Global Traction Inverter Market Size, Share, Trends, and Growth Forecast Report – Segmented By Vehicle Type (Passenger cars, Commercial vehicles, And Two-wheelers), Electric Vehicle (Battery Electric Vehicles (BEVs), Plug-in Hybrid Electric Vehicles (PHEVs), And Hybrid Electric Vehicles (HEVs)), End-User Type (Original equipment manufacturers (OEMs), Automotive manufacturers, and aftermarket suppliers) and Region (North America, Europe, Asia Pacific, Latin America, and Middle East - Africa) – Industry Analysis 2024 to 2032

Global Traction Inverter Market Size (2024 to 2032)

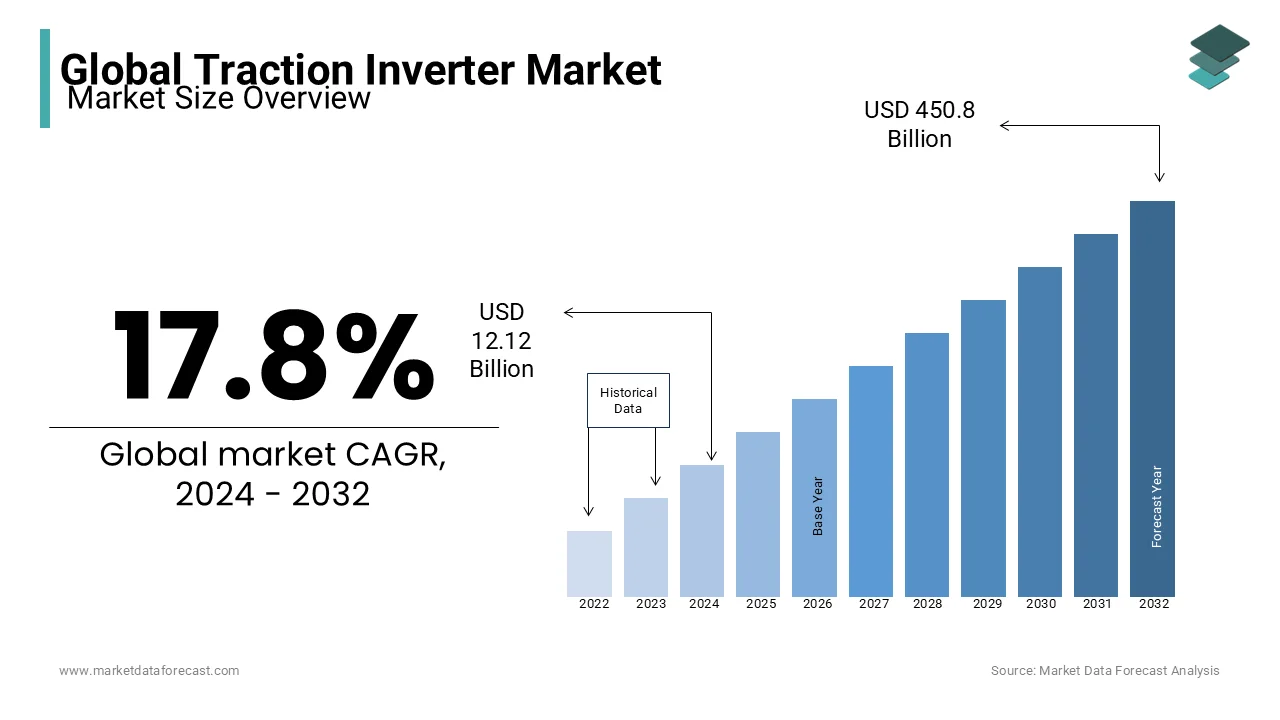

The global traction inverter market was valued at USD 10.32 billion in 2023 and is anticipated to reach USD 12.12 billion in 2024 from USD 450.8 billion by 2032, growing at a CAGR of 17.8% from 2024 to 2032.

The growing adoption of silicon carbide (SiC) is fuelling the demand for traction inverters. Companies are replacing their traditional silicon with SiC in inverters. It helps to reduce losses, increases efficiency, and enables higher power densities. The demand is also increasing due to the rising acceptance of electric vehicles. Moreover, 70 percent of the requirement is expected to come from EVs. Also, China is projected to account for around 40 percent market share of the total SiC demand for EV manufacturing.

Global Traction Inverter Market Drivers

The growing number of advancements in power electronics and the growth of the charging infrastructure are propelling the traction inverter market growth. The rapid installation of charging stations in both developed and emerging economies eliminates a significant obstacle to the adoption of EVs. Moreover, the market for high-performance traction inverters grows in line with the demand for electric cars. This is because charging infrastructure has become widely available and effective. Strict emission standards are propelling the growth of the traction inverter market. The government rules are forcing companies to shift towards electric propulsion. It wants them to comply with reduced vehicle emissions standards. Thus, the traction inverter market is expanding. Also, many governments are offering incentives like tax breaks or subsidies to promote EV adoption. It further accelerates the shift and amplifies the demand for these inverters. An increase in the demand for electric cars is propelling the traction inverter market growth. EV sales have increased tremendously in China, Europe, and the US. The total number of electric cars globally reached 26 million in 2022, a 60% increase from 2021 due to this growth.

A real-time control MCU is expected to be a potential prospect for companies in the traction inverter market. The demand for MCUs is growing due to the need for a decrease in TI size and weight in EVs. Also, gate drivers are presenting opportunities for boosting market share. The industry has frequently used silicon carbide field-effect transistors (FETs) to increase efficiency. Moreover, many gate drivers integrate circuits to reduce turnon and turnoff energy. It ultimately lowers total switching losses by rapidly turning on and off SiC FETs. The use of smart grid technology is another factor that offers a huge potential to boost market growth. It allows advanced energy management in EVs, which improves the performance of traction inverters. This can also actively adjust to changes in energy needs and variations in real time.

Global Traction Inverter Market Restraints

The traction inverter market growth is hindered by the range restriction of EVs. This is a significant disadvantage from the customer's point of view. Thus, affecting the acceptance of these vehicles. The TI's energy capacity and efficiency are completely related to the operational range. It is directly impacted by issues in battery technology and energy density. While charging facilities have increased as compared to previous years, they are still insufficient to meet the existing demand. The possibility of being stuck due to a lack of charging stations discourages EV customers. It creates a psychological barrier to wider adoption. Therefore, improvements in battery and traction inverter efficiency must be made with the growth of charging infrastructure to boost the market share.

Design challenges are one of the major challenges in front of the traction inverter market. Many suppliers are not currently offering commercially viable higher-voltage SiC devices at 3.3, 6.5, and 10 kV because of market obstacles. Also, increased development costs limit market growth. This is due to complex design and functionality, material limitations, testing, and validation requirements. Temperature and weight limitations of silicon and copper for semiconductors silicon for semiconductors and copper for windings must be explored for alternatives like SiC to increase efficiency.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

CAGR |

17.8% |

|

Segments Covered |

By Vehicle Type, Electric Vehicle Type, End-User Type, and Region. |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Siemens AG, Infineon Technologies AG, Continental AG, Robert Bosch GmbH, Delphi Technologies, Hitachi Automotive Systems, Mitsubishi Electric Corporation, Toshiba Corporation, Fuji Electric Co., Ltd., ABB Ltd, Dana Incorporated, Lear Corporation, Texas Instruments Incorporated, STMicroelectronics, ON Semiconductor |

SEGMENT ANALYSIS

Global Traction Inverter Market Analysis By Vehicle Type

The passenger cars segment is expected to move forward with an elevated market growth rate in the coming years. It holds a substantial portion of the traction inverter market. The segment is growing due to the growing demand for electric passenger vehicles. It is driven by advancements in battery technology, government restrictions, and environmental concerns. Meanwhile, the commercial vehicles segment is growing at a slow pace. This is due to the gradual electrification rate, which affected the adoption rate.

Global Traction Inverter Market Analysis By Electric Vehicle Type

The battery electric vehicles (BEVs) segment accounts for the maximum market share. It is expanding significantly as manufacturers focus on electric mobility. Rechargeable batteries are the only source of power for electric vehicles. It runs completely on electricity. Moreover, there is a growing market trend towards the need for high-efficiency TI to boost BEV performance, more range, and low charging time. Companies are working on BEV technology to meet the changing demands. They emphasize lightweight, compact designs and integration with modern battery management systems.

Global Traction Inverter Market Analysis By End-User Type

The automotive manufacturer's segment is the largest category of the traction inverter market. They directly influence inverter requirements and establish long-term collaborations with inverter manufacturers for consistent supply. These companies maintain market dominance by improving performance, efficiency, and cost optimization through investments in research and development.

REGION ANALYSIS

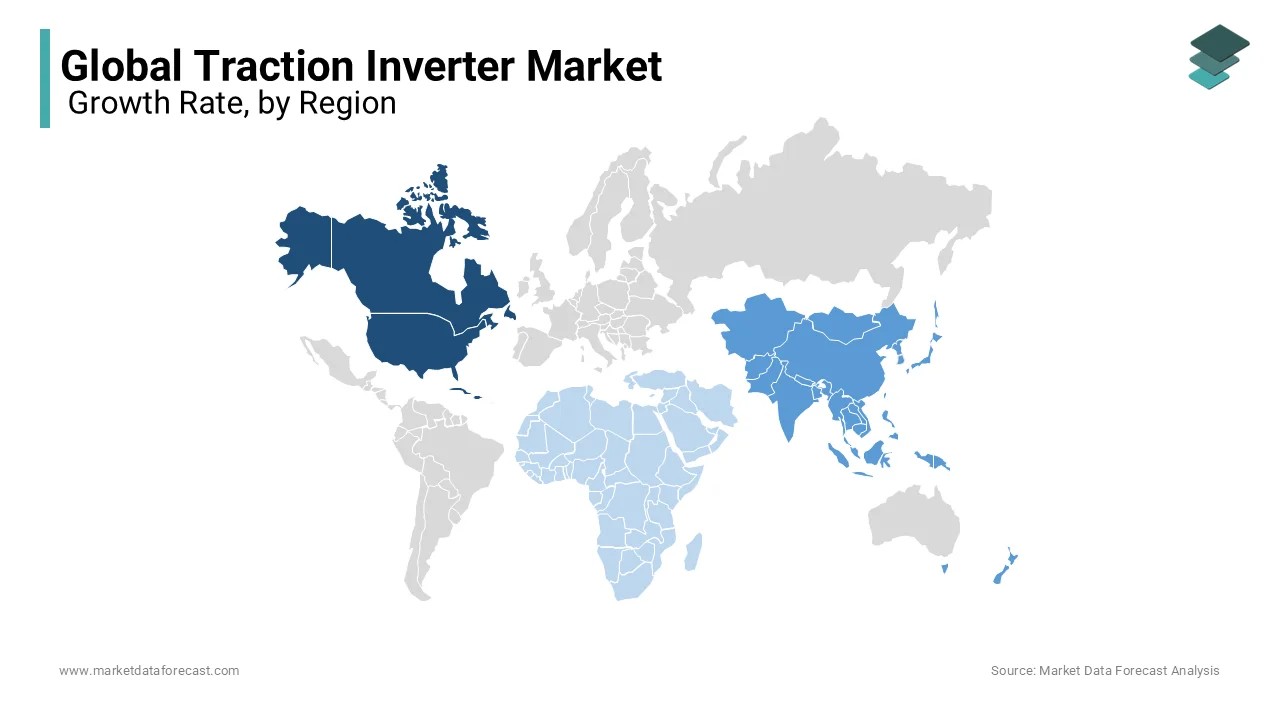

North America holds a substantial share of the traction inverter market. Strong EV adoption and government policies for sustainable transportation are driving the regional market growth rate. Also, large infrastructural investments in EV charging are propelling the demand for TIs. Additionally, the manufacturer's proactive approach to developing EVs is contributing to its dominant position. The market is also propelled by safety concerns; for this, companies are providing features such as enhanced driver aid systems. Furthermore, the need for commercial cars is growing faster. This is due to factors including the development of Amazon's and other e-commerce vehicle fleets along with the increase in logistics and delivery services.

Asia Pacific is projected to achieve a higher market growth rate during the forecast period. The rapid adoption of hybrid and electric vehicles is leading to regional market expansion. The traction inverter market share is also propelled by the strong marketing of EVs by the governments of China, South Korea, and India. They are quickly building a robust ecosystem with supportive policies and initiatives, large charging infrastructure, and partnerships between technology firms and automobile manufacturers. Also, the presence of major traction inverter manufacturers makes it an attractive market.

Europe is experiencing market growth, which is estimated to reach 2.78 billion in 2023. Their stringent emission regulations and rising consumer demand for EVs are taking traction in the inverter market forward. Western Europe has high living standards and a larger GDP. The region's GDP benefited from the car industry's 7 percent contributions. Thus, an increase in EV sales in this area will also drive the market share of traction inverters. In addition, approximately 298 car manufacturing factories were present in Europe. The market for electric cars is rapidly growing. Apart from this, growing fuel prices, a rise in corporate investment, increasing awareness of emission-free transportation, and legal requirements to reduce carbon footprints are propelling the European traction inverter market.

The Middle East and Africa are predicted to propel further at a slower market growth rate. Currently, only a few companies in the Middle East are manufacturing traction inverters for electric vehicles. The regional industry is still in the existence stage when compared to other regions such as Europe and China. However, the increasing development and infrastructure activities in several countries are witnessing a growing demand for commercial vehicles. This is boosting the demand in the MEA traction inverter market.

KEY MARKET PLAYERS

Siemens AG, Infineon Technologies AG, Continental AG, Robert Bosch GmbH, Delphi Technologies, Hitachi Automotive Systems, Mitsubishi Electric Corporation, Toshiba Corporation, Fuji Electric Co., Ltd., ABB Ltd, Dana Incorporated, Lear Corporation, Texas Instruments Incorporated, STMicroelectronics, ON Semiconductor. Some of the major market players are involved in the global traction inverter market.

RECENT HAPPENINGS IN THE GLOBAL TRACTION INVERTER MARKET

- In September 2023, STMicroelectronics will provide BorgWarner with its new MOSFET dice. It is a 750V silicon carbide (Sic) power for BorgWarner's in-house viper-based power module, which is utilized in the inverter platforms of several present and next Volvo Cars electric cars.

- In April 2023, HybridPACK Drive G2 was introduced by Infineon Technologies Ag. It is a new automotive power module. Moreover, It is based on the HybridPACK Drive G1 concept of the B6 integrated package. This provides power and easy use in addition to scalability in the same footprint.

DETAILED SEGMENTATION OF THE GLOBAL TRACTION INVERTER MARKET

This research report on the global traction inverter market is segmented and sub-segmented into the following categories.

By Vehicle Type

- Passenger Cars

- Commercial Vehicles

- Two-Wheelers

By Electric Vehicle Type

- Battery Electric Vehicles (BEVs)

- Plug-in Hybrid Electric Vehicles (PHEVs)

- Hybrid Electric Vehicles (HEVs)

By End-User Type

- Automotive Manufacturers

- Aftermarket Suppliers

- OEMs (Original Equipment Manufacturers)

By Region

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Frequently Asked Questions

What is the current size of the traction inverter market in North America?

The traction inverter market in North America was valued at USD 21.12 billion in 2024.

Which countries in Europe are leading in the adoption of traction inverters for electric vehicles?

Countries like Germany, France, and the Netherlands are leading in the adoption of traction inverters due to supportive government policies and incentives for electric vehicles.

How does the automotive industry in Asia-Pacific contribute to the growth of the traction inverter market?

The booming automotive industry in countries like China, Japan, and South Korea drives the demand for traction inverters in electric and hybrid vehicles, propelling market growth.

What are the key trends shaping the traction inverter market in Latin America?

Trends include the increasing adoption of electric buses, government initiatives to reduce emissions, and the development of charging infrastructure, driving the demand for traction inverters.

How does the transportation sector in India influence the traction inverter market?

The growing demand for electric two-wheelers and three-wheelers in India drives the demand for traction inverters, particularly in urban areas where there is a push for cleaner mobility solutions.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]