Global Smart Meter Market Size, Share, Trends, & Growth Forecast Report - Segmented By Type (Smart Electric Meter, Smart Water Meter, Smart Gas Meter), Technology (Advanced Metering Infrastructure (AMI) and Auto Meter Reading (AMR)), Application (Residential, Commercial, Industrial), and Region (North America, Europe, APAC, Latin America, Middle East and Africa) – Industry Analysis from 2025 to 2033

Global Smart Meter Market Size

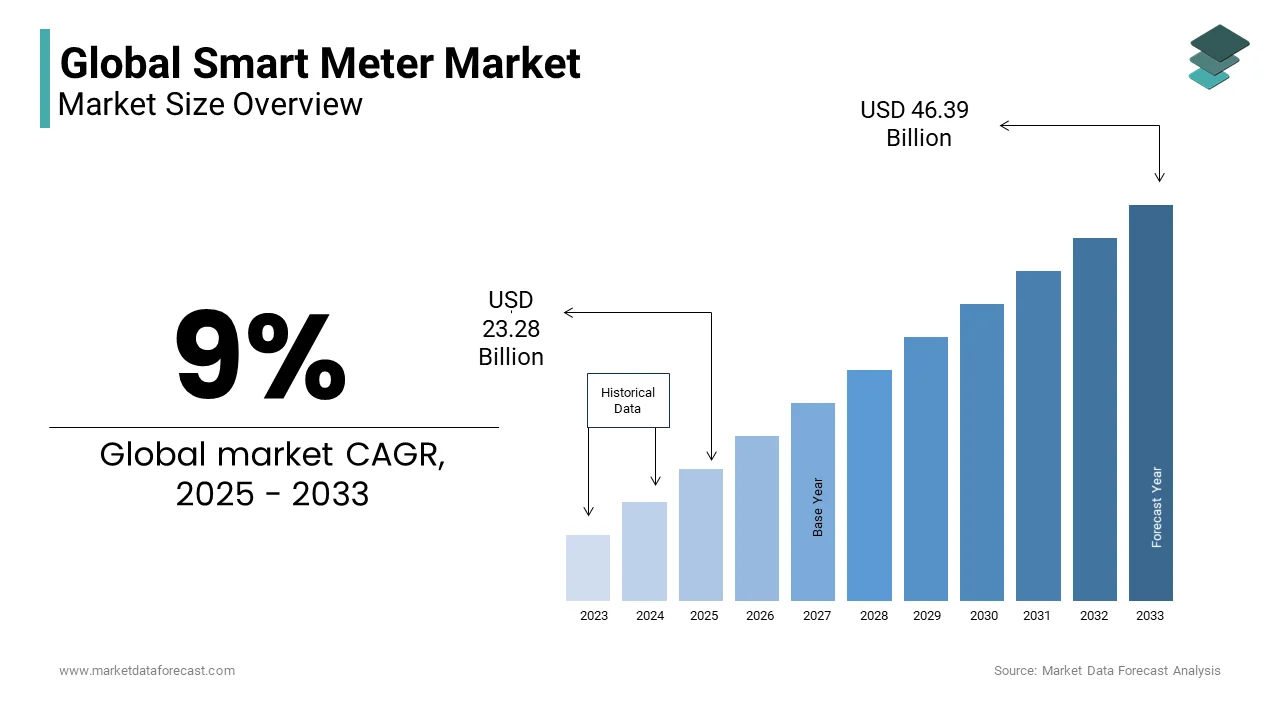

The size of the global smart meter market was worth USD 21.36 billion in 2024. The global market is anticipated to grow at a CAGR of 9% from 2024 to 2033 and be worth USD 46.39 billion by 2033 from USD 23.28 billion in 2025.

A smart meter is an advanced electronic device that measures and records the consumption of electricity, gas, or water in real-time, transmitting this data to both consumers and utility providers. This two-way communication facilitates accurate billing, efficient energy management, and integration with smart grids, thereby enhancing the reliability and sustainability of utility services.

The deployment of smart meters is a critical component in global efforts to modernize energy infrastructure and promote efficient resource utilization. In the United States, for instance, electric utilities had installed approximately 119 million advanced metering infrastructure (AMI) devices by 2022, accounting for about 72% of total electric meter installations, as reported by the U.S. Energy Information Administration. This widespread adoption enables utilities to monitor energy usage patterns more effectively, leading to improved demand response and grid stability.

One significant advantage of smart meters is their role in reducing non-technical losses, such as electricity theft. The World Bank stated that electric power transmission and distribution losses, which include theft, can be substantial, particularly in developing regions. By providing precise, real-time data, smart meters help utilities detect and address unauthorized consumption, thereby enhancing revenue protection and reducing operational inefficiencies.

From a consumer perspective, smart meters offer detailed insights into energy usage, empowering households to make informed decisions about their consumption habits. Studies have shown that access to real-time usage data can lead to energy savings; for example, research indicates that smart meters can result in an average reduction of 3.4% in electricity consumption and 3.0% in gas consumption. These reductions not only lower utility bills for consumers but also contribute to broader environmental sustainability goals by decreasing overall energy demand.

MARKET DRIVERS

Government Policies and Incentives

Government mandates accelerate smart meter adoption through regulations and subsidies. In the UK, the Department for Energy Security and Net Zero targets smart meters in all homes by 2025, with 33.8 million installed by September 2023. The International Energy Agency notes global renewable capacity hit 510 gigawatts in 2023, up 50%, requiring smart meters for grid efficiency. The U.S. Environmental Protection Agency reports a 32% drop in power plant emissions since 1990, partly due to metering-driven efficiency. These policies curb emissions and enhance energy management, boosting market growth as governments prioritize sustainable infrastructure.

Increasing Energy Demand and Grid Modernization

Rising energy needs drive smart meter deployment to upgrade outdated grids. The U.S. Energy Information Administration recorded a 2.4% annual electricity demand increase from 2010 to 2020, stressing legacy systems. The International Energy Agency estimates 1.06 billion smart meters were installed globally by 2023 to manage this surge. The U.S. Department of Energy noted a 20% reduction in outage times since 2015, thanks to smart metering. Urbanization amplifies demand, with modernized grids ensuring reliability, making smart meters essential for efficient energy distribution and market expansion.

MARKET RESTRAINTS

High Installation and Maintenance Costs

Elevated costs of smart meter rollout limit market growth, especially for resource-limited utilities. The U.S. Department of Energy estimates per-meter installation costs at $100 to $300, excluding ongoing maintenance. The International Energy Agency reports 2022 global grid modernization spending reached $300 billion, yet cost recovery remains slow. The U.S. Census Bureau states 12.4% of households were below the poverty line in 2021, reducing consumer support for rate hikes. These financial challenges hinder widespread adoption, particularly in less affluent regions, slowing market penetration.

Cybersecurity Risks and Data Privacy Concerns

Smart meters’ connectivity raises cybersecurity and privacy issues, stalling market progress. The U.S. Federal Bureau of Investigation notes a 70% rise in cyber-attacks on critical infrastructure from 2020 to 2022, targeting energy systems. The UK’s National Cyber Security Centre recorded 607 data breaches in 2023, spotlighting vulnerabilities. The U.S. Census Bureau found 87% of Americans owned internet-connected devices in 2022, heightening privacy worries. These risks deter consumers and regulators, demanding stronger security measures that delay smart meter deployment.

MARKET OPPORTUNITIES

Integration with Renewable Energy Systems

Smart meters enable renewable energy growth, creating market opportunities. The International Energy Agency reports renewables hit 30% of global electricity in 2023, up from 27% in 2020, needing smart meters for stability. The U.S. Energy Information Administration states solar production reached 163 billion kilowatt-hours in 2022, up 26%. The U.S. Department of Energy notes a 15% efficiency boost in renewable integration with smart meters. This supports decarbonization efforts, expanding the market as clean energy reliance grows globally.

Smart City Development Initiatives

Smart cities offer growth potential for smart meters by optimizing urban energy use. The United Nations predicts 68% of people will live in cities by 2050, up from 56% in 2020, increasing energy demands. The U.S. Department of Housing and Urban Development allocated $2.8 billion for smart city projects in 2022, including metering. The UK’s Department for Transport found smart infrastructure cut energy waste by 10% in trials. These efforts position smart meters as vital for sustainable urban development, driving market demand.

MARKET CHALLENGES

Interoperability and Standardization Issues

Inconsistent standards impede smart meter integration, challenging market growth. The International Energy Agency identified over 50 smart meter protocols worldwide in 2023, causing compatibility issues. The U.S. National Institute of Standards and Technology found 60% of smart grid devices met common standards in 2022, slowing progress. The U.S. Department of Energy reports 25% of grid upgrades were delayed in 2021 due to interoperability. This lack of uniformity raises costs and complicates deployment, obstructing market scalability.

Resistance to Adoption and Public Perception

Public distrust hampers smart meter acceptance, posing a market challenge. The UK’s Department for Energy Security and Net Zero found 14.7% of households disliked smart meters in 2023, citing privacy fears. The U.S. Census Bureau notes 33% of adults distrusted smart tech in 2022 due to surveillance concerns. The Australian Bureau of Statistics reports 20% of households rejected smart meters in 2021, favoring traditional systems. This resistance, driven by misconceptions, slows deployment and market expansion efforts.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

9% |

|

Segments Covered |

By Type, Technology, Application, and Region. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Siemens (Germany),ABB (Switzerland),Kamsturp (Denmark),Itron (US),Landis+ Gyr (Switzerland) |

SEGMENTAL ANALYSIS

By Type Insights

The smart electric meter segment dominated the market and held a 60.4% of the share in 2024 which was propelled by widespread adoption for energy management. Its leadership stems from global electrification initiatives and the need for efficient grid monitoring. According to the U.S. Energy Information Administration, 88% of U.S. households had smart electric meters by 2022, reflecting robust demand. The International Energy Agency reports a 2.3% rise in Americas’ energy consumption in 2022, underscoring the need for real-time data to curb waste. This segment’s importance lies in enhancing grid reliability and reducing carbon emissions.

The smart water meter segment is the fastest-growing with a CAGR of 11.1% from 2025-2030 because of water scarcity concerns and conservation efforts. Its rapid growth is driven by the need to reduce non-revenue water losses, which the U.S. Environmental Protection Agency estimates at 6 billion gallons daily in the U.S. The European Union’s Water Framework Directive mandates efficient water use, boosting deployments. The U.S. Department of Energy notes that smart water meters cut leakage by 20% in pilot programs. This segment’s importance lies in sustainable water management amid rising global demand.

By Technology Insights

The AMI segment led with a 65.8% market share in 2024 and is also grows fastest with a CAGR of 10% through 2033 owing to its two-way communication capabilities enhancing utility efficiency. Its dominance is supported by widespread adoption for real-time monitoring. The U.S. Department of Energy states that AMI-equipped utilities reduced outages by 15% in 2022. The International Energy Agency stresses that 1.4 billion smart buildings in North America by 2025 will rely on AMI for energy management. AMI’s importance lies in enabling grid modernization and integrating renewable energy sources effectively. Moreover, the rapid development is driven by demand for advanced grid solutions. Its rapid expansion is fueled by IoT integration and real-time analytics. The U.S. Energy Information Administration reports that AMI installations rose 12% annually from 2020-2022. The European Commission notes that 80% of EU meters will be AMI-enabled by 2024, reflecting regulatory push. This segment’s importance, per the U.S. Department of Energy, includes a 25% improvement in demand response, critical for balancing renewable energy fluctuations.

By Application Insights

The residential segment commanded a substantial portion of market share in 2024 which was driven by its vast customer base and energy conservation focus. Its leadership is due to high household adoption rates, with the U.S. Energy Information Administration reporting 107 million smart meters installed in U.S. homes by 2022. The U.S. Census Bureau notes a 1.3% annual population growth, increasing residential energy demand by 1.4% yearly per the International Energy Agency. This segment’s importance lies in empowering consumers to reduce bills and emissions.

The commercial segment is estimated to register the fastest CAGR of 10% through 2033, propelled by technological adoption and infrastructure upgrades. Its rapid rise is due to businesses prioritizing energy efficiency, with the U.S. Department of Energy estimating a 30% energy cost reduction via smart meters in offices. The U.S. General Services Administration reports that federal buildings with smart meters cut usage by 18% in 2022. This segment’s importance, per the European Commission, includes a 15% billing accuracy boost, vital for commercial sustainability and cost management.

REGIONAL ANALYSIS

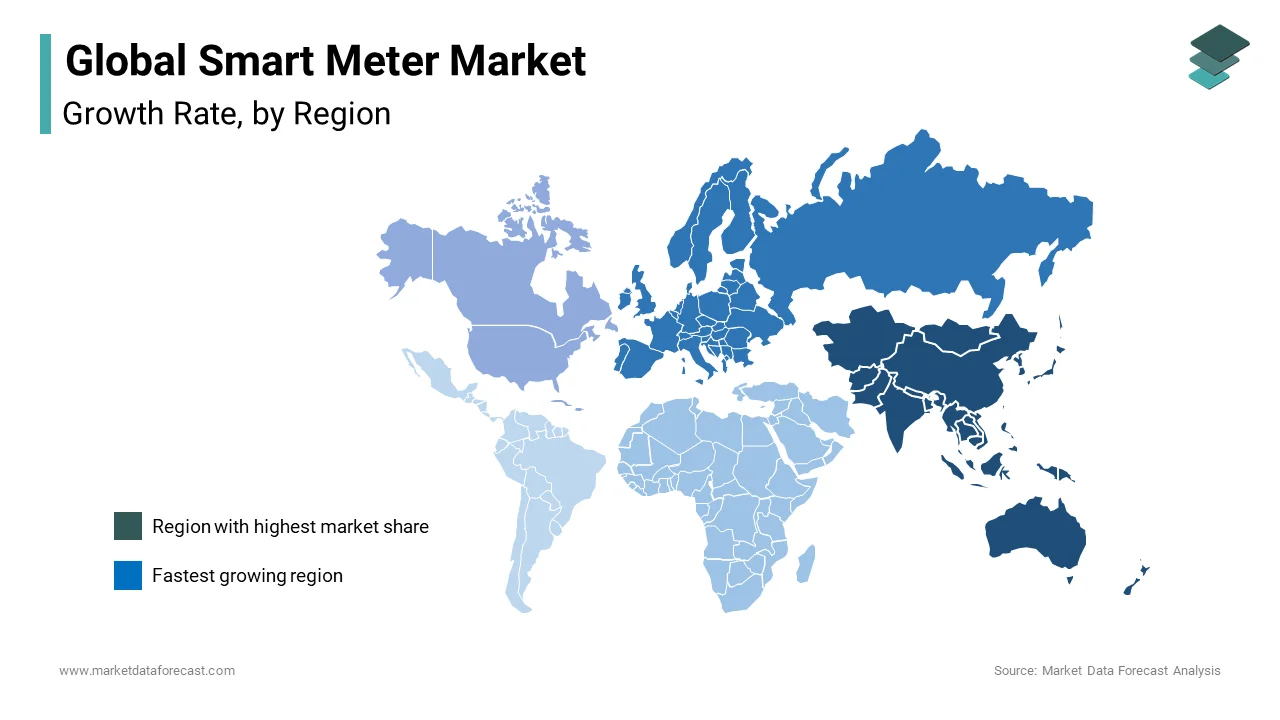

Asia-Pacific stands as the largest share of 55.6% in 2024 and fastest growing market for smart meters. This rapid expansion is driven by substantial government investments in smart grid infrastructure and urbanization. For instance, China's National Energy Administration has implemented policies promoting smart meter installations to enhance energy efficiency and reduce losses. Similarly, Japan's Ministry of Economy, Trade, and Industry has mandated the deployment of smart meters nationwide to support efficient energy management. These initiatives underscore the region's commitment to modernizing its energy infrastructure.

Europe is a significant player in the smart meter market and is expected to grow at a CAGR of 12.2% during the forecast period. The European Union's Third Energy Package mandates member states to equip at least 80% of consumers with smart meters by 2024, aiming to enhance energy efficiency and empower consumers with real-time usage data. Countries like Italy and Sweden have achieved over 90% smart meter penetration, leading the continent in adoption rates. These efforts are part of the EU's broader strategy to transition towards a sustainable and integrated energy system.

North America has been proactive in smart meter deployment with the U.S. Department of Energy reporting that over 90 million smart meters were installed across the United States by 2020, covering approximately 57% of U.S. households. Federal initiatives such as the Smart Grid Investment Grant program have allocated significant funding to modernize the electrical grid, including smart meter installations. Canada also promotes smart meter usage through provincial programs aimed at enhancing energy conservation and grid reliability. These measures reflect the region's focus on leveraging technology to improve energy management and sustainability.

Latin America is gradually embracing smart meter technology, with countries like Brazil and Mexico initiating pilot projects to modernize their energy infrastructure. Brazil's National Electric Energy Agency (ANEEL) has outlined plans to replace traditional meters with smart devices to reduce non-technical losses, which account for a significant portion of energy theft and distribution inefficiencies. Similarly, Mexico's Federal Electricity Commission (CFE) is implementing smart metering systems to enhance billing accuracy and reduce operational costs. These initiatives aim to improve the reliability and efficiency of the region's power systems.

The Middle East and Africa are in the early stages of smart meter adoption, focusing on improving energy access and reducing losses. South Africa's Department of Energy has launched programs to install smart meters in major municipalities to combat electricity theft, which contributes to significant revenue losses. In the Middle East, countries like the United Arab Emirates are investing in smart grid technologies as part of their broader vision to integrate renewable energy sources and enhance energy security. These efforts are crucial for addressing the region's unique energy challenges and promoting sustainable development.

Top 3 Players in the market

Landis+Gyr

Landis+Gyr, headquartered in Switzerland, is a prominent provider of integrated energy management solutions. The company offers a comprehensive range of smart metering products and services for electricity, gas, and heat utilities. With operations in over 30 countries, Landis+Gyr has established a significant global presence. Their commitment to innovation is evident through continuous advancements in smart grid technologies, enabling utilities to enhance operational efficiency and reduce energy losses. Landis+Gyr's extensive deployments worldwide have been instrumental in modernizing energy infrastructure and promoting sustainable energy consumption.

Itron, Inc.

Based in the United States, Itron, Inc. specializes in technology solutions for energy and water resource management. The company's portfolio includes smart meters, communication systems, and data analytics software. Itron's innovative approach focuses on providing utilities with real-time data and insights, facilitating improved decision-making and efficient resource utilization. Their global reach and diverse product offerings have positioned Itron as a key contributor to the advancement of smart metering infrastructure, aiding in the optimization of energy distribution and consumption.

Siemens AG

Siemens AG, a German multinational conglomerate, is a major player in the smart meter market through its Smart Infrastructure division. The company provides a range of smart metering solutions that integrate seamlessly with smart grid systems. Siemens' expertise in automation and digitalization enables utilities to implement advanced metering infrastructure (AMI) that supports real-time data acquisition and analysis. Their solutions contribute to enhanced grid reliability, efficient energy management, and the integration of renewable energy sources, thereby playing a crucial role in the global energy transition.

Top strategies used by the key market participants

Technological Innovation and R&D Investment

Leading smart meter companies such as Landis+Gyr, Itron, and Siemens prioritize continuous innovation and research & development (R&D) to stay ahead in the market. They invest heavily in next-generation smart meters equipped with AI-driven analytics, Internet of Things (IoT) connectivity, and real-time monitoring capabilities. Advanced features such as self-healing networks, edge computing, and enhanced cybersecurity are being integrated into smart meter technology to improve grid reliability and efficiency. These innovations enable utilities to predict energy demand, detect faults, and enhance consumer energy management, making smart meters a crucial component of future smart grids.

Strategic Partnerships & Collaborations

To expand their reach and technological capabilities, smart meter manufacturers form strategic alliances with utilities, software firms, and telecommunication providers. Itron has partnered with Microsoft Azure to integrate cloud-based AI analytics into energy management, while Siemens collaborates with government agencies for smart city and grid modernization projects. Landis+Gyr works with telecom companies to enable 5G-based communication networks for smart meters, ensuring seamless connectivity and real-time energy monitoring. These partnerships strengthen their market presence by enhancing their technological offerings and securing large-scale deployments.

Mergers & Acquisitions for Market Consolidation

Acquiring complementary businesses allows smart meter companies to expand their portfolios and market share. Itron has acquired multiple smart grid software providers to strengthen its analytics and data management solutions. Landis+Gyr purchased Etrel, a leading provider of EV charging solutions, to integrate electric vehicle (EV) management into its smart meter systems. Siemens, with its history of strategic acquisitions, continues to buy automation and IoT firms to advance its digital energy infrastructure. These acquisitions enable companies to offer more comprehensive solutions, expand geographically, and increase technological expertise.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Companies playing a prominent role in the global lamps market are Siemens (Germany),ABB (Switzerland),Kamsturp (Denmark),Itron (US),Landis+ Gyr (Switzerland),Badger Meter (US),Diehl (Germany),Secure Meter Limited(UK),clara Technologies (US),Sensus (US)

The global smart meter market is highly competitive, driven by rapid technological advancements, regulatory mandates, and increasing demand for efficient energy management. Major players such as Landis+Gyr, Itron, Siemens, Schneider Electric, Honeywell, and Sensus dominate the market, offering advanced metering solutions for electricity, gas, and water utilities. These companies compete based on technology innovation, scalability, cybersecurity, and integration with smart grids.

Competition is fueled by government policies supporting smart grid development, such as the UK's smart meter rollout, China's State Grid Corporation projects, and U.S. Department of Energy (DOE) initiatives. Companies seek to differentiate themselves through AI-driven analytics, cloud-based solutions, and IoT connectivity, enabling real-time data monitoring and predictive maintenance.

New entrants, including startups focusing on AI, blockchain, and edge computing, add further competition, pushing established firms to innovate and acquire smaller players to strengthen their portfolios. Regional companies also create pricing pressures by offering cost-effective solutions tailored to local markets.

RECENT HAPPENINGS IN THE MARKET

- In December 2024, private equity firm EQT and GIC acquired a majority stake in Calisen Group, a leading UK-based smart meter provider, in a deal valued at approximately £4 billion. This acquisition aims to strengthen Calisen’s position in the UK smart metering market while expanding its services in renewable energy and EV charging infrastructure.

- In April 2024, global investment firm KKR acquired Smart Metering Systems (SMS), a UK-based energy infrastructure company, for £1.4 billion. This acquisition is expected to accelerate SMS’s growth and support the UK’s energy transition efforts.

- In November 2024, Smart Metering Systems (SMS), under KKR’s ownership, announced a merger with Horizon Energy Infrastructure (HEI) and Smart Meter Assets (SMA), both owned by Arcus Infrastructure Partners. This consolidation is expected to create a leading smart metering infrastructure provider, managing over 6 million meters.

- In October 2024, U.S. private equity firm TPG, in partnership with GIC, acquired Techem, a German metering company, from Partners Group for approximately €7 billion. This deal is expected to strengthen Techem’s global presence, as it manages around 60 million devices for energy and water consumption monitoring.

- In December 2024, Spanish utility Iberdrola announced plans to sell its UK smart metering unit, seeking to raise around £1 billion. This strategic move is intended to capitalize on the increasing investor interest in smart metering assets.

MARKET SEGMENTATION

This research report on the Smart Meter Market has been segmented and sub-segmented into the following categories.

By Type

- Smart Electric Meter

- Smart Gas Meter

- Smart Water Meter

By Technology

- Automatic Meter Reading

- Advanced Meter Infrastructure

By Application

- Residential

- Commercial

- Industrial

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

By Region, which segment would grow at the highest CAGR during the forecast period?

During the forecast period, the Asia-Pacific region would grow at the fastest rate of 9.0%.

What segments are covered in the Smart Meter Market report?

The report segments the Smart Meter market based on Product Type, Technology, End-User, and Region. The market is divided into Smart Electric Meter, Smart Water Meter, and Smart Gas Meter, depending on the product type. Depending on the Technology, Advanced Metering Infrastructure (AMI) and Auto Meter Reading (AMR) can be divided. On the basis of End-User, the market is segmented as Residential, Commercial, and Industrial.

What are key drivers and restraints?

The global market will develop as a result of cost-cutting and operational improvements. Compared to traditional meters, high capital expenditure can stifle worldwide industry expansion.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]