Global Simulators Market Size, Share, Trends & Growth Forecast Report Segmented By Type (Full Flight Simulation, Fixed Base Simulation, Driving Simulation, and Others), End Use Industry, Application, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa), Industry Analysis From 2024 to 2033

Global Simulators Market Size

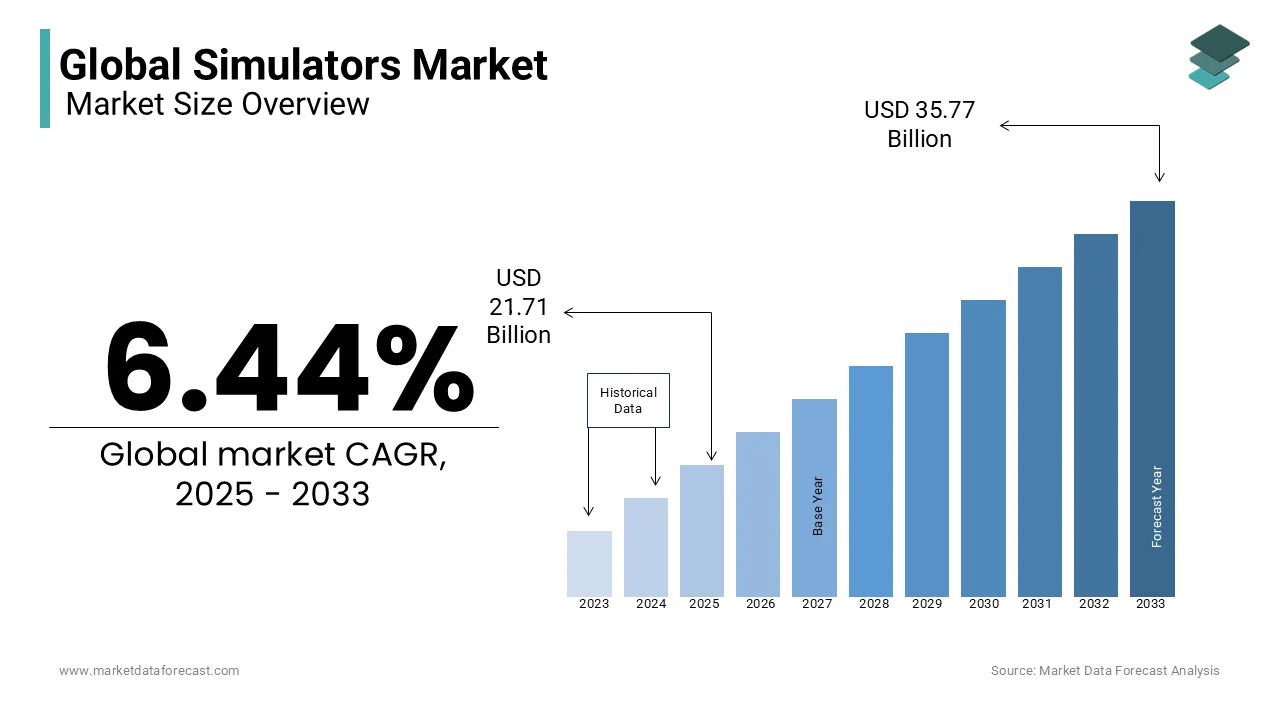

The global Simulators market was valued at USD 20.40 billion in 2024. It is expected to grow from USD 21.71 billion in 2025 to USD 35.77 billion by 2033, reflecting a compound annual growth rate (CAGR) of 6.44% from 2025 to 2033.

Simulators are designed to replicate real-world scenarios for enabling users to engage in training, research, and entertainment within controlled environments. These systems are extensively utilized in sectors such as aviation, defense, healthcare, automotive, and gaming, where precision, risk mitigation, and cost-efficiency are critical.

In aviation, flight simulators are indispensable for pilot training, with over 80% of commercial pilots undergoing simulation-based instruction before operating real aircraft, as noted by the Federal Aviation Administration (FAA). These systems enable pilots to practice emergency responses, navigation, and complex maneuvers without real-world risks. In the defense sector, military forces worldwide use combat simulators to enhance tactical readiness. The U.S. Department of Defense reports that over 60% of modern military training incorporates simulation-based methodologies, significantly reducing live training costs and improving operational efficiency.

The healthcare industry has also integrated simulation technology, particularly in surgical training. Research from the American College of Surgeons indicates that medical simulation can reduce medical errors by up to 30%, improving patient outcomes and procedural accuracy. Simulated training environments allow medical professionals to practice high-risk procedures without jeopardizing patient safety.

In the automotive sector, driver-assistance systems and autonomous vehicle development rely heavily on simulation testing. The National Highway Traffic Safety Administration (NHTSA) states that simulated crash testing has contributed to a 50% reduction in vehicle-related fatalities over the past two decades by improving safety features before real-world deployment. The growing reliance on simulation-based technologies across industries underscores its importance in enhancing safety, efficiency, and skill development while reducing risks and costs associated with traditional training methods.

MARKET DRIVERS

Increasing Emphasis on Safety and Risk Mitigation

The simulators market is significantly driven by the increasing emphasis on safety and risk mitigation across various sectors. In healthcare, simulation-based training has been instrumental in reducing preventable medical errors. A report by the Institute of Medicine highlighted that simulation programs have led to a 60%–90% decrease in preventable deaths due to medical errors. This substantial reduction underscores the critical role of simulators in enhancing patient safety and healthcare outcomes.

Technological Advancements

Technological advancements, particularly in immersive technologies like virtual reality (VR) and augmented reality (AR), are also propelling the simulators market forward. A survey by the U.S. Government Accountability Office found that 17 out of 23 federal civilian agencies reported using immersive technologies in fiscal years 2022 and 2023. These agencies utilized VR and AR for various purposes, including workforce training and public outreach, demonstrating the growing adoption of advanced simulation tools to enhance operational efficiency and engagement.

MARKET RESTRAINTS

High Costs

The simulators market faces significant challenges due to the high costs associated with developing and maintaining advanced simulation systems. For instance, the U.S. Government Accountability Office reported that the Department of Defense's operation and maintenance costs increased by approximately 57% over a recent period, reflecting substantial investments in sophisticated training technologies, including simulators. These elevated expenses can deter smaller organizations and developing nations from adopting such technologies, thereby limiting market expansion.

Technological Complexity

Another notable restraint is the technological complexity involved in creating realistic and effective simulation environments. The National Institute of Standards and Technology emphasizes that developing high-fidelity simulations requires advanced software engineering and precise modeling, which can be resource-intensive and time-consuming. This complexity can lead to extended development timelines and increased costs, potentially hindering the timely deployment of simulation solutions across various industries.

MARKET OPPORTUNITIES

Simulation Technologies

The simulators market is poised for significant growth due to the expanding application of simulation technologies in regulatory processes. The U.S. Food and Drug Administration (FDA) has increasingly incorporated modeling and simulation (M&S) to complement traditional methods for gathering evidence about regulated products. The FDA has highlighted the use of in-silico models, which have been used in over 40% of new drug applications in recent years, as a vital tool in decision-making. This integration underscores the potential for simulators to streamline regulatory assessments, reduce reliance on extensive clinical trials, and expedite product approvals, thereby fostering innovation in healthcare and other regulated industries.

Manufacturing Sector

Another promising opportunity lies in the manufacturing sector, where simulation technology is instrumental in reducing costs, improving quality, and shortening time-to-market for products. The National Institute of Standards and Technology (NIST) emphasizes that simulation provides a low-cost, secure, and fast analysis tool for product design and verification. By enabling virtual testing and optimization, manufacturers can identify potential issues early in the design process, leading to enhanced efficiency and competitiveness. For example, General Electric (GE) used simulation tools in the development of its gas turbines, resulting in a 20% improvement in fuel efficiency and a 10% reduction in manufacturing costs. This application of simulators aligns with strategic manufacturing initiatives, supporting the industry's move towards more agile and responsive production methodologies.

MARKET CHALLENGES

Substantial Financial Investments

The simulators market faces significant challenges due to the substantial financial investments required for establishing and maintaining simulation centers. According to a publication by the National Center for Biotechnology Information, simulation centers and simulation-based training programs can be costly to build and maintain, necessitating substantial long-term investments from their affiliated organizations. For instance, the setup cost of a single high-fidelity medical simulation lab can range from $500,000 to $2 million, depending on the type of equipment and technologies integrated. These high costs can deter institutions, particularly those with limited budgets, from adopting simulation-based training programs, thereby hindering the widespread implementation of simulation technologies.

Manufacturing Industries

Another challenge is the underutilization of simulation technology in manufacturing industries. A report by the National Institute of Standards and Technology highlights that, despite its potential to reduce costs, improve quality, and shorten time-to-market, simulation technology remains largely underutilized in manufacturing. Factors such as a lack of awareness, insufficient training, and the absence of standardized simulation interfaces contribute to this underutilization, limiting the potential benefits that simulation could offer to the manufacturing sector. For instance, a survey by the American Society of Mechanical Engineers found that only 20-30% of U.S. manufacturing firms regularly use simulation software in their product design and production processes, despite the fact that simulations can reduce product development cycles by up to 50%.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

6.44% |

|

Segments Covered |

By Type, End Use Industry, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

The major players in the global simulators market include CAE Inc., RTX Corporation (Collins Aerospace), Thales Group, FlightSafety International Inc., Rheinmetall AG, L3Harris Technologies, Inc., Indra Sistemas S.A., Saab AB, Boeing Company, and BAE Systems Plc. |

SEGMENTAL ANALYSIS

By Type Insights

The full flight simulator (FFS) segment ruled the market by capturing 92.1% of the global market share in 2024. The domination of full flight simulator segment is majorly driven by the extensive use of full flight simulators in pilot training within the aviation industry. Airlines and training institutions worldwide are making substantial investments in FFS technology, with major carriers like Lufthansa and Delta spending over $50 million annually on advanced simulator training programs. For instance, Lufthansa Technik has over 30 full-flight simulators in its training facilities, supporting both commercial and military aviation.

The driving simulation segment is predicted to grow at a CAGR of 12.1% from 2025 to 2033. This rapid growth is driven by the increasing adoption of driving simulators for driver training, road safety research, and automotive development. For instance, the European Union's European Road Safety Data estimates that the use of simulators in driver training can reduce road traffic accidents by up to 20%. Furthermore, car manufacturers like Toyota and Ford have integrated driving simulators into their vehicle design processes to improve safety features, with budgets of around $10 million annually dedicated to these programs. The automotive industry's growing focus on autonomous vehicle development also contributes to the rising demand for advanced driving simulation technologies.

By End Use Industry Insights

The aerospace & defense segment was the largest segment and held 30.3% of the global market share in 2024. The growth of the aerospace and defense segment in the global market is majorly attributed to the increasing demand for flight simulation training to meet both safety standards and skill development needs in the aviation industry. According to the Federal Aviation Administration (FAA), over 10,000 pilots undergo simulator training annually in the U.S. alone, underscoring the sector's reliance on advanced simulators. The rise of unmanned aerial systems (UAS) and new defense technologies also creates additional opportunities for simulation in both military and civilian aerospace applications.

The automotive segment is estimated to register the highest CAGR of 7.5% between 2025 and 2033. This rapid expansion is driven by the increasing adoption of advanced driver-assistance systems (ADAS) and the development of autonomous vehicles, which require extensive simulation for testing and validation. The National Highway Traffic Safety Administration (NHTSA) reports that simulation plays a vital role in evaluating vehicle safety features, contributing to the reduction of traffic fatalities. As the automotive industry continues to innovate, the reliance on simulation technologies is expected to grow, underscoring their importance in ensuring vehicle safety and performance.

By Application Insights

The training segment stands as the biggest application segment in the global simulators market and captured 40.1% of the global market share in 2024. The growth of the training segment is majorly driven by the widespread adoption of simulation-based training across various industries, including aerospace, healthcare, and automotive. For instance, the U.S. military allocates approximately $3 billion annually for simulation-based training programs, emphasizing its role in enhancing operational readiness and safety. Additionally, medical simulation training is becoming increasingly popular; the American College of Surgeons reports that over 100,000 medical professionals engage in simulation-based training annually, improving skills and reducing errors in patient care.

The research & development (R&D) segment is undergoing rapid expansion in the global simulators market and is predicted to witness the fastest CAGR of 13.8% from 2025 to 2033. The surge in R&D investment is driven by the increasing reliance on simulation technologies to accelerate innovation in fields like aerospace, automotive, and healthcare. For example, NASA's annual budget for research and simulation technologies exceeds $1 billion, reflecting the importance of simulators in testing and refining space exploration technologies. Similarly, in the automotive industry, companies like General Motors invest over $300 million annually in simulation-based R&D to develop advanced vehicle technologies, including autonomous systems and electric powertrains. These investments underscore the pivotal role of simulators in advancing research and development across multiple sectors.

REGIONAL ANALYSIS

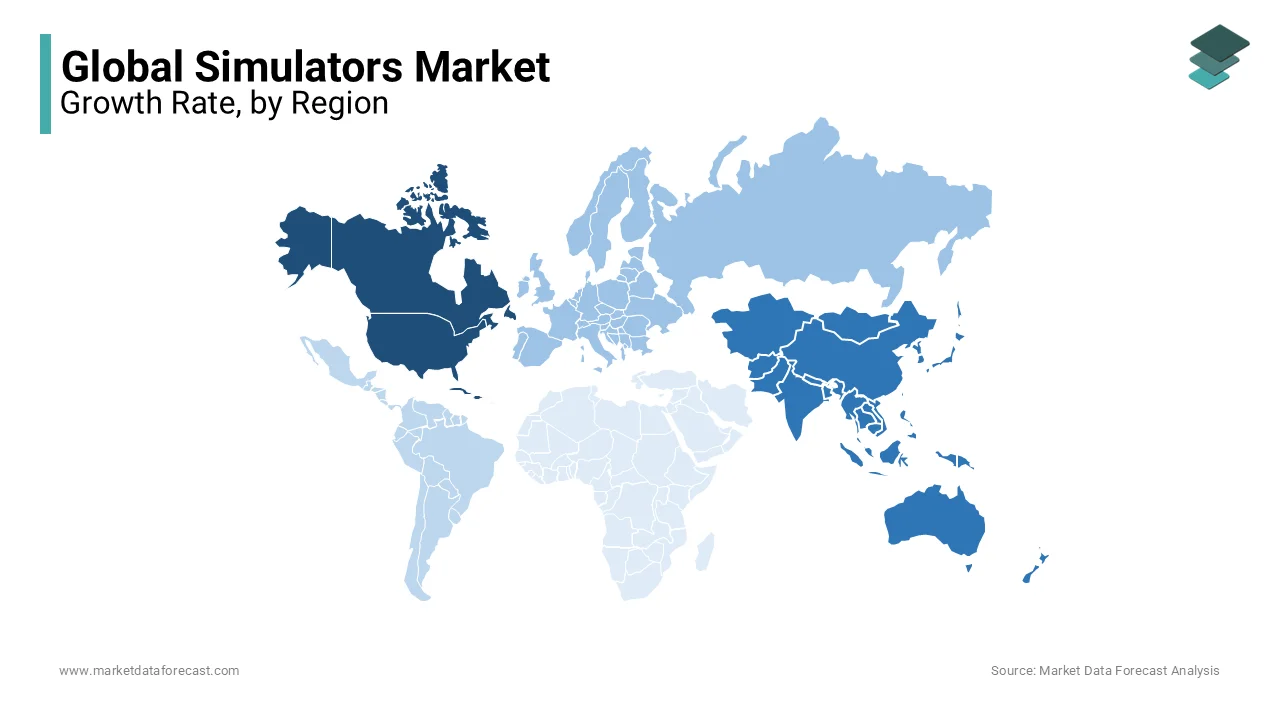

North America led the simulators market worldwide market and occupied 33.7% of the global market share in 2024. The domination of North America is primarily driven by the increasing demand for simulators across aerospace, defense, and automotive sectors. For example, the U.S. Department of Defense allocates billions of dollars annually for training simulations, with a projected $2.4 billion for simulation-based training in 2025 alone. Additionally, the Federal Aviation Administration (FAA) has authorized the use of flight simulators for training, significantly increasing their usage across commercial aviation. As technological advancements continue, North American companies, such as Lockheed Martin and Boeing, are expected to further drive the region's growth in the simulator market by investing heavily in the development of cutting-edge training and testing simulations.

The Asia-Pacific region is a promising regional market for simulators worldwide and is estimated to witness the highest CAGR of 7.1% from 2025 to 2033. This growth is largely driven by expanding aerospace and defense sectors, particularly in countries like China and India. For instance, China has increased its defense spending to over $290 billion in recent years, with a significant portion dedicated to upgrading its training and simulation technologies. Additionally, India has plans to invest $100 billion in its aviation industry by 2030, driving demand for flight simulators. The rising adoption of advanced technology in education and training further supports growth in sectors such as automotive and healthcare simulation. These investments and technological advancements are expected to propel the growth of simulators in the region.

Europe maintains a steady growth in the global simulators market and is likely to be driven by advancements in the automotive and aerospace industries. For example, the European Union has allocated over €1 billion in research and development funding for the aviation sector as part of its Horizon 2020 initiative, fostering innovation in simulation technologies for both training and design. Similarly, in the automotive sector, the European Commission's shift toward autonomous vehicles has led to the development of sophisticated driving simulators, with companies like Volvo and BMW investing millions in simulation-based research and development. These initiatives, alongside a robust demand for training solutions across industries, are supporting Europe’s steady growth in the simulators market.

In Latin America, the adoption of simulation technologies is gradually increasing, particularly in the healthcare and defense sectors. For instance, Brazil's Ministry of Health has invested over $30 million in the past few years to improve medical simulation programs, aiming to enhance the quality of healthcare training and reduce medical errors. Similarly, the defense sector is seeing growth in simulation usage, with countries like Brazil and Mexico expanding their military simulation programs, backed by government spending of over $500 million in defense technology modernization initiatives. These investments are helping drive the adoption of simulation technologies in both sectors, fostering growth in the Latin American market.

The Middle East & Africa region is recognizing the value of simulators, with investments aimed at enhancing training programs in aviation and military applications. For example, the UAE government has committed to investing over $2 billion in its aviation sector over the next decade, part of which will go towards upgrading flight simulators and training facilities. Additionally, Saudi Arabia's defense sector has allocated around $400 million for advanced military simulation technologies, focusing on enhancing training capabilities for its armed forces. These efforts reflect a growing recognition of the importance of simulation for improving operational efficiency and reducing training costs in critical sectors like aviation and defense.

KEY MARKET PLAYERS

The major players in the global simulators market include CAE Inc., RTX Corporation (Collins Aerospace), Thales Group, FlightSafety International Inc., Rheinmetall AG, L3Harris Technologies, Inc., Indra Sistemas S.A., Saab AB, Boeing Company, and BAE Systems Plc.

COMPETITIVE LANSCAPE

The global simulators market is highly competitive, with established industry leaders and emerging players striving to innovate and expand their market presence. Companies such as CAE Inc., L3Harris Technologies, and Thales Group dominate the market by offering advanced simulation solutions across multiple industries, including aviation, defense, healthcare, and automotive. These firms invest heavily in research and development to enhance simulation accuracy, realism, and efficiency, ensuring they maintain a competitive edge.

Competition in the market is further fueled by strategic partnerships, mergers, and acquisitions. Many companies collaborate with governments, defense agencies, and private organizations to develop cutting-edge simulation systems. For instance, defense and aerospace simulation providers frequently secure long-term contracts with military organizations to supply training solutions.

The rise of emerging technologies, such as artificial intelligence (AI), virtual reality (VR), and augmented reality (AR), has also intensified competition. Companies focusing on integrating these advanced technologies into simulation systems are gaining an advantage by offering more immersive and cost-effective training solutions.

Additionally, regional players contribute to market competition by catering to industry-specific needs and regulatory requirements. As demand for high-fidelity simulations grows, companies must continuously innovate and expand their offerings to remain competitive in this dynamic and evolving landscape.

Top 3 Players in the Market

CAE Inc.:

CAE Inc., headquartered in Canada, is a prominent figure in simulation and training solutions across aviation, defense, and healthcare sectors. The company has been at the forefront of integrating advanced technologies into their simulators, enhancing training effectiveness and operational efficiency. Their commitment to innovation has solidified their position as a leader in the global simulators market.

Thales Group:

Based in France, Thales Group specializes in aerospace, defense, and security solutions, offering a comprehensive range of simulation products. The company has developed advanced systems and solutions for civil and military applications, specializing in avionics, cybersecurity, and space systems. Thales' innovations enhance safety, security, and efficiency across various industries, including transportation, defense, and space exploration.

L3Harris Technologies Inc.:

An American technology company, L3Harris Technologies Inc. provides advanced defense and commercial technologies across air, land, sea, space, and cyber domains. The company designs and manufactures surveillance systems, tactical communication equipment, and avionics. L3Harris' cutting-edge technologies improve operational efficiency and security, supporting government and commercial organizations worldwide. The company's solutions enhance defense capabilities and communication networks.

Top Strategies Used by the Key Market Participants

Research and Development (R&D) Investments:

Leading companies invest heavily in R&D to expand their product lines and enhance simulation technologies. This focus on innovation enables the development of advanced simulation solutions that meet evolving industry demands. For instance, CAE Inc. has been at the forefront of integrating advanced technologies into their simulators, enhancing training effectiveness and operational efficiency.

Strategic Partnerships and Agreements:

Major players, including CAE Inc., L3Harris Technologies, Saab AB, Thales, and Indra Sistemas S.A., have adopted strategies such as contracts and agreements to expand their market presence. These collaborations facilitate access to new markets and customer bases, enhancing their competitive positions.

Mergers and Acquisitions:

Companies engage in mergers and acquisitions to broaden their capabilities and market reach. For example, Ten Square Games acquired RORTOS, an Italian mobile flight simulation game developer, to enter the mobile flight simulators market.

RECENT HAPPENINGS IN THE MARKET

- In December 2024, U.S. private equity firm General Atlantic acquired London-based Learning Technologies Group (LTG) for £802.4 million. LTG specializes in corporate training tools, including mobile applications and videos. This acquisition reflects General Atlantic's strategic move to capitalize on the growing demand for advanced training solutions in the corporate sector.

- In August 2024, private equity funds managed by Blackstone and Vista Equity Partners completed the acquisition of Energy Exemplar, a leading global provider of energy market simulation software. This move underscores the increasing interest of private equity firms in simulation technologies that support critical infrastructure sectors.

MARKET SEGMENTATION

This research report on the global simulators market is segmented and sub-segmented into the following categories.

By Type

- Full Flight Simulation

- Fixed Base Simulation

- Driving Simulation

- Others

By End Use Industry

- Aerospace & Defense

- Automotive

- Marine & Naval

- Media & Entertainment

By Application

- Training

- Research & Development

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

What factors are driving the growth of the simulators market?

The growth is driven by advancements in artificial intelligence, increasing safety concerns, cost-effective training solutions, and the need for realistic virtual environments for various applications.

Which industries are the major consumers of simulation technology?

The aviation, defense, healthcare, automotive, and entertainment industries are the largest users of simulation technology, with growing applications in education and industrial training.

How are technological advancements influencing the simulators market?

Technologies like AI, virtual reality, augmented reality, and cloud computing are making simulations more immersive, realistic, and accessible across various industries.

What is the future outlook for the global simulators market?

The market is expected to continue growing with increasing investments in AI-driven simulation, expanded applications in emerging fields, and rising adoption of cloud-based solutions.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com