North America Water Filters Market Size, Share, Trends & Growth Forecast Report By Technology, Distribution Channel, Portability, End-user and Country (The United States, Canada and Rest of North America), Industry Analysis From 2024 to 2032

North America Water Filters Market Size

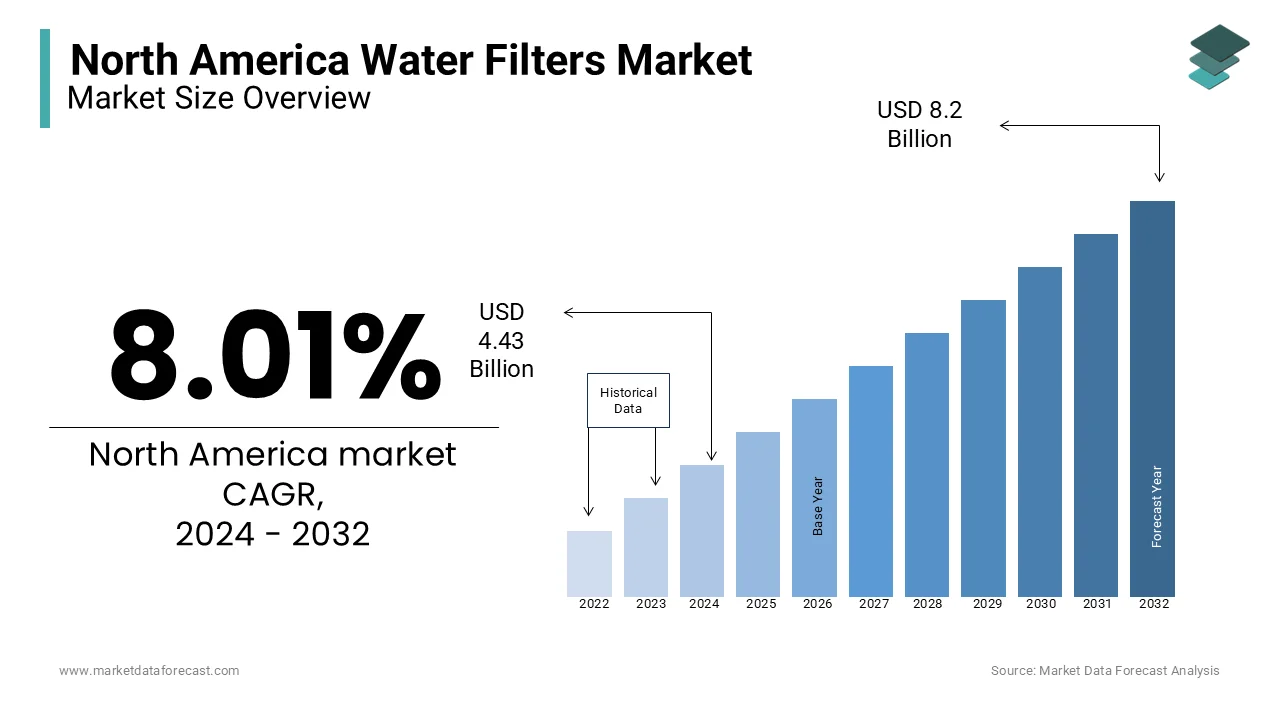

The water filters market size in North America was worth USD 4.1 billion in 2023. The North American market is anticipated to be worth USD 8.2 billion by 2032 from USD 4.43 billion in 2024, growing at a CAGR of 8.01% from 2024 to 2032.

Water filters in North America encompass a range of systems purifying water across the region. From under-the-sink to countertop and whole-house setups, these filters target impurities like sediments, chemicals, and microorganisms, ensuring safer, cleaner drinking water. They employ various filtration methods activated carbon, reverse osmosis, and UV light—to guarantee top-notch quality. These systems cater to diverse needs, addressing concerns about taste, health, and water quality in homes, businesses, and public spaces throughout North America. Whether it's for a cozy household or a bustling office, these filters stand as guardians, delivering reliable and healthier drinking water across the continent.

MARKET DRIVERS

Growing Awareness Among People Regarding the Importance of Water Quality

The North American water filter market is experiencing a robust surge driven by a heightened awareness among consumers regarding water quality concerns. The growing recognition of potential contamination and impurities in drinking water has become a primary catalyst propelling the demand for water filters. In response to a collective desire for safety and purity, consumers are increasingly investing in water filtration solutions to safeguard their health. The market's vitality is underscored by a proactive approach adopted by individuals who seek reliable means to address water quality issues. As a result, manufacturers and providers in the North American water filter market are witnessing a sustained and growing demand for their products, reflecting a broader societal shift towards prioritizing the assurance of clean and safe drinking water in homes and businesses.

In the dynamic landscape of the North American water filter market, a strategic opportunity for growth lies in partnerships with health and wellness brands. Collaborations with these brands offer a unique opportunity to open new distribution channels and expand market reach. By positioning water filters as integral components of a healthy lifestyle, manufacturers can tap into the burgeoning wellness trend. Leveraging the credibility and influence of health and wellness brands, water filter providers can effectively communicate the importance of clean and purified water for overall well-being.

MARKET RESTRAINTS

High Initial Costs

The upfront expenses linked to acquiring and installing water filtration systems can constrain market penetration, especially within price-sensitive demographics. While the demand for clean and safe water is rising, the considerable investment required for these systems may hinder broader accessibility. The market players are faced with addressing this restraint by exploring cost-effective solutions and creating awareness about the long-term benefits of water filtration. As technological advancements progress, there is a growing need for innovations that not only enhance filtration efficiency but also make these systems more affordable, ensuring a more inclusive and widespread adoption across diverse consumer segments.

The North America Water Filters Market confronts technological barriers as advancements in water filtration outpace consumer understanding and acceptance. The swift introduction of sophisticated filtration systems may encounter resistance within specific consumer segments. While innovation drives efficiency and effectiveness, bridging the gap between complex technologies and consumer comprehension remains a challenge. Market players must prioritize education and communication to demystify advanced filtration methods, address concerns and build consumer trust.

IMPACT OF COVID-19 ON THE NORTH AMERICA WATER FILTERS MARKET

The COVID-19 pandemic initially posed a demerit to the North America Water Filters Market as disruptions in supply chains and manufacturing processes led to product shortages and delayed deliveries. The economic uncertainties during the pandemic also resulted in reduced consumer spending, impacting the market's growth. Additionally, the focus on essential goods during the crisis temporarily shifted attention away from non-urgent home improvement purchases, affecting the demand for water filters. On the positive side, the pandemic heightened awareness of health and hygiene, fostering a greater emphasis on safe drinking water. As consumers spent more time at home, there was a surge in interest for home improvement products, including water filters, as people sought to enhance the quality of their living environments. The increased emphasis on health and hygiene is expected to have a lasting positive impact on the North America Water Filters Market as consumers prioritize clean water for their households.

SEGMENTAL ANALYSIS

By Technology Insights

The reverse osmosis (RO) segment is the most prominent technology in the North American water filters market and is expected to account for the largest share of the North American market during the forecast period. It employs a semi-permeable membrane to remove impurities, contaminants, and particles from water. RO systems are effective in eliminating a wide range of pollutants, making them suitable for addressing diverse water quality issues. Their popularity also stems from their ability to produce purified water for various uses, including drinking and cooking.

By Distribution Channel Insights

The retail sales segment is estimated to hold the leading share of the North American market during the forecast period. Retail sales, including brick-and-mortar stores, have traditionally been a significant distribution channel for water filters. Consumers often prefer the hands-on experience of physically inspecting products before making a purchase. Retail outlets, ranging from specialty stores to home improvement centers, provide an immediate and tangible option for consumers to explore different water filtration products.

By Portability Insights

The non-portable segment is the leading segment and is predicted to hold the largest share of the Noth American market during the forecast period. Non-portable water filters are typically installed in fixed locations, such as homes, offices or commercial establishments. These systems are designed for more permanent use and are often integrated into plumbing or water dispensing systems.

By End-User Insights

Based on end-user, the residential segment led the market for water filters in North America in 2023. Residential water filters are designed for use in homes and apartments and are the leading segment. These filters are installed at various points, including kitchen faucets, under sinks, or as whole-house systems. The residential segment dominates the market as individuals and families seek to ensure the quality and safety of their drinking water.

REGIONAL ANALYSIS

The U.S. is a significant player in the North American water filter market and held the major share of the North American market in 2023. It is anticipated that the domination of the U.S. in the North American market will continue throughout the forecast period. The U.S. has a robust demand for water filtration solutions. The dominance of the U.S. in the market is attributed to a combination of factors, including a high level of consumer awareness regarding water quality, stringent regulatory standards, and a widespread preference for home water filtration systems.

Canada also plays a second notable role in the North American water filter market. The demand for water filters in Canada is influenced by factors such as environmental consciousness, health considerations, and a preference for clean and safe drinking water.

KEY PLAYERS IN THE NORTH AMERICA WATER FILTERS MARKET

Companies playing a notable role in the North American water filters market include Culligan International Company, A.O. Smith Corporation, Pentair plc, 3M Company, Whirlpool Corporation, Ecolab Inc., Brita GmbH (Clorox Company), Aquasana Inc. (A.O. Smith Corporation), LG Electronics Inc., Kenmore (Sears Holdings Corporation), DuPont de Nemours, Inc., GE Appliances (Haier Group Corporation), EcoWater Systems LLC, WaterChef (Lifeguard Technologies), Krystal Pure Water Filters (Home Guard Technologies), Aquaguard (Eureka Forbes Ltd.), PurePro USA Corporation, Omnipure Filter Company and Everpure LLC (Pentair plc).

RECENT HAPPENINGS IN THE MARKET

- In 2022, 3M continued its focus on innovative filtration technologies. They might have introduced advanced water filter products catering to residential, commercial, and industrial needs with an emphasis on improved filtration efficiency and longevity.

- In 2023, Pentair likely emphasized eco-friendly and sustainable water filtration solutions. Developments might include products that reduce water waste or use renewable materials in filtration systems.

MARKET SEGMENTATION

This research report on the North American water filter market is segmented and sub-segmented based on the following categories.

By Technology

- UV

- RO

- Gravity-Based

By Distribution Channel

- Retail Sales

- Direct Sales

- Online

By Portability

- Portable

- Non-portable

By End-User

- Commercial

- Residential

By Country

- The U.S.

- Canada

- Rest of North America

Frequently Asked Questions

1. What is the North America Water Filters Market growth rate during the projection period?

The North America Water Filters Market is expected to grow with a CAGR of 8.01% between 2024-2029.

2. What can be the total North America Water Filters Market value?

The North America Water Filters Market size is expected to reach a revised size of US$ 6.51 billion by 2029.

3. Name any three North America Water Filters Market key players?

DuPont de Nemours, Inc., GE Appliances (Haier Group Corporation), and EcoWater Systems LLC, are the three North America Water Filters Market key players.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]