Global Subsea Tree Market Size, Share, Trends, & Growth Forecast Report By Product (Vertical Subsea Trees and Horizontal Subsea Tree), by Application (Depth (max) <1,000 Meters and Depth (max) >1,000 Meters) & Region, Industry Forecast From 2024 to 2033

Global Subsea Tree Market Size

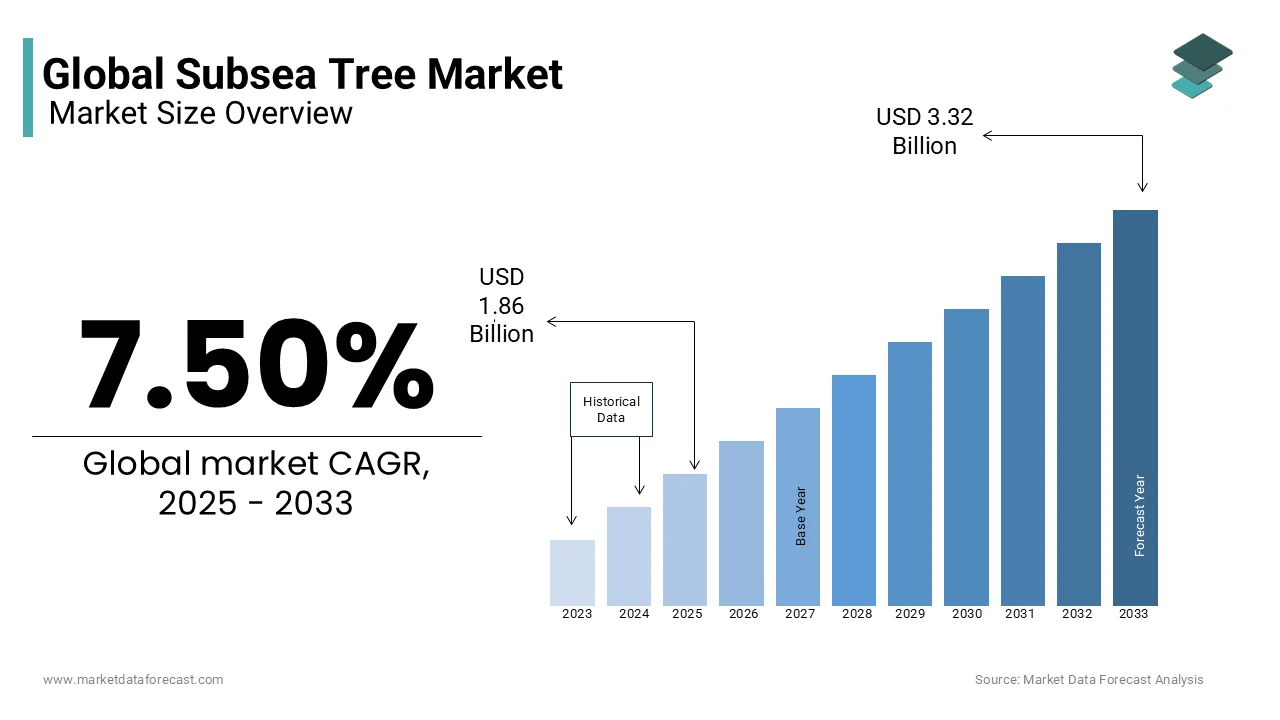

The global subsea tree market size is estimated at USD 1.73 billion in 2024 and is projected to reach a valuation of USD 3.32 billion by 2033 from USD 1.86 billion in 2025, and growing at a CAGR of 7.50% during the forecast period 2025-2033.

The subsea tree is a configuration of complex valves and components installed at the wellhead to control and monitor the production flow and regulate the injection of gas or fluids. It has become an essential part of offshore installations. Subsea trees are controlled and monitored by umbilicals suspended in the form of a catenary and protected in splash zones by tubes attached to the structure. The main purpose of the subsea tree is to control the flow and injection of chemicals and water. The submarine constitutes two types of subsea trees, horizontal and vertical. In a horizontal subsea tree, tube support is installed in the well body instead of the wellhead. On the other hand, the main valves are configured on the tube support in a submarine vertical axis.

MARKET TRENDS

The oil and gas industry is moving to deeper regions in search of oil and gas to meet the rising call. Therefore, the share of subsea production systems is predicted to be the largest among subsea tree segments and further drive the market. As the call for energy grows rapidly, several countries' large companies and investors are looking to deep water because it offers the potential of a guaranteed supply of oil and gas for a few decades. However, this requires advanced technologies to produce oil and gas reserves buried thousands of meters deep on the ocean floor, increasing the need for subsea trees to increase recovery and reduce total cost.

MARKET DRIVERS

Increased offshore drilling activity due to increased demand for oil and gas worldwide is likely to drive the global subsea tree market.

Rapid industrialization and globalization are also supposed to stimulate the call for oil and gas from various end users. Escalating exploration and new discoveries of deep and ultra-deepwater oil and gas reservoirs are driving the market for subsea trees. BP's recent discovery of more than 1 billion barrels of oil at its Thunder Horse field in the Gulf of Mexico is likely to lead to exploration and drilling operations spanning several years. The rising focus on managing capital expenditures for offshore development and the recovery in oil prices will drive the subsea tree market. The increasing implementation of restraint systems and the escalating popularity of the equipment among operators will increase the prospects of the industry. The architecture enables companies to utilize the existing platform, pipelines, and infrastructure, with potential new projects tied to the old platform.

MARKET RESTRAINTS

The low price of crude oil on the international market is a limitation for the subsea tree market. The continuing drop in oil prices has led to massive cuts in exploration and production spending by major oil companies around the world. Expensive offshore projects are thought of twice, taking into account the prevailing scenario.

MARKET OPPORTUNITIES

Escalating investments in offshore exploration and production activities, as well as a substantial reduction in operating costs through continuous technological advancements, will drive the subsea tree market.

Greater use of efficient monitoring and control systems, as well as robust development of automated devices, will complete the business landscape. Also, strict government standards and industry requirements to ensure safe oil production and operations in deep and ultra-high reservoirs will affect the expansion of the industry. Rapid deep-sea discoveries coupled with growing energy call in emerging countries will drive the subsea equipment market. Most of the producing onshore wells have reached maturity, causing a drop in production. As a result, industry players are focusing on developing offshore fields that drive call for products.

MARKET CHALLENGES

The high price of installing subsea trees along with the risks related to offshore drilling is predicted to limit the expansion of the subsea trees industry.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

7.50% |

|

Segments Covered |

By Product, Application, and Region. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Baker Hughes Company, TechnipFMC plc, Aker Solutions, Schlumberger Limited, Solar Alert Sdn Bhd., Delta Corp Ltd, Worldwide Oilfield Machine, The Weir Group PLC, Dril-Quip, Inc., Kingsa Industries (USA), Inc, and Others. |

REGIONAL ANALYSIS

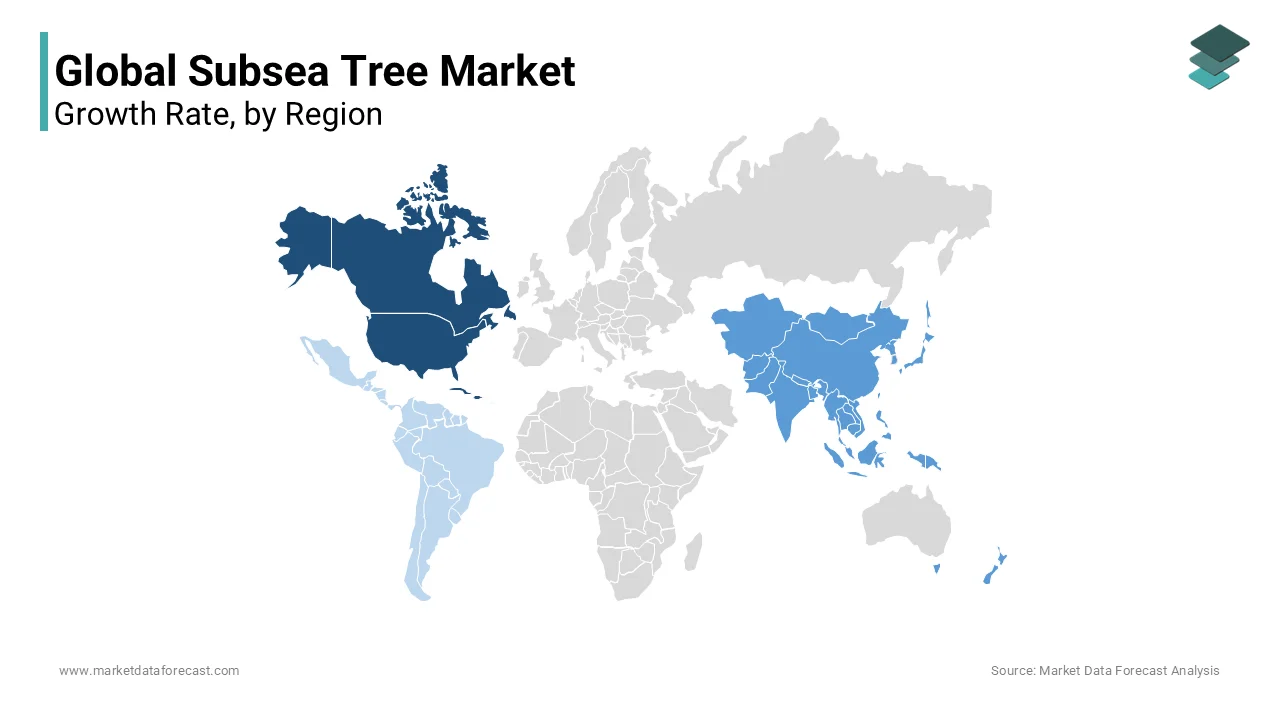

North America dominated the worldwide subsea tree market in 2024. The trend is estimated to continue during the conjecture period due to the discovery of shale gas reserves in the United States and the presence of a large number of private oil companies in the region. Europe is predicted to represent a key part of the worldwide subsea tree market during the outlook period. The North Sea has a large number of offshore platforms installed. The Asia-Pacific market is expected to grow at a sustained pace due to increased offshore exploration activities and increased investment in power generation activities. The Middle East and Africa have significant onshore and offshore oil reserves. Discoveries and development offshore, especially in the Red Sea region, by countries such as Qatar, the United Arab Emirates, and Saudi Arabia are predicted to boost the market for subsea trees in the region. The Latin American market is anticipated to develop at a slow pace during the envisioned period.

Increased deep-water drilling activity coupled with higher safety and security spending in Norway and the UK is predicted to drive market expansion in the region. Europe was followed by the Middle East and Africa (MEA) region. It is expected to be the fastest-growing region for the market during the foreseen period. In this region, Saudi Arabia and the United Arab Emirates are the largest oil and gas exporters and plan to further expand their oil and gas production infrastructure.

KEY PLAYERS IN THE MARKET

Companies playing a prominent role in the global subsea tree market include Baker Hughes Company, TechnipFMC plc, Aker Solutions, Schlumberger Limited, Solar Alert Sdn Bhd., Delta Corp Ltd, Worldwide Oilfield Machine, The Weir Group PLC, Dril-Quip, Inc., Kingsa Industries (USA), Inc, and Others.

RECENT HAPPENINGS IN THE MARKET

- GE and VetcoGray continue to expand the use of the SemStar 5 to power the ModPodsubsea control module and extend its modular design and proven technology employed in the SVXT Shallow-Water S-Series shaft.

- Aker Solutions introduces the latest workover system for offshore fields. The modified workover system will let safe access to the wells for subsea installation and completion.

MARKET SEGMENTATION

This global subsea tree market research report has been segmented and sub-segmented based on product, application, and region.

By Product

- Vertical Subsea Trees

- Horizontal Subsea Trees

By Application

- Depth (max) <1,000 Meters

- Depth (max) >1,000 Meters

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Frequently Asked Questions

How does the global shift toward renewable energy affect the subsea tree market?

The global shift toward renewable energy sources has had a mixed impact on the subsea tree market. While there is a growing focus on renewable energy, the subsea tree market continues to benefit from ongoing oil and gas exploration projects, especially in deep-water regions. However, the market may face slower growth in the long term as renewable energy technologies, such as offshore wind and solar, gradually take precedence.

What technological advancements are shaping the subsea tree market?

Technological advancements such as improved materials for subsea trees, better control systems, and remote monitoring capabilities are shaping the subsea tree market. Innovations like autonomous subsea systems, increased automation in tree operations, and enhanced reliability are allowing oil and gas companies to access harder-to-reach fields more efficiently and safely.

How are environmental regulations influencing the subsea tree market?

Stricter environmental regulations, particularly in Europe and North America, are leading to the development of subsea trees that are more environmentally friendly. These regulations promote the use of technologies that minimize leaks, prevent contamination, and reduce the environmental impact of offshore drilling. Companies are increasingly focused on designing subsea trees that adhere to these evolving standards.

How does the subsea tree market impact the global supply chain for oil and gas?

The subsea tree market is integral to the global supply chain of oil and gas, as subsea trees are key components of the subsea production systems. Delays in subsea tree manufacturing or installation can slow down production timelines for offshore projects, which may impact global oil and gas supply. As a result, oil companies are increasingly focused on ensuring a smooth supply chain for subsea tree manufacturing and maintenance.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]