North America Temperature Sensor Market Size, Share, Trends & Growth Forecast Report By Product Type (Contact Temperature Sensor, Non-Contact Temperature Sensor), Output, Connectivity, End-user Industry, and Country (The United States, Canada and Rest of North America), Industry Analysis From 2024 to 2033

North America Temperature Sensor Market Size

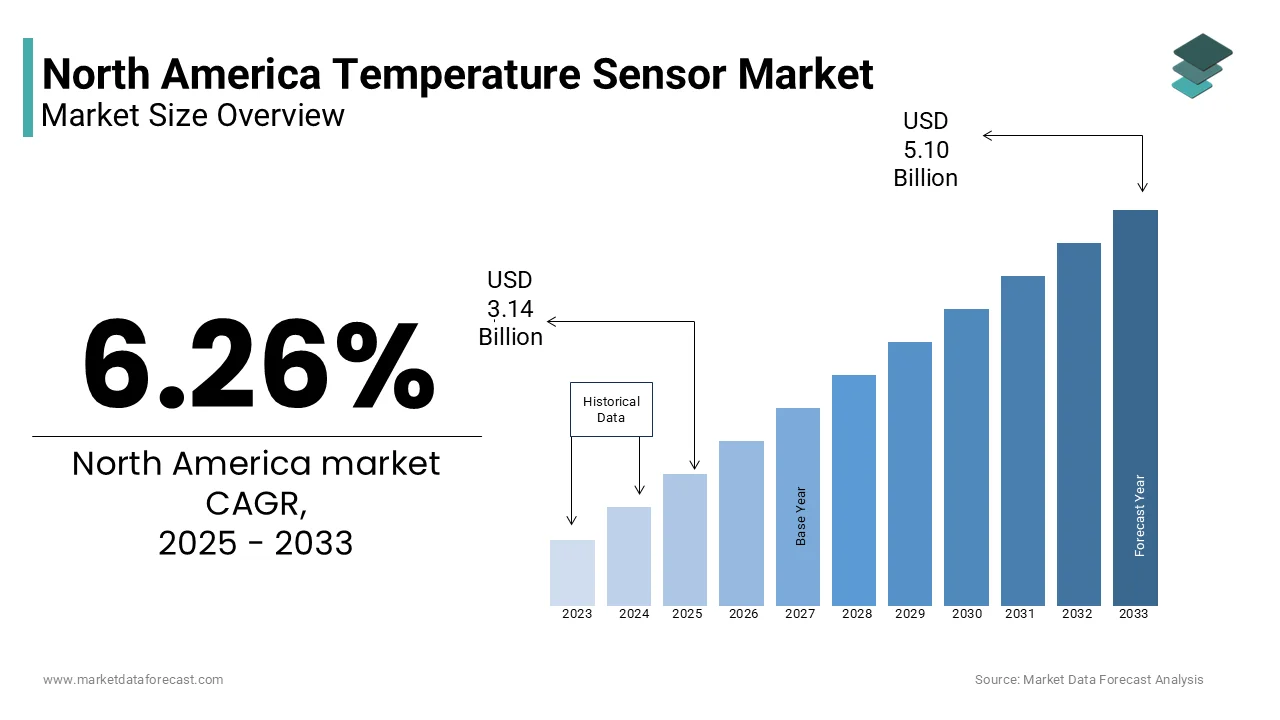

The Temperature Sensor market size in North America was valued at USD 2.96 billion in 2024 and is predicted to be worth USD 5.10 billion by 2033 from USD 3.14 billion in 2025 and grow at a CAGR of 6.26% from 2025 to 2033.

The North American temperature sensor market has emerged as a cornerstone in the region's industrial and technological landscape which is driven by the increasing demand for precision monitoring across diverse sectors. Moreover, the United States accounts for the largest share of the regional revenue, owing to its robust manufacturing sector and advancements in IoT-enabled devices. Canada and Mexico follow, with their contributions bolstered by investments in smart infrastructure and renewable energy projects. A key factor influencing this growth is the stringent regulatory framework governing safety and efficiency in industries such as oil & gas, healthcare, and automotive. For instance, the U.S. Environmental Protection Agency mandates real-time temperature monitoring in refineries, driving adoption rates. Furthermore, the proliferation of smart homes has expanded the consumer electronics segment's reliance on temperature sensors. Despite these positive trends, fluctuating raw material costs and supply chain disruptions remain concerns.

MARKET DRIVERS

Rising Adoption in Smart Homes and IoT Ecosystems

The integration of temperature sensors into smart home ecosystems represents a significant driver for the North American market. Temperature sensors are pivotal in smart thermostats, HVAC systems, and refrigeration units, ensuring optimal energy efficiency and user comfort. Additionally, the proliferation of IoT devices has amplified demand, as sensors enable seamless connectivity and data-driven insights. This trend is further fueled by government incentives promoting energy-efficient technologies, such as tax rebates for smart HVAC installations.

Stringent Regulatory Standards in Industrial Sectors

Stringent regulatory standards across critical industries like oil & gas, pharmaceuticals, and food processing are another major driver. Industries must comply with real-time temperature monitoring requirements to ensure worker safety and operational efficiency. For instance, refineries in Texas use temperature sensors to monitor pipeline integrity, reducing the risk of catastrophic failures. Similarly, the pharmaceutical sector relies on precise temperature control during drug storage and transportation, as highlighted by the FDA’s Good Manufacturing Practices (GMP) guidelines. These regulations not only mandate the use of temperature sensors but also drive innovation, as manufacturers develop more accurate and durable solutions.

MARKET RESTRAINTS

High Initial Costs and Maintenance Challenges

A significant restraint impacting the North American temperature sensor market is the high initial cost associated with advanced sensor technologies. Additionally, maintenance costs pose a challenge, as sensors require periodic calibration and replacement to ensure accuracy. For instance, a study by Deloitte revealed that 35% of industrial users cited maintenance expenses as a barrier to adopting advanced temperature sensors. This financial burden is particularly pronounced in emerging industries like renewable energy, where budget constraints limit large-scale sensor deployment. While technological advancements have reduced costs over time, the upfront investment remains a deterrent for widespread adoption.

Supply Chain Disruptions and Raw Material Shortages

Supply chain disruptions and raw material shortages have emerged as critical restraints for the market. According to McKinsey, semiconductor shortages, exacerbated by geopolitical tensions and the COVID-19 pandemic, have delayed production timelines for temperature sensors. For example, Texas Instruments, a major supplier of sensor components, reported a significant decline in output during the first half of 2022 due to supply chain bottlenecks. This issue is compounded by the rising cost of rare earth metals, such as platinum and nickel, essential for manufacturing high-performance sensors. Moreover, raw material prices surged considerably in 2022, impacting profit margins. These challenges have created uncertainty for manufacturers, forcing them to explore alternative materials and sourcing strategies, which often compromise product quality.

MARKET OPPORTUNITIES

Expansion in Electric Vehicles (EVs)

The rapid growth of the electric vehicle (EV) industry presents a transformative opportunity for the North American temperature sensor market. Temperature sensors play a crucial role in EV battery management systems, ensuring optimal performance and preventing overheating. For instance, Tesla’s Gigafactory in Nevada uses advanced temperature sensors to monitor lithium-ion batteries during production, enhancing safety and longevity. Additionally, the integration of sensors in EV charging stations facilitates real-time temperature monitoring, improving efficiency.

Advancements in Healthcare and Medical Devices

The healthcare sector offers another promising avenue for growth, driven by the increasing use of temperature sensors in medical devices and diagnostics. Temperature sensors are integral to applications such as patient monitoring, vaccine storage, and wearable health trackers. For example, Pfizer’s COVID-19 vaccine requires ultra-cold storage at -70°C, necessitating precise temperature sensors for transportation and distribution. Apart from these, wearable devices like Fitbit and Apple Watch incorporate sensors to monitor body temperature, enabling early detection of health anomalies.

MARKET CHALLENGES

Technological Obsolescence and Rapid Innovation

Another significant challenge is the rapid pace of technological obsolescence which is driven by continuous innovation in sensor design and functionality. This rapid evolution creates challenges for manufacturers, who must constantly innovate to stay competitive. For example, Honeywell reported an increase in R&D spending in 2022 to develop next-generation sensors capable of integrating with AI and IoT platforms. However, smaller firms struggle to keep pace as they lack the resources to invest in cutting-edge technologies. Furthermore, consumer’s growing preference for multifunctional sensors that can measure multiple parameters and is further accelerates obsolescence. So, it is posing a significant hurdle for traditional players.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

6.26% |

|

Segments Covered |

By Product Type, Output, Connectivity, End-User Industry, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

The United States, Canada, Mexico, and Rest of North America |

|

Market Leaders Profiled |

Texas Instruments Inc., Siemens Ltd., TE Connectivity Ltd., Amphenol LTW Ltd., Analog Devices Inc., Emerson Electric Co., Microchip Technology Inc., Panasonic Corporation, Honeywell International, Inc., and NXP Semiconductors N.V., and others |

SEGMENTAL ANALYSIS

By Product Type Insights

The contact temperature sensors segment dominated the North American market by holding 60.8% of the total share in 2024. This position of the segment is attributed to their reliability and accuracy in industrial applications, where direct contact is feasible. For instance, thermocouples and resistance temperature detectors (RTDs) are widely used in oil refineries and chemical plants to monitor process temperatures. A report by the U.S. Department of Energy highlights that industries prioritize contact sensors for their durability and ability to withstand harsh environments. Additionally, advancements in material science have improved sensor performance, enabling them to operate at extreme temperatures.

The non-contact temperature sensors are the fastest-growing category, with a projected CAGR of 18% from 2025 to 2033. This growth is fueled by their versatility and non-invasive nature, making them ideal for applications like food processing and healthcare. For instance, infrared sensors are increasingly used in thermal imaging cameras to detect fever in crowded areas, a trend accelerated by the COVID-19 pandemic. Apart from these, the integration of AI and machine learning has enhanced sensor capabilities, enabling predictive maintenance in industrial settings.

By Output Insights

The analogy temperature sensors segment held the largest market share and accounted for 55.5% of the total output in 2024. This position in the market is supported by their simplicity and cost-effectiveness, making them suitable for applications where digital precision is not critical. For instance, analogy sensors are widely used in HVAC systems and household appliances, where they provide reliable temperature readings at a lower cost. Besides, their compatibility with legacy systems ensures continued demand, particularly in industries resistant to digital transformation.

Digital temperature sensors segment is the swiftest rising category, with a calculated CAGR of 20.1% in the coming years. This rise is propelled by their ability to deliver precise, real-time data, making them ideal for IoT-enabled devices and industrial automation. For instance, digital sensors are integral to smart factories, where they enable predictive maintenance and process optimization. Additionally, advancements in connectivity, such as Bluetooth and Wi-Fi integration, have expanded their applications.

By Connectivity Insights

The wired temperature sensors segment commanded the North American market by capturing a significant portion of the total share in 2024. This dominance is primarily due to their reliability and stability, particularly in industrial applications where uninterrupted data transmission is critical. For instance, wired sensors are extensively used in oil refineries and chemical plants, where they provide consistent readings without interference. According to the U.S. Department of Energy, wired systems are preferred for their durability and resistance to electromagnetic interference. Additionally, their compatibility with existing infrastructure ensures sustained demand, particularly in legacy systems.

Wireless temperature sensors are the fastest-growing segment, with a projected CAGR of 22.1%. This growth is fueled by their flexibility and ease of installation, making them ideal for applications like smart homes and remote monitoring. For instance, wireless sensors are increasingly used in agricultural settings to monitor soil and ambient temperatures, enabling precision farming. Apart from these, advancements in wireless protocols, such as Zigbee and LoRa, have enhanced connectivity and range.

By End-User Industry Insights

The oil & gas industry represented the largest end-user segment by accounting for 35.1% of the total market share in 2024. This control over the market is driven by the critical role temperature sensors play in ensuring operational safety and efficiency. For instance, sensors are used to monitor pipeline temperatures, preventing leaks and explosions. Like, the oil & gas sector invested a substantial amount in sensor technologies, reflecting its commitment to safety and compliance. Also, the integration of IoT-enabled sensors has enabled predictive maintenance, reducing downtime and operational costs.

The consumer electronics segment is moving ahead quickly, with a calculated CAGR of 19.2%. This development is influenced by the increasing adoption of smart home devices such as thermostats and refrigerators, which rely on temperature sensors for functionality. For instance, smart thermostats like Google Nest and Ecobee use advanced sensors to optimize energy consumption, gaining popularity among eco-conscious consumers. Besides, advancements in miniaturization have enabled the integration of sensors into compact devices, such as wearables.

REGIONAL ANALYSIS

The United States led the North American temperature sensor market by commanding a 75.1% share in 2024. This is propelled by its robust industrial base and technological advancements across sectors like automotive, healthcare, and consumer electronics. According to the U.S. Department of Energy, industries such as oil & gas and manufacturing rely heavily on temperature sensors for process optimization and regulatory compliance. For instance, refineries in Texas use advanced thermocouples to monitor pipeline temperatures, reducing operational risks. Prominent companies have capitalized on this trend by launching next-generation sensors that integrate AI and wireless connectivity. Furthermore, federal incentives promoting energy efficiency have accelerated adoption rates, particularly in HVAC systems and electric vehicles (EVs).

Canada is seeing a notable growth in the North American temperature sensor market in the recent years. The country’s development is supported by its focus on renewable energy and smart infrastructure development. For instance, wind turbines in Alberta rely on RTDs to ensure optimal performance under extreme weather conditions. Additionally, Canada’s healthcare sector has embraced temperature sensors for vaccine storage and patient monitoring, particularly during the pandemic. Moreover, government initiatives promoting smart city projects have expanded applications in urban planning and transportation.

Mexico accounts for a smaller share of the regional market. The growth is primarily causede by the expanding automotive and manufacturing sectors, supported by trade agreements like USMCA. Also, the vehicle production in Mexico grew notably in 2022, increasing demand for temperature sensors in engine management systems. Besides, the country’s food processing industry relies on sensors to ensure compliance with international safety standards. Mexico’s strategic location as a manufacturing hub for exports to the U.S. has also bolstered sensor adoption. A study by the International Trade Administration (ITA) reveals that sensor imports into Mexico surged greatly in 2022, reflecting growing industrial activity.

The Rest of North America is encompassing the Caribbean and Central America which collectively holds a key portion of the market. This region’s growth is driven by tourism and hospitality industries, which rely on temperature sensors for guest comfort and safety.

KEY MARKET PLAYERS

Texas Instruments Inc., Siemens Ltd., TE Connectivity Ltd., Amphenol LTW Ltd., Analog Devices Inc., Emerson Electric Co., Microchip Technology Inc., Panasonic Corporation, Honeywell International, Inc., and NXP Semiconductors N.V. are playing dominating role in the North America temperature sensor market.

The North American temperature sensor market is characterized by fierce competition, driven by rapid technological advancements and diverse applications. Leading players like Honeywell, Texas Instruments, and Omega Engineering dominate the landscape by leveraging their expertise in IoT, AI, and material science to differentiate offerings. Smaller firms, however, face challenges due to high R&D costs and the dominance of established brands. The market is also witnessing increased competition from low-cost imports, particularly from Asia, which offer cheaper alternatives but often compromise on quality. Regulatory pressures and the need for compliance with stringent safety standards further complicate the competitive environment. Despite these challenges, opportunities abound in emerging sectors like EVs, healthcare, and smart homes. Companies that balance innovation with affordability while addressing regional needs are likely to thrive. The dynamic nature of the market ensures continuous evolution, with players vying for leadership through strategic investments and cutting-edge solutions.

TOP PLAYERS IN THE MARKET

Honeywell International Inc.

Honeywell dominates the North American temperature sensor market. Its broad portfolio of contact and non-contact sensors caters to diverse industries, including aerospace, automotive, and healthcare. The company’s emphasis on IoT integration has strengthened its global presence.

Texas Instruments Incorporated

Texas Instruments is known for its semiconductor-based sensors, the company serves industries ranging from consumer electronics to industrial automation. Texas Instruments’ digital sensors, integrated with Bluetooth and Wi-Fi, gained traction in recent years, particularly among EV manufacturers. Its focus on miniaturization and energy efficiency has positioned it as a leader in innovative sensor technologies.

Omega Engineering Inc.

Omega Engineering is specializing in high-performance sensors for extreme environments, Omega serves sectors like oil & gas and pharmaceuticals.

TOP STRATEGIES USED BY KEY PLAYERS

Key players in the North American temperature sensor market employ diverse strategies to maintain their competitive edge. Innovation remains central, with companies investing heavily in R&D to develop IoT-enabled and AI-driven sensors. Strategic partnerships with end-user industries, such as automotive and healthcare, ensure tailored solutions. Expanding geographic reach through distribution networks and targeting emerging markets like renewable energy and smart cities further strengthens market presence. Finally, sustainability initiatives, such as eco-friendly materials and energy-efficient designs, align with global trends, appealing to environmentally conscious consumers.

RECENT HAPPENINGS IN THE MARKET

- In January 2023, Honeywell International launched a new line of IoT-enabled temperature sensors designed for industrial automation. This move strengthened its position in the manufacturing sector.

- In March 2023, Texas Instruments acquired SensiTech, a semiconductor startup specializing in wireless sensor technology. This acquisition enhanced its capabilities in IoT integration.

- In June 2023, Omega Engineering partnered with Pfizer to supply precision temperature sensors for vaccine cold chain logistics. This collaboration expanded its footprint in the healthcare sector.

- In September 2023, Honeywell introduced a compact, energy-efficient sensor for smart home applications, targeting eco-conscious consumers. This launch boosted its brand appeal in residential markets.

- In December 2023, Texas Instruments unveiled a next-generation digital sensor with AI-driven analytics, positioning itself as a leader in predictive maintenance solutions.

MARKET SEGMENTATION

This research report on the North America Temperature Sensor market has been segmented and sub-segmented based on the following categories.

By Product Type

- Contact Temperature Sensors

- Thermocouples

- Resistive Temperature Detectors

- Thermistors

- Temperature Sensor ICs

- Bimetallic Temperature Sensors

- Non-contact Temperature Sensors

- Infrared Temperature Sensors

- Fiber Optic Temperature Sensors

By Output

- Digital

- Analog

By Connectivity

- Wired

- Wireless

By End-User Industry

- Chemicals

- Oil & Gas

- Consumer Electronics

- Energy & Power

- Healthcare

- Automotive

- Metals & Mining

- Food & Beverages

- Pulp & Paper

- Advanced Fuel

- Aerospace & Defense

- Glass

- Others

By Country

- The United States

- Canada

- Rest of North America

Frequently Asked Questions

1. What is the projected size of the North America Temperature Sensor market by 2033?

The North America Temperature Sensor market is expected to reach approximately USD 5.10 billion by 2033

2. What are the main factors driving the growth of the temperature sensor market in North America?

Key growth drivers include the rise in industrial automation, increasing demand for energy efficiency, expansion of the electric vehicle (EV) market, and technological advancements such as IoT and AI integration in sensors

3. Which countries are leading the North America temperature sensor market?

The United States dominates the market, while Canada is the fastest-growing region due to investments in automation, clean energy, and manufacturing

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]