Global Premium Gin Market Size, Share, Trends & Growth Forecast Report - Segmented By Production Method (Pot Distilled Gin, Column Distilled Gin, Compound Gin), Distribution Channel (Hypermarkets And Supermarkets, Specialty Stores, Drug Stores, Online Channel, Horeca, Others), And Region(North America, Europe, Asia-Pacific, Latin America, Middle East And Africa) - Global Industry Analysis, Size, Share, Growth, Trends And Forecast 2025 To 2033

Global Premium Gin Market Size

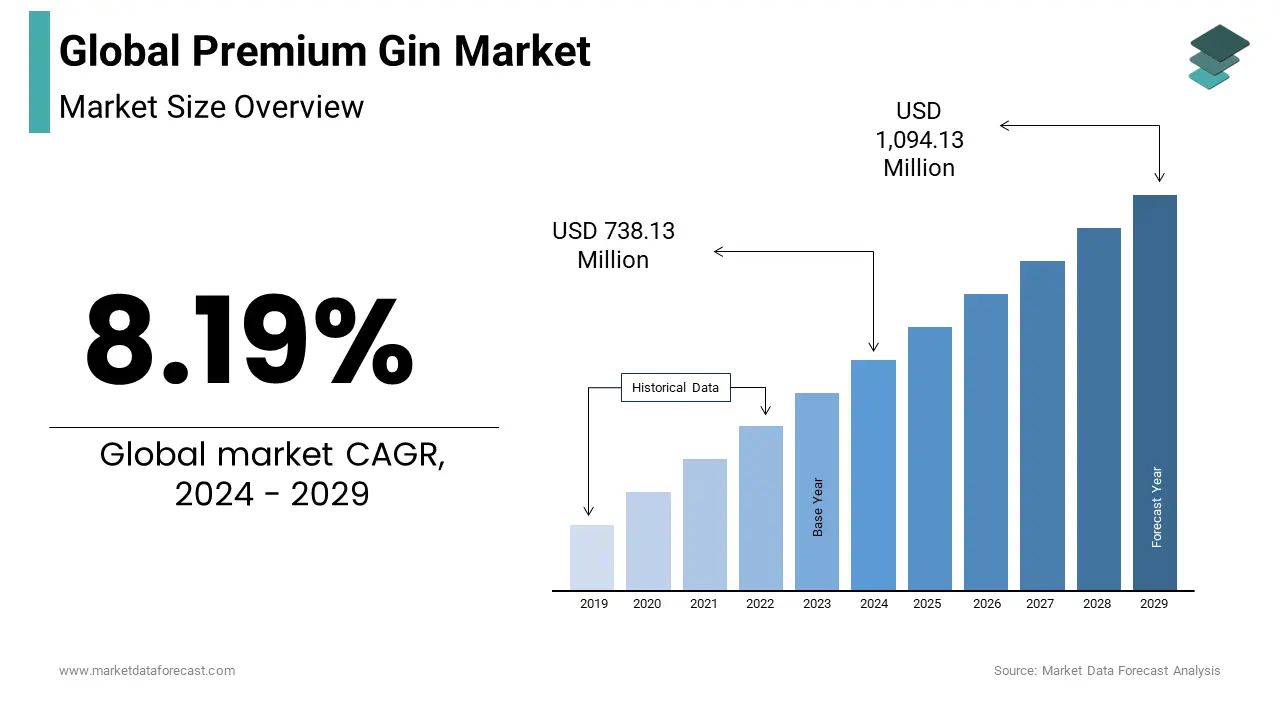

The size of the global premium gin market was expected to be worth USD 738.13 million in 2024 and is anticipated to be worth USD 1.49 billion by 2033 from USD 798.58 million in 2025, growing at a CAGR of 8.19% during the forecast period.

Current Scenario of the Global Premium Gin Market

Premium Gin Market share is dominated by floral, juniper, and fresh and dried fruits. It is a distilled liquor with a transparent to pale yellow color manufactured using refined spirits derived from grain mash. It is also fortified with additional ingredients, such as cinnamon, coriander, almonds, citrus peels, and licorice, to enhance the flavor and texture. Old Tom, London Dry, and Plymouth are commonly available gin varieties. They are commonly used in combinations and mocktails, such as Negroni, Martini, Gin, and Tonic. Gin is rich in Vitamin C and contains antioxidants that help minimize the risk of developing cardiovascular disease, joint pain, and high blood pressure. Premium Gin Market showing a positive trend with the advent of distilleries in the global beverage industry due to the increasing consumption of alcohol by young people and millennial generations around the world. The market offers consumers a variety of alcoholic beverages such as beer, wine, and spirits, among which gin is gaining popularity abroad. One of the significant gin market trends in the growing popularity of gin cocktails in the global gin industry is the consumption of diverse and experimental beverages, which will accelerate the market growth opportunities in the forecast period.

MARKET DRIVERS

Premiumization is one of the most critical factors driving the growth of the alcoholic beverage industry around the world.

The growing popularity of mixed drinks and crafted cocktails drives demand for premium cocktails. Pre-mixed and fresh cocktail manufacturers are shifting from using artificial colors and flavors to emphasizing high-quality ingredients to the natural appeal of drinks. Gin is famous for its natural flavor and earthy appeal, and most commercial counters use large amounts of gin in their premium drinks, contributing significantly to the global premium gin market growth. For Instance, In May 2023, Empress 1908 Indigo Gin launched Empress 1908 Elderflower Rose Gin. This unique gin is handcrafted and distilled with nine unique botanicals.

The growing number of pubs and restaurants worldwide is enhancing the market share of premium gin, shifting consumer preferences, and rising demand from emerging economies, all boosting the expansion of global market revenue. The rising alcohol consumption worldwide and the adoption of the urbanization trend are accelerating the demand for premium alcohol products, which is multiplying the market share globally. The presence of the most significant number of distilleries in developed countries like the U.K. and increased innovation are expected to propel global market growth opportunities. The manufacturers focus on developing innovative and unique locally sourced flavors, gaining consumers' traction and leading to brand ket size expansion. According to research by the University of Derby, United Kingdom, 57% of gin women increased their gin consumption over the past two years.

The growing influence of online commerce is one of the significant trends in the premium gin market and is set to drive market growth further. The global rise of e-commerce has paved the way for gin companies to improve their profitability. This is mainly due to the high customer preference for online shopping, which is mainly due to the convenience of card payments and the elimination of time-consuming travel and billing queues. This trend has forced manufacturers to focus on Internet-savvy customer segments and develop new online retail formats. The e-commerce has supported the market players in expanding their companies through geographical reach.

MARKET RESTRAINTS

As consumers have become more aware of their health, food, and drink in recent years, the paradigm shift in their lifestyles has progressed.

The adverse effects caused by alcohol consumption are the major factor restraining the global market revenue. The government standards and stringent rules regarding the limitation of alcohol consumption are expected to limit the expansion of the premium gin market. According to the Federal Uniform Drinking Age Act of 1984, the legal drinking age in the United States is 21. The high costs associated with premium alcohol will restrict access to all consumers, as these premium gins undergo meticulous production processes and various distillation methods, which increase the product's price, hindering the global market growth.

The adverse effects of alcohol consumption are influencing people to limit intake, which may negatively affect the market expansion. According to the IWSR Drinks Market Analysis Report 2022, about 52% of the U.S. adult population is trying to reduce alcohol consumption. As a result, consumers are shifting their preference from high-alcohol (ABV) spirits such as vodka, gin, and others to low-alcoholic beverages. The IWSR further reveals that the volume of low/non-alcoholic spirits has increased by 32.7%. The presence of high competition in the market and the availability of other premium alcoholic products and alcoholic beverages will impede the global market expansion rate.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

8.19% |

|

Segments Covered |

By Production method, distribution channel, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis; Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Black Forest Distillers, Hendrick’s Gin Distillery Ltd, G and J Distillers, Sipsmith Distillery, William Grant and Sons, Brockmans Distillery, Beefeater Distillery, The Distillery’ London, BOLS VODKA, Warwick Valley Winery and Others. |

SEGMENTAL ANALYSIS

Global Premium Gin Market By Production Method

Based on the Production Method, the market is divided into pot-distilled gin, column-distilled gin, and compound gin. The pot distillation segment dominated the global premium gin market revenue as it is the most common procedure used to produce gin. The pot-distilled premium gin is the most promising method due to its adherence to traditional methods, which drives the segment growth. It is crafted in small batches and is a labor-intensive process. The distillation is primarily done in copper pot stills; this method preserves the complexity of botanical flavors, resulting in a high-taste gin fueling the segment's growth. The pot-distilled label indicates authenticity and appeals to consumers who value artisanal craftsmanship, which fuels the segment's growth. Most experts believe that pot-distilled gin represents the original gin flavors that fuel the market growth in this segment.

Global Premium Gin Market By Distribution Channel

Based on distribution channels, the market is divided into hypermarkets and supermarkets, specialty stores, drug stores, online channels, HoReCa, and Others. Hypermarkets and supermarkets dominate the global market revenue due to rising urbanization, enhancing the number of hypermarkets and supermarkets. People prefer to buy products from these stores because they can get everything required under one roof. The vast distribution network of supermarkets and hypermarkets, which has a broad reach to consumers and allows them to explore various premium gin brands, is driving the segment growth. The availability of competitive pricing and discounts fuels the adoption rate, leading to segment revenue expansion.

The online channel segment is projected to have the fastest growth due to the increased adoption of digital technology among people. Various advantages of online shopping platforms, such as door delivery, coupons, and offers, and the exploration of various brand products, are boosting the segment's growth. The HoReCa segment will grow steadily in the coming years due to the increasing use of alcoholic beverages in hotels and restaurants.

Global Premium Gin Market By Region

The North American region dominated the premium gin market revenue with a significant market share. Most consumers are showing interest in the complex flavors and botanical compositions, enhancing the manufacturers' focus on developing and launching new flavors, augmenting the regional market growth. The trend of urbanization, sedentary lifestyles, and increased alcohol consumption across developed nations like the United States and Canada is boosting the market growth. The United States held a significant market share in the region due to the presence of major market players and high demand among consumers. The local distilleries play a crucial role in the gin production. North American region is estimated to be home to a mix of global gin and local distilleries. The local distilleries are gaining traction due to their premium and craft gins infused with different flavors and botanicals.

The Asia Pacific region is expected to grow the most during the forecast period with a significant CAGR. The premium gin market in this region is experiencing remarkable growth due to shifting consumer preferences and rising disposable incomes. Craft and artisanal gins are gaining traction as consumers prefer locally produced products with unique flavors, propelling the regional market growth.

The European premium gin market is estimated to have steady growth in the coming years due to the rising consumption of alcoholic beverages and the presence of significant market

players.

KEY PLAYERS OF THE GLOBAL PREMIUM GIN MARKET

Major key players of the global premium gin market include Black Forest Distillers, Hendrick’s Gin Distillery Ltd, G and J Distillers, Sipsmith Distillery, William Grant and Sons, Brockmans Distillery, Beefeater Distillery, The Distillery’ London, BOLS VODKA, Warwick Valley Winery and Others.

RECENT HAPPENINGS IN THE MARKET

- In January 2023, Radico Khaitan introduced its four power brands, including Jaisalmer Indian Craft Gin. These product launches are expected to enhance the market offerings.

- In July 2023, Four Corners American Gin introduced its super-premium gin made with botanicals.

- In April 2022, Bombay Sapphire, a brand owned by Bacardi, launched a lemon-flavored gin called Citron Presse gin, made with Mediterranean lemons. The company plans to launch new products across prominent countries, including Australia, Germany, Ireland, Belgium, France, Denmark, Spain, and Switzerland.

- In March 2022, Diageo India invested in Nao Spirits, a producer of high-end Indian handmade gins, "Greater Than" and "Hapusa." With this investment, Diageo India aims to increase its involvement in India's rapidly expanding premium gin market.

- In March 2022, William Grant & Sons launched Hendrick's Neptunia Gin. The master distiller Lesley Gracie used a combination of "unmistakably Hendrick's" Scottish coastal botanicals to produce Hendrick's Neptunia.

- To commemorate the first full moon in 2021, Hendrick's is releasing a limited-edition Lunar Gin.

DETAILED SEGMENTATION OF THE GLOBAL PREMIUM GIN MARKET INCLUDED IN THIS REPORT

This research report on the global premium gin market has been segmented and sub-segmented based on production method, distribution channel, and region.

By Production Method

- Pot Distilled Gin

- Column Distilled Gin

- Compound Gin

By Distribution Channel

- Hypermarkets and Supermarkets

- Specialty Stores

- Drug Stores

- Online Channel

- HoReCa

- Others

By Region

- North America

- Asia and Pacific

- Europe

- Middle East and Africa

- Latin America

Frequently Asked Questions

1. What is driving the growth of the premium gin market?

The growth of the premium gin market is driven by several factors, including increased consumer interest in high-quality, craft spirits, the popularity of gin-based cocktails, and the rise of small-batch and artisanal distilleries.

2. What are the current trends in the premium gin market?

Current trends in the premium gin market include botanical experimentation distilleries are exploring unique and exotic botanicals to create distinct flavor profiles, Sustainability in Eco-friendly production practices and sustainable sourcing of ingredients.

3. What is the future outlook for the premium gin market?

The future outlook is positive, with expectations of continued growth driven by Ongoing consumer interest in premium and craft spirits, Expansion into new markets globally, and Continued innovation in flavors and production techniques.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]