North America Vinyl Flooring Market Size, Share, Trends & Growth Forecast Report By Product (Vinyl Sheets, Vinyl Tiles, and Luxury Vinyl Tiles), Application, and Country (The United States, Canada and Rest of North America), Industry Analysis From 2024 to 2033

North America Vinyl Flooring Market Size

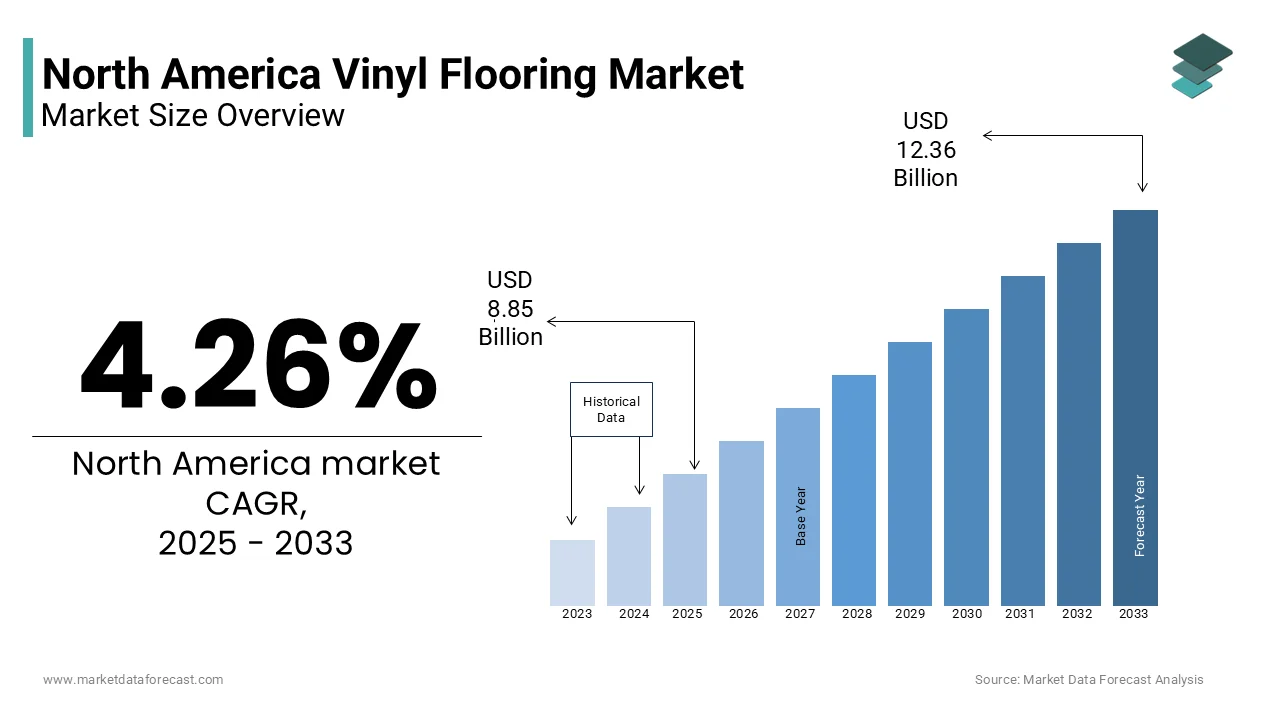

The Vinyl Flooring market size in North America was valued at USD 8.49 billion in 2024 and is predicted to be worth USD 12.36 billion by 2033 from USD 8.85 billion in 2025 and grow at a CAGR of 4.26% from 2025 to 2033.

MARKET DRIVERS

Rising Demand for Low-Maintenance Flooring Solutions

Consumer preferences are shifting toward low-maintenance and durable flooring options, which is driving the North America vinyl flooring market significantly. Vinyl flooring is highly resistant to moisture, scratches, and stains by making it ideal for both residential and commercial spaces. This trend is further amplified by the increasing number of households with pets, which require easy-to-clean surfaces. Additionally, advancements in printing technology have enabled manufacturers to replicate natural textures like wood and stone by enhancing aesthetic appeal without compromising functionality.

Surge in Residential Construction Activities

The booming residential construction sector is another key driver propelling the North America vinyl flooring market forward. The growth is attributed to favorable mortgage rates and millennial homeownership trends. Vinyl flooring’s affordability is typically priced 30-40% lower than hardwood that makes it an attractive option for first-time buyers. Furthermore, as per the U.S. Census Bureau, multifamily housing units experienced a 10% annual growth rate, further fueling demand. The adaptability of vinyl flooring across diverse climates, including humid regions, adds to its widespread adoption.

MARKET RESTRAINTS

Health Concerns Related to VOC Emissions

One significant restraint facing the North America vinyl flooring market is the health concerns associated with volatile organic compound (VOC) emissions. While vinyl flooring offers numerous advantages, certain products emit harmful chemicals during installation and use, raising environmental and health alarms. According to the Environmental Protection Agency (EPA), prolonged exposure to high levels of VOCs can lead to respiratory issues and other health complications. Although manufacturers are increasingly adopting eco-friendly production techniques, skepticism persists among environmentally conscious consumers. A survey conducted by the Healthy Building Network revealed that nearly 60% of respondents expressed hesitation about purchasing vinyl-based products due to perceived risks.

Intense Competition from Alternative Flooring Materials

The vinyl flooring market faces stiff competition from alternative materials such as hardwood, ceramic tiles, and carpeting. Hardwood flooring, for instance, remains a premium choice for upscale homes despite its higher cost. As per data from Floor Covering Weekly, hardwood flooring captured nearly 25% of the total flooring market share in 2023. Similarly, ceramic tiles dominate kitchens and bathrooms due to their water-resistant properties. Moreover, technological advancements in carpet manufacturing have introduced stain-resistant variants by posing additional competition. The availability of these substitutes limits the scope for vinyl flooring penetration in niche markets where aesthetics or prestige outweigh practicality considerations.

MARKET OPPORTUNITIES

Expansion into Emerging Commercial Spaces

A burgeoning opportunity lies in the expansion of vinyl flooring into emerging commercial spaces such as coworking offices, educational institutions, and healthcare facilities. The post-pandemic era has catalyzed investments in flexible workspaces, with Global Workplace Analytics estimating a 25% annual growth in coworking spaces since 2021. Vinyl flooring’s versatility, ease of maintenance, and sound-dampening qualities make it ideal for these environments. For example, luxury vinyl tiles (LVT) are increasingly used in hospitals due to their antimicrobial properties, reducing infection risks. Leveraging this trend presents immense potential for manufacturers targeting specialized applications.

Adoption of Smart Manufacturing Technologies

Another promising avenue is the integration of smart manufacturing technologies to enhance product quality and customization capabilities. Industry 4.0 innovations, including AI-driven design tools and automated production lines, enable precise replication of intricate patterns while minimizing waste. This efficiency allows producers to offer competitively priced products without compromising quality. Furthermore, customizable designs tailored to individual preferences resonate well with millennials and Gen Z consumers, who prioritize personalization.

MARKET CHALLENGES

Fluctuating Raw Material Prices

A persistent challenge for the vinyl flooring market is the volatility in raw material prices, particularly polyvinyl chloride (PVC). PVC constitutes a major component of vinyl flooring, and its price fluctuations are influenced by geopolitical tensions and supply chain disruptions. According to Plastics Today, PVC prices surged by 20% in early 2023 due to limited availability caused by logistical bottlenecks. Such instability impacts profit margins and forces manufacturers to pass on costs to consumers by potentially dampening demand.

Stringent Regulatory Frameworks

Stringent regulatory frameworks governing chemical usage and waste management present another hurdle for the vinyl flooring market. Regulations imposed by bodies like the EPA mandate strict adherence to emission standards by compelling manufacturers to invest heavily in compliance measures. For instance, California’s Proposition 65 requires explicit labeling of hazardous substances, adding complexity to product development. Non-compliance risks hefty fines and reputational damage. As per the Vinyl Institute, regulatory compliance costs account for approximately 15% of total production expenses. These financial burdens constrain innovation budgets and slow down market responsiveness for smaller firms lacking robust infrastructure.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

4.26% |

|

Segments Covered |

By Product, Application, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

The United States, Canada, Mexico, and Rest of North America |

|

Market Leaders Profiled |

Shaw Flooring (US), COREtec (Canada), Mohawk (USA), NuCore Flooring (USA), Home Decorators Collection (USA), Beaulieu (Canada), Locua S.A. De C.V (Mexico), Polyflor, Richmond (Canada)., and others |

SEGMENTAL ANALYSIS

By Product Insights

The Luxury Vinyl Tiles (LVT) dominated the North America vinyl flooring market with 40.4% of share in 2024, with the superior aesthetics and enhanced durability compared to traditional vinyl sheets and tiles. LVTs mimic natural materials like marble and hardwood with remarkable precision, appealing to discerning homeowners and businesses alike. Technological breakthroughs enabling embossed-in-register finishes a technique aligning texture with printed patterns that have elevated user experience. Additionally, LVTs’ waterproof nature makes them indispensable in moisture-prone areas such as bathrooms and basements. The demand for premium flooring solutions continues to escalate with urbanization driving real estate development in tier-1 cities.

The vinyl sheets segment is likely to exhibit a fastest CAGR of 7.5% from 2025 to 2033. This rapid growth is fueled by their affordability and seamless installation process, which appeals to budget-conscious consumers. Vinyl sheets cover large areas without visible seams by ensuring uniformity and ease of cleaning with a critical factor for high-traffic zones like schools and retail outlets. Furthermore, advancements in UV-cured coatings have improved scratch resistance and longevity, addressing earlier durability concerns. Government initiatives promoting affordable housing projects in underserved communities further amplify demand.

By Application Insights

The residential segment was accounted in holding 55.4% of the North America vinyl flooring market share in 2024 with the growing trend of home renovations and remodeling activities. Millennials and Gen X homeowners prioritize upgrading outdated interiors, often opting for vinyl flooring due to its affordability and style versatility. Additionally, the rise of DIY culture, supported by online tutorials and e-commerce platforms, has simplified installations by boosting accessibility. Vinyl flooring’s thermal insulation properties also reduce heating costs, a crucial consideration in colder regions like Canada. The proliferation of smart home technologies complements this trend by encouraging cohesive interior designs that incorporate modern flooring solutions.

The commercial segment is esteemed to hit a CAGR of 8.2% in the next coming years. This acceleration is propelled by the expansion of service-oriented industries requiring durable yet visually appealing flooring. For instance, hospitality venues such as hotels and restaurants favor vinyl flooring for its ability to withstand heavy foot traffic while maintaining elegance. Similarly, corporate offices undergoing redesigns to foster collaborative workspaces increasingly adopt LVTs for their sleek appearance and noise-reducing attributes. Urban redevelopment initiatives, coupled with rising disposable incomes, drive demand in metropolitan hubs.

REGIONAL ANALYSIS

The United States was the top performer in the North America vinyl flooring market with an expected share of 75.5% in 2024. This dominance is fueled by a confluence of factors, including a robust economy, a thriving real estate sector, and cutting-edge manufacturing capabilities. Vinyl flooring’s affordability, durability, and aesthetic versatility make it a preferred choice for homeowners undertaking renovations or building new properties. Additionally, the country’s emphasis on sustainable practices aligns seamlessly with vinyl flooring’s recyclability and low carbon footprint, by appealing to environmentally conscious consumers. Key states like Texas, Florida, and California drive demand due to their unique climatic conditions and rapid urbanization. For instance, hurricane-prone regions favor vinyl flooring for its moisture resistance, while colder states appreciate its thermal insulation properties.

Canada dominated the North America vinyl flooring market with 15.5% of share in 2024 by stringent building codes that mandate the use of eco-friendly materials. Vinyl flooring meets these criteria effectively, gaining widespread acceptance among architects, builders, and homeowners. Provinces like Ontario and British Columbia lead the charge, with urban centers witnessing heightened demand for modern flooring solutions. Canada’s cold climate necessitates thermally efficient flooring options by making vinyl an ideal choice for residential and commercial spaces alike. Government-backed retrofitting schemes aimed at reducing carbon emissions further stimulate demand. For example, the Canada Greener Homes Grant program, launched in 2021, provides financial incentives for homeowners to upgrade to energy-efficient materials, including vinyl flooring. Additionally, the country’s focus on affordable housing initiatives creates opportunities for cost-effective yet durable flooring solutions.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Shaw Flooring (US), COREtec (Canada), Mohawk (USA), NuCore Flooring (USA), Home Decorators Collection (USA), Beaulieu (Canada), Locua S.A. De C.V (Mexico), Polyflor, Richmond (Canada) are playing dominating role in the North America vinyl flooring market.

The North America vinyl flooring market is characterized by intense competition, with leading players vying for market share through innovation, strategic alliances, and customer-centric services. The landscape is dominated by giants like Mohawk Industries, Shaw Industries, and Armstrong World Industries, each employing unique strategies to differentiate themselves. Mohawk’s emphasis on technological advancements and sustainability sets it apart, while Shaw’s focus on personalized marketing campaigns resonates well with younger demographics. Armstrong’s commitment to R&D and acoustic solutions addresses niche market needs in commercial applications. Despite occasional price wars, value-added features such as antimicrobial coatings, embossed textures, and customizable designs mitigate margin pressures. Continuous investment in R&D ensures that companies stay ahead of evolving consumer preferences, particularly the growing demand for eco-friendly and low-maintenance flooring options. Smaller players face challenges competing with established brands but often carve out niches by focusing on specialized applications or localized markets.

TOP PLAYERS IN THE MARKET

Mohawk Industries

Mohawk Industries reigns supreme as the leading player in the North America vinyl flooring market. Renowned for its innovative luxury vinyl tile (LVT) collections, Mohawk leverages cutting-edge technologies to deliver high-performance products tailored to diverse consumer needs. The company’s acquisition of IVC Group in 2022 significantly expanded its product portfolio by reinforcing its dominant position. Mohawk’s flagship brand, RevWood Plus, combines the aesthetics of hardwood with the durability of vinyl, appealing to both residential and commercial customers. Furthermore, the company’s commitment to sustainability is evident in its efforts to recycle over 6 billion plastic bottles annually into flooring products by enhancing its appeal among eco-conscious buyers.

Shaw Industries

Shaw Industries focus on sustainable manufacturing practices, recycling over 800 million pounds of carpet annually. Its COREtec brand dominates the LVT segment, offering waterproof and scratch-resistant flooring solutions that cater to modern lifestyles. Shaw’s strategic partnerships with architects, interior designers, and builders amplify its reach across North America. Additionally, the company invests heavily in digital marketing campaigns targeting tech-savvy millennials and Gen Z consumers, who prioritize personalization and convenience. Shaw’s dedication to innovation and customer satisfaction ensures its continued prominence in the competitive vinyl flooring landscape.

Armstrong World Industries

Armstrong World Industries is known for its resilient flooring solutions, Armstrong invests heavily in research and development to introduce novel textures and finishes that mimic natural materials like wood and stone. The company’s acquisition of Tectum Inc. in September 2023 expanded its acoustic flooring solutions, addressing noise reduction concerns in commercial spaces. Armstrong’s DesignFlooring line combines style and functionality, making it a popular choice for healthcare facilities, educational institutions, and corporate offices. Furthermore, the company’s commitment to sustainability is reflected in its use of bio-based materials and adherence to stringent environmental standards.

TOP STRATEGIES USED BY KEY PLAYERS

Key players in the North America vinyl flooring market employ a variety of strategies to maintain their competitive edge and expand their market presence. Mergers and acquisitions remain a cornerstone strategy, enabling companies to broaden their product portfolios and enter new markets. For instance, Mohawk Industries’ acquisition of IVC Group in 2022 enhanced its global footprint and strengthened its LVT offerings. Product diversification is another critical tactic, with companies introducing innovative lines tailored to specific consumer segments. Shaw Industries’ COREtec brand exemplifies this approach, offering waterproof and durable solutions that cater to modern households. Geographic expansion is equally vital, with manufacturers targeting underserved regions through strategic partnerships and distribution networks. Sustainability-focused initiatives also play a pivotal role, as seen in Armstrong World Industries’ use of bio-based materials and recycling programs. Digital transformation further amplifies competitiveness, with companies leveraging AI-driven quality control systems and online platforms to streamline operations and engage customers.

RECENT HAPPENINGS IN THE MARKET

- In March 2023, Mohawk Industries launched AquaSeal Pro+, a revolutionary waterproof LVT line designed to withstand extreme moisture conditions. This product introduction expanded Mohawk’s offerings and addressed consumer demands for durable, high-performance flooring solutions.

- In June 2023, Shaw Industries partnered with Habitat for Humanity, donating over 1 million square feet of vinyl flooring for affordable housing projects across North America. This initiative not only supported community development but also enhanced Shaw’s brand visibility and reputation.

- In September 2023, Armstrong World Industries acquired Tectum Inc., a leader in acoustic ceiling and wall solutions. This acquisition broadened Armstrong’s product range by enabling it to offer comprehensive noise-reduction solutions for commercial spaces.

- In December 2023, Mannington Mills introduced NatureForm HD, a bio-based vinyl collection crafted from renewable resources. This launch aligned with growing consumer demand for sustainable and eco-friendly flooring options, which is reinforcing Mannington’s commitment to environmental stewardship.

- In February 2024, Congoleum Corporation implemented AI-driven quality control systems across its production facilities. This technological upgrade improved operational efficiency, reduced waste, and ensured consistent product quality by strengthening Congoleum’s competitive position in the market.

MARKET SEGMENTATION

This research report on the North America vinyl flooring market has been segmented and sub-segmented based on the following categories.

By Product

- Vinyl Sheets

- Vinyl Tiles

- Luxury Vinyl Tiles

By Application

- Residential

- Commercial

By Country

- The United States

- Canada

- Rest of North America

Frequently Asked Questions

1. What are the key opportunities in the North America Vinyl Flooring Market?

Key opportunities arise from increasing residential and commercial renovation activities, rising demand for cost-effective and water-resistant flooring solutions, and the growing popularity of luxury vinyl tiles (LVT).

2. What are the major challenges facing the North America Vinyl Flooring Market?

Challenges include environmental concerns related to PVC usage, fluctuating raw material prices, and competition from alternative flooring materials such as laminate and engineered wood.

3. Who are the major players in the North America Vinyl Flooring Market?

Top players include Mohawk Industries, Tarkett S.A., Shaw Industries Group Inc., Armstrong Flooring Inc., and Gerflor Group, offering a wide range of innovative vinyl flooring solutions.

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com