Global Potash Fertilizers Market Size, Share, Trends & Growth Forecast Report, Segmented By Product Type (Sulfate Of Potash, Potassium Chloride And Potassium Nitrate), Crop Type (Fruits And Vegetables, Cereals And Grains And Oilseeds And Pulses), Form (Solid And Liquid), Application Method (Foliar, Broadcasting And Fertigation) And Region (North America, Europe, Asia Pacific, Latin America, and Middle East and Africa), Industrial Analysis From (2025 to 2033)

Global Potash Fertilizers Market Size

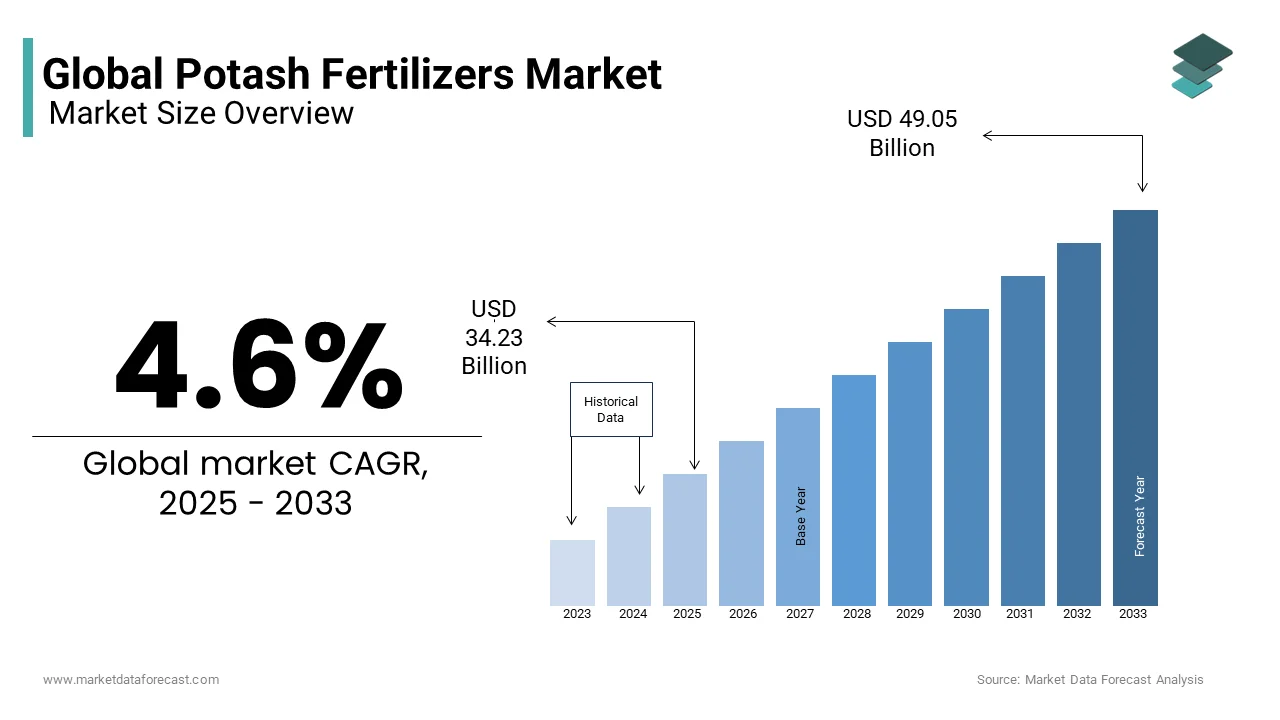

The global potash fertilizers market was valued at USD 32.72 billion in 2024 and is anticipated to reach USD 34.23 billion in 2025 from USD 49.05 billion by 2033, growing at a CAGR of 4.6% during the forecast period from 2025 to 2033.

MARKET DRIVERS

Surge in Global Food Demand

One of the primary drivers of the potash fertilizers market is the escalating global demand for food, fueled by population growth and shifting dietary preferences. By 2050, the world population is projected to surpass 9.7 billion, according to the United Nations by necessitating a 60–70% increase in food production. Potash plays a crucial role in enhancing crop yield and quality, especially for potassium-responsive crops such as fruits, vegetables, sugar beets, and cereals. In 2023, global cereal production rose to 3.01 billion metric tons, as reported by the Food and Agriculture Organization (FAO), directly increasing the need for potassium-based fertilizers. Countries like India and China are major consumers, with India importing over 5 million metric tons of muriate of potash (MOP) annually to support domestic agricultural productivity.

Expansion of Precision Farming Practices

Precision farming techniques are rapidly gaining traction worldwide, significantly boosting the demand for potash fertilizers. These technologies enable farmers to apply fertilizers more efficiently based on soil composition and crop requirements, minimizing waste and maximizing yield. This shift supports targeted use of potash in developed regions like North America and Western Europe, where adoption rates are highest. In the U.S., over 40% of farms now utilize GPS-guided systems for fertilizer application, as stated by the USDA in 2024. Similarly, in Germany, the Federal Ministry of Food and Agriculture reported that precision nutrient management boosted potash efficiency by up to 20% in 2023 by reducing environmental impact while improving productivity.

MARKET RESTRAINTS

Volatility in Raw Material Prices

A significant restraint impacting the potash fertilizers market is the volatility in raw material prices, which affects both production costs and end-user affordability. Potash extraction involves substantial energy inputs, making it sensitive to fluctuations in natural gas and electricity prices. This increase raised operational expenses for potash producers, many of whom rely on energy-intensive mining processes. Additionally, geopolitical disruptions in Eastern Europe have led to inconsistent supply flows of key inputs. For instance, sanctions imposed on Russian and Belarusian potash exports in early 2023 caused short-term supply shocks and price spikes exceeding 15% in some Asian markets, according to ICIS. These price instabilities strain farmers’ budgets, especially in emerging economies where fertilizer subsidies are limited. As a result, inconsistent pricing undermines long-term investment in potash infrastructure and hampers market expansion despite strong underlying demand fundamentals.

Environmental Regulations and Sustainability Concerns

Environmental concerns surrounding potash mining and usage are increasingly shaping regulatory frameworks, which is posing a challenge to market growth. While potash itself is not inherently harmful, the mining process can lead to land degradation, water contamination, and high carbon emissions. Similarly, in Canada, the Saskatchewan government introduced new emission reduction targets requiring potash producers to cut greenhouse gas emissions by 30% by 2030, as outlined in the provincial Climate Strategy. These regulations drive up compliance costs for manufacturers, slowing down project approvals and expansions. Moreover, consumer awareness about sustainable agriculture is growing, leading to a shift toward organic and alternative nutrient sources. These environmental pressures are compelling industry players to invest in greener extraction methods and circular economy models, though such transitions often require time and capital.

MARKET OPPORTUNITIES

Rise in Specialty Potash Products

A promising opportunity within the potash fertilizers market lies in the growing demand for specialty potash products tailored for high-value crops and precision agriculture applications. Unlike conventional muriate of potash (MOP), specialty forms such as sulfate of potash (SOP) and potassium nitrate offer enhanced compatibility with chloride-sensitive crops like fruits, vegetables, and nuts. In 2023, SOP accounted for nearly 15% of total potash consumption, which is primarily driven by horticultural sectors in the U.S., Australia, and Latin America. For example, California’s almond growers applied SOP on over 80% of orchards, citing improved yield and resistance to disease, as reported by the Almond Board of California. Additionally, companies like K+S Potash Canada and Compass Minerals are expanding SOP production capacity to meet this niche demand. With rising investments in controlled-release fertilizers and hydroponic farming, the market for specialized potash variants is poised for sustained growth, offering a strategic avenue for differentiation among producers.

Expansion into Emerging Agricultural Markets

Emerging agricultural economies present a substantial growth opportunity for the potash fertilizers market, particularly in Sub-Saharan Africa and Southeast Asia. These regions currently exhibit low potash application rates but are experiencing rapid agricultural intensification due to population growth and food security concerns. In Indonesia, the Ministry of Agriculture reported a 22% increase in potash imports in 2023, which is driven by rising palm oil and rice production. These developments signal a growing awareness of soil nutrient management and government-backed initiatives aimed at boosting fertilizer accessibility. Companies such as OCP Group and Uralkali are actively engaging in partnerships and distribution agreements across these regions to capitalize on the evolving demand landscape, positioning emerging markets as a key frontier for future market expansion.

MARKET CHALLENGES

Geopolitical Instability in Key Supply Regions

Geopolitical instability in major potash-producing countries presents a persistent challenge to the stability and predictability of the global potash fertilizers market. According to the International Fertilizer Association, these sanctions disrupted global potash supply chains, causing short-term price increases of up to 20% in parts of Asia and Latin America during mid-2023. Although alternative suppliers such as Canada and Brazil ramped up production, they could not fully offset the disruption, leading to supply shortages in several developing nations reliant on affordable imports. Furthermore, ongoing tensions in Eastern Europe continue to create uncertainty around export policies and logistics.

Declining Farmer Profit Margins in Developing Economies

Declining profit margins among farmers in developing economies pose a significant challenge to the consistent uptake of potash fertilizers. In countries like India, Nigeria, and Bangladesh, where smallholder farming dominates, fluctuating crop prices and rising input costs are squeezing farm incomes. According to the Food and Agriculture Organization (FAO), real farm income in India declined by nearly 8% in 2023, despite bumper harvests in certain regions, due to falling prices for staples such as wheat and rice. This financial pressure leads many farmers to reduce or delay fertilizer purchases for higher-cost nutrients like potash. Data from the Indian Ministry of Agriculture shows that potash consumption dropped by 6% in FY 2023 compared to FY 2022, despite government subsidy programs. Similar trends were observed in West Africa, where erratic rainfall and inflationary pressures reduced disposable income for agricultural inputs. The International Fund for Agricultural Development (IFAD) noted that over 60% of smallholder farmers in Sub-Saharan Africa lacked access to credit in 2023, which is limiting their ability to invest in soil-enhancing nutrients.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

4.6% |

|

Segments Covered |

By Product Type, Crop Type, Form, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Eurochem, Israel Chemicals Ltd, Yara International ASA, K+S Aktiengesellschaft, SQM, The Mosaic Company, Sinofert Holdings, Agrium Inc, CF industries, Potash Corporation. |

SEGMENTAL ANALYSIS

By Product Type Insights

The Potassium Chloride (Muriate of Potash) segment held the largest share of the global potash fertilizers market in 2024. The growth of the segment is attributed to its cost-effectiveness and widespread application across major crops, particularly cereals, oilseeds, and grains. In countries like the U.S., Canada, and Brazil, where large-scale commercial farming is prevalent, potassium chloride remains the go-to nutrient source due to its high potassium content and affordability. According to USDA data, over 80% of corn and soybean acreage in the U.S. received MOP applications in 2024, which is reinforcing its entrenched role in staple crop production. Additionally, government subsidies in key agricultural markets such as India and China are further driving demand.

The Sulfate of Potash (SOP) segment is anticipated to grow with a CAGR of 6.1% from 2024 to 2033, owing to the rising demand from high-value horticultural crops, including fruits, vegetables, and nuts, which require chloride-free nutrient sources to optimize yield and quality. SOP’s ability to enhance crop resistance to disease, improve shelf life, and boost sugar content makes it especially valuable in premium agriculture segments. Additionally, the expansion of greenhouse and hydroponic farming in Europe and North America is accelerating SOP adoption, given its solubility and compatibility with drip irrigation systems.

By Crop Type Insights

The Cereals and Grains segment dominated the potash fertilizers market by capturing 45.2% of the share in 2024, with the large cultivated area under staple crops such as wheat, rice, maize, and barley across Asia-Pacific, North America, and Eastern Europe. These crops form the foundation of global food security, and their extensive cultivation necessitates significant nutrient inputs to sustain yields. In India, one of the largest consumers of potash, over 60% of fertilizer application goes toward cereal crops in states like Punjab and Haryana, where rice and wheat are grown intensively. Similarly, in the U.S., the USDA reported that potash application rates on corn remained stable at 90 pounds per acre, reflecting sustained investment in productivity.

The Fruits and Vegetables segment is likely to register a CAGR of 6.8% from 2025 to 2033. The growth of the segment can be driven by increasing consumer preference for nutrient-dense foods, rising disposable incomes in emerging economies, and the expansion of export-oriented horticulture.

Moreover, the expansion of controlled-environment agriculture in North America and Europe is boosting SOP usage, which is preferred over MOP for chloride-sensitive crops. The demand for potassium fertilizers in fruit and vegetable production is set to accelerate further with urbanization and health-conscious diets shaping food consumption patterns globally.

By Form Insights

The solid segment accounted for holding prominent share of the potash fertilizers market with the ease of storage, transportation, and compatibility with existing farm equipment, which is making solid granular or powdered potash the preferred choice for conventional farming practices. Countries with vast agricultural landscapes, such as the U.S., Brazil, and Russia, rely heavily on solid potash formulations for bulk application via spreaders and drills. According to the USDA, over 90% of potash used in Midwestern U.S. farms is in granular form, owing to its integration into no-till and reduced-till systems that preserve soil moisture. In addition, government procurement programs in India prioritize solid MOP imports, ensuring steady availability for domestic distribution.

The Liquid potash fertilizers segment is gaining huge traction with a CAGR of 7.2% from 2025 to 2033. The growth of the segment is driven by the rising adoption of fertigation and foliar feeding techniques, particularly in high-value horticulture, greenhouse farming, and protected cultivation. Liquid potash offers better solubility, faster nutrient uptake, and compatibility with automated irrigation systems, which makes it ideal for precision nutrient delivery.

In Israel, where drip irrigation covers over 70% of cultivated land, the Ministry of Agriculture observed a 19% increase in liquid potash usage in 2023, especially for tomatoes, peppers, and melons. In Europe, the Netherlands’ greenhouse sector, known for advanced hydroponic systems, has also witnessed a 15% year-over-year rise in liquid potash consumption, as per Wageningen University & Research. The liquid potash fertilizers are poised to play an increasingly strategic role in modern agriculture as smart farming technologies continue to evolve.

By Application Insights

The broadcasting segment was the largest by capturing 50.6% of the potash fertilizers market share in 2024. Broadcasting involves spreading granular or powdered potash uniformly across the field before planting, making it a preferred choice for large-scale cereal, grain, and oilseed operations where efficiency and coverage are critical. This method aligns well with conventional tillage systems and mechanized farming in North and South America, Eastern Europe, and parts of Asia.

In Brazil, Embrapa reported that over 75% of soybean fields receive potash via broadcasting, often combined with phosphorus fertilizers to maximize early root development. The simplicity and cost-effectiveness of broadcasting make it highly suitable for soil enrichment in potassium-deficient lands, ensuring broad accessibility for both smallholder and commercial farmers.

The fertigation segment is anticipated to register a CAGR of 8.3% from 2025 to 2033, owing to the increasing adoption of drip and sprinkler irrigation systems in water-scarce regions and high-value crop production zones. Fertigation enables precise and efficient delivery of nutrients directly to the root zone by improving absorption and reducing waste, which is especially beneficial in orchards, vineyards, and greenhouse farming.

COUNTRY ANALYSIS

Top Leading Countries In The Market

North America was the top performer in the global potash fertilizers market owing to the presence of large-scale agricultural activity in the U.S. and Canada. The region is home to some of the world’s largest potash producers, including Canpotex and Mosaic, which operate extensive mines in Saskatchewan, making Canada the largest exporter of potash globally, with over 30% of total production in 2024, as reported by Natural Resources Canada. In the U.S., potash consumption remains robust due to its application on over 85 million acres of corn and soybean fields, according to USDA data from 2024. The region benefits from well-established distribution networks, advanced farming technologies, and strong government support for nutrient-based subsidies, especially in the Midwest. Additionally, rising investments in precision agriculture and soil testing initiatives are enhancing fertilizer efficiency.

Europe was positioned second with 10.3% of the global potash fertilizers market share in 2024. The European market is mature, with fertilizer use optimized to align with sustainability goals and EU regulatory frameworks, as outlined by the European Fertilizer Manufacturers Association (EFMA) in 2024. A key driver in the region is the growing adoption of specialty fertilizers, especially sulfate of potash (SOP), which is favored for high-value crops and organic farming systems.

Asia-Pacific potash fertilizers market is lucratively to grow with prominent growth opportunities in the coming years. Food security remains a top priority by driving consistent demand for nutrient-rich fertilization strategies. According to the Indian Ministry of Chemicals and Fertilizers, India imported 5.2 million metric tons of muriate of potash (MOP) in FY 2024, which reflects government efforts to address widespread soil potassium deficiencies. Additionally, rising awareness about balanced fertilization and growing government subsidy programs are further bolstering potash adoption. With agricultural intensification expected to continue, Asia-Pacific remains the most dynamic and influential region in the global potash fertilizers market.

Latin America is likely to have steady growth in the coming years. The region's expanding agribusiness sector in soybean, corn, and sugarcane production is a primary catalyst for potash demand. According to Embrapa, Brazil’s national agricultural research company, soybean cultivation alone covered over 43 million hectares in 2024, with potash application rates increasing by 7% compared to the previous season, enhancing yield resilience in tropical soils.

The Middle East and Africa potash fertilizers market growth is driven by increased investment in agricultural development in Egypt, South Africa, and Nigeria. While historically low in fertilizer usage, these countries are now prioritizing food self-sufficiency and land productivity by creating new demand for essential nutrients like potassium.

KEY MARKET PLAYERS

Eurochem, Israel Chemicals Ltd, Yara International ASA, K+S Aktiengesellschaft, SQM, The Mosaic Company, Sinofert Holdings, Agrium Inc, CF industries, Potash Corporation. Some of the market players dominate the global potash fertilizers market.

MARKET SEGMENTATION

This research report on the global potash fertilizers market has been segmented and sub-segmented Into Product Type, crop type, form, application, and region.

By Product Type

- Sulfate of Potash

- Potassium Chloride

- Potassium Nitrate

By Crop Type

- Fruits and Vegetables

- Cereals and Grains

- Oilseeds

- pulses

By Form

- Solid and liquid

By Application

- Foliar

- Broadcasting

- Fertigation

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

What is driving the growth of the global potash fertilizers market?

The rising demand for food due to population growth and shrinking arable land is boosting the need for high-efficiency fertilizers like potash.

Which crops benefit the most from potash fertilizers?

Potash is especially beneficial for crops like corn, wheat, rice, soybeans, and fruits, as it improves water retention, yield, and resistance to diseases.

What regions dominate the potash fertilizer market?

North America, particularly Canada, and regions in Asia-Pacific such as China and India, are major producers and consumers due to agricultural intensity and government support.

What are the main types of potash fertilizers used globally?

The most commonly used types are Muriate of Potash (MOP) and Sulfate of Potash (SOP), with MOP being the most widely applied due to cost-effectiveness.

What challenges does the potash fertilizer market face?

Volatile prices, environmental concerns, and dependency on mining and energy-intensive production methods are key challenges in this market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com