North America Vacuum Truck Market Size, Share, Trends & Growth Forecast Report By Product Type (Liquid and Dry Suctioning, Liquid Suctioning Only), Application, and Country (The United States, Canada and Rest of North America), Industry Analysis From 2025 to 2033

North America Vacuum Truck Market Size

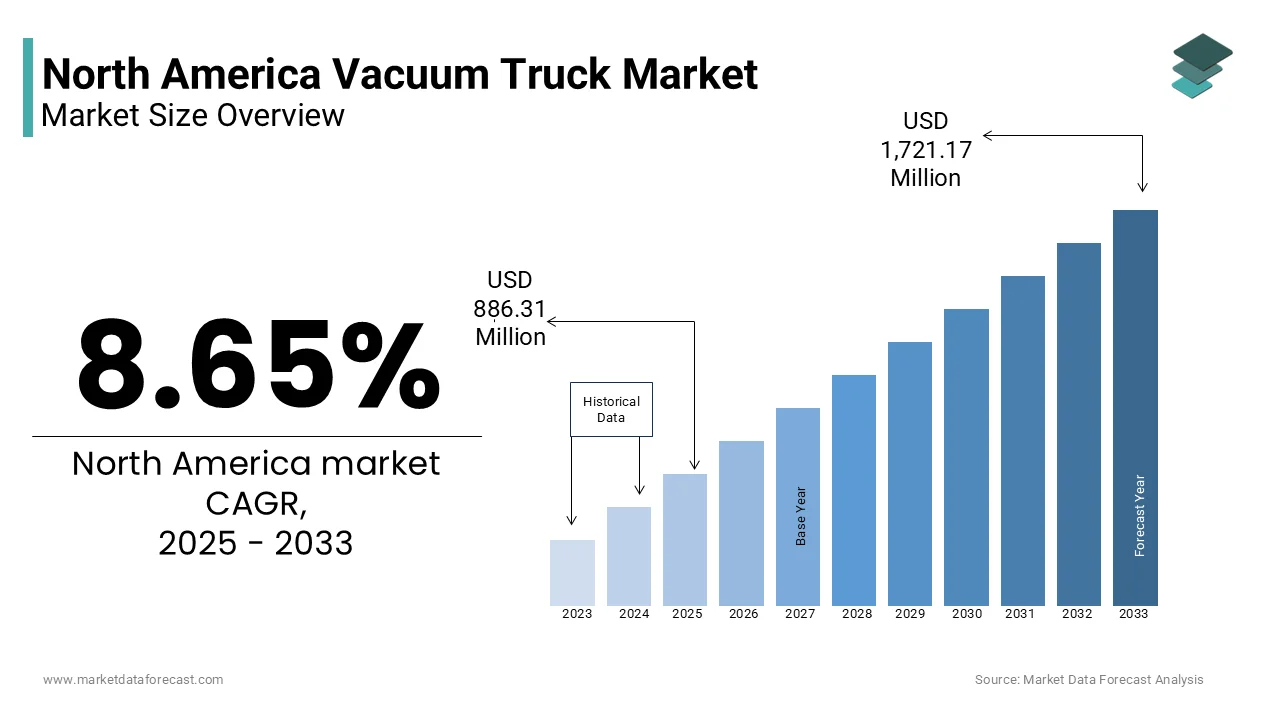

The Vacuum Truck market size in North America was valued at USD 815.75 million in 2024 and is predicted to be worth USD 1,721.17 million by 2033 from USD 886.31 million in 2025 and grow at a CAGR of 8.65% from 2025 to 2033.

MARKET DRIVERS

Stringent Environmental Regulations

Stringent environmental regulations have emerged as a key driver for the North American vacuum truck market. The Clean Water Act and Resource Conservation and Recovery Act (RCRA) mandate industries to adopt sustainable waste management practices, directly boosting vacuum truck demand. Like, non-compliance with these regulations can result in hefty fines per violation and in some cases per day as well, prompting businesses to invest in reliable solutions like vacuum trucks. Furthermore, states like California and Texas have introduced additional mandates for oil spill cleanups, creating a surge in demand for specialized vacuum trucks. These regulatory pressures not only ensure environmental safety but also stimulate market growth by compelling industries to adopt compliant technologies.

Growth in Industrial and Municipal Applications

The expanding industrial and municipal sectors significantly drive the vacuum truck market. Similarly, the industrial sector grew notably in recent years, increasing the need for tank cleaning and pipeline maintenance services. Vacuum trucks are indispensable for managing residues in oil refineries, chemical plants, and food processing units. The vacuum trucks handle a significant portion of industrial waste generated during routine maintenance. Similarly, municipalities rely on vacuum trucks for sewage and stormwater management. Also, substantial amount was invested in water infrastructure projects in the past few years, enhancing the demand for vacuum trucks.

MARKET RESTRAINTS

High Operational Costs

One of the primary restraints impacting the North American vacuum truck market is the high operational cost associated with these vehicles. Vacuum trucks require significant investment in maintenance, fuel, and skilled labor, making them less accessible for small-scale operators. Additionally, the cost of advanced technologies like GPS tracking and automated suction systems further escalates expenses. In support of this, a considerable number of small waste management companies struggle to afford modern vacuum trucks, limiting market penetration. These financial barriers hinder widespread adoption, particularly among smaller players, constraining overall market growth.

Limited Awareness About Advanced Technologies

Limited awareness about advanced vacuum truck technologies poses another significant restraint. Many end-users, especially in rural and underserved regions, remain unaware of innovations like multi-phase separation systems and enhanced suction capabilities. Like, a notable share of municipal authorities still relies on outdated vacuum truck models, citing insufficient knowledge about newer alternatives. This lack of awareness is exacerbated by inadequate training programs and limited marketing efforts by manufacturers. Also, only a limited number of industrial operators receive formal training on advanced vacuum truck features. These gaps in knowledge and education impede the adoption of cutting-edge solutions, slowing technological advancements and market expansion.

MARKET OPPORTUNITIES

Adoption of IoT-Enabled Vacuum Trucks

The integration of Internet of Things (IoT) technology into vacuum trucks presents a transformative opportunity for the North American market. IoT-enabled systems allow real-time monitoring of waste levels, suction efficiency, and vehicle performance, optimizing operations and reducing downtime. Similarly, IoT adoption in industrial vehicles could significantly reduce maintenance costs in the upcoming years. For instance, IoT sensors can alert operators about potential system failures, enabling proactive repairs. Additionally, municipalities benefit from IoT-driven data analytics, improving route planning and resource allocation. Plus, cities leveraging IoT in waste management systems achieved a notable reduction in operational inefficiencies. These advancements position IoT-enabled vacuum trucks as a key growth driver in the market.

Expansion in Renewable Energy Projects

The growing renewable energy sector offers significant opportunities for the vacuum truck market. Solar and wind farms require regular cleaning and maintenance, often involving the use of vacuum trucks for site preparation and residue removal. Ain addition to this, renewable energy projects accounted for a notable portion of total energy capacity additions in recent years, creating new demand for vacuum trucks. Furthermore, bioenergy plants utilize vacuum trucks for handling organic waste and biomass residues. Like, a significant share of bioenergy facilities rely on vacuum trucks for waste collection. These developments show the expanding role of vacuum trucks in supporting renewable energy initiatives, positioning the sector as a promising growth avenue.

MARKET CHALLENGES

Environmental Concerns Over Emissions

Environmental concerns over emissions from vacuum trucks present a major challenge for the market. Traditional diesel-powered vacuum trucks contribute significantly to greenhouse gas emissions, drawing scrutiny from environmental groups and regulators. This issue is compounded by stricter emission standards, such as those outlined in California’s Advanced Clean Trucks Regulation. Compliance with these standards requires significant investments in cleaner technologies, which many operators find financially burdensome. Additionally, public resistance to fossil fuel-dependent vehicles has grown, as substantial percentage of Americans support transitioning to low-emission alternatives. These factors create pressure on the market to innovate while addressing environmental concerns.

Infrastructure Limitations in Rural Areas

Infrastructure limitations in rural areas pose another critical challenge for the vacuum truck market. Many rural regions lack adequate road networks and maintenance facilities, complicating the deployment and operation of vacuum trucks. Also, a considerable share of rural municipalities face challenges in accessing modern waste management equipment. Poor road conditions and limited access to fueling stations further exacerbate operational difficulties. Besides, the dispersed population in rural areas increases travel distances, raising fuel costs and reducing efficiency. Rural areas receive a small share of federal funding for infrastructure development, leaving them underserved. These constraints hinder the effective utilization of vacuum trucks, limiting market reach in rural communities.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

8.65% |

|

Segments Covered |

By Product Type, Application, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

The United States, Canada, Mexico, and Rest of North America |

|

Market Leaders Profiled |

Federal Signal (U.S.), Vac-Con (U.S.), Keith Huber (U.S.), Sewer Equipment (U.S.), Vacall Industries (U.S.), KOKS (Netherlands), Dongzheng (China), and Vactor Inc (U.S.), and others |

SEGMENTAL ANALYSIS

By Product Type Insights

The "Liquid Suctioning Only" segment dominated the North American vacuum truck market by holding approximately 60% of the total market share in 2024. This influenced over the market is driven by its widespread use in industrial applications such as oil spill cleanups, wastewater management, and chemical residue removal. One key factor is the stringent regulatory framework governing liquid waste disposal. Also, the EPA mandates that industries managing hazardous liquids must use specialized equipment like vacuum trucks, creating steady demand for this segment. Like, many oil refineries rely on liquid suctioning vacuum trucks for routine maintenance, exhibiting their indispensability. Another contributing factor is the rise in municipal investments in sewage systems. In support of this, substantial funds were allocated in the past few years for upgrading wastewater infrastructure, directly benefiting the liquid suctioning segment.

The "Liquid and Dry Suctioning" segment is projected to grow at the highest CAGR of 8.5% from 2025 to 2033. This rapid expansion is fueled by its versatility in handling both wet and dry waste, making it ideal for diverse applications. A significant driver is its increasing adoption in excavation projects. Also, vacuum trucks capable of handling both liquid and dry materials are used in significant share of trenchless construction projects, reducing downtime and operational costs. Another factor is the surging emphasis on integrated waste management solutions. Plus, municipalities adopting dual-purpose vacuum trucks achieve a notable improvement in operational efficiency. Additionally, advancements in multi-phase separation technologies have enhanced the performance of these trucks, further accelerating their adoption across industries.

By Application Insights

The industrial application segment led the North American vacuum truck market with a 45.3% of the total revenue in 2024. This control of the segment is credited to the critical role vacuum trucks play in maintaining industrial facilities, particularly in sectors like oil and gas, chemicals, and manufacturing. A main aspect is the increasing frequency of maintenance operations. Moreover, one more propellent is the rising complexity of industrial processes. A study by the Society of Chemical Industry highlights that advanced vacuum trucks with multi-phase separation systems are now essential for managing hazardous waste, ensuring compliance with safety standards. Apart from these, the growth of the renewable energy sector has expanded the industrial application base, with bioenergy plants relying heavily on vacuum trucks for organic waste management.

The municipal application segment is poised to be the swiftest advancing, with a predicted CAGR of 9.2% in the future. This growth is supported by the increasing focus on urban sanitation and wastewater management. One major factor is the rising population in urban areas. A further driver is government investments in smart city initiatives. Additionally, the adoption of IoT-enabled vacuum trucks has improved operational efficiency, enabled real-time monitoring of waste levels and optimized resource allocation. These developments position the municipal segment as a key growth driver in the vacuum truck market.

REGIONAL ANALYSIS

The United States commanded the largest share of the North American vacuum truck market, with 75.2% of the region’s total revenue in 2024. The country’s dominance stems from its robust industrial base and stringent environmental regulations. Essential element is the heavy reliance on vacuum trucks in the oil and gas sector. A different driver is the federal push for sustainable waste management. Furthermore, technological advancements, such as IoT integration, have positioned U.S.-based manufacturers as global leaders. These elements show the country’s pivotal role in shaping the regional vacuum truck landscape.

Canada is also a major player in the North American vacuum truck market by contributing notably to the region’s total revenue. The country’s market growth is propelled by its focus on environmental conservation and mining operations. One crucial aspect is the use of vacuum trucks in mining and excavation projects. An additional factor is the government’s commitment to reducing carbon emissions. Also, vacuum trucks powered by alternative fuels reduced emissions greatly in recent times. Besides, Canada’s vast rural areas have increased demand for vacuum trucks in municipal sewage management, supported by provincial funding programs.

The Rest of North America, involving Mexico and other regions, represents a nascent yet promising segment. The segment’s growth is fueled by the increasing adoption of vacuum trucks in infrastructure development and disaster management. One vital component is Mexico’s investment in urban planning projects, where vacuum trucks are used for site preparation and waste removal. A different aspect is the region’s vulnerability to natural disasters, prompting the use of vacuum trucks for emergency response. Cross-border collaborations with the U.S. have also accelerated technology transfer, fostering market expansion.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Federal Signal (U.S.), Vac-Con (U.S.), Keith Huber (U.S.), Sewer Equipment (U.S.), Vacall Industries (U.S.), KOKS (Netherlands), Dongzheng (China), and Vactor Inc (U.S.) are playing dominating role in the North America vacuum truck market.

The North American vacuum truck market is highly competitive, driven by innovation, regulatory compliance, and diverse applications across industries. Leading players like Federal Signal, Hi-Vac Corporation, and Super Products dominate the landscape, each targeting specific niches such as municipal cleaning, industrial maintenance, and renewable energy support. The competitive environment is further intensified by the entry of new startups and the adoption of disruptive technologies like IoT and AI for real-time monitoring and predictive maintenance. Regulatory frameworks also play a pivotal role, with companies striving to comply with EPA guidelines while innovating within constraints. Collaborations with research institutions and government bodies provide a competitive edge, fostering innovation. Additionally, price differentiation and feature customization are common tactics to capture market share.

TOP PLAYERS IN THE MARKET

Federal Signal Corporation

Federal Signal Corporation is a prominent player in the North American vacuum truck market, renowned for its innovative solutions in industrial and municipal waste management. The company’s Vactor brand offers advanced vacuum trucks equipped with multi-phase separation systems, catering to diverse applications like excavation and sewage management. Additionally, the company expanded its production facilities in Illinois to meet rising demand from municipalities and industrial clients.

Hi-Vac Corporation

Hi-Vac Corporation specializes in manufacturing high-performance vacuum trucks tailored for industrial and environmental applications. Its Hydro Excavator series has gained popularity for trenchless construction and pipeline maintenance. The company also invested in research and development to enhance fuel efficiency and reduce emissions, addressing growing environmental concerns. Furthermore, Hi-Vac launched training programs for operators, ensuring safe and efficient use of its equipment.

Super Products LLC

Super Products LLC is a key innovator in the vacuum truck market, offering versatile solutions for liquid and dry suctioning applications. Its Supervac line is widely used in oil refineries and chemical plants for hazardous waste removal. The company also collaborated with municipal governments to deploy vacuum trucks for urban sanitation projects, improving public health outcomes.

TOP STRATEGIES USED BY KEY PLAYERS

Key players in the North American vacuum truck market employ strategies such as innovation, strategic partnerships, and sustainability initiatives to strengthen their positions. Companies like Federal Signal and Hi-Vac focus on integrating IoT and AI technologies to enhance operational efficiency and address environmental concerns. Strategic alliances with government agencies and private firms help expand their reach, while investments in alternative fuels and emission-reducing technologies align with regulatory mandates. Super Products emphasizes versatility, targeting both industrial and municipal applications through customizable solutions. Another common strategy is acquiring smaller firms to enhance technological portfolios.

RECENT HAPPENINGS IN THE MARKET

- In April 2023, Federal Signal Corporation expanded its Illinois-based production facility to increase output of IoT-enabled vacuum trucks, aiming to meet rising municipal demand.

- In June 2023, Hi-Vac Corporation partnered with renewable energy firms to develop bioenergy-optimized vacuum trucks, aligning with sustainability goals and expanding its application base.

- In August 2023, Super Products LLC acquired an AI-driven waste management startup, enhancing its Supervac line with advanced data analytics capabilities for industrial clients.

- In October 2023, Federal Signal introduced predictive maintenance features in its Vactor series, reducing downtime and operational costs for industrial users.

- In December 2023, Hi-Vac launched operator training programs nationwide, ensuring safe and efficient use of its Hydro Excavator series, thereby improving customer satisfaction and loyalty.

MARKET SEGMENTATION

This research report on the North America vacuum truck market has been segmented and sub-segmented based on the following categories.

By Product Type

- Liquid and Dry Suctioning

- Liquid Suctioning Only

By Application

- Industrial

- Excavation

- Municipal

- General Cleaning

- Others

By Country

- The United States

- Canada

- Rest of North America

Frequently Asked Questions

1. What are the key opportunities in the North America vacuum truck market?

The market is witnessing opportunities from the expansion of industrial cleaning services, increasing demand for effective waste management, and growth in the oil & gas and construction sectors.

2. What challenges are impacting the North America vacuum truck market growth?

Key challenges include high initial investment costs, stringent emission regulations, and the need for skilled operators to handle advanced vacuum truck systems.

3. Who are the key players operating in the North America vacuum truck market?

Leading players include Federal Signal Corporation, Vac-Con Inc., Keith Huber Corporation, Sewer Equipment Co. of America, and Super Products LLC, focusing on product innovation and service expansion.

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com