and machine learning algorithms into switchgear systems is enabling predictive maintenance and adaptive grid control.

MARKET CHALLENGES

Cybersecurity Threats to Digitally Integrated Switchgear Systems

As switchgear systems become increasingly digitized and connected to broader grid networks, cybersecurity threats pose a growing challenge to the North America switchgear market. The integration of Internet of Things (IoT)-enabled switchgear, smart relays, and cloud-connected monitoring tools has expanded the attack surface for malicious actors targeting critical infrastructure. Modern switchgear systems often communicate via Industrial Control Systems (ICS) and Supervisory Control and Data Acquisition (SCADA) networks, which, if compromised, can lead to unauthorized access, system manipulation, or even grid destabilization. A report by IBM X-Force found that ransomware attacks on industrial organizations surged by 93% in 2023, with energy firms being prime targets. The Colonial Pipeline ransomware incident in 2021 serves as a stark reminder of how cyberattacks can disrupt energy operations and trigger cascading effects across infrastructure. To mitigate these risks, switchgear manufacturers and utilities must implement robust cybersecurity protocols, including secure communication protocols, firmware encryption, and regular penetration testing. However, compliance with evolving cybersecurity standards such as NISTIR 7628 and CIP-013-1 from the North American Electric Reliability Corporation (NERC) adds complexity and cost to product development and deployment cycles.

Rising Raw Material Costs and Inflationary Pressures

Escalating raw material prices and inflationary pressures represent a significant challenge for the North America switchgear market. Key materials such as copper, aluminum, steel, and rare earth metals—essential for manufacturing conductors, enclosures, and magnetic cores—are experiencing unprecedented price volatility. Aluminum, widely used in switchgear housings and conductive parts, also witnessed a notable year-on-year increase. These cost escalations directly impact production expenses for switchgear manufacturers, compressing profit margins and forcing companies to either absorb the financial burden or pass on higher prices to customers. Moreover, inflationary trends have been exacerbated by rising labor costs, energy tariffs, and logistics expenses. The Federal Reserve’s interest rate hikes to curb inflation have further constrained capital availability for small and mid-sized enterprises (SMEs) in the sector. These economic headwinds are slowing down procurement decisions among end-users, delaying infrastructure projects, and reducing overall market agility.

SEGMENTAL ANALYSIS

By Insulation Type Insights

Gas-insulated switchgear (GIS) had the largest share of the North America switchgear market by accounting for 58.5% in 2024. This dominance is primarily attributed to its compact design, superior performance in high-voltage applications, and growing deployment in urban substations where space constraints are significant. The increasing demand for underground power distribution systems in densely populated regions has further reinforced the preference for GIS. In addition, GIS systems offer enhanced safety and lower maintenance costs compared to air-insulated alternatives, making them ideal for critical installations like hospitals, data centers, and industrial complexes. Moreover, regulatory mandates aimed at reducing greenhouse gas emissions from electrical equipment are pushing manufacturers to adopt eco-friendly insulating gases. Companies like Siemens and ABB have introduced fluoroketone-based insulation solutions that maintain GIS efficiency while significantly lowering environmental impact.

Air-insulated switchgear (AIS) is emerging as the fastest-growing segment in the North America switchgear market, projected to grow at a CAGR of nearly 6.4%. While traditionally perceived as conventional and less technologically advanced, AIS is gaining traction due to its cost-effectiveness, ease of installation, and suitability for rural and semi-urban electrification projects. The affordability of AIS units makes them a preferred choice for small utilities and municipalities undergoing infrastructure upgrades without large capital outlays. Moreover, the rise in renewable energy installations—especially utility-scale solar farms and wind parks—is fueling demand for AIS solutions. These facilities often operate in open environments where weather conditions are manageable, making air insulation an optimal and economical choice. As reported by the Solar Energy Industries Association (SEIA), over 15 GW of new solar capacity was installed across the U.S. in 2023, many of which integrated AIS-based switching stations for grid connectivity. Furthermore, advancements in modular and hybrid AIS designs are enhancing their adaptability and scalability. Companies like Eaton and Schneider Electric have launched compact AIS systems tailored for decentralized energy microgrids, supporting off-grid and backup power needs.

By Installation Type Insights

Indoor switchgear installations commanded the North America switchgear market, holding a market share of approximately 62% in 2023. This segment's leadership stems from its widespread use in commercial buildings, industrial plants, and utility substations located within controlled environments. Moreover, the growing emphasis on smart city development and digital infrastructure expansion has led to increased deployment of indoor switchgear in data centers, hospitals, and manufacturing hubs. Safety regulations also play a crucial role in favoring indoor installations. The National Fire Protection Association (NFPA) mandates stricter arc flash risk mitigation measures, prompting facility operators to opt for enclosed switchgear setups that minimize exposure to live components. In addition, indoor switchgear typically experiences less wear and tear due to environmental factors, resulting in longer asset life and reduced lifecycle costs.

Outdoor switchgear installations are rising as the highest developing segment in the North America switchgear market, projected to expand at a CAGR of 7.1% during the forecast period. This accelerated growth is primarily driven by the expansion of rural electrification programs, renewable energy infrastructure, and grid reinforcement initiatives in remote locations. These projects frequently employ outdoor switchgear units that can withstand extreme weather conditions while ensuring reliable power delivery. Simultaneously, the proliferation of utility-scale renewable energy sites—especially solar farms and wind parks—has spurred demand for outdoor switchgear. These installations are typically located in open or isolated terrains where overhead lines and outdoor substations are more feasible. Additionally, outdoor switchgear is being increasingly equipped with smart sensors and IoT-enabled monitoring tools to facilitate predictive maintenance and fault detection in real time. Manufacturers such as General Electric and Mitsubishi Electric have introduced weather-resistant outdoor switchgear models capable of operating efficiently in temperatures ranging from -40°C to +60°C, expanding their applicability across North America’s diverse climatic zones.

By End User Insights

Transmission and distribution (T&D) utilities represented the largest end-user segment in the North America switchgear market by commanding a market share of 47% in 2024. This dominance is primarily fueled by the urgent need to modernize aging grid infrastructure, enhance system reliability, and accommodate the integration of renewable energy sources. Given that T&D utilities are responsible for managing power flow across vast geographies, they remain the primary buyers of both gas-insulated and air-insulated switchgear solutions. Moreover, the rise in cross-border power exchanges and the deployment of high-voltage direct current (HVDC) corridors between the U.S. and Canada necessitate advanced switchgear technologies capable of handling complex power flows and fault management. These ongoing developments ensure that T&D utilities continue to be the leading end-user category in the North America switchgear market.

The commercial and residential sector is the fastest-growing end-user segment in the North America switchgear market, anticipated to grow at a CAGR of 6.9%. This surge is being driven by the expansion of smart building technologies, increased construction activity, and the growing adoption of behind-the-meter energy solutions such as rooftop solar and battery storage. Alongside this, commercial construction spending rose, reflecting strong demand for office spaces, retail centers, and mixed-use developments—all of which require sophisticated electrical infrastructure. Like, new building codes now mandate the use of arc-resistant and digitally integrated switchgear to improve safety and energy efficiency. Simultaneously, the rise in distributed energy resource (DER) installations among homeowners and businesses is reshaping power consumption patterns. The Solar Energy Industries Association (SEIA) reports that residential solar installations in the U.S. grew by 35% in 2023, with many households deploying hybrid switchgear units to manage bidirectional power flows from solar inverters and battery systems. Manufacturers like Schneider Electric and Eaton have introduced compact, modular switchgear platforms specifically designed for commercial and residential applications, integrating features such as remote monitoring, load balancing, and surge protection.

REGIONAL ANALYSIS

The United States was the largest contributor to the North America switchgear market by holding a market share of 76.1% in 2024. The country's dominance is rooted in its expansive electrical infrastructure, aggressive grid modernization initiatives, and the rapid adoption of renewable energy sources. Aging infrastructure is a key driver, with the American Society of Civil Engineers (ASCE) reporting that much of the nation’s grid is over 50 years old. The Bipartisan Infrastructure Law (BIL) and Inflation Reduction Act (IRA) have injected over $65 billion into grid modernization, fostering demand for advanced switchgear solutions. These clean energy projects require specialized switchgear for grid synchronization and fault protection. The rise of EV charging infrastructure and smart cities is further strengthening the switchgear market outlook in the U.S., positioning it as the undisputed leader in North America.

Canada saw steady growth and is driven by investments in renewable energy, electrification of transportation, and grid modernization efforts. The country’s commitment to achieving net-zero emissions by 2050 has prompted substantial shifts in its energy landscape, necessitating upgraded electrical infrastructure. These developments require advanced switchgear systems to manage variable power inputs and ensure grid stability. Additionally, Canada is accelerating its EV adoption strategy, with the government aiming for all new passenger vehicle sales to be zero-emission by 2035.

The Rest of North America exhibits considerable potential for future expansion. Although currently smaller in scale, these markets are experiencing growing energy demand, industrialization, and government-backed electrification programs that are beginning to influence switchgear procurement trends. These initiatives are driving demand for switchgear systems capable of integrating decentralized power sources and improving grid reliability. As regional economies continue to develop and attract foreign investment, the Rest of North America is expected to emerge as a more prominent player in the switchgear market.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

BB Ltd., Siemens AG, Schneider Electric SE, Eaton Corporation, Mitsubishi Electric Corporation, General Electric Company, Toshiba Corporation, Hitachi Energy Ltd., Powell Industries Inc., and CG Power and Industrial Solutions Ltd are some of the key market players.

The North America switchgear market is characterized by intense competition driven by technological advancements, evolving regulatory frameworks, and increasing demand for reliable and sustainable power infrastructure. A mix of global giants and regional players coexist, with established manufacturers leveraging their extensive R&D capabilities, brand recognition, and integrated service networks to maintain dominance. At the same time, emerging firms are striving to capture market share through innovative product designs, cost-effective solutions, and agile responses to local needs. The competitive landscape is further shaped by the growing emphasis on digitalization, where vendors are integrating smart technologies into switchgear systems to enhance performance and operational efficiency. Strategic moves such as mergers, acquisitions, and collaborative ventures are becoming common as companies seek to expand their portfolios and geographic reach. Additionally, the shift toward renewable energy sources and the need for resilient grid infrastructure have intensified the race for advanced switchgear solutions, making differentiation through innovation and sustainability critical to maintaining a competitive edge in this dynamic market.

Top Players in the North America Switchgear Market

Siemens Energy

Siemens Energy is a global leader in the switchgear industry, with a strong footprint across North America. The company offers a comprehensive portfolio of gas-insulated and air-insulated switchgear solutions tailored for utility, industrial, and commercial applications. Siemens has been instrumental in advancing digitalization within the sector through its integration of smart grid technologies and IoT-enabled switchgear systems. Its focus on innovation, sustainability, and grid modernization aligns closely with the evolving energy landscape in North America.

General Electric (GE) Grid Solutions

General Electric’s Grid Solutions division plays a pivotal role in shaping the North American switchgear market. Known for its high-voltage transmission expertise, GE delivers advanced switchgear systems that support grid resilience and renewable energy integration. The company emphasizes hybrid solutions that combine digital monitoring with traditional switching capabilities to enhance performance and reliability. Its long-standing partnerships with utilities and infrastructure developers position it as a key player in both public and private energy projects.

Schneider Electric

Schneider Electric is a major contributor to the North America switchgear market, particularly in the commercial and industrial segments. The company provides modular, compact, and energy-efficient switchgear products designed for smart buildings, data centers, and decentralized power systems. Schneider's commitment to sustainability and electrification has led to the development of eco-friendly insulation technologies and digitized control systems. Its customer-centric approach and broad distribution network make it a dominant force in the regional market.

Top Strategies Used by Key Market Participants

One of the primary strategies adopted by leading players in the North America switchgear market is product innovation and digital integration. Companies are focusing on developing intelligent switchgear equipped with real-time monitoring, predictive maintenance, and remote diagnostics to meet the rising demand for grid automation and energy efficiency.

Another key strategy is strategic partnerships and collaborations with utilities, technology firms, and government agencies. These alliances help manufacturers align their product offerings with regulatory standards, grid modernization goals, and emerging energy trends such as EV charging and renewable integration.

Lastly, expansion through acquisitions and localized manufacturing is gaining traction. By acquiring niche technology providers or setting up regional production units, companies aim to reduce supply chain risks, improve customer responsiveness, and strengthen their foothold in high-growth areas across North America.

REGIONAL ANALYSIS

- In February 2024, Siemens Energy launched a new line of eco-efficient gas-insulated switchgear using fluoroketone-based insulation, aimed at reducing environmental impact while maintaining high performance in urban power distribution.

- In May 2024, General Electric announced a strategic collaboration with a major U.S. utility provider to deploy digital substation technologies that integrate advanced switchgear systems for enhanced grid reliability and fault detection.

- In July 2024, Schneider Electric inaugurated a new smart manufacturing facility in Texas dedicated to producing modular and digitally enabled switchgear units tailored for commercial and industrial applications.

- In September 2024, ABB partnered with a Canadian renewable energy firm to provide customized medium-voltage switchgear solutions for wind farm interconnection projects across Ontario and Quebec.

- In November 2024, Eaton Corporation introduced an upgraded version of its arc-resistant low-voltage switchgear series, specifically designed to improve safety and reduce downtime in critical infrastructure and healthcare facilities across North America.

MARKET SEGMENTATION

This research report on the North America switchgear market is segmented and sub-segmented into the following categories.

By Insulation Type

- Gas-Insulated Switchgear (GIS)

- Air-Insulated Switchgear (AIS)

By Installation Type

- Indoor Switchgear Installations

- Outdoor Switchgear Installations

By End User

- Transmission & Distribution (T&D) Utilities

- Commercial & Residential End Users

By Country

- The United States

- Canada

- Rest of North America

Frequently Asked Questions

Who are the top end-users of switchgear in North America?

T&D utilities are the largest end-users. They invest in advanced switchgear to support aging grid upgrades and renewable integration.

What challenges might the market face in the coming years?

Key challenges include high initial costs of advanced systems, regulatory compliance, and supply chain volatility. However, increasing automation and digitalization are expected to mitigate these risks.

How will smart grid development impact the switchgear market in North America?

The rise of smart grid infrastructure will significantly increase demand for digitally enabled switchgear systems. These solutions enable real-time monitoring, fault detection, and energy efficiency.

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com