Global Release Liners Market Size, Share, Trends & Growth Forecast Report - Segmented By Substrate Type (Glassine/Calendered Kraft Paper, Polyolefin Coated Paper, Clay Coated Paper And Others), Application (Labels, Pressure-Sensitive Tapes, Hygiene And Others), and Region (North America, Europe, Asia Pacific, Latin America, Middle east and Africa) – Industry Analysis (2024 to 2032)

Global Release Liners Market Size (2024 to 2032 )

The Global Release Liners Market was worth USD 109.45 billion in 2024 and is anticipated to reach a valuation of USD 209.75 billion by 2032 and it is predicted to register a CAGR of 8.47% during the forecast period 2024 to 2032.

Current Scenario of the Global Release Liners Market

The release liners are thin, flexible sheet with coating which prevents sticky surface from sticking prematurely. The release liners are most widely used in the manufacturing to maintaining the stickers and band-aids sticky till they are applied. These can be made from paper, plastic or other materials which can have variety of coatings include silicone. The global release liners market is accounted with prominent market from the past years and is anticipated to have substantial growth during the forecast period. The increased applications of the release liners in medical devices, packaging and e-commerce sectors are contributing to the extended growth of release liners market. The expansion of the medical and food and beverage industries as the release liners are used in manufacturing of medical dressings, drug delivery systems and extensive utilization of release liners in food packaging is creating market growth opportunities.

MARKET DRIVERS

The growth rate in the release liners market is attributed to the rising consumption of food and beverages, the construction sector, and digital printing.

The market is driven by the heavy implications of digital printing in many countries. This setup is very economical and requires low setup time, and thus, it attracts different industry verticals. In addition to this, the trend for conventional printing is declining, and digital printing also produces less waste which aligns it perfectly with the environment-friendly norms of different governments. The increased penetration of liner-less labels is a big threat to the industry. Liner-less labels expunge the usage of release liners and do the same job, thus liner-less labels may be proven to be a restraining factor for the industry.

The release liners market is segmented by substrate paper-based, and film-based. The film-based segment is expected to dominate the market during the forecasted period as companies are adopting more cost-effective solutions by reducing the usage of paper and thus utilizing film-based release liners. Based on the printing process, flexography held the largest market share by the end of 2019. This is because of its superior properties that include a quick-dry mechanism. Maintenance associated with flexography is also low.

The growing cosmetic, pharmaceutical, automotive, and personal care product industries in advancing regions are furthermore estimated to boost the industry expansion of the release liners.

The rising call from the end-use businesses creates a call requirement for the production of release liners, therefore driving the global industry. The film release liners’ unique adhesive rate and stable release performance make them the major driving factor in the development of the worldwide industry in the forecast period. The major players in the release liner industry continue to focus on growing substrates employed in liner production. This promises high opportunities as there is a broad range of substrates in the liner industry at present. The global release liner market is highly influenced by several factors that include the rising call for it from the food & beverage and construction businesses, the rising adoption of digital printing, and the rising use of smart labels in RFID. Apart from these factors, the high call from growing economies of Asia-Pacific due to the rising end-user businesses in the region is estimated to trigger worldwide release liner industry expansion in the coming future. The rising use of differential release liners is the prevailing trend observed worldwide.

Escalating calls from the end-user business for better labeling is driving the global release liner industry. In addition to that, with the escalating funds in the food and pharmaceutical industry, the call for good quality packaging is determined to rise, in turn, the call for release liner is estimated to escalate. Also, with the escalating population together with increasing international business, the call for quality packaging and labeling is estimated to rise, further escalating the demand for release liner products in the global business. An increasing call for an industrial label, which plays a significant role in the complete packaging industry and in the supply chain of a product is majorly boosting the industry expansion of release liners. Increasing consumption of packaged food due to its benefits like a ready-to-eat option, instant cooking, and ease of eating is boosting the call for release liners in the food & beverage industry that in turn is estimated to support the industry expansion.

Owing to the rising worries over the waste derived from the release liners, makers are adopting linerless technology to make labels and tapes. This technology gets rid of waste and decreases the price related to label-making. This can act as a restraint to the expansion of the industry. Stringent government norms and rules on the basis of environmental sustainability are estimated to hamper the industry expansion of the release liners. Most of the release liners are made up of HDPE and PVC materials, which are dangerous to the environment and can affect the health of people as well.

MARKET RESTRAINTS

The major disadvantage of the film is the presence of heat limitations; as the temperature increases, the film becomes softened, which affects the release flow. Additionally, in the case of paper, the primary drawback is the moisture content, which varies depending on the humidity, and the paper gets easily wet and has issues of tear and curl. All these drawbacks are expected to hamper the expansion of the release liners' market size. There is a stringent regulation regarding the usage of the materials used in liner preparation, where the FDA has banned toxic chemical substances like polyvinyl chloride, which negatively impact market growth. The effect and sustainability depend on the choice of release liners taken, where poorly chosen ones fail to protect the adhesive, and there are high chances of prematurely hindering the market growth rate globally. The high costs associated with film release liners and the production of static electricity from the liner are major concerns limiting the market share growth. Intense competition from international brands is expected to adversely affect the product's pricing, leading to limited market share growth.

MARKET OPPORTUNITIES

Recycling of release liners and adoption of PDMS-based release liners are estimated to offer opportunities to players in the global release liners market in the future. Increasing technological developments by makers to develop next-generation release liners are estimated to boost the industry expansion of release in the determined time. Therefore, escalating technological development, together with the rising application, is estimated to boost the industry expansion of release liners. The rise in the expansion of production facilities in order to meet the increasing call for release liners is estimated to boost the industry expansion in the future.

MARKET CHALLENGES

Strict EU regulations and FDA rules have a ban on the employment of toxic chemical substances like PVC that is estimated to negatively affect the industry expansion of the release liners in the coming years.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

CAGR |

8.47% |

|

Segments Covered |

By Substrate Type, Application, and Region. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa. |

|

Market Leaders Profiled |

3M Company (US), Gascogne Laminates (France), Loparex (US), Mondi Group (Austria), Ahlstrom-Munksjo (Sweden), UPM (Finland), Eastman Corporation (US), Polyplex Corporation Ltd. (India), LINTEC Corporation (Japan), Sappi Limited (South Africa), Rayven Inc(US) and SilTech(Canada), and Others. |

SEGMENTAL ANALYSIS

Global Release Liners Market By Substrate Type

Film-based release liners dominated the global release liners market revenue due to their high sustainability and humidity resistance.

They also provide the smoothest coating of adhesive and offer high tear strength, high-speed rotary cutting, and hot-wire cutting. These advantages of the film are driving the segment's growth rate. The most used film-based release liners are polyester (PET) film liners which are extensively used in electronics, medical, tape and label stock markets which are contributing to the segment growth. These are mostly adopted film-based liners and are highly known for their strength, barrier properties and smoothness. The silicone liners are another highly adopted film release liners where the silicone layer on the film surface is used to minimize back side transfer which fuels the segment expansion.

The glassine or kraft paper segment held a prominent share in the global market as these are cost-effective and economical options. The glassine possesses high density, high gloss and low tear where it is the premium product having smooth finish and light gloss. The glassine is considered as the good choice for applications requiring smooth surface and clear adhesive look. Clay-coated paper is expected to grow moderately in the coming years due to its high resistance to humidity and high-temperature performance.

Global Release Liners Market By Application

The labels segment dominated the release liners market with a dominant share. The liner protects the adhesive on the label until it is ready to be applied. The labels' self-adhesive properties ensure that they can be applied to products without the use of heat, solvents, or water, boosting adoption rate leading to segment expansion. The increased demand for the labels across various industries to provide product information is escalating the demand for release liners leading to market expansion. The extensive utilization of labels in food industry, medical industry, electronics, and various other end-user industries for identification or description of the product is contributing to the segment growth owing to increased adoption rate of release liners.

The pressure-sensitive tapes segment is estimated to grow the fastest during the forecast period. Pressure is necessary to create a binding between the adhesive and the product, which fuels the segment's growth. No requirement of heat, solvents or water is the significant factor augmenting the segment growth rate. The pressure-sensitive tape is having wide applications which includes large surface lamination, sealing, encapsulating gasket attachment and others which are contributing to the segment expansion.

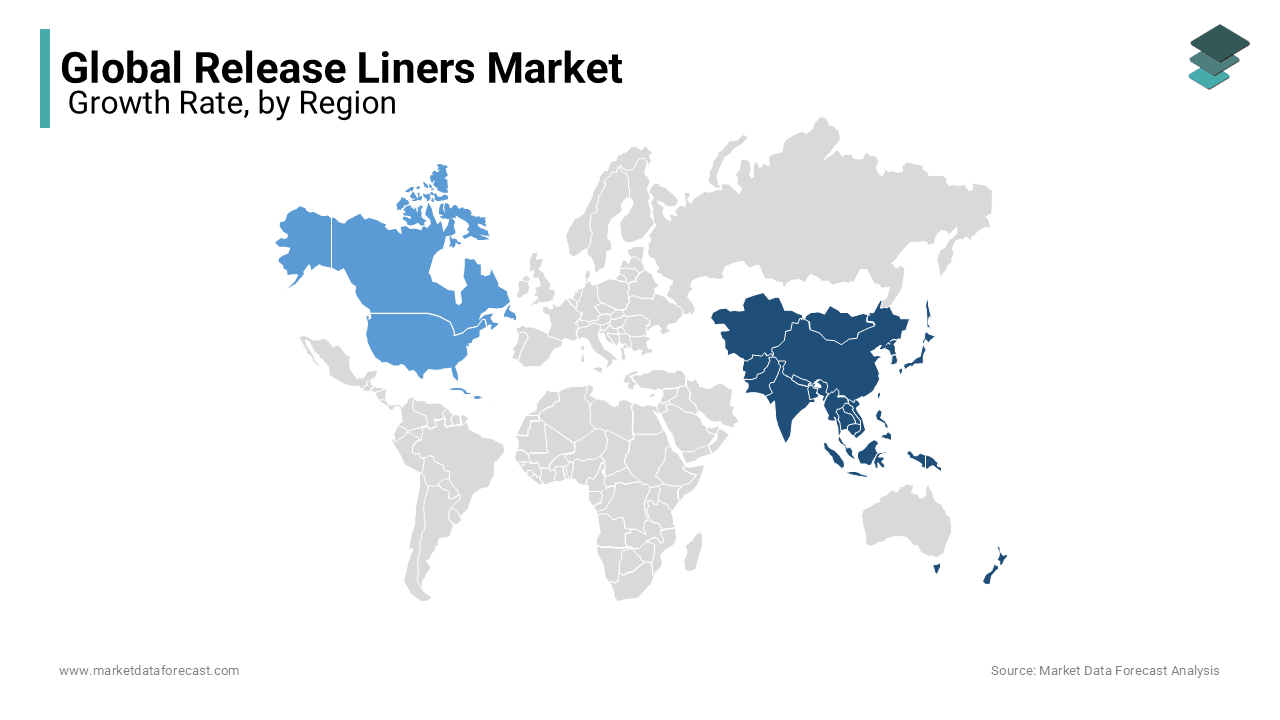

REGIONAL ANALYSIS

The Asia Pacific region dominated the global release liners market revenue due to increasing demand for release liners in the automotive and healthcare industries.

The expanding packaging industry, automobile, and healthcare industries across various countries like China fuel the regional market growth. The rising disposable incomes of the people are allowing them to spend more on products, and rising hygiene products will boost the market growth. The expanding e-commerce sector across the region, growing population, escalation in urbanization in the countries are augmenting the regional market share growth. The extensive usage of release liners in medical, food and beverages along with consumer goods industries is propelling the regional market growth.

The North American region is expected to grow significantly due to the high demand for release liners in the pharmaceutical, packaging, and labeling industries.

The growing adoption of release liners in the healthcare and hygiene sectors augments the regional market share growth. The presence of well-established infrastructure in the region, increased hygiene initiatives by the government and supportive regulatory initiatives and the market players presence in countries like United States and Canada is fueling the regional market growth rate.

The European region is projected to have substantial growth with steady CAGR during the forecast period.

The presence of advanced medical industry and growing demand for hygiene initiatives and supportive government regulations and rising investments by the public and private organizations are contributing to the expansion of the regional market revenue growth.

KEY MARKET PLAYERS

The major key players in the global release liners market are 3M Company (US), Gascogne Laminates (France), Loparex (US), Mondi Group (Austria), Ahlstrom-Munksjo (Sweden), UPM (Finland), Eastman Corporation (US), Polyplex Corporation Ltd. (India), LINTEC Corporation (Japan), Sappi Limited (South Africa), Rayven Inc(US) , SilTech(Canada), and others.

RECENT HAPPENINGS IN THE MARKET

- In February 2024, Loparex announced the launch of its Bubble Liner Technology which enhances the performance and efficiency of release liners in construction applications. This technology is estimated to boost the anti-skid properties, by increasing the safety and handling.

- In October 2023, UPM Specialty Papers and Lohmann announced their partnership to address challenges in paper liner recycling in the tape industry.

- In June 2023, Avery Dennison Corporation acquired the release liner business of Avery Dennison Graphics Solutions. The acquisition is expected to strengthen Avery Dennison's position in the release liners market for graphic arts applications.

- In June 2023, Ahlstrom launched a novel release liner, extending its Acti-V industrial range of high-performance release liners. This new product is designed for double-sided pressure-sensitive adhesive tapes with unbleached and recycled fibers.

- In December 2022, The Felix Schoeller Group announced its plan to expand its capacities in the United States and Canada in three steps by 2025. The company has planned the expansion from 2000 tons to over 40,000 tons per year of paper machine capacity in Canada. The company has planned a total investment of USD 100 million for the production of décor paper and release liner in North America, which adds a capacity of 50,000 tons.

- In May 2022, Mondi, a manufacturer of packaging and paper products, switched its entire portfolio of glassine-based release liners to certified base paper.

DETAILED SEGMENTATION OF THE GLOBAL RELEASE LINERS MARKET INCLUDED IN THIS REPORT

This research report on the global release liners market has been segmented and sub-segmented based on service type, gender, service provider, and region.

By Substrate Type

- Polyolefin Coated

- Clay Coated

- Glassine/Calendared Kraft Paper

By Application

- Labels

- Pressure-Sensitive Tapes

- Hygiene

By Region

- North America

- Latin America

- Europe

- Asia Pacific

- Middle East & Africa

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]