Global Solar Panel Recycling Market Size, Share, Trends, & Growth Forecast Report – Segmented By Process (Mechanical and Laser), Product (Monocrystalline Solar Panel, Thin Film) & Region - Industry Forecast From 2024 to 2032

Global Solar Panel Recycling Market Size (2024 to 2032)

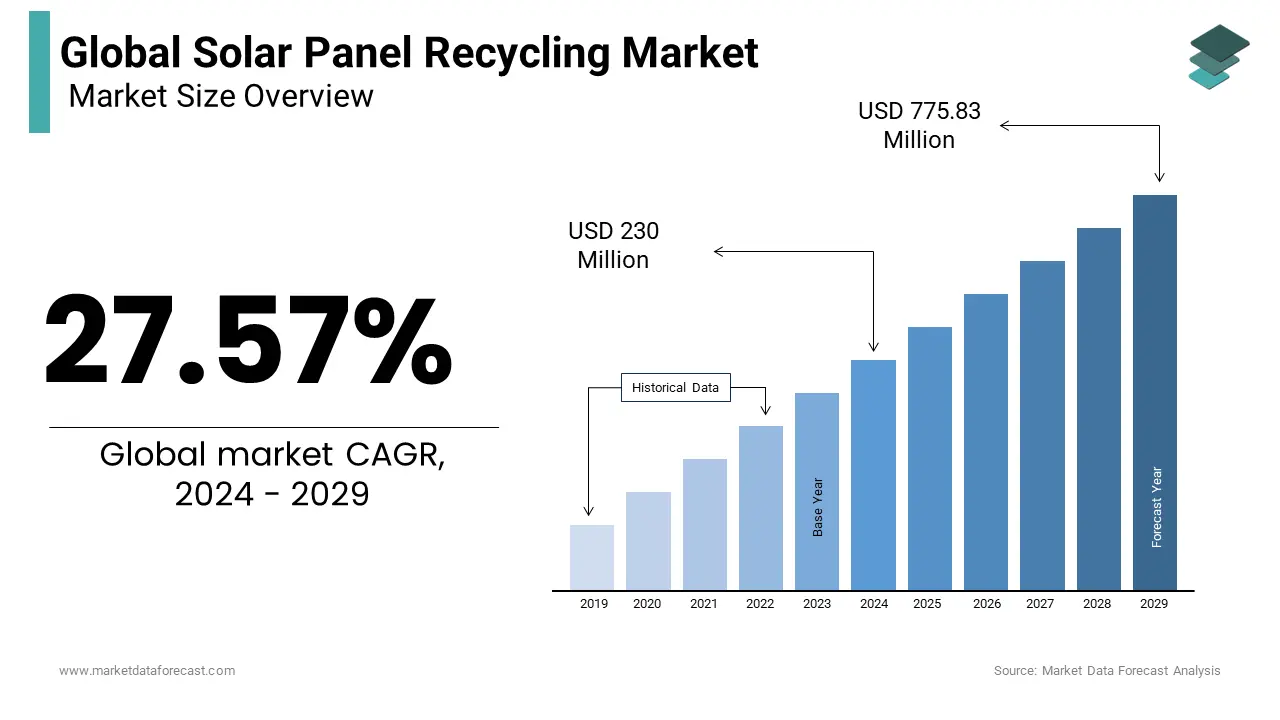

The global solar panel recycling market size was valued at USD 180 million in 2023 and is projected to reach USD 1,613 million by 2032 from USD 230 million in 2024 and grow at a CAGR of 27.57% during the forecast period.

MARKET SCENARIO

Continued profitable technical advancements will drive solar panel adoption, which in turn will improve market prospects. Solar energy has been widely integrated into the existing energy mix over the last decade. Solar panels used in buildings, terrestrial or floating solar panels have an expected average life of 30 years. These panels often contain cadmium, lead, and various toxic chemicals. Therefore, it is essential to recycle or eliminate these toxic elements from the environment to avoid dangerous altercations. According to recent studies, the world's installed solar capacity has increased from 227 GW in 2016 to 500 GW in 2020. Falling prices for solar panels and support for government policies and initiatives for cleaner, more reliable sources of electricity and reliable. Affordable prices are dramatically driving solar panel adoption around the world.

Higher numbers of end-of-life solar panels are creating a demand for recycling activities in the United States. Therefore, companies in the solar panel recycling market are focusing on value recovery opportunities in the United States. As such, the market is expected to reach a value of $ 600 million by the end of 2026. There is a growing demand for the purpose of solar panel management in the United States. Also, California took the lead in the country's head solar power generation in 2019. For this reason, companies in the solar panel recycling market are redoubling their efforts to manage and recycle the waste generated by solar panels at the end of their useful life. The prolonged period of technology development and policy management associated with panels has led to an increase in solar panel recycling activities in the U.S. The growth of the world population, the expansion of the industrial sector, and the rise in business infrastructure development stimulate demand for solar panel recycling.

MARKET DRIVERS

Solar panels have a useful life of 20 to 25 years; they must be replaced afterward. Photovoltaic modules carry heavy metals and, therefore, cannot be dumped in landfills.

Therefore, the solar panel recycling market offers significant potential. The solar panel can be disassembled into different components and can be recycled by various processes, such as mechanical, thermal, chemical, laser, and combination. Therefore, the increase in solid waste is expected to boost the global solar panel recycling market. Solar energy is inexpensive and environmentally friendly. As a result, the demand for solar energy is increasing around the world. There are new methods that accelerate recycling rates, and companies can collaborate with researchers to gain a competitive advantage in the market landscape.

MARKET RESTRAINTS

Lack of awareness and general interest in developing countries in the Asia-Pacific region is expected to hold back market growth.

Recycling costs more than landfills, and the value of recovered materials is less than the original, so interest in recycling is limited. Recycling solar panels is still very expensive, so researchers are experimenting with new recycling methods. Solar panel waste is likely to generate 210 times more toxic waste per unit of energy when compared to nuclear power plants. The waste contains silicon, cadmium, lead, and other toxic chemicals (including carcinogens) that cannot be removed without breaking the entire panel.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

CAGR |

27.57% |

|

Segments Covered |

By Process, Product, and Region. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis; Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

First Solar, Echo Environmental, Silicontel Ltd, Canadian Solar Inc., Silrec Corporation, Beijing Super Silicon Materials Recycling Co., Ltd., Suzhou Huizhijie Photovoltaic Technology Co.Ltd., Shanghai Yuzong Photovoltaic Technology Co. Ltd., SunPower Corporation, Reiling GmbH & Co. KG, Trina Solar, Aurubis, Envaris, SiC Processing GmbH, Yingli Energy Co. Ltd., and Hanwha Group, among others. |

SEGMENTAL ANALYSIS

Global Solar Panel Recycling Market Analysis By Process

The mechanical process accounted for the largest revenue share, over 67%, in 2023 and is expected to continue to develop at a noteworthy growth rate from 2024 to 2029. However, the laser process segment is expected to record the fastest CAGR in terms of revenue and volume during the forecast period and promote market growth throughout the forecast years.

Global Solar Panel Recycling Market Analysis By Product

The monocrystalline solar panel recycling type is expected to generate the highest revenue share of over 70% in 2023. These panels are made with unique crystalline silicon. Thin-film solar panels are expected to emerge as the fastest-growing product segment during the projection period due to their active performance and low cost.

REGIONAL ANALYSIS

Research and development on solar panel recycling are mainly carried out in Germany, France, Italy, Japan, and the United States of America. Most efforts in this region focus on solar panels to recover and recycle silicon and rare metal elements. Europe accounted for the majority of revenues in 2023. It is estimated that it will continue to develop at a significant growth rate from 2024 to 2029, as the region has the maximum number of installed bases of solar parks, which would lead to a grand finale of its life. Solar panels in the coming years. In Germany, the market is expected to exceed $ 70.0 million by 2027 due to technological advances and comprehensive government waste management regulations. Asia-Pacific is expected to be the fastest-growing regional market from 2024 to 2029. China and Japan are the main revenue generators in the APAC market. China has the highest number of solar panel recycling patent applications due to the increasing investment in recycling technology research and development.

KEY PLAYERS IN THE GLOBAL SOLAR PANEL RECYCLING MARKET

Companies playing a prominent role in the global solar panel recycling market include First Solar, Echo Environmental, Silicontel Ltd, Canadian Solar Inc., Silrec Corporation, Beijing Super Silicon Materials Recycling Co., Ltd., Suzhou Huizhijie Photovoltaic Technology Co.Ltd., Shanghai Yuzong Photovoltaic Technology Co. Ltd., SunPower Corporation, Reiling GmbH & Co. KG, Trina Solar, Aurubis, Envaris, SiC Processing GmbH, Yingli Energy Co. Ltd., and Hanwha Group, among others.

RECENT HAPPENINGS IN THE GLOBAL SOLAR PANEL RECYCLING MARKET

-

French water and waste group Veolia has launched what it claims to be the first solar panel recycling plant in Europe and aims to build more. Thousands of tons of aging solar panels are expected to end their lives in the coming years, and Veolia is aiming to build more.

DETAILED SEGMENTATION OF THE GLOBAL SOLAR PANEL RECYCLING MARKET INCLUDED IN THIS REPORT

This research report on the global solar panel recycling market has been segmented and sub-segmented based on process, product, and region.

By Process

- Mechanical

- Laser

By Product

- Monocrystalline Solar Panel

- Thin Film

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Frequently Asked Questions

What is the Solar Panel Recycling Market growth rate during the projection period?

The Global Solar Panel Recycling Market is expected to grow with a CAGR of 27.57% between 2024-2032.

What can be the total Solar Panel Recycling Market value?

The Global Solar Panel Recycling Market size is expected to reach a revised size of USD 1,613.30 million by 2032.

Name any three Solar Panel Recycling Market key players?

SunPower Corporation, Reiling GmbH & Co. KG, and Trina Solar are the three Solar Panel Recycling Market key players.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com