North America Water Soluble Fertilizers Market Size, Share, Growth, Trends, And Forecasts Report, Segmented By Crop Type, Application, Type, And By Region (The USA, Canada, Mexico & Rest of North America), Industry Analysis From 2025 to 2033

North America Water Soluble Fertilizers Market Size

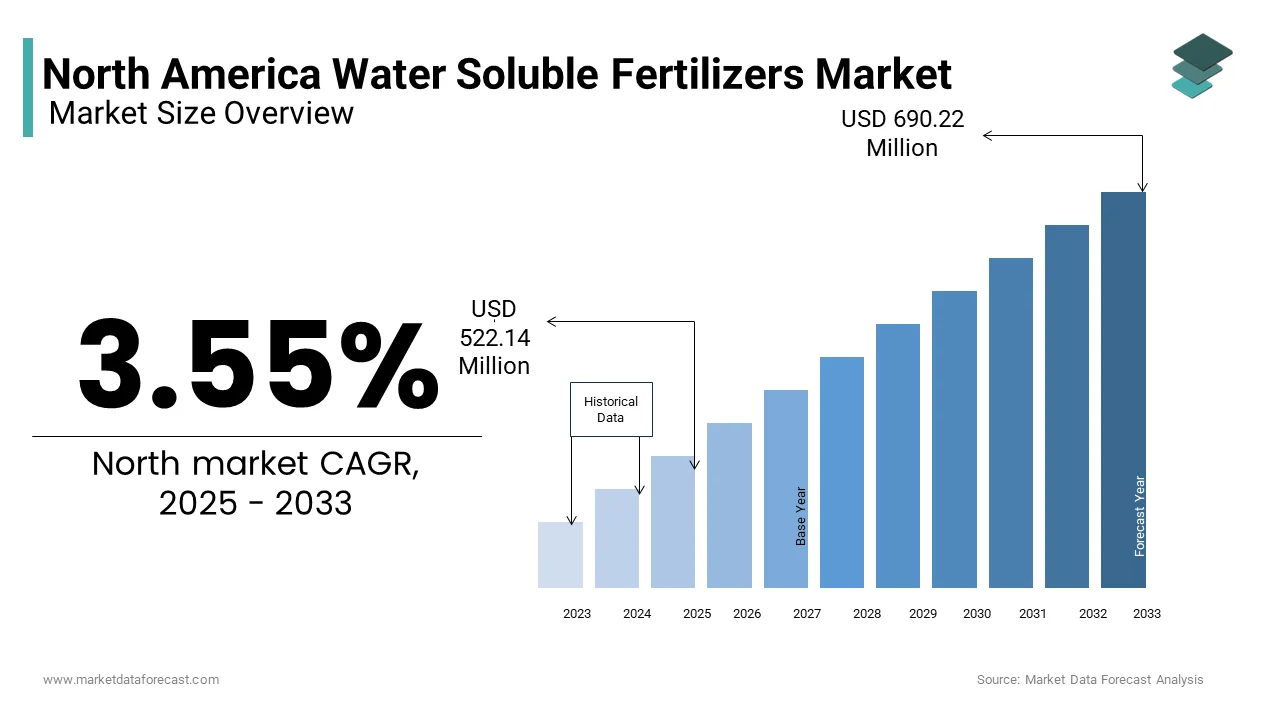

The North American water soluble fertilizers market was valued at USD 504.24 million in 2024 and is anticipated to reach USD 522.14 million in 2025 from USD 690.22 million by 2033, estimated to be growing at a CAGR of 3.55% during the forecast period from 2025 to 2033.

Water-soluble fertilizers (WSF) are nutrient-rich formulations designed to dissolve completely in water, enabling efficient delivery of essential plant nutrients through irrigation systems. These fertilizers contain primary macronutrients such as nitrogen, phosphorus, and potassium, along with secondary nutrients and micronutrients like calcium, magnesium, iron, and zinc. Their solubility allows for precise and uniform nutrient application, making them ideal for high-efficiency agricultural practices such as fertigation and foliar feeding.

MARKET DRIVERS

Expansion of Precision Agriculture and Drip Irrigation Adoption

One of the key drivers fueling the North America Water Soluble Fertilizers Market is the rapid expansion of precision agriculture and the widespread adoption of drip irrigation systems. These technologies enable targeted nutrient delivery, optimizing crop yields while conserving water and reducing input waste factors that are increasingly important in both conventional and organic farming sectors. According to the U.S. Department of Agriculture (USDA), over 65% of high-value crops such as vegetables, fruits, and nuts in the United States are cultivated using micro-irrigation techniques. This method relies heavily on water-soluble fertilizers due to their complete solubility and compatibility with fertigation systems. In Canada, similar trends are observed in greenhouse and specialty crop production.

Rising Demand from Greenhouse and Controlled Environment Agriculture

Another significant driver of the North America Water Soluble Fertilizers Market is the growing reliance on greenhouse and controlled environment agriculture (CEA) in urban and peri-urban areas. These farming systems depend heavily on hydroponics, aquaponics, and aeroponics, all of which require water-soluble fertilizers to deliver essential nutrients directly to plant roots without soil. In Canada, the rise of vertical farming startups has further intensified demand for WSF products. Moreover, as per Agriculture and Agri-Food Canada (AAFC), controlled environment agriculture can reduce water usage by up to 90% compared to traditional field farming, making it an attractive option amid growing concerns about resource conservation. Since water-soluble fertilizers are integral to maintaining nutrient efficiency in such closed-loop systems, their consumption is expected to grow alongside CEA expansion.

MARKET RESTRAINTS

High Cost Compared to Conventional Fertilizers

A major restraint affecting the North America Water Soluble Fertilizers Market is the relatively high cost of water soluble fertilizers when compared to conventional granular or bulk fertilizers. This price differential discourages adoption among commodity crop producers, especially those operating on narrow profit margins. In Canada, the Prairie Farm Rehabilitation Administration (PFRA) notes that many grain and oilseed farmers continue to favor standard dry fertilizers due to their lower upfront costs and ease of application via conventional spreaders. While water-soluble fertilizers offer superior nutrient uptake efficiency, the perceived economic risk limits their integration into large-scale row crop farming. Additionally, some growers remain skeptical about the return on investment associated with WSF products, particularly in regions with adequate rainfall and less intensive irrigation needs. Without clear demonstrations of yield improvements or cost recovery, many farmers opt for familiar and more affordable alternatives.

Limited Shelf Life and Storage Challenges

Another notable constraint impacting the North America Water Soluble Fertilizers Market is the limited shelf life and storage challenges associated with certain types of water-soluble fertilizers. According to the Fertilizer Institute (TFI), the hygroscopic nature of potassium nitrate and monoammonium phosphate-based water-soluble fertilizers makes them susceptible to clumping when exposed to humidity, reducing flowability and application efficiency. This necessitates climate-controlled storage facilities, which add to logistical costs and limit accessibility for rural and smallholder farmers. In addition, blended water-soluble fertilizers containing micronutrients such as boron and zinc may experience chemical interactions over time, leading to reduced efficacy. Moreover, transportation logistics also pose challenges, particularly for remote agricultural regions where warehouse infrastructure is underdeveloped. Distributors often face difficulties in maintaining product integrity throughout the supply chain, contributing to inconsistent availability and consumer dissatisfaction.

MARKET OPPORTUNITIES

Growth of Hydroponics and Indoor Farming in Urban Centers

One of the most promising opportunities in the North America Water Soluble Fertilizers Market is the rapid growth of hydroponics and indoor farming in urban centers. These agricultural systems rely entirely on water-soluble nutrient solutions to cultivate crops without soil, which is making them highly dependent on WSF formulations for optimal plant nutrition. These operations require precisely balanced nutrient blends, which are predominantly sourced from water-soluble fertilizers due to their high purity and solubility. Many of these ventures operate in controlled environments where nutrient recycling and water efficiency are paramount, further reinforcing the necessity of WSF products. Additionally, research conducted by Agriculture and Agri-Food Canada (AAFC) suggests that hydroponic systems using water-soluble fertilizers can achieve up to 30% higher yields compared to conventional farming methods while using 90% less water.

Increasing Demand for Specialty Crop Production

Another emerging opportunity in the North America Water Soluble Fertilizers Market is the expanding production of high-value specialty crops such as fruits, vegetables, herbs, and ornamental plants. These crops require precise nutrient management to ensure superior quality, flavor, and appearance, making water-soluble fertilizers an essential component of modern cultivation practices. These crops benefit significantly from the use of water-soluble fertilizers, which allow for real-time adjustments in nutrient composition based on plant growth stages. Moreover, the growing popularity of organic and premium produce among health-conscious consumers has led to increased demand for nutrient formulations that support sustainable farming practices. Several WSF manufacturers have introduced certified organic variants tailored for specialty crop applications, enhancing their appeal among environmentally conscious growers.

MARKET CHALLENGES

Complexity in Formulation and Compatibility Issues

A major challenge facing the North American Water Soluble Fertilizers Market is the complexity involved in formulating stable and compatible nutrient blends that meet specific crop and soil requirements. Unlike conventional fertilizers, water-soluble formulations must be carefully balanced to prevent precipitation, nutrient antagonism, and inefficiencies in uptake, which can compromise performance if not properly managed.

According to the Fertilizer Institute (TFI), blending incompatible salts such as calcium nitrate and potassium phosphate can lead to the formation of insoluble precipitates, rendering the fertilizer ineffective and potentially damaging irrigation equipment. The Canadian Fertilizer Manufacturers Association (CFMA) emphasizes that incorrect mixing sequences or poor water quality can exacerbate these problems, leading to clogged drippers, uneven nutrient distribution, and reduced crop productivity. Moreover, varying water hardness levels across different regions affect the solubility and effectiveness of WSF products. For instance, hard water rich in bicarbonates can interfere with micronutrient availability, necessitating additional chelation agents or acidification steps that complicate nutrient management.

Regulatory Hurdles and Certification Requirements for Organic Applications

Another significant challenge confronting the North American Water Soluble Fertilizers Market is the evolving regulatory landscape and certification requirements, particularly for organic farming applications. According to the U.S. Department of Agriculture’s National Organic Program (NOP), only certain mineral-based and naturally derived WSF products are approved for use in certified organic farming. Synthetic forms of nutrients, such as ammonium nitrate or potassium chloride, are prohibited, which limits the formulation options available to manufacturers targeting the organic sector. Similarly, in Canada, the Organic Products Regulations enforced by the Canadian Food Inspection Agency (CFIA) mandate that all fertilizers used in organic production must undergo third-party certification. This process involves extensive documentation, ingredient traceability assessments, and periodic audits, adding administrative burden and costs for suppliers. The Organic Materials Review Institute (OMRI) plays a crucial role in evaluating and listing compliant products, but the approval timeline can take several months, which delays market entry for innovative formulations.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

3.55% |

|

Segments Covered |

By Type of Crop, Application, Type of WSF, and By Country |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

The US, Canada, and the Country |

|

Market Leaders Profiled |

PR Agro Nutri Private Ltd. (India), CF Industries (US), The Mosaic Company (US), Israel Chemicals (Israel), Eurochem (Switzerland), Terra Nitrogen Company (US), PT Petrokimia Gresik (Indonesia), Sinofert Holdings (Hong Kong), Americas Petrogas (Canada), and Sirius Minerals (UK). |

SEGMENT ANALYSIS

By Type of Crop Insights

The horticultural crops segment was the largest by occupying 42.3% of the North America Water Soluble Fertilizers Market share in 2024. One of the key drivers behind this dominance is the increasing adoption of high-efficiency irrigation techniques such as drip and micro-sprinkler systems, which are extensively used in horticulture. According to the U.S. Department of Agriculture (USDA), over 65% of vegetable and fruit farms in the United States utilize micro-irrigation methods, all of which rely on water-soluble fertilizers for effective nutrient application. Additionally, the growing consumer preference for fresh, visually appealing produce has intensified pressure on growers to maintain consistent crop performance.

The turf and ornamentals segment is swiftly emerging with a CAGR of 7.9% from 2025 to 2033. According to the National Association of Landscape Professionals (NALP), the U.S. lawn and landscape services industry generated over USD 100 billion in revenue in 2023, with professional landscapers increasingly adopting water-soluble fertilizers due to their ability to deliver fast, visible results without soil degradation. Moreover, golf courses, sports fields, and municipal parks have become major consumers of WSF products, as they require frequent, precise nutrient applications to maintain lush greenery throughout the growing season. The Golf Course Superintendents Association of America (GCSAA) estimates that more than 70% of golf course maintenance professionals now use water-soluble fertilizers in combination with precision irrigation systems to enhance turf health and reduce runoff.

By Application Insights

The fertigation segment accounted for a prominent share of the North America Water Soluble Fertilizers Market in 2024. A primary factor driving its dominance is the widespread adoption of drip and micro-irrigation systems, especially in high-value crop production. According to the U.S. Department of Agriculture (USDA), over 65% of commercial vegetable and fruit farms in the United States employ drip irrigation, all of which integrate fertigation to optimize nutrient uptake and minimize waste.

The foliar application method segment is likely to register a CAGR of 8.4% from 2025 to 2033. Unlike root-based nutrient delivery, foliar application allows for rapid absorption through plant leaves, making it particularly useful in correcting nutrient imbalances caused by soil pH fluctuations or poor root uptake. According to the American Society of Agronomy (ASA), foliar fertilization can improve nutrient use efficiency by up to 30% compared to traditional soil application in high-value crops like citrus, tomatoes, and leafy greens.

By Type of WSF Insights

The nitrogenous water-soluble fertilizers segment was the largest by capturing 37.6% of the North America Water Soluble Fertilizers Market share in 2024. The extensive use of nitrogen-based formulations in high-yield crop cultivation, including corn, wheat, and rice, as well as in specialty crops like vegetables and fruits, is driving the growth of the segment. Additionally, the growing adoption of fertigation systems in both conventional and greenhouse farming has increased reliance on readily available nitrogen sources such as ammonium nitrate, urea, and potassium nitrate.

The micronutrient-based water-soluble fertilizers segment is expected to register a CAGR of 9.2% during the forecast period. Deficiencies in micronutrients such as iron, zinc, manganese, and boron have been identified as limiting factors in several high-value crops, prompting farmers to adopt targeted nutrient correction strategies. In particular, foliar application of micronutrient blends has gained popularity due to their immediate impact on correcting deficiencies and improving crop quality. In Canada, the Canadian Fertilizer Institute (CFI) notes that micronutrient-based WSF formulations are being increasingly integrated into greenhouse and hydroponic systems, where precise nutrient control is essential for maximizing yields in confined environments.

COUNTRY ANALYSIS

United States

The United States was the largest contributor by holding 75.6% of the North American Water Soluble Fertilizers Market share in 2024. One of the key contributors to the U.S. market’s strength is the extensive use of water-soluble fertilizers in specialty crop farming, particularly in states like California, Florida, and Washington. Additionally, the U.S. leads in greenhouse and controlled environment agriculture, with over 15,000 acres dedicated to greenhouse farming, as reported by the U.S. Greenhouse Growers Association (USGGA). Furthermore, the growing emphasis on sustainability and resource conservation has reinforced the shift toward efficient nutrient application methods. The Environmental Protection Agency (EPA) supports programs that encourage reduced fertilizer runoff, aligning with the benefits offered by water-soluble formulations.

Canada

Canada Water Soluble Fertilizers Market is likely to have prominent growth opportunities in the coming years. One of the primary drivers of the Canadian market is the country's expanding greenhouse horticulture industry, especially in Ontario and British Columbia. According to Statistics Canada, greenhouse vegetable production reached CAD 1.2 billion in 2023, with over 90% of these operations utilizing hydroponic systems that require water-soluble fertilizers for nutrient delivery.

Additionally, the rise of vertical farming startups in urban centers like Toronto and Montreal has further boosted demand for WSF products. The Urban Agriculture Network of Canada reports that over 150 new indoor farms launched in 2022, all of which rely on precisely balanced nutrient solutions derived from water-soluble fertilizers.

KEY MARKET PLAYERS

Some of the major companies dominating the market, by their products and services, include PR Agro Nutri Private Ltd. (India), CF Industries (US), The Mosaic Company (US), Israel Chemicas (Israel), Eurochem (Switzerland), Terra Nitrogen Company (US), PT Petrokimia Gresik (Indonesia), Sinofert Holdings (Hong Kong), Americas Petrogas (Canada), and Sirius Minerals (UK).

Top Players In The Market

The Mosaic Company

The Mosaic Company is a global leader in the production and distribution of water-soluble fertilizers, with a strong presence in North America. The company offers a diverse portfolio of phosphate- and potash-based products tailored for precision agriculture, greenhouse farming, and high-value crop cultivation. Its contributions to the global market include advancing nutrient-use efficiency and supporting sustainable farming practices through innovative fertilizer formulations.

Nutrien Ltd.

Nutrien plays a pivotal role in shaping the North American Water Soluble Fertilizers Market by integrating its extensive retail network with customized agronomy solutions. The company provides a wide range of water-soluble nutrients that cater to both conventional and organic farming systems. Through research partnerships and digital agriculture tools, Nutrien enhances grower access to efficient nutrient management strategies, which reinforces its influence on global agricultural sustainability efforts.

ICL Group Ltd.

ICL Group is a key player known for its premium water-soluble fertilizer offerings, particularly in specialty agriculture across North America. The company emphasizes innovation in formulation technology and environmental stewardship, aligning with the growing demand for controlled-release and micronutrient-rich products. Its strategic investments in production capacity and technical support services contribute significantly to global advancements in precision nutrient application.

Top Strategies Used By Key Market Participants

One major strategy employed by key players in the North America Water Soluble Fertilizers Market is product innovation and formulation diversification, where companies develop specialized blends targeting specific crops, soil conditions, and application methods to enhance performance and user adoption.

Another widely adopted approach is expanding agronomic support and farmer education, wherein manufacturers provide technical advisory services, field trials, and training programs to help growers understand the benefits and optimal use of water-soluble fertilizers in different farming systems.

Lastly, strategic partnerships and vertical integration have become crucial for strengthening supply chains and ensuring product availability across key agricultural regions. Companies are collaborating with irrigation equipment providers, greenhouse operators, and agri-tech firms to create integrated solutions that improve overall nutrient efficiency and application accuracy.

COMPETITION OVERVIEW

The competition in the North American Water Soluble Fertilizers Market is characterized by a mix of multinational agribusinesses, regional specialty fertilizer producers, and emerging startups focused on precision agriculture. As demand for resource-efficient nutrient solutions continues to rise, companies are intensifying their focus on product differentiation, customer engagement, and technological integration. Innovation remains a core battleground, with firms investing heavily in advanced formulations, including multi-nutrient blends and enhanced efficiency variants tailored for high-value crops. Additionally, the convergence between digital agriculture and nutrient delivery has opened new avenues for differentiation, prompting players to incorporate smart application technologies into their service offerings. While large-scale producers leverage economies of scale and established distribution networks, smaller players gain traction through niche product positioning and localized technical support. Regulatory developments around nutrient runoff and environmental impact further shape competitive dynamics, which are influencing how companies position themselves in this rapidly evolving industry.

RECENT HAPPENINGS IN THE MARKET

- In January 2023, The Mosaic Company launched a new line of fully water-soluble micronutrient-enriched fertilizers specifically designed for greenhouse and hydroponic applications by aiming to expand its footprint in controlled-environment agriculture across North America.

- In May 2023, Nutrien Ltd. partnered with a leading U.S.-based precision irrigation provider to integrate its water-soluble fertilizer recommendations with smart fertigation software platforms, which are enhancing decision-making capabilities for growers using drip and micro-sprinkler systems.

- In September 2023, ICL Group expanded its North American production capacity by commissioning a new blending and packaging facility in California, which is strategically located near high-intensity horticultural zones to ensure faster delivery and improved service levels for specialty crop farmers.

- In February 2024, Koch Agronomic Services introduced an extended-range line of stabilized water-soluble fertilizers, incorporating proprietary nutrient release technologies aimed at improving uptake efficiency and reducing leaching losses in open-field and orchard applications.

- In July 2024, ScottsMiracle-Gro acquired a stake in a Canadian-based startup specializing in AI-driven foliar nutrient diagnostics by allowing the company to offer more precise and data-backed WSF recommendations for turf and ornamental applications across North America.

MARKET SEGMENTATION

This research report on the North America Water Soluble Fertilizers Market is segmented and sub-segmented into the following categories.

By Type of Crop

- Field

- Horticultural

- Turf & Ornamentals

By Application

- Fertigation

- Foliar method

By Type of WSF

- Nitrogenous

- Potassic

- Phosphatic

- Micronutrients

By Country

- The USA

- Canada

- Mexico

-

Rest of North America

Frequently Asked Questions

What is the projected CAGR of the North America Water Soluble Fertilizers Market from 2024 to 2033?

The North America water soluble fertilizers market is expected to grow at a CAGR of 5.15% from 2024 to 2033, driven by increasing adoption in precision agriculture, greenhouse farming, and high-value crop cultivation in the U.S. and Canada.

Which country leads in water soluble fertilizer consumption in North America?

The U.S. accounts for over 85% of total water-soluble fertilizer usage, especially in high-tech farming states like California, Florida, and Texas. According to the USDA Economic Research Service, U.S. imports of potassium nitrate-based and NPK water-soluble blends rose by 19% in 2023, reflecting growing demand in specialty crops.

How many metric tons of water soluble fertilizers were used across North America in 2023?

In 2023, approximately 1.3 million metric tons of water-soluble fertilizers were consumed across the U.S. and Canada, according to Statistics Canada and the U.S. Geological Survey (USGS). This represents a 14% increase since 2020, largely attributed to expansion in greenhouse vegetable and berry production.

Which type of crop drives the highest demand for water soluble fertilizers in North America?

Fruits and vegetables account for nearly 45% of total WSF demand, particularly in California’s Central Valley and Florida’s citrus belt, where drip irrigation systems and nutrient monitoring technologies are widely adopted for maximizing yield and quality.

How much does water soluble fertilizer application reduce water usage in agriculture?

According to a 2023 study by the University of California Cooperative Extension, integrating water-soluble fertilizers into drip and micro-irrigation systems can improve water-use efficiency by up to 30%, reducing leaching losses while enhancing nutrient uptake in row crops and orchards.

How has the rise of vertical and indoor farming impacted WSF demand in the U.S.?

With over 320 commercial vertical farms now operating in the U.S. , as reported by Agritecture Advisors LLC, the demand for water-soluble fertilizers increased by 22% since 2021, particularly in hydroponic lettuce, basil, and cannabis operations in urban farming hubs like Chicago, New York, and Denver.

Which nutrient formulation dominates the water soluble fertilizer market in North America?

NPK (Nitrogen-Phosphorus-Potassium) blends account for over 50% of all WSF sales , especially among greenhouse growers and fertigation-focused producers. In 2023, calcium nitrate and mono-potassium phosphate formulations saw rising demand due to their compatibility with soilless and low-residue irrigation systems.

What percentage of greenhouse growers in Canada use water soluble fertilizers?

Over 78% of commercial greenhouse operators in Ontario and British Columbia rely on water-soluble fertilizers for tomato, cucumber, and pepper production, as reported by Agriculture and Agri-Food Canada (AAFC). These fertilizers allow precise nutrient control and real-time adjustments to meet crop growth stage requirements.

How do water soluble fertilizers support controlled-release nutrient management in smart agriculture?

As per the International Plant Nutrition Institute (IPNI) , water soluble fertilizers are increasingly being used in fertigation systems integrated with IoT sensors , allowing real-time nutrient delivery and plant response tracking , improving both yield and environmental sustainability in precision farming setups.

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com