Global Power Tools Market Size, Share, Trends & Growth Forecast Report – Segmented By Tool Type (Material Removal, Drilling & Fastening, Demolition and Sawing), Power Source (Pneumatic Power Tools and Electric Power Tools), End-User (Commercial (Automotive, Aerospace & Logistics) and Residential) and Region (North America, Latin America, Europe, Asia Pacific, Middle East & Africa) - Industry Analysis (2024 to 2032)

Global Power Tools Market Size (2024 to 2032)

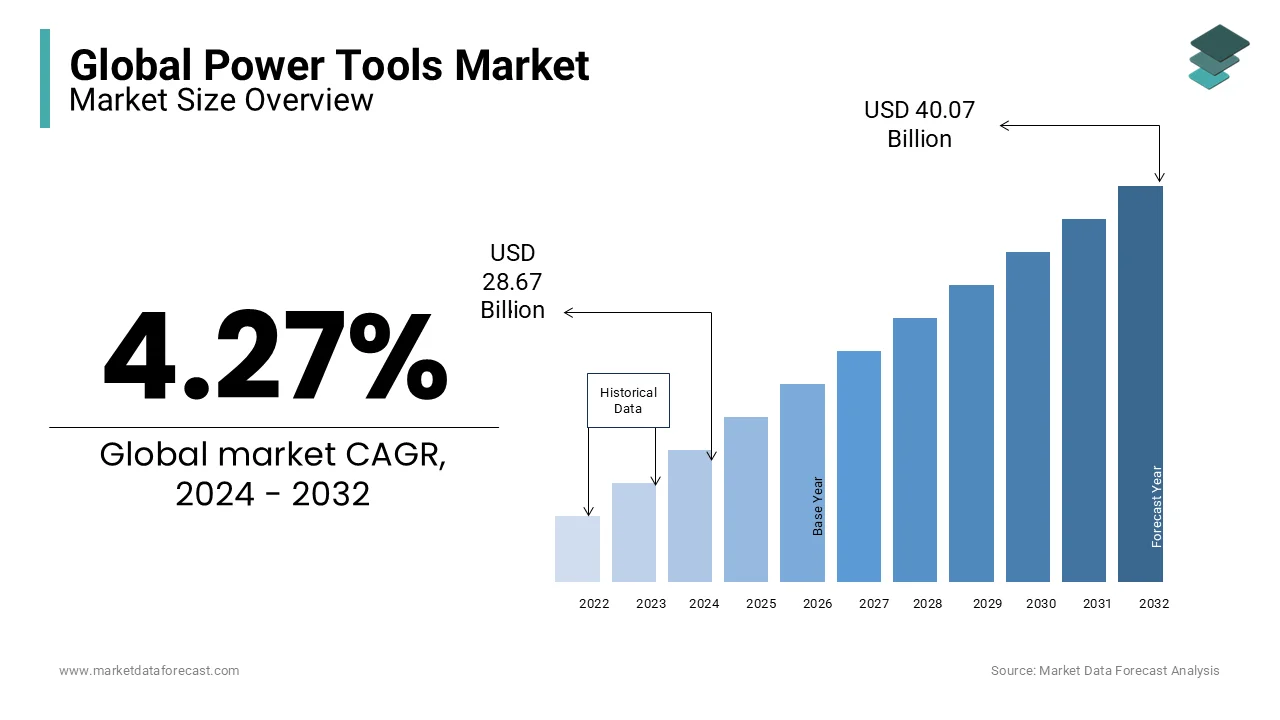

The global power tools market was worth USD 27.50 billion in 2023. It is expected to grow at a CAGR of 4.27% from 2024 to 2032 and be worth USD 40.07 billion by 2032 from USD 28.67 billion in 2024.

Current Scenario of the Global Power Tools Market

A large variety of tools used in construction, carpentry, metalworking, and do-it-yourself projects can be found in the power tools, a growing segment of the economy. Power tools enable users to finish jobs swiftly and with less effort than they could with conventional hand tools. They are made to make labor easier and more efficient. Power tools are portable or fixed mechanical tools that are propelled by an internal combustion engine, an electric motor, or compressed air. Drilling, cutting, grinding, sanding, polishing, and sculpting materials like wood, metal, concrete, and plastic are just a few of the many activities these instruments are employed for. Power tools have been widely adopted by sectors like construction, aircraft, automotive, shipbuilding, and energy. Additionally, homeowners use them for a range of domestic needs. Best-quality materials are used in the design, production, and sale of a wide range of power tools by power tool makers. Power tool demand in the automotive industry is high, building activities are expanding in emerging nations, and battery power tool use is increasing globally.

MARKET DRIVERS

The rapidly expanding construction sector worldwide is likely to be one of the major factors propelling the growth of the power tools market.

The global economy relies heavily on the construction sector, which is predicted to rise in the upcoming years. Power tool demand is anticipated to rise as more infrastructure projects are developed and put into action globally. Power tool manufacturers are selling more products because of rising consumer demand, which boosts market sales volumes and revenue. Power tool demand has increased, which has increased market competition as producers compete to create cutting-edge items that will satisfy consumer demand. Power tool market demand has fuelled technological developments in the sector, leading manufacturers to release new and improved devices with features including longer battery life, enhanced ergonomics, and increased power and performance.

As the market for power tools expands, it opens job opportunities for those involved in their design, manufacture, distribution, and sale. Additionally, With the increasing trend of industrial automation, there is a greater demand for power tools that can perform jobs more efficiently and correctly. The rise in do-it-yourself projects and the development of automated power tools are further contributing to the expansion of the power tools market. Due to the rising need for portable and user-friendly products, the power tool market is anticipated to expand significantly.

The growing demand for linked and smart equipment is one of the key prospects for the power tool market. Several factors drive this trend; by offering real-time data and analytics, and smart and connected technologies, organizations in the market can increase efficiency and productivity by empowering workers to make educated decisions and optimize their work processes. Through the provision of timely alerts and warnings when there are potential hazards or malfunctions, smart and connected tools can also increase safety. By enabling workers to manage and troubleshoot tools from a distance, smart and connected machines can be remotely monitored and managed, minimizing downtime and maintenance expenses. Professionals and DIY enthusiasts are increasingly in demand for smart and connected tools as they provide increased convenience and functionality, fueling demand and expanding the power tools market.

The power tools market has a significant chance to create cutting-edge solutions that satisfy both consumer and professional needs because of the rising demand for smart and connected tools. Features like wireless networking, cutting-edge sensors, and cloud-based data storage and analysis might be a part of this. Additionally, producers can create tools that are tailored for particular sectors and use, like manufacturing, construction, and automotive repair, which will positively affect the expansion of the power tools market.

MARKET RESTRAINTS

The fluctuation of raw material prices, particularly those for steel and aluminum, is one of the major factors limiting the market for power tools now.

Due to trade disputes around the world and the COVID-19 pandemic's effects on the supply chain, the prices of these materials have been shifting. Power tool producers now face higher production expenses, which they must either bear outright or pass along to customers in the form of higher prices. As a result, the market's size may be impacted since some customers might decide to put off purchases or select less expensive options. Furthermore, as many manufacturers rely on these chips for the electronic components of their products, the ongoing semiconductor chip shortage is also having an impact on the market for power tools. Power tool manufacturers have experienced production delays and higher costs because of this shortage, which may ultimately have an influence on the market's size and profitability. The power tools market is typically impacted by the volatility of raw material prices and the scarcity of semiconductor chips, which could result in slower growth and reduced market size in the near future.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

CAGR |

4.27% |

|

Segments Covered |

By Type, Source, End-use, and Region |

|

Various Analyses Covered |

Global, Regional, and Country Level Analysis; Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Stanley Black & Decker Inc., Robert Bosch GmbH, Atlas Copco AB, Actuant Corporation, Techtronic Industries Co. Limited, Danaher Corporation, Makita Corporation, Hitachi Koki Co. Ltd., Emerson Electric Co & Hilti Corporation. |

SEGMENTAL ANALYSIS

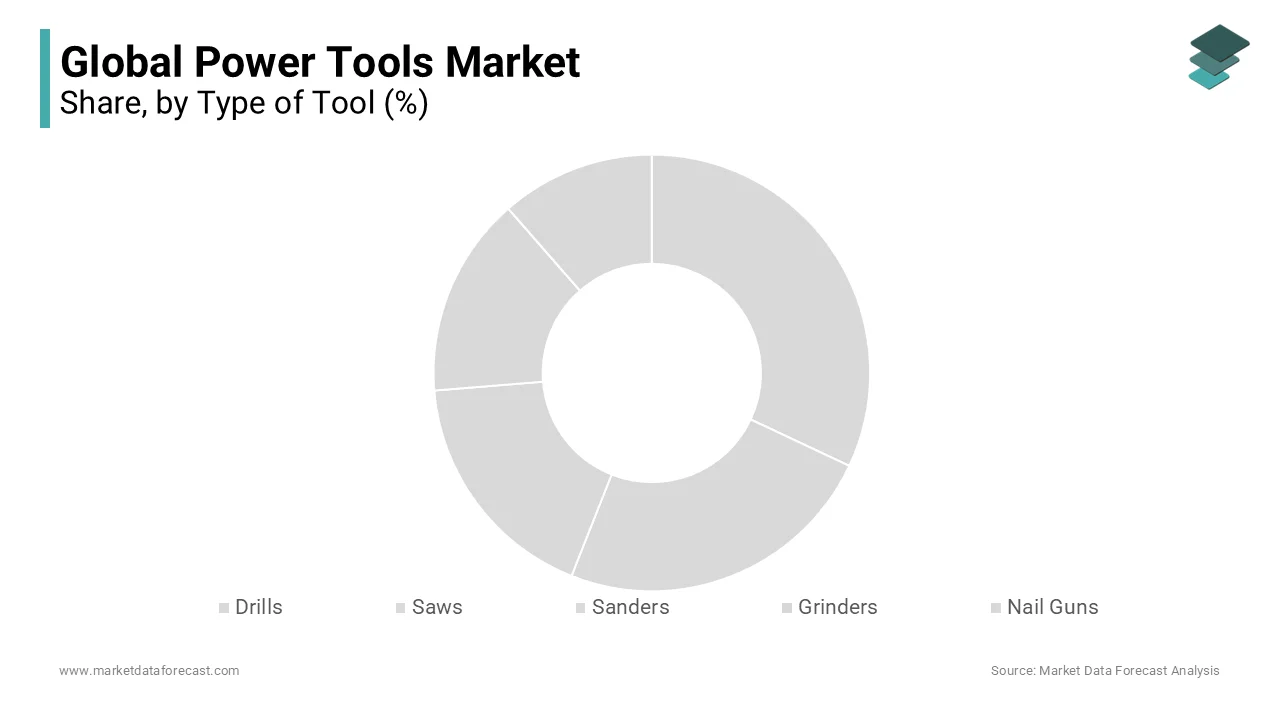

Global Power Tools Market Analysis By Type of Tool

The drills segment is dominating the largest shares of the market. Drills are necessary equipment for many tasks, such as DIY projects, building, and carpentry. They can be employed for many fastening activities, including drilling holes and driving screws. Additionally, it is anticipated that improvements in battery technology and the growing use of cordless drills will fuel this market's expansion in the upcoming years.

In the power tool market, fastening instruments like impact drivers and nail guns play a significant role. They are frequently used for jobs like framing, roofing, and plasterboard installation in the construction, manufacturing, and automotive repair industries. Due to their portability and convenience, cordless versions of these tools are also gaining popularity, much like drills. Saws, sanders, grinders, and routers are a few additional crucial power tool market sectors. These devices are frequently used for cutting and shaping materials in the building and manufacturing industries, as well as in metalworking and woodworking applications.

Global Power Tools Market Analysis By Type of Power Source

The market for cordless power tools has gained popularity recently and is predicted to remain dominant in the years to come. The convenience and portability of cordless tools, which enable users to work in a wider variety of locations without being constrained by a power outlet, as well as the growing availability of high-capacity lithium-ion batteries, which offer longer run times and faster charging, are some of the causes of this. Additionally, cordless tools can now deliver performance on par with that of their corded counterparts thanks to advancements in brushless motor technology. However, the market for corded power tools remains heavily populated by this category, especially for tasks that require constant power, like heavy-duty drilling or cutting. Additionally, corded tools typically cost less than their cordless counterparts, making them a popular choice for consumers on a tight budget.

Global Power Tools Market Analysis By Application

The construction segment has the dominant share of the market. Power tools like drills, saws, and nail guns are crucial in the construction sector for jobs like framing, roofing, and plasterboard installation. Power tool consumption is anticipated to rise as the global construction market continues to expand. The need for energy-saving and environmentally friendly power tools is also anticipated to rise as green building techniques are increasingly adopted. Power tools like grinders, sanders, and saws are utilized in the manufacturing sector for a number of activities, including cutting, shaping, and finishing.

Automotive repair, woodworking, and DIY are a few other crucial power tool applications. The automobile sector uses power equipment like air compressors and impact wrenches for jobs like tire changes and engine repairs. Power tools like routers and sanders are crucial for the construction and finishing of furniture and other wooden products.

Global Power Tools Market Analysis By End User

The professional segment is likely to have the largest share of the market during the forecast period.

Contractors, builders, electricians, mechanics, and other professionals in skilled trades use power tools professionally. These users frequently need instruments that are more robust and capable of handling the everyday rigors of use on construction sites or in workshops. Professional users may prefer power tools with advanced features and capabilities to aid in their ability to operate more accurately and effectively because they tend to have a greater level of technical knowledge and expertise. Although DIY users make up a significant portion of the power tool market, they frequently lack the technical expertise and knowledge of professional users and may place a higher value on affordability and ease of use than on high-end features and performance. For chores like house repairs, carpentry projects, or handicrafts, DIYers may employ power tools.

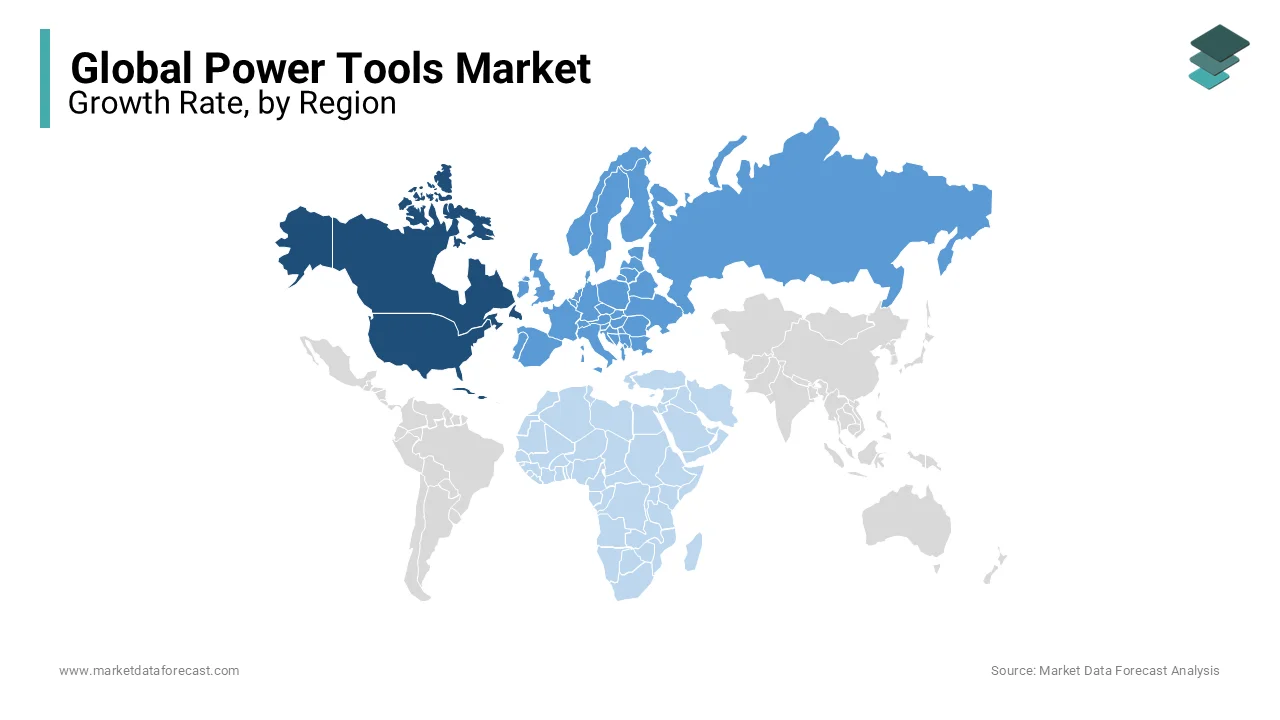

REGIONAL ANALYSIS

North America is gaining traction over the shares of the market. The major markets in this region are the United States and Canada, where there is a high demand for cordless power tools and a growing focus on ergonomics and safety.

Another developed market for power tools in Europe. There is fierce competition among well-known manufacturers, and there is a rising need for energy- and environmentally-conscious instruments. The biggest markets in this area are in Germany and the UK, where professional users are prevalent, and the DIY market is expanding.

Power tool sales are expanding at the quickest rate in the Asia-Pacific region, thanks to rising building activity and the expansion of the power tools sector. With a growing middle class and increased demand for power tools for both professional and DIY use, China and India are the two main markets in this area.

With a rising need for electric and cordless equipment in the manufacturing and construction sectors, Latin America is a burgeoning market for power tools. The biggest markets in this region are in Brazil and Mexico, where professional users are widely present, and the DIY market is expanding.

Power tool demand is increasing in the Middle East and Africa due to their use in manufacturing and construction. The biggest markets in this region are South Africa and Saudi Arabia, where professional users are widely present, and the DIY market is expanding.

KEY PLAYERS IN THE GLOBAL POWER TOOLS MARKET

Companies playing a prominent role in the global power tools market include Stanley Black & Decker Inc., Robert Bosch GmbH, Makita Corporation, Techtronic Industries Co. Ltd., Hilti Corporation, Atlas Copco AB, Snap-On Inc., Hitachi Koki Co. Ltd., Emerson Electric Co., and Festool GmbH are some of the major players in the global power tools market.

RECENT HAPPENINGS IN THE GLOBAL POWER TOOLS MARKET

- Bosch introduced a new line of cordless power tools with improved connection and cutting-edge safety features in October 2021.

- A new line of high-performance cordless power tools from Milwaukee Tool that are intended for heavy-duty applications will be available starting in November 2021.

- In December 2021, A new cordless angle grinder from Makita with an upgraded safety system and a brushless motor was released.

- DeWalt introduced a new line of cordless power tools in January 2022 that is intended to be more manageable and portable due to their lighter weight and increased compactness.

- In February 2022, in order to increase the productivity and safety of sanding operations, Festool introduced a new line of sanders that incorporates cutting-edge dust extraction technology.

DETAILED SEGMENTATION OF THE GLOBAL POWER TOOLS MARKET INCLUDED IN THIS REPORT.

This research report on the global power tools market has been segmented and sub-segmented based on type of tool, power source type, application, end-user, and region.

By Type of Tool

- Drills

- Saws

- Sanders

- Grinders

- Nail Guns

By Type of Power Source

- Corded

- Cordless Tools

By Application

- Construction

- Woodworking

- Automotive

- Manufacturing

By End User

- Professional

- DIY Users

By Region

- North America

- Europe

- Asia Pacific

- Middle East and Africa

- Latin America

Frequently Asked Questions

What is the projected growth rate of the Global Power Tools Market?

The Global Power Tools Market is expected to grow from $28.62 billion in 2024 to $40.07 billion by 2029, marking a CAGR of 4.27% during the forecast period from 2024 to 2032.

What are the primary drivers of the Power Tools Market?

The expanding construction sector, rising demand for do-it-yourself projects, technological advancements in power tools, and the development of automated power tools are the primary drivers of the Power Tools Market.

What are the major challenges facing the Power Tools Market?

Challenges in the Power Tools Market include fluctuation of raw material prices, particularly steel and aluminum, and the ongoing semiconductor chip shortage, which impact production costs and lead to slower growth and reduced market size.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com