Global Pipes Market Size, Share, Trends & Growth Forecast Report - Segmented By Product (Steel, Plastics, and Concrete Pipe), Pipe Size, Application, Region (North America, Europe, Asia Pacific, Latin America, And Middle East & Africa) - Industry Analysis (2025 to 2033)

Global Pipes Market Size

The global Pipes market size was valued at USD 119.46 billion in 2024 and is expected to reach USD 190.47 billion by 2033 from USD 125.82 billion in 2025. The market is projected to grow at a CAGR of 5.32%.

MARKET DRIVERS

Urbanization and Infrastructure Development

Urbanization is a primary driver of the pipes market, with cities expanding rapidly to accommodate growing populations. According to the United Nations, 68% of the global population will live in urban areas by 2050 by necessitating upgrades to water, sewage, and gas distribution systems. In India, the Smart Cities Mission has allocated over $15 billion for urban infrastructure projects, including piping networks for water and sanitation. Industrial growth further amplifies this trend. The International Energy Agency states that global energy infrastructure requires 12,000 kilometers of new pipelines annually to meet rising energy demands.

Sustainability and Green Initiatives

Sustainability is reshaping the pipes market, with governments and corporations prioritizing eco-friendly materials and technologies. The European Union’s Green Deal mandates the replacement of outdated metal pipes with sustainable alternatives, driving adoption in water and wastewater systems. Additionally, renewable energy projects are spurring demand. The Global Wind Energy Council reports that offshore wind farms require 200 kilometers of subsea pipelines per project , creating opportunities for high-performance materials.

MARKET RESTRAINTS

Fluctuating Raw Material Prices

Fluctuations in raw material prices pose a significant challenge to the pipes market, which is impacting profitability and project timelines. This volatility forces manufacturers to either absorb higher costs or pass them on to consumers, by reducing affordability. Plastic-based pipes, such as PVC and HDPE, are equally affected. These price swings deter long-term investments in large-scale infrastructure projects, as contractors face uncertainty in budgeting.

Stringent Regulatory Standards

Regulatory standards aimed at ensuring safety and environmental compliance create hurdles for pipe manufacturers. The International Organization for Standardization (ISO) mandates rigorous testing and certification processes, which can increase production costs by up to 20% , according to Deloitte. For instance, pipelines used in oil & gas must adhere to API 5L standards, which is requiring advanced metallurgy and quality control measures.

Smaller players often struggle to meet these requirements, by limiting market entry. Additionally, evolving regulations, such as the EU’s ban on certain plastic additives, force companies to invest in R&D for compliant materials. While these standards enhance product reliability, they also slow down production and raise barriers for mid-tier manufacturers.

MARKET OPPORTUNITIES

Smart Piping Solutions

The integration of IoT and smart technologies into piping systems presents a transformative opportunity for the market. Sensors embedded in pipes can detect leaks, pressure fluctuations, and corrosion by reducing downtime and repair costs. For example, Saudi Aramco implemented smart piping systems across its refineries by achieving a 30% reduction in maintenance expenses in 2023.

Emerging Markets and Rural Development

Emerging markets present untapped potential for the pipes market, fueled by rural development and agricultural expansion. According to the Food and Agriculture Organization (FAO), 70% of freshwater withdrawals globally are used for agriculture by necessitating robust irrigation systems. Countries like Brazil and India are investing heavily in rural infrastructure, with the Indian government allocating $10 billion for irrigation projects in 2023. Additionally, rural electrification drives demand for underground cables and conduits.

MARKET CHALLENGES

Environmental Concerns and Recycling Issues

Environmental concerns surrounding the disposal and recycling of pipes pose a significant challenge to market growth. According to the Environmental Protection Agency (EPA), over 10 million tons of plastic waste from pipes and conduits end up in landfills annually, contributing to pollution. Traditional materials like PVC and HDPE, while durable, are difficult to recycle, exacerbating the problem. Efforts to address this issue have been slow. The Ellen MacArthur Foundation states that only 9% of plastic waste globally is recycled, leaving the majority unprocessed. This lack of infrastructure discourages the adoption of eco-friendly alternatives, as companies face logistical and financial hurdles. Unless scalable recycling solutions emerge, the market risks reputational damage and regulatory backlash.

Competition from Alternative Materials

The rise of alternative materials threatens traditional pipe manufacturers by intensifying competition. Composite materials, such as fiberglass-reinforced polymers (FRP), are gaining traction due to their lightweight and corrosion-resistant properties. Additionally, innovations in bioplastics challenge established players. However, these materials often come at a premium, deterring cost-sensitive customers. Manufacturers must balance innovation with affordability to remain competitive in this evolving landscape.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

5.32% |

|

Segments Covered |

By Product, Pipe Size, Application, and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Aliaxis Group S.A. (Belgium), Pipelife Austria GmbH & Co KG (Austria), Sekisui Chemical Co., Ltd. (Japan), Wienerberger AG (Austria), Plasticos Ferro, S.L.U. (Spain), Orbia (Mexico), Advanced Drainage Systems (U.S.), Supreme.Co.In. (India), Agru (Austria), Northwest Pipe Company (U.S.), CPM Drainage Group (U.K.), Xinjiang Guotong Pipeline Co., Ltd (China), Thompson Pipe Group (U.S.), Finolex Industries Ltd. (India), and Cemex S.A.B. De C.V. (Mexico), and others. |

SEGMENTAL ANALYSIS

By Product Insights

The steel pipes segment dominated the global pipes market with 40.3% of the share in 2024. The growth of the segment is driven by their versatility and strength, which is making them indispensable in industries like oil & gas, construction, and water infrastructure. Urbanization further fuels demand. The United Nations projects that 68% of the global population will live in urban areas by 2050, which is necessitating robust infrastructure for water supply, sewage, and industrial applications.

The plastic pipes segment is likely to register a 6.5% in the next coming years. This rapid expansion is fueled by increasing adoption in residential and agricultural sectors. Plastics like PVC and HDPE are lightweight, corrosion-resistant, and cost-effective, which is making them ideal for irrigation and plumbing systems. The Food and Agriculture Organization states that 70% of freshwater withdrawals globally are used for agriculture, which is driving demand for durable plastic pipes. Sustainability initiatives also play a pivotal role. The European Union’s Green Deal mandates the replacement of outdated metal pipes with eco-friendly alternatives, boosting plastic pipe adoption.

By Pipe Size Insights

The 2-5 inches pipe size segment led the pipes market by occupying 30.3% of share in 2024 due to its versatility across residential, commercial, and industrial applications. For instance, pipes in this range are widely used in water distribution systems, HVAC installations, and small-scale industrial setups. According to the U.S. Environmental Protection Agency, 60% of water pipelines in urban areas fall within this size range by ensuring consistent demand. Affordability and ease of installation further bolster adoption. Retailers like Home Depot report that 40% of their plumbing inventory consists of pipes in this size range, reflecting widespread consumer preference.

The above 20 inches segment is projected to expand at a CAGR of 7.2% throughout the forecast period. This growth is driven by large-scale infrastructure projects requiring high-capacity pipelines. Urbanization and industrialization amplify demand. For example, China’s Belt and Road Initiative includes over 50,000 kilometers of planned pipelines , predominantly in this size range. Additionally, desalination plants in the Middle East require large-diameter pipes for seawater intake and distribution, as reported by Gulf News. As governments invest in mega-projects, the above 20 inches segment continues to outpace others.

By Application Insights

By Application Insights

The infrastructure dominated the pipes market by accounting for 35.4% of share in 2024. Additionally, renewable energy projects fuel demand. The Global Wind Energy Council reports that offshore wind farms require 200 kilometers of subsea pipelines per project that often falling under infrastructure applications. Governments worldwide are prioritizing sustainable development, with the European Investment Bank allocating €75 billion for green infrastructure in 2023.

The agriculture segment is likely to exhibit a CAGR of 5.8% in the next coming years. This growth is fueled by rising food demand and the need for efficient irrigation systems. The Food and Agriculture Organization states that 70% of freshwater is used for agriculture with the driving adoption of durable piping solutions. In regions like India and Africa, government-funded rural development programs are accelerating growth. For instance, the Indian government allocated $10 billion for irrigation projects in 2023, primarily using plastic and concrete pipes.

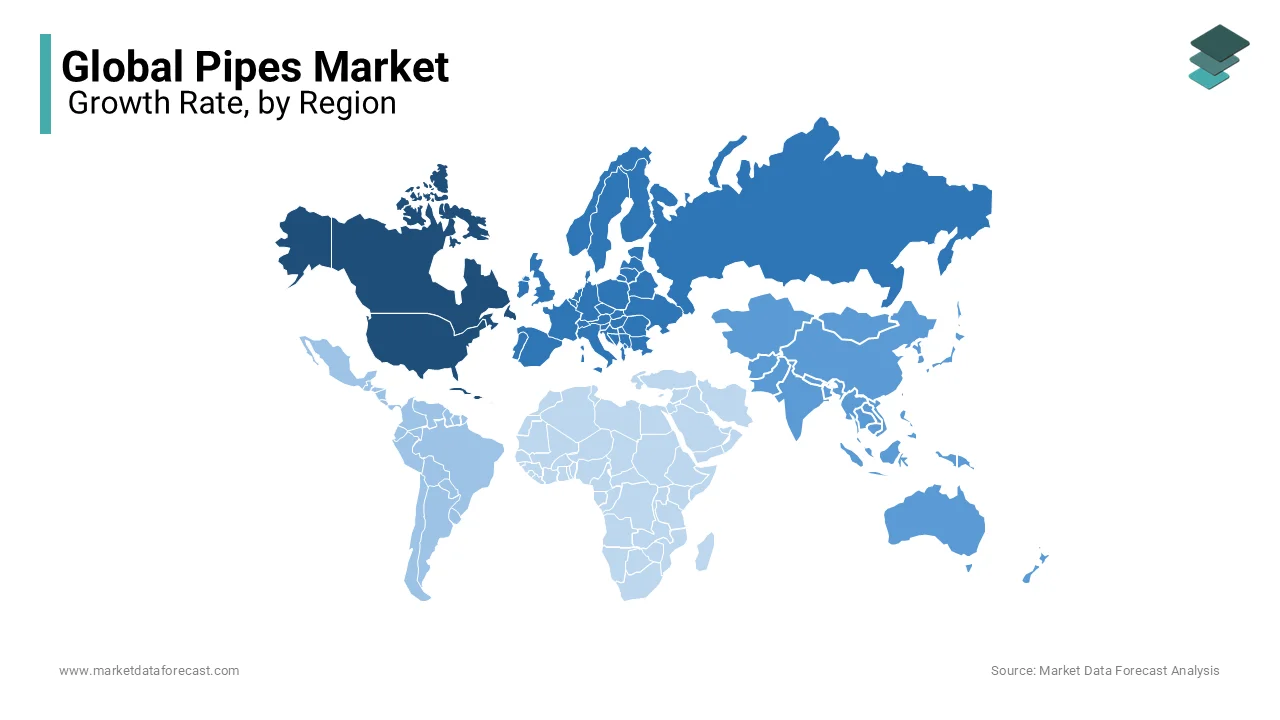

REGIONAL ANALYSIS

North America was the largest and held 20.5% of the global pipes market share in 2024 with the U.S. leading consumption. Aging infrastructure drives demand, with the American Society of Civil Engineers estimating a $1 trillion investment gap in water and sewer systems by 2030. Urbanization and sustainability initiatives further shape the market. Cities like New York are replacing old lead pipes with eco-friendly alternatives, supported by federal funding. Additionally, shale gas exploration boosts industrial demand by ensuring steady growth despite mature market conditions.

Europe was ranked second with 18.5% of the global pipes market share in 2024 by focusing on sustainability and innovation. Germany leads with investments in green infrastructure, including eco-friendly pipes for water and wastewater systems. The European Union’s Green Deal mandates the replacement of outdated materials, which is driving adoption of PVC and HDPE pipes.

Industrial demand remains strong, with the chemical sector requiring corrosion-resistant pipes. According to the European Chemical Industry Council, the region produces over 50 million tons of chemicals annually, by necessitating robust piping networks.

Asia-Pacific pipes market is the fastets growing region owing to the rapid urbanization and industrialization. China leads, producing nearly 40% of global steel pipes , primarily for energy and infrastructure projects. India follows, with Smart Cities Mission projects driving demand for water and sewage systems. Agricultural expansion further amplifies growth. Government investments in rural infrastructure ensure sustained demand, which is making Asia-Pacific the engine room of the pipes market.

Latin America is gaining traction over the growth over the Brazil and Mexico leading consumption, as per Statista. Urbanization and agricultural expansion drive demand, particularly for plastic and concrete pipes. The Inter-American Development Bank reports that 60% of rural areas lack reliable water infrastructure by creating opportunities for growth.

The Middle East and Africa is likely to gain huge traction over the growth rate in the coming years. Saudi Arabia and the UAE lead, investing heavily in desalination plants requiring large-diameter pipes. Gulf News reports that the region plans to add 5 million cubic meters of desalination capacity annually, boosting pipe demand. Africa’s urbanization and rural development create additional opportunities. The African Development Bank highlights that 600 million people lack access to electricity, necessitating pipeline installations for power generation.

KEY MARKET PARTICIPANTS AND COMPETITIVE LANDSCAPE

Aliaxis Group S.A. (Belgium), Pipelife Austria GmbH & Co KG (Austria), Sekisui Chemical Co., Ltd. (Japan), Wienerberger AG (Austria), Plasticos Ferro, S.L.U. (Spain), Orbia (Mexico), Advanced Drainage Systems (U.S.), Supreme.Co.In. (India), Agru (Austria), Northwest Pipe Company (U.S.), CPM Drainage Group (U.K.), Xinjiang Guotong Pipeline Co., Ltd (China), Thompson Pipe Group (U.S.), Finolex Industries Ltd. (India), and Cemex S.A.B. De C.V. (Mexico) are playing a dominating role in the global pipes market.

The pipes market is highly competitive, characterized by a mix of established giants, mid-tier players, and emerging innovators vying for dominance. Large-scale manufacturers like Tata Steel and Tenaris dominate industrial applications, leveraging their expertise in steel and alloy-based solutions for energy and construction sectors. Meanwhile, JM Eagle leads the plastic pipes segment, focusing on affordability and versatility for residential and agricultural use. Regional dynamics shape competition, with Asia-Pacific favoring cost-effective options and Europe prioritizing sustainability.

Technological advancements, such as smart piping systems, are intensifying rivalry, as companies strive to offer cutting-edge solutions. Regulatory pressures further complicate the landscape, with stringent environmental standards forcing smaller players to innovate or exit the market.

TOP 3 PLAYERS IN THE MARKET

Tata Steel

Tata Steel is a global leader in the pipes market, renowned for its high-quality steel pipes used in critical infrastructure projects. The company’s focus on innovation and sustainability has positioned it as a preferred supplier for oil & gas, water distribution, and construction sectors. Tata Steel leverages advanced metallurgy to produce corrosion-resistant pipes, catering to harsh environmental conditions. Its commitment to eco-friendly practices, such as recyclable materials and energy-efficient manufacturing that aligns with global sustainability goals. By expanding its production capacity in emerging markets like India and Africa, Tata Steel continues to strengthen its global footprint.

JM Eagle

JM Eagle dominates the plastic pipes segment, particularly PVC and HDPE pipes, which are widely used in water and irrigation systems. As the largest plastic pipe manufacturer globally, JM Eagle emphasizes durability, cost-effectiveness, and environmental compliance. The company invests heavily in R&D to develop innovative solutions, such as smart pipes with IoT-enabled sensors for real-time monitoring. JM Eagle’s strategic partnerships with governments and municipalities ensure large-scale adoption of its products in urban infrastructure projects.

Tenaris

Tenaris specializes in premium steel pipes for the oil & gas industry, offering high-performance solutions for drilling, exploration, and transportation. The company’s global network and proximity to key energy hubs enable rapid delivery and customization. Tenaris focuses on technological advancements, such as thermally enhanced coatings and seamless pipe designs, to meet stringent industry standards. Additionally, its commitment to sustainability is evident through initiatives like carbon-neutral production facilities.

STRATEGIES USED BY THE MARKET PLAYERS

Innovation in Smart Piping Solutions

Leading players are integrating IoT and AI technologies into piping systems to enhance efficiency and reliability. For instance, JM Eagle introduced smart PVC pipes embedded with sensors that monitor water flow, pressure, and leaks in real time. These innovations reduce operational costs and downtime, appealing to industries like oil & gas and municipal water management.

Strategic Partnerships and Collaborations

Collaborations with governments and private entities are crucial for securing large-scale projects. In April 2024, Tata Steel partnered with Indian state governments to supply eco-friendly steel pipes for Smart Cities Mission projects, ensuring compliance with sustainability mandates. Similarly, Tenaris collaborates with energy companies to co-develop customized solutions for offshore drilling. These partnerships not only expand market reach but also enhance brand credibility and customer loyalty.

Focus on Sustainability and Eco-Friendly Materials

Sustainability is a key differentiator in the competitive landscape. Companies like BASF and JM Eagle are investing in recyclable materials and energy-efficient manufacturing processes. For example, BASF launched a line of bioplastic pipes in December 2023, reducing carbon footprints by 25% compared to traditional plastics . Governments worldwide are incentivizing green infrastructure, creating opportunities for manufacturers prioritizing eco-friendly innovations. This strategy ensures compliance with regulations while attracting environmentally conscious buyers.

RECENT HAPPENINGS IN THE MARKET

- In April 2024, Tata Steel launched a new line of eco-friendly steel pipes designed for water infrastructure projects in India by aligning with government sustainability goals and capturing a larger share of public contracts.

- In November 2023, JM Eagle introduced advanced HDPE pipes embedded with IoT sensors for real-time monitoring by enhancing their competitiveness in smart infrastructure projects across North America.

- In August 2023, Saudi Aramco partnered with local manufacturers to produce corrosion-resistant steel pipes for its offshore oil projects by reducing import dependency and boosting domestic production capabilities.

- In December 2022, BASF expanded its PVC pipe production facility in Germany, focusing on recyclable materials to meet EU Green Deal requirements and strengthening its position in Europe’s sustainable infrastructure initiatives.

- In October 2022, China National Petroleum Corporation invested in large-diameter concrete pipes for its Belt and Road Initiative projects by ensuring cost-effective solutions for cross-border energy and water distribution systems.

MARKET SEGMENTATION

This research report on the global Pipes market has been segmented and sub-segmented based on , and region.

By Product

- Steel

- Plastics

- Concrete Pipe

By Pipe Size

- Upto ½ Inches

- ½ to 1 Inches

- 1 to 2 Inches

- 2-5 Inches

- 5-10 Inches

- 10-20 Inches

- Above 20 Inches

By Application

- Building

- Infrastructure

- Industrial

- Agriculture

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

1. What is the projected market size of the global pipes market by 2033?

The global pipes market is expected to reach USD 190.47 billion by 2033.

2. What are the primary drivers of growth in the pipes market?

Growth is driven by increasing construction activities, expanding oil & gas exploration, water management infrastructure, and industrialization in emerging economies.

3. What sectors are the main consumers of pipes?

Major end-use sectors include construction, water & wastewater management, oil & gas, agriculture, and industrial processing.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]