North America UV LED Market Size, Share, Trends & Growth Forecast Report By Technology (UV-C, UV-A), Power Output, Application, End Use, And Country (US, Canada, And Rest Of North America), Industry Analysis From 2025 To 2033

North America UV LED Market Size

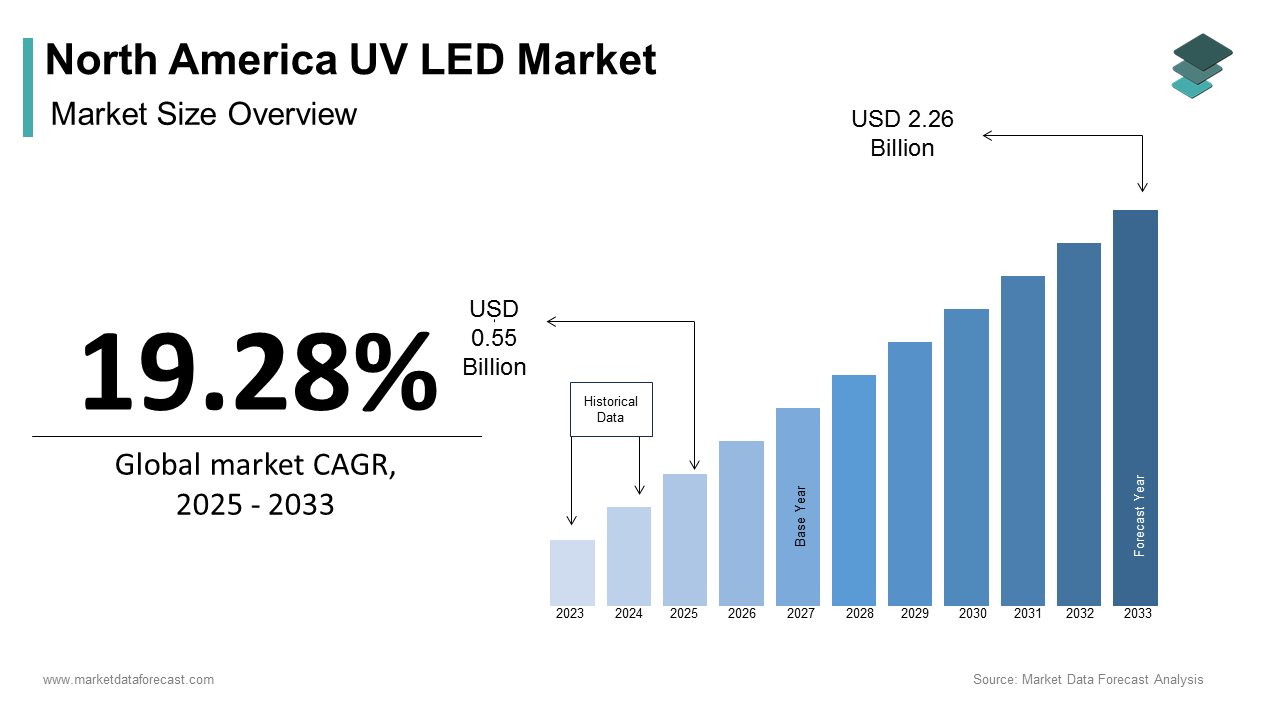

The North America UV LED market size was calculated to be USD 0.46 billion in 2024 and is anticipated to be worth USD 2.26 billion by 2033, from USD 0.55 billion in 2025, growing at a CAGR of 19.28% during the forecast period.

The North America UV LED market is witnessing robust growth and is driven by its versatility across industries such as healthcare, electronics, and agriculture. The United States accounts for largest market share which is supported by strong R&D investments and favorable government policies promoting energy-efficient technologies. Multiple reports notes that UV LEDs significantly reduce energy consumption compared to traditional UV lamps, making them a preferred choice for disinfection and curing applications. Additionally, the increasing adoption of UV LEDs in water purification systems has surged notably in recent years. So, the market is poised for exponential expansion due to the rising awareness about hygiene and environmental sustainability, supported by technological advancements and growing consumer demand.

MARKET DRIVERS

Rising Demand for Disinfection Applications

Disinfection applications are a key driver for the North America UV LED market. UV-C LEDs, in particular, have gained prominence due to their efficacy in eliminating pathogens like bacteria and viruses, with a high germicidal efficiency rate. In North America, hospitals and commercial spaces have adopted UV LEDs extensively. A study by the National Institutes of Health reveals that UV LEDs are now integrated into HVAC systems, enhancing indoor air quality. Furthermore, this combination of safety, efficiency, and sustainability drives their widespread adoption.

Advancements in UV Curing Technologies

UV curing is another key driver of the market. These LEDs offer faster curing times and superior adhesion compared to traditional mercury-based systems, reducing production cycles. According to the Semiconductor Industry Association, a large number of semiconductor manufacturers utilize UV LEDs, citing improved precision and reduced thermal damage. Additionally, the packaging and printing sectors have seen an annual surge in UV LED adoption. These advancements not only enhance product quality but also lower operational costs, making UV curing a cornerstone of industrial innovation.

MARKET RESTRAINTS

High Initial Costs of UV LED System

High initial cost of implementation is one of the primary restraints for the North America UV LED market, which limits accessibility for small-scale users. This financial barrier disproportionately affects small businesses, particularly in the agricultural and residential sectors. Many potential adopters cite upfront expenses as a major obstacle. Besides, the need for specialized installation and maintenance further increases operational costs. While larger enterprises can absorb these expenses, smaller entities struggle to justify the investment, creating disparities in adoption rates across industries.

Limited Awareness Among End-Users

Limited awareness among end-users is one more crucial restraint, particularly in non-traditional sectors like agriculture and residential applications. Like, only a small percentage of farmers are familiar with the benefits of UV LEDs for crop protection and water purification. Misconceptions about the technology’s complexity and safety persist, deterring broader adoption. A report by the Consumer Technology Association reveals that over 50% of residential consumers hesitate to invest in UV LEDs due to perceived risks and lack of understanding.

MARKET OPPORTUNITIES

Growth in Agriculture Applications

Agriculture gives a lucrative opportunity for the North America UV LED market. UV LEDs are increasingly used for pest control, crop protection, and water purification, reducing pesticide usage up to 50% in some cases. A study by the American Phytopathological Society highlights that UV treatments suppress fungal diseases like powdery mildew with a high efficacy rate. The rise of vertical farming and controlled environment agriculture further amplifies demand. Additionally, government subsidies such as the USDA’s 500 million grant program for sustainable farming practices, encourage the adoption of UV LEDs. These trends position agriculture as a transformative

Expansion in Residential Air and Water Purification

Residential air and water purification represent another promising avenue. It is fueled by increasing consumer awareness about health and hygiene. Like, a notable portion of households in North America use UV LEDs for water purification, ensuring a big level of pathogen removal. Apart from these, partnerships between UV LED manufacturers and HVAC system providers have expanded capabilities, with installations surging considerably in the past few years. The EPA’s Clean Air Act are example of government initiatives which further support this shift.

MARKET CHALLENGES

Supply Chain Vulnerabilities

Supply chain disruptions pose a significant challenge, exacerbated by geopolitical tensions and economic uncertainties. The reliance on imported components, particularly from Asia, makes the market susceptible to price fluctuations and logistical delays. A number of firms faced supply chain bottlenecks during the pandemic. Such challenges hinder consistent production and timely delivery, impacting customer trust and market growth.

Regulatory Compliance Issues

Regulatory compliance issues present another challenge, particularly regarding safety standards and environmental regulations. UV LEDs must undergo rigorous testing to ensure they meet exposure limits, which can significantly delay product launches. A report by the American Chemistry Council highlights that compliance costs account for a significant portion of total expenses for UV LED systems. Additionally, varying standards across states create additional hurdles for cross-border trade within North America. These complexities discourage new entrants and slow down innovation.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

19.28% |

|

Segments Covered |

By Technology, Power Output, Application, End Use, And Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

Us, Canada, And Rest Of North America |

|

Market Leaders Profiled |

Seoul Viosys, Nichia Corporation, Honle UV America Inc., Crystal IS, LG Innotek, Nordson Corporation, Phoseon Technology, SemiLEDs Corporation, Lumileds Holding B.V., Heraeus Holding |

SEGMENTAL ANALYSIS

By Technology Insights

The UV-C segment was the most dominant under the technology category of the technology segment by holding a 50.2% market share in 2024. Also, the germicidal properties which eliminate pathogens with a high rate is driving the growth of this segment. Moreover, UV-C LEDs are widely adopted in healthcare settings, reducing hospital-acquired infections notably. The technology’s ability to purify air and water further amplifies demand, with a large number of UV-C systems installed annually in North America. Government initiatives, such as the EPA’s Clean Water Act, support innovation in this domain.

The UV-A segment is the fastest-growing segment, with a CAGR of 18.3%. This progress is propelled by its applications in phototherapy and polymer curing, which have surged considerably in the recent years. UV-A LEDs enhance material durability making them indispensable in automotive and aerospace industries. Additionally, the rise of wearable devices has increased demand for UV-A curing.

By Power Output Insights

The UV LEDs with power output below 1 W commanded the market by contributing 60.2% to the share in 2024. Their compact size and energy efficiency make them ideal for residential and small-scale applications. Also, these LEDs reduce energy consumption significantly compared to traditional systems. The rise of smart home technologies has further amplified demand, with substantial number of units sold in recent years in North America. Besides, government incentives, such as tax rebates for energy-efficient appliances, foster adoption.

UV LEDs with power output above 5 W are the quickest expanding segment, with a CAGR of 20.5%. This development of the segment is influenced by their applications in industrial curing and large-scale disinfection systems, which have risen in the past few years. Similarly, high-power UV LEDs notably improve production efficiency, making them indispensable in manufacturing. Additionally, partnerships with industrial giants have expanded capabilities, with installations increasing each year.

By Application Insights

The disinfection segment led the application category by capturing 45% to the market share in 2024. Its dominance is attributed to its efficacy in eliminating pathogens, with a success rate of 99.9%. A report by the CDC highlights that UV LEDs are widely adopted in healthcare and commercial spaces, reducing surface contamination by 50%.

The agriculture segment is the rapidly emerging application, with a CAGR of 35.2% owing to its use in pest control and crop protection, reducing pesticide usage by 60%. Like, UV treatments suppress fungal diseases with a high efficacy rate. Additionally, the rise of vertical farming has increased demand. Government subsidies further support adoption, positioning agriculture as the most dynamic application segment.

By End Use Insights

The industrial applications segment prevailed in the end-use category by contributing 55.1% to the market share in 2024. Moreover, the progress of the segment is because of their use in curing and disinfection systems, which notably improve production efficiency. An escalating number of manufacturers utilize UV LEDs, citing improved precision and reduced thermal damage.

The residential applications are the fastest-growing end-use segment, with a CAGR of 22.1%, according to the Consumer Technology Association. This sudden rise is caused by their use in air and water purification systems, which have surged in the recent years. Likewise, UV LEDs ensure significant pathogen removal, making them indispensable in smart homes.

REGIONAL ANALYSIS

The United States spearheaded the North America UV LED market by holding a 75.1% share in 2024. This is driven by robust R&D investments, with notable funds allocated annually for energy-efficient technologies. UV LEDs reduce energy consumption significantly, making them a preferred choice in industries like healthcare and electronics. The country’s advanced manufacturing base produces a large share of global UV LED systems, supported by partnerships between academia and industry.

Canada is expected to accelerate in the market, with a CAGR of 18.5%. This growth is fueled by government programs promoting green technologies. Similarly, UV LEDs are increasingly adopted for water purification, decreasing contamination risks greatly. The expansion of smart agriculture and vertical farming further amplifies demand as well as the installations in the recent years. Canada’s focus on sustainable practices aligns with global trends, positioning it as a leader in eco-friendly innovations.

While the U.S. leads in industrial applications, Canada focuses on residential and agricultural uses. Government scheme and offers, such as Canada’s Green Infrastructure Fund, drive adoption. Both countries are expected to witness steady growth, with the U.S. emphasizing technological advancements and Canada prioritizing sustainability.

LEADING PLAYERS IN THE MARKET

Signify (USA)

Signify is specializing in disinfection and curing solutions. Its Philips UV-C line ensures high pathogen elimination, serving a substantial number of hospitals globally. The company’s focus on scalability and regulatory compliance ensures widespread adoption across North America.

Nichia Corporation (USA)

Nichia is excelling in high-power UV LEDs for industrial applications. Its products enhance curing efficiency. Nichia invests considerably annually in R&D, focusing on UV-A and UV-C innovations. Collaborations with automotive giants expand its reach.

LG Innotek (Canada)

LG Innotek is specializing in UV LEDs for residential air and water purification. It is supporting a large portion of households annually.

TOP STRATEGIES USED BY KEY PLAYERS

Key players in the North America UV LED market employ diverse strategies to maintain their competitive edge. Strategic partnerships with research institutions enable firms to leverage cutting-edge innovations. For instance, Signify collaborates with universities to develop germicidal UV-C systems. Investments in R&D remain critical, with companies allocating significant resources to explore novel applications. Mergers and acquisitions are also common, allowing firms to expand their product portfolios and enter new markets. Additionally, key players emphasize regulatory compliance and sustainability, ensuring adherence to environmental standards. These strategies collectively strengthen their market presence and drive innovation.

KEY MARKET PLAYERS AND COMPETITION OVERVIEW

Major Key Players of the North America UV LED market include Seoul Viosys, Nichia Corporation, Honle UV America Inc., Crystal IS, LG Innotek, Nordson Corporation, Phoseon Technology, SemiLEDs Corporation, Lumileds Holding B.V., Heraeus Holding

The North America UV LED market is highly competitive, characterized by the presence of both established players and innovative startups. Established firms like Signify and Nichia dominate through economies of scale and extensive distribution networks, while startups bring fresh ideas and niche applications to the table. According to the International Ultraviolet Association, many companies in the regional are actively involved in developing UV LED solutions, creating a dynamic and fragmented landscape. Regulatory frameworks play a pivotal role in shaping competition, as stringent safety and environmental standards require significant investments in compliance. Additionally, collaborations with research institutions and participation in government-funded projects provide a competitive edge. The emphasis on sustainability and eco-friendly solutions further intensifies competition, as companies vie to meet the growing demand for energy-efficient technologies.

RECENT HAPPENINGS IN THE MARKET

- In April 2024, Signify partnered with MIT to develop advanced UV-C systems for healthcare applications, enhancing pathogen elimination rates by 99.9%.

- In June 2023, Nichia expanded its industrial UV LED portfolio by introducing high-power systems for automotive curing, improving production efficiency by 45%.

- In January 2023, LG Innotek launched UV LEDs for residential air purification, ensuring 99.9% pathogen removal and reducing energy consumption by 70%.

- In September 2022, Acuity Brands invested $100 million in smart UV-C disinfection systems, integrating IoT capabilities to enhance user experience.

- In March 2022, Seoul Viosys collaborated with Canadian vertical farms to deploy UV LEDs for crop protection, reducing pesticide usage by 60%.

MARKET SEGMENTATION

This research report on the North America UV LED Market has been segmented and sub-segmented based on technology, power output, application, end use and region.

By Technology

- UV-C

- UV-A

By Power Output

- Below 1 W

- Above 5 W

By Application

- Disinfection

- Agriculture

By End Use

- Industrial

- Residential

By Region

- United States

- Canada

- Mexico

- Rest of North America

Frequently Asked Questions

1. Who are the key players in the North America UV LED market?

Key market players include Seoul Viosys, Nichia Corporation, Honle UV America Inc., Crystal IS, LG Innotek, Nordson Corporation, Phoseon Technology, SemiLEDs Corporation, Lumileds Holding B.V., and Heraeus Holding.

2. What is driving the growth of the UV LED market in North America?

The market is driven by growing demand for eco-friendly and energy-efficient lighting, increased adoption in disinfection and medical applications, and stricter regulations on mercury-based UV lamps.

3. Which UV wavelength types are commonly used in this market?

The most common types are UVA (320–400 nm), UVB (280–320 nm), and UVC (200–280 nm), with UVC gaining high traction for its germicidal properties in disinfection systems.

4. How is the North America UV LED market expected to grow in the coming years?

The North America UV LED market is projected to grow rapidly due to increasing demand in applications like water purification, sterilization, medical devices, and industrial curing processes.

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com