Global Wheeled Tractor Machinery Market Size, Share, Trends & Growth Forecast Report By Design (Two Wheeled Tractors And Four Wheeled Tractors), Function (Implement Carrier, Garden Tractor, Earth Moving Tractor, Row Crop Tractors, Utility Tractors, Industrial Tractors, Rotatory Tillers, And Orchard Tractors), And By Region (North America, Europe, Asia Pacific, Latin America, Middle East & Africa) - Industry Analysis (2025 to 2033)

Global Wheeled Tractor Machinery Market Size

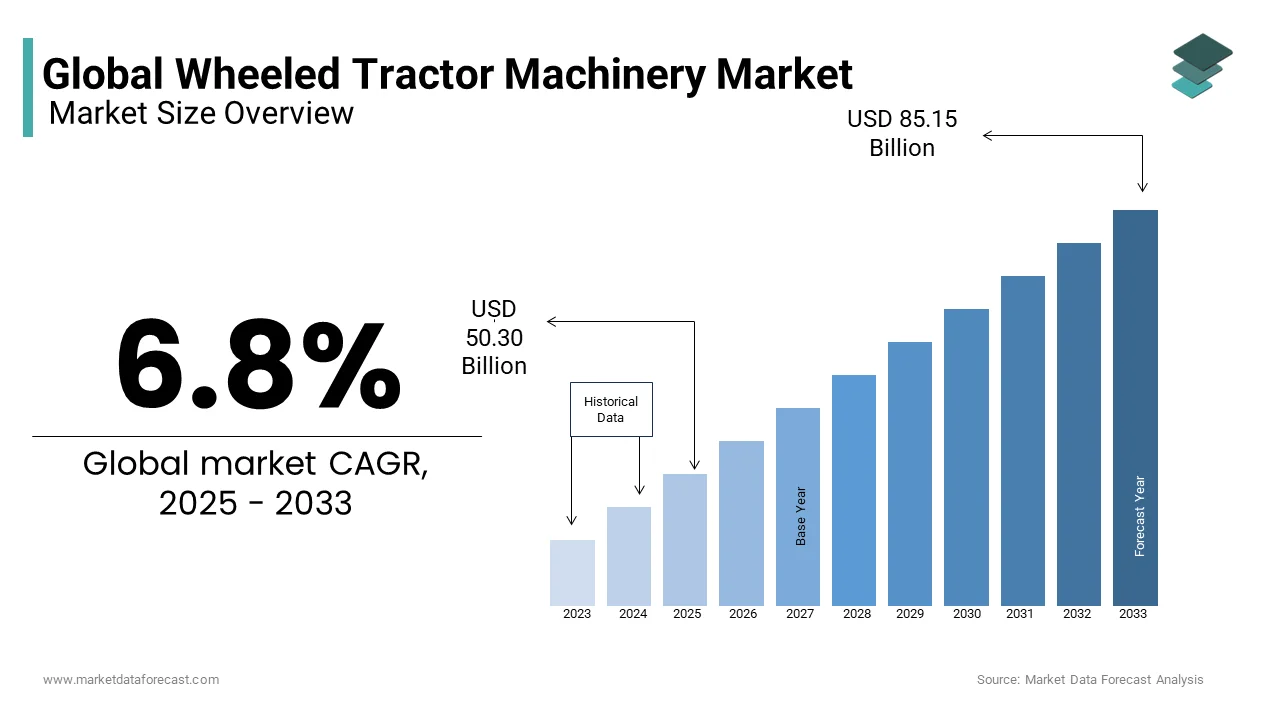

The global wheeled tractor machinery market was valued at USD 47.10 billion in 2024 and is anticipated to reach USD 50.30 billion in 2025 from USD 85.15 billion in 2033, growing at a CAGR of 6.8% during the forecast period from 2025 to 2033.

The global wheeled tractor machinery market is experiencing steady growth. The global market growth is driven primarily by the expansion of agricultural mechanization and the increased demand for efficient farming solutions. Wheeled tractors are essential in various applications, including tilling, plowing, seeding, and hauling, making them crucial for both small- and large-scale farms. As labor shortages persist in several agricultural regions, especially in developed economies, mechanization becomes increasingly necessary. This trend is complemented by government subsidies and initiatives aimed at supporting farmers in emerging economies, encouraging them to adopt advanced machinery. Technological advancements in tractor design, such as GPS-enabled guidance systems, AI-driven precision agriculture, and fuel-efficient engines, are also enhancing productivity and attracting more farmers to invest in modern equipment.

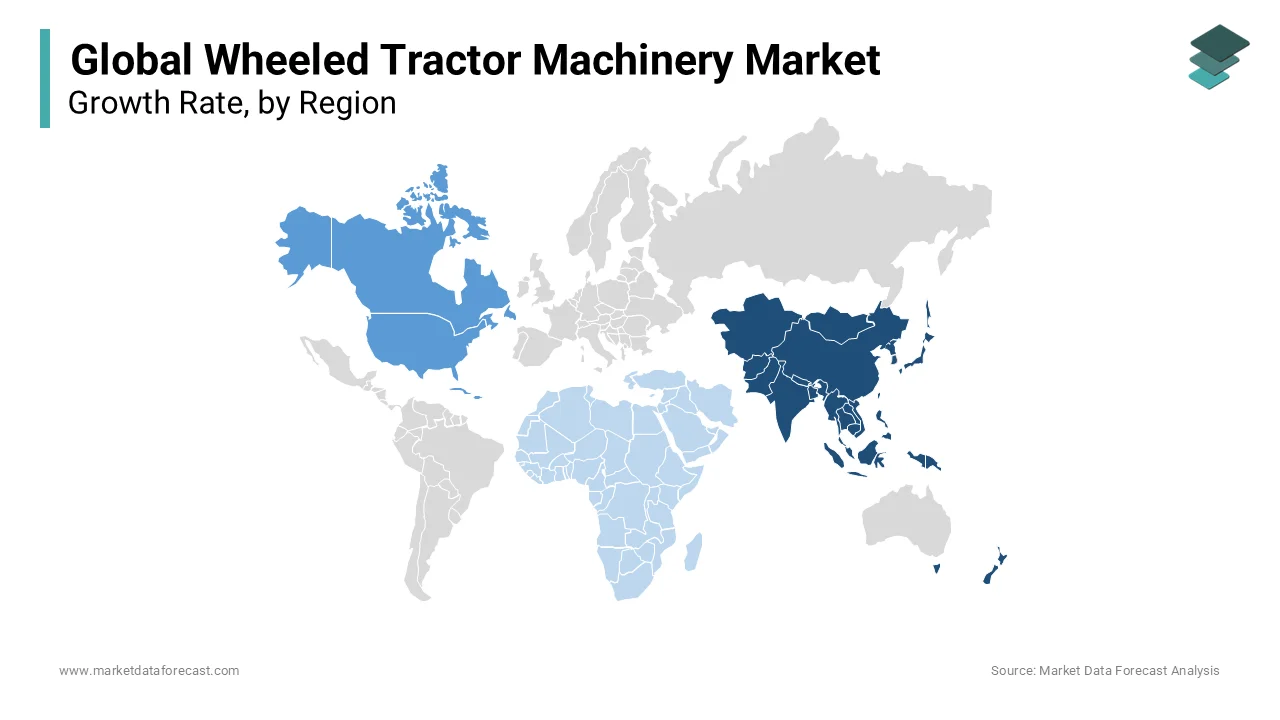

The Asia-Pacific region, led by countries like China and India, dominates the wheeled tractor market due to a large agricultural workforce and increased farm mechanization efforts. Meanwhile, North America and Europe continue to see demand owing to the need for sustainable and technologically advanced machinery.

MARKET DRIVERS

The rising need for agricultural mechanization worldwide is propelling global market growth.

As global food demand rises, efficient farming has become essential. Studies by the Food and Agriculture Organization (FAO) show that mechanized farming can increase productivity by up to 30%, helping farmers manage larger fields with fewer resources. This is crucial in regions with rural labor shortages, where mechanization ensures that farms can operate more productively. Technological advancements in tractors are another major factor contributing to the expansion of the global wheeled tractor machinery market. New technologies are transforming tractors into high-precision machines. For instance, GPS guidance can improve planting accuracy by up to 20%, which further reduces overlap and saves resources. Enhanced engines and automated steering help reduce fuel consumption, making tractors not only more productive but also environmentally friendly. These features appeal to farmers looking for sustainable, efficient equipment.

The support and incentives from the governments of several countries for wheeled tractor machinery are aiding the market growth.

Governments worldwide encourage agricultural mechanization through subsidies, grants, and low-interest loans, especially in developing regions. For example, India's agricultural mechanization schemes have increased equipment adoption among small-scale farmers by nearly 40% in some areas (source: Indian Ministry of Agriculture). This support helps more farmers afford tractors, driving the shift from manual labor to machinery.

MARKET RESTRAINTS

High initial costs associated with the wheeled tractor machinery is the biggest restraint to the global market growth.

The upfront cost of wheeled tractors can be a major barrier, especially for small and medium-scale farmers. According to the World Bank, agricultural equipment often represents one of the largest capital expenses for farmers, which can strain budgets and limit access. This is particularly challenging in developing regions, where farmers may lack access to affordable financing options. High purchase and maintenance costs discourage widespread adoption, as many farmers hesitate to make such investments without guaranteed returns.

The growing fuel costs are further hindering the expansion of the wheeled tractor machinery market.

Tractors are fuel-intensive machines, making them costly to operate as global fuel prices fluctuate. According to a study by the International Energy Agency (IEA), diesel prices impact agricultural machinery costs significantly, often accounting for over 10% of a tractor’s operating expenses. High fuel prices can limit tractor use and make it harder for farmers to justify the purchase. Consequently, fuel dependency affects the total cost of ownership and reduces the economic appeal of tractors for farmers on tighter budgets.

MARKET OPPORTUNITIES

Expansion of precision agriculture is a significant opportunity in the global market.

Precision agriculture technologies, such as GPS and IoT-enabled devices, are increasingly integrated into tractors to enhance efficiency. According to research from the International Society of Precision Agriculture, using precision technologies can improve crop yields by up to 15% through accurate planting and resource application. Farmers are drawn to these tools for reducing waste and optimizing productivity, creating a strong demand for “smart” tractors. As these technologies become more affordable, adoption is expected to increase, particularly among large-scale farms focused on maximizing efficiency and yield.

The Rising environmental concerns, the shift toward electric and hybrid tractors presents a promising opportunity.

The U.S. Department of Agriculture highlights that electric tractors can reduce fuel-related costs by up to 40%, offering a sustainable alternative to traditional models. Leading manufacturers are investing in electric-powered tractor models that promise lower emissions and reduced noise pollution. As energy efficiency becomes a top priority, farmers increasingly consider electric options, particularly in regions with strict emissions regulations and high fuel prices.

MARKET CHALLENGES

Intense competition and price pressure are major challenges in the global wheeled tractor machinery market.

The market is highly competitive, with numerous global and regional manufacturers, which leads to significant price pressure. According to the U.S. Department of Agriculture, small-scale manufacturers often lower prices to compete with established brands, making profit margins thinner for all players. This competition pushes companies to find a balance between affordability and quality, which can be challenging in regions with cost-sensitive customers. Intense competition also requires continuous investment in innovation, further straining profits for manufacturers already dealing with high production costs.

The lack of skilled labor for operation and maintenance is another notable challenge.

Operating modern tractors with advanced features requires skilled labor, which can be scarce, especially in developing markets. A report from the International Labour Organization notes that many rural areas lack training facilities for agricultural machinery, resulting in low familiarity with tractors' latest technology. This skills gap hinders adoption, as farmers are less inclined to invest in machinery that they or their workers cannot operate or maintain effectively. Additionally, a lack of trained mechanics increases downtime, affecting productivity and discouraging further investments.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

6.8% |

|

Segments Covered |

By Design, Function, And Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Mahindra & Mahindra, Deere and Company, AGCO tractor, CNH Global NV, Massey Ferguson, Farmtrac Tractor, Escorts, Foton Loval, Goldani, Kukje, Lindner, LS Mtron, Machinery and Industrial Group NV, Shibaura, Tractorul UTB, VST Tillers. |

SEGMENT ANALYSIS

Global Wheeled Tractor Machinery By Design

The four-wheeled tractors segment dominated the wheeled tractor machinery market and held 85.1% of global market share in 2023. These tractors are highly versatile and used extensively for a wide range of applications like tilling, plowing, harvesting, and hauling, making them the primary choice for both large and small farms worldwide. Their popularity is driven by higher horsepower and adaptability for various farming tasks and terrains, which smaller tractors cannot manage as effectively. According to the Food and Agriculture Organization (FAO), four-wheeled tractors can improve farm productivity by up to 30% compared to traditional farming methods, which underscores their importance in meeting global food demands.

On the other hand, the two-wheeled tractors segment is expected to grow at the fastest CAGR and is likely to register a CAGR of 8.18% over the forecast period. This growth is largely driven by their affordability and compact size, making them particularly attractive in emerging markets where smallholder farmers dominate. In countries like India and African nations, where farmland is often fragmented and relatively small, two-wheeled tractors provide an efficient mechanization option. Additionally, these tractors are ideal for rice and wheat fields, as well as for tasks like inter-row cultivation. Their low maintenance and fuel efficiency make them a sustainable choice for small-scale farming, promoting agricultural productivity in regions with limited resources.

Global Wheeled Tractor Machinery By Function Insights

The utility tractors segment led the market and captured 30.2% of the global market share in 2023. Utility tractors are highly versatile and used for a variety of farming tasks, including plowing, hauling, mowing, and light construction, which makes them essential for farms of all sizes. Their adaptability and range of available attachments allow them to perform multiple tasks efficiently, reducing the need for multiple machines. Additionally, utility tractors are particularly popular among small and medium-sized farms, where their moderate size and power offer an ideal balance of functionality and cost-effectiveness.

The orchard tractors segment is predicted to register a CAGR of 8.08% over the forecast period. The increasing demand for orchard tractors is driven by the growth of fruit and nut cultivation worldwide, especially in countries like the U.S., Italy, and Spain. These tractors are designed with narrow builds to maneuver between rows in orchards and vineyards, reducing crop damage and increasing harvest efficiency. With the global rise in specialty farming and horticulture, orchard tractors are becoming essential for improving productivity in high-value crop sectors, supporting their rapid adoption in the agricultural industry.

REGIONAL INSIGHTS

Asia-Pacific was the largest regional market for wheeled tractor machinery and commanded 45.4% of the global market share in 2023. This dominance stems from extensive agricultural activity and a strong demand for mechanization in countries like China and India, which have vast arable lands and a high reliance on farming. Both countries have implemented policies to increase access to farming machinery, such as subsidies and financing options for smallholder farmers. These policies, ongoing rural labor shortages, and rising food demand are further boosting the regional market growth. As a result, Asia-Pacific is expected to retain its leading position in the market for the foreseeable future, with China and India continuing as the primary contributors.

North America held a considerable share of the worldwide market in 2023 and is anticipated to grow at a promising CAGR during the forecast period. The growth of the wheeled tractor machinery market in North America is largely fuelled by large-scale farming operations in the U.S., where there is a strong preference for technologically advanced, high-power tractors. The focus on precision agriculture in North America is significant, with many farms investing in GPS-enabled and autonomous tractors to increase efficiency. The U.S. remains the dominant country within the region, with Canada also showing steady demand due to similar agricultural practices and technological adoption.

Europe is another notable regional segment in the global market. The market of European market is driven by its well-established agricultural sector and a strong focus on sustainability, which has led to high demand for low-emission, fuel-efficient tractors. Strict environmental regulations across the European Union have encouraged manufacturers to develop tractors with advanced, eco-friendly features to meet these standards. Though Europe’s market growth is relatively mature, the demand for sustainable machinery is expected to continue supporting stable growth. France, Germany, and Italy are the primary contributors to the European market, driven by government programs that promote environmentally friendly farming technologies.

Latin America is estimated to register an encouraging CAGR over the forecast period. Mechanization in agriculture is increasing, particularly in countries like Brazil and Argentina, where large-scale farming operations drive demand for robust tractor machinery. As Latin American countries expand their mechanized farming efforts, especially for key exports such as soybeans and corn, the demand for wheeled tractor machinery is likely to improve in this region. Brazil leads the region’s market, benefitting from both the rise of large-scale agriculture and a shift toward improved productivity through mechanization to strengthen export capabilities.

The wheeled tractor machinery market in the Middle East and Africa currently holds a smaller share of the global wheeled tractor market, but it boasts the highest growth potential. This growth is largely due to low existing tractor penetration rates, coupled with significant efforts to increase agricultural productivity to address food security challenges. Many countries in the MEA region are beginning to prioritize agricultural mechanization, supported by government and international investments aimed at increasing self-sufficiency and reducing food imports. South Africa, Egypt, and Nigeria lead the region in adopting modern agricultural machinery as infrastructure and financing options improve, and these countries are poised to drive substantial growth in the region's wheeled tractor market.

KEY MARKET PLAYERS

Mahindra & Mahindra, Deere and Company, AGCO tractor, CNH Global NV, Massey Ferguson, Farmtrac Tractor, Escorts, Foton Loval, Goldani, Kukje, Lindner, LS Mtron, Machinery and Industrial Group NV, Shibaura, Tractorul UTB and VST Tillers are a few of the notable players that dominate the global wheeled tractor machinery market.

MARKET SEGMENTATION

This research report on the global wheeled tractor machinery market is segmented and sub-segmented based on design, function, and region.

By Design

- Two-Wheeled Tractors

- Four-Wheeled Tractors

By Function

- Implement Carrier

- Garden Tractor

- Earth Moving Tractor

- Row Crop Tractors

- Utility Tractors

- Industrial Tractors

- Rotatory Tillers

- Orchard Tractors

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

What is the current market size of the global wheeled tractor machinery market?

The current market size of the global wheeled tractor machinery market was valued at USD 50.30 billion in 2025

What are the market drivers that are driving the global wheeled tractor machinery market?

The rising need for agricultural mechanization worldwide is propelling global market growth, and the support and incentives from the governments of several countries for wheeled tractor machinery are aiding the market growth.

What are the market opportunities in global wheeled tractor machinery market?

The expansion of precision agriculture is a significant opportunity in the global market, and with rising environmental concerns, the shift toward electric and hybrid tractors presents a promising opportunity.

What challenges are faced the global wheeled tractor machinery market?

Intense competition and price pressure are major challenges in the global wheeled tractor machinery market, and the lack of skilled labor for operation and maintenance is another notable challenge.

Who are the market players that are dominating the global wheeled tractor machinery market?

Mahindra & Mahindra, Deere and Company, AGCO tractor, CNH Global NV, Massey Ferguson, Farmtrac Tractor, Escorts, Foton Loval, Goldani, Kukje, Lindner, LS Mtron, Machinery and Industrial Group NV, Shibaura, Tractorul UTB and VST Tillers are a few of the notable players that dominate the global wheeled tractor machinery market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com