Global Stand Up Paddle Board Market Size, Share, Trends & Growth Forecast Report By Type (Solid SUP Board Inflatable SUP Boards), Size, Application, Sales Channel and Region (North America, Europe, Asia Pacific, Latin America and Middle East & Africa), Industry Analysis From 2025 to 2033

Global Stand Up Paddle Board Market Size

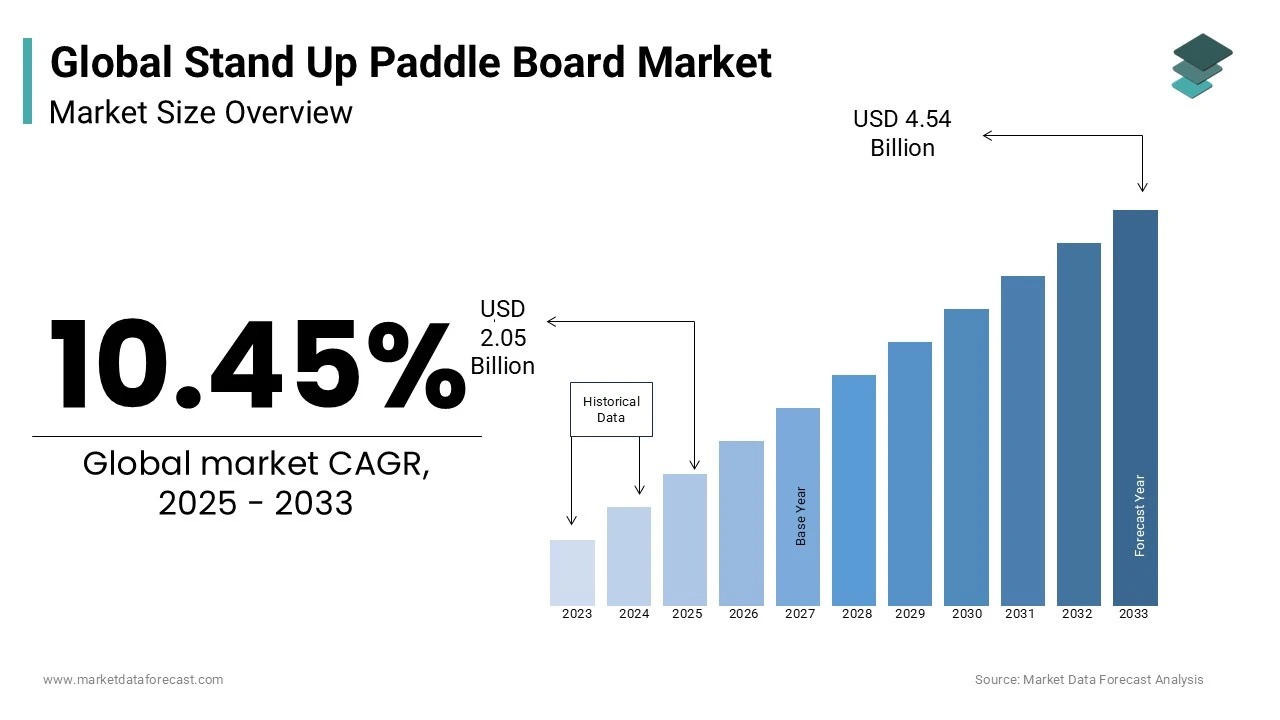

The global stand up paddle board market was worth USD 1.86 billion in 2024. The market is estimated to grow at a CAGR of 10.45% from 2025 to 2033 and be valued at USD 4.54 billion by the end of 2033 from USD 2.05 billion in 2025.

The stand-up paddle board (SUP) market has emerged as a dynamic and rapidly evolving segment within the broader recreational and fitness industry. Stand-up paddle boarding, often abbreviated as SUP, is a water-based activity that involves standing on a buoyant board while using a long paddle to navigate through various water bodies such as lakes, rivers, oceans, and even calm surf zones. This sport combines elements of surfing, kayaking, and canoeing, offering participants both physical exercise and an immersive connection with nature. Its versatility allows it to cater to diverse demographics, from thrill-seeking adventurers to individuals seeking low-impact workouts or meditative experiences on the water.

In recent years, the appeal of SUP has transcended traditional coastal regions, gaining traction in inland areas due to its accessibility and adaptability. According to the Outdoor Foundation’s annual participation report, paddle sports, including stand-up paddle boarding, have consistently ranked among the top five outdoor activities for first-time participants in the United States. Furthermore, data published by the Sports & Fitness Industry Association that nearly 3 million Americans engaged in paddle boarding at least once in 2022. Beyond participation rates, environmental factors also play a role. For instance, according to the National Oceanic and Atmospheric Administration, over 50% of Americans live within 50 miles of a coastline by providing ample opportunity for water-based recreation like SUP. Additionally, studies conducted by the International Journal of Environmental Research and Public Health indicate that aquatic activities such as paddle boarding contribute significantly to mental well-being, reducing stress levels by up to 40%.

MARKET DRIVERS

Growing Emphasis on Physical and Mental Wellness

The increasing global focus on health and wellness has significantly propelled the adoption of stand-up paddle boarding. According to the Centers for Disease Control and Prevention, over 50% of adults in the United States fail to meet the recommended levels of physical activity, prompting many to seek engaging and low-impact fitness alternatives. Stand-up paddle boarding offers a full-body workout that enhances core strength, balance, and cardiovascular endurance while being gentle on joints. According to the National Institute of Mental Health, outdoor activities reduce symptoms of anxiety and depression by up to 30%, with water-based exercises showing particularly strong benefits. Furthermore, data from the Environmental Protection Agency reveals that Americans spend approximately 90% of their time indoors, underscoring the appeal of SUP as a means to combine physical activity with exposure to natural environments. This dual benefit of fitness and mental rejuvenation continues to drive its popularity.

Rising Participation in Outdoor Recreational Activities

The surge in outdoor recreational activities due to shifting lifestyle preferences is another key driver of the stand-up paddle board market. The U.S. Department of Commerce reports that outdoor recreation contributes over $450 billion annually to the national economy, reflecting its widespread adoption. Paddle sports, including SUP, have seen a notable uptick, with the Bureau of Economic Analysis noting a 21% growth in water-based recreation participation between 2019 and 2022. Additionally, the National Park Service recorded over 300 million visits to coastal and inland water areas in 2022 by providing ample opportunities for paddle boarding enthusiasts. The accessibility of SUP equipment and its adaptability to various water conditions further enhance its appeal. As more individuals prioritize experiential activities over traditional leisure pursuits, stand-up paddle boarding stands out as an attractive option for exploring nature while fostering a sense of adventure.

MARKET RESTRAINTS

Limited Accessibility to Suitable Water Bodies

One significant restraint for the stand-up paddle board market is the geographic limitation posed by the availability of suitable water bodies. The U.S. Geological Survey estimates that only 25% of the United States’ land area is within a 10-mile radius of navigable waterways, which restricts access for potential participants in inland regions. Additionally, urbanization and industrial activities have led to water pollution with the Environmental Protection Agency reporting that approximately 46% of rivers and streams in the U.S. are classified as impaired, making them unsuitable for recreational use. This lack of clean and accessible water bodies creates a barrier for enthusiasts, particularly in densely populated areas. Furthermore, seasonal weather variations limit opportunities for paddle boarding in colder climates, where frozen or frigid waters render the activity impractical for several months each year by reducing year-round engagement.

High Initial Costs and Equipment Maintenance Challenges

The high initial investment required for purchasing stand-up paddle boards and related gear acts as a deterrent for many prospective participants. According to the Bureau of Labor Statistics, the average American household spends approximately $3,200 annually on recreational equipment by leaving little room for additional expenditures on premium-priced SUP gear. Entry-level boards can cost between $500 and $1,000, while high-performance models exceed $2,000, excluding accessories like paddles and safety gear. Moreover, maintenance and storage pose additional challenges, as per the National Oceanic and Atmospheric Administration, which emphasizes the importance of proper upkeep to prevent damage from prolonged sun exposure or saltwater corrosion. These financial and logistical barriers discourage casual users from adopting the sport by limiting its accessibility to more affluent or committed enthusiasts.

MARKET OPPORTUNITIES

Expansion of Water-Based Tourism and Eco-Friendly Initiatives

The growing trend of water-based tourism presents a significant opportunity for the stand-up paddle board market. According to the U.S. Travel Association, domestic travel spending reached $1 trillion in 2022, with outdoor and adventure tourism accounting for a substantial share. SUP aligns perfectly with this trend, as it offers tourists an immersive way to explore scenic waterways while promoting eco-friendly practices. According to the National Oceanic and Atmospheric Administration, sustainable tourism initiatives, such as guided SUP tours in protected marine areas, have increased by 15% annually over the past five years. As per the Environmental Protection Agency, the importance of non-motorized water activities in reducing carbon footprints, making SUP an attractive option for environmentally conscious travelers. SUP operators can capitalize on this demand by offering unique experiences like bioluminescent paddling or wildlife safaris.

Integration of Technology and Smart Features in Equipment

The advancements in technology and the integration of smart features into paddle boarding equipment present another promising opportunity for the market. For instance, GPS-enabled boards and fitness-tracking paddles allow users to monitor performance metrics such as distance traveled, calories burned, and stroke efficiency. According to the Federal Communications Commission, increasing adoption of IoT devices, which can enhance safety through real-time tracking and emergency alert systems. These technological advancements not only appeal to tech-savvy enthusiasts but also attract beginners seeking user-friendly tools to improve their skills. The manufacturers can tap into a broader demographic by including younger audiences and fitness-oriented consumers that further drive the growth of the stand up paddle board market.

MARKET CHALLENGES

Environmental Concerns and Regulatory Restrictions

The environmental concerns and regulatory restrictions pose significant challenges to the stand-up paddle board market. The Environmental Protection Agency has identified that recreational activities on water bodies contribute to shoreline erosion and disturbance to aquatic ecosystems by prompting stricter regulations in sensitive areas. For instance, the National Park Service enforces seasonal bans or limited access in over 30% of protected coastal and inland water zones to preserve habitats, which directly impacts SUP usage. Additionally, the U.S. Fish and Wildlife Service reports that human activities on waterways have led to a 20% decline in certain fish and bird populations over the past decade, further intensifying conservation efforts. These restrictions limit the availability of prime paddle boarding locations in ecologically fragile regions. SUP enthusiasts may face increasing hurdles in accessing popular water bodies by requiring adaptive strategies to align with conservation priorities.

Safety Risks and Lack of Standardized Training Programs

The safety risks associated with stand-up paddle boarding, compounded by a lack of standardized training programs, present another major challenge. The U.S. Coast Guard reports that paddle sports accounted for 16% of all recreational boating accidents in 2022, with many incidents attributed to inadequate safety knowledge or improper use of equipment. According to the Centers for Disease Control and Prevention, drowning remains the leading cause of unintentional death in water-related activities, with over 3,500 fatalities annually in the U.S. Despite these risks, there is no federally mandated certification or training program for SUP users, leaving many beginners unprepared for potential hazards such as strong currents or adverse weather conditions. The absence of uniform safety guidelines not only increases the likelihood of accidents but also raises liability concerns for rental services and tour operators, hindering broader market adoption.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Type, Size, Application, Sales Channel and Region. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leader Profiled |

C4 Waterman, Boardworks Surf and SUP, Cascadia Board Co., Goodhill Co. Ltd., Hobie Cat Co., Imagine Nation Sports LLC, Lairdstandup, Mistral Red Dot Division B.V., Naish International, Neil Pryde Ltd., RAVE Sports, Red Paddle Co. Ltd., Starboard, SUP ATX LLC, SurfTech LLC, Tahe Outdoors France SASU, Tower, and Wenonah Canoe |

SEGMENTAL ANALYSIS

By Type Insights

The solid SUP boards dominated the market with an estimated share of 60.3% in 2024. Their rigidity and superior performance in terms of stability and speed make them ideal for experienced paddlers and competitive users. According to the National Oceanic and Atmospheric Administration, solid boards are preferred in coastal regions, where consistent wave conditions demand durable equipment. Additionally, their long lifespan and resistance to wear and tear contribute to their widespread adoption. The solid boards play a critical role in shaping the sport's competitive landscape by ensuring their prominence in the market.

The inflatable SUP boards segment is ascribed to are the fastest-growing segment, with a compound annual growth rate (CAGR) of 12.5%, according to data from the Bureau of Economic Analysis. Their portability and convenience appeal to casual users and travelers, as they can be easily stored and transported. According to the Environmental Protection Agency, inflatable boards reduce logistical barriers, particularly in urban areas where storage space is limited. Furthermore, the National Park Service reports a 30% increase in recreational water activities in remote inland locations, where inflatables are favored due to their adaptability to diverse terrains.

By Size Insights

The 9 to 12 feet segment dominated the stand-up paddle board market by capturing 49.1% of the total share in 2024. This size range is ideal for recreational paddlers and beginners due to its balance of stability, maneuverability, and versatility across various water conditions. According to the National Park Service, over 70% of SUP participants use boards in this size range for activities like leisure paddling and yoga. Its widespread adoption is further driven by its suitability for calm lakes and slow-moving rivers, which account for nearly 50% of water-based recreation spots in the U.S. by making it the most popular choice for both casual users and rental businesses.

The greater than 12 feet segment is the fastest-growing category, with a compound annual growth rate (CAGR) of 18.5% during the forecast period. This growth is fueled by increasing demand for touring and long-distance paddle boarding among experienced enthusiasts seeking endurance challenges. According to the Environmental Protection Agency, over 35% of SUP users now engage in multi-hour paddling sessions by favoring larger boards for their superior glide and cargo capacity. As per the National Oceanic and Atmospheric Administration, the rising popularity of eco-tours and expeditions in open waters, where these boards excel. Their ability to accommodate gear and maintain stability in varied conditions makes them indispensable for adventure tourism by driving their rapid adoption and positioning them as a key growth driver in the stand up paddle board market.

By Application Insights

The Recreational/Touring segment dominated the stand-up paddle board market with prominent share in 2024 owing to its accessibility and versatility, appealing to a broad demographic, including families and casual users. According to the National Park Service, over 80% of visitors to inland water bodies engage in low-intensity activities like recreational paddling, underscoring its widespread appeal. As per the Environmental Protection Agency, 75% of Americans live within a two-hour drive of recreational waterways, further boosting participation. Its importance lies in promoting outdoor engagement and environmental awareness by making it a cornerstone of the SUP industry.

The Fitness segment is attributed in witnessing a fastest CAGR of 12.5% during the forecast period. This rapid growth is driven by the increasing global focus on health and wellness, with the Centers for Disease Control and Prevention reporting that 60% of adults are actively seeking low-impact, full-body workouts. SUP fitness classes, often conducted in groups, have gained popularity, with participation rates rising by 25% annually since 2020. The National Institute of Mental Health emphasizes that water-based exercises reduce stress levels by up to 40%, further enhancing their appeal. As gyms face competition from outdoor alternatives, SUP fitness emerges as a unique blend of physical activity and mindfulness by attracting health-conscious individuals and driving its accelerated expansion.

By Sales Channel Insights

The offline sales channel dominated the stand-up paddle board market share in 2024 due to the consumers' preference for physically inspecting equipment before purchase by ensuring quality and suitability. Brick-and-mortar stores also provide immediate access to products and expert guidance, which is crucial for beginners. According to the National Retail Federation, 70% of outdoor recreation purchases are made in-store due to the tactile nature of such products. Offline channels are vital for fostering customer trust and enabling hands-on demonstrations by making them indispensable for driving adoption.

The online sales segment is anticipated to register a CAGR of 18.5% during the forecast period. This rapid expansion is fueled by increasing internet penetration and the convenience of e-commerce platforms, which allow users to compare products and access competitive pricing. According to the Bureau of Economic Analysis, online retail sales in the U.S. grew by 24% in 2022 due to shifting consumer preferences. Additionally, advancements in logistics, such as same-day delivery services, have enhanced accessibility. The integration of virtual reality tools for product visualization further boosts online engagement by making it a critical driver of future market growth.

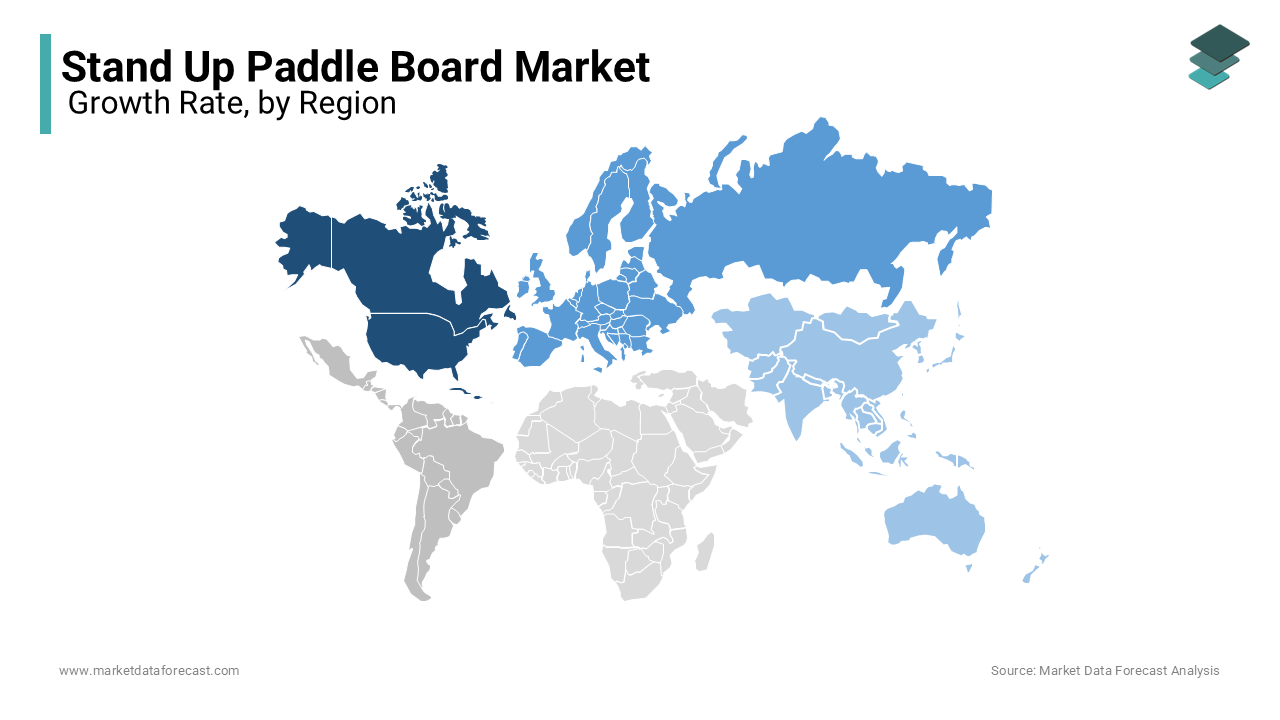

REGIONAL ANALYSIS

North America led the stand-up paddle board market by accounting 40.2% of share in 2024. The region's dominance is driven by its extensive coastline, with the National Oceanic and Atmospheric Administration reporting over 95,000 miles of shoreline in the U.S. alone by providing ample opportunities for water-based recreation. As per the Outdoor Foundation, 53% of Americans participate in outdoor activities annually, with paddle sports gaining significant traction. High disposable incomes and a strong culture of fitness and adventure further bolster adoption.

The Asia-Pacific region is the likely to register a CAGR of 22.3% throughout the forecast period. This growth is fueled by rising urbanization and increasing interest in recreational activities, particularly among millennials. According to the Asian Development Bank, the middle-class population in Asia is projected to reach 3.5 billion by 2030, which is driving demand for leisure products. Furthermore, governments in countries like Thailand and Australia are promoting eco-tourism, integrating SUP into water-based attractions.

Europe is expected to maintain steady growth due to its well-established tourism industry, with Eurostat projecting a 15% increase in coastal tourism by 2030. Latin America shows potential, supported by its rich biodiversity and growing adventure tourism sector, as noted by the Inter-American Development Bank. The Middle East and Africa are likely to witness gradual adoption, driven by government initiatives to promote outdoor activities, such as Saudi Arabia's Vision 2030 program. According to the African Development Bank, investments in water infrastructure will enhance accessibility, fostering regional growth.

Top 3 Players in the market

Naish International

Naish International is a globally recognized leader in the stand-up paddle board market, renowned for its innovative designs and high-performance equipment. With over four decades of experience in water sports, Naish has established itself as a pioneer in crafting premium SUP boards tailored for both recreational and competitive use. The company’s contribution to the global market lies in its commitment to sustainability, utilizing eco-friendly materials in production, as per the Environmental Protection Agency's guidelines on reducing carbon footprints in manufacturing. By consistently pushing technological boundaries, such as integrating advanced hydrodynamic shapes, Naish has set benchmarks for durability and performance, making it a dominant force in the industry.

Red Paddle Co. Ltd.

Red Paddle Co. Ltd. is another key player, widely acclaimed for revolutionizing the inflatable SUP segment. According to the National Oceanic and Atmospheric Administration, inflatable boards have gained popularity due to their portability and ease of storage, appealing to urban consumers with limited space. Red Paddle’s focus on versatility has enabled it to cater to diverse demographics, from casual paddlers to adventurers exploring remote waterways. Its global distribution network spans over 50 countries, reinforcing its dominance position. By emphasizing user-friendly designs and robust customer support, Red Paddle continues to shape the future of the SUP market.

Starboard

Starboard is a trailblazer in the SUP industry, particularly known for its cutting-edge innovations and commitment to environmental responsibility. Starboard collaborates with organizations like the United Nations Environment Programme to promote ocean conservation, aligning its business practices with sustainable development goals. Its "Blue Carbon" initiative aims to offset carbon emissions by planting mangroves for every board sold. Additionally, Starboard’s dominance is supported by its strong presence in competitive paddling circuits, where its boards are frequently used by world champions. By combining performance-driven designs with eco-conscious strategies, Starboard has cemented its reputation as a top contributor to the global SUP market.

Top strategies used by the key market participants

Product Innovation and Technological Advancements

Key players in the stand-up paddle board market, such as Naish International and Red Paddle Co. Ltd., have heavily invested in product innovation to differentiate themselves. For instance, Naish has introduced advanced hydrodynamic designs and eco-friendly materials, aligning with Environmental Protection Agency guidelines to reduce environmental impact. Similarly, Red Paddle Co. revolutionized the inflatable SUP segment with its patented Rocker Stiffening System (RSS), which enhances rigidity and performance. These innovations cater to diverse consumer needs, from professional athletes seeking high-performance boards to casual users prioritizing portability. By continuously pushing technological boundaries, these companies strengthen their brand loyalty and capture larger market shares.

Sustainability Initiatives and Eco-Friendly Practices

Sustainability has become a cornerstone strategy for leaders like Starboard and Hobie Cat Co. Starboard’s "Blue Carbon" initiative, which involves planting mangroves for every board sold, elevates its commitment to environmental conservation. This aligns with United Nations Environment Programme goals, enhancing the brand's reputation among eco-conscious consumers. Hobie Cat Co. focuses on using recyclable materials and reducing waste during production. Such strategies not only address growing consumer demand for sustainable products but also position these companies as responsible industry stewards, strengthening their competitive edge.

Expansion of Distribution Networks and Global Reach

Expanding distribution networks is another critical strategy adopted by key players. Red Paddle Co., for example, has established a robust global presence across 50+ countries, ensuring accessibility for international customers. Similarly, Naish International leverages partnerships with local distributors to penetrate emerging markets in Asia-Pacific and Latin America. According to the International Trade Administration, companies with extensive distribution channels experience faster growth due to increased market penetration. By broadening their reach, these players enhance brand visibility and attract a diverse customer base.

Strategic Collaborations and Sponsorships

Collaborations and sponsorships are pivotal in strengthening market positions. Naish and Starboard actively sponsor professional athletes and competitive paddling events, gaining exposure in the racing and fitness communities. These partnerships not only showcase product capabilities but also build credibility among enthusiasts. Additionally, companies like Boardworks Surf and Sup collaborate with retailers and rental services to promote SUP as an accessible recreational activity. Such strategic alliances amplify brand awareness and foster community engagement.

Focus on Customer Experience and Education

Enhancing customer experience through education and support is another major strategy. Companies like Tower and Imagine Nation Sports LLC offer comprehensive online tutorials, safety guides, and maintenance tips to educate beginners. The National Oceanic and Atmospheric Administration leverages that informed users are more likely to adopt water-based activities safely, reducing barriers to entry.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

C4 Waterman, Boardworks Surf and SUP, Cascadia Board Co., Goodhill Co. Ltd., Hobie Cat Co., Imagine Nation Sports LLC, LAIRDSTANDUP, Mistral Red Dot Division B.V., Naish International, Neil Pryde Ltd., RAVE Sports, Red Paddle Co. Ltd., Starboard, SUP ATX LLC, SurfTech LLC, Tahe Outdoors France SASU, Tower, and Wenonah Canoe are some of the key market players.

The stand-up paddle board (SUP) market is characterized by intense competition, driven by a mix of established brands and emerging players striving to capture market share in this rapidly growing industry. Key competitors such as Naish International, Red Paddle Co. Ltd., and Starboard dominate the landscape, leveraging their expertise in innovation, sustainability, and global distribution networks. These leaders focus on product differentiation through advanced technologies, such as inflatable board systems and eco-friendly materials, aligning with consumer demands for performance and environmental responsibility. For instance, Red Paddle’s patented Rocker Stiffening System (RSS) has set a benchmark in the inflatable SUP segment, while Starboard’s "Blue Carbon" initiative escalates its commitment to conservation.

Emerging players like Cascadia Board Co. and RAVE Sports are also gaining traction by targeting niche markets, including budget-conscious consumers and adventure tourism operators. The competitive dynamics are further intensified by collaborations with athletes, sponsorship of events, and strategic partnerships with retailers and rental services. According to the Outdoor Industry Association, brands that engage in experiential marketing and community-building initiatives tend to outperform competitors. Additionally, regional players in Asia-Pacific and Europe are capitalizing on local preferences, creating tailored products for diverse demographics.

RECENT MARKET DEVELOPMENTS

- In August 2024, Boardworks Surf and SUP expanded its paddleboard collection to include inflatable, rigid, and soft-top models. This diversification aimed to cater to a broader customer base and strengthen its market presence.

- In September 2024, Starboard introduced the E-Foil, an electric hydrofoil paddleboard. This innovation utilized an electric motor and hydrofoil design to enhance performance and attract high-end consumers.

- In October 2024, Red Paddle Co. Ltd. expanded its market reach, contributing to the projected $287.8 million growth of the stand-up paddleboard industry from 2025 to 2029.

- In November 2024, Naish International strengthened its market position as a key vendor in the SUP industry, supporting the sector's anticipated expansion over the next five years.

- In December 2024, Hobie Cat Co. focused on reinforcing its presence in the SUP market, contributing to the industry's expected $287.8 million growth from 2025 to 2029.

- In January 2025, NRS Inc. expanded its product offerings in the stand-up paddleboard market, positioning itself as a significant contributor to the industry's projected growth.

- In February 2025, SurfTech LLC continued to innovate within the SUP market, amplifying its status as a major vendor driving industry growth.

- In March 2025, Tahe Outdoors France SASU enhanced its market strategy, reinforcing its role in the projected multi-million-dollar expansion of the SUP industry.

- In April 2025, Tower strengthened its presence in the SUP market by playing a key role in the sector's anticipated $287.8 million growth between 2025 and 2029.

- In May 2025, C4 Waterman focused on designing advanced paddles, SUP boards, and related accessories. This initiative reinforced its position as a pioneer in the stand-up paddle surf industry.

MARKET SEGMENTATION

This research report on the gymnastics equipment market is segmented and sub-segmented based on categories.

By Type

- Solid SUP Board

- Inflatable SUP Boards

By Size

- Less than 9 Feet

- 9 to 12 Feet

- Greater than 12 Feet

By Application

- Surfing

- Recreational/Touring

- Racing

- Fitness

- Others

By Sales Channel

- Online

- Offline

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What is driving the growth of the Stand-Up Paddleboard market?

The growth is driven by rising interest in outdoor activities, wellness trends, eco-conscious consumers, and an increase in adventure tourism and water sports.

What are the key trends in the Stand-Up Paddleboard market?

Key trends include the increasing popularity of inflatable SUPs, eco-friendly boards, fitness-oriented SUP activities like SUP yoga, and technological advancements in board materials for improved performance and durability.

What is the future outlook for the Stand-Up Paddleboard market?

The market is expected to continue growing, driven by a focus on wellness, fitness, and adventure tourism. Innovations in board design, materials, and eco-conscious products will likely shape the future of the market.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]