Global Real Time Location Systems Market Size, Share, Trends, & Growth Forecast Report By Offering (Hardware, Software, and Services), Technology, Application, Vertical, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa), Industry Analysis From 2024 to 2033

Global Real Time Location Systems Market Size

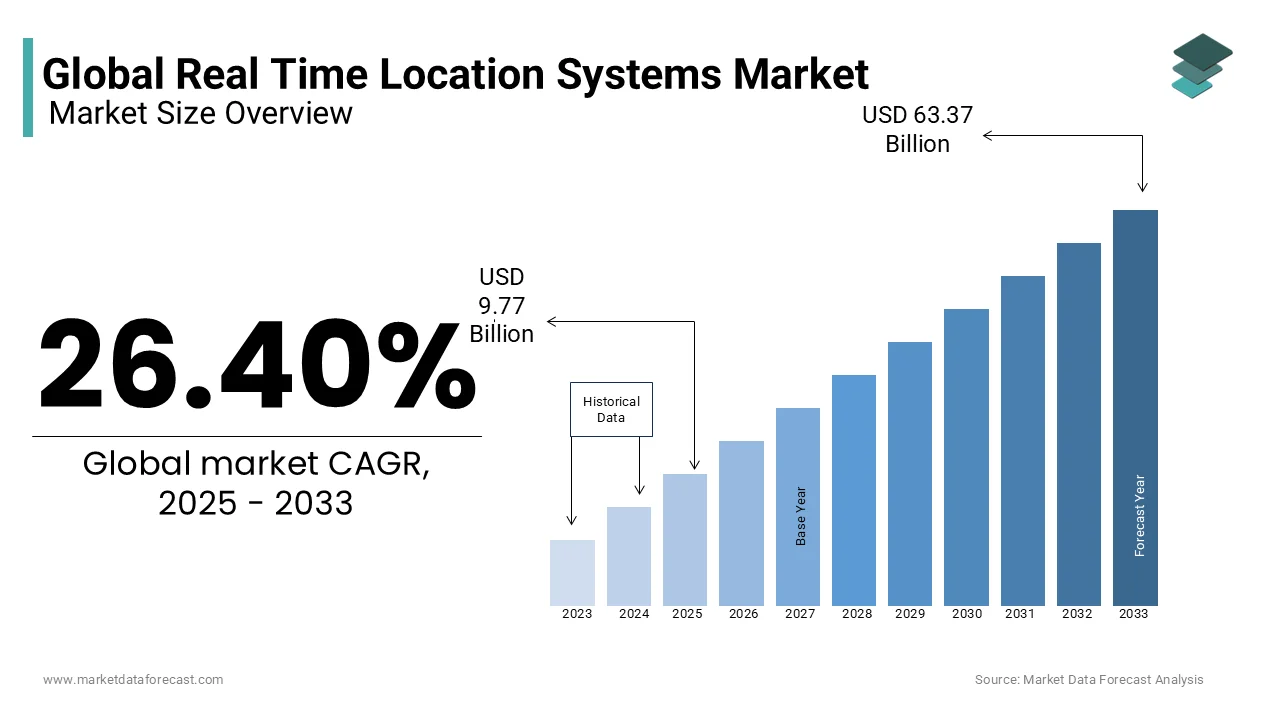

The global real time location systems market was worth USD 7.73 billion in 2024. The global market is expected to reach USD 63.37 billion by 2033 from USD 9.77 billion in 2025, rising at a CAGR of 26.40% from 2025 to 2033.

Real-Time Location Systems (RTLS) are smart tracking solutions that help businesses and organizations keep track of assets, employees, and equipment in real-time. These systems use special hardware, like tags, sensors, and receivers, combined with advanced software to provide continuous updates on the location of important resources. RTLS relies on different technologies, including Radio Frequency Identification (RFID), Bluetooth Low Energy (BLE), Ultra-Wideband (UWB), Wi-Fi, and infrared, to ensure accurate tracking across different environments.

In hospitals, RTLS has been very useful in improving efficiency and patient safety. Research shows that nurses often waste up to 60 minutes per shift searching for medical equipment, which reduces productivity. By using RTLS, hospitals can cut this search time by 50%, allowing nurses to spend more time with patients. It has also helped improve hand hygiene compliance, a key factor in preventing infections. A UK hospital found that real-time tracking increased hand hygiene events from 600 visual checks to one million electronic observations, improving infection control.

Apart from healthcare, RTLS is also used in manufacturing, logistics, and retail. In manufacturing, tracking tools and materials in real-time has reduced production time by 25%, helping companies operate more efficiently. In logistics, RTLS has helped reduce theft and lost goods by 40% by providing accurate shipment tracking, making supply chains safer and more reliable.

The demand for RTLS is growing as businesses seek better ways to manage assets, improve safety, and run smoother operations. As technology advances, combining RTLS with Artificial Intelligence (AI) and the Internet of Things (IoT) is expected to make tracking systems even smarter, adapting to changing business needs and improving overall efficiency.

MARKET DRIVERS

Enhancing Healthcare Efficiency

Real-Time Location Systems (RTLS) have greatly improved how hospitals and clinics operate. A great example is Leighton Hospital in the UK, which introduced RTLS to track important medical devices like infusion pumps and patient trolleys. This change resulted in a 75% drop in clinical incidents related to missing or misplaced equipment. Additionally, it saved frontline staff up to 30 minutes daily, allowing them to focus more on patient care. Due to this success, the hospital now plans to expand the system to 7,500 medical assets, ensuring even better efficiency and patient safety. By reducing wasted time and improving asset tracking, RTLS makes healthcare facilities more effective.

Boosting Manufacturing Productivity

RTLS plays a key role in increasing efficiency in factories. The National Institute of Standards and Technology (NIST) states that using RTLS in manufacturing helps reduce downtime, improve decision-making, and enhance productivity. By collecting and analyzing real-time data, factories can monitor equipment, track materials, and streamline production processes. This advanced tracking technology also helps manufacturers quickly detect issues, avoid delays, and use resources more efficiently. The result is a more flexible and resilient production system that improves both cost savings and productivity. This is why many industries are turning to RTLS to improve manufacturing performance.

MARKET RESTARINTS

Implementation Challenges

Setting up RTLS is not always easy. A key issue is that it requires a strong infrastructure to work effectively. According to the National Institute of Standards and Technology (NIST), RTLS systems need precise data calibration and careful planning before they can be successfully deployed. Factors like building layout, floor materials, and radio signal interference can make the process even more complicated. Additionally, since each factory or workplace is different, customized setup is often required, which makes installation expensive and time-consuming. These challenges slow down the adoption of RTLS, especially in businesses that lack the budget or expertise to integrate the system smoothly.

Data Privacy and Security Concerns

Since RTLS collects real-time location data, privacy and security risks are a major concern. The National Institute of Standards and Technology (NIST) warns that unauthorized access to location data can expose sensitive information. This could include tracking people's movements, monitoring confidential assets, or even exposing security vulnerabilities. Hackers or unauthorized users could misuse this data, leading to privacy violations, identity theft, or security breaches. To prevent this, companies must follow strict data protection laws and use advanced encryption methods. Ensuring security is a major challenge because location tracking systems require constant monitoring to keep information safe.

MARKET OPPORTUNITIES

Enhancing Emergency Response Efficiency

RTLS can play a vital role in improving emergency response services. By providing real-time location data on assets, emergency vehicles, and personnel, RTLS helps firefighters, paramedics, and police allocate resources more effectively. The U.S. Fire Administration reports that the nationwide 90th percentile response time to structure fires is less than 11 minutes. By using RTLS, emergency teams can respond even faster by tracking the closest available units and providing precise location updates. Since faster response times can save lives, RTLS is a valuable tool for improving emergency management.

Optimizing Public Transportation Systems

Public transportation can benefit greatly from RTLS technology. The Federal Transit Administration found that real-time tracking of buses and trains improves rider satisfaction and increases safety. When passengers can see accurate arrival times, they spend less time waiting and feel more confident using public transport. RTLS also helps transit agencies optimize routes, reduce delays, and improve overall system reliability. By improving tracking and reducing uncertainties in schedules, RTLS contributes to a better experience for commuters and supports environmental goals by encouraging more people to use public transit.

MARKET CHALLENGES

High Initial Implementation Costs

One major hurdle in adopting RTLS is the high upfront cost. Installing RTLS requires hardware like sensors, tags, and readers, as well as software for data processing and analysis. The National Institute of Standards and Technology (NIST) states that small and medium-sized businesses often struggle to afford RTLS implementation due to these high costs. While RTLS can save money over time by improving efficiency, the initial investment remains a significant challenge. Businesses must carefully consider the return on investment before committing to RTLS adoption.

Interference and Signal Obstacles

RTLS relies on wireless signals, which can be disrupted by walls, metal objects, and electronic interference. The National Institute of Standards and Technology (NIST) explains that these barriers reduce tracking accuracy and require additional adjustments for RTLS to work effectively. Companies may need to invest in additional technology or infrastructure modifications, making installation more expensive. These challenges make RTLS harder to implement in environments with high levels of interference, such as factories, hospitals, or underground facilities. Ensuring consistent and reliable RTLS performance in these areas remains a technical challenge for businesses.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

26.40% |

|

Segments Covered |

By Offering, Technology, Application, Vertical, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

AeroScout, Inc., AiRISTA Flow, Alien Technology, Aruba Networks, Awarepoint Corporation (Centrak Inc.), BlueIOT, CenTrak Healthcare company, Decawave, Ekahau, Inc., and GE Healthcare. |

SEGMENTAL ANALYSIS

By Offering Insights

The hardware segment dominated the Real-Time Location Systems (RTLS) market and held 55.6% of the market share in 2024 owing to the widespread adoption of devices such as RFID tags, GPS trackers, and sensors. According to the Semiconductor Industry Association (SIA), global semiconductor sales reached $574 billion in 2022 which is underpinning the production of RTLS hardware components. Additionally, the number of IoT-connected devices is projected to exceed 29 billion by 2030 and is further driving demand for RTLS hardware. Hardware is critical as it forms the foundation of RTLS infrastructure, enabling real-time tracking and data collection across industries like healthcare, logistics, and manufacturing.

The services segment registered the fastest-growing rate in the RTLS market and is predicted to have a CAGR of 18.2% during the forecast period. The demand is increasing for system integration, maintenance, and consulting services which is fuelling the growth of this segment in the global market. The International Data Corporation (IDC) reported that global spending on digital transformation will reach $3.4 trillion by 2026 and that is driving the need for service-based solutions. Furthermore, the European Commission emphasizes that over 60% of businesses are prioritizing IoT-enabled services to enhance operational efficiency. RTLS services are vital for optimizing hardware and software, ensuring seamless implementation and scalability. Their importance lies in addressing customization needs and providing end-to-end solutions, making them indispensable for long-term RTLS adoption.

By Technology Insights

The RFID (Radio Frequency Identification) segment was the largest segment in the Real-Time Location Systems (RTLS) market in 2024 and captured 35.4% of the market share. Its dominance is linked to the widespread adoption in retail, healthcare, and logistics for asset tracking and inventory management. According to the National Retail Federation (NRF) , U.S. retailers lose over $60 billion annually due to inventory shrinkage which is driving RFID adoption to enhance accuracy. Additionally, GS1 is a global standards organization and it reported that RFID adoption has grown by 20% annually since 2020 underscoring its scalability. RFID's importance lies in its cost-effectiveness, reliability, and ability to operate without line-of-sight, making it indispensable across industries.

On the other hand, the Ultra-Wideband (UWB) segment is expected to exhibit a noteworthy CAGR of 24.5% from 2025 to 2033 due to the increasing demand for high-precision location tracking in industrial automation, healthcare, and smart cities. The Federal Communications Commission (FCC) stated UWB’s ability to deliver centimeter-level accuracy, surpassing technologies like Wi-Fi and Bluetooth. Furthermore, UWB-enabled devices will exceed 1.3 billion units globally by 2025 , fueled by smartphone integration and IoT applications. For instance, Apple and Samsung have integrated UWB into their flagship devices, boosting adoption. UWB’s importance lies in its low power consumption, immunity to interference, and superior accuracy, making it ideal for critical applications like patient monitoring and autonomous systems.

By Application Insights

The Inventory/Asset Tracking & Management led the market by capturing a 30.2% of the market share in 2024 because of the growing need for efficient asset utilization and reduced operational costs. The U.S. Department of Commerce reports that inventory shrinkage costs U.S. businesses over $60 billion annually, underscoring the importance of RTLS solutions. Additionally, global warehouse automation spending will exceed $31 billion by 2025 , further boosting RTLS adoption. RTLS enables real-time visibility, improving accuracy and reducing losses, making it indispensable for industries like retail, manufacturing, and logistics.

The supply Chain Management & Operational Automation/Visibility segment is expanding at the fastest pace and is predicted to have a CAGR of 21.3% from 2025 to 2033. The increasing complexity of global supply chains and the demand for end-to-end visibility is mainly propelling the growth of this segment. The International Trade Administration (ITA) states that global supply chain disruptions cost businesses over $1 trillion annually and is driving investments in RTLS for better tracking and optimization. Furthermore, companies adopting IoT-enabled supply chain solutions achieve a 10-20% reduction in operational costs . RTLS enhances supply chain resilience by enabling real-time monitoring, predictive analytics, and seamless integration with Industry 4.0 technologies, making it critical for modern enterprises.

By Vertical Insights

Inventory/Asset Tracking & Management was the biggest application segment in the Real-Time Location Systems (RTLS) market and maintained a 30.6% of the market share in 2024 owing to the growing need for efficient asset utilization and reduced operational costs. According to the National Retail Federation (NRF), inventory shrinkage costs U.S. businesses over $61.7 billion annually , underscoring the importance of RTLS solutions. Additionally, GS1 , a global standards organization, found that 85% of companies adopting RFID and RTLS technologies report improved inventory accuracy. RTLS enables real-time visibility, reducing losses and enhancing operational efficiency, making it indispensable for industries like retail, manufacturing, and logistics.

However, the Supply Chain Management & Operational Automation/Visibility is on the rise and is expected to be the fastest growing segment in the global market by witnessing a CAGR of 17.3% during the forecast period. This progress is fuelled by the increasing complexity of global supply chains and the demand for end-to-end visibility. The World Trade Organization (WTO) states that global trade disruptions cost businesses $2.8 trillion in 2022 alone , driving investments in RTLS for better tracking and optimization. Furthermore, companies leveraging IoT-enabled supply chain solutions achieve a 10-15% reduction in operational costs and a 20-30% improvement in delivery times . RTLS enhances supply chain resilience by enabling real-time monitoring, predictive analytics, and seamless integration with Industry 4.0 technologies, making it critical for modern enterprises.

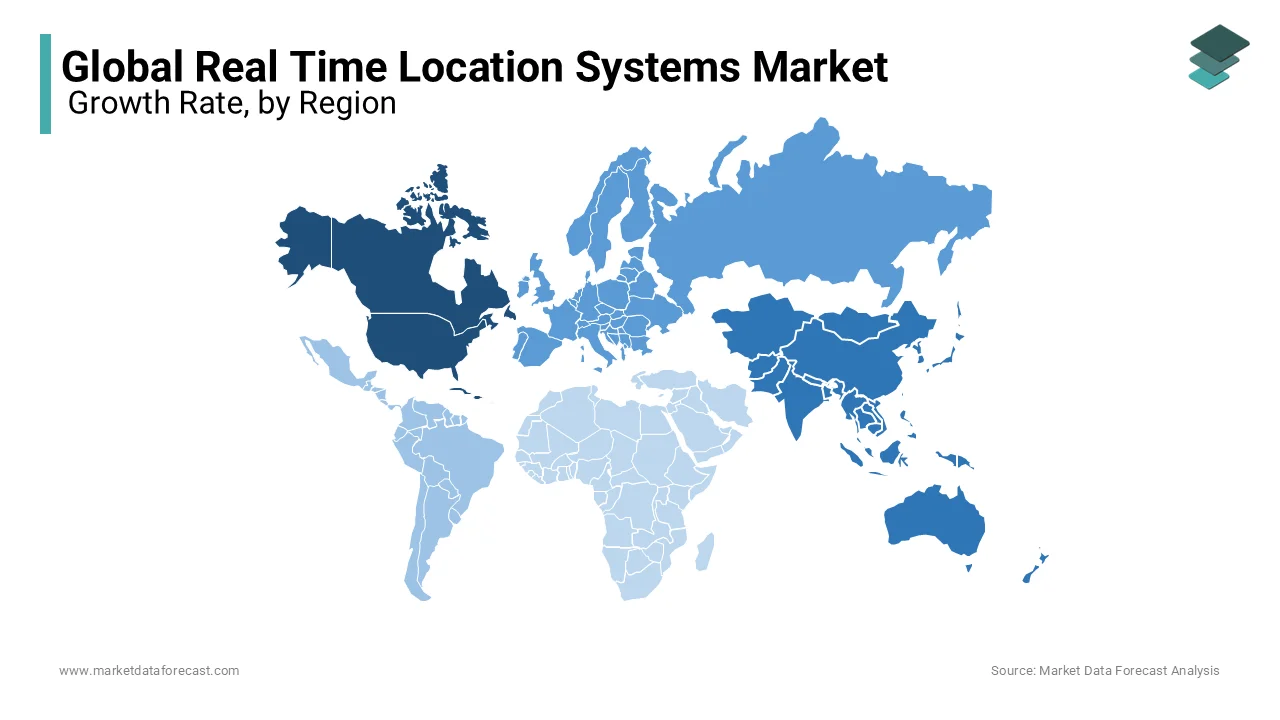

REGIONAL ANALYSIS

North America had the largest share of the Real-Time Location Systems (RTLS) market and accounted for 35.7% in 2024. The United States is the biggest contributor in this region, mainly because of the high demand for RTLS in healthcare and logistics. According to the Centers for Medicare & Medicaid Services (CMS), healthcare spending in the U.S. reached $4.3 trillion in 2021, and hospitals are increasingly using RTLS to track medical equipment and improve patient safety. The growth of e-commerce has also increased the need for automated warehouses, where RTLS helps track goods and manage inventory efficiently. The U.S. Census Bureau reports that e-commerce grew by 7.4% annually, which has led to higher demand for warehouse automation. Additionally, the Federal Aviation Administration noted that over 18 million square feet of new warehouse space was added in 2022, further increasing the need for RTLS technology. With strong investments in digital infrastructure and smart logistics, North America will continue to lead in RTLS adoption.

Asia-Pacific was the fastest expanding RTLS segment and is predicted to attain a CAGR of 16.7% from 2025 to 2033 due to the rapid industrialization and smart city initiatives. According to China’s Ministry of Industry and Information Technology, there are over 500 smart cities currently under development, and many of them use IoT-based RTLS solutions for better traffic control and city management. India is also contributing to this growth through the Digital India initiative, which is expected to drive IoT investments up to $15 billion by 2025, according to NITI Aayog. Meanwhile, Japan’s Ministry of Economy, Trade, and Industry has reported a 12% annual increase in industrial robot shipments, showing the country's strong focus on automation in factories. These investments in IoT, automation, and smart city development are increasing RTLS adoption in manufacturing, healthcare, and logistics across the region.

Europe remained a key player in the RTLS market and is driven by regulatory frameworks and technological advancements. The European Commission reports that the General Data Protection Regulation (GDPR) has led to higher demand for secure location-tracking technologies, especially in healthcare and logistics. The European market is also growing due to increased investments in IoT. By 2025, total IoT spending in Europe is expected to reach €240 billion, with Germany and the UK leading the adoption of RTLS solutions. Additionally, the European Investment Bank (EIB) states that over €150 billion is invested annually in smart city projects, which is helping expand RTLS applications in urban mobility and public asset management. The manufacturing sector in Europe is also integrating RTLS to improve efficiency and track production workflows, ensuring stable market growth. With continued investments in smart technologies, Europe is steadily expanding its RTLS usage across industries.

Latin America’s RTLS market is supported by economic recovery and digital transformation initiatives. The World Bank predicts that Brazil’s economy will grow by 1.8% in 2024, increasing investments in IoT and smart infrastructure. In Mexico, the National Institute of Statistics and Geography (INEGI) reports a 6.5% annual rise in e-commerce, which is driving higher demand for warehouse automation and RTLS solutions. One example of RTLS adoption is Colombia’s Medellín smart city project, supported by the Inter-American Development Bank (IDB). This initiative is helping urban planners use real-time tracking systems to manage city infrastructure efficiently. While limited infrastructure and funding challenges remain in some parts of Latin America, government initiatives like Argentina’s $1.2 billion digitalization fund are expected to support steady RTLS expansion across industries.

The Middle East and Africa are emerging as promising regions for Real-Time Location Systems (RTLS) and is propelled by smart city initiatives and rising IoT adoption. The African Development Bank (AfDB) stated that over $1.5 billion in ICT investments, while GSMA Intelligence reports mobile penetration exceeding 46%, enabling RTLS applications in supply chain and urban planning. In the Middle East, Saudi Arabia’s Vision 2030 allocates $3.3 trillion for infrastructure, boosting RTLS in logistics and construction. Dubai’s Smart City 2025 strategy integrates RTLS for urban mobility, and Qatar’s FIFA World Cup 2022 accelerated its use for crowd management. Despite challenges like limited funding, government-led digitalization efforts will drive steady RTLS growth across both regions.

KEY MARKET PLAYERS & COMPETITIVE LANDSCAPE

The major players in the global real time location systems market include AeroScout, Inc., AiRISTA Flow, Alien Technology, Aruba Networks, Awarepoint Corporation (Centrak Inc.), BlueIOT, CenTrak Healthcare company, Decawave, Ekahau, Inc., and GE Healthcare.

The Real-Time Location Systems (RTLS) market is highly competitive, with numerous global and regional players striving to capture market share. The market is characterized by technological innovation, industry-specific solutions, and strategic partnerships that differentiate companies from their competitors. Leading players such as Zebra Technologies, Ubisense, CenTrak, Stanley Healthcare, and Impinj dominate the market by continuously upgrading their offerings with AI-driven analytics, Ultra-Wideband (UWB), RFID, Bluetooth Low Energy (BLE), and cloud-based RTLS solutions.

Competition is driven by the increasing demand for real-time asset tracking, personnel monitoring, and supply chain visibility across industries such as healthcare, manufacturing, retail, logistics, and smart cities. Companies that offer scalable, cost-effective, and high-accuracy solutions gain a competitive advantage. Startups and emerging players are also entering the market with specialized RTLS applications, intensifying the rivalry.

Strategic mergers and acquisitions, along with collaborations with IoT, AI, and cloud service providers, play a crucial role in market positioning. Additionally, regulatory compliance, cybersecurity measures, and industry-specific certifications are becoming essential differentiators. As industries increasingly adopt RTLS for operational efficiency, the market is expected to remain dynamic, with competition centered around innovation, service reliability, and cost-effectiveness.

Top 3 Players in the Market

Zebra Technologies Corporation

Zebra Technologies, headquartered in the United States, is a prominent leader in the RTLS market. The company specializes in providing tracking technology and solutions that offer real-time visibility into assets, people, and transactions across various industries, including healthcare, manufacturing, and logistics. Zebra's RTLS solutions integrate advanced technologies such as RFID, Wi-Fi, and Ultra-Wideband (UWB) to deliver precise location tracking and monitoring. Their innovative approach has enabled businesses to enhance operational efficiency, improve asset utilization, and achieve greater supply chain transparency. By continuously investing in research and development, Zebra Technologies has maintained its position at the forefront of the RTLS market.

Ubisense Limited

Ubisense, based in the United Kingdom, is renowned for its advanced RTLS solutions that cater to complex industrial environments. The company's offerings are designed to provide real-time tracking of assets and personnel, enabling organizations to optimize their operations and enhance safety protocols. Ubisense's RTLS technology leverages a combination of sensors, software, and analytics to deliver high-precision location data. This capability is particularly beneficial in sectors such as manufacturing, where precise tracking of tools, equipment, and products is critical. Ubisense's commitment to innovation has solidified its reputation as a key contributor to the global RTLS market.

CenTrak, Inc.

CenTrak, a U.S.-based company, has established itself as a leading provider of RTLS solutions, particularly within the healthcare sector. The company offers a comprehensive suite of products designed to track medical equipment, patients, and staff in real-time. CenTrak's technology combines various location technologies, including Second Generation Infrared (Gen2IR), RFID, and Wi-Fi, to deliver accurate and reliable tracking data. This integration enables healthcare facilities to improve patient care, streamline workflows, and enhance operational efficiency. CenTrak's focus on delivering tailored RTLS solutions has significantly contributed to the advancement of location-based technologies in healthcare settings.

TOP STRATEGIES USED BY THE KEY MARKET PARTICIPANTS

Technological Innovation and Product Development

Key players in the Real-Time Location Systems (RTLS) market focus on continuous technological advancements to maintain a competitive edge. Companies like Zebra Technologies, Ubisense, and CenTrak invest heavily in research and development to enhance the accuracy, scalability, and integration of their RTLS solutions. By leveraging technologies such as Ultra-Wideband (UWB), RFID, Bluetooth Low Energy (BLE), and AI-driven analytics, these companies develop next-generation tracking systems. For example, Zebra Technologies has integrated machine learning and cloud-based analytics into its RTLS solutions, enabling businesses to gain deeper insights into asset movement and operational efficiency.

Strategic Acquisitions and Partnerships

Mergers, acquisitions, and strategic collaborations are key strategies adopted by RTLS market leaders to expand their technological capabilities and market reach. Companies acquire innovative startups or establish partnerships with market leaders to strengthen their solution offerings. For instance, CenTrak has acquired several healthcare-focused technology firms to enhance its RTLS solutions for hospitals and clinics. Similarly, Ubisense has formed partnerships with AI and IoT firms to develop more intelligent tracking solutions for industrial applications, improving automation and operational visibility.

Market Expansion and Industry-Specific Solutions

Leading RTLS companies target new markets and industries by tailoring their solutions to specific needs. While RTLS was initially focused on logistics and supply chain management, it has now expanded into healthcare, manufacturing, retail, and even smart cities. Companies like CenTrak specialize in healthcare-specific RTLS solutions, ensuring compliance with hospital regulations and improving patient safety. Meanwhile, Zebra Technologies has expanded into warehousing, e-commerce, and transportation, developing RTLS solutions that improve inventory management and last-mile delivery tracking.

RECENT HAPPENINGS IN THE MARKET

- In October 2024, WISER Systems launched a new generation of RTLS Tags at FABTECH 2024. These tags utilize proprietary Ultra-Wide Band (UWB) Redundant Radio Location & Tracking (RRLT) technology, offering enhanced performance and an extended battery life of up to 10 years. The ruggedized design is rated IP67, making it suitable for various industrial environments.

- In August 2024: Ubisense introduced its next-generation RTLS platform, designed to complement AI-led manufacturing processes. This advanced platform features a more intuitive user interface, seamless AI integration, scalability, advanced analytics, and robust security measures, aiming to enhance operational efficiency and decision-making in manufacturing environments.

- In June 2024, Inpixon launched the Inpixon Asset Tag, a compact, active radio frequency (RF) tag for long-range RTLS asset tracking. The tag offers up to 300 meters of range with one-meter location precision and includes an integrated 3D accelerometer to sense movement. Designed for both indoor and outdoor use, it is ideal for tracking high-value assets such as hospital equipment, tools, and vehicles.

MARKET SEGMENTATION

This research report on the global real time location systems market is segmented and sub-segmented into the following categories.

By Offering

- Hardware

- Software

- Services

By Technology

- RFID

- Wi-Fi

- UWB

- Bluetooth Low Energy (BLE)

- Infrared (IR)

- Ultrasound

- GPS

- Others

By Application

- Inventory/asset tracking & management

- Personnel/staff locating & monitoring

- Access control/security

- Environmental monitoring

- Yard, dock, fleet & warehouse management & monitoring

- Supply chain management & operational automation/visibility

- Others

By Vertical

- Healthcare

- Manufacturing and automotive

- Retail

- Transportation and logistics

- Government and defense

- Education

- Oil & gas, mining

- Sports & Entertainment

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

How is the healthcare sector contributing to the expansion of the Real-Time Locating Systems (RTLS) market worldwide?

In the healthcare sector, Real-Time Locating Systems (RTLS) are extensively used for asset tracking, patient monitoring, staff management, and improving overall workflow efficiency. The demand for RTLS solutions in healthcare is driven by the need for enhanced patient care, reduced operational costs, and compliance with regulatory standards.

How are advancements in technology influencing the evolution of Real-Time Locating Systems (RTLS) globally?

Technological advancements such as the integration of RFID, GPS, Bluetooth Low Energy (BLE), and Ultra-Wideband (UWB) technologies are driving innovation in the Real-Time Locating Systems (RTLS) market, enabling more accurate, scalable, and cost-effective solutions for various applications.

How are regulatory frameworks influencing the deployment of Real-Time Locating Systems (RTLS) worldwide?

Regulatory frameworks related to data privacy, healthcare standards, and industry-specific compliance requirements play a significant role in shaping the adoption of Real-Time Locating Systems (RTLS) across different regions. Adherence to regulatory standards is crucial for RTLS vendors and end-users to ensure legal compliance and data protection.

How do market dynamics such as mergers, acquisitions, and partnerships impact the competitive landscape of the global Real-Time Locating Systems (RTLS) market?

Market dynamics such as mergers, acquisitions, and partnerships among key players in the Real-Time Locating Systems (RTLS) market contribute to market consolidation, technological advancements, and geographic expansion. These strategic initiatives enable companies to strengthen their product portfolios, enhance market presence, and capitalize on emerging opportunities.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com